The Nova Scotia government is defending itself after three other provinces levelled accusations that it is being secretive and undermining Canada’s fight against the United States over softwood lumber. Nova Scotia is urging the US Department of Commerce to reject requests from Quebec, Alberta and Ontario for the Atlantic province to provide much greater detail on how it calculates fees charged for harvesting timber. …Nova Scotia asserts that it should not be blamed for its surveys of private timberland owners that could result in higher fees for cutting down trees when compared with other provinces. The US has levied countervailing duties, arguing that other provinces have tree-harvesting fees that are too low when compared with Nova Scotia, which is exempt from US lumber duties. …Lawyers for Quebec, Alberta and Ontario urged the Commerce Department to make inquiries, saying the US should even consider abandoning the private surveys as a benchmark. [to access the full story a Globe & Mail subscription is required]

The Nova Scotia government is defending itself after three other provinces levelled accusations that it is being secretive and undermining Canada’s fight against the United States over softwood lumber. Nova Scotia is urging the US Department of Commerce to reject requests from Quebec, Alberta and Ontario for the Atlantic province to provide much greater detail on how it calculates fees charged for harvesting timber. …Nova Scotia asserts that it should not be blamed for its surveys of private timberland owners that could result in higher fees for cutting down trees when compared with other provinces. The US has levied countervailing duties, arguing that other provinces have tree-harvesting fees that are too low when compared with Nova Scotia, which is exempt from US lumber duties. …Lawyers for Quebec, Alberta and Ontario urged the Commerce Department to make inquiries, saying the US should even consider abandoning the private surveys as a benchmark. [to access the full story a Globe & Mail subscription is required]

The Canadian and American economies are woven together tightly. So when Donald Trump slapped 25% tariffs on Canadian imports last year, many economists—myself included saw a disaster looming. …The most exposed sectors were those most dependent on US demand: steel, aluminum, autos, energy and lumber. …In our worst-case scenario, we expected it would shrink Canada’s GDP by 2.6 per cent, leading to a moderate recession and shaving nearly $2,000 a year off income for every Canadian. So far, however, that doomsday scenario hasn’t materialized. This was possible because of the Canada-US-Mexico trade agreement. …Avoiding the worst of the tariffs doesn’t mean we’ve won or even survived the trade war. Communities across the country are still hurting. …Regions in Quebec and British Columbia are under strain, with key industrial sectors—steel, aluminum, copper, lumber—are facing additional tariffs under Section 232 authority.

The Canadian and American economies are woven together tightly. So when Donald Trump slapped 25% tariffs on Canadian imports last year, many economists—myself included saw a disaster looming. …The most exposed sectors were those most dependent on US demand: steel, aluminum, autos, energy and lumber. …In our worst-case scenario, we expected it would shrink Canada’s GDP by 2.6 per cent, leading to a moderate recession and shaving nearly $2,000 a year off income for every Canadian. So far, however, that doomsday scenario hasn’t materialized. This was possible because of the Canada-US-Mexico trade agreement. …Avoiding the worst of the tariffs doesn’t mean we’ve won or even survived the trade war. Communities across the country are still hurting. …Regions in Quebec and British Columbia are under strain, with key industrial sectors—steel, aluminum, copper, lumber—are facing additional tariffs under Section 232 authority.

The National Lumber & Building Material Dealers Association (NLBMDA) released its

The National Lumber & Building Material Dealers Association (NLBMDA) released its

ATLANTA — A proposed amendment to the Georgia Constitution would end sales taxes on timber, a major industry battered by mill closings and storms. House Majority Leader Chuck Efstration said a bipartisan group of legislators want to help protect “a cornerstone of the state’s rural economy.” “The timber tax cut is necessary because Georgia timber farmers are facing severe economic hardship following the closure of multiple sawmills in Georgia and significant losses in the aftermath of Hurricane Helene,” said Efstration, R-Mulberry, the sponsor of House Resolution 1000. “Georgia is a national leader in forestry, and I want to help this state’s rural economy and the livelihood of many Georgians.” Georgia’s forestry industry was the largest in the nation in 2021 based on harvest volume and product export values of nearly $4 billion, according to a report by the Georgia Forestry Association. But timber producers have suffered in recent years.

