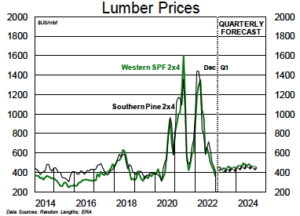

Lumber prices are rebounding off multi-year lows as major sawmill downtime (mostly in BC) starts to bite. S-P-F 2x4s are trading at $415, an increase of $80 in the past three weeks, while SYP 2x4s are trading at $403, up $39 over the same period. We expect this rally to fade in Q2 (or sooner). Lumber demand remains sluggish but should tick higher later in the quarter as the spring building season approaches. Lumber producers’ earnings dropped dramatically in Q4/22, and further declines are expected. First half 2023 earnings will be a fraction of prior-year levels, with red ink expected at some companies.

Lumber prices are rebounding off multi-year lows as major sawmill downtime (mostly in BC) starts to bite. S-P-F 2x4s are trading at $415, an increase of $80 in the past three weeks, while SYP 2x4s are trading at $403, up $39 over the same period. We expect this rally to fade in Q2 (or sooner). Lumber demand remains sluggish but should tick higher later in the quarter as the spring building season approaches. Lumber producers’ earnings dropped dramatically in Q4/22, and further declines are expected. First half 2023 earnings will be a fraction of prior-year levels, with red ink expected at some companies.

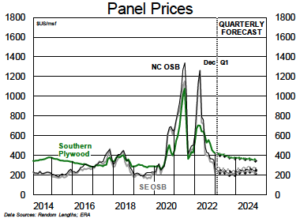

OSB prices have also recovered from multi-year lows, but gains have been much more muted than in lumber. The near-term upside runway appears limited for several reasons (e.g., less producer downtime and greater exposure to weakness in housing). Benchmark North Central 7/16″ is now trading at $235, up slightly from a low of $220 at the beginning of the year. In plywood, prices are also trending higher after drifting lower through Q4/22. A decline in offshore plywood imports is certainly helping, but demand prospects for 2023 remain weak.

OSB prices have also recovered from multi-year lows, but gains have been much more muted than in lumber. The near-term upside runway appears limited for several reasons (e.g., less producer downtime and greater exposure to weakness in housing). Benchmark North Central 7/16″ is now trading at $235, up slightly from a low of $220 at the beginning of the year. In plywood, prices are also trending higher after drifting lower through Q4/22. A decline in offshore plywood imports is certainly helping, but demand prospects for 2023 remain weak.

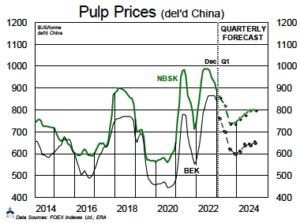

Pulp prices have begun the year with ongoing measured declines across most grades. Softwood prices have rolled over in all major markets despite the announced closure of 280kmt of NBSK by Canfor Pulp (and its +$30 Feb hike attempt), as well as reduced operating rates in BC. Buyer discounts are up by another ~2%. Hardwood availability is improving in North America and Europe, and we expect further price softening. New mills in South America will be ramping up in first half 2023 (Arauco, UPM) and will be seeking buyers. Fluff and DP spot prices are down steeply. The weaker USD has taken some pressure off buyers. The wild card for all pulp grades will be the appetite of Chinese buyers following the Lunar New Year.

Pulp prices have begun the year with ongoing measured declines across most grades. Softwood prices have rolled over in all major markets despite the announced closure of 280kmt of NBSK by Canfor Pulp (and its +$30 Feb hike attempt), as well as reduced operating rates in BC. Buyer discounts are up by another ~2%. Hardwood availability is improving in North America and Europe, and we expect further price softening. New mills in South America will be ramping up in first half 2023 (Arauco, UPM) and will be seeking buyers. Fluff and DP spot prices are down steeply. The weaker USD has taken some pressure off buyers. The wild card for all pulp grades will be the appetite of Chinese buyers following the Lunar New Year.

