The total monthly value of building permits in Canada increased 3.4% in August to $11.9 billion, with strong gains in the non-residential sector offsetting modest declines in residential construction intentions. On a constant dollar basis (2012=100), the total value of building permits was up 4.3% to $6.9 billion in August. …The total monthly value of residential permits declined 3.7% to $6.8 billion in August, led by weaker multi-unit construction intentions in Ontario (-15.8% or -$315.6 million), Manitoba (-44.9% or -$90.3 million), Quebec (-7.9% or -$57.1 million), and Nova Scotia (-27.3% or -$29.9 million). These declines were partly offset by monthly gains in the value of single-family home permits.

The total monthly value of building permits in Canada increased 3.4% in August to $11.9 billion, with strong gains in the non-residential sector offsetting modest declines in residential construction intentions. On a constant dollar basis (2012=100), the total value of building permits was up 4.3% to $6.9 billion in August. …The total monthly value of residential permits declined 3.7% to $6.8 billion in August, led by weaker multi-unit construction intentions in Ontario (-15.8% or -$315.6 million), Manitoba (-44.9% or -$90.3 million), Quebec (-7.9% or -$57.1 million), and Nova Scotia (-27.3% or -$29.9 million). These declines were partly offset by monthly gains in the value of single-family home permits.

Challenging conditions prevailed in July for Japan’s housing market. In July total housing starts fell 6.7% to finish at 68,151 units. While single family owner-occupied housing fell 7.8%, rental housing increased 1.6%. After posting 3 months of gains, the mansion condominium market plunged 28%. Total wooden starts declined 3.9% to 40,136 units. Post and beam starts dropped 5.2% to 31,441 units. Wooden prefab starts fell 3.7% to 915 units and total prefab housing declined 4% to 9,719 units. Platform frame starts bucked the trend, edging up 1.8% to 7,780 units. Results of 2×4 starts by housing type were as follows: single family custom homes fell 3.3% to 2,564 units, rental housing advanced 8.0% to 4,443 units and built for sale spec housing declined 11.6% to 766 units. …Market weakness was also evident in commercial and institutional construction. July total non-residential starts decreased 8.5% to 3,888 units and wooden non-residential starts fell 11% to 1,439 units.

Challenging conditions prevailed in July for Japan’s housing market. In July total housing starts fell 6.7% to finish at 68,151 units. While single family owner-occupied housing fell 7.8%, rental housing increased 1.6%. After posting 3 months of gains, the mansion condominium market plunged 28%. Total wooden starts declined 3.9% to 40,136 units. Post and beam starts dropped 5.2% to 31,441 units. Wooden prefab starts fell 3.7% to 915 units and total prefab housing declined 4% to 9,719 units. Platform frame starts bucked the trend, edging up 1.8% to 7,780 units. Results of 2×4 starts by housing type were as follows: single family custom homes fell 3.3% to 2,564 units, rental housing advanced 8.0% to 4,443 units and built for sale spec housing declined 11.6% to 766 units. …Market weakness was also evident in commercial and institutional construction. July total non-residential starts decreased 8.5% to 3,888 units and wooden non-residential starts fell 11% to 1,439 units.

