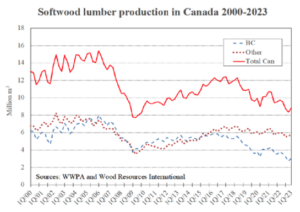

![]() OTTAWA — Real gross domestic product (GDP) was essentially unchanged for a second consecutive month in August as factors such as higher interest rates, inflation, forest fires and drought conditions continued to weigh on the economy. Overall, 8 of 20 industrial sectors increased. …Wholesale trade (+2.3%) increased in August for the third time in four months. The machinery, equipment and supplies subsector led the growth with a 5.1% gain. …The manufacturing sector contracted 0.6% in August, as both non-durable goods and durable goods manufacturing contributed to the decrease for a third month in a row. …Agriculture, forestry, fishing and hunting contracted 3.2% in August, its largest decline since August 2021. …Advance information indicates that real GDP by industry was essentially unchanged in September.

OTTAWA — Real gross domestic product (GDP) was essentially unchanged for a second consecutive month in August as factors such as higher interest rates, inflation, forest fires and drought conditions continued to weigh on the economy. Overall, 8 of 20 industrial sectors increased. …Wholesale trade (+2.3%) increased in August for the third time in four months. The machinery, equipment and supplies subsector led the growth with a 5.1% gain. …The manufacturing sector contracted 0.6% in August, as both non-durable goods and durable goods manufacturing contributed to the decrease for a third month in a row. …Agriculture, forestry, fishing and hunting contracted 3.2% in August, its largest decline since August 2021. …Advance information indicates that real GDP by industry was essentially unchanged in September.

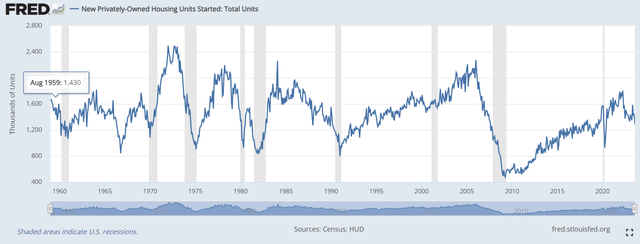

John Cooney, equity research analyst at ERA Forest Products Research, joins BNN Bloomberg to discuss lumber prices, which are under pressure as higher mortgage rates slow home construction. Many mills are losing money, he says.

John Cooney, equity research analyst at ERA Forest Products Research, joins BNN Bloomberg to discuss lumber prices, which are under pressure as higher mortgage rates slow home construction. Many mills are losing money, he says.

VANCOUVER, B.C. – West Fraser Timber reported its third quarter results of 2023. Third quarter sales were

VANCOUVER, B.C. – West Fraser Timber reported its third quarter results of 2023. Third quarter sales were

While Canadian inflation’s surprise September slowdown sparked some optimism, many remain skeptical. A similar situation is unfolding in the United States and the euro zone. Global monthly inflation rates have slowed sharply, yet still-high price levels, reignited oil and gas prices and the spectre of wage-price spirals fan sticky fears. Don’t panic. …Canada’s September headline CPI cooled to a 3.8 per cent year-over-year – well below the high of 8 per cent in June, 2022. Meanwhile, Canadian core inflation slowed to 2.8 per cent – under half the 6.1.-per-cent rate of June, 2022. U.S. CPI, meanwhile, dropped to 3.7 per cent year-over-year from a 9.1-per-cent high. Preliminary euro zone readings show inflation at 4.3 per cent – far off the 10.6 per cent of October, 2022. …Yet many gripe that prices remain far above 2019 levels. But it is the current rate of price gains – not current prices – that matters now. Reversing 2021-2022 price increases would take epic deflation… [and] no one wants that.

While Canadian inflation’s surprise September slowdown sparked some optimism, many remain skeptical. A similar situation is unfolding in the United States and the euro zone. Global monthly inflation rates have slowed sharply, yet still-high price levels, reignited oil and gas prices and the spectre of wage-price spirals fan sticky fears. Don’t panic. …Canada’s September headline CPI cooled to a 3.8 per cent year-over-year – well below the high of 8 per cent in June, 2022. Meanwhile, Canadian core inflation slowed to 2.8 per cent – under half the 6.1.-per-cent rate of June, 2022. U.S. CPI, meanwhile, dropped to 3.7 per cent year-over-year from a 9.1-per-cent high. Preliminary euro zone readings show inflation at 4.3 per cent – far off the 10.6 per cent of October, 2022. …Yet many gripe that prices remain far above 2019 levels. But it is the current rate of price gains – not current prices – that matters now. Reversing 2021-2022 price increases would take epic deflation… [and] no one wants that.

