Kevin Mason

Tariff anxiety continues and is now refocused on the latest “deadline”. Despite all the tumult and spilt ink, markets are generally ascribing a low probability to duties actually being introduced. While tariff speculation is dominating conversations between buyers and sellers… we have heard no reports of meaningful pre-buying or “insurance” purchases. This is unsurprising given various supply-chain constraints, the high cost of working capital, and the difficultly of developing new relationships in short order. Buyers want protection against tariffs, but that isn’t going to happen because the US can’t self-supply most forest products. Buyers will pay up.

For some commodities, imports (and imports from Canada specifically) are a small part of US domestic consumption, so would be easier to replace. For others (including lumber, OSB, newsprint and uncoated mechanicals), replacing imports would be slow and expensive, allowing suppliers to pass on all—or almost all—of the tariff amount to consumers. In some cases, producers straddle the border and may be able to slow/idle Canadian operations while running their US assets at full tilt. …However, if some producers expect the tariff regime to be a mere negotiating ploy, with the possibility they could be reduced/removed over the next year, drastic actions (i.e., outright closures in Canada and/or new mills in the US) would not be taken. Everyone is trying to navigate through these times, with no easy answers other than “be prepared.”

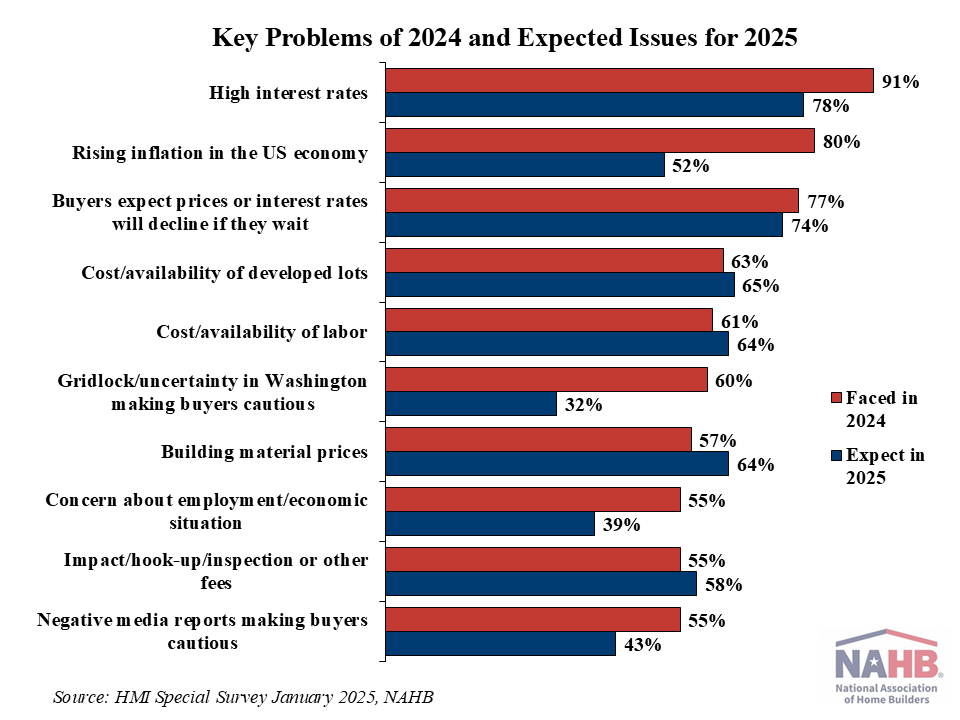

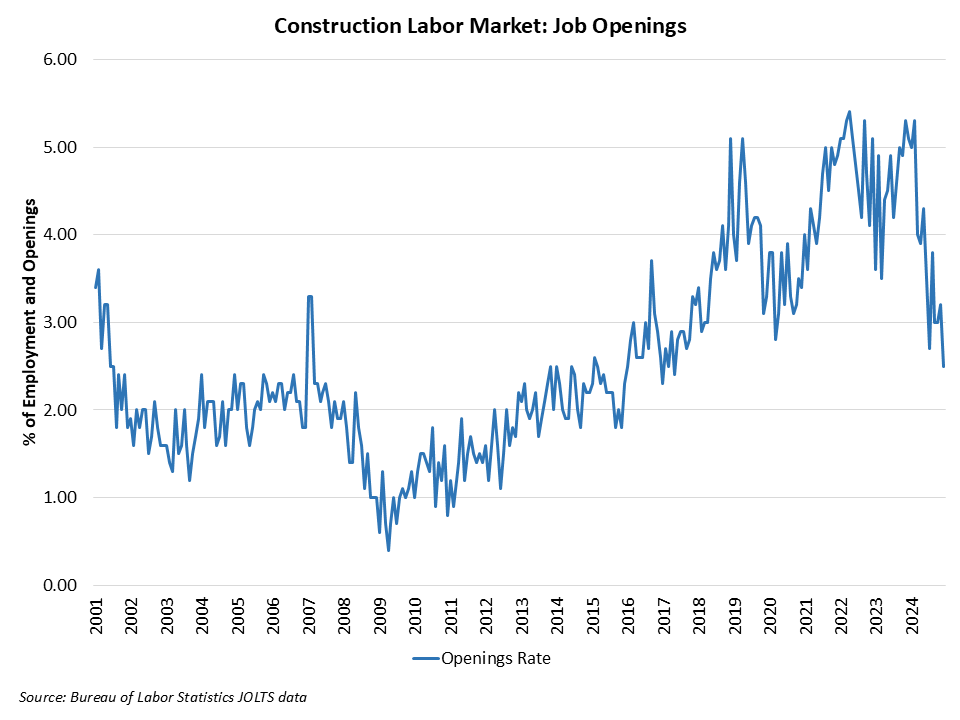

As President Donald Trump ushers in a slew of new policy changes, the proposed 25 percent tariffs on imports from Canada and Mexico—if implemented after the recently introduced 30-day pause—could significantly escalate the cost of lumber, further complicating the already strained U.S. housing market. Some experts predict a near-tripling of costs that could undermine home affordability at a time when the nation grapples with a housing crunch. …According to Carl Harris, chairman of the National Association of Home Builders (NAHB), over 70% of softwood lumber and gypsum, which is used in drywall, originate from Canada and Mexico. …Robert Dietz, chief economist at the NAHB, outlined the risks posed by tariffs as it relates to lumber costs. …Per Dietz, not only could they nearly triple the cost of lumber, a critical component of home building, but they would also drive up prices for consumers, putting homeownership out of reach for many Americans.

