VANCOUVER — David Eby appears to be ready to put B.C. on a trade war footing in response to American tariff threats, with an arsenal that includes supporting federal taxes and bans on exports, like critical minerals, and bolstering B.C.’s energy and resource sector to make it more competitive by accelerating permitting for energy and resource projects, and reforming government programs like BC Timber Sales. No industry in Canada understands the negative impact of American duties and tariffs better than the B.C. forestry sector, which has been labouring under American duties on softwood lumber for nearly a decade now. Eby said he would encourage the Canadian government to respond to the tariffs with taxes and bans on key exports.

B.C. forestry companies already pay an average of 14.4% in duties on lumber exports to the U.S., and they could double next year. It’s unclear whether the 25 per cent tariffs Trump has threatened would be additive to existing duties. …Forestry companies in B.C. face an even stiffer tariff of sorts right here at home, in the form of regulatory burdens, including policies that have restricted access to timber, and stumpage charges that can make the available timber uneconomic to cut. …He suggested some relief may be on the way for resource industries in B.C. …One key reform will be to BC Timber Sales. Eby has struck a new task force with the mandate of overhauling it.

BC Timber Sales accounts for about 20% of the timber harvested from Crown lands, and uses auctioning to establish market pricing in order to set the rates (stumpage) charged to forestry companies to harvest timber on Crown lands. Forestry companies have complained that the rates are often too high, not responsive enough to lumber price swings, and can make it uneconomic to harvest timber, even when it is available for harvest. …“The elaborate process that we go through with B.C. Timber Sales in order to appease the Americans on softwood lumber duties has absolutely not done that,” he said. “The tariffs continue, the tariffs. …“Obviously, now, in the context of 25% across-the-board tariffs – we are in a trade war with the United States – that anxiety goes away.”

On Day 1 of the Truck Loggers Association 80th Annual Convention, Russ Taylor and Don Wright tackled the pressing question:

On Day 1 of the Truck Loggers Association 80th Annual Convention, Russ Taylor and Don Wright tackled the pressing question: The Politics over Lunch panel at the TLA Conference featured Rob Shaw, Richard Zussman, and moderator Vaughn Palmer, offering insights into BC’s political dynamics and their implications for forestry. The discussion focused heavily on the NDP-Green Party agreement and its announcement of a comprehensive review of forestry policies. Shaw expressed frustration with the process’s redundancy, questioning, “What in the world do you have to do another review for at this point?” Zussman described the agreement as more “political positioning than practical policy”, urging industry to actively engage in the process to ensure their concerns and advancements are recognized. The panelists emphasized that this review presents an opportunity for the sector to highlight its advancements in carbon sequestration, sustainable harvesting, and Indigenous partnerships. They urged proactive engagement with policymakers to ensure practical outcomes. The panel concluded with strategies for improving media engagement, stressing transparency, timely communication, and relatable storytelling to rebuild public trust and reshape perceptions of the forestry sector.

The Politics over Lunch panel at the TLA Conference featured Rob Shaw, Richard Zussman, and moderator Vaughn Palmer, offering insights into BC’s political dynamics and their implications for forestry. The discussion focused heavily on the NDP-Green Party agreement and its announcement of a comprehensive review of forestry policies. Shaw expressed frustration with the process’s redundancy, questioning, “What in the world do you have to do another review for at this point?” Zussman described the agreement as more “political positioning than practical policy”, urging industry to actively engage in the process to ensure their concerns and advancements are recognized. The panelists emphasized that this review presents an opportunity for the sector to highlight its advancements in carbon sequestration, sustainable harvesting, and Indigenous partnerships. They urged proactive engagement with policymakers to ensure practical outcomes. The panel concluded with strategies for improving media engagement, stressing transparency, timely communication, and relatable storytelling to rebuild public trust and reshape perceptions of the forestry sector. The Wildfire and Climate Mitigation Strategies panel at the TLA Conference brought together experts to address BC’s escalating wildfire risks and explore climate-conscious forestry solutions. Moderated by Vaughn Palmer, the session featured John Davies, Jason Fisher, David Greer, and Jamie Stephen. John Davies emphasized the importance of integrating wildfire risk assessments into forestry planning and shifting from reactive firefighting to proactive measures like prescribed burns and mechanical thinning. Jason Fisher highlighted community-centred approaches, showcasing partnerships with Indigenous communities and forest enhancement initiatives that reduce wildfire risks and boost ecological resilience. David Greer provided insights into the evolution of wildfire management, stressing year-round strategies and shared responsibility through initiatives like FireSmart and risk-sharing partnerships. Jamie Stephen explored the role of bioenergy, advocating for policies that leverage forest biomass to reduce fuel loads and support rural economies while meeting climate goals. The panel underscored the need for collaboration, innovation, and sustainable investments to build resilient forests and communities.

