Scarcity and an acute, sustained rise in building material costs — from softwood lumber to distribution transformers — are driving up the cost to construct homes and harming housing affordability. There are several factors driving this trend, notably inflationary pressures and global factors, including trade uncertainty. …A tariff is essentially a tax on an imported good, meaning the importer pays an additional cost for importing such an item. …So tariffs on building materials raise the cost of housing, and consumers end up paying for the tariffs in the form of higher home prices. Two essential materials used in new home construction, softwood lumber and gypsum (used for drywall), are largely sourced from Canada and Mexico, respectively. Proposed new tariffs on China, Canada and Mexico are projected to raise the cost of imported construction materials by $3 billion to $4 billion, depending on the specific rates.

Scarcity and an acute, sustained rise in building material costs — from softwood lumber to distribution transformers — are driving up the cost to construct homes and harming housing affordability. There are several factors driving this trend, notably inflationary pressures and global factors, including trade uncertainty. …A tariff is essentially a tax on an imported good, meaning the importer pays an additional cost for importing such an item. …So tariffs on building materials raise the cost of housing, and consumers end up paying for the tariffs in the form of higher home prices. Two essential materials used in new home construction, softwood lumber and gypsum (used for drywall), are largely sourced from Canada and Mexico, respectively. Proposed new tariffs on China, Canada and Mexico are projected to raise the cost of imported construction materials by $3 billion to $4 billion, depending on the specific rates.

The Bank of Canada is being pulled in a few different directions ahead of its first interest rate decision of the year on Wednesday. On one hand, there are signs of trouble bubbling up in underlying inflation that could make an argument for keeping borrowing costs higher for longer. On the other: Donald Trump has reiterated threats to impose tariffs of 25% on Canadian goods that could be set to take effect mere days after the central bank’s rate decision. …A trade blow like that would normally push the Bank of Canada towards steeper rate cuts in a bid to salvage economic growth. But dropping rates too quickly at a time when the loonie is already struggling risks fuelling more inflation on imports from the US. Economists say they’re betting the Bank of Canada will go ahead with another cut.

The Bank of Canada is being pulled in a few different directions ahead of its first interest rate decision of the year on Wednesday. On one hand, there are signs of trouble bubbling up in underlying inflation that could make an argument for keeping borrowing costs higher for longer. On the other: Donald Trump has reiterated threats to impose tariffs of 25% on Canadian goods that could be set to take effect mere days after the central bank’s rate decision. …A trade blow like that would normally push the Bank of Canada towards steeper rate cuts in a bid to salvage economic growth. But dropping rates too quickly at a time when the loonie is already struggling risks fuelling more inflation on imports from the US. Economists say they’re betting the Bank of Canada will go ahead with another cut. U.S. trade with Canada and Mexico is back in Trump’s crosshairs with the tariff threat. …Much of the focus has centered on autos but Canada is also the top trading partner of the U.S. for critical chemicals, an industry now bracing for the potential impact. …Mineral firms in Canada are considered domestic sources under Title III of the Defense Production Act and have received U.S. federal funding for critical minerals projects in Canada. …Canada is also the largest supplier of U.S. energy imports, including crude oil, natural gas, and electricity. …Rand Ghayad, chief economist at the Association of American Railroads, said the interconnected rail network between the U.S. and Canada is a cornerstone of North American trade, underpinning economic growth and supply chain resilience. …The inflationary effects from tariffs will take some time to materialize, as these costs will need to be passed through to end buyers.