Canada’s inflation rate decelerated to 3.8 per cent in September, down from four per cent in August. The figure, which was reported by Statistics Canada on Tuesday, was lower than economists were expecting. The data agency said the deceleration in the cost of living was “broad-based” and stemmed from lower prices for a variety of goods and services, including travel, durable goods and some grocery items. On a monthly basis, the cost of living actually declined in September, by 0.1 per cent. That’s the first time that’s happened since November of last year. …Jay Zhao-Murray, an analyst with foreign exchange firm Monex said… “Today’s report is perhaps the best news that the Bank of Canada has received in months”.

Canada’s inflation rate decelerated to 3.8 per cent in September, down from four per cent in August. The figure, which was reported by Statistics Canada on Tuesday, was lower than economists were expecting. The data agency said the deceleration in the cost of living was “broad-based” and stemmed from lower prices for a variety of goods and services, including travel, durable goods and some grocery items. On a monthly basis, the cost of living actually declined in September, by 0.1 per cent. That’s the first time that’s happened since November of last year. …Jay Zhao-Murray, an analyst with foreign exchange firm Monex said… “Today’s report is perhaps the best news that the Bank of Canada has received in months”.

The Conference Board Consumer Confidence Index® declined moderately in October to 102.6 (1985=100), down from an upwardly revised 104.3 in September. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—declined to 143.1 (1985=100) from 146.2. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell slightly to 75.6 (1985=100) in October, after declining to 76.4 in September. The Expectations index is still below 80—the level that historically signals a recession within the next year. Consumer fears of an impending recession remain elevated, consistent with the short and shallow economic contraction we anticipate for the first half of 2024.

The Conference Board Consumer Confidence Index® declined moderately in October to 102.6 (1985=100), down from an upwardly revised 104.3 in September. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—declined to 143.1 (1985=100) from 146.2. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell slightly to 75.6 (1985=100) in October, after declining to 76.4 in September. The Expectations index is still below 80—the level that historically signals a recession within the next year. Consumer fears of an impending recession remain elevated, consistent with the short and shallow economic contraction we anticipate for the first half of 2024.

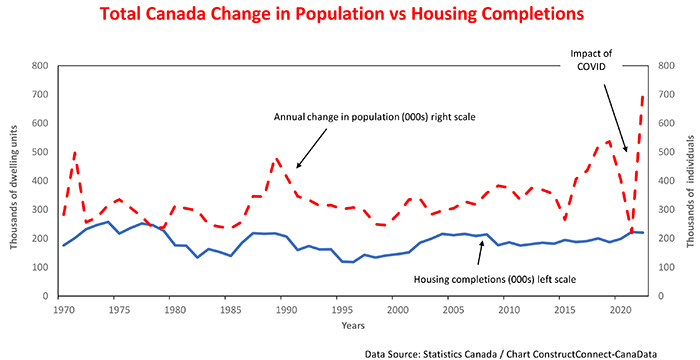

WASHINGTON – Sales of new U.S. single-family homes surged to a 19-month high in September as the annual median house price dropped by the most since 2009 amid discounts offered by builders to woo buyers. A chronic shortage of previously owned houses is driving buyers to new construction, a situation that builders are taking advantage of by giving a range of incentives to improve affordability. “Homebuilders are offering buyers interest rate buydown incentives that funnel demand into the newly built segment,” said Bill Adams, at Comerica Bank in Dallas.” …New home sales rebounded 12.3% to a seasonally adjusted annual rate of 759,000 units last month, the highest level since February 2022. August’s sales pace was revised up to 676,000 units from the previously reported 675,000 units. Last month, new home sales jumped 22.5% in the Northeast, 14.6% in the South, 7.5% in the West and 4.7% in the Midwest.

WASHINGTON – Sales of new U.S. single-family homes surged to a 19-month high in September as the annual median house price dropped by the most since 2009 amid discounts offered by builders to woo buyers. A chronic shortage of previously owned houses is driving buyers to new construction, a situation that builders are taking advantage of by giving a range of incentives to improve affordability. “Homebuilders are offering buyers interest rate buydown incentives that funnel demand into the newly built segment,” said Bill Adams, at Comerica Bank in Dallas.” …New home sales rebounded 12.3% to a seasonally adjusted annual rate of 759,000 units last month, the highest level since February 2022. August’s sales pace was revised up to 676,000 units from the previously reported 675,000 units. Last month, new home sales jumped 22.5% in the Northeast, 14.6% in the South, 7.5% in the West and 4.7% in the Midwest.

