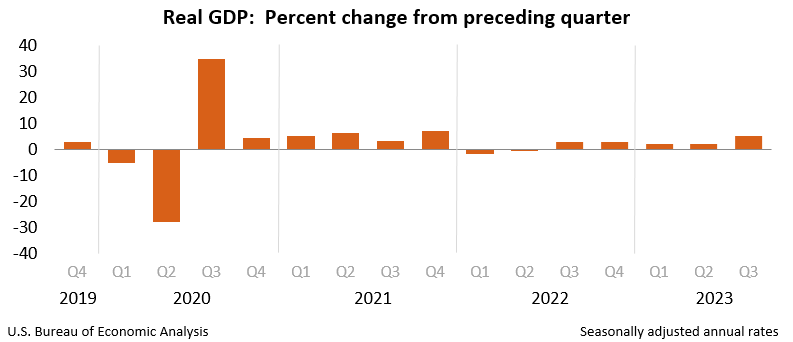

The Bank of Canada today held its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening. The global economy continues to slow and inflation has eased further. In the United States, growth has been stronger than expected, led by robust consumer spending, but is likely to weaken in the months ahead as past policy rate increases work their way through the economy. …In Canada, economic growth stalled through the middle quarters of 2023. Real GDP contracted at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter. Higher interest rates are clearly restraining spending. …With further signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet.

The Bank of Canada today held its target for the overnight rate at 5%, with the Bank Rate at 5¼% and the deposit rate at 5%. The Bank is continuing its policy of quantitative tightening. The global economy continues to slow and inflation has eased further. In the United States, growth has been stronger than expected, led by robust consumer spending, but is likely to weaken in the months ahead as past policy rate increases work their way through the economy. …In Canada, economic growth stalled through the middle quarters of 2023. Real GDP contracted at a rate of 1.1% in the third quarter, following growth of 1.4% in the second quarter. Higher interest rates are clearly restraining spending. …With further signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold the policy rate at 5% and to continue to normalize the Bank’s balance sheet.

Lumber and OSB up w/w. Lumber and OSB up w/w. According to Random Lengths (“RL”), the Framing Lumber Composite increased $3 w/w to $379 and the OSB Composite increased $6 w/w to $425. For next week, RBC ElementsTM forecasts that the RL Framing Lumber Composite will increase $2 w/w to $381 and that the RL OSB Composite will decrease $4 w/w to $421.

Lumber and OSB up w/w. Lumber and OSB up w/w. According to Random Lengths (“RL”), the Framing Lumber Composite increased $3 w/w to $379 and the OSB Composite increased $6 w/w to $425. For next week, RBC ElementsTM forecasts that the RL Framing Lumber Composite will increase $2 w/w to $381 and that the RL OSB Composite will decrease $4 w/w to $421. On Tuesday, December 5, RBC will host its Capital Markets’ annual Forest Products Conference in Toronto. Key topics for discussions include:

On Tuesday, December 5, RBC will host its Capital Markets’ annual Forest Products Conference in Toronto. Key topics for discussions include: Canada’s economy shrank in the third quarter, according to Statistics Canada, adding fuel to the narrative that the Bank of Canada will need to lower interest rates soon to avoid a deep recession – but economists have varying views on when to expect cuts. “We’re not thinking the bank is going to move until the second half of next year,” David Watt at HSBC Canada said. Watt said he believes the Bank of Canada will be “cooler” on rate cuts because it may take some time for inflation to reach the bank’s target rate of two per cent. Douglas Porter, with BMO Capital Markets, agrees. …National Bank of Canada’s Stefane Marion expects the Bank of Canada to cut rates by around 100 basis points by the end of next year. Meanwhile, Tu Nguyen of RSM Canada predicts a rate cut could come as early as the second quarter of next year.

Canada’s economy shrank in the third quarter, according to Statistics Canada, adding fuel to the narrative that the Bank of Canada will need to lower interest rates soon to avoid a deep recession – but economists have varying views on when to expect cuts. “We’re not thinking the bank is going to move until the second half of next year,” David Watt at HSBC Canada said. Watt said he believes the Bank of Canada will be “cooler” on rate cuts because it may take some time for inflation to reach the bank’s target rate of two per cent. Douglas Porter, with BMO Capital Markets, agrees. …National Bank of Canada’s Stefane Marion expects the Bank of Canada to cut rates by around 100 basis points by the end of next year. Meanwhile, Tu Nguyen of RSM Canada predicts a rate cut could come as early as the second quarter of next year.

