As most may have heard by now, Premier Eby has announced an agreement in principle between the BC NDP and Greens. …Of key significance to the forest sector, the agreement commits “to undertake a review of BC forests with First Nations, workers, unions, business and community to address concerns about sustainability, jobs, environmental protection and the future of the industry.” Such broad encompassing reviews typically take several months, if not over a year to complete and even longer before acting on recommendations. To propose such a review now is a prime example of just how forestry in British Columbia has truly become all about politics and not common sense. The two parties in their wisdom, have agreed to a review while the BC forest industry is literally in its death throes.

As most may have heard by now, Premier Eby has announced an agreement in principle between the BC NDP and Greens. …Of key significance to the forest sector, the agreement commits “to undertake a review of BC forests with First Nations, workers, unions, business and community to address concerns about sustainability, jobs, environmental protection and the future of the industry.” Such broad encompassing reviews typically take several months, if not over a year to complete and even longer before acting on recommendations. To propose such a review now is a prime example of just how forestry in British Columbia has truly become all about politics and not common sense. The two parties in their wisdom, have agreed to a review while the BC forest industry is literally in its death throes.

People, please we are in a CODE RED situation when it comes to solutions and immediate action for the survival of BC forestry. Trump’s proposed 25% tariff on Canadian goods and the US softwood lumber duties of 14.4%, which are expected to double mid-next year will bring the BC forest sector to a stop. …One of the most painful aspects of this proposed review is that it implies more uncertainty as the outcome(s) of a review are awaited. If there is one thing the BC forest sector most definitely does not need is more uncertainty, in fact, it is the absolute worst idea at this moment in time. …Putting aside my grumblings about this pending review, and in support of Minister Parmar’s “getting to work” attitude, the following ideas are suggested for the Minister to explore as solutions in anticipation of tough times ahead in 2025. …I agree with Minister Parmar on getting to work because it is immediate action that is needed now.

NEW YORK — The U.S. increasingly relies on Canadian crude oil to meet domestic demand and that relationship faces potential strain amid the threat of tariffs from President-elect Trump. More than 50% of crude oil imported to the U.S. comes from Canada, up from 33% in 2013. The increase follows a jump in production from Canada’s western provinces and growing pipeline capacity to its southern neighbor. Trump has threatened blanket tariffs of up to 25% on products from both Canada and Mexico. That has raised concerns about higher energy costs trickling through the entire U.S. economy. “All three countries remain heavily reliant on each other economically, and hefty taxes on key U.S. imports like crude oil or softwood lumber risk exacerbating U.S. consumer inflation,” said the Americas for UBS Financial Services. …Canada, with its proximity to the U.S., is also the nation’s biggest trading partner.

NEW YORK — The U.S. increasingly relies on Canadian crude oil to meet domestic demand and that relationship faces potential strain amid the threat of tariffs from President-elect Trump. More than 50% of crude oil imported to the U.S. comes from Canada, up from 33% in 2013. The increase follows a jump in production from Canada’s western provinces and growing pipeline capacity to its southern neighbor. Trump has threatened blanket tariffs of up to 25% on products from both Canada and Mexico. That has raised concerns about higher energy costs trickling through the entire U.S. economy. “All three countries remain heavily reliant on each other economically, and hefty taxes on key U.S. imports like crude oil or softwood lumber risk exacerbating U.S. consumer inflation,” said the Americas for UBS Financial Services. …Canada, with its proximity to the U.S., is also the nation’s biggest trading partner.  The B.C. government has appointed a new chair and three new directors to the BC Hydro board of directors. …Glen Clark has been appointed the new chair of the BC Hydro board of directors. Clark will take over the post from current chair, Lori Wanamaker, whose term will end on Dec. 31, 2024. …Merran Smith is president of New Economy Canada and brings award-winning leadership uniting industry, government and civil-society partners. …Brynn Bourke is executive director of the BC Building Trades (BCBT). …Don Kayne is president and CEO of Canfor Corporation, and former CEO of Canfor Pulp Products Inc. Kayne has deep experience in international sales and marketing, human resources and executive compensation through 45 years with the forest company.

