SÃO PAULO, Brazil — Suzano, the world’s largest pulp producer, and Kimberly-Clark announced the creation of a US$3.4 billion joint venture focused on the manufacture, marketing and distribution of consumer and professional tissue products, such as toilet paper, napkins, paper towels and facial tissues in over 70 countries. Suzano will acquire a 51% interest in the new entity, with Kimberly-Clark holding a 49% interest. Suzano will pay Kimberly-Clark US$1.734 billion in cash at the closing of the transaction. …The transaction is expected to close in mid-2026 and involves approximately 9,000 employees. The new business will be a company incorporated in the Netherlands and will include 22 manufacturing facilities located in 14 countries. Collectively, these facilities have capacity to produce 1 million tonnes of tissue a year. The assets to be included in the new joint venture generated net sales in 2024 of US$3.3 billion. Kimberly-Clark will retain its consumer tissue and professional businesses in the US.

SÃO PAULO, Brazil — Suzano, the world’s largest pulp producer, and Kimberly-Clark announced the creation of a US$3.4 billion joint venture focused on the manufacture, marketing and distribution of consumer and professional tissue products, such as toilet paper, napkins, paper towels and facial tissues in over 70 countries. Suzano will acquire a 51% interest in the new entity, with Kimberly-Clark holding a 49% interest. Suzano will pay Kimberly-Clark US$1.734 billion in cash at the closing of the transaction. …The transaction is expected to close in mid-2026 and involves approximately 9,000 employees. The new business will be a company incorporated in the Netherlands and will include 22 manufacturing facilities located in 14 countries. Collectively, these facilities have capacity to produce 1 million tonnes of tissue a year. The assets to be included in the new joint venture generated net sales in 2024 of US$3.3 billion. Kimberly-Clark will retain its consumer tissue and professional businesses in the US.

SLAVE LAKE, Alberta — On Saturday, May 24, West Fraser’s Slave Lake Veneer plant celebrated its 50th anniversary with the community of Slave Lake. Several hundred community members, elected officials, Indigenous leaders, employees and retirees joined the company for a day of festivities, including lunch, bouncy castles, face painting and an opportunity to learn more about the history of Slave Lake Veneer’s operations. These directly employ 150 local residents, mostly in the mill, but also in the woodlands department, as well hundreds of more with contractors that supply the operation. …West Fraser acquired Slave Lake Veneer in 1999, as part of its acquisition of Zeidler Forest Products. At the time, the mill operated as both a veneer plant and a stud mill. In 2016, all lumber production was transferred to the newly-acquired sawmill in High Prairie. Today, veneer output is almost 13 times higher than when the plant opened in 1973.

SLAVE LAKE, Alberta — On Saturday, May 24, West Fraser’s Slave Lake Veneer plant celebrated its 50th anniversary with the community of Slave Lake. Several hundred community members, elected officials, Indigenous leaders, employees and retirees joined the company for a day of festivities, including lunch, bouncy castles, face painting and an opportunity to learn more about the history of Slave Lake Veneer’s operations. These directly employ 150 local residents, mostly in the mill, but also in the woodlands department, as well hundreds of more with contractors that supply the operation. …West Fraser acquired Slave Lake Veneer in 1999, as part of its acquisition of Zeidler Forest Products. At the time, the mill operated as both a veneer plant and a stud mill. In 2016, all lumber production was transferred to the newly-acquired sawmill in High Prairie. Today, veneer output is almost 13 times higher than when the plant opened in 1973. CHEMAINUS, BC — Fifty-five workers are scheduled to be laid off after a shortage of viable logs has forced production at the Chemainus Sawmill starting this month. According to North Cowichan mayor Rob Douglas, Western Forest Products has informed the municipality they intend to start curtailment of the jobs on Jun. 18. “The company has indicated the reason for the shutdown is due to their inability to find a viable supply of fiber,” Douglas says. “We don’t have a date as to when Western Forest Products is going to resume operations at the Chemainus Mill, but we hope it’s very short term.” …“I have reached out to the forest minister (Ravi Parmar),” he says. …Delays in permits and cutting fiber is a long-standing issue in BC, which has led to shutdowns and impacting production, but Douglas says he has been reassured by Parmar that the province is addressing the issue.

CHEMAINUS, BC — Fifty-five workers are scheduled to be laid off after a shortage of viable logs has forced production at the Chemainus Sawmill starting this month. According to North Cowichan mayor Rob Douglas, Western Forest Products has informed the municipality they intend to start curtailment of the jobs on Jun. 18. “The company has indicated the reason for the shutdown is due to their inability to find a viable supply of fiber,” Douglas says. “We don’t have a date as to when Western Forest Products is going to resume operations at the Chemainus Mill, but we hope it’s very short term.” …“I have reached out to the forest minister (Ravi Parmar),” he says. …Delays in permits and cutting fiber is a long-standing issue in BC, which has led to shutdowns and impacting production, but Douglas says he has been reassured by Parmar that the province is addressing the issue.