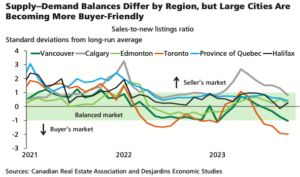

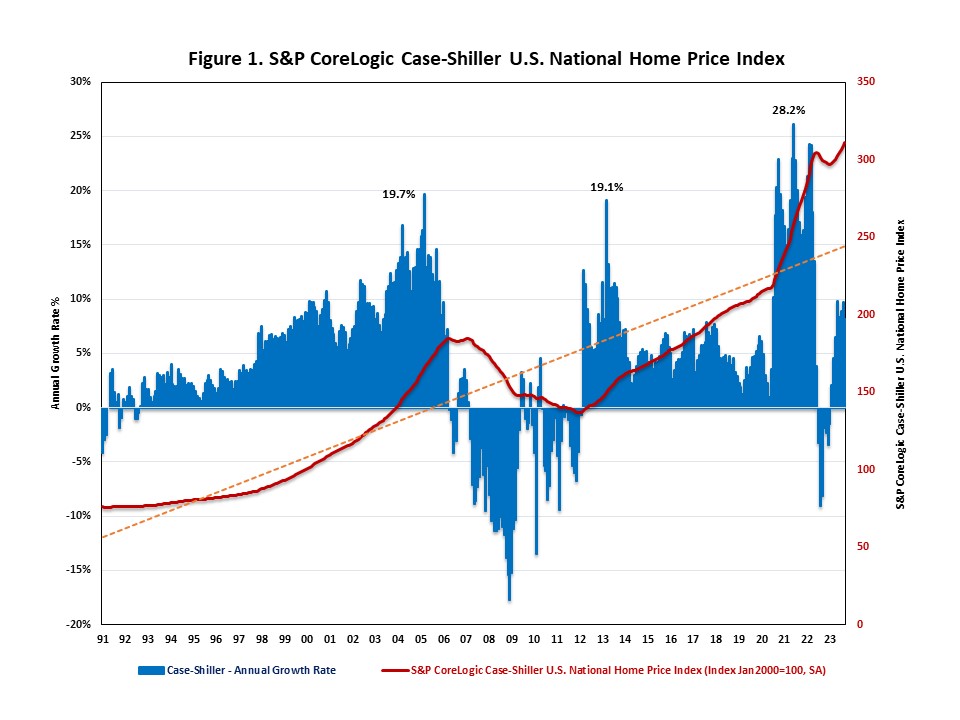

A new report looks ahead at Canadian housing in 2024, and forecasts softer sales and prices across all major markets, as well as a drop-off in homebuilding activity. Though it seems more than likely that the Bank of Canada (BoC) is done hiking rates for this cycle, the housing market is expected to remain soft through the spring.

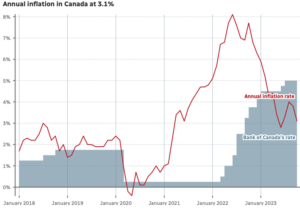

A new report looks ahead at Canadian housing in 2024, and forecasts softer sales and prices across all major markets, as well as a drop-off in homebuilding activity. Though it seems more than likely that the Bank of Canada (BoC) is done hiking rates for this cycle, the housing market is expected to remain soft through the spring.  Real gross domestic product remained essentially unchanged for a second consecutive month in August. Inflationary pressures remain higher than recent historical trends after rising 3.1% year over year in October 2023, although this remains lower than the peak in June 2022. Also in October 2023, employment was little changed, while the unemployment rate rose to 5.7%, marking the fourth monthly increase in the past six months. …Majority of businesses expect to face cost-related obstacles over the next three months. …In the fourth quarter, when asked to indicate which of the businesses’ expected obstacles would be the most challenging, 14.2% of businesses identified rising inflation, 11.0% reported rising interest rates and debt costs, and 10.5% identified rising costs of inputs.