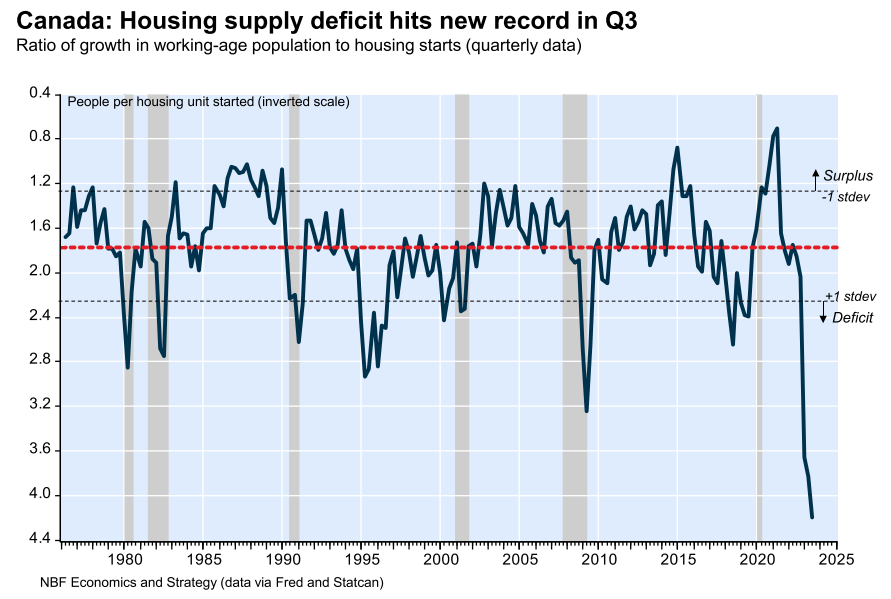

Ottawa saw the fewest freehold housing starts in 25 years during the first half of 2023, as price increases and high mortgage rates reduced demand for freehold housing. …The Canada Mortgage and Housing Corporation says housing starts were down 18 per cent in the first six months of 2023 compared to the same period in 2022. There were 3,574 housing starts in Ottawa in the first half of 2023, including 2,164 apartments. The purpose-build rental starts posted a record first-half gain. “However, the number of starts remains high because the decrease follows 3 years of record-setting levels of activity,” CMHC said. “For example, the number of housing starts in the first half of 2023 (nearly 3,600) outpaced starts from the same period in most years before the pandemic.” The CMHC says the decline in housing starts is concentrated in the single-detached, semi-detached and row houses, which were down 49% from 2022.

Ottawa saw the fewest freehold housing starts in 25 years during the first half of 2023, as price increases and high mortgage rates reduced demand for freehold housing. …The Canada Mortgage and Housing Corporation says housing starts were down 18 per cent in the first six months of 2023 compared to the same period in 2022. There were 3,574 housing starts in Ottawa in the first half of 2023, including 2,164 apartments. The purpose-build rental starts posted a record first-half gain. “However, the number of starts remains high because the decrease follows 3 years of record-setting levels of activity,” CMHC said. “For example, the number of housing starts in the first half of 2023 (nearly 3,600) outpaced starts from the same period in most years before the pandemic.” The CMHC says the decline in housing starts is concentrated in the single-detached, semi-detached and row houses, which were down 49% from 2022.

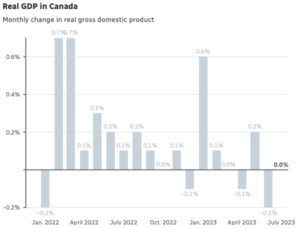

Canada’s gross domestic product was essentially unchanged in July, as the service sector expanded slightly while goods-producing industries shrank. Statistics Canada reported Friday that the total value of Canada’s entire economy was essentially unchanged during the month, with zero per cent growth. Economists had been expecting a slight expansion of about 0.1 per cent. The manufacturing sector shrank by 1.5 per cent, its biggest contraction in more than two years. Agriculture and forestry, transportation and warehousing, retail and professional services also shrank. …The GDP number for July was weaker than economists were expecting, and the early indicators for August look similar, with preliminary numbers showing a 0.1 per cent expansion. That’s less than the 0.2 per cent that had been expected.