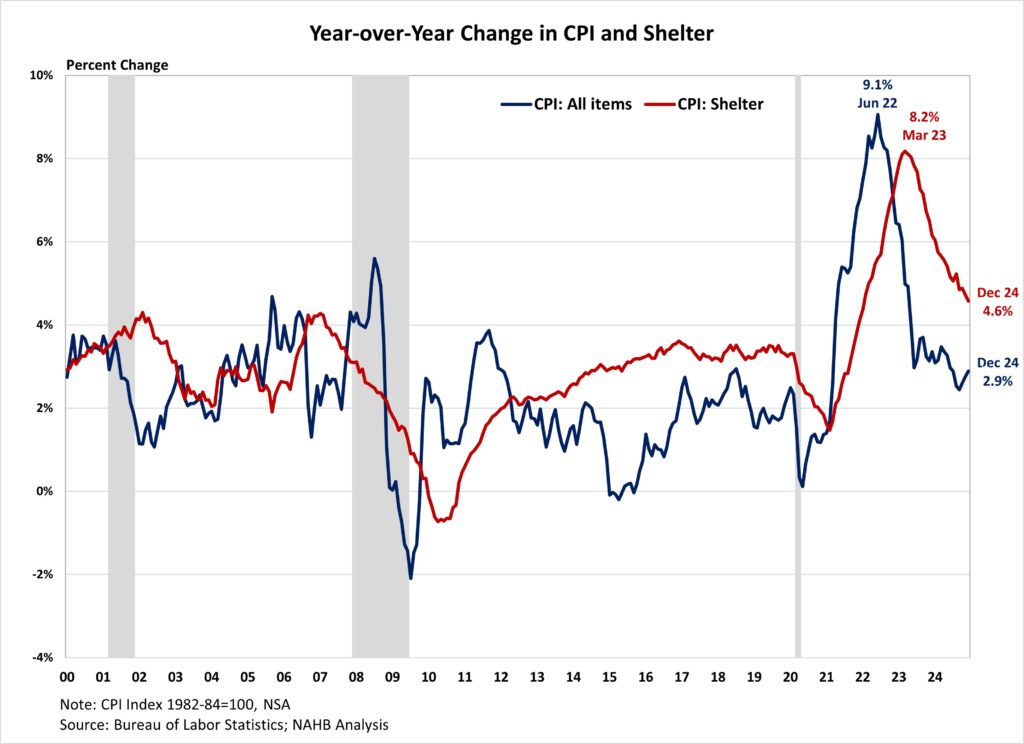

U.S. trade with Canada and Mexico is back in Trump’s crosshairs with the tariff threat. …Much of the focus has centered on autos but Canada is also the top trading partner of the U.S. for critical chemicals, an industry now bracing for the potential impact. …Mineral firms in Canada are considered domestic sources under Title III of the Defense Production Act and have received U.S. federal funding for critical minerals projects in Canada. …Canada is also the largest supplier of U.S. energy imports, including crude oil, natural gas, and electricity. …Rand Ghayad, chief economist at the Association of American Railroads, said the interconnected rail network between the U.S. and Canada is a cornerstone of North American trade, underpinning economic growth and supply chain resilience. …The inflationary effects from tariffs will take some time to materialize, as these costs will need to be passed through to end buyers. OTTAWA — The Consumer Price Index (CPI) rose 1.8% on a year-over-year basis in December, down from a 1.9% increase in November. …The CPI excluding food rose 2.1% in December. A temporary GST/HST break on certain goods was introduced on December 14, 2024. …The shelter component grew at a slightly slower pace in December, rising 4.5% year over year following a 4.6% increase in November. Rent prices decelerated on a year-over-year basis in December (+7.1%) compared with November (+7.7%). However since December 2021, rent prices have increased 22.1%. The mortgage interest cost index decelerated for the 16th consecutive month, reaching 11.7% year over year in December 2024, the smallest increase since October 2022 (+11.4%) as interest rates continued to rise.

