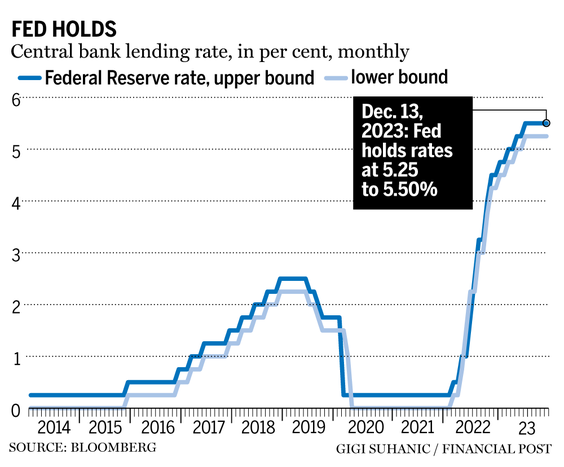

TORONTO – Deloitte Canada says the Canadian economy will return to growth in the second half of 2024, with interest rate cuts as early as this spring. The firm’s economic outlook report predicts stagnant growth during the first half of the year as the effects of higher interest rates continue to work their way through the system. The Bank of Canada held its key rate steady at five per cent in December after a heavy-handed hiking campaign to fight inflation. Deloitte says inflation is still uncomfortably high at 3.1 per cent as of November, but it’s unlikely the central bank will hike rates further. However, Deloitte Canada chief economist Dawn Desjardins says we shouldn’t expect interest rates to return to their pre-pandemic lows. Desjardins says momentum in the economy and the job market is poised to improve in the second half of 2024 as confidence starts to recover. [END]

TORONTO – Deloitte Canada says the Canadian economy will return to growth in the second half of 2024, with interest rate cuts as early as this spring. The firm’s economic outlook report predicts stagnant growth during the first half of the year as the effects of higher interest rates continue to work their way through the system. The Bank of Canada held its key rate steady at five per cent in December after a heavy-handed hiking campaign to fight inflation. Deloitte says inflation is still uncomfortably high at 3.1 per cent as of November, but it’s unlikely the central bank will hike rates further. However, Deloitte Canada chief economist Dawn Desjardins says we shouldn’t expect interest rates to return to their pre-pandemic lows. Desjardins says momentum in the economy and the job market is poised to improve in the second half of 2024 as confidence starts to recover. [END]

The Bank of Canada overnight rate started 2023 at 4.25 per cent and will finish the year at five per cent, for a rise of 0.75 per cent after a rise of four per cent in 2022. I believe we will see a two per cent decline in rates by the end of 2024, back to an overnight rate of three per cent. The impacts of this decline will be the story of 2024. Just for fun and to really stick my neck out there, here is my detailed prediction for the central bank’s moves in 2024: Jan. 24: no rate change; March 6: no rate change; April 10: 25-basis-point (bps) drop; June 5: 50 bps drop; July 24: 50 bps drop; Sept. 4: 25 bps drop; Oct. 23: 25 bps drop; and Dec. 11: 25 bps drop. …In summary, I see five-year variable rate mortgages coming down 2.3 per cent over the year, three-year fixed-rate mortgages dropping by 1.1 per cent and five-year fixed-rate mortgages falling 1.2 per cent by year-end.

The Bank of Canada overnight rate started 2023 at 4.25 per cent and will finish the year at five per cent, for a rise of 0.75 per cent after a rise of four per cent in 2022. I believe we will see a two per cent decline in rates by the end of 2024, back to an overnight rate of three per cent. The impacts of this decline will be the story of 2024. Just for fun and to really stick my neck out there, here is my detailed prediction for the central bank’s moves in 2024: Jan. 24: no rate change; March 6: no rate change; April 10: 25-basis-point (bps) drop; June 5: 50 bps drop; July 24: 50 bps drop; Sept. 4: 25 bps drop; Oct. 23: 25 bps drop; and Dec. 11: 25 bps drop. …In summary, I see five-year variable rate mortgages coming down 2.3 per cent over the year, three-year fixed-rate mortgages dropping by 1.1 per cent and five-year fixed-rate mortgages falling 1.2 per cent by year-end.