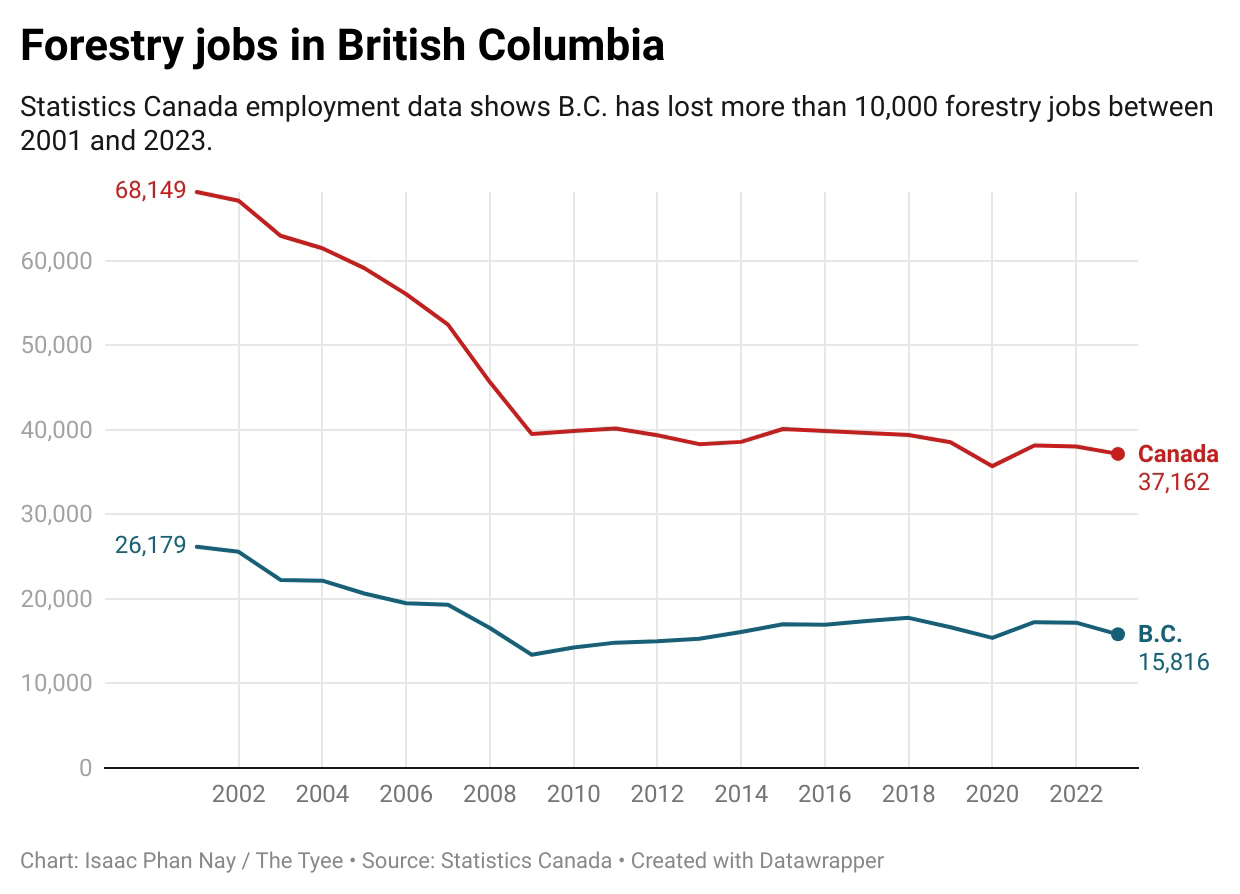

As President Donald Trump ushers in a slew of new policy changes, the proposed 25 percent tariffs on imports from Canada and Mexico—if implemented after the recently introduced 30-day pause—could significantly escalate the cost of lumber, further complicating the already strained U.S. housing market. Some experts predict a near-tripling of costs that could undermine home affordability at a time when the nation grapples with a housing crunch. …According to Carl Harris, chairman of the National Association of Home Builders (NAHB), over 70% of softwood lumber and gypsum, which is used in drywall, originate from Canada and Mexico. …Robert Dietz, chief economist at the NAHB, outlined the risks posed by tariffs as it relates to lumber costs. …Per Dietz, not only could they nearly triple the cost of lumber, a critical component of home building, but they would also drive up prices for consumers, putting homeownership out of reach for many Americans. WASHINGTON — Reports indicate that the B.C. Minister of Forests has created an “Advisory Council” to develop strategies for combating U.S. antidumping and countervailing duties. These duties are in place as a result of repeated findings by the U.S. Department of Commerce and U.S. International Trade Commission that Canada’s egregious ongoing dumping practices and long-standing subsidies to its industry have caused havoc in the U.S. market. Andrew Miller, Chairman and Owner of Stimson Lumber, stated that “this is not a complicated issue. Canada must stop dumping its excess lumber production into the U.S. market and should stop subsidizing its industry instead of convening an ‘Advisory Council’ in British Columbia to study ways of getting around U.S. trade laws.”

WASHINGTON — Reports indicate that the B.C. Minister of Forests has created an “Advisory Council” to develop strategies for combating U.S. antidumping and countervailing duties. These duties are in place as a result of repeated findings by the U.S. Department of Commerce and U.S. International Trade Commission that Canada’s egregious ongoing dumping practices and long-standing subsidies to its industry have caused havoc in the U.S. market. Andrew Miller, Chairman and Owner of Stimson Lumber, stated that “this is not a complicated issue. Canada must stop dumping its excess lumber production into the U.S. market and should stop subsidizing its industry instead of convening an ‘Advisory Council’ in British Columbia to study ways of getting around U.S. trade laws.”