ATLANTA — A proposed amendment to the Georgia Constitution would end sales taxes on timber, a major industry battered by mill closings and storms. House Majority Leader Chuck Efstration said a bipartisan group of legislators want to help protect “a cornerstone of the state’s rural economy.” “The timber tax cut is necessary because Georgia timber farmers are facing severe economic hardship following the closure of multiple sawmills in Georgia and significant losses in the aftermath of Hurricane Helene,” said Efstration, R-Mulberry, the sponsor of House Resolution 1000. “Georgia is a national leader in forestry, and I want to help this state’s rural economy and the livelihood of many Georgians.” Georgia’s forestry industry was the largest in the nation in 2021 based on harvest volume and product export values of nearly $4 billion, according to a report by the Georgia Forestry Association. But timber producers have suffered in recent years.

There are solid reasons to expect near-term strength in the US and Canadian construction markets. In the US, rapid technological progress and supportive federal policies are driving major investments in semiconductor fabrication, AI-related data centers, and energy infrastructure, with growing momentum toward nuclear power. In Canada, federal and provincial governments are promoting “nation-building” projects that emphasize LNG export capacity, port expansions, and new mines for critical minerals required by the digital economy. Both nations recognize that housing supply must rise substantially to meet population needs, signaling a long-term boost in residential construction. Yet, 2025 proved disappointing for overall construction performance, especially in employment. …Housing activity revealed a sharper divide between the two nations. U.S. housing starts in November 2025 dropped to an annualized 1.246 million units, the lowest since the pandemic. Most analysts believe the country needs at least 1.5 million starts per year to meet demand.

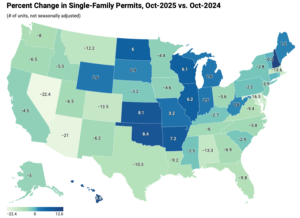

There are solid reasons to expect near-term strength in the US and Canadian construction markets. In the US, rapid technological progress and supportive federal policies are driving major investments in semiconductor fabrication, AI-related data centers, and energy infrastructure, with growing momentum toward nuclear power. In Canada, federal and provincial governments are promoting “nation-building” projects that emphasize LNG export capacity, port expansions, and new mines for critical minerals required by the digital economy. Both nations recognize that housing supply must rise substantially to meet population needs, signaling a long-term boost in residential construction. Yet, 2025 proved disappointing for overall construction performance, especially in employment. …Housing activity revealed a sharper divide between the two nations. U.S. housing starts in November 2025 dropped to an annualized 1.246 million units, the lowest since the pandemic. Most analysts believe the country needs at least 1.5 million starts per year to meet demand.  In October, single-family building permits weakened, reflecting continued caution among builders amid affordability constraints and financing challenges. In contrast, multifamily permit activity remained steady and continued to perform relatively well. Together, these trends suggest that while demand for new housing persists, builders are adjusting residential construction activity in response to evolving market conditions. Because permits typically precede construction starts, these patterns offer insight into the near-term outlook for residential building activity. Over the first ten months of 2025, the number of single-family permits issued nationwide reached 787,122. On a year-over-year basis, this represents a 7.0 percent decline compared with the October 2024 year-to-date total of 846,446. Multifamily permitting activity was stronger, with 426,352 permits issued nationwide, marking a 5.7 percent increase from the same period last year.