OTTAWA – The Canadian economy’s soft patch continued for the third straight month in October and a modest growth forecast for November will further support investors bet for an interest rate cut in the first quarter of next year, economists said. Latest data released by the Statistics Canada data on Friday showed that the Canadian economy was unchanged in October, while analysts polled by Reuters had forecast a 0.2% month-over-month rise. September’s GDP was downwardly revised to zero growth from an initial report of 0.1% growth. The last big data release in Canada for 2023 paints a picture of an economy stuttering under the impact of the Bank of Canada’s 10 rate hikes between March 2022 and July, which took the benchmark interest rate to a 22-year high of 5%. GDP unexpectedly declined in the third quarter, and the central bank expects growth to remain weak for a few quarters.

OTTAWA – The Canadian economy’s soft patch continued for the third straight month in October and a modest growth forecast for November will further support investors bet for an interest rate cut in the first quarter of next year, economists said. Latest data released by the Statistics Canada data on Friday showed that the Canadian economy was unchanged in October, while analysts polled by Reuters had forecast a 0.2% month-over-month rise. September’s GDP was downwardly revised to zero growth from an initial report of 0.1% growth. The last big data release in Canada for 2023 paints a picture of an economy stuttering under the impact of the Bank of Canada’s 10 rate hikes between March 2022 and July, which took the benchmark interest rate to a 22-year high of 5%. GDP unexpectedly declined in the third quarter, and the central bank expects growth to remain weak for a few quarters.

Industry analyst Russ Taylor reflects on a tough 2023 and what lies ahead for the forest sector in BC. —Please click the Read More to listen to this interview.

