The Nova Scotia government is defending itself after three other provinces levelled accusations that it is being secretive and undermining Canada’s fight against the United States over softwood lumber. Nova Scotia is urging the US Department of Commerce to reject requests from Quebec, Alberta and Ontario for the Atlantic province to provide much greater detail on how it calculates fees charged for harvesting timber. …Nova Scotia asserts that it should not be blamed for its surveys of private timberland owners that could result in higher fees for cutting down trees when compared with other provinces. The US has levied countervailing duties, arguing that other provinces have tree-harvesting fees that are too low when compared with Nova Scotia, which is exempt from US lumber duties. …Lawyers for Quebec, Alberta and Ontario urged the Commerce Department to make inquiries, saying the US should even consider abandoning the private surveys as a benchmark. [to access the full story a Globe & Mail subscription is required]

The Nova Scotia government is defending itself after three other provinces levelled accusations that it is being secretive and undermining Canada’s fight against the United States over softwood lumber. Nova Scotia is urging the US Department of Commerce to reject requests from Quebec, Alberta and Ontario for the Atlantic province to provide much greater detail on how it calculates fees charged for harvesting timber. …Nova Scotia asserts that it should not be blamed for its surveys of private timberland owners that could result in higher fees for cutting down trees when compared with other provinces. The US has levied countervailing duties, arguing that other provinces have tree-harvesting fees that are too low when compared with Nova Scotia, which is exempt from US lumber duties. …Lawyers for Quebec, Alberta and Ontario urged the Commerce Department to make inquiries, saying the US should even consider abandoning the private surveys as a benchmark. [to access the full story a Globe & Mail subscription is required]

ATLANTA — A proposed amendment to the Georgia Constitution would end sales taxes on timber, a major industry battered by mill closings and storms. House Majority Leader Chuck Efstration said a bipartisan group of legislators want to help protect “a cornerstone of the state’s rural economy.” “The timber tax cut is necessary because Georgia timber farmers are facing severe economic hardship following the closure of multiple sawmills in Georgia and significant losses in the aftermath of Hurricane Helene,” said Efstration, R-Mulberry, the sponsor of House Resolution 1000. “Georgia is a national leader in forestry, and I want to help this state’s rural economy and the livelihood of many Georgians.” Georgia’s forestry industry was the largest in the nation in 2021 based on harvest volume and product export values of nearly $4 billion, according to a report by the Georgia Forestry Association. But timber producers have suffered in recent years.

ATLANTA — A proposed amendment to the Georgia Constitution would end sales taxes on timber, a major industry battered by mill closings and storms. House Majority Leader Chuck Efstration said a bipartisan group of legislators want to help protect “a cornerstone of the state’s rural economy.” “The timber tax cut is necessary because Georgia timber farmers are facing severe economic hardship following the closure of multiple sawmills in Georgia and significant losses in the aftermath of Hurricane Helene,” said Efstration, R-Mulberry, the sponsor of House Resolution 1000. “Georgia is a national leader in forestry, and I want to help this state’s rural economy and the livelihood of many Georgians.” Georgia’s forestry industry was the largest in the nation in 2021 based on harvest volume and product export values of nearly $4 billion, according to a report by the Georgia Forestry Association. But timber producers have suffered in recent years.  TORONTO — The review of North America’s free trade agreement will play a large part in determining the trajectory of the Canadian economy, as one strategist says he is optimistic that certain concessions could help achieve a positive outcome. Ashish Dewan, a senior investment strategist at Vanguard, said the Canadian economy is still significantly reliant on US trade despite attempts to diversify its trading partners. He said Canada currently has a “trade advantage,” due to a lower effective tariff rate compared with other nations, sitting around six per cent compared with about 16 to 19 per cent faced by other nations. “What’s really having a negative impact on the Canadian economy are those Section 232 sectoral tariffs,” Dewan said. Tariffs covered by Section 232 of the U.S. Trade Expansion Act of 1962 cover a wide range of products like steel, aluminum and lumber and are generally not exempt under the Canada-U.S.-Mexico Agreement, better known as CUSMA.

TORONTO — The review of North America’s free trade agreement will play a large part in determining the trajectory of the Canadian economy, as one strategist says he is optimistic that certain concessions could help achieve a positive outcome. Ashish Dewan, a senior investment strategist at Vanguard, said the Canadian economy is still significantly reliant on US trade despite attempts to diversify its trading partners. He said Canada currently has a “trade advantage,” due to a lower effective tariff rate compared with other nations, sitting around six per cent compared with about 16 to 19 per cent faced by other nations. “What’s really having a negative impact on the Canadian economy are those Section 232 sectoral tariffs,” Dewan said. Tariffs covered by Section 232 of the U.S. Trade Expansion Act of 1962 cover a wide range of products like steel, aluminum and lumber and are generally not exempt under the Canada-U.S.-Mexico Agreement, better known as CUSMA.