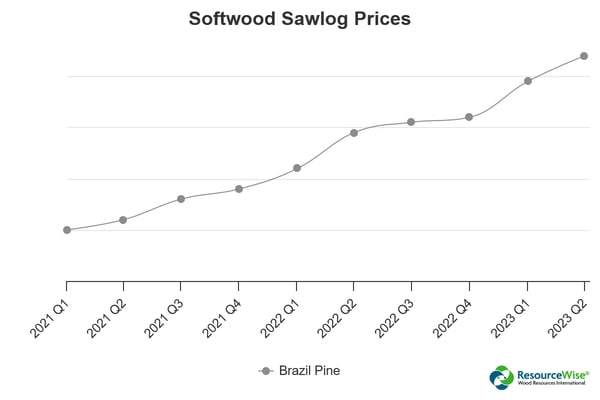

Southern Forest Products Association’s Alania Hanson attended the 2023 International Softwood Conference in Vienna, Austria, from October 11-12. Here are a few quick takes:

Southern Forest Products Association’s Alania Hanson attended the 2023 International Softwood Conference in Vienna, Austria, from October 11-12. Here are a few quick takes:

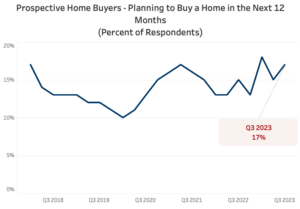

Despite mortgage rates topping 7%, Americans persist in their desire to buy a home. According to the latest Housing Trends Report*, the share of adults with plans to purchase a home within a year edged up to 17% in the third quarter of 2023, up from 15% a quarter earlier. The share has fluctuated up and down without a clear trend for over a year, likely due to the push-pull between two opposing forces: higher interest rates/home prices and persistent demand stemming from demographic growth. Meanwhile, interest for newly built homes continues to rise as the collapse of existing home inventory leaves new homes as the only option in many areas. In the third quarter of 2023, 27% of prospective buyers were looking to buy new construction, up for a third consecutive quarter after falling to 20% in the final quarter of 2022.

Despite mortgage rates topping 7%, Americans persist in their desire to buy a home. According to the latest Housing Trends Report*, the share of adults with plans to purchase a home within a year edged up to 17% in the third quarter of 2023, up from 15% a quarter earlier. The share has fluctuated up and down without a clear trend for over a year, likely due to the push-pull between two opposing forces: higher interest rates/home prices and persistent demand stemming from demographic growth. Meanwhile, interest for newly built homes continues to rise as the collapse of existing home inventory leaves new homes as the only option in many areas. In the third quarter of 2023, 27% of prospective buyers were looking to buy new construction, up for a third consecutive quarter after falling to 20% in the final quarter of 2022.

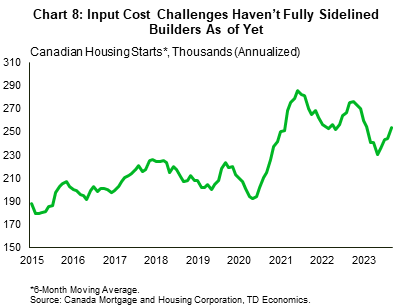

WASHINGTON – U.S. single-family homebuilding rebounded in September, boosted by demand for new construction amid an acute housing shortage, but the highest mortgage rates in nearly 23 years could slow momentum and delay the overall housing market recovery. That was flagged by other data on Wednesday showing applications for loans to purchase a home plunged last week to levels last seen in 1995. In addition, the jump in housing starts partially recouped the decline in August. The rebound in homebuilding probably reflected permits approved several months ago before mortgage rates broke above 7%. A survey this week showed confidence among single-family homebuilders slumped to a nine-month low in October, with builders reporting lower levels of traffic. Single-family housing starts increased 3.2% to a seasonally adjusted annual rate of 963,000 units last month, the Commerce Department said. Data for August was revised to show starts dropping to a rate of 933,000 units instead of 941,000 units as previously reported.

