Prime Minister Mark Carney has chosen former Privy Council clerk Janice Charette to head Canada’s trade negotiations as it prepares for a review of the North American trade pact. Charette’s title is chief trade negotiator to the United States, according to a Monday news release from the Prime Minister’s Office (PMO). She’ll be a senior adviser to Carney and Canada-U.S. Trade Minister Dominic LeBlanc. “Charette brings extraordinary leadership, expertise and a deep commitment to advancing Canada’s interests,” Carney said in the release. “She will advance Canadian interests and a strengthened trade and investment relationship that benefits workers and industries in both Canada and the United States.” The announcement comes as the federal government prepares for a scheduled review of the Canada-U.S.-Mexico Agreement (CUSMA) this year. It also comes a day after Mark Wiseman, a global investment banker and pension fund manager, took the reins as Canada’s next ambassador to Washington.

Prime Minister Mark Carney has chosen former Privy Council clerk Janice Charette to head Canada’s trade negotiations as it prepares for a review of the North American trade pact. Charette’s title is chief trade negotiator to the United States, according to a Monday news release from the Prime Minister’s Office (PMO). She’ll be a senior adviser to Carney and Canada-U.S. Trade Minister Dominic LeBlanc. “Charette brings extraordinary leadership, expertise and a deep commitment to advancing Canada’s interests,” Carney said in the release. “She will advance Canadian interests and a strengthened trade and investment relationship that benefits workers and industries in both Canada and the United States.” The announcement comes as the federal government prepares for a scheduled review of the Canada-U.S.-Mexico Agreement (CUSMA) this year. It also comes a day after Mark Wiseman, a global investment banker and pension fund manager, took the reins as Canada’s next ambassador to Washington.

Almost three years after declaring bankruptcy, and more than two years under new owners, legal proceedings for Penticton’s Structurlam are continuing through the courts as it fights with the company that sent it into bankruptcy in the first place. In January, the case returned to the BC Supreme Court in Vancouver to order two Canadian engineering firms to produce documents and reports for the proceedings as Structurlam faces $80 million US in claims from Walmart, according to a decision published on Feb. 11. In 2023, Structurlam began bankruptcy proceedings after Walmart ended its contract to build the company’s new home office campus in Arkansas. …In July, Walmart filed a claim for over $80 million US for allegedly defective, nonconforming, rejected, nondelivered, or returned goods that it had paid for and alleged costs to replace said goods. The January 2026 B.C. Supreme Court decision orders two engineering firms to provide their documentation.

Almost three years after declaring bankruptcy, and more than two years under new owners, legal proceedings for Penticton’s Structurlam are continuing through the courts as it fights with the company that sent it into bankruptcy in the first place. In January, the case returned to the BC Supreme Court in Vancouver to order two Canadian engineering firms to produce documents and reports for the proceedings as Structurlam faces $80 million US in claims from Walmart, according to a decision published on Feb. 11. In 2023, Structurlam began bankruptcy proceedings after Walmart ended its contract to build the company’s new home office campus in Arkansas. …In July, Walmart filed a claim for over $80 million US for allegedly defective, nonconforming, rejected, nondelivered, or returned goods that it had paid for and alleged costs to replace said goods. The January 2026 B.C. Supreme Court decision orders two engineering firms to provide their documentation.

The BC government is forecasting that the natural gas industry will play a larger role as the top driver of provincial resource revenue, while warning about tough times in the former economic powerhouse of forestry. Natural gas royalties are expected to ring in at nearly $1.3-billion for the 12 months ending March 31, 2027, up 38%. …The government is anticipating $521-million in forestry revenue for the 2026-27 fiscal year, up 3%, but still down sharply when compared with several years ago. …In the 2020-21 fiscal year, forestry revenue surpassed $1.3-billion and natural gas royalties reached $196-million. …Tuesday’s budget introduces a temporary Stumpage Payment Deferral Program in an effort to ease the cash crunch for companies. The voluntary program covers the first 11 months of 2026. …The government anticipates that the trend of depressed annual volumes of tree harvesting will continue over the next several years, restricting the production of softwood lumber. [to access the full story a Globe & Mail subscription is required]