One of Canada’s lumber producers, Groupe Rémabec, will temporarily lay off most of its workers as the industry faces rising US duties and weakening demand. The manufacturing division, Arbec Forest Products, is shutting down indefinitely, leading to more than 1,000 immediate job cuts. The number may reach 1,400 in the coming weeks, according to a company statement that blamed “persistent imbalances in both access to the resource and international markets.” Groupe Rémabec employs about 2,000 people and is headquartered in La Tuque, Quebec, about 300 kilometers north of Montreal. President Trump’s administration is poised to more than double the duties on Canadian softwood lumber. …Rémabec said, with Arbec’s deposits representing an “astronomical amount.” …Rémabec also said a “feeling of exasperation is widespread” in the Quebec forestry industry over regulations that have created “an increasingly unstable ecosystem, without predictability or coherence.” The Quebec government has been trying to modernize its forestry legislation.

One of Canada’s lumber producers, Groupe Rémabec, will temporarily lay off most of its workers as the industry faces rising US duties and weakening demand. The manufacturing division, Arbec Forest Products, is shutting down indefinitely, leading to more than 1,000 immediate job cuts. The number may reach 1,400 in the coming weeks, according to a company statement that blamed “persistent imbalances in both access to the resource and international markets.” Groupe Rémabec employs about 2,000 people and is headquartered in La Tuque, Quebec, about 300 kilometers north of Montreal. President Trump’s administration is poised to more than double the duties on Canadian softwood lumber. …Rémabec said, with Arbec’s deposits representing an “astronomical amount.” …Rémabec also said a “feeling of exasperation is widespread” in the Quebec forestry industry over regulations that have created “an increasingly unstable ecosystem, without predictability or coherence.” The Quebec government has been trying to modernize its forestry legislation. While the pulp and paper industry is inherently local—particularly in terms of production and sourcing of raw materials—trade is fundamentally cross-border and international. As a result, the sector is highly exposed to trade barriers and tensions, such as those created by the tariff policies introduced during the Trump administration. Tariffs are expected to put significant pressure on transportation and logistics—sectors that are intrinsically linked to the pulp and paper industry. This strain is partly mitigated by the fact that many pulp and paper companies have made substantial investments in overseas production capacity. Recent mergers in the industry, such as the Smurfit Kappa–WestRock merger and the International Paper–DS Smith merger, are also likely to offset some of the negative impacts of tariffs. These newly formed giants now operate production facilities in both Europe and the US. …This consolidation trend may render the pulp and paper industry more resilient.

While the pulp and paper industry is inherently local—particularly in terms of production and sourcing of raw materials—trade is fundamentally cross-border and international. As a result, the sector is highly exposed to trade barriers and tensions, such as those created by the tariff policies introduced during the Trump administration. Tariffs are expected to put significant pressure on transportation and logistics—sectors that are intrinsically linked to the pulp and paper industry. This strain is partly mitigated by the fact that many pulp and paper companies have made substantial investments in overseas production capacity. Recent mergers in the industry, such as the Smurfit Kappa–WestRock merger and the International Paper–DS Smith merger, are also likely to offset some of the negative impacts of tariffs. These newly formed giants now operate production facilities in both Europe and the US. …This consolidation trend may render the pulp and paper industry more resilient.  KINGSPORT, Tennessee — It could be the third or fourth quarter of 2026 before an anaerobic digester is completed to help with odor mitigation at the Kingsport mill, Domtar officials shared Tuesday. Charlie Floyd, VP of strategic capital projects for Domtar, and Bonnie Depew, environmental manager at Domtar’s Kingsport mill, presented updates about Project Bandit to the Kingsport Economic Development Board. Floyd said the biggest holdup is waiting on permits from the Tennessee Department of Environment and Conservation. TDEC has already asked for two extensions to review the permit application, state records show. …His hope is for the permit to be in the hands of Domtar by the end of the month. Over 80% of the equipment for the anaerobic digester has been purchased, according to Floyd. …At the height of construction, Floyd said there will be around 150 contractors on site to help build the digester and associated equipment.

KINGSPORT, Tennessee — It could be the third or fourth quarter of 2026 before an anaerobic digester is completed to help with odor mitigation at the Kingsport mill, Domtar officials shared Tuesday. Charlie Floyd, VP of strategic capital projects for Domtar, and Bonnie Depew, environmental manager at Domtar’s Kingsport mill, presented updates about Project Bandit to the Kingsport Economic Development Board. Floyd said the biggest holdup is waiting on permits from the Tennessee Department of Environment and Conservation. TDEC has already asked for two extensions to review the permit application, state records show. …His hope is for the permit to be in the hands of Domtar by the end of the month. Over 80% of the equipment for the anaerobic digester has been purchased, according to Floyd. …At the height of construction, Floyd said there will be around 150 contractors on site to help build the digester and associated equipment. The EU has imposed anti-dumping duties on Chinese plywood imports, just a few days after Beijing tried to ease trade tensions between the two. The provisional levies of up to 62.4% follow a surge in imports of hardwood plywood over the past three years that had damaged domestic producers, the European Commission said. The Greenwood Consortium of EU producers, which brought a complaint against Chinese competitors last year, said it welcomed the move but argued for “definitive duties to be even higher than these provisional levels” when the commission makes a final decision later this year. Brussels has also taken the unusual step of monitoring imports of softwood plywood, which is not subject to duties, after allegations that Chinese exporters were disguising hardwood products in anticipation of the levies. …“The alleged practice consisted of placing very thin outer layers of softwood veneer on top of the hardwood plywood face veneer.

