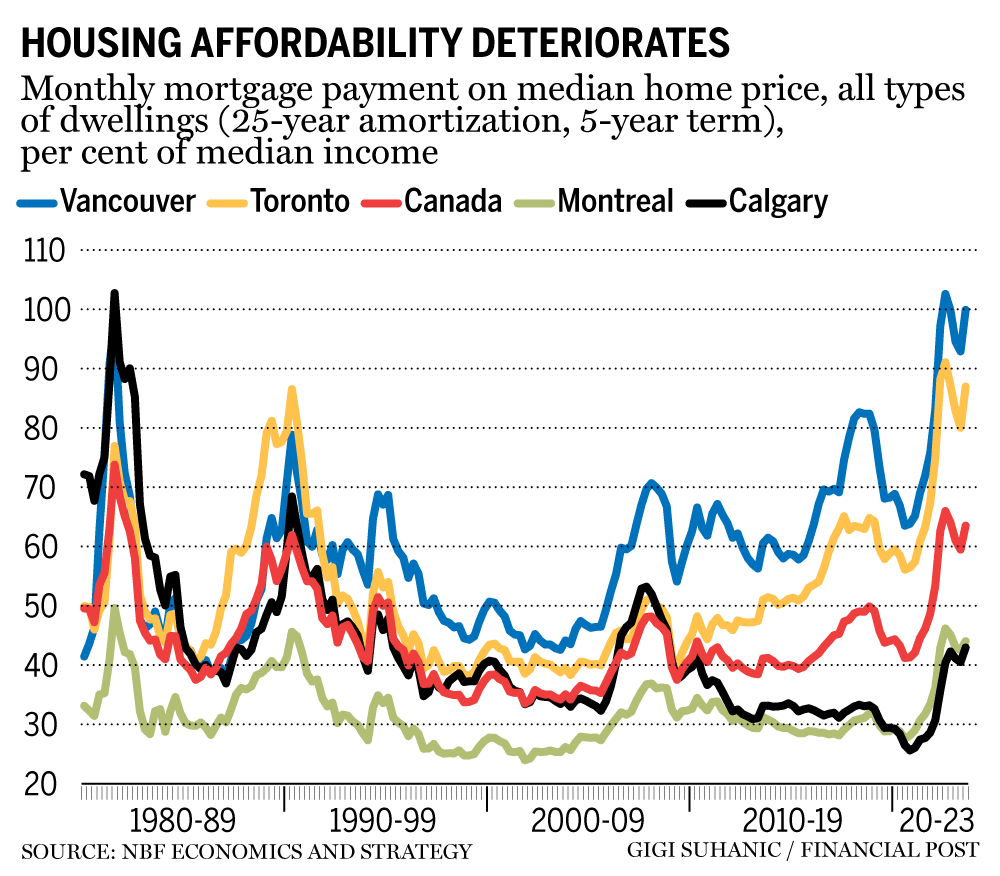

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), fell 1.0% month over month in October and were 2.7% lower than in October 2022. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), declined 2.5% on a monthly basis in October 2023 and fell 0.8% year over year. …Prices for energy and petroleum products fell 5.7% month over month in October, after posting four months of consecutive increases. …The price of softwood lumber fell 6.4% in October, the largest monthly decrease since March 2023 (-6.7%). Lower lumber prices were partially impacted by ongoing weak seasonal demand. High interest rates also continued to dampen real estate activities.

Prices of products manufactured in Canada, as measured by the Industrial Product Price Index (IPPI), fell 1.0% month over month in October and were 2.7% lower than in October 2022. Prices of raw materials purchased by manufacturers operating in Canada, as measured by the Raw Materials Price Index (RMPI), declined 2.5% on a monthly basis in October 2023 and fell 0.8% year over year. …Prices for energy and petroleum products fell 5.7% month over month in October, after posting four months of consecutive increases. …The price of softwood lumber fell 6.4% in October, the largest monthly decrease since March 2023 (-6.7%). Lower lumber prices were partially impacted by ongoing weak seasonal demand. High interest rates also continued to dampen real estate activities.

NORTH AMERICA — Production has been low according to recent reports, with some regions’ lumber production data being better than others, both in Canada and the U.S. … With the shortage of certain key items, like Red Oak and Hard Maple, prices are being affected. Some suppliers stated they are having depleted stocks of upper grade Hard Maple, and Red and White Oak. They added that inventories are declining for other grades as well. Ash supplies are noted as meeting current market needs, although shipments of this species have contracted for certain areas. …Aspen is often used as an alternative to other higher priced species, demand for it is on a firm foundation for certain applications. …Sales of Hard Maple have substantially declined.