The BC government is forecasting that the natural gas industry will play a larger role as the top driver of provincial resource revenue, while warning about tough times in the former economic powerhouse of forestry. Natural gas royalties are expected to ring in at nearly $1.3-billion for the 12 months ending March 31, 2027, up 38%. …The government is anticipating $521-million in forestry revenue for the 2026-27 fiscal year, up 3%, but still down sharply when compared with several years ago. …In the 2020-21 fiscal year, forestry revenue surpassed $1.3-billion and natural gas royalties reached $196-million. …Tuesday’s budget introduces a temporary Stumpage Payment Deferral Program in an effort to ease the cash crunch for companies. The voluntary program covers the first 11 months of 2026. …The government anticipates that the trend of depressed annual volumes of tree harvesting will continue over the next several years, restricting the production of softwood lumber. [to access the full story a Globe & Mail subscription is required] The United Steelworkers union found positives in a difficult BC budget. …Recognizing the uncertainty created by US trade policy… USW Western Canada Director Scott Lunny said… “Today’s budget advances the government’s work towards long-term economic stability, including BC’s goal of securing $200 billion in private-sector investment over the next decade in sectors including mining, forestry and manufacturing”. …USW noted positives, including: a continued commitment in funding to strengthen permitting capacity in resource industries; a $400- million Strategic Investments Special Account to leverage federal government dollars for investment and job creation in key sectors like value-added forestry, responsible mining, manufacturing and clean energy; and unprecedented investment in skilled trades funding as well as a training grant to encourage apprenticeships. …”While we welcome the $20 million to help workers and employers in tariff-impacted sectors like steel and forestry, there is still a missing commitment to stabilizing and sustaining the primary forestry sector,” said Lunny.

The United Steelworkers union found positives in a difficult BC budget. …Recognizing the uncertainty created by US trade policy… USW Western Canada Director Scott Lunny said… “Today’s budget advances the government’s work towards long-term economic stability, including BC’s goal of securing $200 billion in private-sector investment over the next decade in sectors including mining, forestry and manufacturing”. …USW noted positives, including: a continued commitment in funding to strengthen permitting capacity in resource industries; a $400- million Strategic Investments Special Account to leverage federal government dollars for investment and job creation in key sectors like value-added forestry, responsible mining, manufacturing and clean energy; and unprecedented investment in skilled trades funding as well as a training grant to encourage apprenticeships. …”While we welcome the $20 million to help workers and employers in tariff-impacted sectors like steel and forestry, there is still a missing commitment to stabilizing and sustaining the primary forestry sector,” said Lunny.

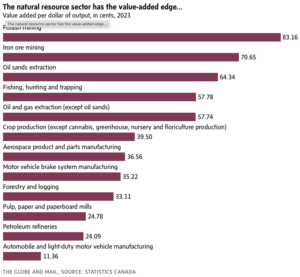

It’s been nearly a century since political economist Harold Innis popularized the phrase “hewers of wood and drawers of water” in decrying Canada’s dependence on natural resources. …Underpinning that cry is the (wrongheaded) assumption that natural resources such as mining, agriculture and energy are second-grade economic activity, less desirable than manufacturing. …That mistake is the foundation for many public policy blunders over many decades. The numbers demolish that myth, and tell a very different story, one in which energy, mining and other natural resources sectors create enormous economic value and are globally competitive. …The federal government needs to get itself out of the way of some of the strongest parts of the Canadian economy. Stop subsidizing inefficient sectors. Stop raising protective tariffs that harm other parts of the economy. Focus on rolling back unjustified regulatory barriers that harm the ability of the entire economy, particularly globally exposed natural resources sectors, to compete. And, most of all, stop the undervaluing Canada’s great natural advantage in natural resources. [to access the full story a Globe & Mail subscription is required]