Real gross domestic product remained essentially unchanged for a second consecutive month in August. Inflationary pressures remain higher than recent historical trends after rising 3.1% year over year in October 2023, although this remains lower than the peak in June 2022. Also in October 2023, employment was little changed, while the unemployment rate rose to 5.7%, marking the fourth monthly increase in the past six months. …Majority of businesses expect to face cost-related obstacles over the next three months. …In the fourth quarter, when asked to indicate which of the businesses’ expected obstacles would be the most challenging, 14.2% of businesses identified rising inflation, 11.0% reported rising interest rates and debt costs, and 10.5% identified rising costs of inputs.

Canada’s consumer price index rose by 3.1% in the year up to October, down from 3.8% the previous month but in line with what economists were expecting. Statistics Canada reported Tuesday that the biggest reason for the deceleration in the cost of living was a drop in the cost of gasoline, which declined by 6.4% during the month of October alone. If gasoline is stripped out of the numbers, the inflation rate would have been 3.6% in October. …Overall, shelter costs are up by more than 6% in the past year. That’s about twice the overall inflation rate. …The costs associated with owning are no better, with mortgage interest costs up by more than 30% in the past year. …If one were to strip mortgage costs out of the numbers, the inflation rate would be 2.2% and if one were to strip out shelter entirely, it would be 1.9%.

Canada’s consumer price index rose by 3.1% in the year up to October, down from 3.8% the previous month but in line with what economists were expecting. Statistics Canada reported Tuesday that the biggest reason for the deceleration in the cost of living was a drop in the cost of gasoline, which declined by 6.4% during the month of October alone. If gasoline is stripped out of the numbers, the inflation rate would have been 3.6% in October. …Overall, shelter costs are up by more than 6% in the past year. That’s about twice the overall inflation rate. …The costs associated with owning are no better, with mortgage interest costs up by more than 30% in the past year. …If one were to strip mortgage costs out of the numbers, the inflation rate would be 2.2% and if one were to strip out shelter entirely, it would be 1.9%. Nationally, job creation still looks quite healthy. …But even as employment gains hold up, there are signs conditions in labour market are shifting. In B.C. the economic indicators are also softening, including retail sales, exports, new building activity and residential home sales. But the job market here has weakened much more quickly than elsewhere in the country. Since last fall, total employment growth has slowed from around three per cent to just 1.7 per cent. …Looking ahead, there is ample reason to believe labour market conditions will continue to deteriorate. Higher interest rates are hammering consumer spending and demand, which in turn slows hiring. …At the same time, B.C.’s forest sector is still contracting, new home construction is decreasing and most segments of the province’s manufacturing sector continue to struggle. The difference between the national job market and B.C.’s is already quite jarring.

Nationally, job creation still looks quite healthy. …But even as employment gains hold up, there are signs conditions in labour market are shifting. In B.C. the economic indicators are also softening, including retail sales, exports, new building activity and residential home sales. But the job market here has weakened much more quickly than elsewhere in the country. Since last fall, total employment growth has slowed from around three per cent to just 1.7 per cent. …Looking ahead, there is ample reason to believe labour market conditions will continue to deteriorate. Higher interest rates are hammering consumer spending and demand, which in turn slows hiring. …At the same time, B.C.’s forest sector is still contracting, new home construction is decreasing and most segments of the province’s manufacturing sector continue to struggle. The difference between the national job market and B.C.’s is already quite jarring.