In October, single-family building permits weakened, reflecting continued caution among builders amid affordability constraints and financing challenges. In contrast, multifamily permit activity remained steady and continued to perform relatively well. Together, these trends suggest that while demand for new housing persists, builders are adjusting residential construction activity in response to evolving market conditions. Because permits typically precede construction starts, these patterns offer insight into the near-term outlook for residential building activity. Over the first ten months of 2025, the number of single-family permits issued nationwide reached 787,122. On a year-over-year basis, this represents a 7.0 percent decline compared with the October 2024 year-to-date total of 846,446. Multifamily permitting activity was stronger, with 426,352 permits issued nationwide, marking a 5.7 percent increase from the same period last year.

Global markets plunged Tuesday after President Trump reignited fears of a US trade war with the European Union, America’s largest trading partner. The president showed no signs of backing off his threat from Saturday to hit seven EU countries and the United Kingdom with new tariffs unless they supported his push for American control of Greenland. Asked if he would be willing to use force to seize the semi-autonomous Danish territory, Trump replied, “No comment,” on Monday. The S&P 500 sold off by around 1.3% in early trading, while the Nasdaq Composite plunged 1.7%. The Dow Jones Industrial Average dropped more than 600 points. The S&P 500 has erased its gains for the year so far. Investors also sold off U.S. government bonds, driving up interest rates. Rising returns on US treasuries usually translate into higher mortgage rates and interest on new personal loans.

Global markets plunged Tuesday after President Trump reignited fears of a US trade war with the European Union, America’s largest trading partner. The president showed no signs of backing off his threat from Saturday to hit seven EU countries and the United Kingdom with new tariffs unless they supported his push for American control of Greenland. Asked if he would be willing to use force to seize the semi-autonomous Danish territory, Trump replied, “No comment,” on Monday. The S&P 500 sold off by around 1.3% in early trading, while the Nasdaq Composite plunged 1.7%. The Dow Jones Industrial Average dropped more than 600 points. The S&P 500 has erased its gains for the year so far. Investors also sold off U.S. government bonds, driving up interest rates. Rising returns on US treasuries usually translate into higher mortgage rates and interest on new personal loans.

U.S. forests have stored more carbon in the past two decades than at any time in the last century, an increase attributable to a mix of natural factors and human activity. To unravel the cause behind this spike, researchers used nationwide forest data to examine how six environmental factors may have contributed to the increase in carbon sequestered by forests. They found that natural forces such as increasing temperatures, shifting precipitation, and carbon fertilization are among the largest contributors to carbon gains, but human drivers, like letting forests get older and planting trees, are also becoming bigger factors. …this new analysis aims to help researchers better separate what portion of carbon held by forests is related to human action and which portion isn’t. …This work highlights the vast difference in the amount of carbon forests can absorb naturally versus when they are actively managed.

U.S. forests have stored more carbon in the past two decades than at any time in the last century, an increase attributable to a mix of natural factors and human activity. To unravel the cause behind this spike, researchers used nationwide forest data to examine how six environmental factors may have contributed to the increase in carbon sequestered by forests. They found that natural forces such as increasing temperatures, shifting precipitation, and carbon fertilization are among the largest contributors to carbon gains, but human drivers, like letting forests get older and planting trees, are also becoming bigger factors. …this new analysis aims to help researchers better separate what portion of carbon held by forests is related to human action and which portion isn’t. …This work highlights the vast difference in the amount of carbon forests can absorb naturally versus when they are actively managed.  One of the least visible workforce developments of 2025 — the departure of more than 20,000 employees from the U.S. Department of Agriculture — became public just before the week between Christmas and New Year’s, a period that typically draws limited public attention. According to payroll data reviewed by USDA’s Office of Inspector General, 20,300 employees left the department between mid-January and mid-June, reducing total staffing from roughly 110,300 employees. The departures occurred as USDA prepares to administer an estimated $234 billion in farm, food, nutrition, conservation, and rural development programs in fiscal year 2026. …Two agencies recorded the largest number of departures in absolute terms. The U.S. Forest Service and the Natural Resources and Conservation Service experienced the highest staffing losses across USDA agencies. The Forest Service, “which oversees millions of acres of federal land,” reported Politico, “lost 5,860 workers,” while NRCS lost 2,673 employees.

