Russ Taylor travelled in Europe and China in October to obtain a first-hand view of market conditions.

My personal view is that the real situation is probably worse that what is being reported. European demand will be about 11% lower in 2023 vs. 2022 and lower again in 2024. China’s consumption levels are completely stalled from a construction market in chaos. Consequently, it is going to take until some time next year for a recovery to occur. …Overall consumer sentiment in China is at a 12-month low as there continue to be lingering concerns over the future of the Chinese construction market. This has been not only a key driver of the economy (up to 24% of GDP but now closer to 19%), but a key driver in the wealth of Chinese citizens. With the construction industry awash in massive debts and no clear path ahead, this is having a negative impact on end users’ demand for imported logs and low-grade lumber for use in construction.

Inventories of logs and lumber at ocean ports and distribution yards are very low in China, especially when compared to previous years. …Most importers in China are worried about what happens after Chinese New Year in 2024. They remember very clearly what happened in 2023, as everyone thought there would be rising demand and higher prices after the COVID lockdowns were removed. The opposite occurred, and many overbought high-priced lumber in all grades in first quarter 2023 and have been licking their wounds ever since. …If there are more shocks to consumer confidence, then all bets are off for any increases in imported logs or lumber or prices until well after Chinese New Year in 2024. …This all means that lumber exporters to China should be also careful on their shipment volumes, as their future business in China could be negatively impacted if prices decline from weaker demand and/or there are excessive inventories after Chinese New Year.

UPM business units UPM Pulp, UPM Timber, UPM Communication Papers and UPM Biofuels will start change negotiations on possible temporary layoffs. The negotiations are conducted to prepare for possible temporary adjustment of production in the Finnish units should the uncertainty in the operating environment continue, UPM announced. Earlier this year, the company already conducted change negotiations concerning temporary layoffs in UPM Specialty Papers, UPM Plywood, UPM Raflatac, UPM Biocomposites and UPM Raumacell. The current negotiations affect all UPM pulp mills, sawmills, and graphic paper mills in Finland, as well as the Lappeenranta biorefinery. …Possible temporary layoffs could take place from 1 January until 30 June 2024 in UPM Pulp, UPM Timber and UPM Biofuels and from 1 March until 31 August 2024 in UPM Communication Papers.

UPM business units UPM Pulp, UPM Timber, UPM Communication Papers and UPM Biofuels will start change negotiations on possible temporary layoffs. The negotiations are conducted to prepare for possible temporary adjustment of production in the Finnish units should the uncertainty in the operating environment continue, UPM announced. Earlier this year, the company already conducted change negotiations concerning temporary layoffs in UPM Specialty Papers, UPM Plywood, UPM Raflatac, UPM Biocomposites and UPM Raumacell. The current negotiations affect all UPM pulp mills, sawmills, and graphic paper mills in Finland, as well as the Lappeenranta biorefinery. …Possible temporary layoffs could take place from 1 January until 30 June 2024 in UPM Pulp, UPM Timber and UPM Biofuels and from 1 March until 31 August 2024 in UPM Communication Papers.  AUSTRALIA — A pulp mill using recycled fibre is set to be built in Australia that will then export the output material. An investment of AUD$137 million (£72 million) is being made into what will be Australia’s largest paper recycling facility that will be located in South East Queensland. It is a joint initiative by Auswaste Recycling and the state of Queensland and Australian national Government. The new facility will process an estimated 220,000 tonnes per annum of recycled waste paper and cardboard into pulp for export. The Australian Recycled Pulp and Paper Project (ARPPP) forms part of a AUD$1 billion (£524 million) plan to boost recycling infrastructure across the country, while supporting jobs and keeping valuable material out of landfill. …Construction of the ARPPP facilities is planned to commence mid 2024, and projected to be completed in the middle of 2025.