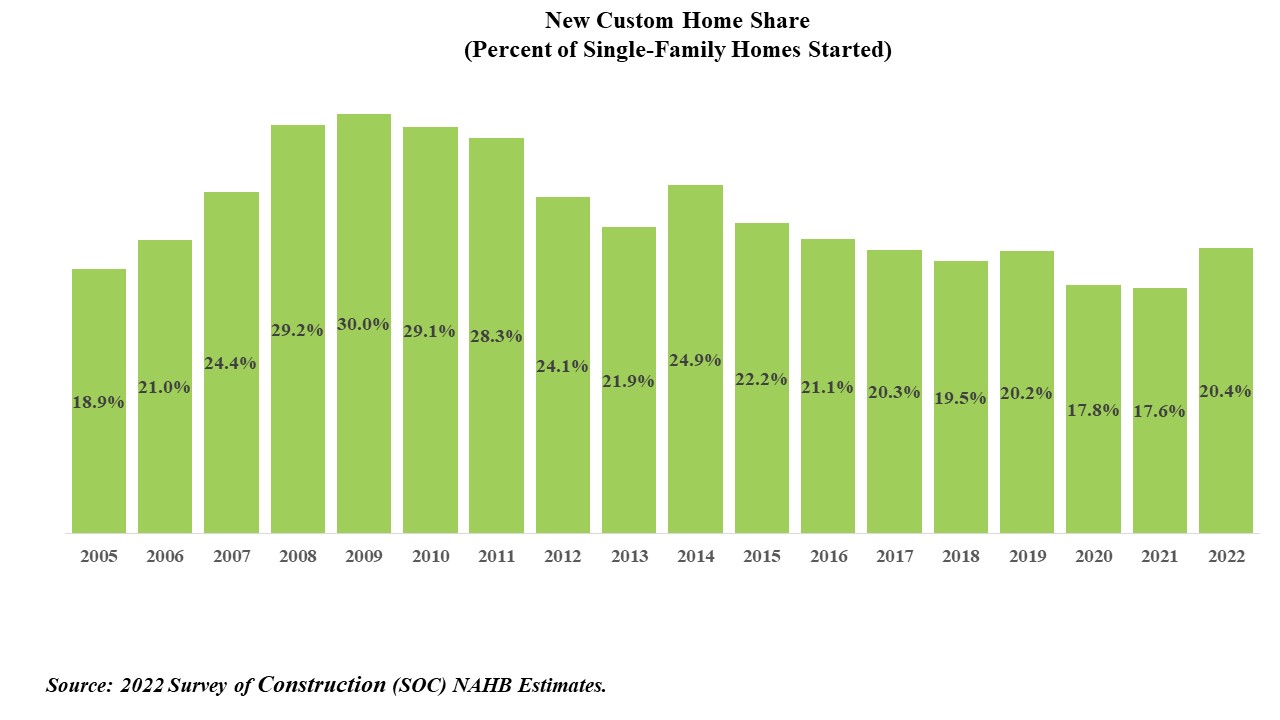

ONTARIO — To build enough homes to restore affordability to the market we must find ways of improving productivity in the residential sector and specifically look to offsite housing construction as one of the solutions. Don’t get me wrong, there are plenty of remedies that must be adopted. …But offsite construction is certainly a key piece to solving the puzzle. …At a recent housing summit hosted by RESCON, Albert Bendersky of BECC Modular noted there is a 30% to 50% reduction in time spent on a site for mid-size projects when offsite construction is used. …Offsite construction is also more cost-efficient. The construction sites are cleaner and obviously safer as there are fewer vehicles on site. In Sweden, offsite construction now accounts for 84% of the country’s residential construction market share. In Japan, 15% of the country’s new homes are built offsite.