The Wildfire and Climate Mitigation Strategies panel at the TLA Conference brought together experts to address BC’s escalating wildfire risks and explore climate-conscious forestry solutions. Moderated by Vaughn Palmer, the session featured John Davies, Jason Fisher, David Greer, and Jamie Stephen. John Davies emphasized the importance of integrating wildfire risk assessments into forestry planning and shifting from reactive firefighting to proactive measures like prescribed burns and mechanical thinning. Jason Fisher highlighted community-centred approaches, showcasing partnerships with Indigenous communities and forest enhancement initiatives that reduce wildfire risks and boost ecological resilience. David Greer provided insights into the evolution of wildfire management, stressing year-round strategies and shared responsibility through initiatives like FireSmart and risk-sharing partnerships. Jamie Stephen explored the role of bioenergy, advocating for policies that leverage forest biomass to reduce fuel loads and support rural economies while meeting climate goals. The panel underscored the need for collaboration, innovation, and sustainable investments to build resilient forests and communities. The Our Path Forward panel at the Truck Loggers Association (TLA) Conference explored the future of BC’s forest industry, moderated by Vaughn Palmer. Jeff Bromley, Chair of the United Steelworkers Wood Council, stressed the need for collaboration, bold leadership, and revenue-sharing models with First Nations to address the industry’s challenges, including mill closures and declining annual allowable cuts. Ken Kalesnikoff, President of Kalesnikoff Lumber, highlighted his company’s shift from traditional sawmilling to value-added mass timber production. He showcased seismic-resistant structures and modular prefabricated components, emphasizing the role of innovation and government incentives in supporting rural economies and sustainable practices. Shannon Janzen of Iskum Investments shared insights on integrating Indigenous perspectives, advocating for “unlearning” outdated practices and embracing collaboration to redefine success. Dr. Michelle Corfield emphasized the need for systemic reforms, such as increased Indigenous representation and equitable revenue-sharing, to achieve reconciliation and foster economic resilience.

The Our Path Forward panel at the Truck Loggers Association (TLA) Conference explored the future of BC’s forest industry, moderated by Vaughn Palmer. Jeff Bromley, Chair of the United Steelworkers Wood Council, stressed the need for collaboration, bold leadership, and revenue-sharing models with First Nations to address the industry’s challenges, including mill closures and declining annual allowable cuts. Ken Kalesnikoff, President of Kalesnikoff Lumber, highlighted his company’s shift from traditional sawmilling to value-added mass timber production. He showcased seismic-resistant structures and modular prefabricated components, emphasizing the role of innovation and government incentives in supporting rural economies and sustainable practices. Shannon Janzen of Iskum Investments shared insights on integrating Indigenous perspectives, advocating for “unlearning” outdated practices and embracing collaboration to redefine success. Dr. Michelle Corfield emphasized the need for systemic reforms, such as increased Indigenous representation and equitable revenue-sharing, to achieve reconciliation and foster economic resilience. With President-elect Trump set to take over the Oval Office on January 20, the Canadian lumber industry looks to be taking action… advising customers that they will add 25% to lumber exports to the US when the tariff is announced. With Canadian mills already paying an average of 14.4% import duties on US shipments, they have no alternative but to increase prices by the 25% to cover the potential tariff. Nic Wilson, CEO of the Denver Mass Timber Group Summit reports that… “