The EU has imposed anti-dumping duties on Chinese plywood imports, just a few days after Beijing tried to ease trade tensions between the two. The provisional levies of up to 62.4% follow a surge in imports of hardwood plywood over the past three years that had damaged domestic producers, the European Commission said. The Greenwood Consortium of EU producers, which brought a complaint against Chinese competitors last year, said it welcomed the move but argued for “definitive duties to be even higher than these provisional levels” when the commission makes a final decision later this year. Brussels has also taken the unusual step of monitoring imports of softwood plywood, which is not subject to duties, after allegations that Chinese exporters were disguising hardwood products in anticipation of the levies. …“The alleged practice consisted of placing very thin outer layers of softwood veneer on top of the hardwood plywood face veneer.

New Zealand exporters sending wood, beef and leather products to the European Union will soon have to comply with new rules that aim to reduce deforestation in the supply chain. New Zealand government officials and industry opposed the approach to anti-deforestation taken by the incoming European Union Deforestation Regulation (EUDR). This was due to increased compliance costs exporters would face in proving their products had not contributed to the loss of trees. …For New Zealand, this will affect the $213 million export trade. Exporters of wood products – a trade to Europe valued at around $100 million – would be required to provide traceability processes to show that their products did not contribute to deforestation, too. …The Wood Processors and Manufacturers’ Association’s Mark Ross, said a working group with forest growers, wood processors, and the Government had been set up to work through some issues, such as geolocation requirements.

New Zealand exporters sending wood, beef and leather products to the European Union will soon have to comply with new rules that aim to reduce deforestation in the supply chain. New Zealand government officials and industry opposed the approach to anti-deforestation taken by the incoming European Union Deforestation Regulation (EUDR). This was due to increased compliance costs exporters would face in proving their products had not contributed to the loss of trees. …For New Zealand, this will affect the $213 million export trade. Exporters of wood products – a trade to Europe valued at around $100 million – would be required to provide traceability processes to show that their products did not contribute to deforestation, too. …The Wood Processors and Manufacturers’ Association’s Mark Ross, said a working group with forest growers, wood processors, and the Government had been set up to work through some issues, such as geolocation requirements. The final presenter at International Pulp Week, Emanuele Bona, VP of Europe for the Pulp and Paper Products Council (PPPC), provided a comprehensive update on global market pulp demand trends, with a particular focus on the rebound underway in 2025 and the longer-term outlook for key markets and product segments. Bona began by noting that 2024 had been a weak year for market pulp demand, with global chemical market pulp demand falling by 0.9 percent. However, the first months of 2025 showed a marked improvement. “In 2025, after four months, demand is up almost one million tonnes,” he reported. Both softwood and hardwood pulp segments contributed to this recovery. …Looking ahead, Bona projected that global market pulp demand would return to growth but at a more moderate pace. “Growth to average 1.5 percent through 2029,” he said. The long-term trend for softwood pulp was expected to remain flat at best, while hardwood demand growth was projected to slow despite ongoing substitution trends.

The final presenter at International Pulp Week, Emanuele Bona, VP of Europe for the Pulp and Paper Products Council (PPPC), provided a comprehensive update on global market pulp demand trends, with a particular focus on the rebound underway in 2025 and the longer-term outlook for key markets and product segments. Bona began by noting that 2024 had been a weak year for market pulp demand, with global chemical market pulp demand falling by 0.9 percent. However, the first months of 2025 showed a marked improvement. “In 2025, after four months, demand is up almost one million tonnes,” he reported. Both softwood and hardwood pulp segments contributed to this recovery. …Looking ahead, Bona projected that global market pulp demand would return to growth but at a more moderate pace. “Growth to average 1.5 percent through 2029,” he said. The long-term trend for softwood pulp was expected to remain flat at best, while hardwood demand growth was projected to slow despite ongoing substitution trends. At International Pulp Week, Mathieu Wener, Senior Economist at Numera Analytics, provided a detailed overview of current trends in key end-use markets for pulp, with a particular focus on tissue and printing and writing papers. Drawing on recent data and modelling, he examined how these sectors have evolved post-pandemic, what is driving demand patterns today, and what may lie ahead. Wener began with tissue markets, where profitability has remained strong despite considerable cost pressures in recent years. “Producers passed through rising costs since 2022,” he noted, showing how eurozone parent roll and pulp prices had shifted over that period. Although price differentials between pulp and tissue had narrowed, margins remained healthy.” …Wener underscored the importance of tracking both macroeconomic forces and demographic trends in shaping pulp demand. For tissue, slowing population growth and cautious consumer behaviour would temper growth expectations. For printing and writing papers, the secular decline would continue, but at a somewhat more stable pace.

At International Pulp Week, Mathieu Wener, Senior Economist at Numera Analytics, provided a detailed overview of current trends in key end-use markets for pulp, with a particular focus on tissue and printing and writing papers. Drawing on recent data and modelling, he examined how these sectors have evolved post-pandemic, what is driving demand patterns today, and what may lie ahead. Wener began with tissue markets, where profitability has remained strong despite considerable cost pressures in recent years. “Producers passed through rising costs since 2022,” he noted, showing how eurozone parent roll and pulp prices had shifted over that period. Although price differentials between pulp and tissue had narrowed, margins remained healthy.” …Wener underscored the importance of tracking both macroeconomic forces and demographic trends in shaping pulp demand. For tissue, slowing population growth and cautious consumer behaviour would temper growth expectations. For printing and writing papers, the secular decline would continue, but at a somewhat more stable pace.

