Canada-US Trade Minister Dominic LeBlanc says he sees a path to renew the Canada-United States-Mexico Agreement (CUSMA) and anticipates more specifics from the U.S. administration soon. Gearing up to head back to Washington, DC next week to meet with US Trade Representative Jamieson Greer and “others” next week, LeBlanc said he’s “not pessimistic about renewing the trilateral framework.” “Renewing. It doesn’t expire, it expires in 2036. But the review is not a renegotiation,” LeBlanc said. LeBlanc said two of the key factors underpinning his optimism are that when US President Trump levied his latest global tariff, he maintained the CUSMA exemption, and because American political and business leaders are “speaking up more now.” …Amid speculation that Trump wants to scrap the trilateral trade pact and strike trade deals with Canada and Mexico independently, LeBlanc said the way he sees it, Trump may pursue separate bilateral deals, but that doesn’t necessarily mean the end of CUSMA.

Canada-US Trade Minister Dominic LeBlanc says he sees a path to renew the Canada-United States-Mexico Agreement (CUSMA) and anticipates more specifics from the U.S. administration soon. Gearing up to head back to Washington, DC next week to meet with US Trade Representative Jamieson Greer and “others” next week, LeBlanc said he’s “not pessimistic about renewing the trilateral framework.” “Renewing. It doesn’t expire, it expires in 2036. But the review is not a renegotiation,” LeBlanc said. LeBlanc said two of the key factors underpinning his optimism are that when US President Trump levied his latest global tariff, he maintained the CUSMA exemption, and because American political and business leaders are “speaking up more now.” …Amid speculation that Trump wants to scrap the trilateral trade pact and strike trade deals with Canada and Mexico independently, LeBlanc said the way he sees it, Trump may pursue separate bilateral deals, but that doesn’t necessarily mean the end of CUSMA.

Federal Natural Resources Minister Tim Hodgson says Ottawa will continue to come to the forestry sector’s aid in the face of punishing tariffs, even amid threats from the US alleging that Canada is now further escalating with new subsidies. It’s a threat Hodgson dismissed as “hyperbole.” …Since August, the federal government has introduced over $2.35 billion in measures designed to ensure Canada’s forest sector remains competitive and resilient in the face of escalating US tariffs. …But it also comes as the US Lumber Coalition has begun to allege that a wide range of federal and provincial programs amount to unfair subsidies. … “We are in no way inflaming the situation with the Americans by reducing the amount of our fibre that goes into commodity lumber by doing other value-added products. That’s actually good for Canada, that’s good for Canadian workers, and it reduces the amount of wood that gets sent to the United States.”

Trade negotiations used to be underpinned by an unspoken assumption: that trade barriers were lose-lose propositions. All sides could gain something if they mutually disarmed. …[They] were always about how much tariffs and other walls would go down, not how much they would go up. …United States Trade Representative Jamieson Greer sums up the Trump administration’s break with the postwar trade consensus, saying the administration is “focused on reshoring supply chains related to automotive, steel, aluminum … If Canada wants to come in and participate in this type of reshoring we’re trying to do, we’re happy to have those discussions.” …The U.S. wants higher tariffs at home, and lower tariffs abroad. The old give-and-take is now take-and-take. …”We want to have production here. We don’t necessarily want to be dependent on China, Canada or anybody else for things like cars.” [This article is only available to subscribers to the Globe and Mail]

Trade negotiations used to be underpinned by an unspoken assumption: that trade barriers were lose-lose propositions. All sides could gain something if they mutually disarmed. …[They] were always about how much tariffs and other walls would go down, not how much they would go up. …United States Trade Representative Jamieson Greer sums up the Trump administration’s break with the postwar trade consensus, saying the administration is “focused on reshoring supply chains related to automotive, steel, aluminum … If Canada wants to come in and participate in this type of reshoring we’re trying to do, we’re happy to have those discussions.” …The U.S. wants higher tariffs at home, and lower tariffs abroad. The old give-and-take is now take-and-take. …”We want to have production here. We don’t necessarily want to be dependent on China, Canada or anybody else for things like cars.” [This article is only available to subscribers to the Globe and Mail]