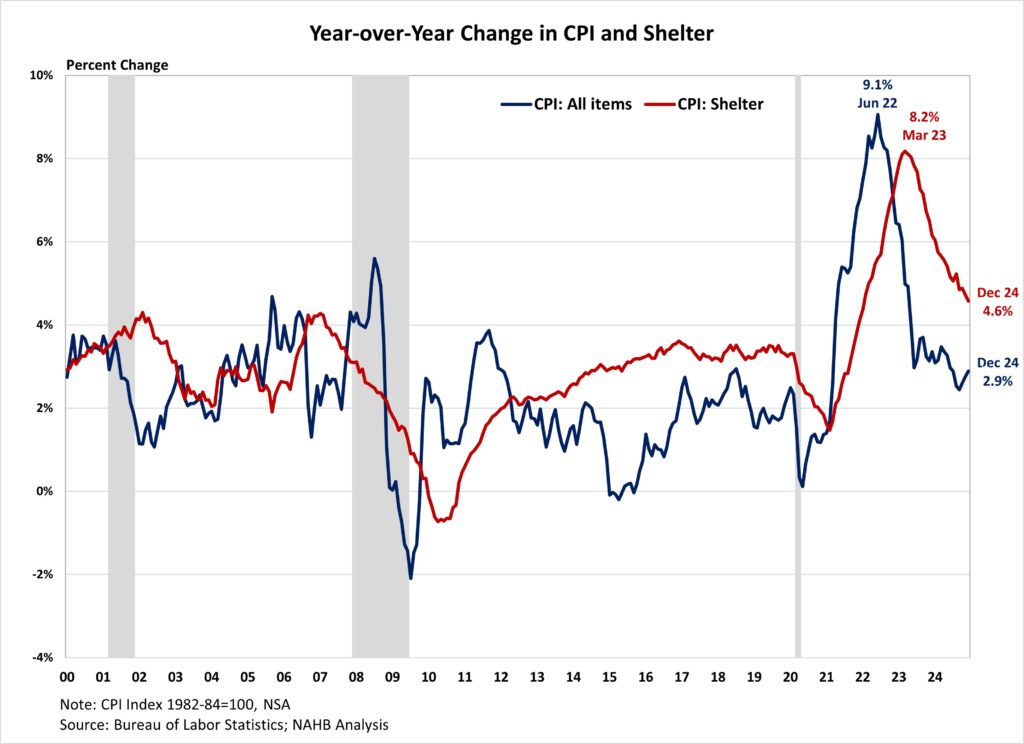

With President-elect Trump set to take over the Oval Office on January 20, the Canadian lumber industry looks to be taking action… advising customers that they will add 25% to lumber exports to the US when the tariff is announced. With Canadian mills already paying an average of 14.4% import duties on US shipments, they have no alternative but to increase prices by the 25% to cover the potential tariff. Nic Wilson, CEO of the Denver Mass Timber Group Summit reports that… “ BC could face severe economic consequences from president-elect Donald Trump’s proposed 25% tariff on Canadian imports. The province projects a cumulative economic loss of $69 billion over four years, with real GDP potentially declining by 0.6% annually in 2025 and 2026. The BC. Ministry of Finance, estimates significant job losses and revenue reductions during this period, with the unemployment rate possibly increasing to 6.7% in 2025 and 7.1% in 2026. The tariff’s effects on the labor market could result in 124,000 job losses by 2028, with the most affected sectors being natural resources, manufacturing, transportation, and retail. Corporate profits could decrease annually by $3.6 billion to $6.1 billion. …Experts indicate that the tariffs could disrupt the US lumber supply chain. Rajan Parajuli, an NC State University professor, said that… US lumber producers might profit from higher prices, consumers would face increased costs if demand remains steady. The Peterson Institute for International Economics notes that these tariffs could extend beyond Canada, impacting the broader wood product sector.

BC could face severe economic consequences from president-elect Donald Trump’s proposed 25% tariff on Canadian imports. The province projects a cumulative economic loss of $69 billion over four years, with real GDP potentially declining by 0.6% annually in 2025 and 2026. The BC. Ministry of Finance, estimates significant job losses and revenue reductions during this period, with the unemployment rate possibly increasing to 6.7% in 2025 and 7.1% in 2026. The tariff’s effects on the labor market could result in 124,000 job losses by 2028, with the most affected sectors being natural resources, manufacturing, transportation, and retail. Corporate profits could decrease annually by $3.6 billion to $6.1 billion. …Experts indicate that the tariffs could disrupt the US lumber supply chain. Rajan Parajuli, an NC State University professor, said that… US lumber producers might profit from higher prices, consumers would face increased costs if demand remains steady. The Peterson Institute for International Economics notes that these tariffs could extend beyond Canada, impacting the broader wood product sector.

Nicolas Schmitt, an economics professor at SFU, highlighted that the province’s economy has shifted from a goods-based to a service-driven model. He said this transition has made the economy more diversified and resilient. With key regions like Vancouver and the Okanagan Valley showing strong growth in service sectors, B.C. is well-positioned to withstand global economic uncertainties and to continue thriving. “This war might affect more interior B.C. than urban B.C. That is a potential problem for the interior. Where those lumber mines and all those goods are being exported. So that creates an urban rural divide.” In a statement provided by Kurt Niquidet president of the B.C. Lumber Trade Council, he said federal parties must collaborate to tackle the ongoing softwood lumber duties and the potential imposition of further tariffs. …While B.C.’s diversified economy offers resilience, the potential impacts on industries like lumber, especially in rural areas, require attention.