WASHINGTON – U.S. single-family homebuilding rebounded in September, boosted by demand for new construction amid an acute housing shortage, but the highest mortgage rates in nearly 23 years could slow momentum and delay the overall housing market recovery. That was flagged by other data on Wednesday showing applications for loans to purchase a home plunged last week to levels last seen in 1995. In addition, the jump in housing starts partially recouped the decline in August. The rebound in homebuilding probably reflected permits approved several months ago before mortgage rates broke above 7%. A survey this week showed confidence among single-family homebuilders slumped to a nine-month low in October, with builders reporting lower levels of traffic. Single-family housing starts increased 3.2% to a seasonally adjusted annual rate of 963,000 units last month, the Commerce Department said. Data for August was revised to show starts dropping to a rate of 933,000 units instead of 941,000 units as previously reported.

Consumer sentiment fell back about 7% this October following two consecutive months of very little change. Assessments of personal finances declined about 15%, primarily on a substantial increase in concerns over inflation, and one-year expected business conditions plunged about 19%. However, long-run expected business conditions are little changed, suggesting that consumers believe the current worsening in economic conditions will not persist. Nearly all demographic groups posted setbacks in sentiment, reflecting the continued weight of high prices. Year-ahead inflation expectations rose from 3.2% last month to 3.8% this month. The current reading is the highest since May 2023 and remains well above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations edged up from 2.8% last month to 3.0% this month, again staying within the narrow 2.9-3.1% range for 25 of the last 27 months.

Consumer sentiment fell back about 7% this October following two consecutive months of very little change. Assessments of personal finances declined about 15%, primarily on a substantial increase in concerns over inflation, and one-year expected business conditions plunged about 19%. However, long-run expected business conditions are little changed, suggesting that consumers believe the current worsening in economic conditions will not persist. Nearly all demographic groups posted setbacks in sentiment, reflecting the continued weight of high prices. Year-ahead inflation expectations rose from 3.2% last month to 3.8% this month. The current reading is the highest since May 2023 and remains well above the 2.3-3.0% range seen in the two years prior to the pandemic. Long-run inflation expectations edged up from 2.8% last month to 3.0% this month, again staying within the narrow 2.9-3.1% range for 25 of the last 27 months.

According to Chinese customs statistics, in the first half of 2023, China’s plywood exports amounted to 5.13 million cubic meters, valued at 2.368 billion US dollars, a decrease of 9% and 20% respectively compared to the same period in 2022. The Chinese plywood export market presents diversity, but 50% of exports are only sold to 10 countries. The Philippines and the United Kingdom are the two major markets for plywood in China, but in the first half of 2023, plywood exports to these two markets showed a significant decline. Exports to the Philippines decreased by 7%, while exports to the UK decreased by 18%. This has affected the export performance of the entire industry. …Affected by continuous trade frictions, China’s plywood exports to the United States in the first half of the year totaled only 143000 cubic meters, valued at 103 million US dollars, a year-on-year decrease of 39% and 51%, respectively.