OTTAWA — The Consumer Price Index (CPI) rose 1.8% on a year-over-year basis in December, down from a 1.9% increase in November. …The CPI excluding food rose 2.1% in December. A temporary GST/HST break on certain goods was introduced on December 14, 2024. …The shelter component grew at a slightly slower pace in December, rising 4.5% year over year following a 4.6% increase in November. Rent prices decelerated on a year-over-year basis in December (+7.1%) compared with November (+7.7%). However since December 2021, rent prices have increased 22.1%. The mortgage interest cost index decelerated for the 16th consecutive month, reaching 11.7% year over year in December 2024, the smallest increase since October 2022 (+11.4%) as interest rates continued to rise. Lumber prices remained above $590 per thousand board feet in January, hovering at eight-week highs as robust demand for building materials in the US compounded with dovish expectations for Federal Reserve policy. U.S. housing starts in December surged 15.8% from the previous month to a seasonally adjusted annual rate of 1.499 million units, the highest since February 2024 and well above market expectations of 1.32 million. Although building permits fell 0.7% to 1.483 million units, they exceeded forecasts of 1.46 million. At the same time, easing core inflation from the latest CPI report reinforced expectations of Federal Reserve rate cuts by mid-year, while mortgage applications jumped 33.3%, marking the largest weekly increase since 2020, as buyers sought to lock in borrowing costs despite rates exceeding 7%. Additionally, U.S. buyers stockpiled inventory ahead of a proposed 25% tariff on Canadian softwood lumber, while existing 14.4% duties further constrained supply. [END]

Lumber prices remained above $590 per thousand board feet in January, hovering at eight-week highs as robust demand for building materials in the US compounded with dovish expectations for Federal Reserve policy. U.S. housing starts in December surged 15.8% from the previous month to a seasonally adjusted annual rate of 1.499 million units, the highest since February 2024 and well above market expectations of 1.32 million. Although building permits fell 0.7% to 1.483 million units, they exceeded forecasts of 1.46 million. At the same time, easing core inflation from the latest CPI report reinforced expectations of Federal Reserve rate cuts by mid-year, while mortgage applications jumped 33.3%, marking the largest weekly increase since 2020, as buyers sought to lock in borrowing costs despite rates exceeding 7%. Additionally, U.S. buyers stockpiled inventory ahead of a proposed 25% tariff on Canadian softwood lumber, while existing 14.4% duties further constrained supply. [END] Lumber prices surged to around $580 per thousand board feet in January, marking a six-week high, as uncertainty surrounding potential tariffs on Canadian softwood lumber imports to the U.S. stoked panic buying. The looming 25% tariff proposed by President-elect Trump has prompted U.S. buyers to rapidly secure inventories ahead of anticipated price hikes, further escalating demand. With Canadian lumber already subject to an average 14.4% import duty, the additional tariff is expected to push prices even higher. U.S. reliance on Canadian softwood lumber remains substantial, as Canada supplies a significant portion of the country’s lumber needs. While alternative suppliers, such as Germany and Sweden, may partially fill the gap, they lack the capacity to match Canada’s production in the long run. Meanwhile, domestic challenges, including workforce shortages and sawmill closures, are limiting U.S. production, contributing to ongoing supply constraints. [END]

Lumber prices surged to around $580 per thousand board feet in January, marking a six-week high, as uncertainty surrounding potential tariffs on Canadian softwood lumber imports to the U.S. stoked panic buying. The looming 25% tariff proposed by President-elect Trump has prompted U.S. buyers to rapidly secure inventories ahead of anticipated price hikes, further escalating demand. With Canadian lumber already subject to an average 14.4% import duty, the additional tariff is expected to push prices even higher. U.S. reliance on Canadian softwood lumber remains substantial, as Canada supplies a significant portion of the country’s lumber needs. While alternative suppliers, such as Germany and Sweden, may partially fill the gap, they lack the capacity to match Canada’s production in the long run. Meanwhile, domestic challenges, including workforce shortages and sawmill closures, are limiting U.S. production, contributing to ongoing supply constraints. [END] The mere threat of tariffs being tacked onto Canadian lumber imports in the U.S. is raising fears of panic buying that could roil lumber markets and prices. “A number of Canadian lumber companies are now advising customers that they will add 25% to lumber exports to the U.S. when the tariff is announced,”

