The UBC Alumni Builder Awards recognize alumni who have significantly contributed to the university and enriched the lives of others, and in doing so, have supported alumni UBC’s vision of a global alumni community for an exceptional UBC and a better world. We are proud to honour this year’s Alumni Builder Awards recipients whose generous contributions have been recognized by their UBC faculty.

Nick Arkle, BSF’84, and Louise Arkle, BA’82, MA’85

Nick Arkle, BSF’84, and Louise Arkle, BA’82, MA’85

Office of the Principal and Deputy Vice – Chancellor

Nick and Louise Arkle are community leaders and philanthropists whose dedication has strengthened UBC Okanagan and the broader region. As CEO of Gorman Group, Nick has advanced BC’s forestry sector while providing influential leadership across the profession, championing initiatives that strengthen industry and trade. He has supported community growth through the Kelowna Chamber of Commerce, United Way, and the Central Okanagan Economic Development Commission, while also serving on the inaugural UBC Okanagan Advisory Council. Louise is a dedicated advocate for education and community development, working to expand equity and opportunity, serving in several leadership roles for the Central Okanagan Bursary and Scholarship Society and as a volunteer for the Loran Scholars Foundation.

John Mohammed, BSc(ForSci)’91

John Mohammed, BSc(ForSci)’91

Faculty of Forestry

John Mohammed is president of A&A Trading, a BC-based family forestry company. With deep industry roots and experience across logging, timber valuation, and trading, he is a respected leader in the sector. John actively hires UBC graduates and co-leads an annual exercise in negotiation that equips students with essential career skills, an initiative now adopted and being used in other areas of the faculty. John’s dedication to mentorship and education has made a lasting impact on the next generation of forestry professionals. As a board member of the BC Council of Forest Industries, he continues to champion leadership and learning.

Canada’s forest industry is being dismantled in plain sight. …For decades, Canada built its forest economy around a single export market and a narrow set of commodity products. That strategy has now been exposed as dangerously fragile. Our closest trading partner has proven unreliable, and the cost of over-dependence is being paid by rural workers and regions across the country. Canada does not have a forestry problem. We have a market diversification problem. Ironically, today’s global uncertainty has created a once-in-a-generation opportunity. …Capital is mobile, and companies are actively looking for stable jurisdictions in which to build new production facilities. Canada can and should be at the top of that list—but we need to build the foundational infrastructure to make this happen. …The federal government’s new Canadian Forest Sector Transformation Task Force opens a critical window to address structural weaknesses in Canada’s forest economy.

Canada’s forest industry is being dismantled in plain sight. …For decades, Canada built its forest economy around a single export market and a narrow set of commodity products. That strategy has now been exposed as dangerously fragile. Our closest trading partner has proven unreliable, and the cost of over-dependence is being paid by rural workers and regions across the country. Canada does not have a forestry problem. We have a market diversification problem. Ironically, today’s global uncertainty has created a once-in-a-generation opportunity. …Capital is mobile, and companies are actively looking for stable jurisdictions in which to build new production facilities. Canada can and should be at the top of that list—but we need to build the foundational infrastructure to make this happen. …The federal government’s new Canadian Forest Sector Transformation Task Force opens a critical window to address structural weaknesses in Canada’s forest economy.  OTTAWA — Canada’s premiers are set for two days of huddling in the nation’s capital with the economy, affordability and trade expected to be high on the agenda. The premiers meet with Prime Minister Mark Carney on Thursday, and will want to show a united “Team Canada” front as trade tensions rise again with Canada’s largest trading partner. The meetings come a year after U.S. President Donald Trump assumed office and hit Canada with blistering tariffs, and just ahead of negotiations to renew the Canada-United States-Mexico agreement, due for its first formal review this summer. Trump threatened Canada in recent days with 100% across-the-board tariffs on exports, which would land on top of the sectors already hit by steep U.S. tariffs, such as steel, softwood lumber and vehicles. Ontario Premier Doug Ford said the premiers will show they stand united as the whole Canadian economy remains under attack.