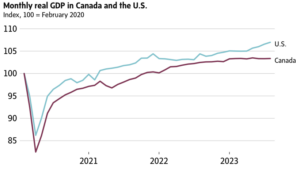

NORTH AMERICA — Production has been low according to recent reports, with some regions’ lumber production data being better than others, both in Canada and the U.S. … With the shortage of certain key items, like Red Oak and Hard Maple, prices are being affected. Some suppliers stated they are having depleted stocks of upper grade Hard Maple, and Red and White Oak. They added that inventories are declining for other grades as well. Ash supplies are noted as meeting current market needs, although shipments of this species have contracted for certain areas. …Aspen is often used as an alternative to other higher priced species, demand for it is on a firm foundation for certain applications. …Sales of Hard Maple have substantially declined.  The Bank of Canada and the U.S. Federal Reserve both began raising interest rates in March, 2022 and both tightened monetary policy. In Canada, that’s pushed the economy to the edge of a recession, while the U.S. economy is defying gravity. …The picture is clearest when you look at gross domestic product. Canadian GDP contracted between April and June then stalled through the summer and early fall. In the US, GDP grew at an annualized rate of 2.1% in the second quarter and accelerated to a whopping 4.9% in the third quarter. …The key reasons for the different directions include: …Canadians spend about 15 cents of every after tax dollar [servicing debt], and Americans were spending about 10 cents. …American homebuyers typically take out 30-year mortgages… In Canada, most mortgages reset every five years. That means rising interest rates are felt relatively quickly. …and low productivity is a drag on Canada’s economy. [to access the full story a Globe & Mail subscription is required]

The Bank of Canada and the U.S. Federal Reserve both began raising interest rates in March, 2022 and both tightened monetary policy. In Canada, that’s pushed the economy to the edge of a recession, while the U.S. economy is defying gravity. …The picture is clearest when you look at gross domestic product. Canadian GDP contracted between April and June then stalled through the summer and early fall. In the US, GDP grew at an annualized rate of 2.1% in the second quarter and accelerated to a whopping 4.9% in the third quarter. …The key reasons for the different directions include: …Canadians spend about 15 cents of every after tax dollar [servicing debt], and Americans were spending about 10 cents. …American homebuyers typically take out 30-year mortgages… In Canada, most mortgages reset every five years. That means rising interest rates are felt relatively quickly. …and low productivity is a drag on Canada’s economy. [to access the full story a Globe & Mail subscription is required] VANCOUVER, BC – For the third quarter of 2023, Canfor Corporation reported a consolidated operating loss of

VANCOUVER, BC – For the third quarter of 2023, Canfor Corporation reported a consolidated operating loss of  VANCOUVER, B.C. – Canfor Pulp Products reported an operating loss of $49.3 million for the third quarter of 2023, compared to an operating loss of $37.9 million for the second quarter of 2023. After taking into consideration a net $2.0 million reversal of a previously recognized inventory write-down, the Company’s adjusted operating loss was $51.3 million, compared to an adjusted operating loss of $31.0 million. These results principally reflected the continuation of soft global pulp market conditions throughout most of the current period combined with extensive downtime at the Company’s Northwood Northern Bleached Softwood Kraft pulp mill driven by supply chain disruptions and scheduled maintenance, as well as persistent reliability challenges and a delayed restart. …CPPI’s CEO, Kevin Edgson, said, “global pulp market conditions continued to be challenged with high pulp producer inventories and tepid demand.”