One of the least visible workforce developments of 2025 — the departure of more than 20,000 employees from the U.S. Department of Agriculture — became public just before the week between Christmas and New Year’s, a period that typically draws limited public attention. According to payroll data reviewed by USDA’s Office of Inspector General, 20,300 employees left the department between mid-January and mid-June, reducing total staffing from roughly 110,300 employees. The departures occurred as USDA prepares to administer an estimated $234 billion in farm, food, nutrition, conservation, and rural development programs in fiscal year 2026. …Two agencies recorded the largest number of departures in absolute terms. The U.S. Forest Service and the Natural Resources and Conservation Service experienced the highest staffing losses across USDA agencies. The Forest Service, “which oversees millions of acres of federal land,” reported Politico, “lost 5,860 workers,” while NRCS lost 2,673 employees.

A recent federal court ruling tossing out a streamlined environmental review for three Oregon timber projects will point the way for conservation groups to challenge the Trump administration’s nationwide logging agenda, natural resources attorneys say. Judge Michael McShane of the US District Court for the District of Oregon in his Jan. 13 ruling set aside a categorical exclusion under the National Environmental Policy Act called “CE-6.” The 1992 exclusion allowed for quick approval of logging projects designed to thin forests to reduce wildfire hazards. Fast-tracking an expansion of logging on federal land is among President Donald Trump’s top priorities in order to cut lumber imports and grow domestic timber industry jobs. The administration is loosening public notice and environmental review requirements for logging and other projects under NEPA, and it’s rolling back protections for roadless areas in national forests in order to open them to possible logging projects.

A recent federal court ruling tossing out a streamlined environmental review for three Oregon timber projects will point the way for conservation groups to challenge the Trump administration’s nationwide logging agenda, natural resources attorneys say. Judge Michael McShane of the US District Court for the District of Oregon in his Jan. 13 ruling set aside a categorical exclusion under the National Environmental Policy Act called “CE-6.” The 1992 exclusion allowed for quick approval of logging projects designed to thin forests to reduce wildfire hazards. Fast-tracking an expansion of logging on federal land is among President Donald Trump’s top priorities in order to cut lumber imports and grow domestic timber industry jobs. The administration is loosening public notice and environmental review requirements for logging and other projects under NEPA, and it’s rolling back protections for roadless areas in national forests in order to open them to possible logging projects. New Mexico’s Forestry Division is concerned after thousands of trees died last year due to warm temperatures, drought conditions, and native insects. Victor Lucero, the forest health program coordinator, said in 2024, about 67,000 acres of trees died. Last year, that jumped to about 209,000 acres. Most of the damage is south of I-40, including parts of the Lincoln National Forest near Ruidoso and areas west of Socorro in the Gila National Forest. The main culprit is native bark beetles. Lucero explained that when it’s warm and dry, trees get stressed and weakened, giving off chemicals that attract the beetles. Once the beetles get under the bark, they tunnel in, cut off the tree’s ability to move water and nutrients, and bring in fungi, leading to the tree’s death over time.

New Mexico’s Forestry Division is concerned after thousands of trees died last year due to warm temperatures, drought conditions, and native insects. Victor Lucero, the forest health program coordinator, said in 2024, about 67,000 acres of trees died. Last year, that jumped to about 209,000 acres. Most of the damage is south of I-40, including parts of the Lincoln National Forest near Ruidoso and areas west of Socorro in the Gila National Forest. The main culprit is native bark beetles. Lucero explained that when it’s warm and dry, trees get stressed and weakened, giving off chemicals that attract the beetles. Once the beetles get under the bark, they tunnel in, cut off the tree’s ability to move water and nutrients, and bring in fungi, leading to the tree’s death over time.