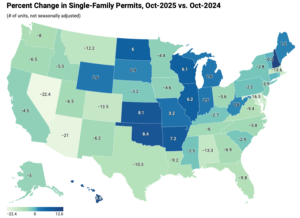

In October, single-family building permits weakened, reflecting continued caution among builders amid affordability constraints and financing challenges. In contrast, multifamily permit activity remained steady and continued to perform relatively well. Together, these trends suggest that while demand for new housing persists, builders are adjusting residential construction activity in response to evolving market conditions. Because permits typically precede construction starts, these patterns offer insight into the near-term outlook for residential building activity. Over the first ten months of 2025, the number of single-family permits issued nationwide reached 787,122. On a year-over-year basis, this represents a 7.0 percent decline compared with the October 2024 year-to-date total of 846,446. Multifamily permitting activity was stronger, with 426,352 permits issued nationwide, marking a 5.7 percent increase from the same period last year.

In October, single-family building permits weakened, reflecting continued caution among builders amid affordability constraints and financing challenges. In contrast, multifamily permit activity remained steady and continued to perform relatively well. Together, these trends suggest that while demand for new housing persists, builders are adjusting residential construction activity in response to evolving market conditions. Because permits typically precede construction starts, these patterns offer insight into the near-term outlook for residential building activity. Over the first ten months of 2025, the number of single-family permits issued nationwide reached 787,122. On a year-over-year basis, this represents a 7.0 percent decline compared with the October 2024 year-to-date total of 846,446. Multifamily permitting activity was stronger, with 426,352 permits issued nationwide, marking a 5.7 percent increase from the same period last year.

Global markets plunged Tuesday after President Trump reignited fears of a US trade war with the European Union, America’s largest trading partner. The president showed no signs of backing off his threat from Saturday to hit seven EU countries and the United Kingdom with new tariffs unless they supported his push for American control of Greenland. Asked if he would be willing to use force to seize the semi-autonomous Danish territory, Trump replied, “No comment,” on Monday. The S&P 500 sold off by around 1.3% in early trading, while the Nasdaq Composite plunged 1.7%. The Dow Jones Industrial Average dropped more than 600 points. The S&P 500 has erased its gains for the year so far. Investors also sold off U.S. government bonds, driving up interest rates. Rising returns on US treasuries usually translate into higher mortgage rates and interest on new personal loans.

Global markets plunged Tuesday after President Trump reignited fears of a US trade war with the European Union, America’s largest trading partner. The president showed no signs of backing off his threat from Saturday to hit seven EU countries and the United Kingdom with new tariffs unless they supported his push for American control of Greenland. Asked if he would be willing to use force to seize the semi-autonomous Danish territory, Trump replied, “No comment,” on Monday. The S&P 500 sold off by around 1.3% in early trading, while the Nasdaq Composite plunged 1.7%. The Dow Jones Industrial Average dropped more than 600 points. The S&P 500 has erased its gains for the year so far. Investors also sold off U.S. government bonds, driving up interest rates. Rising returns on US treasuries usually translate into higher mortgage rates and interest on new personal loans.

.png)

On this episode of This is Oregon Podcast, we’re joined by Judith Sheine, Professor of Architecture and Director of Design of the TallWood Design Institute at the University of Oregon. She shares her work with helping mass timber become more accessible and discusses it potential to create affordable, sustainable housing. Sheine also discusses the challenges and opportunities in advancing mass timber development and what its future could look like for the Pacific Northwest and homeowners. This is part two of our conversation with Judith Sheine. Part one is titled:

On this episode of This is Oregon Podcast, we’re joined by Judith Sheine, Professor of Architecture and Director of Design of the TallWood Design Institute at the University of Oregon. She shares her work with helping mass timber become more accessible and discusses it potential to create affordable, sustainable housing. Sheine also discusses the challenges and opportunities in advancing mass timber development and what its future could look like for the Pacific Northwest and homeowners. This is part two of our conversation with Judith Sheine. Part one is titled:

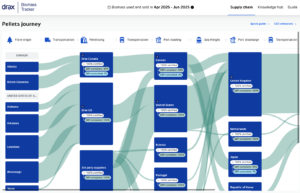

Drax launched its Biomass Tracker, a new digital tool that provides greater visibility into the journey our woody biomass takes through the company’s global supply chain. The interactive tool shows the countries and states where Drax sources its biomass, the types of fibre used in Drax’s own woody biomass, how it is transported, and the carbon associated with each stage of its journey to Drax Power Station or to third-party customers. It also includes data on independent sustainability certifications, helping to strengthen accountability across the sector. The Biomass Tracker uses quarterly real-world data presented through an interactive Sankey diagram, allowing users to explore each stage of the supply chain from fibre origin (for Drax-own pellets), pelletising to transport, storage and use. …The tool is available to access on

Drax launched its Biomass Tracker, a new digital tool that provides greater visibility into the journey our woody biomass takes through the company’s global supply chain. The interactive tool shows the countries and states where Drax sources its biomass, the types of fibre used in Drax’s own woody biomass, how it is transported, and the carbon associated with each stage of its journey to Drax Power Station or to third-party customers. It also includes data on independent sustainability certifications, helping to strengthen accountability across the sector. The Biomass Tracker uses quarterly real-world data presented through an interactive Sankey diagram, allowing users to explore each stage of the supply chain from fibre origin (for Drax-own pellets), pelletising to transport, storage and use. …The tool is available to access on  U.S. forests have stored more carbon in the past two decades than at any time in the last century, an increase attributable to a mix of natural factors and human activity. To unravel the cause behind this spike, researchers used nationwide forest data to examine how six environmental factors may have contributed to the increase in carbon sequestered by forests. They found that natural forces such as increasing temperatures, shifting precipitation, and carbon fertilization are among the largest contributors to carbon gains, but human drivers, like letting forests get older and planting trees, are also becoming bigger factors. …this new analysis aims to help researchers better separate what portion of carbon held by forests is related to human action and which portion isn’t. …This work highlights the vast difference in the amount of carbon forests can absorb naturally versus when they are actively managed.

U.S. forests have stored more carbon in the past two decades than at any time in the last century, an increase attributable to a mix of natural factors and human activity. To unravel the cause behind this spike, researchers used nationwide forest data to examine how six environmental factors may have contributed to the increase in carbon sequestered by forests. They found that natural forces such as increasing temperatures, shifting precipitation, and carbon fertilization are among the largest contributors to carbon gains, but human drivers, like letting forests get older and planting trees, are also becoming bigger factors. …this new analysis aims to help researchers better separate what portion of carbon held by forests is related to human action and which portion isn’t. …This work highlights the vast difference in the amount of carbon forests can absorb naturally versus when they are actively managed.  One of the least visible workforce developments of 2025 — the departure of more than 20,000 employees from the U.S. Department of Agriculture — became public just before the week between Christmas and New Year’s, a period that typically draws limited public attention. According to payroll data reviewed by USDA’s Office of Inspector General, 20,300 employees left the department between mid-January and mid-June, reducing total staffing from roughly 110,300 employees. The departures occurred as USDA prepares to administer an estimated $234 billion in farm, food, nutrition, conservation, and rural development programs in fiscal year 2026. …Two agencies recorded the largest number of departures in absolute terms. The U.S. Forest Service and the Natural Resources and Conservation Service experienced the highest staffing losses across USDA agencies. The Forest Service, “which oversees millions of acres of federal land,” reported Politico, “lost 5,860 workers,” while NRCS lost 2,673 employees.

One of the least visible workforce developments of 2025 — the departure of more than 20,000 employees from the U.S. Department of Agriculture — became public just before the week between Christmas and New Year’s, a period that typically draws limited public attention. According to payroll data reviewed by USDA’s Office of Inspector General, 20,300 employees left the department between mid-January and mid-June, reducing total staffing from roughly 110,300 employees. The departures occurred as USDA prepares to administer an estimated $234 billion in farm, food, nutrition, conservation, and rural development programs in fiscal year 2026. …Two agencies recorded the largest number of departures in absolute terms. The U.S. Forest Service and the Natural Resources and Conservation Service experienced the highest staffing losses across USDA agencies. The Forest Service, “which oversees millions of acres of federal land,” reported Politico, “lost 5,860 workers,” while NRCS lost 2,673 employees.