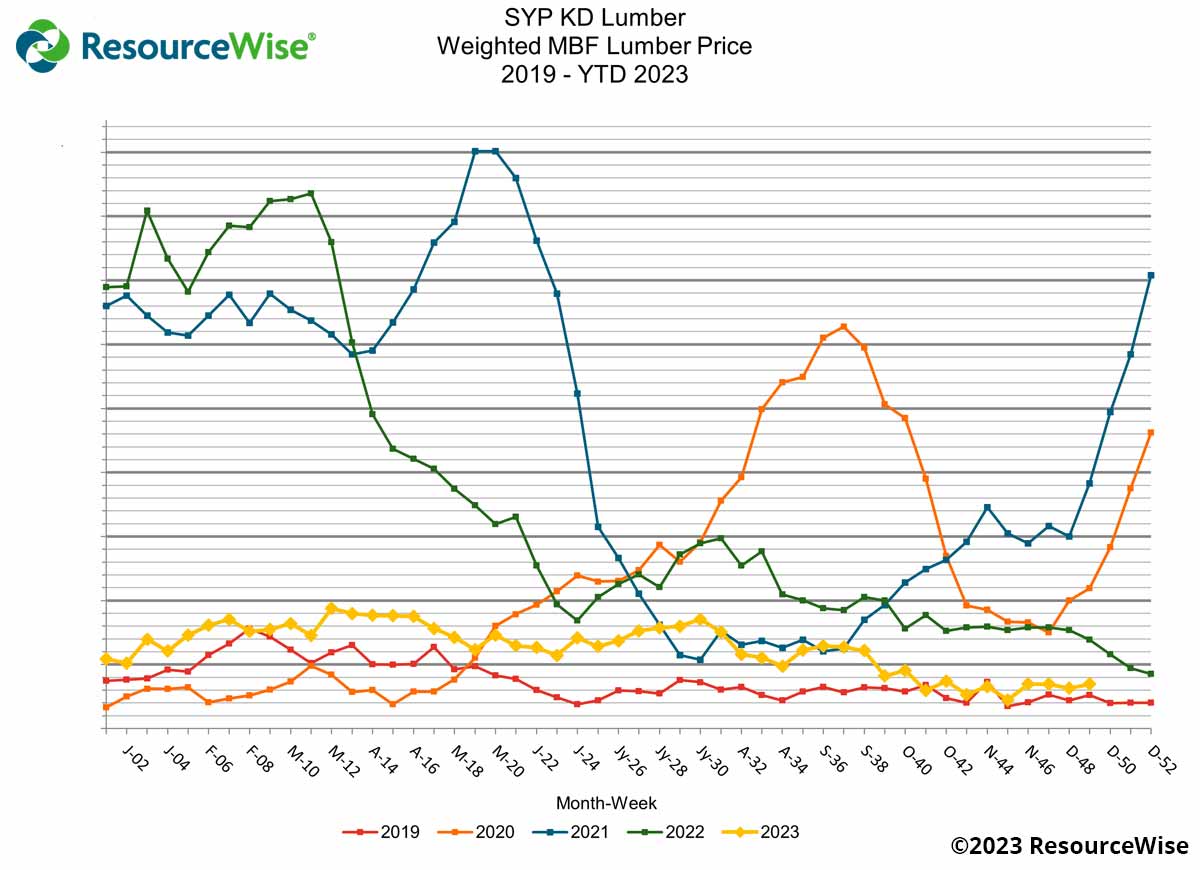

Industry analyst Russ Taylor reflects on a tough 2023 and what lies ahead for the forest sector in BC. —Please click the Read More to listen to this interview. In 2021 and the first half of 2022, there were what might be termed ‘freakish’ year-over-year increases in construction material costs. At its most extreme, the y/y price climb for construction material inputs collectively approached plus one third. Since then, they have largely settled down, to the point where y/y material input costs are now being exceeded by y/y wage hikes (i.e., -0.5% compared with +5.9%. …The changes in material prices for an array of inputs are most clearly shown. The easing-off is readily apparent in forestry products, most steel items, and in energy-related areas. At present, with little in the way of moderation, or only a flattening, are gypsum, cement and related products, insulation materials, what are termed ‘accessory’ materials (e.g., glass, paint, lighting and plumbing fixtures), and equipment.

In 2021 and the first half of 2022, there were what might be termed ‘freakish’ year-over-year increases in construction material costs. At its most extreme, the y/y price climb for construction material inputs collectively approached plus one third. Since then, they have largely settled down, to the point where y/y material input costs are now being exceeded by y/y wage hikes (i.e., -0.5% compared with +5.9%. …The changes in material prices for an array of inputs are most clearly shown. The easing-off is readily apparent in forestry products, most steel items, and in energy-related areas. At present, with little in the way of moderation, or only a flattening, are gypsum, cement and related products, insulation materials, what are termed ‘accessory’ materials (e.g., glass, paint, lighting and plumbing fixtures), and equipment. No other phrase has defined the 2023 housing market as much as the “mortgage rate lock-in effect” – a phenomenon that brought the industry to a standstill, putting downward pressure on everything from inventory levels to home sales. The pandemic-era sub-5% mortgage interest rates that 85% of mortgage holders are locked in to kept homeowners from selling their home and buying another at elevated interest rates, which peaked at 7.79% the week ending Oct. 26, according to Freddie Mac. But will things change this year? There are signs that market conditions will be improving. Mortgage rates dropped steadily over the past seven weeks, providing a boost to existing-home sales, according to the National Association of Realtors. …One thing most experts don’t expect to see is an end to shortage of homes for sale.

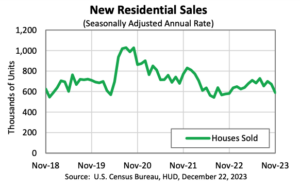

No other phrase has defined the 2023 housing market as much as the “mortgage rate lock-in effect” – a phenomenon that brought the industry to a standstill, putting downward pressure on everything from inventory levels to home sales. The pandemic-era sub-5% mortgage interest rates that 85% of mortgage holders are locked in to kept homeowners from selling their home and buying another at elevated interest rates, which peaked at 7.79% the week ending Oct. 26, according to Freddie Mac. But will things change this year? There are signs that market conditions will be improving. Mortgage rates dropped steadily over the past seven weeks, providing a boost to existing-home sales, according to the National Association of Realtors. …One thing most experts don’t expect to see is an end to shortage of homes for sale. The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential sales statistics for November 2023. …Sales of new single‐family houses in November 2023 were at a seasonally adjusted annual rate of 590,000. This is 12.2% below the revised October rate of 672,000, but is 1.4% above the November 2022 estimate of 582,000. …The median sales price of new houses sold in November 2023 was $434,700. The average sales price was $488,900. …The seasonally‐adjusted estimate of new houses for sale at the end of November was 451,000. This represents a supply of 9.2 months at the current sales rate.

The U.S. Census Bureau and the U.S. Department of Housing and Urban Development jointly announced the following new residential sales statistics for November 2023. …Sales of new single‐family houses in November 2023 were at a seasonally adjusted annual rate of 590,000. This is 12.2% below the revised October rate of 672,000, but is 1.4% above the November 2022 estimate of 582,000. …The median sales price of new houses sold in November 2023 was $434,700. The average sales price was $488,900. …The seasonally‐adjusted estimate of new houses for sale at the end of November was 451,000. This represents a supply of 9.2 months at the current sales rate. Twelve months ago, few would have backed a debt-laden used-car sales platform and a building supplies group to be among the standout performers on the US stock market. …In terms of sectors, homebuilders’ success was the one most didn’t see coming. Rising rates were expected to lower house prices but instead they effectively trapped US homeowners reluctant to give up their low 30-year fixed-rate mortgages — something that last happened too long ago for most to remember. The resulting supply shortage squeezed prices to new records and developers couldn’t build fast enough. Even Warren Buffett bought in, but it was a supplier that actually did best. Builders FirstSource rose more than 150%, joining the S&P 500 in December, where its gains rank it in the top five performers for the year. The simplest takeaway is the oldest one: when you first see a gold rush, buy shovels.