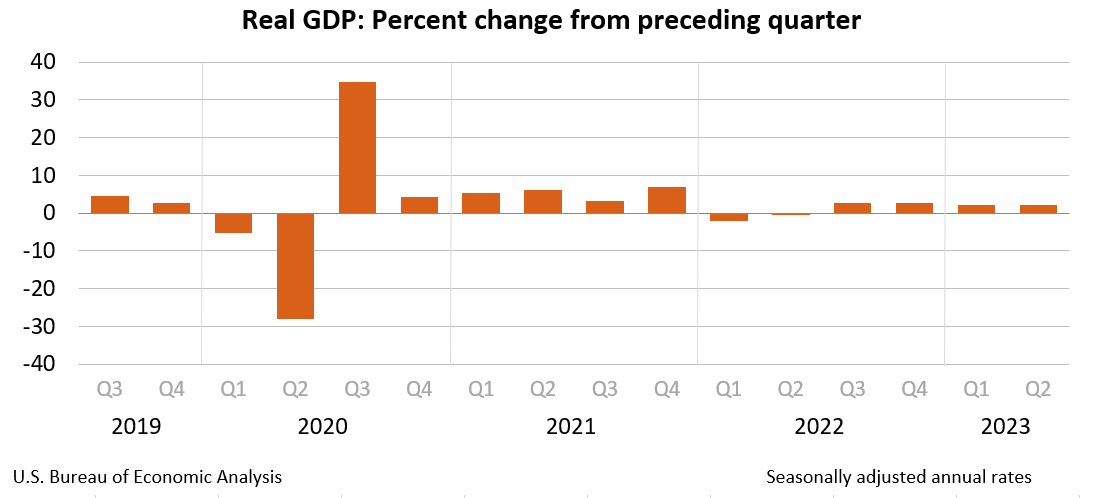

Canada’s gross domestic product was essentially unchanged in July, as the service sector expanded slightly while goods-producing industries shrank. Statistics Canada reported Friday that the total value of Canada’s entire economy was essentially unchanged during the month, with zero per cent growth. Economists had been expecting a slight expansion of about 0.1 per cent. The manufacturing sector shrank by 1.5 per cent, its biggest contraction in more than two years. Agriculture and forestry, transportation and warehousing, retail and professional services also shrank. …The GDP number for July was weaker than economists were expecting, and the early indicators for August look similar, with preliminary numbers showing a 0.1 per cent expansion. That’s less than the 0.2 per cent that had been expected. Real gross domestic product (GDP) of the natural resources sector decreased 0.4% in the second quarter, the third consecutive quarterly decline. In contrast, the economy-wide real GDP was nearly unchanged. The decrease in real GDP in the second quarter was driven by the forestry (-4.4%), minerals and mining (-2.2%) and hunting, fishing and water (-1.8%) subsectors. At the same time, the energy subsector increased 0.4%. The decline in the forestry subsector was attributable to primary sawmill and wood products (-6.5%), which reflected drops in new construction (-8.2%) and renovation activities (-4.3%) and coincided with higher borrowing costs and lower demand for mortgage funds. …Natural resources exports rose 0.5%, with increases in the minerals and mining (+3.2%) and energy (+0.1%) subsectors being offset by a decline in the forestry subsector (

Real gross domestic product (GDP) of the natural resources sector decreased 0.4% in the second quarter, the third consecutive quarterly decline. In contrast, the economy-wide real GDP was nearly unchanged. The decrease in real GDP in the second quarter was driven by the forestry (-4.4%), minerals and mining (-2.2%) and hunting, fishing and water (-1.8%) subsectors. At the same time, the energy subsector increased 0.4%. The decline in the forestry subsector was attributable to primary sawmill and wood products (-6.5%), which reflected drops in new construction (-8.2%) and renovation activities (-4.3%) and coincided with higher borrowing costs and lower demand for mortgage funds. …Natural resources exports rose 0.5%, with increases in the minerals and mining (+3.2%) and energy (+0.1%) subsectors being offset by a decline in the forestry subsector (

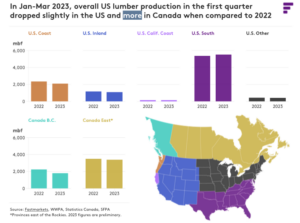

While Canadian western spruce pine fir’s (W-SPF) production has decreased over the past decade, American southern yellow pine’s production has been on a steady rise. The decrease can be attributed to several factors. Firstly, an infestation of bark beetles. Also, wildfires… policy factors… and duties applied to Canadian lumber. Conversely, American southern yellow pine (SYP) has experienced steady growth in production over the past few years. …While the production cuts in British Columbia are a key headwind to the supply forecast over the coming years, supply growth in the US south is expected to help fill the void. …We forecast that the US South will continue to take a share of the total North American production mix. We expect the South’s share of US production to rise from 34% in 2018-22 to 39% from 2023-27 as demand grows.