VANCOUVER, B.C. – Canfor Pulp Products reported an operating loss of $49.3 million for the third quarter of 2023, compared to an operating loss of $37.9 million for the second quarter of 2023. After taking into consideration a net $2.0 million reversal of a previously recognized inventory write-down, the Company’s adjusted operating loss was $51.3 million, compared to an adjusted operating loss of $31.0 million. These results principally reflected the continuation of soft global pulp market conditions throughout most of the current period combined with extensive downtime at the Company’s Northwood Northern Bleached Softwood Kraft pulp mill driven by supply chain disruptions and scheduled maintenance, as well as persistent reliability challenges and a delayed restart. …CPPI’s CEO, Kevin Edgson, said, “global pulp market conditions continued to be challenged with high pulp producer inventories and tepid demand.” BURNABY, BC — Interfor Corporation recorded a Net loss in Q3’23 of $42.4 million compared to a Net loss of $14.1 million in Q2’23 and Net earnings of $3.5 million in Q3’22. Adjusted EBITDA was $31.9 million on sales of $828.1 million in Q3’23 versus $41.9 million on sales of $871.8 million in Q2’23 and $129.5 million on sales of $1.0 billion in Q3’22. Notable items in the quarter Lumber production totaled 1.0 billion board feet, representing a decrease of 26 million board feet quarter-over-quarter. The decrease was primarily due to the temporary closure of a sawmill in B.C. as a result of wildfires. …Weak Lumber Prices. Lumber prices continued to reflect softened demand driven by the elevated interest rate environment and ongoing economic uncertainty. …Interfor expects that over the mid-term, lumber markets will continue to benefit from favourable underlying supply and demand fundamentals.

BURNABY, BC — Interfor Corporation recorded a Net loss in Q3’23 of $42.4 million compared to a Net loss of $14.1 million in Q2’23 and Net earnings of $3.5 million in Q3’22. Adjusted EBITDA was $31.9 million on sales of $828.1 million in Q3’23 versus $41.9 million on sales of $871.8 million in Q2’23 and $129.5 million on sales of $1.0 billion in Q3’22. Notable items in the quarter Lumber production totaled 1.0 billion board feet, representing a decrease of 26 million board feet quarter-over-quarter. The decrease was primarily due to the temporary closure of a sawmill in B.C. as a result of wildfires. …Weak Lumber Prices. Lumber prices continued to reflect softened demand driven by the elevated interest rate environment and ongoing economic uncertainty. …Interfor expects that over the mid-term, lumber markets will continue to benefit from favourable underlying supply and demand fundamentals.  NEW YORK, New York — Mercer International reported that Operating EBITDA in the third quarter was $37.5 million compared to $140.9 million in the same quarter of 2022 and improved from negative $68.7 million in the prior quarter of 2023. In the third quarter of 2023, net loss was $26.0 million compared to net income of $66.7 million and a net loss of $98.3 million in the second quarter of 2023. In the nine months ended September 30, 2023, Operating EBITDA was negative $3.7 million compared to positive $440.4 million in the same period of 2022. …Mr. Juan Carlos Bueno, CEO, stated: “Fiber costs for all our mills decreased in the third quarter from the prior quarter driven by the availability of calamity wood in Germany, our renegotiation of fiber costs for Celgar and the ramp up of our wood room at the Peace River mill.

NEW YORK, New York — Mercer International reported that Operating EBITDA in the third quarter was $37.5 million compared to $140.9 million in the same quarter of 2022 and improved from negative $68.7 million in the prior quarter of 2023. In the third quarter of 2023, net loss was $26.0 million compared to net income of $66.7 million and a net loss of $98.3 million in the second quarter of 2023. In the nine months ended September 30, 2023, Operating EBITDA was negative $3.7 million compared to positive $440.4 million in the same period of 2022. …Mr. Juan Carlos Bueno, CEO, stated: “Fiber costs for all our mills decreased in the third quarter from the prior quarter driven by the availability of calamity wood in Germany, our renegotiation of fiber costs for Celgar and the ramp up of our wood room at the Peace River mill.

VANCOUVER, BC — Western Forest Products reported a net loss of $17.4 million in the third quarter of 2023, as compared to a net loss of $20.7 million in the second quarter of 2023, and net income of $6.6 million in the third quarter of 2022. …Adjusted EBITDA was negative $11.6 million as compared to Adjusted EBITDA of negative $12.0 million in the second quarter of 2023, and adjusted EBITDA of $17.3 million in the third quarter of 2022. Operating loss prior to restructuring and other items was $25.8 million as compared to income of $4.7 million in the third quarter of 2022. …CEO Steven Hofer said, “While our results reflect the continued challenging operating environment and cost structure in BC, we are encouraged by the progress we’ve made in repositioning our business for the future. The agreement announced with the Tlowitsis, We Wai Kai, Wei Wai Kum and K’ómoks First Nations is a significant step forward.”

