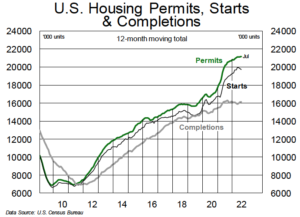

We typically focus on U.S. housing starts as the best indicator of solid-wood demand from new residential construction. However, when a growing percentage of these starts do not convert into completions (or the lag between starts and completions grows far beyond the typical six- or seven-month time frame), housing-starts data become a less effective proxy for near-term solid-wood demand. In 2019, U.S. housing starts totalled 1.29MM units while completions ran at 1.26MM (i.e., a ~98% “completion” rate). By 2020, starts had climbed to 1.38MM units while completions rose to 1.29MM (~93% completion rate). Last year, starts surged to 1.6MM units while completions grew to only 1.34MM (~84% completion rate). This decoupling of starts from completions is reflected in the massive backlog of uncompleted new homes we’ve highlighted before. The highest volume of solid wood gets consumed in the first half of construction (i.e., when the home is being framed), but this backlog of unfinished works is nonetheless a positive for lumber and panel demand.

We typically focus on U.S. housing starts as the best indicator of solid-wood demand from new residential construction. However, when a growing percentage of these starts do not convert into completions (or the lag between starts and completions grows far beyond the typical six- or seven-month time frame), housing-starts data become a less effective proxy for near-term solid-wood demand. In 2019, U.S. housing starts totalled 1.29MM units while completions ran at 1.26MM (i.e., a ~98% “completion” rate). By 2020, starts had climbed to 1.38MM units while completions rose to 1.29MM (~93% completion rate). Last year, starts surged to 1.6MM units while completions grew to only 1.34MM (~84% completion rate). This decoupling of starts from completions is reflected in the massive backlog of uncompleted new homes we’ve highlighted before. The highest volume of solid wood gets consumed in the first half of construction (i.e., when the home is being framed), but this backlog of unfinished works is nonetheless a positive for lumber and panel demand.

While housing starts have dipped over the last two months (averaging an adjusted 1.52MM in June and July), the most recent data on completions paints a slightly more bullish picture. On a seasonally adjusted basis, we have seen no significant pullback in housing completions ytd. In fact, completions are down just 0.1% ytd versus the first seven months of 2021. For July, completions came in at 1.42MM units (SAAR), up ~3.5% y/y, while housing starts were off by over 8% y/y for the same month.

Further declines in housing starts are likely in H2/22; however, it is highly possible completions will remain at current levels, or even move modestly higher, in the next 12 months. Home-purchase cancellations and affordability challenges may prevent us from returning to the high-90% completion rates we saw in 2019, but we expect to see this metric move up in the quarters to come.

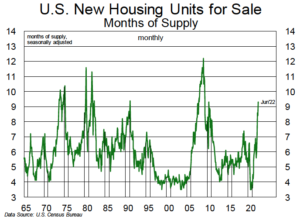

The number of new homes for sale may be causing some concern about the scale and duration of the upcoming downturn in U.S. housing. The inventory of new homes for sale ballooned to 9.4 months’ supply (on an actual basis) in June, up from 7.5 in May and 5.8 in June 2021. Often a jump in months’ supply can be attributed to a slowdown in home sales, and new-home sales did slip to 49,000 units last month (compared to 59,000 in the prior month and 61,000 a year ago). However, and perhaps more worrying, is that the bigger factor by far contributing to the spike in months’ supply appears to be a glut of inventory sitting on the market. The for-sale inventory at June’s end grew to 463,000 units—the highest since March 2008 and up 4% m/m and fully 33% y/y.

The number of new homes for sale may be causing some concern about the scale and duration of the upcoming downturn in U.S. housing. The inventory of new homes for sale ballooned to 9.4 months’ supply (on an actual basis) in June, up from 7.5 in May and 5.8 in June 2021. Often a jump in months’ supply can be attributed to a slowdown in home sales, and new-home sales did slip to 49,000 units last month (compared to 59,000 in the prior month and 61,000 a year ago). However, and perhaps more worrying, is that the bigger factor by far contributing to the spike in months’ supply appears to be a glut of inventory sitting on the market. The for-sale inventory at June’s end grew to 463,000 units—the highest since March 2008 and up 4% m/m and fully 33% y/y.

Likely related to the bulging inventory levels, home-purchase cancellation rates moved up for most of the publicly traded U.S. homebuilders last quarter. For D.R. Horton, cancellation rates spiked to 24% in Q2, up from 17% in Q1. So far, the company has had little trouble reselling to new, qualified buyers (likely helped by the ~50bp decline in the 30-year mortgage rate over the summer months), but builders may need to pull more affordability levers to keep these cancellation rates from climbing further in Q3.

Ballooning inventories will lead to caution among homebuilders as they contemplate sales prospects for the coming quarters; nonetheless, a few small positive signs have emerged recently that point to modest improvements in homebuyer sentiment. The National Association of Homebuilders found that 49% of prospective homebuyers were actively engaged in the process of buying a home in Q2, up from 46% in Q1/22 and reversing three straight quarters of declines. Further, the share of prospective buyers who expect the home search process to get easier in the months ahead grew to 22% in Q2, up from 17% in Q1.

Kevin Mason