The mere threat of tariffs being tacked onto Canadian lumber imports in the U.S. is raising fears of panic buying that could roil lumber markets and prices. “A number of Canadian lumber companies are now advising customers that they will add 25% to lumber exports to the U.S. when the tariff is announced,”  A potential hike in tariffs imposed on Canadian exports to the US as early as January will highlight developments that could define first-quarter trends in the softwood lumber market. …Many traders have expressed a perception that the US economy will prosper in 2025 with a more business friendly administration in the White House. However, if the tariffs are imposed, they could significantly alter the flow of softwood lumber and panels from Canada to the US. Some Canadian producers have already noted that they will withdraw from the US market rather than deal with the rising costs. If returns on shipments to the US plunge, many Canadian mills could funnel a larger percentage of production offshore, especially to Pacific Rim destinations. …Southern Pine traders hope the first quarter sets the stage for a rebound after a difficult year in 2024. Production outpaced demand for most of the year, sustaining steady downward pressure on prices.

A potential hike in tariffs imposed on Canadian exports to the US as early as January will highlight developments that could define first-quarter trends in the softwood lumber market. …Many traders have expressed a perception that the US economy will prosper in 2025 with a more business friendly administration in the White House. However, if the tariffs are imposed, they could significantly alter the flow of softwood lumber and panels from Canada to the US. Some Canadian producers have already noted that they will withdraw from the US market rather than deal with the rising costs. If returns on shipments to the US plunge, many Canadian mills could funnel a larger percentage of production offshore, especially to Pacific Rim destinations. …Southern Pine traders hope the first quarter sets the stage for a rebound after a difficult year in 2024. Production outpaced demand for most of the year, sustaining steady downward pressure on prices. Canada recorded a ninth consecutive monthly trade deficit in November, albeit smaller than expected as exports rose faster than imports, data showed on Tuesday. Total exports rose 2.2 per cent in November, helped by gains in a broad section of product categories, while imports were up 1.8 per cent, led by consumer goods and chemical, plastic and rubber products, Statistics Canada said. As a result, Canada’s trade deficit narrowed to $323-million from a revised $544-million deficit in October. Analysts polled by Reuters had expected a $900-million deficit in November. The trade surplus with the United States, by far Canada’s largest trading partner, widened to $8.2-billion from $6.6-billion in October. The surplus with the U.S. nearly offset Canada’s trade deficit with all other countries – which widened to $8.5-billion in November from $7.2-billion – underscoring the potential impact of the U.S. President-elect’s threat to impose tariffs on Canadian goods.

Canada recorded a ninth consecutive monthly trade deficit in November, albeit smaller than expected as exports rose faster than imports, data showed on Tuesday. Total exports rose 2.2 per cent in November, helped by gains in a broad section of product categories, while imports were up 1.8 per cent, led by consumer goods and chemical, plastic and rubber products, Statistics Canada said. As a result, Canada’s trade deficit narrowed to $323-million from a revised $544-million deficit in October. Analysts polled by Reuters had expected a $900-million deficit in November. The trade surplus with the United States, by far Canada’s largest trading partner, widened to $8.2-billion from $6.6-billion in October. The surplus with the U.S. nearly offset Canada’s trade deficit with all other countries – which widened to $8.5-billion in November from $7.2-billion – underscoring the potential impact of the U.S. President-elect’s threat to impose tariffs on Canadian goods. Calgary’s construction industry is hoping the threat of American tariffs doesn’t slow its momentum in 2025. …Bill Black, the head of the Calgary Construction Association, says when it comes to certain building materials, the tariffs could cause unrepairable damage. “Lumber suppliers selling are obviously going to feel a really significant impact on their volume that goes into the U.S.,” Black said. “The overall viability of the lumber business is based on a blend of the two markets, and if one market becomes unfeasible because of tariffs, that then puts pressure on the operating businesses. “That could impact their ability to service the Canadian market as well.” …The city has seen consecutive years of a record number of housing starts, and those in the sector don’t want to lose vital momentum. …Alberta’s forest ministry reiterated the importance of cross-border trade Friday, saying there’s still optimism a tariff-stopping solution can be found.

