Kurt Niquidet opened the panel by discussing timber supply in BC. He explained that the annual allowable cut (AAC) has been trending down, now sitting at approximately 60 million cubic meters. This decline, attributed to factors like the mountain pine beetle outbreak and wildfires, is contributing to a growing gap between the AAC and actual harvests. “The gap between the AAC and actual harvest has widened, contributing to rising costs and economic instability,” Niquidet said. He also mentioned that government regulation is playing a significant role in the decline of the AAC. “Regulatory constraints are limiting the ability to manage timber supply effectively, further exacerbating the issue,” Niquidet explained. He also pointed out the challenges in meeting timber targets, especially with BC Timber Sales (BCTS) falling short of its targets, further stressing the supply crunch.

While the AAC decline has been a critical issue, Niquidet noted that BC’s increasing costs are another significant concern. “BC has become a high-cost jurisdiction for forestry,” he stated. This situation has been exacerbated by regulatory challenges, fluctuating market conditions, and tariffs. Niquidet emphasized that these factors have made it harder for companies to maintain operations in the province. He specifically pointed to the tariffs imposed by the U.S. on Canadian lumber, noting their broad economic implications. “These tariffs are more than just a policy issue; they’re creating real-world impacts,” Niquidet explained. “They drive up costs, limit export opportunities, and inject uncertainty into long-term planning.”

Despite these challenges, Niquidet highlighted the resilience of the industry, especially with increased productivity. “The forest sector has become more productive, with each worker creating more value, even as employment and wood supply have contracted,” Niquidet noted.

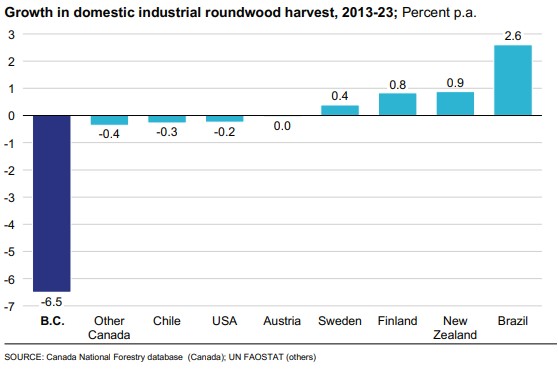

O’Kelly shared troubling news regarding BC’s economic performance over the past decade. “In the last 10 years, BC’s forestry sector has seen a 3.6% decline in GDP, the lowest of the peer group,” O’Kelly noted. He added that employment in the sector had also fallen, with exports declining by 3% annually, a rate twice as high as other jurisdictions. “This is primarily due to the rapid decline in wood supply, which has decreased by 6.5% over the last decade,” O’Kelly explained.

In terms of sustainability, O’Kelly noted that BC performs well compared to other regions. “BC is one of the highest performers on sustainability metrics,” O’Kelly said, referring to ratings from the World Wildlife Fund. However, he cautioned that economic performance has not kept pace with environmental efforts.

O’Kelly also highlighted the importance of First Nations involvement in the forestry sector. “First Nations have been a part of BC’s forestry sector for decades, and their increasing involvement presents an opportunity for stability and growth,” O’Kelly said. He emphasized the importance of partnerships with First Nations as a means of navigating the current challenges. “Many First Nations are increasing their role in forestry, holding tenures, and even purchasing operations from major corporations,” O’Kelly noted. “This is an important step in creating stability in the industry.”

Regarding BC’s future, O’Kelly discussed the potential for expanding markets in the Indo-Pacific region. “The Indo-Pacific region is projected to account for over half of the global economy in the next two decades,” O’Kelly said. “There is growing demand in countries like Japan and China for high-quality lumber, which aligns with BC’s strengths in the sector.” He expressed hope that strengthening trade relationships in these markets could help mitigate some of the risks posed by the U.S. trade situation.

Niquidet and O’Kelly both emphasized the need for collaboration among all stakeholders—government, industry, First Nations, and local communities—to address the sector’s challenges. “We need to work together to find solutions, streamline regulations, and build a more reliable timber supply chain,” Niquidet said. O’Kelly added that partnerships with First Nations are critical in driving long-term stability. “First Nations are key players in this sector, and we need to build strong partnerships that ensure mutual benefits,” O’Kelly said.

Drafted with the assistance of digital tools to streamline the process.