Twelve months ago, few would have backed a debt-laden used-car sales platform and a building supplies group to be among the standout performers on the US stock market. …In terms of sectors, homebuilders’ success was the one most didn’t see coming. Rising rates were expected to lower house prices but instead they effectively trapped US homeowners reluctant to give up their low 30-year fixed-rate mortgages — something that last happened too long ago for most to remember. The resulting supply shortage squeezed prices to new records and developers couldn’t build fast enough. Even Warren Buffett bought in, but it was a supplier that actually did best. Builders FirstSource rose more than 150%, joining the S&P 500 in December, where its gains rank it in the top five performers for the year. The simplest takeaway is the oldest one: when you first see a gold rush, buy shovels.

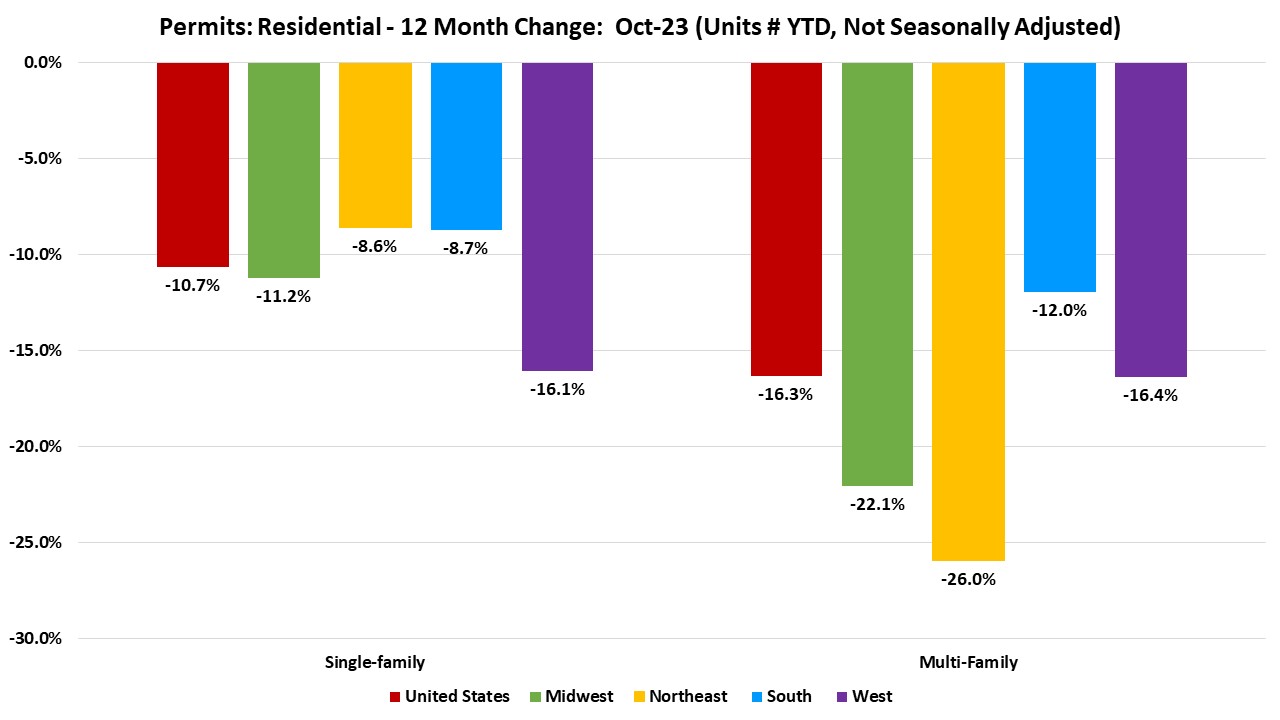

WASHINGTON – The number of Americans filing new claims for unemployment benefits rose marginally last week, the latest suggestion that the economy was regaining some momentum as the year winds down. The smaller-than-expected increase in weekly jobless claims reported by the Labor Department on Thursday followed recent data showing retail sales unexpectedly rising in November, while single-family housing starts and building permits scaled 1-1/2-year highs. Those reports prompted economists to boost their growth estimates for the fourth quarter. The economy had appeared in danger of stalling at the start of the quarter. There was even more good news on inflation, with other data on Thursday showing significantly more progress made toward returning it to the Federal Reserve’s 2% target in the third quarter than previously reported.