OTTAWA — Canada’s premiers are set for two days of huddling in the nation’s capital with the economy, affordability and trade expected to be high on the agenda. The premiers meet with Prime Minister Mark Carney on Thursday, and will want to show a united “Team Canada” front as trade tensions rise again with Canada’s largest trading partner. The meetings come a year after U.S. President Donald Trump assumed office and hit Canada with blistering tariffs, and just ahead of negotiations to renew the Canada-United States-Mexico agreement, due for its first formal review this summer. Trump threatened Canada in recent days with 100% across-the-board tariffs on exports, which would land on top of the sectors already hit by steep U.S. tariffs, such as steel, softwood lumber and vehicles. Ontario Premier Doug Ford said the premiers will show they stand united as the whole Canadian economy remains under attack.

Cherie Whelan has been named the new chief executive officer of the B.C. Forest Safety Council. She takes over on April 1 from Rob Moonen, who announced his retirement in October. Whelan served as CEO of the Newfoundland & Labrador Construction Safety Association for two years and previously held the position of director of SAFE Companies at B.C. Forest Safety Council. The Nanaimo-based council delivers safety training and advisory services to British Columbia’s forest industry.

Cherie Whelan has been named the new chief executive officer of the B.C. Forest Safety Council. She takes over on April 1 from Rob Moonen, who announced his retirement in October. Whelan served as CEO of the Newfoundland & Labrador Construction Safety Association for two years and previously held the position of director of SAFE Companies at B.C. Forest Safety Council. The Nanaimo-based council delivers safety training and advisory services to British Columbia’s forest industry. The Regional District of Nanaimo board will plead with fellow municipalities to pressure the B.C. and Canadian governments to prohibit raw log exports. At the Jan. 27 RDN board meeting, Paul Manly, City of Nanaimo director, proposed a resolution for the upcoming Association of Vancouver Island and Coastal Communities conference, asking B.C. local governments to call on senior government to “ban the export of raw logs and lumber cants from B.C. to ensure that forests harvested [on] Crown land and private-managed forest lands are processed in B.C.…” The resolution passed and will be brought before AVICC. Should it pass there, it would be forwarded to the Union of B.C. Municipalities. Manly …pointed to recent mill closures on the Island, with a key factor being “lack of accessible and affordable fibre”. …Leanne Salter, Coombs area director, said she thought the resolution needed to be tweaked.

The Regional District of Nanaimo board will plead with fellow municipalities to pressure the B.C. and Canadian governments to prohibit raw log exports. At the Jan. 27 RDN board meeting, Paul Manly, City of Nanaimo director, proposed a resolution for the upcoming Association of Vancouver Island and Coastal Communities conference, asking B.C. local governments to call on senior government to “ban the export of raw logs and lumber cants from B.C. to ensure that forests harvested [on] Crown land and private-managed forest lands are processed in B.C.…” The resolution passed and will be brought before AVICC. Should it pass there, it would be forwarded to the Union of B.C. Municipalities. Manly …pointed to recent mill closures on the Island, with a key factor being “lack of accessible and affordable fibre”. …Leanne Salter, Coombs area director, said she thought the resolution needed to be tweaked.

A federal task force announced earlier this month will attempt to save Canada’s stricken forest industry from further decline through product and market diversification. While the support will no doubt be welcomed by the industry, in BC the more immediate need is access to timber. Canada’s forestry sector has been pummeled by a one-two punch of low lumber prices, and US duties on softwood lumber. The situation is particularly dire in BC where an integrated industry of lumber, remanufacturing, pulp and pellet mills has been collapsing like a row of dominos. …The industry is in crisis, a number of speakers said at the