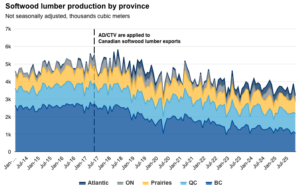

Anti-dumping and countervailing duties, and now additional tariffs on softwood lumber and derivative wood products add to a long history of trade measures applied to Canadian exports. …Recent trade data shows exports of targeted wood products to the US have declined by roughly 11% in 2025 from a year earlier with losses concentrated in Quebec and BC. Export gains elsewhere have only partially compensated for reduced US market access—in part reflecting the geographical constraints in shipping lumber and wood products. …Average industrial capacity utilization rate for wood product manufacturing has declined roughly 10 percentage points to 75% in 2025 Q3 from a decade earlier, while employment in sawmills and wood preservation fell roughly 20% between May 2017 and November 2025 with more pronounced declines in BC (-32%) and Quebec (-13%). …Reduced domestic supply could also put pressure on downstream industries such as pulp and paper mills and construction. The combination of weak demand and constrained supply raises the risk of further production curtailments and mill closures.

Anti-dumping and countervailing duties, and now additional tariffs on softwood lumber and derivative wood products add to a long history of trade measures applied to Canadian exports. …Recent trade data shows exports of targeted wood products to the US have declined by roughly 11% in 2025 from a year earlier with losses concentrated in Quebec and BC. Export gains elsewhere have only partially compensated for reduced US market access—in part reflecting the geographical constraints in shipping lumber and wood products. …Average industrial capacity utilization rate for wood product manufacturing has declined roughly 10 percentage points to 75% in 2025 Q3 from a decade earlier, while employment in sawmills and wood preservation fell roughly 20% between May 2017 and November 2025 with more pronounced declines in BC (-32%) and Quebec (-13%). …Reduced domestic supply could also put pressure on downstream industries such as pulp and paper mills and construction. The combination of weak demand and constrained supply raises the risk of further production curtailments and mill closures.

The Forest Products Association of Canada responded to the federal government’s announcement to support and retool our forest sector to ensure it remains a pillar of national strength and prosperity. The Minister of Energy and Natural Resources, launched a national

The Forest Products Association of Canada responded to the federal government’s announcement to support and retool our forest sector to ensure it remains a pillar of national strength and prosperity. The Minister of Energy and Natural Resources, launched a national

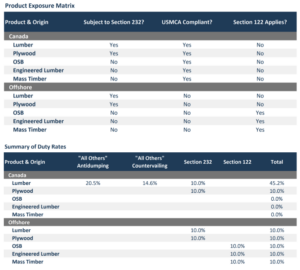

President Donald Trump announced a temporary import duty under Section 122 of the Trade Act of 1974, shortly after the US Supreme Court struck down his tariffs imposed under the International Emergency Economic Powers Act. The Section 122 surcharge is scheduled to take effect February 24 and remain in place for up to 150 days. Under the proclamation, Section 122 duties do not apply to goods that are subject to Section 232 of the Trade Expansion Act of 1962 or that are USMCA compliant. The implications for wood products are as follows:

President Donald Trump announced a temporary import duty under Section 122 of the Trade Act of 1974, shortly after the US Supreme Court struck down his tariffs imposed under the International Emergency Economic Powers Act. The Section 122 surcharge is scheduled to take effect February 24 and remain in place for up to 150 days. Under the proclamation, Section 122 duties do not apply to goods that are subject to Section 232 of the Trade Expansion Act of 1962 or that are USMCA compliant. The implications for wood products are as follows: Delaware – President Trump’s announcement of a 15% tariff following last week’s Supreme Court ruling has created uncertainty in financial markets. While some retailers and consumer companies may benefit from reduced trade barriers, domestic lumber and packaging firms face increased competition from cheaper imports. …On Monday, domestic lumber companies saw their stock prices drop amid concerns that cheaper foreign imports could undercut their pricing power. The court’s tariff decision threatens to erode the competitive advantage that domestic packaging and lumber businesses previously held against lower-cost foreign competitors, industry analysts warn. RBC analysts identified potential negative consequences for companies including Clearwater Paper, Rayonier, Sylvamo, and Smurfit WestRock. A recent industry survey revealed that most U.S. purchasers reported declining containerboard prices in February, as increased European imports expanded supply and created additional pricing pressures. Monday trading saw Smurfit and domestic competitor International Paper decline by 7% and 6%, respectively.