It’s been nearly a century since political economist Harold Innis popularized the phrase “hewers of wood and drawers of water” in decrying Canada’s dependence on natural resources. …Underpinning that cry is the (wrongheaded) assumption that natural resources such as mining, agriculture and energy are second-grade economic activity, less desirable than manufacturing. …That mistake is the foundation for many public policy blunders over many decades. The numbers demolish that myth, and tell a very different story, one in which energy, mining and other natural resources sectors create enormous economic value and are globally competitive. …The federal government needs to get itself out of the way of some of the strongest parts of the Canadian economy. Stop subsidizing inefficient sectors. Stop raising protective tariffs that harm other parts of the economy. Focus on rolling back unjustified regulatory barriers that harm the ability of the entire economy, particularly globally exposed natural resources sectors, to compete. And, most of all, stop the undervaluing Canada’s great natural advantage in natural resources. [to access the full story a Globe & Mail subscription is required] The pace of homebuilding in Canada continues to slow with no near-term signs of a turnaround, said Canada Mortgage and Housing Corp. on Monday. The national housing agency said the seasonally-adjusted annual pace of housing starts declined 15% in January. Housing starts can vary considerably month-to-month as big projects get started, but the agency’s six-month moving average for annual starts also showed a 3.5% decline. “The six-month trend has decreased for the fourth consecutive month,” said CMHC deputy chief economist Tania Bourassa-Ochoa in a news release. “We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity.” She said a near-term turnaround is looking unlikely, and reflects what the agency has been hearing from developers over recent months. The pullback comes amid a variety of pressures, including lower immigration numbers and US trade policy.

The pace of homebuilding in Canada continues to slow with no near-term signs of a turnaround, said Canada Mortgage and Housing Corp. on Monday. The national housing agency said the seasonally-adjusted annual pace of housing starts declined 15% in January. Housing starts can vary considerably month-to-month as big projects get started, but the agency’s six-month moving average for annual starts also showed a 3.5% decline. “The six-month trend has decreased for the fourth consecutive month,” said CMHC deputy chief economist Tania Bourassa-Ochoa in a news release. “We expect new construction to continue trending lower going forward as trade and geopolitical uncertainty, high construction costs, weaker demand, and rising inventories continue to constrain developer activity.” She said a near-term turnaround is looking unlikely, and reflects what the agency has been hearing from developers over recent months. The pullback comes amid a variety of pressures, including lower immigration numbers and US trade policy. Canada’s annual inflation rate edged down to 2.3% in January, Statistics Canada said on Tuesday, driven downward by a decline in the cost of gasoline. Economists were largely expecting the rate to remain unchanged from December’s 2.4%. Pump prices put pressure on the headline rate, having fallen 16.7% in January compared to the same period last year. With gas excluded, January’s inflation rate came in at 3%. The Bank of Canada’s preferred measures of core inflation, which strip away volatility from one-time tax changes and gas prices, all ticked down in January — bringing those rates closer to the central bank’s two per cent inflation target. “Overall, this is an encouraging result for the Bank of Canada, with inflation finally nearing the [2%] target on a broader basis,” wrote Douglas Porter, chief economist at Bank of Montreal. ›

Canada’s annual inflation rate edged down to 2.3% in January, Statistics Canada said on Tuesday, driven downward by a decline in the cost of gasoline. Economists were largely expecting the rate to remain unchanged from December’s 2.4%. Pump prices put pressure on the headline rate, having fallen 16.7% in January compared to the same period last year. With gas excluded, January’s inflation rate came in at 3%. The Bank of Canada’s preferred measures of core inflation, which strip away volatility from one-time tax changes and gas prices, all ticked down in January — bringing those rates closer to the central bank’s two per cent inflation target. “Overall, this is an encouraging result for the Bank of Canada, with inflation finally nearing the [2%] target on a broader basis,” wrote Douglas Porter, chief economist at Bank of Montreal. › BURNABY, BC — Interfor recorded a net loss in Q4, 2025 of $104.6 million, compared to a net loss of $215.8 million in Q3’25 and a net loss of $49.9 million in Q4’24. Adjusted EBITDA was a loss of $29.2 million on sales of $600.6 million in Q4’25 versus an Adjusted EBITDA loss of $183.8 million on sales of $689.3 million in Q3’25 and Adjusted EBITDA of $80.4 million on sales of $746.5 million in Q4’24. …During and subsequent to Q4’25, Interfor completed a series of financing transactions. Taken together, these transactions significantly enhance Interfor’s financial flexibility, bolster liquidity and provide meaningful additional runway as the Company continues to navigate volatile lumber market conditions. …Lumber production of 753 million board feet was down 159 million board feet versus the preceding quarter. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle.