AUSTRALIA — A pulp mill using recycled fibre is set to be built in Australia that will then export the output material. An investment of AUD$137 million (£72 million) is being made into what will be Australia’s largest paper recycling facility that will be located in South East Queensland. It is a joint initiative by Auswaste Recycling and the state of Queensland and Australian national Government. The new facility will process an estimated 220,000 tonnes per annum of recycled waste paper and cardboard into pulp for export. The Australian Recycled Pulp and Paper Project (ARPPP) forms part of a AUD$1 billion (£524 million) plan to boost recycling infrastructure across the country, while supporting jobs and keeping valuable material out of landfill. …Construction of the ARPPP facilities is planned to commence mid 2024, and projected to be completed in the middle of 2025.

UK — Commercial forestry values fell for the first time in almost a decade with a 10%-20% drop in the past year, according to a new industry

UK — Commercial forestry values fell for the first time in almost a decade with a 10%-20% drop in the past year, according to a new industry  In a year marked just as much by closures and downtime as with facility openings, companies across the paper industry are hopeful a demand boost is on the horizon. Since the start of the year, WestRock, Packaging Corp. of America, International Paper, Greif, Domtar and ND Paper all have announced shutdowns in response to what has been a challenging market, with box demand reaching lows not seen in more than a decade. …“International Paper has been rolling downtime through their mills; WestRock’s done permanent closures; [and] Packaging Corp. [of America] has done a … permanent idle of sorts of their new Wallula [, Washington] mill.” While all three of those companies have reported less downtime quarter to quarter, they each continue to report significant economic downtime compared with a year ago.

In a year marked just as much by closures and downtime as with facility openings, companies across the paper industry are hopeful a demand boost is on the horizon. Since the start of the year, WestRock, Packaging Corp. of America, International Paper, Greif, Domtar and ND Paper all have announced shutdowns in response to what has been a challenging market, with box demand reaching lows not seen in more than a decade. …“International Paper has been rolling downtime through their mills; WestRock’s done permanent closures; [and] Packaging Corp. [of America] has done a … permanent idle of sorts of their new Wallula [, Washington] mill.” While all three of those companies have reported less downtime quarter to quarter, they each continue to report significant economic downtime compared with a year ago.

AUSTRALIA – Timber adoption as a pathway to decarbonising construction has captured the imagination of the Australian construction industry. …Many organisations, including the Materials Embodied Carbon Leaders’ Alliance support the uptake of more engineered wood products as the market and industry expands. …But, despite the growing interest in timber and the recognition that it is a low carbon alternative building material, there are still several barriers to its uptake in the Australian market. On Wednesday, MECLA hosted a Spotlight on Timber Myth Busting. Industry professionals across the supply chain confronted some of the prevailing myths around timber use. The conversation addressed a range of myths. … Karl-Heinz Weiss, director at Weiss Insights, explored the challenges around insuring mid-rise timber buildings because of misperceptions of fire risk among insurers.

AUSTRALIA – Timber adoption as a pathway to decarbonising construction has captured the imagination of the Australian construction industry. …Many organisations, including the Materials Embodied Carbon Leaders’ Alliance support the uptake of more engineered wood products as the market and industry expands. …But, despite the growing interest in timber and the recognition that it is a low carbon alternative building material, there are still several barriers to its uptake in the Australian market. On Wednesday, MECLA hosted a Spotlight on Timber Myth Busting. Industry professionals across the supply chain confronted some of the prevailing myths around timber use. The conversation addressed a range of myths. … Karl-Heinz Weiss, director at Weiss Insights, explored the challenges around insuring mid-rise timber buildings because of misperceptions of fire risk among insurers.

AMSTERDAM — Built by Nature, a network and grant-making fund, has announced a global prize totalling €500,000 to recognise innovation and stimulate scalability in the use of biobased materials such as timber, bamboo, hemp, straw, algae, and fungi in construction. The built environment generates up to 40% of the world’s greenhouse gases, and the increased use of sustainably sourced timber and renewable biobased materials offers a tangible, realistic solution to address climate change through decarbonisation of our cities and buildings. …The Built by Nature Prize aims to identify and attract biobased construction material manufacturers and their market-ready innovations from all regions and help those producers overcome barriers to mainstream market entry. …To qualify, proposed solutions must… already be in market, whether through an early-stage pilot project or openly available.