Delaware – President Trump’s announcement of a 15% tariff following last week’s Supreme Court ruling has created uncertainty in financial markets. While some retailers and consumer companies may benefit from reduced trade barriers, domestic lumber and packaging firms face increased competition from cheaper imports. …On Monday, domestic lumber companies saw their stock prices drop amid concerns that cheaper foreign imports could undercut their pricing power. The court’s tariff decision threatens to erode the competitive advantage that domestic packaging and lumber businesses previously held against lower-cost foreign competitors, industry analysts warn. RBC analysts identified potential negative consequences for companies including Clearwater Paper, Rayonier, Sylvamo, and Smurfit WestRock. A recent industry survey revealed that most U.S. purchasers reported declining containerboard prices in February, as increased European imports expanded supply and created additional pricing pressures. Monday trading saw Smurfit and domestic competitor International Paper decline by 7% and 6%, respectively. US President Donald Trump just lost his biggest emergency tariff weapon at the US Supreme Court – but for Canadian exporters and long‑term investors, the real story is that the pressure has shifted to narrower, more strategic sectors that matter for jobs, growth and returns. …Trump reacted by promising new tariffs through other statutes. …Section 232 now defines Canada’s real exposure. …Softwood timber and lumber: 10 percent tariffs imposed last October, alongside US countervailing and anti‑dumping duties on Canadian lumber that the Commerce Department increased from 14.5 percent to 35 percent earlier this year. …Upholstered wooden furniture, cabinets and vanities: 25 percent tariffs since last October; a planned increase in January was paused. …Dominic LeBlanc, Canada’s minister for US–Canadian trade relations, told CBC News that “what’s hurting the Canadian economy are the sectoral tariffs under a different American law,” and said this “reminds us again of the importance of diversifying our trading relationships.”

US President Donald Trump just lost his biggest emergency tariff weapon at the US Supreme Court – but for Canadian exporters and long‑term investors, the real story is that the pressure has shifted to narrower, more strategic sectors that matter for jobs, growth and returns. …Trump reacted by promising new tariffs through other statutes. …Section 232 now defines Canada’s real exposure. …Softwood timber and lumber: 10 percent tariffs imposed last October, alongside US countervailing and anti‑dumping duties on Canadian lumber that the Commerce Department increased from 14.5 percent to 35 percent earlier this year. …Upholstered wooden furniture, cabinets and vanities: 25 percent tariffs since last October; a planned increase in January was paused. …Dominic LeBlanc, Canada’s minister for US–Canadian trade relations, told CBC News that “what’s hurting the Canadian economy are the sectoral tariffs under a different American law,” and said this “reminds us again of the importance of diversifying our trading relationships.”  The US Lumber Coalition has expanded its list of complaints against Canadian softwood producers. The group has presented nine “new subsidy allegations,” claiming that Canadian producers benefit from federal government programs, including one that offers refundable tax credits for clean technology such as solar power. …The Commerce Department is investigating the nine new allegations put forward by the group. Canada has repeatedly rejected American arguments that Canadian producers benefit from subsidies and also denies dumping. …One of the group’s complaints targets a federal program in Canada, open to eligible forestry companies, that provides refundable tax credits for carbon capture, utilization and storage. In addition, the group’s allegations name provincial programs in BC, Alberta, Ontario and Quebec. …The Commerce Department deferred a potential probe, suggested by the Coalition, into cases pertaining to alleged subsidies for long-term timber tenures in BC and Alberta. [to access the full story a Globe & Mail subscription is required]