The Province has formed a new council to advance BC’s interests in the long-standing softwood lumber dispute with the US. The council brings together leaders from the forestry sector and labour, alongside experts on US relations and officials from the BC government. The B.C. Softwood Lumber Advisory Council convened its first meeting on Jan. 30. It advises the Minister of Forests, including the sixth administrative review, providing recommendations on steps BC can take to eliminate the 14.4% duties. The council will also help the Province advocate to the federal government. Parmar will chair the council… and the US Council members are:

The Province has formed a new council to advance BC’s interests in the long-standing softwood lumber dispute with the US. The council brings together leaders from the forestry sector and labour, alongside experts on US relations and officials from the BC government. The B.C. Softwood Lumber Advisory Council convened its first meeting on Jan. 30. It advises the Minister of Forests, including the sixth administrative review, providing recommendations on steps BC can take to eliminate the 14.4% duties. The council will also help the Province advocate to the federal government. Parmar will chair the council… and the US Council members are:

BURNABY, BC — The United Steelworkers union welcomes Premier David Eby and the Government of BC’s decision to expedite major projects, representing an investment of approximately $20 billion, and for establishing a council to advocate for forest workers in the face of existing and pending duties and tariffs. The strategic move to advance critical mineral and energy products not only boosts the province’s economic resilience, but also ensures job security for USW members. …By accelerating these projects, the province is taking proactive steps to mitigate external economic pressures and reinforce that B.C. is a key leader in the sector. The advisory council to deal with potential impacts of increased duties and possible additive tariffs on lumber exports to the U.S. is equally important. The USW is pleased to be included in the council, which is working to get rid of the softwood duties.