While Canadian western spruce pine fir’s (W-SPF) production has decreased over the past decade, American southern yellow pine’s production has been on a steady rise. The decrease can be attributed to several factors. Firstly, an infestation of bark beetles. Also, wildfires… policy factors… and duties applied to Canadian lumber. Conversely, American southern yellow pine (SYP) has experienced steady growth in production over the past few years. …While the production cuts in British Columbia are a key headwind to the supply forecast over the coming years, supply growth in the US south is expected to help fill the void. …We forecast that the US South will continue to take a share of the total North American production mix. We expect the South’s share of US production to rise from 34% in 2018-22 to 39% from 2023-27 as demand grows.

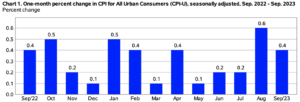

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis, after increasing 0.6 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment. The index for shelter was the largest contributor to the monthly all items increase, accounting for over half of the increase. An increase in the gasoline index was also a major contributor to the all items monthly rise. While the major energy component indexes were mixed in September, the energy index rose 1.5 percent over the month. The food index increased 0.2 percent in September, as it did in the previous two months. The index for food at home increased 0.1 percent over the month while the index for food away from home rose 0.4 percent.

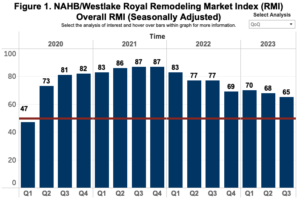

The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in September on a seasonally adjusted basis, after increasing 0.6 percent in August, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment. The index for shelter was the largest contributor to the monthly all items increase, accounting for over half of the increase. An increase in the gasoline index was also a major contributor to the all items monthly rise. While the major energy component indexes were mixed in September, the energy index rose 1.5 percent over the month. The food index increased 0.2 percent in September, as it did in the previous two months. The index for food at home increased 0.1 percent over the month while the index for food away from home rose 0.4 percent.  The NAHB/Westlake Royal Remodeling Market Index (RMI) for the third quarter of 2023 posted a reading of 65, edging down 3 points from the previous quarter. While there is still demand for remodeling, some customers are pulling back on potential projects due to higher prices and increased interest rates. Even though remodeling spending has experienced some slow down over the past year, it accounts for 43% of total residential construction as of June 2023, up from 31% at the beginning of 2002. NAHB forecasts that the remodeling market will experience mild growth in 2024 & 2025. …In the third quarter of 2023, the Current Conditions component index was 72, falling 5 points from the previous quarter. …The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in and the current backlog of remodeling projects.

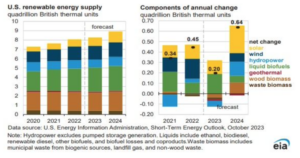

The NAHB/Westlake Royal Remodeling Market Index (RMI) for the third quarter of 2023 posted a reading of 65, edging down 3 points from the previous quarter. While there is still demand for remodeling, some customers are pulling back on potential projects due to higher prices and increased interest rates. Even though remodeling spending has experienced some slow down over the past year, it accounts for 43% of total residential construction as of June 2023, up from 31% at the beginning of 2002. NAHB forecasts that the remodeling market will experience mild growth in 2024 & 2025. …In the third quarter of 2023, the Current Conditions component index was 72, falling 5 points from the previous quarter. …The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in and the current backlog of remodeling projects. Renewables are expected to account for 25 percent of U.S. electricity generation next year, up from 22 percent in 2023, according to the U.S. Energy Information Administration’s latest Short-Term Energy Outlook, released Oct. 11. Renewables accounted for 22 percent of U.S. electricity generation in 2022. Biomass electricity generation is currently expected to reach 23.5 billion kilowatt hours (kWh) this year, increasing to 24.6 billion kWh in 2024. Biomass was used to generate 26.7 billion kWh of electricity last year. The U.S. electric power sector had approximately 2.9 gigawatts (GW) of waste biomass production capacity in place as of the end of 2022. Waste biomass capacity is expected to increase to 3 GW this year and be maintained at that level through 2023. The sector also had 2.4 GW of wood biomass capacity in place last year, with that level of capacity expected to be maintained through 2023 and 2024.