The B.C. government has appointed a new chair and three new directors to the BC Hydro board of directors. …Glen Clark has been appointed the new chair of the BC Hydro board of directors. Clark will take over the post from current chair, Lori Wanamaker, whose term will end on Dec. 31, 2024. …Merran Smith is president of New Economy Canada and brings award-winning leadership uniting industry, government and civil-society partners. …Brynn Bourke is executive director of the BC Building Trades (BCBT). …Don Kayne is president and CEO of Canfor Corporation, and former CEO of Canfor Pulp Products Inc. Kayne has deep experience in international sales and marketing, human resources and executive compensation through 45 years with the forest company.  The monitor for the San Group of companies has been granted broader powers by the Supreme Court of B.C. to manage and make decisions about the financially troubled forestry company, which has operations in Port Alberni. The San Group’s protection from creditors was extended at a court hearing in Vancouver on Thursday. The next hearing is set for Jan. 16. Expanded powers granted to Deloitte include the ability to administer the company’s restructuring and any winding down of the business, plus liquidating property and disposing of assets. The monitor is permitted to continue running the business, and said it anticipates working with current management. The various parties are expected to be back in court to ask for approval for a sale and investment solicitation process. …The court agreed the company can increase its borrowing limit to $1 million — up by $400,000 — to keep operations going.

The monitor for the San Group of companies has been granted broader powers by the Supreme Court of B.C. to manage and make decisions about the financially troubled forestry company, which has operations in Port Alberni. The San Group’s protection from creditors was extended at a court hearing in Vancouver on Thursday. The next hearing is set for Jan. 16. Expanded powers granted to Deloitte include the ability to administer the company’s restructuring and any winding down of the business, plus liquidating property and disposing of assets. The monitor is permitted to continue running the business, and said it anticipates working with current management. The various parties are expected to be back in court to ask for approval for a sale and investment solicitation process. …The court agreed the company can increase its borrowing limit to $1 million — up by $400,000 — to keep operations going.

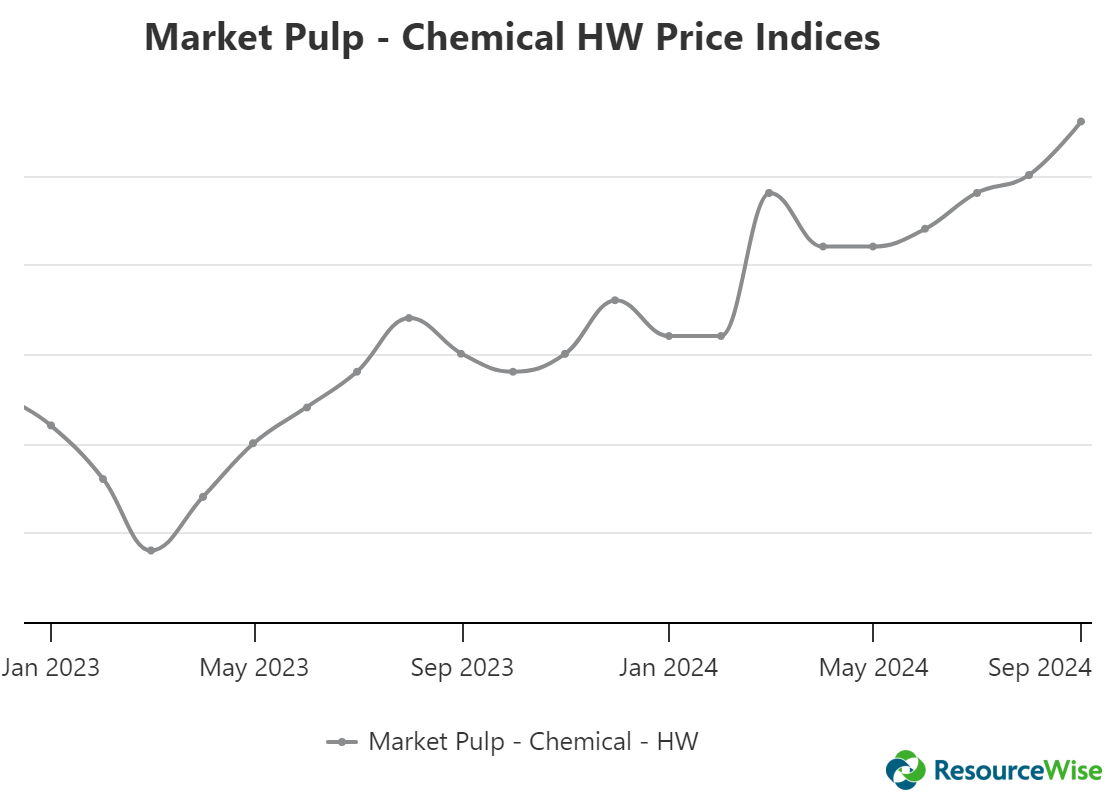

SPOKANE, Washington — Brazil’s Suzano is exploring an offer for Clearwater Paper, according to people with knowledge of the matter. The company is working with an adviser as it seeks to reach an agreement, said the people. A deal hasn’t been finalized and it’s possible one won’t be reached. Representatives for Suzano and Clearwater declined to comment. Spokane, Washington-based Clearwater, which manufactures pulp and paperboard products, had a market capitalization of $409 million as of Thursday’s close and its shares have fallen 31.6% this year. Clearwater’s shares jumped as much as 19% after the close of regular trading Thursday. Suzano, which is the largest supplier of hardwood market pulp in North America, has been pushing further into the US, most recently buying two paperboard mills in Arkansas and North Carolina in a deal valued at $110 million. [END]