MONTANA — A proposal to use thinning and prescribed burning to remove vegetation across portions of the Flathead National Forest bordering the Middle Fork Flathead River has gained wide attention for its inclusion of sensitive management areas in the project’s 67,536-acre footprint, which provides wildlife with critical habitat and is one of the region’s most popular havens of outdoor recreation. But even as conservation groups push for additional layers of environmental review, proponents of the project, including industry leaders, recreation advocates and residents, say it’s needed to reduce the risk of wildfire in a corridor brimming with untreated fuels that threaten infrastructure and communities on US Highway 2, as well as to support local timber mills and improve forest health. If approved, portions of the project would occur in recommended wilderness areas, although the scope of that work would be confined to whitebark pine restoration and tree planting with hand tools.

MONTANA — A proposal to use thinning and prescribed burning to remove vegetation across portions of the Flathead National Forest bordering the Middle Fork Flathead River has gained wide attention for its inclusion of sensitive management areas in the project’s 67,536-acre footprint, which provides wildlife with critical habitat and is one of the region’s most popular havens of outdoor recreation. But even as conservation groups push for additional layers of environmental review, proponents of the project, including industry leaders, recreation advocates and residents, say it’s needed to reduce the risk of wildfire in a corridor brimming with untreated fuels that threaten infrastructure and communities on US Highway 2, as well as to support local timber mills and improve forest health. If approved, portions of the project would occur in recommended wilderness areas, although the scope of that work would be confined to whitebark pine restoration and tree planting with hand tools.

A major logging project has been proposed on the southern border of Glacier National Park, prompting concern from conservationists… “This is the heart of some of our wildest, most intact landscapes left in the U.S., anywhere south of Alaska,” said Peter Metcalf, the executive director of the Glacier-Two Medicine Alliance, a conservation organization in East Glacier Park, Montana. “We are really concerned that this kind of logging proposal would be slated for this landscape.” U.S. Forest Service district ranger Robert Davies said he plans to use the emergency authority authorized by an April 2025 executive order to expedite the project. The order calls for increasing timber production and reducing wildfire risk in areas of national forest considered to have very high or high wildfire risk. Roughly half the proposed project qualifies, but the entire project is subject to the streamlined timeline, which cuts out the majority of opportunities for public participation.

A major logging project has been proposed on the southern border of Glacier National Park, prompting concern from conservationists… “This is the heart of some of our wildest, most intact landscapes left in the U.S., anywhere south of Alaska,” said Peter Metcalf, the executive director of the Glacier-Two Medicine Alliance, a conservation organization in East Glacier Park, Montana. “We are really concerned that this kind of logging proposal would be slated for this landscape.” U.S. Forest Service district ranger Robert Davies said he plans to use the emergency authority authorized by an April 2025 executive order to expedite the project. The order calls for increasing timber production and reducing wildfire risk in areas of national forest considered to have very high or high wildfire risk. Roughly half the proposed project qualifies, but the entire project is subject to the streamlined timeline, which cuts out the majority of opportunities for public participation. In 1980, Washington State’s Mount St Helens erupted…causing an ecological nightmare as the volcano spewed lava, ash, and debris over the surrounding landscape that was followed by mudflows and pyroclastic flows, leaving the vegetation covered in mud and detritus as far as 27 kilometers from the volcano. …But one team of scientists had an unconventional idea to help jumpstart the process: send a few gophers on a one-day mission to the mountain. “Gophers are known as ‘hole diggers’,” says a 2024 paper assessing the long-term effects of the rodents at Mount St Helens, adding, “a single gopher can move 227 kg [500 pounds] of soil per month”. Digging is a useful quality in restoring an area devastated by volcanic eruption. Plant life was struggling to return… But while the top layers of soil were destroyed by the eruption and lava flows, the soil underneath could still have been rich in bacteria and fungi.