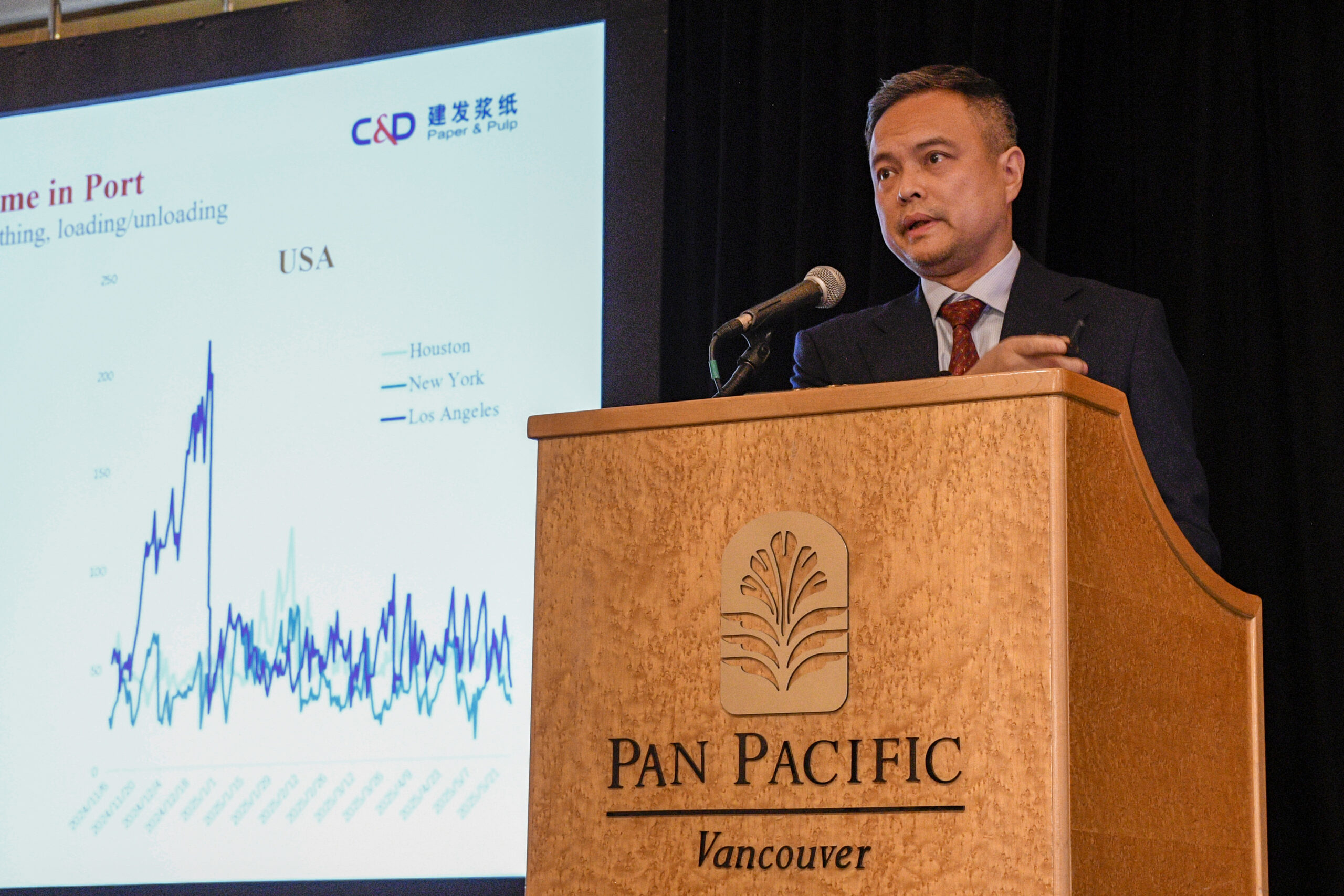

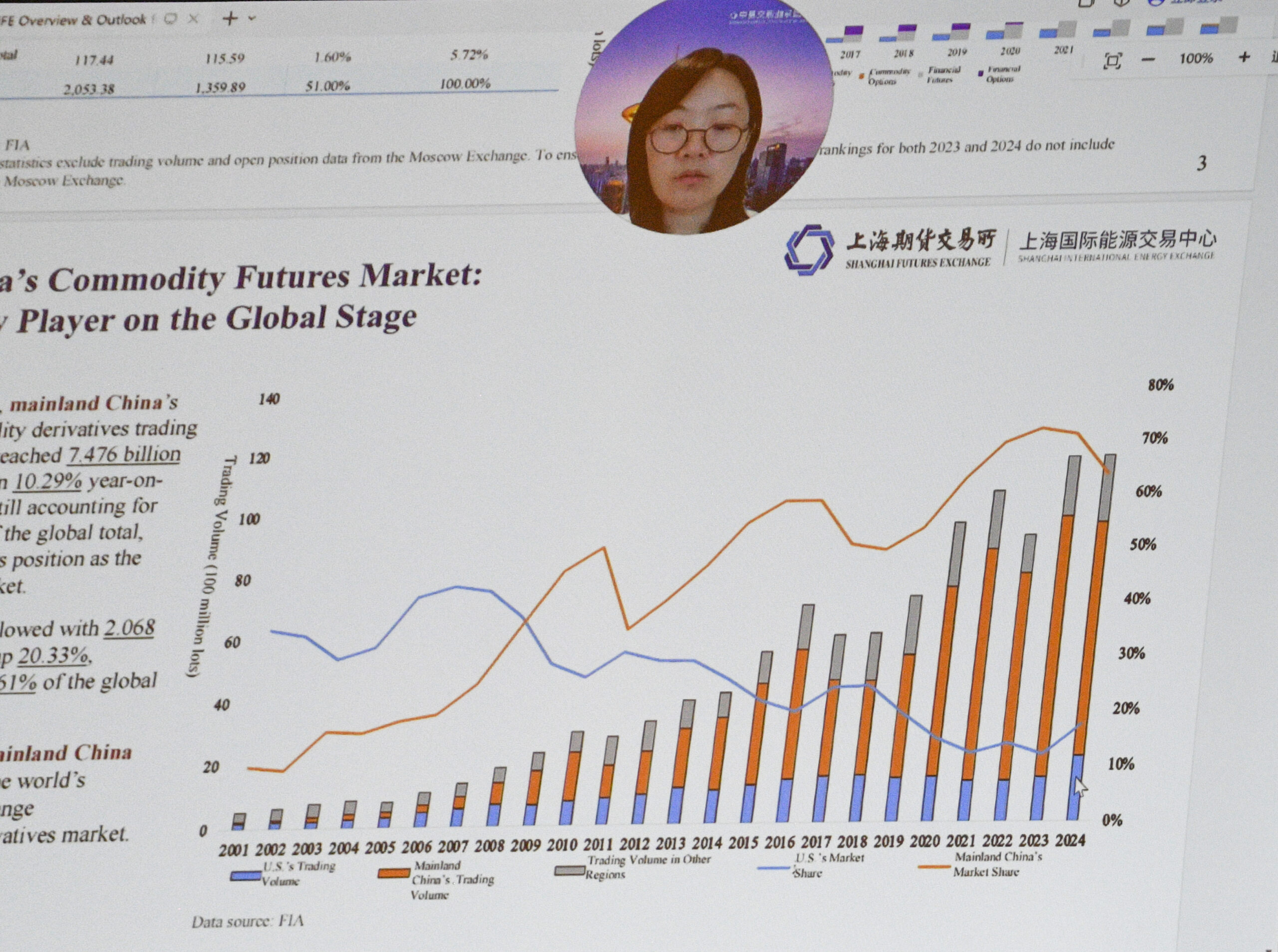

At International Pulp Week, three speakers discussed businesses that connect to China’s role in the global pulp industry — including trading, port logistics and the futures market. Haidong Weng, Executive Vice President of Pulp & Paper Research at Xiamen C&D… explained that after the US implemented its third wave of tariffs, Chinese exports of paper and board to the US fell sharply, with vessel density in major Chinese ports reflecting a significant pullback in trade flows. …He also described the cascading effects on US retail markets. …The scale and resilience of China’s port logistics were front and centre in a presentation by Tian Jun, representing the Shanghai International Port Group’s Luo Jing Terminal. Tian explained that SIPG views pulp as a strategic growth cargo across its network of general cargo terminals. …Another presentation came via video from Chi-Fei Fei of the Shanghai Futures Exchange (SHFE), who provided an overview of China’s pulp futures market.

At International Pulp Week, three speakers discussed businesses that connect to China’s role in the global pulp industry — including trading, port logistics and the futures market. Haidong Weng, Executive Vice President of Pulp & Paper Research at Xiamen C&D… explained that after the US implemented its third wave of tariffs, Chinese exports of paper and board to the US fell sharply, with vessel density in major Chinese ports reflecting a significant pullback in trade flows. …He also described the cascading effects on US retail markets. …The scale and resilience of China’s port logistics were front and centre in a presentation by Tian Jun, representing the Shanghai International Port Group’s Luo Jing Terminal. Tian explained that SIPG views pulp as a strategic growth cargo across its network of general cargo terminals. …Another presentation came via video from Chi-Fei Fei of the Shanghai Futures Exchange (SHFE), who provided an overview of China’s pulp futures market. The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. Since the April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the US have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high. While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs. …In Canada, economic growth in the first quarter came in at 2.2%. …CPI inflation eased to 1.7% in April. …Excluding taxes, inflation rose 2.3% in April.