The US Lumber Coalition has expanded its list of complaints against Canadian softwood producers. The group has presented nine “new subsidy allegations,” claiming that Canadian producers benefit from federal government programs, including one that offers refundable tax credits for clean technology such as solar power. …The Commerce Department is investigating the nine new allegations put forward by the group. Canada has repeatedly rejected American arguments that Canadian producers benefit from subsidies and also denies dumping. …One of the group’s complaints targets a federal program in Canada, open to eligible forestry companies, that provides refundable tax credits for carbon capture, utilization and storage. In addition, the group’s allegations name provincial programs in BC, Alberta, Ontario and Quebec. …The Commerce Department deferred a potential probe, suggested by the Coalition, into cases pertaining to alleged subsidies for long-term timber tenures in BC and Alberta. [to access the full story a Globe & Mail subscription is required] OTTAWA — The Supreme Court of Canada will help decide the appropriate means of reviewing a company’s complaint about the service provided by a railway. In November 2023, the Canadian Transportation Agency ruled that Canadian National Railway Co. failed to meet the level of service it owed to Alberta Pacific Forest Industries Inc. The agency is a federal regulator and quasi-judicial tribunal and, under section 41 of the Canadian Transportation Act, its decisions may be appealed to the Federal Court of Appeal on questions of law or jurisdiction. CN wanted to contest factual findings so it pursued an appeal under a provision of the Federal Courts Act, not under section 41.

OTTAWA — The Supreme Court of Canada will help decide the appropriate means of reviewing a company’s complaint about the service provided by a railway. In November 2023, the Canadian Transportation Agency ruled that Canadian National Railway Co. failed to meet the level of service it owed to Alberta Pacific Forest Industries Inc. The agency is a federal regulator and quasi-judicial tribunal and, under section 41 of the Canadian Transportation Act, its decisions may be appealed to the Federal Court of Appeal on questions of law or jurisdiction. CN wanted to contest factual findings so it pursued an appeal under a provision of the Federal Courts Act, not under section 41. Join Bryan Yu, Chief Economist at Central 1 Credit Union, for a clear-eyed keynote on the economic forces shaping the year ahead. In his presentation, 2026 Macroeconomic Outlook he will examine trade uncertainty, global competition, and pressure at home. What’s ahead for BC and Canada’s economy? Hear what the outlook means for BC’s forest sector and the strategic decisions leaders will face in a rapidly changing economy. Mark your calendar for April 8 – 10, and register before March 6 to take advantage of Early Bird discounts.

Join Bryan Yu, Chief Economist at Central 1 Credit Union, for a clear-eyed keynote on the economic forces shaping the year ahead. In his presentation, 2026 Macroeconomic Outlook he will examine trade uncertainty, global competition, and pressure at home. What’s ahead for BC and Canada’s economy? Hear what the outlook means for BC’s forest sector and the strategic decisions leaders will face in a rapidly changing economy. Mark your calendar for April 8 – 10, and register before March 6 to take advantage of Early Bird discounts.

Raw logs were being loaded for export at the shuttered Crofton pulp mill – just weeks after hundreds of local workers were laid off over a lack of wood fibre, and as about 120 sidelined Chemainus sawmill employees brace for their EI benefits to run dry. “I don’t want a handout, I want a job,” said Brian Bull, who was laid off from Western Forest Products’ Chemainus sawmill. …North Cowichan’s mayor says repeated appeals to federal officials to grant workers the additional 20 weeks of EI benefits promised by the Prime Minister in the summer of 2025 have gone unanswered. “There’s about 120 workers impacted at the Chemainus sawmill. The majority are set to lose their EI benefits next month. …So laid-off Chemainus sawmill workers are urging the provincial government to stop raw log exports. Elzinga said he fears their the Chemainus sawmill may never re-open, due a lack of fibre supply.