In 1980, Washington State’s Mount St Helens erupted…causing an ecological nightmare as the volcano spewed lava, ash, and debris over the surrounding landscape that was followed by mudflows and pyroclastic flows, leaving the vegetation covered in mud and detritus as far as 27 kilometers from the volcano. …But one team of scientists had an unconventional idea to help jumpstart the process: send a few gophers on a one-day mission to the mountain. “Gophers are known as ‘hole diggers’,” says a 2024 paper assessing the long-term effects of the rodents at Mount St Helens, adding, “a single gopher can move 227 kg [500 pounds] of soil per month”. Digging is a useful quality in restoring an area devastated by volcanic eruption. Plant life was struggling to return… But while the top layers of soil were destroyed by the eruption and lava flows, the soil underneath could still have been rich in bacteria and fungi. PORTLAND, Ore. — In a win for conservation groups, a federal judge

PORTLAND, Ore. — In a win for conservation groups, a federal judge  Western Washington forests are vital to the identity, economy, and quality of life vital to the region. From the Puget Sound to the Olympic Peninsula and Columbia Gorge, healthy forests provide clean air and water, sustain fish and wildlife habitat, store carbon, and support local jobs in forestry, recreation, and tourism. …The Western Washington Forest Health Strategic Plan is the result of an holistic and collaborative effort by the Washington State Department of Natural Resources to bring partners representing all lands and stakeholder groups together to identify priorities and strategies for how to steward and manage western Washington forests at a landscape scale. This plan builds on lessons learned from the development and implementation of the

Western Washington forests are vital to the identity, economy, and quality of life vital to the region. From the Puget Sound to the Olympic Peninsula and Columbia Gorge, healthy forests provide clean air and water, sustain fish and wildlife habitat, store carbon, and support local jobs in forestry, recreation, and tourism. …The Western Washington Forest Health Strategic Plan is the result of an holistic and collaborative effort by the Washington State Department of Natural Resources to bring partners representing all lands and stakeholder groups together to identify priorities and strategies for how to steward and manage western Washington forests at a landscape scale. This plan builds on lessons learned from the development and implementation of the  PUEBLO, Colo. — The Pike-San Isabel National Forests & Cimarron and Comanche National Grasslands began a 10-year partnership and $7.3 million investment to implement forest health treatments as part of the War Department’s Readiness and Environmental Protection Integration (REPI) program. The partners will use $3 million in REPI funds, along with $4.3 million in partner contributions, to treat 2,000 acres of National Forest System land and nonfederal lands near the U.S. Air Force Academy and Cheyenne Mountain Space Force Station. The REPI program preserves military missions by avoiding land use conflicts near military installations, addressing environmental restrictions that limit military activities and increasing military installation resilience.

PUEBLO, Colo. — The Pike-San Isabel National Forests & Cimarron and Comanche National Grasslands began a 10-year partnership and $7.3 million investment to implement forest health treatments as part of the War Department’s Readiness and Environmental Protection Integration (REPI) program. The partners will use $3 million in REPI funds, along with $4.3 million in partner contributions, to treat 2,000 acres of National Forest System land and nonfederal lands near the U.S. Air Force Academy and Cheyenne Mountain Space Force Station. The REPI program preserves military missions by avoiding land use conflicts near military installations, addressing environmental restrictions that limit military activities and increasing military installation resilience.  As climate change drives more frequent and severe wildfires across boreal forests in Alaska and northwestern Canada, scientists are asking a critical question: Will these ecosystems continue to store carbon or become a growing source of carbon emissions? New research published shows that when forests shift from coniferous—consisting mostly of pines, spruces and larches—to deciduous—consisting mostly of birches and aspens—they could release substantially less carbon when they burn. The study, led by researchers from the Center for Ecosystem Science and Society (ECOSS) at Northern Arizona University and published in Nature Climate Change, found that boreal forests dominated by deciduous species lose less than half as much carbon per unit area burned compared to historically dominant black spruce forests. Even under severe fire weather conditions, carbon losses in deciduous stands were consistently lower than those in conifer forests.