WASHINGTON – The number of Americans filing new claims for unemployment benefits rose marginally last week, the latest suggestion that the economy was regaining some momentum as the year winds down. The smaller-than-expected increase in weekly jobless claims reported by the Labor Department on Thursday followed recent data showing retail sales unexpectedly rising in November, while single-family housing starts and building permits scaled 1-1/2-year highs. Those reports prompted economists to boost their growth estimates for the fourth quarter. The economy had appeared in danger of stalling at the start of the quarter. There was even more good news on inflation, with other data on Thursday showing significantly more progress made toward returning it to the Federal Reserve’s 2% target in the third quarter than previously reported.

The housing market will improve slightly in 2024, but low housing affordability and a weak economic backdrop will help constrain demand, according to projections from Fitch Ratings. According to Fitch, higher-for-longer mortgage rates, elevated home prices, and higher unemployment in 2024 will be headwinds for the housing sector. …In 2024, Fitch Ratings projects single-family housing starts will grow between 3% and 4%, single-family sales will grow in the low single digits, and multifamily starts will fall in the high teens. Fitch projects existing-home inventory will remain tight in the coming year, creating a benefit for builders with the ability to offer quick move-in homes. According to the outlook, the new-home share of the overall housing market will be elevated compared with historical levels over thee last decade and a half.

The housing market will improve slightly in 2024, but low housing affordability and a weak economic backdrop will help constrain demand, according to projections from Fitch Ratings. According to Fitch, higher-for-longer mortgage rates, elevated home prices, and higher unemployment in 2024 will be headwinds for the housing sector. …In 2024, Fitch Ratings projects single-family housing starts will grow between 3% and 4%, single-family sales will grow in the low single digits, and multifamily starts will fall in the high teens. Fitch projects existing-home inventory will remain tight in the coming year, creating a benefit for builders with the ability to offer quick move-in homes. According to the outlook, the new-home share of the overall housing market will be elevated compared with historical levels over thee last decade and a half. Realtor.com economists predict that mortgage rates, which have declined over the past five weeks, will slide into the 6% territory in 2024. Fannie Mae expects mortgage rates to decline gradually over the next two years, reaching 6.9% for the 30-year mortgage by 2025. …That’s good news for the market that recently saw mortgage rates climb close to 8%, but the dip won’t be enough to entice existing homeowners with sub-5% mortgages back into the fray. This will continue to complicate supply availability. …With mortgage rates finally decreasing, affordability will likely return to the market, enticing some buyers back. …The forecast for housing is optimistic but hinges on continued moderation of inflation and that the Federal Reserve will begin easing its stance on interest rates. If inflation were to see a resurgence instead, home sales could slip lower instead of steadying, according to Hale.

Realtor.com economists predict that mortgage rates, which have declined over the past five weeks, will slide into the 6% territory in 2024. Fannie Mae expects mortgage rates to decline gradually over the next two years, reaching 6.9% for the 30-year mortgage by 2025. …That’s good news for the market that recently saw mortgage rates climb close to 8%, but the dip won’t be enough to entice existing homeowners with sub-5% mortgages back into the fray. This will continue to complicate supply availability. …With mortgage rates finally decreasing, affordability will likely return to the market, enticing some buyers back. …The forecast for housing is optimistic but hinges on continued moderation of inflation and that the Federal Reserve will begin easing its stance on interest rates. If inflation were to see a resurgence instead, home sales could slip lower instead of steadying, according to Hale.

It is said that the Year of the Wood Dragon will bring great energy and transformation. And with the spotlight returning to the element of wood in Chinese astrology this year, it is also hoped that forestry funds and other nature-based real assets will bring more fortune as they move into the investment mainstream. In the wake of geopolitical uncertainties and interest rate hikes, investors in Asia have been re-evaluating their asset allocation strategies with many attracted to sustainable investing, according to the Schroders Global Investor Study 2023, “The findings of the [study] underlined the widespread but growing recognition of the importance of active ownership to sustainable investment,” says Andy Howard. And forestry funds could be an emerging star of alternative investments. …The long-term outlook for the forestry fund sector looks positive, driven by sustained demand, supply shortages, regulatory support, and a commitment to sustainable practices.