A federal task force announced earlier this month will attempt to save Canada’s stricken forest industry from further decline through product and market diversification. While the support will no doubt be welcomed by the industry, in BC the more immediate need is access to timber. Canada’s forestry sector has been pummeled by a one-two punch of low lumber prices, and US duties on softwood lumber. The situation is particularly dire in BC where an integrated industry of lumber, remanufacturing, pulp and pellet mills has been collapsing like a row of dominos. …The industry is in crisis, a number of speakers said at the  VICTORIA — The president of the Tahltan Central Government, Kerry Carlick, said British Columbia shouldn’t change its Declaration on the Rights of Indigenous Peoples Act, just as the First Nation and the provincial government celebrate a landmark agreement based on the legislation. Carlick said it is not a “good idea to take anything away from DRIPA,” adding that “if anything, it should be strengthened.” Carlick was speaking at an event with deputy premier Niki Sharma where they co-signed an agreement to share mineral tax revenue from the Eskay Creek mine. The ceremony came after the provincial government issued an environmental assessment certificate to Eskay Creek Mining Ltd. to restart gold and silver mining after a first-of-its kind collaborative assessment process with the First Nation under DRIPA. The provincial government has said it plans to revise the act after a series of court rulings around Aboriginal title, responding specifically to those decisions.

VICTORIA — The president of the Tahltan Central Government, Kerry Carlick, said British Columbia shouldn’t change its Declaration on the Rights of Indigenous Peoples Act, just as the First Nation and the provincial government celebrate a landmark agreement based on the legislation. Carlick said it is not a “good idea to take anything away from DRIPA,” adding that “if anything, it should be strengthened.” Carlick was speaking at an event with deputy premier Niki Sharma where they co-signed an agreement to share mineral tax revenue from the Eskay Creek mine. The ceremony came after the provincial government issued an environmental assessment certificate to Eskay Creek Mining Ltd. to restart gold and silver mining after a first-of-its kind collaborative assessment process with the First Nation under DRIPA. The provincial government has said it plans to revise the act after a series of court rulings around Aboriginal title, responding specifically to those decisions. Make an impact with our Forestry Program Management Consulting Team as a Consultant and program lead. Our diverse team of professionals deliver program administration for a large forestry grant funding organization. As a trusted advisor, you’ll collaborate with the team in the delivery of forestry-related projects within the funding programs. Our team is based in Edmonton and works in our downtown office, this is an in-person, on-site position. The forestry Consultant supports the delivery and administration of forestry funding programs, working with government, industry, Indigenous groups, academics, and other stakeholders. The role involves managing and assessing projects such as silviculture, habitat restoration, wildfire mitigation, and forest health, including tracking activities, reviewing deliverables and expenses, and preparing reports. Responsibilities also include proposal review support, developing Requests for Proposals, limited GIS use, occasional field assessments, and providing advice to senior management and boards, while contributing to the growth of MNP’s forestry consulting practice.

Make an impact with our Forestry Program Management Consulting Team as a Consultant and program lead. Our diverse team of professionals deliver program administration for a large forestry grant funding organization. As a trusted advisor, you’ll collaborate with the team in the delivery of forestry-related projects within the funding programs. Our team is based in Edmonton and works in our downtown office, this is an in-person, on-site position. The forestry Consultant supports the delivery and administration of forestry funding programs, working with government, industry, Indigenous groups, academics, and other stakeholders. The role involves managing and assessing projects such as silviculture, habitat restoration, wildfire mitigation, and forest health, including tracking activities, reviewing deliverables and expenses, and preparing reports. Responsibilities also include proposal review support, developing Requests for Proposals, limited GIS use, occasional field assessments, and providing advice to senior management and boards, while contributing to the growth of MNP’s forestry consulting practice. The Municipality of North Cowichan says it is preparing for the possibility of another mill closure in Chemainus, while hoping it can be avoided. Western Forest Products announced Friday it is extending curtailment at the Chemainus sawmill, affecting about 150 workers. Mayor Rob Douglas said the priority is protecting jobs and preparing for potential financial impacts. “We’re going to be looking at impacts on our tax base, especially with the municipality already seeing the effects of the Crofton mill closure this year,” Douglas said. “We’ll prepare for the potential closure of the Chemainus mill in 2027.” Douglas said a permanent closure in Chemainus would affect future finances, but not to the same extent as the Crofton mill shutdown. “Western Forest Products has three sites, and with two of them operating that will continue to provide a significant portion of our industrial tax revenue,” he said.