Nicolas Schmitt, an economics professor at SFU, highlighted that the province’s economy has shifted from a goods-based to a service-driven model. He said this transition has made the economy more diversified and resilient. With key regions like Vancouver and the Okanagan Valley showing strong growth in service sectors, B.C. is well-positioned to withstand global economic uncertainties and to continue thriving. “This war might affect more interior B.C. than urban B.C. That is a potential problem for the interior. Where those lumber mines and all those goods are being exported. So that creates an urban rural divide.” In a statement provided by Kurt Niquidet president of the B.C. Lumber Trade Council, he said federal parties must collaborate to tackle the ongoing softwood lumber duties and the potential imposition of further tariffs. …While B.C.’s diversified economy offers resilience, the potential impacts on industries like lumber, especially in rural areas, require attention.

Advisors on Trump’s incoming economic team are considering a gradual implementation of tariffs, increasing them incrementally each month. This approach is intended to strengthen their negotiating position while minimizing the risk of sudden inflation, according to sources familiar with the discussions. One concept involves a plan to raise tariffs by 2% to 5% per month, using executive powers granted under the International Emergency Economic Powers Act. The idea is still in its early stages and has not yet been formally presented to Trump, indicating that the strategy is in the initial phase of consideration. Trump has not yet approved of the plan. Supporters include Trump advisors Bessent, Haslett and Miran. [to access the full story a Bloomberg subscription is required]

Advisors on Trump’s incoming economic team are considering a gradual implementation of tariffs, increasing them incrementally each month. This approach is intended to strengthen their negotiating position while minimizing the risk of sudden inflation, according to sources familiar with the discussions. One concept involves a plan to raise tariffs by 2% to 5% per month, using executive powers granted under the International Emergency Economic Powers Act. The idea is still in its early stages and has not yet been formally presented to Trump, indicating that the strategy is in the initial phase of consideration. Trump has not yet approved of the plan. Supporters include Trump advisors Bessent, Haslett and Miran. [to access the full story a Bloomberg subscription is required] Lumber prices surged to around $580 per thousand board feet in January, marking a six-week high, as uncertainty surrounding potential tariffs on Canadian softwood lumber imports to the U.S. stoked panic buying. The looming 25% tariff proposed by President-elect Trump has prompted U.S. buyers to rapidly secure inventories ahead of anticipated price hikes, further escalating demand. With Canadian lumber already subject to an average 14.4% import duty, the additional tariff is expected to push prices even higher. U.S. reliance on Canadian softwood lumber remains substantial, as Canada supplies a significant portion of the country’s lumber needs. While alternative suppliers, such as Germany and Sweden, may partially fill the gap, they lack the capacity to match Canada’s production in the long run. Meanwhile, domestic challenges, including workforce shortages and sawmill closures, are limiting U.S. production, contributing to ongoing supply constraints. [END]

Lumber prices surged to around $580 per thousand board feet in January, marking a six-week high, as uncertainty surrounding potential tariffs on Canadian softwood lumber imports to the U.S. stoked panic buying. The looming 25% tariff proposed by President-elect Trump has prompted U.S. buyers to rapidly secure inventories ahead of anticipated price hikes, further escalating demand. With Canadian lumber already subject to an average 14.4% import duty, the additional tariff is expected to push prices even higher. U.S. reliance on Canadian softwood lumber remains substantial, as Canada supplies a significant portion of the country’s lumber needs. While alternative suppliers, such as Germany and Sweden, may partially fill the gap, they lack the capacity to match Canada’s production in the long run. Meanwhile, domestic challenges, including workforce shortages and sawmill closures, are limiting U.S. production, contributing to ongoing supply constraints. [END] The mere threat of tariffs being tacked onto Canadian lumber imports in the U.S. is raising fears of panic buying that could roil lumber markets and prices. “A number of Canadian lumber companies are now advising customers that they will add 25% to lumber exports to the U.S. when the tariff is announced,”