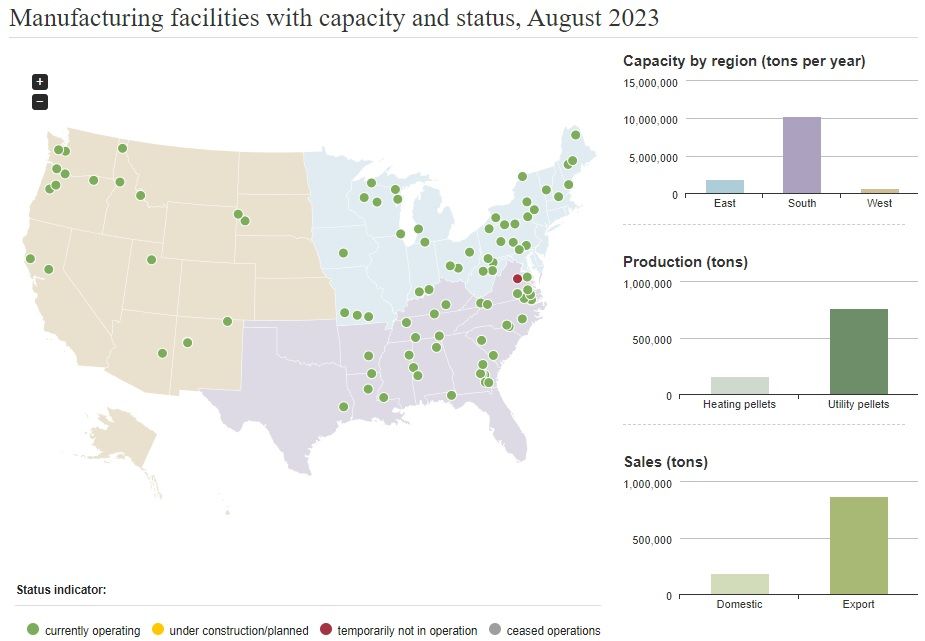

ONTARIO — To build enough homes to restore affordability to the market we must find ways of improving productivity in the residential sector and specifically look to offsite housing construction as one of the solutions. Don’t get me wrong, there are plenty of remedies that must be adopted. …But offsite construction is certainly a key piece to solving the puzzle. …At a recent housing summit hosted by RESCON, Albert Bendersky of BECC Modular noted there is a 30% to 50% reduction in time spent on a site for mid-size projects when offsite construction is used. …Offsite construction is also more cost-efficient. The construction sites are cleaner and obviously safer as there are fewer vehicles on site. In Sweden, offsite construction now accounts for 84% of the country’s residential construction market share. In Japan, 15% of the country’s new homes are built offsite. The U.S. exported 835,552.7 metric tons of wood pellets in October, up from both the 796,988 metric tons exported the previous month and the 750,997.7 metric tons exported in October 2022, according to data released by the USDA Foreign Agricultural Service on Dec. 6. The U.S. exported wood pellets to approximately 17 countries in October. The U.K. was the top destination for U.S. wood pellet exports at 476,743.7 metric tons, followed by the Netherlands at 125,978.3 metric tons and Japan at 119,128 metric tons. The value of U.S. wood pellet exports reached $155.47 million in October, up from both $147.53 million in September and $132.29 million in October of last year. Total U.S. wood pellet exports for the first 10 months of 2023 reached 7.88 million metric tons at a value of $1.45 billion, compared to 7.38 million metric tons exported during the same period of 2022 at a value of $1.28 billion.

The U.S. exported 835,552.7 metric tons of wood pellets in October, up from both the 796,988 metric tons exported the previous month and the 750,997.7 metric tons exported in October 2022, according to data released by the USDA Foreign Agricultural Service on Dec. 6. The U.S. exported wood pellets to approximately 17 countries in October. The U.K. was the top destination for U.S. wood pellet exports at 476,743.7 metric tons, followed by the Netherlands at 125,978.3 metric tons and Japan at 119,128 metric tons. The value of U.S. wood pellet exports reached $155.47 million in October, up from both $147.53 million in September and $132.29 million in October of last year. Total U.S. wood pellet exports for the first 10 months of 2023 reached 7.88 million metric tons at a value of $1.45 billion, compared to 7.38 million metric tons exported during the same period of 2022 at a value of $1.28 billion.

Insight/2023/11.2023/11.28.2023_Building%20Products%20Housing%20Market%20Update/001-indexed-price-performance-building-products-ecosystem.png)