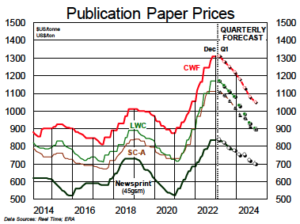

SC prices were generally stable to start the year, although a couple of mills got higher prices from some accounts that had benefited from price caps in 2022. Coated grades are trending sideways on limited domestic supply, but imports are soaring. Some one-off deals have been seen (due to specific customer situations). The next overall pricing move will be down. Imports are the huge unknown. Newsprint prices are holding firm, with some strong prices still on offer in the export markets (notably Europe/Asia less so). Demand is collapsing, but traditional supply discipline will prevent a parallel collapse in prices.

SC prices were generally stable to start the year, although a couple of mills got higher prices from some accounts that had benefited from price caps in 2022. Coated grades are trending sideways on limited domestic supply, but imports are soaring. Some one-off deals have been seen (due to specific customer situations). The next overall pricing move will be down. Imports are the huge unknown. Newsprint prices are holding firm, with some strong prices still on offer in the export markets (notably Europe/Asia less so). Demand is collapsing, but traditional supply discipline will prevent a parallel collapse in prices.

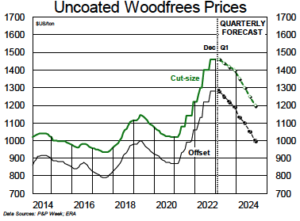

Uncoated woodfree prices remain stable for now, but many orders were cancelled in December and January has been bereft of orders for many mills/traders. The return to offices and inventory restocking boosted demand last year, but now buyers are comfortably stocked and looking to draw down inventories. Mill inventories are on the rise and the seasonal weakness will necessitate downtime to keep prices from falling too fast. Imports neared a stunning 20% market share in December (a new all-time high). How, or if, that import surge will be restrained is an open question and will determine the path forward.

Uncoated woodfree prices remain stable for now, but many orders were cancelled in December and January has been bereft of orders for many mills/traders. The return to offices and inventory restocking boosted demand last year, but now buyers are comfortably stocked and looking to draw down inventories. Mill inventories are on the rise and the seasonal weakness will necessitate downtime to keep prices from falling too fast. Imports neared a stunning 20% market share in December (a new all-time high). How, or if, that import surge will be restrained is an open question and will determine the path forward.

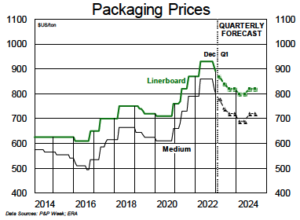

Containerboard producers took substantial downtime through second half 2022, yet it was insufficient to keep prices from falling. With new capacity ahead, and a near-term demand recovery unlikely, further price declines are assured. Closures are expected, but who steps up? Exports have provided no outlet for extra tons and both volumes and prices are poor. Boxboard demand continues to post better numbers than containerboard, and that will persist for a while. SBS/CUK markets may have received a mild benefit from the labour dispute at WRK’s CUK mill, but the next move in prices will be lower (although we don’t foresee slippage until late Q2). Recycled grades are coming under pressure, with URB prices already down. GPK may shut some CRB capacity to help.

Containerboard producers took substantial downtime through second half 2022, yet it was insufficient to keep prices from falling. With new capacity ahead, and a near-term demand recovery unlikely, further price declines are assured. Closures are expected, but who steps up? Exports have provided no outlet for extra tons and both volumes and prices are poor. Boxboard demand continues to post better numbers than containerboard, and that will persist for a while. SBS/CUK markets may have received a mild benefit from the labour dispute at WRK’s CUK mill, but the next move in prices will be lower (although we don’t foresee slippage until late Q2). Recycled grades are coming under pressure, with URB prices already down. GPK may shut some CRB capacity to help.