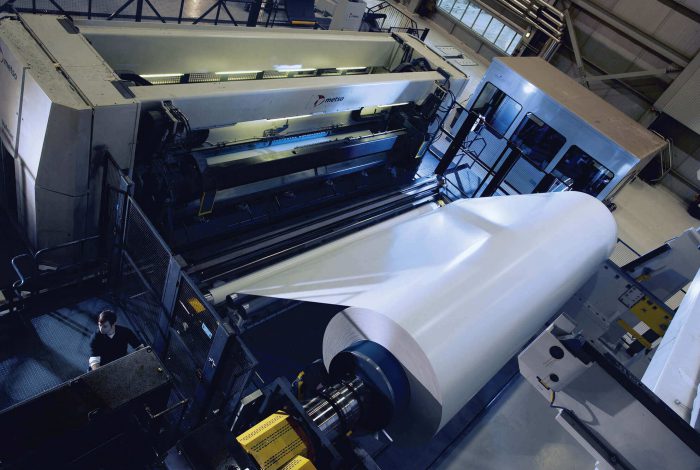

BURNABY, BC — Interfor recorded a net loss in Q4, 2025 of $104.6 million, compared to a net loss of $215.8 million in Q3’25 and a net loss of $49.9 million in Q4’24. Adjusted EBITDA was a loss of $29.2 million on sales of $600.6 million in Q4’25 versus an Adjusted EBITDA loss of $183.8 million on sales of $689.3 million in Q3’25 and Adjusted EBITDA of $80.4 million on sales of $746.5 million in Q4’24. …During and subsequent to Q4’25, Interfor completed a series of financing transactions. Taken together, these transactions significantly enhance Interfor’s financial flexibility, bolster liquidity and provide meaningful additional runway as the Company continues to navigate volatile lumber market conditions. …Lumber production of 753 million board feet was down 159 million board feet versus the preceding quarter. …Interfor’s strategy of maintaining a diversified portfolio of operations in multiple regions allows the Company to both reduce risk and maximize returns on capital over the business cycle. NEW YORK, New York — Mercer International reported fourth quarter 2025 Operating EBITDA of negative $20.1 million compared to positive $99.2 million in the same quarter of 2024 and negative $28.1 million in the third quarter of 2025. In the fourth quarter of 2025, net loss was $308.7 million compared to net income of $16.7 million in the fourth quarter of 2024 and a net loss of $80.8 million in the third quarter of 2025. The net loss in the fourth quarter of 2025 included total non-cash impairments of $238.7 million. This included non-cash impairments of $203.5 million recognized against long-lived assets at our Peace River mill due to the continued down-cycle environment of hardwood pulp markets, $12.2 million against certain obsolete equipment and $23.0 million against pulp inventory due to low prices and high fiber costs. …Mr. Juan Carlos Bueno, CEO: “We continue to prioritize improving liquidity and working capital, committing to rebalancing our asset portfolio and maintaining operating discipline.”

NEW YORK, New York — Mercer International reported fourth quarter 2025 Operating EBITDA of negative $20.1 million compared to positive $99.2 million in the same quarter of 2024 and negative $28.1 million in the third quarter of 2025. In the fourth quarter of 2025, net loss was $308.7 million compared to net income of $16.7 million in the fourth quarter of 2024 and a net loss of $80.8 million in the third quarter of 2025. The net loss in the fourth quarter of 2025 included total non-cash impairments of $238.7 million. This included non-cash impairments of $203.5 million recognized against long-lived assets at our Peace River mill due to the continued down-cycle environment of hardwood pulp markets, $12.2 million against certain obsolete equipment and $23.0 million against pulp inventory due to low prices and high fiber costs. …Mr. Juan Carlos Bueno, CEO: “We continue to prioritize improving liquidity and working capital, committing to rebalancing our asset portfolio and maintaining operating discipline.”

