The Trump 2.0 administration is underway and disruption is the word of the day in Washington, D.C. The new Trump team hit the ground running, with policy action expected in the areas of regulatory reform, a smaller and more efficient federal workforce, extension of the 2017 tax cuts, tariffs as revenue generators and negotiation tools, and more to come on immigration actions and a more secure border. The sheer breadth of policy actions is a lot for the economy to digest. These policies will offer home builders and remodelers both positive and negative risks in the months ahead. This dual set of risks has been reflected in financial markets, with stocks valuing the focus on growth and efficiency but the bond market reflecting inflation and budget deficit concerns. As a result, investors have pushed long-term interest rates higher since last fall, with the 10-year Treasury rate in the 4.5% to 4.6% range. Mortgage rates remain elevated near 7%.

NAHB projects more economic growth in the quarters ahead, albeit with some disruption in the presidential transition. There is a solid base to build on, with fourth quarter GDP growth coming in at a better-than-expected 2.3% annualized rate. Housing’s share of GDP registered at 16.2% at the end of 2024. The Federal Reserve is undecided on future risks to both inflation and unemployment and will likely hold the federal funds rate at the current top target of 4.5% until at least the third quarter. …However, home sales and building conditions will depend greatly on which policies are for negotiation (such as a proposed 25% tariff on Canadian and Mexican imports) and which policies are intended to be long-term changes to the economy (regulatory reform, for example).Tariffs on Canadian lumber are a near-term concern, with the existing duty rate speculated to increase from a current 14.5% rate to near 30% later this summer.

Reciprocal tariffs are straightforward in theory: The U.S. would pose the same levies on imported goods from a given country that the other country imposes on their U.S. imports. But it gets far murkier in practice, as countries often charge different tariffs on different classes of goods. Goldman Sachs economists outlined three approaches Trump could take. “Country-level reciprocity” is the “simplest” strategy which would have the U.S. impose the same average tariffs. “Product-level reciprocity by country” would have the U.S. place marching tariffs on a good-by-good basis by trading partner.” Reciprocity including non-tariff barriers” is the “most difficult” approach as it would encompass a complicated web of inputs including inspection fees and value-added taxes. …4.8% is the U.S.’ weighted average tariff rate if Trump implemented the country-level strategy. …Goods from the 20 countries the U.S. has free trade agreements with, including Australia, Canada, Mexico and Panama, won’t be affected – though Trump has targeted several of those countries in recent weeks.

Reciprocal tariffs are straightforward in theory: The U.S. would pose the same levies on imported goods from a given country that the other country imposes on their U.S. imports. But it gets far murkier in practice, as countries often charge different tariffs on different classes of goods. Goldman Sachs economists outlined three approaches Trump could take. “Country-level reciprocity” is the “simplest” strategy which would have the U.S. impose the same average tariffs. “Product-level reciprocity by country” would have the U.S. place marching tariffs on a good-by-good basis by trading partner.” Reciprocity including non-tariff barriers” is the “most difficult” approach as it would encompass a complicated web of inputs including inspection fees and value-added taxes. …4.8% is the U.S.’ weighted average tariff rate if Trump implemented the country-level strategy. …Goods from the 20 countries the U.S. has free trade agreements with, including Australia, Canada, Mexico and Panama, won’t be affected – though Trump has targeted several of those countries in recent weeks. U.S. President Donald Trump in an all-caps post on Truth Social Thursday teased a new round of sweeping reciprocal tariffs, matching the higher rates other nations charge to import American goods. …Reciprocal tariffs were one of Trump’s core campaign pledges — his method for evening the score with foreign nations that place taxes on American goods and to solve what he has said are unfair trade practices. …He is set to share more details on the tariffs ahead of his visit with Indian Prime Minister Narendra Modi, White House press secretary Karoline Leavitt told reporters on Wednesday. …The tariffs are likely to hit developing countries hardest, especially India, Brazil, Vietnam and other Southeast Asian and African countries, given that they have some of the widest differences in tariff rates charged on U.S. goods brought into their countries compared to what the U.S. charges them.

U.S. President Donald Trump in an all-caps post on Truth Social Thursday teased a new round of sweeping reciprocal tariffs, matching the higher rates other nations charge to import American goods. …Reciprocal tariffs were one of Trump’s core campaign pledges — his method for evening the score with foreign nations that place taxes on American goods and to solve what he has said are unfair trade practices. …He is set to share more details on the tariffs ahead of his visit with Indian Prime Minister Narendra Modi, White House press secretary Karoline Leavitt told reporters on Wednesday. …The tariffs are likely to hit developing countries hardest, especially India, Brazil, Vietnam and other Southeast Asian and African countries, given that they have some of the widest differences in tariff rates charged on U.S. goods brought into their countries compared to what the U.S. charges them.