AMSTERDAM — Built by Nature, a network and grant-making fund, has announced a global prize totalling €500,000 to recognise innovation and stimulate scalability in the use of biobased materials such as timber, bamboo, hemp, straw, algae, and fungi in construction. The built environment generates up to 40% of the world’s greenhouse gases, and the increased use of sustainably sourced timber and renewable biobased materials offers a tangible, realistic solution to address climate change through decarbonisation of our cities and buildings. …The Built by Nature Prize aims to identify and attract biobased construction material manufacturers and their market-ready innovations from all regions and help those producers overcome barriers to mainstream market entry. …To qualify, proposed solutions must… already be in market, whether through an early-stage pilot project or openly available. SAO PAULO – Brazil plans to propose a “huge” fund to pay for the conservation of tropical forests at the United Nations COP28 climate change summit that begins later this month in Dubai. That potential financing mechanism, not previously reported, would be the latest in a proliferation of multilateral environmental funds. Countries agreed in the past year to establish a giant fund dedicated to biodiversity and another to pay for the destruction caused by climate change. The funds funnel money from rich countries to poor developing nations that struggle to otherwise pay for their environmental efforts. Brazil is the world’s largest rainforest nation and contains some 60% of the Amazon jungle. It is seen as vital to curbing climate change and protecting unique plant and animal species. …The fund would not value forest conservation in terms of carbon, since protecting forests would primarily prevent further greenhouse gas emissions rather than absorbing additional CO2.

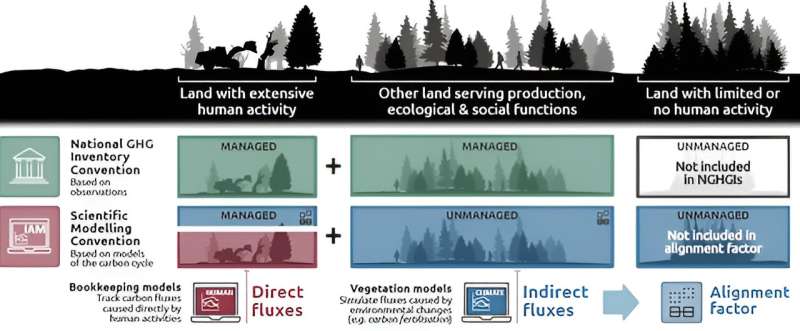

SAO PAULO – Brazil plans to propose a “huge” fund to pay for the conservation of tropical forests at the United Nations COP28 climate change summit that begins later this month in Dubai. That potential financing mechanism, not previously reported, would be the latest in a proliferation of multilateral environmental funds. Countries agreed in the past year to establish a giant fund dedicated to biodiversity and another to pay for the destruction caused by climate change. The funds funnel money from rich countries to poor developing nations that struggle to otherwise pay for their environmental efforts. Brazil is the world’s largest rainforest nation and contains some 60% of the Amazon jungle. It is seen as vital to curbing climate change and protecting unique plant and animal species. …The fund would not value forest conservation in terms of carbon, since protecting forests would primarily prevent further greenhouse gas emissions rather than absorbing additional CO2.

:focal(2400x1806:2401x1807)/https://tf-cmsv2-smithsonianmag-media.s3.amazonaws.com/filer_public/75/ed/75ed16cf-58d8-4bcd-ac46-e129dcf7a6be/dsc4464_copia.jpg)

Brazil is planning to launch a global financing framework to support tropical forests, according to government officials, as the country seeks to regain its role as an environmental leader at the upcoming UN climate summit in Dubai. Under the proposal, a fund would be created to offer compensation to residents and landowners who help preserve forested areas such as the Amazon. …“We need to have resources in volume, quantity and frequency to finance those who own forests,” Brazil’s environment minister said. “Because today the initiatives we have only encourage those who are deforesting to stop deforesting. They don’t encourage or pay those who are already preserving and keeping the forests standing.” One option being considered is an investment fund with money from institutional and other long-term investors, with a set rate of return. …The fund would be likely to be co-ordinated by a multilateral institution such as the World Bank.