As climate change drives more frequent and severe wildfires across boreal forests in Alaska and northwestern Canada, scientists are asking a critical question: Will these ecosystems continue to store carbon or become a growing source of carbon emissions? New research published shows that when forests shift from coniferous—consisting mostly of pines, spruces and larches—to deciduous—consisting mostly of birches and aspens—they could release substantially less carbon when they burn. The study, led by researchers from the Center for Ecosystem Science and Society (ECOSS) at Northern Arizona University and published in Nature Climate Change, found that boreal forests dominated by deciduous species lose less than half as much carbon per unit area burned compared to historically dominant black spruce forests. Even under severe fire weather conditions, carbon losses in deciduous stands were consistently lower than those in conifer forests. Tribes in Wisconsin and beyond are opposing the Trump administration’s proposal to end protections for millions of acres of roadless areas on national forest land. …But Wisconsin Ojibwe tribes said the move was conducted without consultation and threatens natural resources they rely on, said Conrad St. John, chairman of the St. Croix Chippewa Indians of Wisconsin. “They want to log it for the mature timber… which is revenue-based to create money for big corporations,” St. John said. …In Wisconsin, roadless areas account for less than 5 percent of the national forest’s 1.5 million acres. But Dylan Bizhikiins Jennings said they make up a vital portion of the region’s national forests, saying the administration’s actions show disregard for tribal sovereignty and treaty rights. He’s director of public information for the Great Lakes Indian Fish and Wildlife Commission, which represents 11 tribes in Wisconsin, Michigan and Minnesota.

Tribes in Wisconsin and beyond are opposing the Trump administration’s proposal to end protections for millions of acres of roadless areas on national forest land. …But Wisconsin Ojibwe tribes said the move was conducted without consultation and threatens natural resources they rely on, said Conrad St. John, chairman of the St. Croix Chippewa Indians of Wisconsin. “They want to log it for the mature timber… which is revenue-based to create money for big corporations,” St. John said. …In Wisconsin, roadless areas account for less than 5 percent of the national forest’s 1.5 million acres. But Dylan Bizhikiins Jennings said they make up a vital portion of the region’s national forests, saying the administration’s actions show disregard for tribal sovereignty and treaty rights. He’s director of public information for the Great Lakes Indian Fish and Wildlife Commission, which represents 11 tribes in Wisconsin, Michigan and Minnesota.

New Hampshire and its counties may soon be barred from enrolling publicly owned lands in carbon sequestration programs. “We don’t see sequestration as a traditional use,” said Rep. Mike Ouellet, a Colebrook Republican, at a hearing before the House Committee on Municipal and County Government on Tuesday. The committee later voted, 13-1, to recommend passage of House Bill 1205, which would prohibit “carbon sequestration projects” on state- and county-owned lands. …No county- or state-owned land is currently listed on the registry of New Hampshire carbon sequestration projects. But the long duration of forest carbon contracts and the possibility they would impose restrictions on land use were two reasons bill proponents cited for preventing them on public lands in the future. …Others said timber harvest could be an important source of revenue for counties and the state, and worried the contracts would have a negative impact on the timber industry.

New Hampshire and its counties may soon be barred from enrolling publicly owned lands in carbon sequestration programs. “We don’t see sequestration as a traditional use,” said Rep. Mike Ouellet, a Colebrook Republican, at a hearing before the House Committee on Municipal and County Government on Tuesday. The committee later voted, 13-1, to recommend passage of House Bill 1205, which would prohibit “carbon sequestration projects” on state- and county-owned lands. …No county- or state-owned land is currently listed on the registry of New Hampshire carbon sequestration projects. But the long duration of forest carbon contracts and the possibility they would impose restrictions on land use were two reasons bill proponents cited for preventing them on public lands in the future. …Others said timber harvest could be an important source of revenue for counties and the state, and worried the contracts would have a negative impact on the timber industry.

Deposits $10.6 Billion CAD + Interest 2.6 Billion + FX Gain 0.5 Billion = Total $13.7 Billion

Canadian softwood lumber exporters are currently paying a combined duty deposit rate of 45.16% on lumber imported into the United States.