SPOKANE, Washington — Brazil’s Suzano is exploring an offer for Clearwater Paper, according to people with knowledge of the matter. The company is working with an adviser as it seeks to reach an agreement, said the people. A deal hasn’t been finalized and it’s possible one won’t be reached. Representatives for Suzano and Clearwater declined to comment. Spokane, Washington-based Clearwater, which manufactures pulp and paperboard products, had a market capitalization of $409 million as of Thursday’s close and its shares have fallen 31.6% this year. Clearwater’s shares jumped as much as 19% after the close of regular trading Thursday. Suzano, which is the largest supplier of hardwood market pulp in North America, has been pushing further into the US, most recently buying two paperboard mills in Arkansas and North Carolina in a deal valued at $110 million. [END]

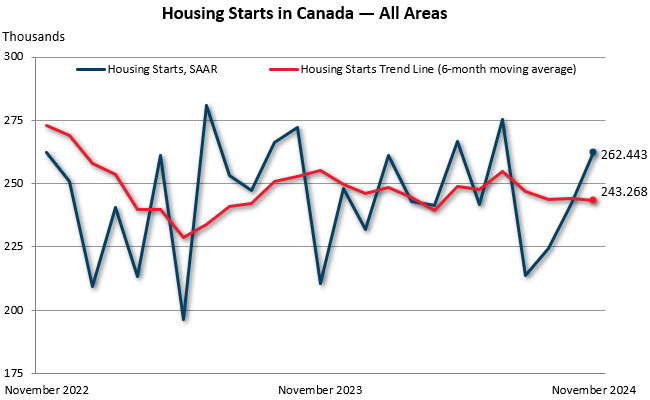

WASHINGTON — U.S. single-family homebuilding rebounded in November as the drag from hurricanes faded, but the threat of tariffs on imported goods and potential labor shortages from mass deportations could hamper new construction next year. Single-family housing starts, which account for the bulk of homebuilding, jumped 6.4% to a seasonally adjusted annual rate of 1.011 million units last month, the Commerce Department’s Census Bureau said. Data for October was revised to show homebuilding declining to a rate of 950,000 units from the previously reported pace of 970,000 units. …A National Association of Home Builders survey on Tuesday showed a measure of sales expectations in the next six months surging in December to the highest level since April 2022. …But economists were less enthusiastic, warning of even higher lumber prices and severe worker shortages if Trump followed through with tariffs and expulsions of undocumented immigrants, which would undermine the housing market.

WASHINGTON — U.S. single-family homebuilding rebounded in November as the drag from hurricanes faded, but the threat of tariffs on imported goods and potential labor shortages from mass deportations could hamper new construction next year. Single-family housing starts, which account for the bulk of homebuilding, jumped 6.4% to a seasonally adjusted annual rate of 1.011 million units last month, the Commerce Department’s Census Bureau said. Data for October was revised to show homebuilding declining to a rate of 950,000 units from the previously reported pace of 970,000 units. …A National Association of Home Builders survey on Tuesday showed a measure of sales expectations in the next six months surging in December to the highest level since April 2022. …But economists were less enthusiastic, warning of even higher lumber prices and severe worker shortages if Trump followed through with tariffs and expulsions of undocumented immigrants, which would undermine the housing market. The inventory destocking that occurred in virtually every industry in 2023 is coming to an end. Destocking occurred as supply chains normalized in a post-COVID world.

The inventory destocking that occurred in virtually every industry in 2023 is coming to an end. Destocking occurred as supply chains normalized in a post-COVID world. DUBLIN, Ireland —The housing affordability crisis that has frustrated young Americans for a decade has now taken hold in many big cities in Europe and beyond. The common threads: robust job growth, rising demand and not enough new development, causing rents and sales prices to rise faster than wages. Globally, homes are now less affordable than they were in the run-up to the 2008 housing crisis. …The resulting housing crunches are eroding living standards for poor and middle-class workers, intensifying wealth inequality and stoking political tensions. …In the 50 years through 2021, the countries with the sharpest rise in home prices around the world have been New Zealand, the U.K., Canada, Australia and Ireland. …Politicians in Canada, the U.K., Australia, Germany and South Korea are trying to boost construction by easing rules, including opening up undeveloped land for construction. National governments, though, are hamstrung by state and local rules that favor existing homeowners over renters, Hughes and Hilber said.