As Denmark has recently tightened its standards for new construction with the aim of reducing embodied carbon, what lessons can Canada draw from this experience? In 2023, the Danish Building Code made life-cycle assessment (LCA) mandatory for all new buildings over their first fifty years. …The government also mandated researchers to provide practitioners with a list of generic material data for cases where an Environmental Product Declaration (EPD)—required to perform an LCA. When the regulation came into force in 2023, the entire construction industry was opposed to it, recalls Thomas Graabaek. “ And then slowly there was a movement within architects and engineers that actually we need to have even stricter demands.” …“Unfortunately, in Canada, [architects] have been educated only around operations, [not on its entire life cycle],” explains Kelly Alvarez Doran. He advocates for the establishment of embodied-carbon targets at different regulatory scales.

As Denmark has recently tightened its standards for new construction with the aim of reducing embodied carbon, what lessons can Canada draw from this experience? In 2023, the Danish Building Code made life-cycle assessment (LCA) mandatory for all new buildings over their first fifty years. …The government also mandated researchers to provide practitioners with a list of generic material data for cases where an Environmental Product Declaration (EPD)—required to perform an LCA. When the regulation came into force in 2023, the entire construction industry was opposed to it, recalls Thomas Graabaek. “ And then slowly there was a movement within architects and engineers that actually we need to have even stricter demands.” …“Unfortunately, in Canada, [architects] have been educated only around operations, [not on its entire life cycle],” explains Kelly Alvarez Doran. He advocates for the establishment of embodied-carbon targets at different regulatory scales.

Modern Methods of Construction Education (MMC Edu) is a national platform that connects education and industry to advance construction training in Canada. It is a key outcome of the Mass Timber Training Network: Advancing Trades for a Sustainable Future (MTAT) project, which brings together a national network to advance wood as a low-carbon building material by addressing major barriers to mass timber adoption across the country. Led by the British Columbia Institute of Technology (BCIT) in partnership with Natural Resources Canada (NRCan) through the Green Construction Through Wood Program (GC Wood), the MTAT project focuses on education and training as a key vehicle for reducing barriers and preparing the next generation of the workforce. MMC Edu serves as a shared platform where network members, industry partners, and educators can exchange knowledge and access resources that support innovation, sustainability, and workforce readiness across Canada.

Modern Methods of Construction Education (MMC Edu) is a national platform that connects education and industry to advance construction training in Canada. It is a key outcome of the Mass Timber Training Network: Advancing Trades for a Sustainable Future (MTAT) project, which brings together a national network to advance wood as a low-carbon building material by addressing major barriers to mass timber adoption across the country. Led by the British Columbia Institute of Technology (BCIT) in partnership with Natural Resources Canada (NRCan) through the Green Construction Through Wood Program (GC Wood), the MTAT project focuses on education and training as a key vehicle for reducing barriers and preparing the next generation of the workforce. MMC Edu serves as a shared platform where network members, industry partners, and educators can exchange knowledge and access resources that support innovation, sustainability, and workforce readiness across Canada. International Pulp Week (IPW) is the premier annual gathering for the global market pulp sector, organized by the Pulp and Paper Products Council (PPPC). Set for May 10–12, 2026 at the Sutton Place Hotel in Vancouver, BC, the three-day conference brings together producers, customers, logistics providers, analysts and other key stakeholders from around the world to share market intelligence, expert insights and strategic dialogue on trends shaping the future of pulp markets. Through keynote presentations, expert panels and extensive networking opportunities, IPW offers decision-makers high-value analysis, opportunities for business development, and collaboration across the pulp supply chain. The event has become a must-attend forum for those involved in international pulp production, trade and investment, with participants from more than 40 countries expected to attend.