Raw logs were being loaded for export at the shuttered Crofton pulp mill – just weeks after hundreds of local workers were laid off over a lack of wood fibre, and as about 120 sidelined Chemainus sawmill employees brace for their EI benefits to run dry. “I don’t want a handout, I want a job,” said Brian Bull, who was laid off from Western Forest Products’ Chemainus sawmill. …North Cowichan’s mayor says repeated appeals to federal officials to grant workers the additional 20 weeks of EI benefits promised by the Prime Minister in the summer of 2025 have gone unanswered. “There’s about 120 workers impacted at the Chemainus sawmill. The majority are set to lose their EI benefits next month. …So laid-off Chemainus sawmill workers are urging the provincial government to stop raw log exports. Elzinga said he fears their the Chemainus sawmill may never re-open, due a lack of fibre supply.

Snuneymuxw First Nation is calling on other levels of government to act to protect its waters following an oil spill and long-standing discharge of “toxic sawmill effluent” at Duke Point near Nanaimo. The nation is calling for a full environmental investigation following the incidents it says are caused by Environmental 360 and Western Forest Products. The nation has sent letters to the federal, provincial and municipal governments calling on them to act. This comes after an

Snuneymuxw First Nation is calling on other levels of government to act to protect its waters following an oil spill and long-standing discharge of “toxic sawmill effluent” at Duke Point near Nanaimo. The nation is calling for a full environmental investigation following the incidents it says are caused by Environmental 360 and Western Forest Products. The nation has sent letters to the federal, provincial and municipal governments calling on them to act. This comes after an  The CN railway running through 100 Mile House will not be discontinued after all. District of 100 Mile House Mayor Maureen Pinkney said that the consultant hired to assess the rail line’s future had told her, and around 87 other stakeholders in the region between North Vancouver and Prince George, that removal of the rails was off the table. …CN Rail announced it would be discontinuing service between Squamish and 100 Mile House… and that rails and ties are removed after discontinuance. …Potentials for the new use of the rail tracks include the return of passenger rail to 100 Mile House. …Pinkney said that there could be opportunities from the saved rail line to make up for lost tax revenue from the closure of the West Fraser Mill, as well as the OSB plant.

The CN railway running through 100 Mile House will not be discontinued after all. District of 100 Mile House Mayor Maureen Pinkney said that the consultant hired to assess the rail line’s future had told her, and around 87 other stakeholders in the region between North Vancouver and Prince George, that removal of the rails was off the table. …CN Rail announced it would be discontinuing service between Squamish and 100 Mile House… and that rails and ties are removed after discontinuance. …Potentials for the new use of the rail tracks include the return of passenger rail to 100 Mile House. …Pinkney said that there could be opportunities from the saved rail line to make up for lost tax revenue from the closure of the West Fraser Mill, as well as the OSB plant.  The Ontario Forest Industries Association is looking forward to welcoming you to our 83rd Annual Convention at One King West Hotel & Residence in Toronto, April 28 – 29, 2026. We are planning another high-impact event, and we want to ensure your visit is as smooth and enjoyable as possible. If you have not registered for the event, do so as soon as possible as limited spots remain. If you haven’t yet secured accommodations, we encourage you to do so as soon as possible. There are options at the One King West Hotel as well as several hotels within a short walking distance of One King West. The OFIA is a trade association representing Ontario’s sustainable forest industry and serves as a unified voice for forest products companies across the province — from timber producers to wood manufacturers — advocating on policy, market access, sustainability, and economic development issues. The Annual Convention is our flagship event, intended to bring together industry leaders, members, and stakeholders for networking, education, discussion, and celebration.