Calgary’s construction industry is hoping the threat of American tariffs doesn’t slow its momentum in 2025. …Bill Black, the head of the Calgary Construction Association, says when it comes to certain building materials, the tariffs could cause unrepairable damage. “Lumber suppliers selling are obviously going to feel a really significant impact on their volume that goes into the U.S.,” Black said. “The overall viability of the lumber business is based on a blend of the two markets, and if one market becomes unfeasible because of tariffs, that then puts pressure on the operating businesses. “That could impact their ability to service the Canadian market as well.” …The city has seen consecutive years of a record number of housing starts, and those in the sector don’t want to lose vital momentum. …Alberta’s forest ministry reiterated the importance of cross-border trade Friday, saying there’s still optimism a tariff-stopping solution can be found. New support for forest-sector manufacturers throughout the province will create and protect jobs, strengthen local economies and diversify the range of fibre sources used to manufacture high-value, made-in-B.C. forest products. “The BC Manufacturing Jobs Fund is partnering with forestry companies throughout the province to grow and stabilize their operations and get the most out of our fibre supply, while producing more made-in-B.C. engineered wood products,” said Diana Gibson, Minister of Jobs, Economic Development and Innovation. Through the BC Manufacturing Jobs Fund (BCMJF), the Government of B.C. is contributing as much as $5.1 million toward seven forest-sector capital projects and five planning projects in communities throughout the province. Cedarland Forest Products Ltd. in Maple Ridge will receive as much as $1.3 million… Gilbert Smith Forest Products in Barriere will receive as much as $1.1 million…

New support for forest-sector manufacturers throughout the province will create and protect jobs, strengthen local economies and diversify the range of fibre sources used to manufacture high-value, made-in-B.C. forest products. “The BC Manufacturing Jobs Fund is partnering with forestry companies throughout the province to grow and stabilize their operations and get the most out of our fibre supply, while producing more made-in-B.C. engineered wood products,” said Diana Gibson, Minister of Jobs, Economic Development and Innovation. Through the BC Manufacturing Jobs Fund (BCMJF), the Government of B.C. is contributing as much as $5.1 million toward seven forest-sector capital projects and five planning projects in communities throughout the province. Cedarland Forest Products Ltd. in Maple Ridge will receive as much as $1.3 million… Gilbert Smith Forest Products in Barriere will receive as much as $1.1 million… Predictions for 2025 include: Energy output will jump… we’ll stop talking about hybrid work… maybe… the education boom will end… the north will struggle to retain population… we’ll stop ignoring the provincial deficit. …The outlook for f

Predictions for 2025 include: Energy output will jump… we’ll stop talking about hybrid work… maybe… the education boom will end… the north will struggle to retain population… we’ll stop ignoring the provincial deficit. …The outlook for f