International Pulp Week (IPW) is the premier annual gathering for the global market pulp sector, organized by the Pulp and Paper Products Council (PPPC). Set for May 10–12, 2026 at the Sutton Place Hotel in Vancouver, BC, the three-day conference brings together producers, customers, logistics providers, analysts and other key stakeholders from around the world to share market intelligence, expert insights and strategic dialogue on trends shaping the future of pulp markets. Through keynote presentations, expert panels and extensive networking opportunities, IPW offers decision-makers high-value analysis, opportunities for business development, and collaboration across the pulp supply chain. The event has become a must-attend forum for those involved in international pulp production, trade and investment, with participants from more than 40 countries expected to attend.

Applications Now Open For FPAC’s 2026

Applications Now Open For FPAC’s 2026

A BC First Nation in the final stages of treaty negotiation is suing the province for allegedly breaching the “honour of the Crown” after an official extended an expiring timber licence in its traditional territory. Filed in a BC Supreme Court last week, the application for judicial review from ’Wuìk̓inux̌v Nation seeks to overturn an August 2025 decision… that gave Interfor a three-year extension to log an estimated 50,000 cubic metres of timber. The court application argues that allowing a third party to continue harvesting on the nation’s lands—without their consent and against their environmental concerns—is a step backward that the law no longer allows. The claim, which also names Interfor, arrives at a volatile moment for BC politics: by leaning on a landmark legal precedent set in December 2025, it lands squarely in the middle of a heated debate over how the province manages its natural resources in an era of reconciliation.

A BC First Nation in the final stages of treaty negotiation is suing the province for allegedly breaching the “honour of the Crown” after an official extended an expiring timber licence in its traditional territory. Filed in a BC Supreme Court last week, the application for judicial review from ’Wuìk̓inux̌v Nation seeks to overturn an August 2025 decision… that gave Interfor a three-year extension to log an estimated 50,000 cubic metres of timber. The court application argues that allowing a third party to continue harvesting on the nation’s lands—without their consent and against their environmental concerns—is a step backward that the law no longer allows. The claim, which also names Interfor, arrives at a volatile moment for BC politics: by leaning on a landmark legal precedent set in December 2025, it lands squarely in the middle of a heated debate over how the province manages its natural resources in an era of reconciliation. North Cowichan wants something done about the growing amount of fibreglass pollution in the Cowichan estuary. Council passed a motion at its meeting on Feb. 4 that the municipality write a letter to senior levels of government and the appropriate regulatory authorities asking that they raise awareness of the issue and take action to deal with the problem. Coun. Christopher Justice, who made the motion, said that the issue of derelict and deteriorating fibreglass boats is something that is becoming more acute in local harbours and waterways. …North Cowichan Mayor Rob Douglas said the municipality must signal its support for the continued operation of the Western Forest Products sawmill, which operates in that area. He said he spoke to officials at the mill before the council meeting. “They advised me that they are not aware of any fibreglass contamination coming from the mill site,” Douglas said.

North Cowichan wants something done about the growing amount of fibreglass pollution in the Cowichan estuary. Council passed a motion at its meeting on Feb. 4 that the municipality write a letter to senior levels of government and the appropriate regulatory authorities asking that they raise awareness of the issue and take action to deal with the problem. Coun. Christopher Justice, who made the motion, said that the issue of derelict and deteriorating fibreglass boats is something that is becoming more acute in local harbours and waterways. …North Cowichan Mayor Rob Douglas said the municipality must signal its support for the continued operation of the Western Forest Products sawmill, which operates in that area. He said he spoke to officials at the mill before the council meeting. “They advised me that they are not aware of any fibreglass contamination coming from the mill site,” Douglas said.