New Mexico’s Forestry Division is concerned after thousands of trees died last year due to warm temperatures, drought conditions, and native insects. Victor Lucero, the forest health program coordinator, said in 2024, about 67,000 acres of trees died. Last year, that jumped to about 209,000 acres. Most of the damage is south of I-40, including parts of the Lincoln National Forest near Ruidoso and areas west of Socorro in the Gila National Forest. The main culprit is native bark beetles. Lucero explained that when it’s warm and dry, trees get stressed and weakened, giving off chemicals that attract the beetles. Once the beetles get under the bark, they tunnel in, cut off the tree’s ability to move water and nutrients, and bring in fungi, leading to the tree’s death over time.

New Mexico’s Forestry Division is concerned after thousands of trees died last year due to warm temperatures, drought conditions, and native insects. Victor Lucero, the forest health program coordinator, said in 2024, about 67,000 acres of trees died. Last year, that jumped to about 209,000 acres. Most of the damage is south of I-40, including parts of the Lincoln National Forest near Ruidoso and areas west of Socorro in the Gila National Forest. The main culprit is native bark beetles. Lucero explained that when it’s warm and dry, trees get stressed and weakened, giving off chemicals that attract the beetles. Once the beetles get under the bark, they tunnel in, cut off the tree’s ability to move water and nutrients, and bring in fungi, leading to the tree’s death over time.

MONTANA — A proposal to use thinning and prescribed burning to remove vegetation across portions of the Flathead National Forest bordering the Middle Fork Flathead River has gained wide attention for its inclusion of sensitive management areas in the project’s 67,536-acre footprint, which provides wildlife with critical habitat and is one of the region’s most popular havens of outdoor recreation. But even as conservation groups push for additional layers of environmental review, proponents of the project, including industry leaders, recreation advocates and residents, say it’s needed to reduce the risk of wildfire in a corridor brimming with untreated fuels that threaten infrastructure and communities on US Highway 2, as well as to support local timber mills and improve forest health. If approved, portions of the project would occur in recommended wilderness areas, although the scope of that work would be confined to whitebark pine restoration and tree planting with hand tools.

MONTANA — A proposal to use thinning and prescribed burning to remove vegetation across portions of the Flathead National Forest bordering the Middle Fork Flathead River has gained wide attention for its inclusion of sensitive management areas in the project’s 67,536-acre footprint, which provides wildlife with critical habitat and is one of the region’s most popular havens of outdoor recreation. But even as conservation groups push for additional layers of environmental review, proponents of the project, including industry leaders, recreation advocates and residents, say it’s needed to reduce the risk of wildfire in a corridor brimming with untreated fuels that threaten infrastructure and communities on US Highway 2, as well as to support local timber mills and improve forest health. If approved, portions of the project would occur in recommended wilderness areas, although the scope of that work would be confined to whitebark pine restoration and tree planting with hand tools.

Tribes in Wisconsin and beyond are opposing the Trump administration’s proposal to end protections for millions of acres of roadless areas on national forest land. …But Wisconsin Ojibwe tribes said the move was conducted without consultation and threatens natural resources they rely on, said Conrad St. John, chairman of the St. Croix Chippewa Indians of Wisconsin. “They want to log it for the mature timber… which is revenue-based to create money for big corporations,” St. John said. …In Wisconsin, roadless areas account for less than 5 percent of the national forest’s 1.5 million acres. But Dylan Bizhikiins Jennings said they make up a vital portion of the region’s national forests, saying the administration’s actions show disregard for tribal sovereignty and treaty rights. He’s director of public information for the Great Lakes Indian Fish and Wildlife Commission, which represents 11 tribes in Wisconsin, Michigan and Minnesota.

Tribes in Wisconsin and beyond are opposing the Trump administration’s proposal to end protections for millions of acres of roadless areas on national forest land. …But Wisconsin Ojibwe tribes said the move was conducted without consultation and threatens natural resources they rely on, said Conrad St. John, chairman of the St. Croix Chippewa Indians of Wisconsin. “They want to log it for the mature timber… which is revenue-based to create money for big corporations,” St. John said. …In Wisconsin, roadless areas account for less than 5 percent of the national forest’s 1.5 million acres. But Dylan Bizhikiins Jennings said they make up a vital portion of the region’s national forests, saying the administration’s actions show disregard for tribal sovereignty and treaty rights. He’s director of public information for the Great Lakes Indian Fish and Wildlife Commission, which represents 11 tribes in Wisconsin, Michigan and Minnesota.

Deposits $10.6 Billion CAD + Interest 2.6 Billion + FX Gain 0.5 Billion = Total $13.7 Billion

Canadian softwood lumber exporters are currently paying a combined duty deposit rate of 45.16% on lumber imported into the United States.