Brazil is planning to launch a global financing framework to support tropical forests, according to government officials, as the country seeks to regain its role as an environmental leader at the upcoming UN climate summit in Dubai. Under the proposal, a fund would be created to offer compensation to residents and landowners who help preserve forested areas such as the Amazon. …“We need to have resources in volume, quantity and frequency to finance those who own forests,” Brazil’s environment minister said. “Because today the initiatives we have only encourage those who are deforesting to stop deforesting. They don’t encourage or pay those who are already preserving and keeping the forests standing.” One option being considered is an investment fund with money from institutional and other long-term investors, with a set rate of return. …The fund would be likely to be co-ordinated by a multilateral institution such as the World Bank.

The European Commission wants to introduce regulations to reduce the quantity of packaging and make it more sustainable, but environmental groups warn pressure is being put on forests to produce more paper, which some see as a more sustainable option. Across the world, three billion trees are cut down every year to meet the demand for paper packaging, according to environmental groups, and the pressure on forests keeps increasing as consumption goes up. According to the European Commission, the total mass of packaging waste generated in the EU rose by 20% in the ten years leading up to 2020, with paper and cardboard representing 41%. “Packaging production is set to increase by 19% between now and 2030 if nothing is done,” warned Hannah Mowat, campaign coordinator at Fern, a non-profit dedicated to protecting forests. But that could be about to change with the EU’s Packaging and Packaging Waste Regulation (PPWR), tabled in November last year.

The European Commission wants to introduce regulations to reduce the quantity of packaging and make it more sustainable, but environmental groups warn pressure is being put on forests to produce more paper, which some see as a more sustainable option. Across the world, three billion trees are cut down every year to meet the demand for paper packaging, according to environmental groups, and the pressure on forests keeps increasing as consumption goes up. According to the European Commission, the total mass of packaging waste generated in the EU rose by 20% in the ten years leading up to 2020, with paper and cardboard representing 41%. “Packaging production is set to increase by 19% between now and 2030 if nothing is done,” warned Hannah Mowat, campaign coordinator at Fern, a non-profit dedicated to protecting forests. But that could be about to change with the EU’s Packaging and Packaging Waste Regulation (PPWR), tabled in November last year.

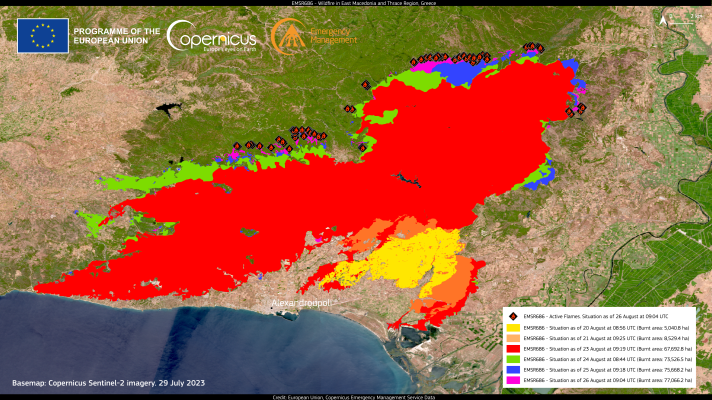

Earth is on track for 3 degrees Celsius of warming, and humanity needs to make deep emission cuts this decade to have a chance of fulfilling the goals of the Paris climate agreement, the United Nations said in a report released Monday. The findings come amid record setting global temperatures and as the amount of planet warming pollution in the atmosphere reaches new heights. It also underscores the enormity of the task facing climate negotiators as they prepare for talks in Dubai, United Arab Emirates, later this month. …The

Earth is on track for 3 degrees Celsius of warming, and humanity needs to make deep emission cuts this decade to have a chance of fulfilling the goals of the Paris climate agreement, the United Nations said in a report released Monday. The findings come amid record setting global temperatures and as the amount of planet warming pollution in the atmosphere reaches new heights. It also underscores the enormity of the task facing climate negotiators as they prepare for talks in Dubai, United Arab Emirates, later this month. …The