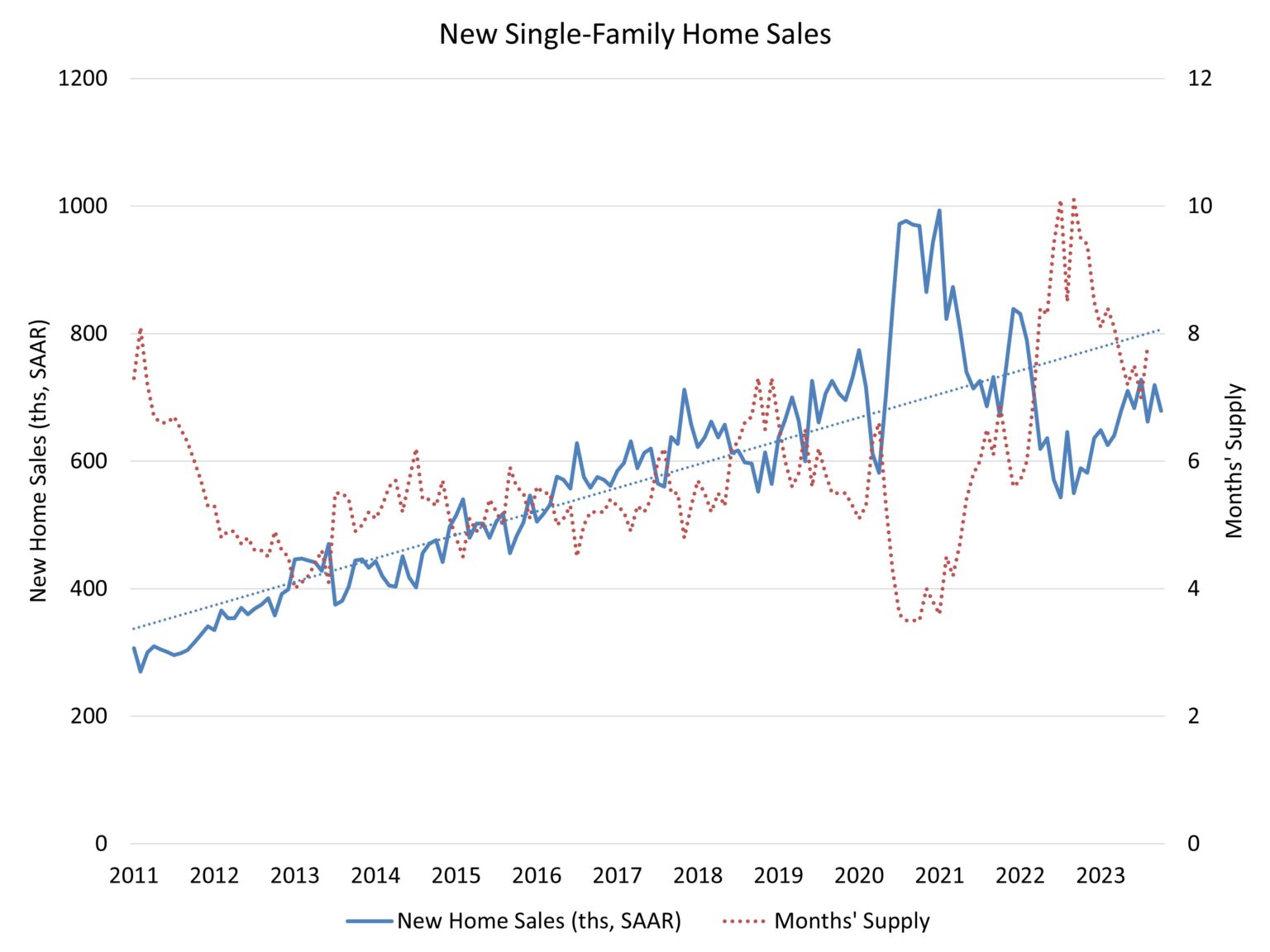

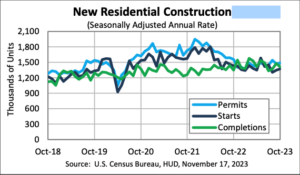

The US housing market is seeing a positive shift in sales, inventory, and construction – all possible signs the ice age in the residential real estate market could finally be nearing its end. Pending home sales ticked higher 1% on a monthly basis in October, according to Redfin data, reaching the highest seasonally adjusted level seen in a year. Meanwhile, mortgage applications jumped 6% on a monthly basis and soared 40% from levels last year, according to the Mortgage Bankers Association. …Builders also appear to be revving up their pace of construction, though total home building still remains below 2022 levels. …Those are all positive signs for the housing market, which has been at a standstill for much of the past year as sky-high mortgage rates have sidelined both buyers and sellers. …Other experts, though, have warned more trouble could be on the horizon, especially as the US economy begins to decelerate.

The US housing market is seeing a positive shift in sales, inventory, and construction – all possible signs the ice age in the residential real estate market could finally be nearing its end. Pending home sales ticked higher 1% on a monthly basis in October, according to Redfin data, reaching the highest seasonally adjusted level seen in a year. Meanwhile, mortgage applications jumped 6% on a monthly basis and soared 40% from levels last year, according to the Mortgage Bankers Association. …Builders also appear to be revving up their pace of construction, though total home building still remains below 2022 levels. …Those are all positive signs for the housing market, which has been at a standstill for much of the past year as sky-high mortgage rates have sidelined both buyers and sellers. …Other experts, though, have warned more trouble could be on the horizon, especially as the US economy begins to decelerate.