BURNABY, BC — The United Steelworkers union welcomes Premier David Eby and the Government of BC’s decision to expedite major projects, representing an investment of approximately $20 billion, and for establishing a council to advocate for forest workers in the face of existing and pending duties and tariffs. The strategic move to advance critical mineral and energy products not only boosts the province’s economic resilience, but also ensures job security for USW members. …By accelerating these projects, the province is taking proactive steps to mitigate external economic pressures and reinforce that B.C. is a key leader in the sector. The advisory council to deal with potential impacts of increased duties and possible additive tariffs on lumber exports to the U.S. is equally important. The USW is pleased to be included in the council, which is working to get rid of the softwood duties.

CALIFORNIA — Home builders have avoided a price hike in materials — especially lumber — after the Trump administration said it would delay steep tariffs on Canadian and Mexican goods for at least 30 days. …The temporary reprieve is good news for the construction industry, said Danielle Hale, chief economist at Realtor.com. “In particular, Canadian lumber is an important input in home construction, finishes such as cabinets, and furniture,” Hale said, adding that this is happening at a time when the U.S. is already dealing with an ongoing housing shortage. Prior to the pause, Carl Harris, chairman of the National Association of Home Builders, sent a letter to President Donald Trump outlining the organization’s “serious concerns” about the effects of the proposed North American tariffs. NAHB is particularly concerned about two essential building materials: softwood lumber and gypsum, which is used for drywall. More than 70% of those materials come from Canada and Mexico.

CALIFORNIA — Home builders have avoided a price hike in materials — especially lumber — after the Trump administration said it would delay steep tariffs on Canadian and Mexican goods for at least 30 days. …The temporary reprieve is good news for the construction industry, said Danielle Hale, chief economist at Realtor.com. “In particular, Canadian lumber is an important input in home construction, finishes such as cabinets, and furniture,” Hale said, adding that this is happening at a time when the U.S. is already dealing with an ongoing housing shortage. Prior to the pause, Carl Harris, chairman of the National Association of Home Builders, sent a letter to President Donald Trump outlining the organization’s “serious concerns” about the effects of the proposed North American tariffs. NAHB is particularly concerned about two essential building materials: softwood lumber and gypsum, which is used for drywall. More than 70% of those materials come from Canada and Mexico. NORTH CAROLINA — International trade is complex and one of the least understood components of the globally connected world. …International trade promised cheaper goods and economic growth, and it delivered. But for many Americans, international trade came at a severe cost — the loss of good-paying jobs that helped build the middle class. The frustration isn’t just nostalgia; it’s real. However, trade is not just about economics — it also involves politics, regulations, and agreements that can create both opportunities and unexpected tensions between nations. One example of how regulations impact trade is the lumber industry. In the US, environmental regulations limit how much timber can be harvested, making production more expensive and restrictive. …When US tariffs on Canadian softwood lumber were imposed in 2017, home builders in North Carolina faced a significant hike in costs, affecting new home construction. The construction industry’s experience is not isolated. Trade wars create a domino effect that reaches far beyond political brinkmanship.

NORTH CAROLINA — International trade is complex and one of the least understood components of the globally connected world. …International trade promised cheaper goods and economic growth, and it delivered. But for many Americans, international trade came at a severe cost — the loss of good-paying jobs that helped build the middle class. The frustration isn’t just nostalgia; it’s real. However, trade is not just about economics — it also involves politics, regulations, and agreements that can create both opportunities and unexpected tensions between nations. One example of how regulations impact trade is the lumber industry. In the US, environmental regulations limit how much timber can be harvested, making production more expensive and restrictive. …When US tariffs on Canadian softwood lumber were imposed in 2017, home builders in North Carolina faced a significant hike in costs, affecting new home construction. The construction industry’s experience is not isolated. Trade wars create a domino effect that reaches far beyond political brinkmanship.