The Municipality of North Cowichan says it is preparing for the possibility of another mill closure in Chemainus, while hoping it can be avoided. Western Forest Products announced Friday it is extending curtailment at the Chemainus sawmill, affecting about 150 workers. Mayor Rob Douglas said the priority is protecting jobs and preparing for potential financial impacts. “We’re going to be looking at impacts on our tax base, especially with the municipality already seeing the effects of the Crofton mill closure this year,” Douglas said. “We’ll prepare for the potential closure of the Chemainus mill in 2027.” Douglas said a permanent closure in Chemainus would affect future finances, but not to the same extent as the Crofton mill shutdown. “Western Forest Products has three sites, and with two of them operating that will continue to provide a significant portion of our industrial tax revenue,” he said.

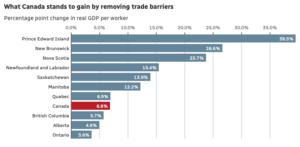

Canada’s economy could gain nearly 7%, or $210 billion, in real GDP over a gradual period by fully removing internal trade barriers between the country’s 13 provinces and territories, according to a report published Tuesday by the International Monetary Fund (IMF). On average, regulation-related barriers are the equivalent of a 9% tariff nationally, estimates the report, which was co-authored by IMF researchers Federico J. Diez and Yuanchen Yang with contributions from University of Calgary economist Trevor Tombe. …Because of the trade barriers between provinces, “Canada isn’t really one economy. It’s really 10 economies,” said Alicia Planincic, director of policy and economics at the Business Council of Alberta in Calgary. …The report points to finance, telecom, transportation and professional services as far-reaching sectors that “ripple through the economy” and raise costs for all of the businesses they touch.

Canada’s economy could gain nearly 7%, or $210 billion, in real GDP over a gradual period by fully removing internal trade barriers between the country’s 13 provinces and territories, according to a report published Tuesday by the International Monetary Fund (IMF). On average, regulation-related barriers are the equivalent of a 9% tariff nationally, estimates the report, which was co-authored by IMF researchers Federico J. Diez and Yuanchen Yang with contributions from University of Calgary economist Trevor Tombe. …Because of the trade barriers between provinces, “Canada isn’t really one economy. It’s really 10 economies,” said Alicia Planincic, director of policy and economics at the Business Council of Alberta in Calgary. …The report points to finance, telecom, transportation and professional services as far-reaching sectors that “ripple through the economy” and raise costs for all of the businesses they touch.  The Bank of Canada held its overnight interest rate steady at 2.25 per cent on Wednesday in a move widely expected by economists. The announcement comes amid ongoing trade uncertainty, with increased focus on the negotiation of the Canada-U.S.-Mexico Agreement and a murky outlook for the Canadian economy later in the year. Ahead of the announcement, economists polled by Reuters were unanimous in their expectations for a hold today, and nearly 75% forecast the central bank will stay on hold through 2026. In its December decision the Bank also held its policy rate stable. …“While this rate hold provides some stability, other factors such as economic uncertainty, potential job loss and affordability are continuing to put downward pressure on the housing market,” Rates.ca mortgage and real estate expert Victor Tran said in a statement following today’s decision.”