Pressing ahead with steep tariffs on Canada and Mexico risks exacerbating the US housing crisis and threatening the broader economy, dozens of congressional Democrats have warned Donald Trump. …In a letter to Trump seen by the Guardian, Democrats noted that the US imports key construction materials worth billions of dollars – from lumber to cement products – from Canada and Mexico each year. “Given the severe housing shortage, compounded by rising construction costs, persistent supply chain disruptions, and an estimated shortfall of 6m homes, these looming tariffs, while intended to protect domestic industries, risk further exacerbating the housing supply and affordability crisis while stifling the development of new housing,” they wrote. More than 40 Democrats urged the White House to consider housebuilding industry estimates that the proposed tariffs will raise the cost of imported construction materials by up to $4bn.

Pressing ahead with steep tariffs on Canada and Mexico risks exacerbating the US housing crisis and threatening the broader economy, dozens of congressional Democrats have warned Donald Trump. …In a letter to Trump seen by the Guardian, Democrats noted that the US imports key construction materials worth billions of dollars – from lumber to cement products – from Canada and Mexico each year. “Given the severe housing shortage, compounded by rising construction costs, persistent supply chain disruptions, and an estimated shortfall of 6m homes, these looming tariffs, while intended to protect domestic industries, risk further exacerbating the housing supply and affordability crisis while stifling the development of new housing,” they wrote. More than 40 Democrats urged the White House to consider housebuilding industry estimates that the proposed tariffs will raise the cost of imported construction materials by up to $4bn. The significant risk that tariffs pose to Canada’s economy casts a potentially dark shadow over the housing market. Any economic turbulence arising from tariffs would be felt by participants, whose confidence is critical to the stability of the housing market. …Therefore, assessing the outlook for Canada’s housing market at this juncture is like putting a price on a home before an earthquake—it’s hard to know what shape the structure will be in at the end of the day. Still, we highlight some of the key themes in 2025. …Lower interest rates heat up demand. …Inventory of homes for sale is rebuilding in Canada. …Strained affordability, immigration and uncertainty to keep buyers cautious. …Affordability relief from rate drop will only be partial. …Absent any major economic shock, we’d expect housing market demand and supply to stay balanced in the year ahead, yielding minimal price increases Canada-wide.

The significant risk that tariffs pose to Canada’s economy casts a potentially dark shadow over the housing market. Any economic turbulence arising from tariffs would be felt by participants, whose confidence is critical to the stability of the housing market. …Therefore, assessing the outlook for Canada’s housing market at this juncture is like putting a price on a home before an earthquake—it’s hard to know what shape the structure will be in at the end of the day. Still, we highlight some of the key themes in 2025. …Lower interest rates heat up demand. …Inventory of homes for sale is rebuilding in Canada. …Strained affordability, immigration and uncertainty to keep buyers cautious. …Affordability relief from rate drop will only be partial. …Absent any major economic shock, we’d expect housing market demand and supply to stay balanced in the year ahead, yielding minimal price increases Canada-wide. Experts told us that, in theory, if the US stopped importing crude oil and lumber from Canada and Mexico, it still would be able to meet domestic demand using natural resources available in the U.S. But, in reality, they said, the transition would be costly and take some time to implement, among other complications. “Sure: we could probably meet most of our lumber needs domestically,” said Marc McDill at Penn State University. “The reasons why we don’t boil down to two things: 1) sometimes imports are cheaper than our own suppliers, and 2) we value our forests for a lot of other things.” He added that without lumber from Canada, “1) prices would go up, 2) we would harvest more of our own trees, and 3) we would import more from countries.” …Rhett Jackson at the University of Georgia, said that differences in the lumber produced in the US and Canada may be problematic. …“All lumber is not created equally.”

Experts told us that, in theory, if the US stopped importing crude oil and lumber from Canada and Mexico, it still would be able to meet domestic demand using natural resources available in the U.S. But, in reality, they said, the transition would be costly and take some time to implement, among other complications. “Sure: we could probably meet most of our lumber needs domestically,” said Marc McDill at Penn State University. “The reasons why we don’t boil down to two things: 1) sometimes imports are cheaper than our own suppliers, and 2) we value our forests for a lot of other things.” He added that without lumber from Canada, “1) prices would go up, 2) we would harvest more of our own trees, and 3) we would import more from countries.” …Rhett Jackson at the University of Georgia, said that differences in the lumber produced in the US and Canada may be problematic. …“All lumber is not created equally.” The U.S. market accounts for 5-10% of Sweden’s forest industry exports, depending on the segment, meaning the direct impact of potential new tariffs remains limited, said Christian Nielsen, market analyst for wood products at Swedish Forest Industries Federation. The U.S. relies on imports for 25% of its lumber consumption, primarily from Canada. Higher tariffs on Canadian wood could raise costs for American consumers while improving the competitive position of European suppliers. However, Nielsen noted that future tariffs directly targeting EU exports remain uncertain. In the pulp and paper sector, the U.S. could rely entirely on domestic production, reducing the need for imports. Sweden currently exports 7% of its pulp and 5% of its paper and board products to the US. In total, Sweden exports 92% of its paper and board production, and global trade flows could be affected by tariff changes. [END]