DUBLIN, Ireland —The housing affordability crisis that has frustrated young Americans for a decade has now taken hold in many big cities in Europe and beyond. The common threads: robust job growth, rising demand and not enough new development, causing rents and sales prices to rise faster than wages. Globally, homes are now less affordable than they were in the run-up to the 2008 housing crisis. …The resulting housing crunches are eroding living standards for poor and middle-class workers, intensifying wealth inequality and stoking political tensions. …In the 50 years through 2021, the countries with the sharpest rise in home prices around the world have been New Zealand, the U.K., Canada, Australia and Ireland. …Politicians in Canada, the U.K., Australia, Germany and South Korea are trying to boost construction by easing rules, including opening up undeveloped land for construction. National governments, though, are hamstrung by state and local rules that favor existing homeowners over renters, Hughes and Hilber said. The federal government has pushed its target to achieve a net-zero electricity grid back 15 years to 2050 as part of new clean electricity regulations announced Tuesday — though officials maintain that target date was always the goal. Canada had previously signalled an aim to fully decarbonize electricity grids by 2035. But some provinces, namely Alberta and Saskatchewan, said that was simply not doable. Alberta Premier Danielle Smith swiftly responded to Ottawa’s plan by saying her province would immediately mount a legal challenge because the regulations wade into provincial jurisdiction. …The country’s electricity grid is already substantially green, with 85% of Canada’s power supply coming from non-emitting sources. But four provinces — Alberta, Saskatchewan, Nova Scotia and New Brunswick — still rely on coal and natural gas. Committing to a net-zero electricity grid is an easy move for the other six provinces, which are already more than 90 per cent of the way there.

The federal government has pushed its target to achieve a net-zero electricity grid back 15 years to 2050 as part of new clean electricity regulations announced Tuesday — though officials maintain that target date was always the goal. Canada had previously signalled an aim to fully decarbonize electricity grids by 2035. But some provinces, namely Alberta and Saskatchewan, said that was simply not doable. Alberta Premier Danielle Smith swiftly responded to Ottawa’s plan by saying her province would immediately mount a legal challenge because the regulations wade into provincial jurisdiction. …The country’s electricity grid is already substantially green, with 85% of Canada’s power supply coming from non-emitting sources. But four provinces — Alberta, Saskatchewan, Nova Scotia and New Brunswick — still rely on coal and natural gas. Committing to a net-zero electricity grid is an easy move for the other six provinces, which are already more than 90 per cent of the way there. BOSTON — Procter & Gamble has agreed to provide additional information regarding its practices related to sourcing wood pulp from the boreal forests of Canada. The updates will reiterate the company’s aim to eliminate sourcing from intact forest landscapes and to protect primary forests. …The agreement came after discussions earlier this year with investment firms Green Century Capital Management, AXA Investment Managers, BNP Paribas Asset Management, and Robeco. In exchange, these investors agreed to withdraw a shareholder proposal asking the company to enhance its disclosures in relation to its existing efforts to mitigate risks to biodiversity and forest resilience. “These disclosures will help investors better understand how P&G is managing the risks associated with sourcing from such an ecologically important area,” said Leslie Samuelrich, President of Green Century Funds. …In addition, P&G will renew its investment in the development of alternative fibers.

BOSTON — Procter & Gamble has agreed to provide additional information regarding its practices related to sourcing wood pulp from the boreal forests of Canada. The updates will reiterate the company’s aim to eliminate sourcing from intact forest landscapes and to protect primary forests. …The agreement came after discussions earlier this year with investment firms Green Century Capital Management, AXA Investment Managers, BNP Paribas Asset Management, and Robeco. In exchange, these investors agreed to withdraw a shareholder proposal asking the company to enhance its disclosures in relation to its existing efforts to mitigate risks to biodiversity and forest resilience. “These disclosures will help investors better understand how P&G is managing the risks associated with sourcing from such an ecologically important area,” said Leslie Samuelrich, President of Green Century Funds. …In addition, P&G will renew its investment in the development of alternative fibers. For the first time since the pandemic, Canada had a year-over-year decline in its greenhouse gas emissions — though it is still a long way off its 2030 target. A preliminary

For the first time since the pandemic, Canada had a year-over-year decline in its greenhouse gas emissions — though it is still a long way off its 2030 target. A preliminary