It is said that the Year of the Wood Dragon will bring great energy and transformation. And with the spotlight returning to the element of wood in Chinese astrology this year, it is also hoped that forestry funds and other nature-based real assets will bring more fortune as they move into the investment mainstream. In the wake of geopolitical uncertainties and interest rate hikes, investors in Asia have been re-evaluating their asset allocation strategies with many attracted to sustainable investing, according to the Schroders Global Investor Study 2023, “The findings of the [study] underlined the widespread but growing recognition of the importance of active ownership to sustainable investment,” says Andy Howard. And forestry funds could be an emerging star of alternative investments. …The long-term outlook for the forestry fund sector looks positive, driven by sustained demand, supply shortages, regulatory support, and a commitment to sustainable practices. Russia was the world’s largest exporter of softwood lumber in 2020 and 2021. In 2022, shipments fell dramatically, resulting from Russia’s invasion of Ukraine and the boycott of Russian forest products in Europe, North America, and key markets in Asia. Export volumes have plunged from a record high of over 31 million m3 in 2020 to about 23 million m3 in 2022. The decline has continued in 2023, with shipments estimated to reach less than 21 million m3 for the year. The halt of sales to Europe resulted in a 4.6 million m3 drop in export volume from 2021 to 2023. Most of the lost shipments to Europe, mainly from sawmills in the Northwestern province, have not been redirected to other importing countries in Asia, CIS states, or the MENA region as some lumber manufacturers in Russia had hoped. Instead, export volumes to Russia’s traditional markets have declined over the past two years.

Russia was the world’s largest exporter of softwood lumber in 2020 and 2021. In 2022, shipments fell dramatically, resulting from Russia’s invasion of Ukraine and the boycott of Russian forest products in Europe, North America, and key markets in Asia. Export volumes have plunged from a record high of over 31 million m3 in 2020 to about 23 million m3 in 2022. The decline has continued in 2023, with shipments estimated to reach less than 21 million m3 for the year. The halt of sales to Europe resulted in a 4.6 million m3 drop in export volume from 2021 to 2023. Most of the lost shipments to Europe, mainly from sawmills in the Northwestern province, have not been redirected to other importing countries in Asia, CIS states, or the MENA region as some lumber manufacturers in Russia had hoped. Instead, export volumes to Russia’s traditional markets have declined over the past two years.  There appears to be various reports coming out on China, its log and lumber suppliers, and some US and global forecasts that are… either inaccurate and/or use unreliable assumptions. Most of these erroneous articles and outlooks are so-called “data reports” – these tend to rely on statistics and/or statistical analysis with little or no confirmation with the actual reality on what is currently happening on the ground. A few excerpts from various erroneous reports include the following:

There appears to be various reports coming out on China, its log and lumber suppliers, and some US and global forecasts that are… either inaccurate and/or use unreliable assumptions. Most of these erroneous articles and outlooks are so-called “data reports” – these tend to rely on statistics and/or statistical analysis with little or no confirmation with the actual reality on what is currently happening on the ground. A few excerpts from various erroneous reports include the following: Hiring in the US was unexpectedly strong last month, as the American economy continued to defy forecasts of a slowdown. Employers added 216,000 jobs and the unemployment rate was unchanged at 3.7%, the Labor Department said. Government hiring drove the gains, which extended one of the strongest streaks of job creation on record. The growth has confounded forecasters expecting job losses as higher borrowing costs slowed the economy. But it has raised hopes that the US central bank will be able to get a grip on inflation, the rate at which prices rise, without triggering a painful downturn. …President Joe Biden, who has struggled to convince voters that an economy can be strong while slowing, cheered the figures in a statement that also pointed to slowing price inflation.

Hiring in the US was unexpectedly strong last month, as the American economy continued to defy forecasts of a slowdown. Employers added 216,000 jobs and the unemployment rate was unchanged at 3.7%, the Labor Department said. Government hiring drove the gains, which extended one of the strongest streaks of job creation on record. The growth has confounded forecasters expecting job losses as higher borrowing costs slowed the economy. But it has raised hopes that the US central bank will be able to get a grip on inflation, the rate at which prices rise, without triggering a painful downturn. …President Joe Biden, who has struggled to convince voters that an economy can be strong while slowing, cheered the figures in a statement that also pointed to slowing price inflation.