The Bank of Canada held its overnight interest rate steady at 2.25 per cent on Wednesday in a move widely expected by economists. The announcement comes amid ongoing trade uncertainty, with increased focus on the negotiation of the Canada-U.S.-Mexico Agreement and a murky outlook for the Canadian economy later in the year. Ahead of the announcement, economists polled by Reuters were unanimous in their expectations for a hold today, and nearly 75% forecast the central bank will stay on hold through 2026. In its December decision the Bank also held its policy rate stable. …“While this rate hold provides some stability, other factors such as economic uncertainty, potential job loss and affordability are continuing to put downward pressure on the housing market,” Rates.ca mortgage and real estate expert Victor Tran said in a statement following today’s decision.” In November, the volume of cargo carried by Canadian railways was up slightly (+0.5%) from November 2024 to 31.4 million tonnes. Higher volumes of intermodal shipments (mainly containers) as well as higher carloadings of wheat largely contributed to the increase in November 2025. The overall freight volume in November was on par with the five-year average of 31.5 million tonnes for the month. …Growth in non-intermodal freight loadings in November was moderated by declines in several commodities. Loadings of other oil seeds and nuts, and other agricultural products were down sharply by 35.4% (-312 000 tonnes) year over year—the largest drop in tonnage since December 2018. In November 2025, loadings of iron ores and concentrates decreased 6.4% (-287 000 tonnes) compared with November 2024, while loadings of lumber were down 22.1% (-143 000 tonnes), a fourth consecutive month of year-over-year decline.

In November, the volume of cargo carried by Canadian railways was up slightly (+0.5%) from November 2024 to 31.4 million tonnes. Higher volumes of intermodal shipments (mainly containers) as well as higher carloadings of wheat largely contributed to the increase in November 2025. The overall freight volume in November was on par with the five-year average of 31.5 million tonnes for the month. …Growth in non-intermodal freight loadings in November was moderated by declines in several commodities. Loadings of other oil seeds and nuts, and other agricultural products were down sharply by 35.4% (-312 000 tonnes) year over year—the largest drop in tonnage since December 2018. In November 2025, loadings of iron ores and concentrates decreased 6.4% (-287 000 tonnes) compared with November 2024, while loadings of lumber were down 22.1% (-143 000 tonnes), a fourth consecutive month of year-over-year decline. In the construction industry, ideas or materials first seen on the margins of construction processes later become an established part of those processes. …And so it seems to be with Mass Timber Construction (MTC). MTC entered the construction industry as an intriguing approach to reduce embodied carbon. …Today, MTC has become a mainstream building method. Across North America, there are reportedly 2,500 MTC buildings already built or in the planning stages. Similar levels of acceptance are seen in Europe. The world’s leading architects and designers have embraced MTC by incorporating wood components into a wide range of building types and sizes, from commercial offices to housing, campuses, infrastructure and even data centres. Interest and acceptance have moved beyond the pure environmental benefits of using MTC. Economics, simple dollars and cents, are now recognized as a persuasive factor as well. This is because mass timber changes the mechanics of construction.

In the construction industry, ideas or materials first seen on the margins of construction processes later become an established part of those processes. …And so it seems to be with Mass Timber Construction (MTC). MTC entered the construction industry as an intriguing approach to reduce embodied carbon. …Today, MTC has become a mainstream building method. Across North America, there are reportedly 2,500 MTC buildings already built or in the planning stages. Similar levels of acceptance are seen in Europe. The world’s leading architects and designers have embraced MTC by incorporating wood components into a wide range of building types and sizes, from commercial offices to housing, campuses, infrastructure and even data centres. Interest and acceptance have moved beyond the pure environmental benefits of using MTC. Economics, simple dollars and cents, are now recognized as a persuasive factor as well. This is because mass timber changes the mechanics of construction.

The BC Truck Loggers Association sent a letter to the North Island College regarding the potential discontinuation of two forestry programs. This would mean a significant loss of forestry education for the forest industry, and we’re asking for your support by copying and pasting our letter into an email and sending it to the college Board of Governors at bog@nic.bc.ca …The North Island College forestry programs are an essential contributor to education and economic opportunity for students in Campbell River and the north Island and provides an important stream of new graduates for forestry businesses. The program has strong backing from local industry, government and First Nations, and it would be regrettable to see the program discontinued at a time when sustained investment in forestry education is vital to British Columbia’s future.