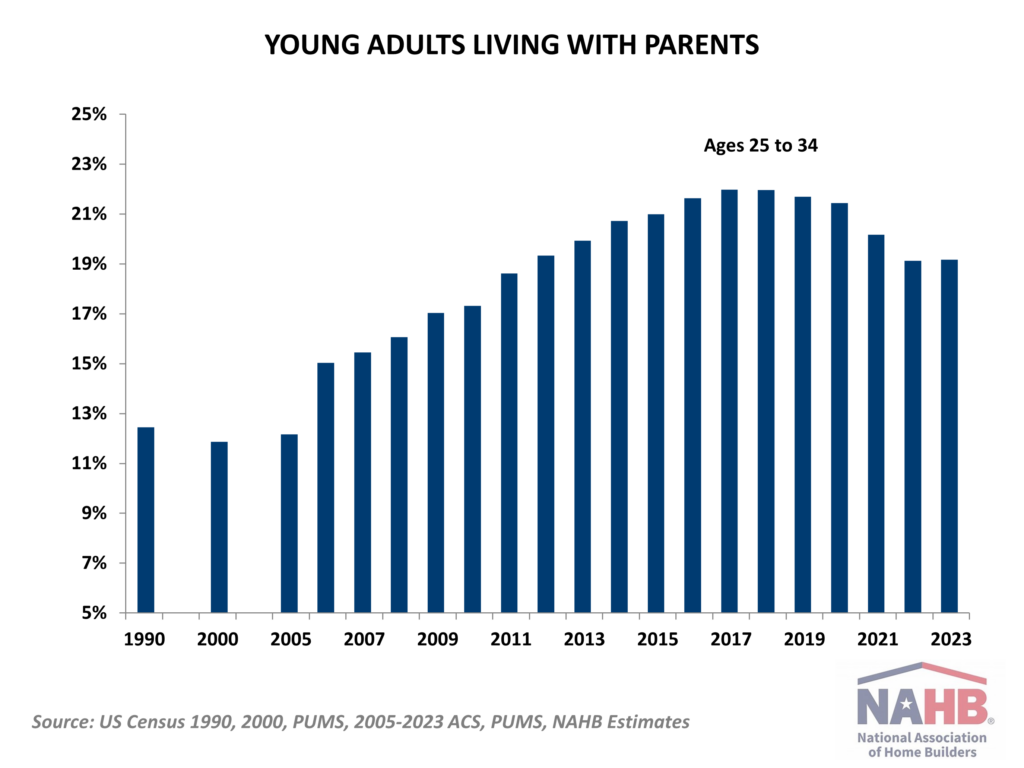

President Donald Trump’s proposal to implement significant tariffs on the country’s key trading partners could have ripple effects on the U.S. housing market. …The tariffs could drive up prices for new homes and renovations, further straining an already tight market. “The tariffs will raise the cost of materials, which could directly increase the cost of constructing new homes,” said Wayne Winegarden at Pacific Research Institute. Experts said tariffs are a tax that increases the costs of imported goods, including building materials. …Higher material and construction costs caused by the tariffs could make buying a home out of reach for many people. “The tariffs will slow down the economy and will also encourage the Federal Reserve to pursue a higher interest rate environment,” Winegarden said. …Together, the higher rates coupled with the rising cost of construction will significantly reduce housing affordability.”

President Donald Trump’s proposal to implement significant tariffs on the country’s key trading partners could have ripple effects on the U.S. housing market. …The tariffs could drive up prices for new homes and renovations, further straining an already tight market. “The tariffs will raise the cost of materials, which could directly increase the cost of constructing new homes,” said Wayne Winegarden at Pacific Research Institute. Experts said tariffs are a tax that increases the costs of imported goods, including building materials. …Higher material and construction costs caused by the tariffs could make buying a home out of reach for many people. “The tariffs will slow down the economy and will also encourage the Federal Reserve to pursue a higher interest rate environment,” Winegarden said. …Together, the higher rates coupled with the rising cost of construction will significantly reduce housing affordability.”

The NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 68 for the fourth quarter of 2024, up five points compared to the previous quarter. Remodelers are more optimistic about the market than they were earlier in the year, corroborated by NAHB’s recent analysis of home improvement loan applications. Demand in many parts of the country was stronger than usual for the fall season, especially demand for larger projects, with leads coming in after the uncertainty about the November elections was removed. …The Current Conditions Index averaged 75, increasing three points from the previous quarter. All three components remained well above 50 in positive territory: large remodeling projects rose eight points to 75, moderate remodeling projects increased two points to 73, and small remodeling projects inched down one point to 76. …The Future Indicators Index was 61, up six points from the previous quarter.