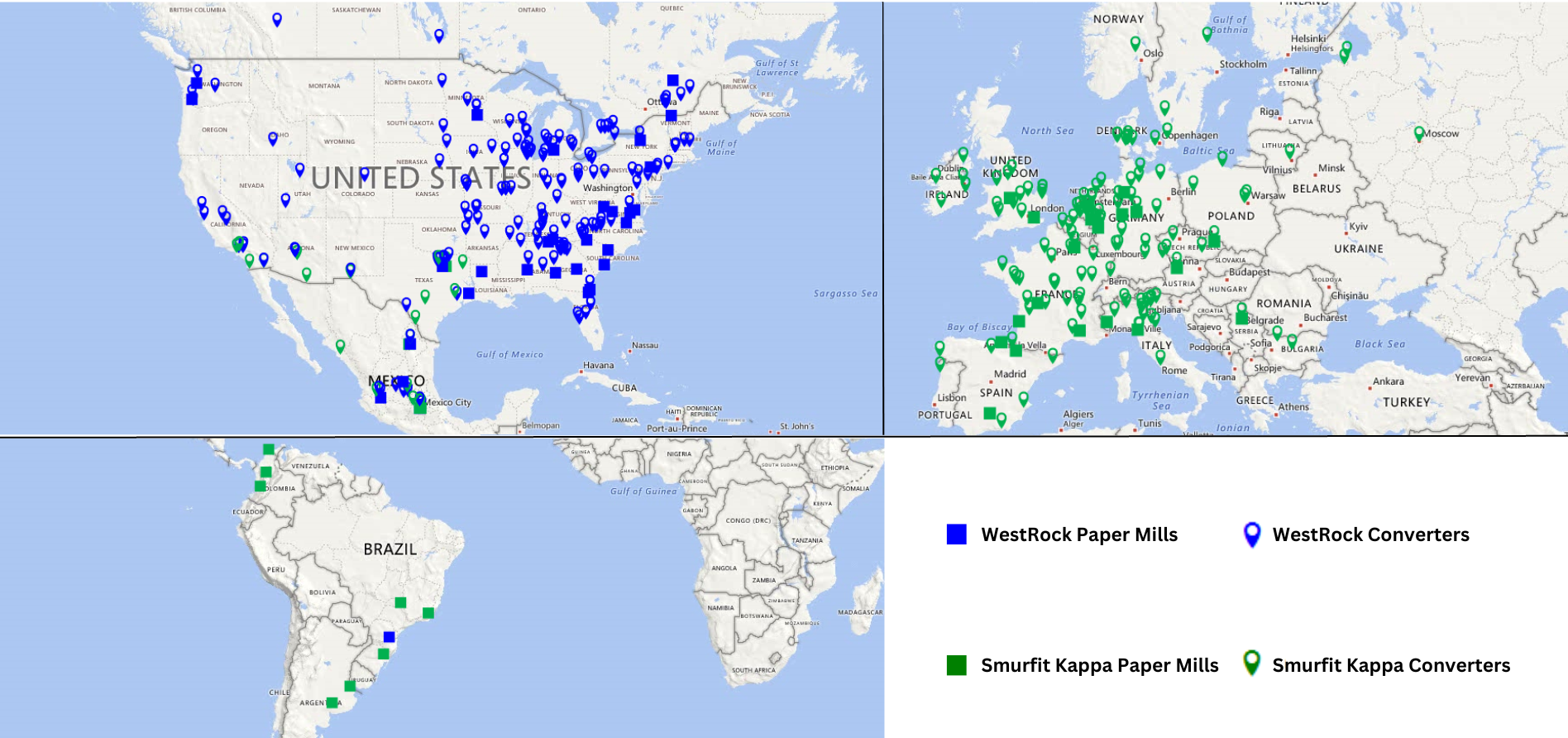

According to Chinese customs statistics, in the first half of 2023, China’s plywood exports amounted to 5.13 million cubic meters, valued at 2.368 billion US dollars, a decrease of 9% and 20% respectively compared to the same period in 2022. The Chinese plywood export market presents diversity, but 50% of exports are only sold to 10 countries. The Philippines and the United Kingdom are the two major markets for plywood in China, but in the first half of 2023, plywood exports to these two markets showed a significant decline. Exports to the Philippines decreased by 7%, while exports to the UK decreased by 18%. This has affected the export performance of the entire industry. …Affected by continuous trade frictions, China’s plywood exports to the United States in the first half of the year totaled only 143000 cubic meters, valued at 103 million US dollars, a year-on-year decrease of 39% and 51%, respectively. Recovered paper markets in both North America and Europe are beginning to stabilize, and in some cases, beginning to show a modest strengthening, according to the latest Bureau of International Recycling (BIR) World Mirror on Recovered Paper released in mid-October. Myles Cohen, of the Vipa Group, says while the market is not back to the high prices of 2021 and early 2022, seven or eight consecutive months of small increases have created some optimism within the recovered paper marketplace. For example, old corrugated container (OCC) pricing is up $10 per ton in every U.S. region, lifting the average price for the seventh straight month as reported in the Oct. 5 edition of Fastmarkets RISI’s Pulp & Paper Week. “The rising price trend is being driven by the same factors that have been in play over the past six to nine months, including low supply/collections,” Cohen writes.

Recovered paper markets in both North America and Europe are beginning to stabilize, and in some cases, beginning to show a modest strengthening, according to the latest Bureau of International Recycling (BIR) World Mirror on Recovered Paper released in mid-October. Myles Cohen, of the Vipa Group, says while the market is not back to the high prices of 2021 and early 2022, seven or eight consecutive months of small increases have created some optimism within the recovered paper marketplace. For example, old corrugated container (OCC) pricing is up $10 per ton in every U.S. region, lifting the average price for the seventh straight month as reported in the Oct. 5 edition of Fastmarkets RISI’s Pulp & Paper Week. “The rising price trend is being driven by the same factors that have been in play over the past six to nine months, including low supply/collections,” Cohen writes.