The BC Truck Loggers Association sent a letter to the North Island College regarding the potential discontinuation of two forestry programs. This would mean a significant loss of forestry education for the forest industry, and we’re asking for your support by copying and pasting our letter into an email and sending it to the college Board of Governors at bog@nic.bc.ca …The North Island College forestry programs are an essential contributor to education and economic opportunity for students in Campbell River and the north Island and provides an important stream of new graduates for forestry businesses. The program has strong backing from local industry, government and First Nations, and it would be regrettable to see the program discontinued at a time when sustained investment in forestry education is vital to British Columbia’s future.

We are pleased to announce the upcoming

We are pleased to announce the upcoming

Nature markets are systems for measuring an ecological improvement on some land, then creating a representation of that improvement as a credit, which can then be bought and sold. In theory, they allow governments to attract more private investment and diversify funds that help restore nature. The reality is much more complicated. I recently

Nature markets are systems for measuring an ecological improvement on some land, then creating a representation of that improvement as a credit, which can then be bought and sold. In theory, they allow governments to attract more private investment and diversify funds that help restore nature. The reality is much more complicated. I recently  Record forest fires, under-utilized agricultural residues like straw and husks and struggling sawmills have left Canada with an abundance of undervalued biomass. If carefully and strategically managed, this resource could become a powerful ally in the fight against climate change. Canada’s biomass sectors are facing significant uncertainty because of political and natural disruptions. The forestry sector was hit last year by new American tariffs announced by the Donald Trump administration on Canadian forest products, bringing the total duties imposed on Canadian lumber to 45 per cent. The agricultural and agri-food sector is also particularly vulnerable, since it exports more than 70 per cent of its main crops. In addition to facing these political uncertainties, biomass sectors are increasingly experiencing the effects of climate disasters.

Record forest fires, under-utilized agricultural residues like straw and husks and struggling sawmills have left Canada with an abundance of undervalued biomass. If carefully and strategically managed, this resource could become a powerful ally in the fight against climate change. Canada’s biomass sectors are facing significant uncertainty because of political and natural disruptions. The forestry sector was hit last year by new American tariffs announced by the Donald Trump administration on Canadian forest products, bringing the total duties imposed on Canadian lumber to 45 per cent. The agricultural and agri-food sector is also particularly vulnerable, since it exports more than 70 per cent of its main crops. In addition to facing these political uncertainties, biomass sectors are increasingly experiencing the effects of climate disasters.

The Arctic Bioenergy Summit and Tour: Sustainable Bioenergy for Northern Communities: Reliable. Affordable. Local. starts today in Yellowknife and runs until January 28. Hosted by the Arctic Energy Alliance and the Wood Pellet Association of Canada, this in-person event replaces the 2026 edition of the Northwest Territories Biomass Week and brings together energy leaders, policymakers, and practitioners from across Canada to explore sustainable bioenergy solutions for northern and remote communities. The Summit begins with a full-day tour of local biomass installations, including bioheat and district heat systems, followed by a two-day conference at Chateau Nova. …For those involved in biomass boiler operations, the Arctic Energy Alliance will also host a two-day NWT Biomass Boiler and Heating Plant Training Session, January 29 and 30, 2026.

The Arctic Bioenergy Summit and Tour: Sustainable Bioenergy for Northern Communities: Reliable. Affordable. Local. starts today in Yellowknife and runs until January 28. Hosted by the Arctic Energy Alliance and the Wood Pellet Association of Canada, this in-person event replaces the 2026 edition of the Northwest Territories Biomass Week and brings together energy leaders, policymakers, and practitioners from across Canada to explore sustainable bioenergy solutions for northern and remote communities. The Summit begins with a full-day tour of local biomass installations, including bioheat and district heat systems, followed by a two-day conference at Chateau Nova. …For those involved in biomass boiler operations, the Arctic Energy Alliance will also host a two-day NWT Biomass Boiler and Heating Plant Training Session, January 29 and 30, 2026.