VANCOUVER, BC — Western Forest Products reported a net loss of $17.4 million in the third quarter of 2023, as compared to a net loss of $20.7 million in the second quarter of 2023, and net income of $6.6 million in the third quarter of 2022. …Adjusted EBITDA was negative $11.6 million as compared to Adjusted EBITDA of negative $12.0 million in the second quarter of 2023, and adjusted EBITDA of $17.3 million in the third quarter of 2022. Operating loss prior to restructuring and other items was $25.8 million as compared to income of $4.7 million in the third quarter of 2022. …CEO Steven Hofer said, “While our results reflect the continued challenging operating environment and cost structure in BC, we are encouraged by the progress we’ve made in repositioning our business for the future. The agreement announced with the Tlowitsis, We Wai Kai, Wei Wai Kum and K’ómoks First Nations is a significant step forward.” VANCOUVER, BC — Conifex Timber reported results for the third quarter ended September 30, 2023. EBITDA was negative $6.7 million for the quarter compared to EBITDA of $4.2 million in the third quarter of 2022. The third quarter results were favourably impacted by $1.7 million in recoveries of duty deposit overpayments which were more than offset by $2.4 million in further inventory write-downs that were taken in response to lower lumber prices and after disposing of a logging camp that was lost in a wildfire this summer for $0.6 million. Net loss was $8.0 million for the quarter versus net income of $0.9 million or $0.02 per share in the year-earlier quarter. The results reflect reduced operating earnings on lower lumber prices.

VANCOUVER, BC — Conifex Timber reported results for the third quarter ended September 30, 2023. EBITDA was negative $6.7 million for the quarter compared to EBITDA of $4.2 million in the third quarter of 2022. The third quarter results were favourably impacted by $1.7 million in recoveries of duty deposit overpayments which were more than offset by $2.4 million in further inventory write-downs that were taken in response to lower lumber prices and after disposing of a logging camp that was lost in a wildfire this summer for $0.6 million. Net loss was $8.0 million for the quarter versus net income of $0.9 million or $0.02 per share in the year-earlier quarter. The results reflect reduced operating earnings on lower lumber prices.

MONTREAL, Quebec — Stella-Jones announced financial results for its third quarter ended September 30, 2023. Sales in the third quarter of 2023 increased by 13% to $949 million, compared to sales of $842 million last year. Excluding the contribution from the acquisition of Texas Electric Cooperatives and the positive effect of currency conversion, sales were up $61 million or 7%. …Led by the continued strong organic sales growth, particularly for the Company’s largest product category, utility poles, EBITDA increased to $193 million in the third quarter of 2023 compared to $119 million in the third quarter last year and EBITDA margin expanded from 14.1% in 2022 to 20.3% in 2023. …“In Q3, Stella-Jones made notable progress in its growth trajectory, delivering not only another quarter of strong sales growth, but record increase in profitability,” said Eric Vachon, President and CEO.

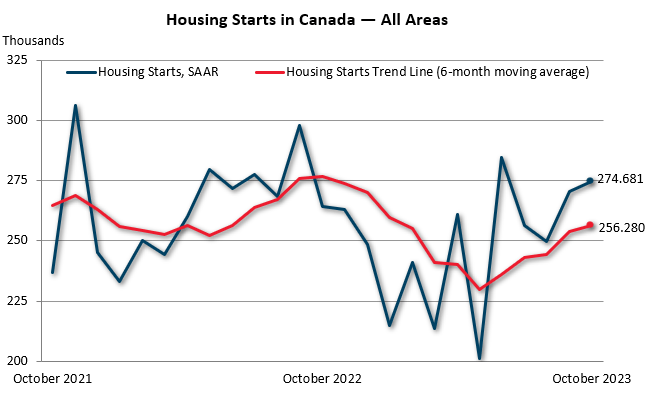

MONTREAL, Quebec — Stella-Jones announced financial results for its third quarter ended September 30, 2023. Sales in the third quarter of 2023 increased by 13% to $949 million, compared to sales of $842 million last year. Excluding the contribution from the acquisition of Texas Electric Cooperatives and the positive effect of currency conversion, sales were up $61 million or 7%. …Led by the continued strong organic sales growth, particularly for the Company’s largest product category, utility poles, EBITDA increased to $193 million in the third quarter of 2023 compared to $119 million in the third quarter last year and EBITDA margin expanded from 14.1% in 2022 to 20.3% in 2023. …“In Q3, Stella-Jones made notable progress in its growth trajectory, delivering not only another quarter of strong sales growth, but record increase in profitability,” said Eric Vachon, President and CEO. TORONTO — Ontario’s fall economic statement showed that projections for housing starts are up from what the province had expected when the spring budget was tabled, but still well short of the pace needed to build 1.5 million homes. The Progressive Conservative government has pledged to build that many homes within 10 years, by 2031, but at no point in the next few years does the province expect to even hit 100,000 new homes per year. Finance Minister Peter Bethlenfalvy’s fall economic statement shows the province expects to see almost 90,000 housing starts this year, more or less the same levels for the next two years, then up to about 94,000 in 2026. …But Bethlenfalvy said he’s not willing to say the government’s target of 1.5 million homes is not achievable.