The Bank of Canada today maintained its target for the overnight rate at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%. Since the April Monetary Policy Report, the US administration has continued to increase and decrease various tariffs. China and the US have stepped back from extremely high tariffs and bilateral trade negotiations have begun with a number of countries. However, the outcomes of these negotiations are highly uncertain, tariff rates are well above their levels at the beginning of 2025, and new trade actions are still being threatened. Uncertainty remains high. While the global economy has shown resilience in recent months, this partly reflects a temporary surge in activity to get ahead of tariffs. …In Canada, economic growth in the first quarter came in at 2.2%. …CPI inflation eased to 1.7% in April. …Excluding taxes, inflation rose 2.3% in April. There has been a lot of news recently on higher tariffs between the U.S. and its trading partners, including Canada and Mexico. One concern that is top of mind for many LBM dealers is how these new tariffs will affect lumber and other materials sold at yards and stores across the country. How concerned should I be and what action, if any, can I take to protect my business? Responses from lumberyards, full-line building material dealers, and specialty dealers/distributors:

There has been a lot of news recently on higher tariffs between the U.S. and its trading partners, including Canada and Mexico. One concern that is top of mind for many LBM dealers is how these new tariffs will affect lumber and other materials sold at yards and stores across the country. How concerned should I be and what action, if any, can I take to protect my business? Responses from lumberyards, full-line building material dealers, and specialty dealers/distributors: Uncertainty regarding tariffs continues to challenge companies across industries. It’s a common theme in every conversation I’ve had with fellow business owners lately: How do we plan, price or grow when the rules are constantly shifting? In our case, the lumber industry got a temporary break—framing lumber from Canada, which makes up over 30% of the US market, was exempt from the original tariffs. That’s good news for now, especially for residential construction. But there’s still no clarity on imports from other key countries like Brazil and China, where tariffs remain in full effect. That could have a serious impact on specialty products like Ipe and hardwood veneers. Other building materials—fasteners, finishes, flooring, and more—are also caught in the middle. …That cost will be passed on to the end user. Businesses like ours don’t have the luxury of absorbing increased costs indefinitely. If we did, we’d be out of business.

Uncertainty regarding tariffs continues to challenge companies across industries. It’s a common theme in every conversation I’ve had with fellow business owners lately: How do we plan, price or grow when the rules are constantly shifting? In our case, the lumber industry got a temporary break—framing lumber from Canada, which makes up over 30% of the US market, was exempt from the original tariffs. That’s good news for now, especially for residential construction. But there’s still no clarity on imports from other key countries like Brazil and China, where tariffs remain in full effect. That could have a serious impact on specialty products like Ipe and hardwood veneers. Other building materials—fasteners, finishes, flooring, and more—are also caught in the middle. …That cost will be passed on to the end user. Businesses like ours don’t have the luxury of absorbing increased costs indefinitely. If we did, we’d be out of business. WASHINGTON, DC – Fannie Mae published the results of its May 2025 National Housing Survey® (NHS), which includes the

WASHINGTON, DC – Fannie Mae published the results of its May 2025 National Housing Survey® (NHS), which includes the

SACRAMENTO, California — There is already a crisis of available and affordable housing in America. But now, political uncertainty and economic volatility could make home buying even less attainable. …The proposed Trump tariffs on building materials are creating financial volatility that could send housing prices up significantly. Since his announcement of widespread tariffs on April 2, the additional costs imposed on imported lumber, gypsum, aluminum, electronics and other related materials delayed the nation’s housing starts in April, according to NAHB. …“More tariffs equal more anxiety and uncertainty for American businesses and consumers,” said David French, at the National Retail Federation. “Tariffs are a tax paid by the U.S. importer that will be passed along to the end consumer. …One of the largest material costs for housing construction is lumber, and the largest amounts are imported into the US from Canada.

SACRAMENTO, California — There is already a crisis of available and affordable housing in America. But now, political uncertainty and economic volatility could make home buying even less attainable. …The proposed Trump tariffs on building materials are creating financial volatility that could send housing prices up significantly. Since his announcement of widespread tariffs on April 2, the additional costs imposed on imported lumber, gypsum, aluminum, electronics and other related materials delayed the nation’s housing starts in April, according to NAHB. …“More tariffs equal more anxiety and uncertainty for American businesses and consumers,” said David French, at the National Retail Federation. “Tariffs are a tax paid by the U.S. importer that will be passed along to the end consumer. …One of the largest material costs for housing construction is lumber, and the largest amounts are imported into the US from Canada.

Crystal To… is part of a small crew of tree planters who are slowly filling the Whitehorse South fuel break with aspen. It’s her first time doing the job. …The goal of the fuel break is to protect the capital city from wildfires by creating a natural barrier, removing all the highly flammable conifers in an 800-hectare area and replacing them with more fire-resistant aspens. The Yukon government began work on the fuel break in 2020, near the Mary Lake subdivision. It’s one of the first such projects in Canada, and the goal is to have it finished by 2032. The aspens are being planted by the thousands every summer. This year, 232,000 seedlings will be planted.