The Ontario Forest Industries Association is looking forward to welcoming you to our 83rd Annual Convention at One King West Hotel & Residence in Toronto, April 28 – 29, 2026. We are planning another high-impact event, and we want to ensure your visit is as smooth and enjoyable as possible. If you have not registered for the event, do so as soon as possible as limited spots remain. If you haven’t yet secured accommodations, we encourage you to do so as soon as possible. There are options at the One King West Hotel as well as several hotels within a short walking distance of One King West. The OFIA is a trade association representing Ontario’s sustainable forest industry and serves as a unified voice for forest products companies across the province — from timber producers to wood manufacturers — advocating on policy, market access, sustainability, and economic development issues. The Annual Convention is our flagship event, intended to bring together industry leaders, members, and stakeholders for networking, education, discussion, and celebration. The Quebec government says it will hold a “mini-reform” of the province’s forest regime to provide relief for sawmills and other businesses pressured by cumulative U.S. tariffs. Jean-François Simard, Quebec’s minister of natural resources and forests, said that the changes aim to prevent plant closures and job losses which have surged in recent months. Simard said in a statement on Tuesday that 60,000 jobs are at risk. Quebec’s forestry and logging industry is the second largest in Canada in terms of employment, according to Statistics Canada. The forest regime dictates how Quebec’s forests are managed and harvested. The announcement comes days after a group of Indigenous land guardians and First Nations hereditary chiefs filed a lawsuit seeking formal recognition of their rights over a vast stretch of Quebec. Their legal challenge aims to curb industrial logging and ensure the protection of their traditional way of life.

The Quebec government says it will hold a “mini-reform” of the province’s forest regime to provide relief for sawmills and other businesses pressured by cumulative U.S. tariffs. Jean-François Simard, Quebec’s minister of natural resources and forests, said that the changes aim to prevent plant closures and job losses which have surged in recent months. Simard said in a statement on Tuesday that 60,000 jobs are at risk. Quebec’s forestry and logging industry is the second largest in Canada in terms of employment, according to Statistics Canada. The forest regime dictates how Quebec’s forests are managed and harvested. The announcement comes days after a group of Indigenous land guardians and First Nations hereditary chiefs filed a lawsuit seeking formal recognition of their rights over a vast stretch of Quebec. Their legal challenge aims to curb industrial logging and ensure the protection of their traditional way of life.

The decision by the US Supreme Court to invalidate many of President Trump’s tariffs has been met with mixed reactions in Quebec, as the steel, aluminum and lumber sectors remain subject to US tariffs. Economy Minister Jean Boulet said, “its effects for Quebec seem limited,” noting that Quebec exports in accordance with CUSMA were already exempt. “American tariffs on lumber and other key sectors remain in place,” Boulet stressed. …Stakeholders from Quebec’s economic and union sectors pointed out that Friday’s ruling is far from putting an end to the trade war with our southern neighbors. …“While this decision is great news for free trade, its impact on Canada remains limited and we are not out of the woods yet,” said senior public policy analyst Gabriel Giguère in a statement. Moreover, the review of the USMCA planned for this year still looms over Canada-US relations.

The decision by the US Supreme Court to invalidate many of President Trump’s tariffs has been met with mixed reactions in Quebec, as the steel, aluminum and lumber sectors remain subject to US tariffs. Economy Minister Jean Boulet said, “its effects for Quebec seem limited,” noting that Quebec exports in accordance with CUSMA were already exempt. “American tariffs on lumber and other key sectors remain in place,” Boulet stressed. …Stakeholders from Quebec’s economic and union sectors pointed out that Friday’s ruling is far from putting an end to the trade war with our southern neighbors. …“While this decision is great news for free trade, its impact on Canada remains limited and we are not out of the woods yet,” said senior public policy analyst Gabriel Giguère in a statement. Moreover, the review of the USMCA planned for this year still looms over Canada-US relations.

It took only a few hours after the

It took only a few hours after the  The US Customs and Border Protection agency said it will halt collections of tariffs imposed under the International Emergency Economic Powers Act at 12:01 a.m. EST on Tuesday, more than three days after the US Supreme Court declared the duties illegal. The agency said in a message to shippers on its Cargo Systems Messaging Service that it will de-activate all tariff codes associated with US President Trump’s prior IEEPA-related orders as of Tuesday. The IEEPA tariff collection halt coincides with Trump’s imposition of a new, 15% global tariff under a different legal authority to replace the ones struck down by the Supreme Court on Friday. CBP gave no reason why it was continuing to collect the tariffs days after the Supreme Court’s ruling. The message noted that the collection halt does not affect other tariffs imposed by Trump under the Section 232 national security statute and the Section 301 unfair trade practices statute.