TORONTO — Ontario’s fall economic statement showed that projections for housing starts are up from what the province had expected when the spring budget was tabled, but still well short of the pace needed to build 1.5 million homes. The Progressive Conservative government has pledged to build that many homes within 10 years, by 2031, but at no point in the next few years does the province expect to even hit 100,000 new homes per year. Finance Minister Peter Bethlenfalvy’s fall economic statement shows the province expects to see almost 90,000 housing starts this year, more or less the same levels for the next two years, then up to about 94,000 in 2026. …But Bethlenfalvy said he’s not willing to say the government’s target of 1.5 million homes is not achievable.

Lumber prices have somewhat stabilized this year after years of unusual volatility during the pandemic, making it easier for B.C. forestry companies to plan their business activities, analysts say. …But prices are expected to rise in February when orders for lumber products to fulfill U.S. housing demand increase, according to Keta Kosman, Madison’s Lumber Reporter. …It is estimated that there was a 6.4-million-home gap between single-family home construction and household formations in the U.S. between 2012 and 2022. That gap is down to 2.3 million homes if multi-family construction is included, according to Realtor.com analysis. …The anticipated average price of US$390/mbf in 2023 means that B.C. sawmills would have operated “at a loss for much if not all of the year,” as their break-even price is US$444 to US$493 per thousand board feet, according to Russ Taylor, president of Russ Taylor Global.

Lumber prices have somewhat stabilized this year after years of unusual volatility during the pandemic, making it easier for B.C. forestry companies to plan their business activities, analysts say. …But prices are expected to rise in February when orders for lumber products to fulfill U.S. housing demand increase, according to Keta Kosman, Madison’s Lumber Reporter. …It is estimated that there was a 6.4-million-home gap between single-family home construction and household formations in the U.S. between 2012 and 2022. That gap is down to 2.3 million homes if multi-family construction is included, according to Realtor.com analysis. …The anticipated average price of US$390/mbf in 2023 means that B.C. sawmills would have operated “at a loss for much if not all of the year,” as their break-even price is US$444 to US$493 per thousand board feet, according to Russ Taylor, president of Russ Taylor Global. North American new orders for tropical hardwoods have experienced a modest slowdown, but the demand for the hardwoods remain robust especially in high-end projects and exterior applications, according to

North American new orders for tropical hardwoods have experienced a modest slowdown, but the demand for the hardwoods remain robust especially in high-end projects and exterior applications, according to

Russ Taylor (Canada) and Margules Groome (New Zealand & Australia) have teamed up to present a strategic analysis and outlook on China. …The China wood products market is becoming complex! A slowdown is one thing, but there are some new and evolving fibre supply dynamics that will be played out in China over the next few years and beyond that should be game changers. We are predicting by when and what happens when China’s economic and construction problems are ameliorated, and a degree of confidence is restored. This is likely to result in significant supply-side responses and changes. All these factors could lead to some surprising and positive changes in prices for softwood log and lumber exporters. The current ongoing rapid expansion of the China’s pulp and paper capacity will also create exciting opportunities for hardwood woodchip exporters.

Russ Taylor (Canada) and Margules Groome (New Zealand & Australia) have teamed up to present a strategic analysis and outlook on China. …The China wood products market is becoming complex! A slowdown is one thing, but there are some new and evolving fibre supply dynamics that will be played out in China over the next few years and beyond that should be game changers. We are predicting by when and what happens when China’s economic and construction problems are ameliorated, and a degree of confidence is restored. This is likely to result in significant supply-side responses and changes. All these factors could lead to some surprising and positive changes in prices for softwood log and lumber exporters. The current ongoing rapid expansion of the China’s pulp and paper capacity will also create exciting opportunities for hardwood woodchip exporters.