The mere threat of tariffs being tacked onto Canadian lumber imports in the U.S. is raising fears of panic buying that could roil lumber markets and prices. “A number of Canadian lumber companies are now advising customers that they will add 25% to lumber exports to the U.S. when the tariff is announced,”  Predictions for 2025 include: Energy output will jump… we’ll stop talking about hybrid work… maybe… the education boom will end… the north will struggle to retain population… we’ll stop ignoring the provincial deficit. …The outlook for f

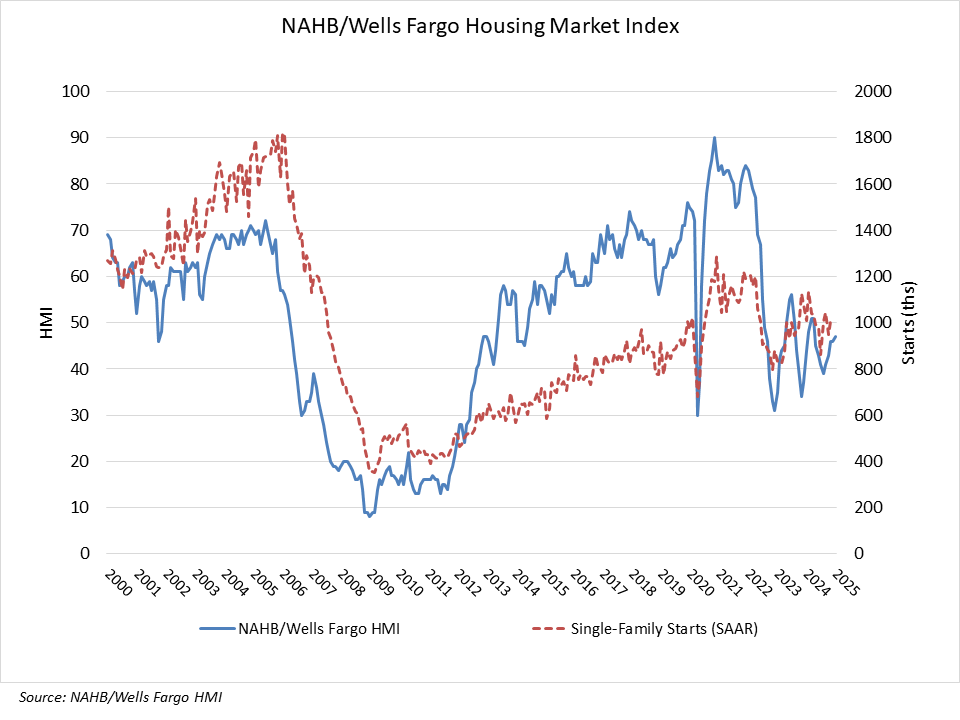

Predictions for 2025 include: Energy output will jump… we’ll stop talking about hybrid work… maybe… the education boom will end… the north will struggle to retain population… we’ll stop ignoring the provincial deficit. …The outlook for f A report released by the Commerce Department on Friday showed new residential construction in the U.S. surged by much more than anticipated in the month of December. The Commerce Department said housing starts soared by 15.8 percent to an annual rate of 1.499 million in December after tumbling by 3.7 percent to a revised rate of 1.294 million in November. …The spike by housing starts came amid a substantial rebound by multi-family starts, which skyrocketed by 61.5 percent to an annual rate of 449,000 in December after plummeting by 30.7 percent to an annual rate of 278,000 in November. Single-family starts also shot up by 3.3 percent to an annual rate of 1.050 million in December after surging by 7.7 percent to an annual rate of 1.016 million in November. Meanwhile, the report said building permits slid by 0.7 percent to an annual rate of 1.483 million in December after surging by 5.2 percent to a revised rate of 1.493 million in November.

A report released by the Commerce Department on Friday showed new residential construction in the U.S. surged by much more than anticipated in the month of December. The Commerce Department said housing starts soared by 15.8 percent to an annual rate of 1.499 million in December after tumbling by 3.7 percent to a revised rate of 1.294 million in November. …The spike by housing starts came amid a substantial rebound by multi-family starts, which skyrocketed by 61.5 percent to an annual rate of 449,000 in December after plummeting by 30.7 percent to an annual rate of 278,000 in November. Single-family starts also shot up by 3.3 percent to an annual rate of 1.050 million in December after surging by 7.7 percent to an annual rate of 1.016 million in November. Meanwhile, the report said building permits slid by 0.7 percent to an annual rate of 1.483 million in December after surging by 5.2 percent to a revised rate of 1.493 million in November. The NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 68 for the fourth quarter of 2024, up five points compared to the previous quarter. Remodelers are more optimistic about the market than they were earlier in the year, corroborated by NAHB’s recent analysis of home improvement loan applications. Demand in many parts of the country was stronger than usual for the fall season, especially demand for larger projects, with leads coming in after the uncertainty about the November elections was removed. …The Current Conditions Index averaged 75, increasing three points from the previous quarter. All three components remained well above 50 in positive territory: large remodeling projects rose eight points to 75, moderate remodeling projects increased two points to 73, and small remodeling projects inched down one point to 76. …The Future Indicators Index was 61, up six points from the previous quarter.

The NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 68 for the fourth quarter of 2024, up five points compared to the previous quarter. Remodelers are more optimistic about the market than they were earlier in the year, corroborated by NAHB’s recent analysis of home improvement loan applications. Demand in many parts of the country was stronger than usual for the fall season, especially demand for larger projects, with leads coming in after the uncertainty about the November elections was removed. …The Current Conditions Index averaged 75, increasing three points from the previous quarter. All three components remained well above 50 in positive territory: large remodeling projects rose eight points to 75, moderate remodeling projects increased two points to 73, and small remodeling projects inched down one point to 76. …The Future Indicators Index was 61, up six points from the previous quarter.

Firefighters in southern California are battling the Palisades and Eaton Fires. …Residents of many fire-prone areas have grown familiar with the orange, apocalyptic haze of wildfire smoke as these blazes have become more common because of climate change. Such smoke can contain an unpredictable cocktail of chemicals associated with heart and lung diseases and even cancer, which is the leading cause of death among firefighters. Here’s what makes wildfire smoke so dangerous. When trees, shrubbery and other organic matter burn, they release carbon dioxide, water, heat—and, depending on the available fuel, various volatile compounds, gaseous pollutants and particulate matter. Those tiny particles, which become suspended in the air, can include soot (black carbon), metals, dust, and more. If they’re smaller than 2.5 microns in diameter, they can evade our body’s natural defenses when inhaled, penetrating deep into the lungs and triggering a wide variety of health problems.

Firefighters in southern California are battling the Palisades and Eaton Fires. …Residents of many fire-prone areas have grown familiar with the orange, apocalyptic haze of wildfire smoke as these blazes have become more common because of climate change. Such smoke can contain an unpredictable cocktail of chemicals associated with heart and lung diseases and even cancer, which is the leading cause of death among firefighters. Here’s what makes wildfire smoke so dangerous. When trees, shrubbery and other organic matter burn, they release carbon dioxide, water, heat—and, depending on the available fuel, various volatile compounds, gaseous pollutants and particulate matter. Those tiny particles, which become suspended in the air, can include soot (black carbon), metals, dust, and more. If they’re smaller than 2.5 microns in diameter, they can evade our body’s natural defenses when inhaled, penetrating deep into the lungs and triggering a wide variety of health problems. PACIFIC PALISADES, California − Firefighters were progressing in their battle against two massive wildfires as winds eased early Thursday, bringing a respite to frustrated and beleaguered residents across Los Angeles County who have been on edge for over a week. All “particularly dangerous situation” red flag warnings largely expired by Wednesday night without causing any significant fire growth, according to the National Weather Service. But dry conditions and locally gusty winds were forecast to linger into Thursday − particularly in the mountains, the weather service warned. According to the weather services, temperatures were also expected to drop five to 10 degrees below normal for the remainder of the week, and Friday is predicted to be the coldest. “Good news,” the weather service’s Los Angeles office said. “Bad News: Next week is a concern. While confident that we will NOT see a repeat of last week, dangerous fire weather conditions are expected.”

PACIFIC PALISADES, California − Firefighters were progressing in their battle against two massive wildfires as winds eased early Thursday, bringing a respite to frustrated and beleaguered residents across Los Angeles County who have been on edge for over a week. All “particularly dangerous situation” red flag warnings largely expired by Wednesday night without causing any significant fire growth, according to the National Weather Service. But dry conditions and locally gusty winds were forecast to linger into Thursday − particularly in the mountains, the weather service warned. According to the weather services, temperatures were also expected to drop five to 10 degrees below normal for the remainder of the week, and Friday is predicted to be the coldest. “Good news,” the weather service’s Los Angeles office said. “Bad News: Next week is a concern. While confident that we will NOT see a repeat of last week, dangerous fire weather conditions are expected.”