The US Customs and Border Protection agency said it will halt collections of tariffs imposed under the International Emergency Economic Powers Act at 12:01 a.m. EST on Tuesday, more than three days after the US Supreme Court declared the duties illegal. The agency said in a message to shippers on its Cargo Systems Messaging Service that it will de-activate all tariff codes associated with US President Trump’s prior IEEPA-related orders as of Tuesday. The IEEPA tariff collection halt coincides with Trump’s imposition of a new, 15% global tariff under a different legal authority to replace the ones struck down by the Supreme Court on Friday. CBP gave no reason why it was continuing to collect the tariffs days after the Supreme Court’s ruling. The message noted that the collection halt does not affect other tariffs imposed by Trump under the Section 232 national security statute and the Section 301 unfair trade practices statute. An Oregon jury has awarded $305 million to 16 wildfire survivors harmed by the Santiam Canyon wildfire that burned across hundreds of thousands of acres in 2020. This is the largest jury verdict issued in relation to the James v. PacifiCorp class-action lawsuit, pushing PacifiCorp’s total liability past $1 billion. PacifiCorp — the parent company of Pacific Power, Oregon’s second-largest electric utility — kept its lines charged over the 2020 Labor Day weekend, despite fire officials’ warnings about hot, windy weather. Five people died in the Santiam Canyon fire, and more than 400,000 acres burned across four counties. In 2023, a jury found PacifiCorp was reckless and acted in “gross negligence” in relation to multiple wildfires, including the Santiam fire. In addition to the 17 plaintiffs who sued the company in that case, the jury found a broader class of thousands of people can bring additional claims against PacifiCorp for those wildfires.

An Oregon jury has awarded $305 million to 16 wildfire survivors harmed by the Santiam Canyon wildfire that burned across hundreds of thousands of acres in 2020. This is the largest jury verdict issued in relation to the James v. PacifiCorp class-action lawsuit, pushing PacifiCorp’s total liability past $1 billion. PacifiCorp — the parent company of Pacific Power, Oregon’s second-largest electric utility — kept its lines charged over the 2020 Labor Day weekend, despite fire officials’ warnings about hot, windy weather. Five people died in the Santiam Canyon fire, and more than 400,000 acres burned across four counties. In 2023, a jury found PacifiCorp was reckless and acted in “gross negligence” in relation to multiple wildfires, including the Santiam fire. In addition to the 17 plaintiffs who sued the company in that case, the jury found a broader class of thousands of people can bring additional claims against PacifiCorp for those wildfires.

MOSINEE, Wisconsin — About 200 employees at the Mosinee paper mill were told before their shifts this week that their jobs are at risk as Ahlstrom moves forward with a phased shutdown of key operations at the plant. Several employees, speaking on condition of anonymity, told Wausau Pilot late Wednesday that management told workers Paper Machine No. 2 will shut down June 30, with Paper Machine No. 3 and the pulp mill slated to close Sept. 30. …In the letter to suppliers, Ahlstrom said it plans to permanently close the pulp mill and idle the M2 and M3 paper machines as part of a restructuring of operations at the Mosinee facility. The company cited rising costs and limited automation at those operations as reasons for the decision. …Ahlstrom said Paper Machines No. 1 and No. 4 will continue operating at the Mosinee mill. The company also said it plans to invest in modern technologies at those remaining machines.

MOSINEE, Wisconsin — About 200 employees at the Mosinee paper mill were told before their shifts this week that their jobs are at risk as Ahlstrom moves forward with a phased shutdown of key operations at the plant. Several employees, speaking on condition of anonymity, told Wausau Pilot late Wednesday that management told workers Paper Machine No. 2 will shut down June 30, with Paper Machine No. 3 and the pulp mill slated to close Sept. 30. …In the letter to suppliers, Ahlstrom said it plans to permanently close the pulp mill and idle the M2 and M3 paper machines as part of a restructuring of operations at the Mosinee facility. The company cited rising costs and limited automation at those operations as reasons for the decision. …Ahlstrom said Paper Machines No. 1 and No. 4 will continue operating at the Mosinee mill. The company also said it plans to invest in modern technologies at those remaining machines.