US privately‐owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,487,000. This is 1.1% above the revised September rate of 1,471,000, but is 4.4% below the October 2022 rate of 1,555,000. Single‐family authorizations in October were at a rate of 968,000; this is 0.5% above the revised September figure of 963,000. …Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,372,000. This is 1.9% above the revised September estimate of 1,346,000, but is 4.2% below the October 2022 rate of 1,432,000. Single‐family housing starts in October were at a rate of 970,000; this is 0.2% above the revised September figure of 968,000. …Privately‐owned housing completions in October were at a seasonally adjusted annual rate of 1,410,000. This is 4.6% below the revised September estimate of 1,478,000, but is 4.6% above the October 2022 rate of 1,348,000. Single‐family housing completions in October were at a rate of 993,000; this is 0.9% below the revised September rate of 1,002,000.

US privately‐owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 1,487,000. This is 1.1% above the revised September rate of 1,471,000, but is 4.4% below the October 2022 rate of 1,555,000. Single‐family authorizations in October were at a rate of 968,000; this is 0.5% above the revised September figure of 963,000. …Privately‐owned housing starts in October were at a seasonally adjusted annual rate of 1,372,000. This is 1.9% above the revised September estimate of 1,346,000, but is 4.2% below the October 2022 rate of 1,432,000. Single‐family housing starts in October were at a rate of 970,000; this is 0.2% above the revised September figure of 968,000. …Privately‐owned housing completions in October were at a seasonally adjusted annual rate of 1,410,000. This is 4.6% below the revised September estimate of 1,478,000, but is 4.6% above the October 2022 rate of 1,348,000. Single‐family housing completions in October were at a rate of 993,000; this is 0.9% below the revised September rate of 1,002,000.

UK — Commercial forestry values fell for the first time in almost a decade with a 10%-20% drop in the past year, according to a new industry