Len Apedaile, RPF, is the general manager of Tiičma Forestry, a small market logger based up in Ka:’yu:’k’t’h’/Che:k’tles7et’h’ First Nations (KCFN) territory on Vancouver Island’s north coast. He thinks, if anything, the American tariffs scenario of 25% on all Canadian imports will give businesses the opportunity to re-evaluate how they fundamentally do things. …“This doesn’t happen overnight, but I think that you’ll see that this will spur on those efforts over time,” said Apedaile. …“We really don’t understand where these tariffs are coming from because they just don’t make sense for the Americans or us. …Tiičma Forestry operates in a high-cost area of Vancouver Island. The relatively new First Nations forestry company sells west coast old and second growth logs to a Terminal Forest Products sawmill on the mainland who exports primarily to the U.S.

Len Apedaile, RPF, is the general manager of Tiičma Forestry, a small market logger based up in Ka:’yu:’k’t’h’/Che:k’tles7et’h’ First Nations (KCFN) territory on Vancouver Island’s north coast. He thinks, if anything, the American tariffs scenario of 25% on all Canadian imports will give businesses the opportunity to re-evaluate how they fundamentally do things. …“This doesn’t happen overnight, but I think that you’ll see that this will spur on those efforts over time,” said Apedaile. …“We really don’t understand where these tariffs are coming from because they just don’t make sense for the Americans or us. …Tiičma Forestry operates in a high-cost area of Vancouver Island. The relatively new First Nations forestry company sells west coast old and second growth logs to a Terminal Forest Products sawmill on the mainland who exports primarily to the U.S.

The UK government has agreed a new funding arrangement with the controversial wood-burning Drax power station that it says will cut subsidies in half. …The new agreement will run from 2027 to 2031 and will see the power station only used as a back-up to cheaper renewable sources of power. …The government says the company currently receives nearly a billion pounds a year in subsidies and and predicts that figure will more than halve to £470m under the new deal. …The new agreement also states that 100% of the wood pellets Drax burns must be “sustainably sourced” and that “material sourced from primary and old growth forests” will not be able to receive support payments. All the pellets Drax burns are imported, with most of them coming from the USA and Canada. BBC has previously reported that Drax held logging licences in British Columbia, and used wood, including whole trees, from primary forests for its pellets.

The UK government has agreed a new funding arrangement with the controversial wood-burning Drax power station that it says will cut subsidies in half. …The new agreement will run from 2027 to 2031 and will see the power station only used as a back-up to cheaper renewable sources of power. …The government says the company currently receives nearly a billion pounds a year in subsidies and and predicts that figure will more than halve to £470m under the new deal. …The new agreement also states that 100% of the wood pellets Drax burns must be “sustainably sourced” and that “material sourced from primary and old growth forests” will not be able to receive support payments. All the pellets Drax burns are imported, with most of them coming from the USA and Canada. BBC has previously reported that Drax held logging licences in British Columbia, and used wood, including whole trees, from primary forests for its pellets. The Government has announced a new support mechanism for sustainable biomass generation post-2027. From 2027, Drax and other eligible large-scale biomass generators will be supported via a lowcarbon dispatchable CfD (Contract for Difference). If approved, the plan will keep the power station running until 2031. Under this proposed agreement, Drax Power Station can step in to increase generation when there isn’t enough electricity, helping to avoid the need to use more gas or import power from Europe. When there’s too much electricity on the UK grid, Drax can reduce generation, helping to balance the system. Importantly, the mechanism will result in a net saving for consumers. …The agreement also prioritises biomass sustainability. Drax supports these developments and will continue to engage with the UK Government on the implementation of any future reporting requirements.

The Government has announced a new support mechanism for sustainable biomass generation post-2027. From 2027, Drax and other eligible large-scale biomass generators will be supported via a lowcarbon dispatchable CfD (Contract for Difference). If approved, the plan will keep the power station running until 2031. Under this proposed agreement, Drax Power Station can step in to increase generation when there isn’t enough electricity, helping to avoid the need to use more gas or import power from Europe. When there’s too much electricity on the UK grid, Drax can reduce generation, helping to balance the system. Importantly, the mechanism will result in a net saving for consumers. …The agreement also prioritises biomass sustainability. Drax supports these developments and will continue to engage with the UK Government on the implementation of any future reporting requirements. As institutional interest in real asset investing grows, forestry is gaining recognition beyond its core enthusiasts for its ability to produce income and capital growth, alongside added benefits like carbon sequestration and biodiversity protection. However, trust in sustainability-focused investments remains a challenge. In EY’s 2024 Institutional Investor Survey, 85% of respondents said misleading claims about sustainability are more of a problem today than five years ago, despite regulators’ efforts to quash exaggerated ESG statements. …A persistent narrative is that established timberlands are better, safer investments than new greenfield developments. The truth is more nuanced. Greenfield projects, which involve reforesting degraded or underused land, offer an opportunity to achieve ‘additionality’ – a crucial component of effective carbon sequestration. …For forestry investors, the upshot is clear: regulatory uncertainty is currently a barrier to restoring widespread trust in carbon markets, and resolving this will take time.