Crystal To… is part of a small crew of tree planters who are slowly filling the Whitehorse South fuel break with aspen. It’s her first time doing the job. …The goal of the fuel break is to protect the capital city from wildfires by creating a natural barrier, removing all the highly flammable conifers in an 800-hectare area and replacing them with more fire-resistant aspens. The Yukon government began work on the fuel break in 2020, near the Mary Lake subdivision. It’s one of the first such projects in Canada, and the goal is to have it finished by 2032. The aspens are being planted by the thousands every summer. This year, 232,000 seedlings will be planted. It was not long ago that the small town of Darrington, Washington drew its life from the towering stands of Douglas fir, cedar and hemlock on federal lands. …Efforts to protect the spotted owl severely restricted timber sales on federal land. “We’ve struggled since the owl wars to find an economy,” says Dan Rankin, who grew up in a local logging family and has for the past 14 years been the mayor of Darrington. So Mr. Rankin had reason for hope when Donald Trump re-entered the White House with promises to start cutting trees again. …But more than four months into Mr. Trump’s turbulent second mandate, an alternative outcome is already looming: that the dramatic actions his administration has taken since its return to office could result in fewer federal trees being cut. …Mr. Rankin’s worries are rooted in what he has seen happening at the U.S. Forest Service office. [to access the full story a Globe & Mail subscription is required]

It was not long ago that the small town of Darrington, Washington drew its life from the towering stands of Douglas fir, cedar and hemlock on federal lands. …Efforts to protect the spotted owl severely restricted timber sales on federal land. “We’ve struggled since the owl wars to find an economy,” says Dan Rankin, who grew up in a local logging family and has for the past 14 years been the mayor of Darrington. So Mr. Rankin had reason for hope when Donald Trump re-entered the White House with promises to start cutting trees again. …But more than four months into Mr. Trump’s turbulent second mandate, an alternative outcome is already looming: that the dramatic actions his administration has taken since its return to office could result in fewer federal trees being cut. …Mr. Rankin’s worries are rooted in what he has seen happening at the U.S. Forest Service office. [to access the full story a Globe & Mail subscription is required] Seattle-based Mast Reforestation had a novel idea to help save the planet: sell voluntary carbon credits and use that money to replant forests destroyed by wildfire. …Mast positioned itself as a rising star in the carbon credit market, claiming to be the only “vertically-integrated reforestation carbon credit developer in the industry.”…Now, the company is facing allegations that it deceived potential partners to secure its reforestation projects. The way Mast structures its credits is central to the controversy. Mast sells carbon credits to businesses that want to voluntarily offset emissions. …But Mast’s model hinges on future climate benefits. Instead of waiting for trees to grow and capture carbon, Mast sells its credits based on projections of reductions. …In a wrongful termination lawsuit filed in Siskiyou County, Mast’s former senior director of business development Arnoud de Villegas, claims the company misled potential partners.

Seattle-based Mast Reforestation had a novel idea to help save the planet: sell voluntary carbon credits and use that money to replant forests destroyed by wildfire. …Mast positioned itself as a rising star in the carbon credit market, claiming to be the only “vertically-integrated reforestation carbon credit developer in the industry.”…Now, the company is facing allegations that it deceived potential partners to secure its reforestation projects. The way Mast structures its credits is central to the controversy. Mast sells carbon credits to businesses that want to voluntarily offset emissions. …But Mast’s model hinges on future climate benefits. Instead of waiting for trees to grow and capture carbon, Mast sells its credits based on projections of reductions. …In a wrongful termination lawsuit filed in Siskiyou County, Mast’s former senior director of business development Arnoud de Villegas, claims the company misled potential partners. SWEDEN — To combat the growing risks from unsustainable business practices, governments and regulators worldwide require corporates to bring greater transparency and reporting to their sustainability impact. When comes to reporting, however, arguably, not all industries are the same. Forests are key to addressing both climate change and biodiversity loss, two of the most urgent challenges for the global community. …If reporting (and other) regulations are to encourage forestry organizations, and their stakeholders, to make more sustainable choices, more needs to be done to increase understanding of the specific sustainability impacts of the industry. Three key areas should be addressed: reporting models, underlying data, and success cases. …An evolving regulatory environment with potential broad implications for forest companies combined with a fragmented reporting landscape diminishes the useability of information for stakeholders as a steering tool.

SWEDEN — To combat the growing risks from unsustainable business practices, governments and regulators worldwide require corporates to bring greater transparency and reporting to their sustainability impact. When comes to reporting, however, arguably, not all industries are the same. Forests are key to addressing both climate change and biodiversity loss, two of the most urgent challenges for the global community. …If reporting (and other) regulations are to encourage forestry organizations, and their stakeholders, to make more sustainable choices, more needs to be done to increase understanding of the specific sustainability impacts of the industry. Three key areas should be addressed: reporting models, underlying data, and success cases. …An evolving regulatory environment with potential broad implications for forest companies combined with a fragmented reporting landscape diminishes the useability of information for stakeholders as a steering tool.  Replanting forests can help cool the planet even more than some scientists once believed, especially in the tropics. But even if every tree lost since the mid-19th century is replanted, the total effect won’t cancel out human-generated warming. …In a new study

Replanting forests can help cool the planet even more than some scientists once believed, especially in the tropics. But even if every tree lost since the mid-19th century is replanted, the total effect won’t cancel out human-generated warming. …In a new study  GEORGETOWN, South Carolina — Over 650 Georgetown residents have signed a petition opposing a proposed biomass plant at the site of the International Paper mill that closed last year. The group Citizens for Georgetown says it is working to revitalize the town’s waterfront through “thoughtful redevelopment.” 653 people are opposing the plant that would generate energy for Santee Cooper from tree waste. …Citizens for Georgetown Chairman Tom Swatzel. “Now, we face a critical choice: leave decades of pollution in the land and water, continue with heavy industry OR clean up the site and reimagine these properties into a vibrant, sustainable future that benefits all residents.” …State Sen. Stephen Goldfinch expressed cautious optimism over the proposed plant, saying that it could involve an investment of nearly $4 billion and create new jobs.