PRINCE GEORGE – [Local forester and forestry advocate Michelle Connolly says what’s being suggested in a recent report, titled “From Conflict to Care: BC’s Forest Future,” is off the mark.] “One of the core beliefs is that people are better at managing nature, than nature is, even though forests have been self-organizing and self-managing for millennia,” says Connolly. “The lack of self-awareness right up front in that report is troubling, because it means that they’re not aware of their own biases and belief systems that are guiding the things they’re putting in this report.” Kiel Giddens, Conservative MLA for Prince George-Mackenzie, says the report overlooks a lot of industry concerns. …Giddens says, while the report misses the mark overall, he agrees with Objective Number 2 around regional decision making. …But Connolly says where the report truly hits the mark is over what is seen as a lack of transparency in the decision-making processes.

PRINCE GEORGE – [Local forester and forestry advocate Michelle Connolly says what’s being suggested in a recent report, titled “From Conflict to Care: BC’s Forest Future,” is off the mark.] “One of the core beliefs is that people are better at managing nature, than nature is, even though forests have been self-organizing and self-managing for millennia,” says Connolly. “The lack of self-awareness right up front in that report is troubling, because it means that they’re not aware of their own biases and belief systems that are guiding the things they’re putting in this report.” Kiel Giddens, Conservative MLA for Prince George-Mackenzie, says the report overlooks a lot of industry concerns. …Giddens says, while the report misses the mark overall, he agrees with Objective Number 2 around regional decision making. …But Connolly says where the report truly hits the mark is over what is seen as a lack of transparency in the decision-making processes.

Whistler is fortunate to be surrounded by temperate rainforest, which is essential to the resort’s appeal as a tourist destination. Forests have also proven to be highly beneficial for human mental and physical health. …Old-growth forests, defined as undisturbed for at least 250 years, are vital to addressing the interconnected biodiversity and climate crises. …On the climate side, old-growth forests store vast amounts of carbon in living trees, dead wood, and undisturbed soil. …Since the early 1900s, Whistler’s forests have been logged extensively, and low-elevation old-growth forests that once covered the valley are now found only in limited areas. Commercial logging and thinning have continued by the Cheakamus Community Forest (CCF) since 2009, though old-growth logging was deferred in 2021. …Given that old-growth forests thrive on stability, attempting to manage them doesn’t make ecological sense, especially since they are already among the most climate-resilient ecosystems on Earth.

Whistler is fortunate to be surrounded by temperate rainforest, which is essential to the resort’s appeal as a tourist destination. Forests have also proven to be highly beneficial for human mental and physical health. …Old-growth forests, defined as undisturbed for at least 250 years, are vital to addressing the interconnected biodiversity and climate crises. …On the climate side, old-growth forests store vast amounts of carbon in living trees, dead wood, and undisturbed soil. …Since the early 1900s, Whistler’s forests have been logged extensively, and low-elevation old-growth forests that once covered the valley are now found only in limited areas. Commercial logging and thinning have continued by the Cheakamus Community Forest (CCF) since 2009, though old-growth logging was deferred in 2021. …Given that old-growth forests thrive on stability, attempting to manage them doesn’t make ecological sense, especially since they are already among the most climate-resilient ecosystems on Earth.

A Williams Lake man was of three people to be recognized by Forest Professional British Columbia (FPBC). At the 78th annual forestry conference on February 5, John Walker was honored as a Distinguished Forest Professional. …“John is a respected collaborator and mentor across BC, particularly in the Cariboo region, where he builds strong connections between forestry practices, First Nations stewardship and research,” Forest Professionals BC Board Chair Dave Clarke said. “I’ve been in Williams Lake since 1996 starting in consulting making decisions on a block by block level. Now working with Williams Lake First Nation it’s more landscape level working towards different policies and then also being operational. A lot of the Fire Mitigation work around town we’ve been a part of and helped push for,” Walker said. He has also collaborated with the BC Wildfire Service to develop thinning methods for prescribed burns, reducing wildfire risk, restoring culturally important plants, and enhancing operational efficiency.