The U.S. market accounts for 5-10% of Sweden’s forest industry exports, depending on the segment, meaning the direct impact of potential new tariffs remains limited, said Christian Nielsen, market analyst for wood products at Swedish Forest Industries Federation. The U.S. relies on imports for 25% of its lumber consumption, primarily from Canada. Higher tariffs on Canadian wood could raise costs for American consumers while improving the competitive position of European suppliers. However, Nielsen noted that future tariffs directly targeting EU exports remain uncertain. In the pulp and paper sector, the U.S. could rely entirely on domestic production, reducing the need for imports. Sweden currently exports 7% of its pulp and 5% of its paper and board products to the US. In total, Sweden exports 92% of its paper and board production, and global trade flows could be affected by tariff changes. [END] A 30-day delay in implementation of tariffs on Canadian shipments to the US reset recent trends in framing lumber markets. Sales picked up in most regions and species, but higher quotes early in the week retreated nearer to last week’s levels. Western S-P-F sales were mixed, but several secondaries reported their strongest days of the year as buyers padded relatively thin inventories with insurance loads. Prices remained close to last week’s levels, but supplies of some items tightened in late trading. Lumber futures swung from extreme volatility Monday and Tuesday to an upward trend towards the end of the week. The threat of tariffs drove prices up, but selling commenced after the delay. The biggest gains were posted in green Fir, where a supply-side rally pushed Std/#2&Btr dimension prices $15-35 higher. The Random Lengths Framing Lumber Composite Price posted another modest adjustment, finishing $5 higher. Most Southern Pine producers throttled back quotes.

A 30-day delay in implementation of tariffs on Canadian shipments to the US reset recent trends in framing lumber markets. Sales picked up in most regions and species, but higher quotes early in the week retreated nearer to last week’s levels. Western S-P-F sales were mixed, but several secondaries reported their strongest days of the year as buyers padded relatively thin inventories with insurance loads. Prices remained close to last week’s levels, but supplies of some items tightened in late trading. Lumber futures swung from extreme volatility Monday and Tuesday to an upward trend towards the end of the week. The threat of tariffs drove prices up, but selling commenced after the delay. The biggest gains were posted in green Fir, where a supply-side rally pushed Std/#2&Btr dimension prices $15-35 higher. The Random Lengths Framing Lumber Composite Price posted another modest adjustment, finishing $5 higher. Most Southern Pine producers throttled back quotes. Year-end 2024 Southern Pine lumber (treated and untreated) exports hit 565.7 Mbf, which was up 11% over the previous year, according to December 2024 data from the USDA. On a monthly basis, Southern Pine lumber exports were up 21.9% in December 2024 over the same month in 2023 but down 2.2% from November 2024. …Softwood imports, meanwhile, were down 11.5% in December 2024 compared with the same month a year ago and down 11% from November 2024. …Mexico remains the largest export market (by volume) of Southern Pine and treated lumber, up 23% over 2023 with 150.2 Mbf of imports. The Dominican Republic, the No. 2 importer of Southern Pine, ended the year 19.1% ahead of 2023 with 92.3 Mbf. India’s total of SYP imports ended 3.1% ahead of last year with 36.6 Mbf. Canada: up 30% with 27.4 Mbf in 2024. Canada ended the year as the No. 5 importer of Southern Pine lumber (treated and untreated).

Year-end 2024 Southern Pine lumber (treated and untreated) exports hit 565.7 Mbf, which was up 11% over the previous year, according to December 2024 data from the USDA. On a monthly basis, Southern Pine lumber exports were up 21.9% in December 2024 over the same month in 2023 but down 2.2% from November 2024. …Softwood imports, meanwhile, were down 11.5% in December 2024 compared with the same month a year ago and down 11% from November 2024. …Mexico remains the largest export market (by volume) of Southern Pine and treated lumber, up 23% over 2023 with 150.2 Mbf of imports. The Dominican Republic, the No. 2 importer of Southern Pine, ended the year 19.1% ahead of 2023 with 92.3 Mbf. India’s total of SYP imports ended 3.1% ahead of last year with 36.6 Mbf. Canada: up 30% with 27.4 Mbf in 2024. Canada ended the year as the No. 5 importer of Southern Pine lumber (treated and untreated).