GEORGETOWN, South Carolina — Over 650 Georgetown residents have signed a petition opposing a proposed biomass plant at the site of the International Paper mill that closed last year. The group Citizens for Georgetown says it is working to revitalize the town’s waterfront through “thoughtful redevelopment.” 653 people are opposing the plant that would generate energy for Santee Cooper from tree waste. …Citizens for Georgetown Chairman Tom Swatzel. “Now, we face a critical choice: leave decades of pollution in the land and water, continue with heavy industry OR clean up the site and reimagine these properties into a vibrant, sustainable future that benefits all residents.” …State Sen. Stephen Goldfinch expressed cautious optimism over the proposed plant, saying that it could involve an investment of nearly $4 billion and create new jobs. The sun and sky had a much more eerie appearance to it on Saturday evening and Sunday morning. It was a sign that smoke from wildfires burning more than 4,000 miles (6,400km) away in central Canada had made it across the Atlantic to sit in the skies over the UK. BBC WeatherWatchers from all corners of the country were out capturing the spectacle. …The change in the appearance of the sun and sky is due to smoke particles in the atmosphere scattering the blue wavelengths of light more, allowing predominantly orange and red hues to reach our eyes. …The presence of wildfire smoke from North America over the UK, whilst not common, does occasionally happen during the summer months. …Here in the UK, the smoke plume is at too high an altitude to affect our air quality.

The sun and sky had a much more eerie appearance to it on Saturday evening and Sunday morning. It was a sign that smoke from wildfires burning more than 4,000 miles (6,400km) away in central Canada had made it across the Atlantic to sit in the skies over the UK. BBC WeatherWatchers from all corners of the country were out capturing the spectacle. …The change in the appearance of the sun and sky is due to smoke particles in the atmosphere scattering the blue wavelengths of light more, allowing predominantly orange and red hues to reach our eyes. …The presence of wildfire smoke from North America over the UK, whilst not common, does occasionally happen during the summer months. …Here in the UK, the smoke plume is at too high an altitude to affect our air quality. Fighting forest fires has always been a physically demanding and dangerous job. But it can take a toll on firefighters’ mental health as well. In 2023, the deaths of six wildland firefighters in B.C. highlighted the importance of mental health, both for frontline responders and support staff. Wildland firefighters are challenged with stress and exhaustion, but the loss of colleagues heavily contributed to the mental toll on firefighters during the 2023 wildfire season, said Jessa Barber, a former wildland firefighter who is now a safety officer with the BC Wildfire Service. …BC Wildfire said it is being proactive, implementing policies and practices to support the mental health of its staff. …One of these practices is the New Recruit Boot Camp, which prioritizes educating recruits about the risks and dangers of being a wildland firefighter both physically and mentally. Ongoing support is provided to recruits.

Fighting forest fires has always been a physically demanding and dangerous job. But it can take a toll on firefighters’ mental health as well. In 2023, the deaths of six wildland firefighters in B.C. highlighted the importance of mental health, both for frontline responders and support staff. Wildland firefighters are challenged with stress and exhaustion, but the loss of colleagues heavily contributed to the mental toll on firefighters during the 2023 wildfire season, said Jessa Barber, a former wildland firefighter who is now a safety officer with the BC Wildfire Service. …BC Wildfire said it is being proactive, implementing policies and practices to support the mental health of its staff. …One of these practices is the New Recruit Boot Camp, which prioritizes educating recruits about the risks and dangers of being a wildland firefighter both physically and mentally. Ongoing support is provided to recruits.

BC Wildfire Service crews are responding to an out-of-control, 10-hectare blaze south of Sproat Lake on Vancouver Island and say it’s expected to spread. Gordon Robinson, Coastal Fire Centre information officer, tells CHEK News 18 firefighters, three helicopters and a response officer are on scene in the Beverly Main area, west of Port Alberni. The fire currently measures 10 hectares, reads information online. The blaze was discovered on Sunday – and as of around 2 p.m., it’s listed as “out-of-control,” meaning it’s “anticipated to spread beyond the current perimeter or control line. Robinson says the fire is believed to be human-caused because there hasn’t been any lightning in the area. Crews are trying to determine the cause, the BC Wildfire website says, adding that such investigations “often take time and can be very complex.”

BC Wildfire Service crews are responding to an out-of-control, 10-hectare blaze south of Sproat Lake on Vancouver Island and say it’s expected to spread. Gordon Robinson, Coastal Fire Centre information officer, tells CHEK News 18 firefighters, three helicopters and a response officer are on scene in the Beverly Main area, west of Port Alberni. The fire currently measures 10 hectares, reads information online. The blaze was discovered on Sunday – and as of around 2 p.m., it’s listed as “out-of-control,” meaning it’s “anticipated to spread beyond the current perimeter or control line. Robinson says the fire is believed to be human-caused because there hasn’t been any lightning in the area. Crews are trying to determine the cause, the BC Wildfire website says, adding that such investigations “often take time and can be very complex.”