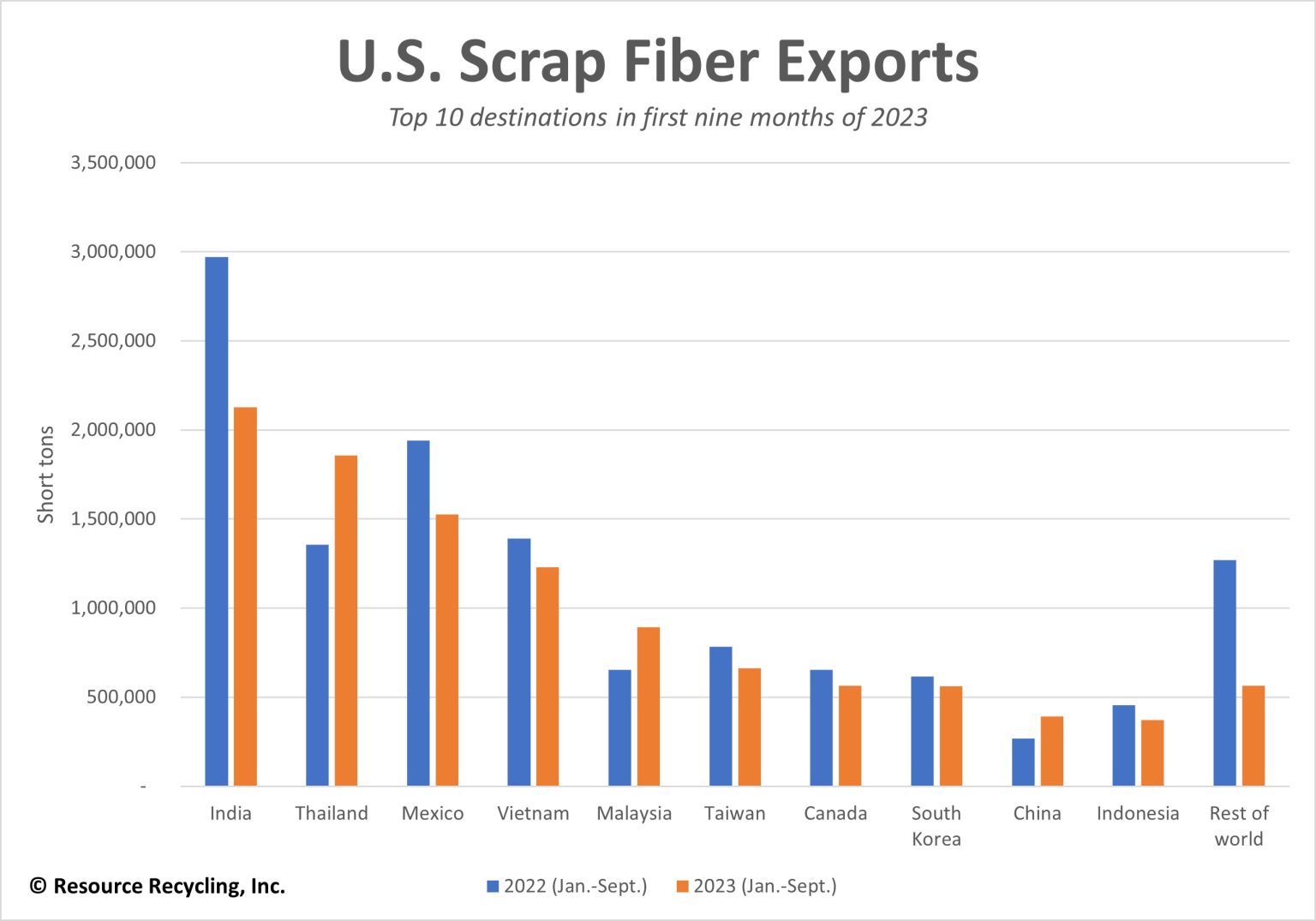

UK — Commercial forestry values fell for the first time in almost a decade with a 10%-20% drop in the past year, according to a new industry  In a year marked just as much by closures and downtime as with facility openings, companies across the paper industry are hopeful a demand boost is on the horizon. Since the start of the year, WestRock, Packaging Corp. of America, International Paper, Greif, Domtar and ND Paper all have announced shutdowns in response to what has been a challenging market, with box demand reaching lows not seen in more than a decade. …“International Paper has been rolling downtime through their mills; WestRock’s done permanent closures; [and] Packaging Corp. [of America] has done a … permanent idle of sorts of their new Wallula [, Washington] mill.” While all three of those companies have reported less downtime quarter to quarter, they each continue to report significant economic downtime compared with a year ago.

In a year marked just as much by closures and downtime as with facility openings, companies across the paper industry are hopeful a demand boost is on the horizon. Since the start of the year, WestRock, Packaging Corp. of America, International Paper, Greif, Domtar and ND Paper all have announced shutdowns in response to what has been a challenging market, with box demand reaching lows not seen in more than a decade. …“International Paper has been rolling downtime through their mills; WestRock’s done permanent closures; [and] Packaging Corp. [of America] has done a … permanent idle of sorts of their new Wallula [, Washington] mill.” While all three of those companies have reported less downtime quarter to quarter, they each continue to report significant economic downtime compared with a year ago. NEW ZEALAND — Prices for log exports are slowly improving, but a forestry consultant says the sector must find new international markets to reduce its reliance on China. Export prices have firmed this month, with sales to New Zealand’s largest customer, China, picking up – despite its post-Covid construction slowdown. November prices rose $9 on October, approaching NZ$110 per Japanese Agricultural Standard metre-squared at the wharf gate of South Island ports, and $5-10 more for North Island exporters. Sales are solid for log exporters. New Zealand exports to China have been dropping. …Allan Laurie said it was vital forestry companies tried to seek new markets. “China continues to be 80% of what we do into export markets,” Laurie said. …”It’s really time for New Zealand forestry Inc to get out into the world and start to look at other markets and improve our sales opportunities internationally, looking to non-traditional markets.”

NEW ZEALAND — Prices for log exports are slowly improving, but a forestry consultant says the sector must find new international markets to reduce its reliance on China. Export prices have firmed this month, with sales to New Zealand’s largest customer, China, picking up – despite its post-Covid construction slowdown. November prices rose $9 on October, approaching NZ$110 per Japanese Agricultural Standard metre-squared at the wharf gate of South Island ports, and $5-10 more for North Island exporters. Sales are solid for log exporters. New Zealand exports to China have been dropping. …Allan Laurie said it was vital forestry companies tried to seek new markets. “China continues to be 80% of what we do into export markets,” Laurie said. …”It’s really time for New Zealand forestry Inc to get out into the world and start to look at other markets and improve our sales opportunities internationally, looking to non-traditional markets.”