As institutional interest in real asset investing grows, forestry is gaining recognition beyond its core enthusiasts for its ability to produce income and capital growth, alongside added benefits like carbon sequestration and biodiversity protection. However, trust in sustainability-focused investments remains a challenge. In EY’s 2024 Institutional Investor Survey, 85% of respondents said misleading claims about sustainability are more of a problem today than five years ago, despite regulators’ efforts to quash exaggerated ESG statements. …A persistent narrative is that established timberlands are better, safer investments than new greenfield developments. The truth is more nuanced. Greenfield projects, which involve reforesting degraded or underused land, offer an opportunity to achieve ‘additionality’ – a crucial component of effective carbon sequestration. …For forestry investors, the upshot is clear: regulatory uncertainty is currently a barrier to restoring widespread trust in carbon markets, and resolving this will take time. To formally pull the United States out of the Paris Agreement, the Trump administration will need to formally submit a withdrawal letter to the United Nations, which administers the pact. The withdrawal would become official one year after the submission. The formal withdrawal of the United States and subsequent changes to agreements under the UN Framework Convention on Climate Change cannot be transmitted to the United Nations until President Trump’s nominee to be US Ambassador to the UN, Rep. Elise Stefanik (R-NY), is confirmed by the Senate. …The withdrawal raises key questions about the future of the voluntary carbon market (VCM), particularly in light of the Paris Climate Accords’ role in driving offset demand. …Without the federal endorsement of climate goals, corporate strategies might shift away from investing in carbon offsets, diminishing demand for carbon credits. Furthermore, uncertainty surrounding federal support could delay or derail the development of new VCM projects.

To formally pull the United States out of the Paris Agreement, the Trump administration will need to formally submit a withdrawal letter to the United Nations, which administers the pact. The withdrawal would become official one year after the submission. The formal withdrawal of the United States and subsequent changes to agreements under the UN Framework Convention on Climate Change cannot be transmitted to the United Nations until President Trump’s nominee to be US Ambassador to the UN, Rep. Elise Stefanik (R-NY), is confirmed by the Senate. …The withdrawal raises key questions about the future of the voluntary carbon market (VCM), particularly in light of the Paris Climate Accords’ role in driving offset demand. …Without the federal endorsement of climate goals, corporate strategies might shift away from investing in carbon offsets, diminishing demand for carbon credits. Furthermore, uncertainty surrounding federal support could delay or derail the development of new VCM projects. Swedes and Finns have long monetized their forests. EU climate goals — seen as a threat to both family wealth and the two national economies — are fast becoming a lightning rod for anger. …In Sweden and neighboring Finland, forestry is, to all intents and purposes, a retail asset class. In Sweden, some 300,000 people own, in total, half of the country’s forests. In Finland, 60% of forests belong to 600,000 individuals. Owners like Velander have been able to work their land with relatively light regulations, generally free to harvest trees when and as they chose. The way these small forest owners traditionally manage their land is, they contend, also good for the climate. But this approach, along with their investments, is under threat from a growing number of European Union regulations aimed at protecting biodiversity and reducing the bloc’s carbon emissions. In Sweden and Finland these measures have been interpreted as a potential ban on logging. [to access the full story a Bloomberg subscription is required]

Swedes and Finns have long monetized their forests. EU climate goals — seen as a threat to both family wealth and the two national economies — are fast becoming a lightning rod for anger. …In Sweden and neighboring Finland, forestry is, to all intents and purposes, a retail asset class. In Sweden, some 300,000 people own, in total, half of the country’s forests. In Finland, 60% of forests belong to 600,000 individuals. Owners like Velander have been able to work their land with relatively light regulations, generally free to harvest trees when and as they chose. The way these small forest owners traditionally manage their land is, they contend, also good for the climate. But this approach, along with their investments, is under threat from a growing number of European Union regulations aimed at protecting biodiversity and reducing the bloc’s carbon emissions. In Sweden and Finland these measures have been interpreted as a potential ban on logging. [to access the full story a Bloomberg subscription is required]