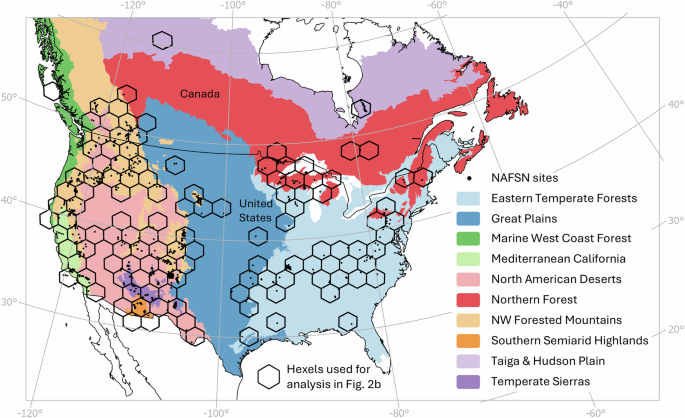

U.S. Senator Jon Ossoff is introducing a bipartisan bill to help grow Georgia’s forestry industry. Sen. Ossoff and Sen. Bill Cassidy, M.D. (R-LA) introduced the bipartisan Forest Data Modernization Act, which would modernize and improve the U.S. Forest Service’s Forest Inventory and Analysis program to ensure reliable data is available to inform forest management decision making. The bipartisan bill would require the Forest Service to prepare an updated strategic plan to expand data collection and further integrate advanced remote sensing technology. According to the forestry industry, the improvements would unlock new economic opportunities for foresters and better protect the environment. The companion bipartisan bill is being introduced by Representatives Kim Schrier (D-WA-08) and Barry Moore (R-AL-01) in the U.S. House of Representatives …“The Georgia Forestry Association (GFA) commends Senators Ossoff and Cassidy for their bipartisan leadership in re-introducing the Forest Data Modernization Act.

U.S. Senator Jon Ossoff is introducing a bipartisan bill to help grow Georgia’s forestry industry. Sen. Ossoff and Sen. Bill Cassidy, M.D. (R-LA) introduced the bipartisan Forest Data Modernization Act, which would modernize and improve the U.S. Forest Service’s Forest Inventory and Analysis program to ensure reliable data is available to inform forest management decision making. The bipartisan bill would require the Forest Service to prepare an updated strategic plan to expand data collection and further integrate advanced remote sensing technology. According to the forestry industry, the improvements would unlock new economic opportunities for foresters and better protect the environment. The companion bipartisan bill is being introduced by Representatives Kim Schrier (D-WA-08) and Barry Moore (R-AL-01) in the U.S. House of Representatives …“The Georgia Forestry Association (GFA) commends Senators Ossoff and Cassidy for their bipartisan leadership in re-introducing the Forest Data Modernization Act. Surprise, surprise, a mighty £7bn of subsidies since 2012 have not been enough to get Drax to stand on its own feet. More bungs are required to keep the wood fires burning at the enormous power plant in North Yorkshire. The energy minister Michael Shanks at least sounded embarrassed. He railed against the “unacceptably large profits” Drax has made, said past subsidy arrangements “did not deliver a good enough deal for bill payers” and vowed that that the definition of a “sustainable” wood pellet would be tightened. But the bottom line is that the government has agreed to crank the subsidy handle once again, just at a slower rate. Why? As he didn’t quite put it, Drax has us over a barrel if we’re not prepared to use more gas to generate electricity. A renewables-heavy system needs firm, reliable power as backup. Transporting wood pellets from North America to burn in Yorkshire is deemed the solution.

Surprise, surprise, a mighty £7bn of subsidies since 2012 have not been enough to get Drax to stand on its own feet. More bungs are required to keep the wood fires burning at the enormous power plant in North Yorkshire. The energy minister Michael Shanks at least sounded embarrassed. He railed against the “unacceptably large profits” Drax has made, said past subsidy arrangements “did not deliver a good enough deal for bill payers” and vowed that that the definition of a “sustainable” wood pellet would be tightened. But the bottom line is that the government has agreed to crank the subsidy handle once again, just at a slower rate. Why? As he didn’t quite put it, Drax has us over a barrel if we’re not prepared to use more gas to generate electricity. A renewables-heavy system needs firm, reliable power as backup. Transporting wood pellets from North America to burn in Yorkshire is deemed the solution.