A Williams Lake man was of three people to be recognized by Forest Professional British Columbia (FPBC). At the 78th annual forestry conference on February 5, John Walker was honored as a Distinguished Forest Professional. …“John is a respected collaborator and mentor across BC, particularly in the Cariboo region, where he builds strong connections between forestry practices, First Nations stewardship and research,” Forest Professionals BC Board Chair Dave Clarke said. “I’ve been in Williams Lake since 1996 starting in consulting making decisions on a block by block level. Now working with Williams Lake First Nation it’s more landscape level working towards different policies and then also being operational. A lot of the Fire Mitigation work around town we’ve been a part of and helped push for,” Walker said. He has also collaborated with the BC Wildfire Service to develop thinning methods for prescribed burns, reducing wildfire risk, restoring culturally important plants, and enhancing operational efficiency. Fire departments across BC are concerned about changes to the FireSmart program and how funding is provided to communities as they plan for wildfires. The Ministry of Forests says it’s moving to a more “holistic approach” based on where risk is the highest but the fire chief who was at the centre of the Wesley Ridge wildfire on Vancouver Island last summer says the program is too important to change. Nick Acciavatti says funding from the provincial FireSmart program was instrumental in saving numerous homes in the Wesley Ridge fire. …The program provides funding to local fire departments that then go into local neighbourhoods to educate and undertake fire prevention work like brush clearing and cleaning properties of combustible materials. But that money may no longer be available to any fire department that applies for it is something Acciavatti is concerned about, considering the changing wildfire conditions here on Vancouver Island.

Fire departments across BC are concerned about changes to the FireSmart program and how funding is provided to communities as they plan for wildfires. The Ministry of Forests says it’s moving to a more “holistic approach” based on where risk is the highest but the fire chief who was at the centre of the Wesley Ridge wildfire on Vancouver Island last summer says the program is too important to change. Nick Acciavatti says funding from the provincial FireSmart program was instrumental in saving numerous homes in the Wesley Ridge fire. …The program provides funding to local fire departments that then go into local neighbourhoods to educate and undertake fire prevention work like brush clearing and cleaning properties of combustible materials. But that money may no longer be available to any fire department that applies for it is something Acciavatti is concerned about, considering the changing wildfire conditions here on Vancouver Island.

Montreal — An activist group calling itself Les Robins des ruelles has followed its recent Robin Hood-style grocery store heists in Montreal with a claim to have sabotaged planned logging operations in a forest in the Mauricie region. …Translated as the Robins of the Alleyways, the group’s name is intended to evoke the legendary English folk hero who robbed from the rich to give to the poor. The group says on social media that although it delivered the booty to community kitchens and low-cost housing complexes, the grocery heists were political statements against the current economic order. …The latest such move by the group seems to be an action intended to discourage logging in some old-growth forests of Mékinac, in the Mauricie region. In a statement … the Robins say they have “armed the forest by driving steel bars through the trees on the site.” …The president of Forex Langlois Inc., said he is taking the sabotage claims “very seriously”

Montreal — An activist group calling itself Les Robins des ruelles has followed its recent Robin Hood-style grocery store heists in Montreal with a claim to have sabotaged planned logging operations in a forest in the Mauricie region. …Translated as the Robins of the Alleyways, the group’s name is intended to evoke the legendary English folk hero who robbed from the rich to give to the poor. The group says on social media that although it delivered the booty to community kitchens and low-cost housing complexes, the grocery heists were political statements against the current economic order. …The latest such move by the group seems to be an action intended to discourage logging in some old-growth forests of Mékinac, in the Mauricie region. In a statement … the Robins say they have “armed the forest by driving steel bars through the trees on the site.” …The president of Forex Langlois Inc., said he is taking the sabotage claims “very seriously”  Strategically planting trees along the northern edge of Canada’s boreal forest could remove multiple gigatonnes of carbon dioxide from the atmosphere by the end of the century, according to a new study led by researchers at the University of Waterloo. The research, published in

Strategically planting trees along the northern edge of Canada’s boreal forest could remove multiple gigatonnes of carbon dioxide from the atmosphere by the end of the century, according to a new study led by researchers at the University of Waterloo. The research, published in