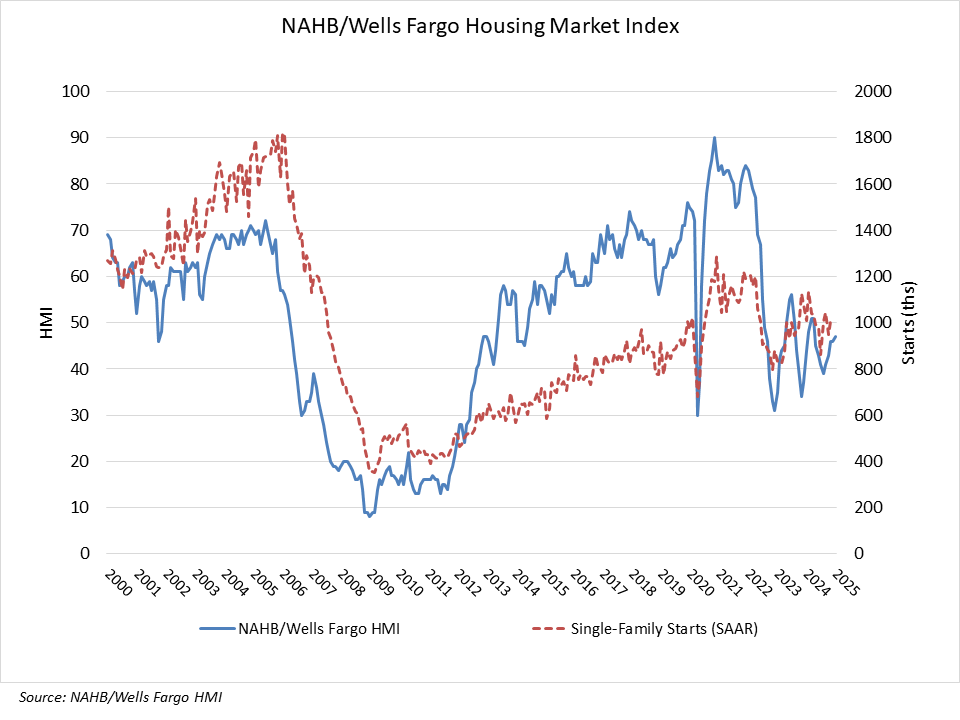

The NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 68 for the fourth quarter of 2024, up five points compared to the previous quarter. Remodelers are more optimistic about the market than they were earlier in the year, corroborated by NAHB’s recent analysis of home improvement loan applications. Demand in many parts of the country was stronger than usual for the fall season, especially demand for larger projects, with leads coming in after the uncertainty about the November elections was removed. …The Current Conditions Index averaged 75, increasing three points from the previous quarter. All three components remained well above 50 in positive territory: large remodeling projects rose eight points to 75, moderate remodeling projects increased two points to 73, and small remodeling projects inched down one point to 76. …The Future Indicators Index was 61, up six points from the previous quarter.  A report released by the Commerce Department on Friday showed new residential construction in the U.S. surged by much more than anticipated in the month of December. The Commerce Department said housing starts soared by 15.8 percent to an annual rate of 1.499 million in December after tumbling by 3.7 percent to a revised rate of 1.294 million in November. …The spike by housing starts came amid a substantial rebound by multi-family starts, which skyrocketed by 61.5 percent to an annual rate of 449,000 in December after plummeting by 30.7 percent to an annual rate of 278,000 in November. Single-family starts also shot up by 3.3 percent to an annual rate of 1.050 million in December after surging by 7.7 percent to an annual rate of 1.016 million in November. Meanwhile, the report said building permits slid by 0.7 percent to an annual rate of 1.483 million in December after surging by 5.2 percent to a revised rate of 1.493 million in November.

A report released by the Commerce Department on Friday showed new residential construction in the U.S. surged by much more than anticipated in the month of December. The Commerce Department said housing starts soared by 15.8 percent to an annual rate of 1.499 million in December after tumbling by 3.7 percent to a revised rate of 1.294 million in November. …The spike by housing starts came amid a substantial rebound by multi-family starts, which skyrocketed by 61.5 percent to an annual rate of 449,000 in December after plummeting by 30.7 percent to an annual rate of 278,000 in November. Single-family starts also shot up by 3.3 percent to an annual rate of 1.050 million in December after surging by 7.7 percent to an annual rate of 1.016 million in November. Meanwhile, the report said building permits slid by 0.7 percent to an annual rate of 1.483 million in December after surging by 5.2 percent to a revised rate of 1.493 million in November.

RUSS TAYLOR GLOBAL is pleased to provide the latest quarterly report from the

RUSS TAYLOR GLOBAL is pleased to provide the latest quarterly report from the