Renewables are expected to account for 25 percent of U.S. electricity generation next year, up from 22 percent in 2023, according to the U.S. Energy Information Administration’s latest Short-Term Energy Outlook, released Oct. 11. Renewables accounted for 22 percent of U.S. electricity generation in 2022. Biomass electricity generation is currently expected to reach 23.5 billion kilowatt hours (kWh) this year, increasing to 24.6 billion kWh in 2024. Biomass was used to generate 26.7 billion kWh of electricity last year. The U.S. electric power sector had approximately 2.9 gigawatts (GW) of waste biomass production capacity in place as of the end of 2022. Waste biomass capacity is expected to increase to 3 GW this year and be maintained at that level through 2023. The sector also had 2.4 GW of wood biomass capacity in place last year, with that level of capacity expected to be maintained through 2023 and 2024.

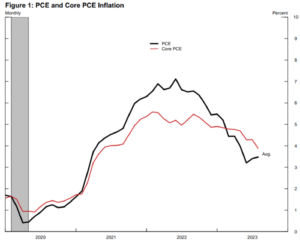

At the 65th Annual Meeting of the National Association for Business Economics, Dallas, Texas. …Even though recent inflation data have been encouraging, inflation remains too high. Over the 12 months ending in August, total Personal Consumption Expenditures prices rose 3.5 percent, the black line in

At the 65th Annual Meeting of the National Association for Business Economics, Dallas, Texas. …Even though recent inflation data have been encouraging, inflation remains too high. Over the 12 months ending in August, total Personal Consumption Expenditures prices rose 3.5 percent, the black line in  Biomass continued to be the second largest source of renewable electricity in the U.K. last year, trailing only offshore and onshore wind, according to an annual report released by the U.K. Association for Renewable Energy and Clean Technology (REA) on Oct. 4. The annual state of the industry report, titled Review23, indicates that renewables accounted for 41.7 percent of U.K. power generation last year, up from 39.6 percent in 2021. Biomass provided 6.9 percent of the U.K.’s electricity needs last year, down from 8.78 percent in 2021. While remaining relatively small contributors, anaerobic digestion and waste-to-energy technologies have continued to grow consistently, according to the report. The biomass power sector, which includes facilities fueled by energy crops, straw and wood pellets, generated approximately 22,000 gigawatt hours (GWh) of electricity last year, down 16 percent from 2021.

Biomass continued to be the second largest source of renewable electricity in the U.K. last year, trailing only offshore and onshore wind, according to an annual report released by the U.K. Association for Renewable Energy and Clean Technology (REA) on Oct. 4. The annual state of the industry report, titled Review23, indicates that renewables accounted for 41.7 percent of U.K. power generation last year, up from 39.6 percent in 2021. Biomass provided 6.9 percent of the U.K.’s electricity needs last year, down from 8.78 percent in 2021. While remaining relatively small contributors, anaerobic digestion and waste-to-energy technologies have continued to grow consistently, according to the report. The biomass power sector, which includes facilities fueled by energy crops, straw and wood pellets, generated approximately 22,000 gigawatt hours (GWh) of electricity last year, down 16 percent from 2021.

With mortgage rates above 7% – making housing affordability even more difficult for the average American — some builders have been making adjustments to compensate. This includes using less costly materials along with some residential construction companies turning to smaller builds. But the rules of the playing field didn’t change overnight. Home sizes and off-site construction see continuing declines: as home sizes have seen a gradual decline over the past decade, so has the number of residential builds created off-site. Citing data from the Census Bureau’s Survey of Construction, the NAHB said a total of 29,000 homes at 5,000-plus square feet were started in 2022, down from 33,000 in 2021. In comparison, new 5,000-plus square feet homes reached a peak of 45,000 in 2006 and then fell to 37,000 in 2007. …Saunders noted that some home builders have switched to building smaller homes while swapping out lesser-priced materials in order to bring down the overall cost of a new home.

With mortgage rates above 7% – making housing affordability even more difficult for the average American — some builders have been making adjustments to compensate. This includes using less costly materials along with some residential construction companies turning to smaller builds. But the rules of the playing field didn’t change overnight. Home sizes and off-site construction see continuing declines: as home sizes have seen a gradual decline over the past decade, so has the number of residential builds created off-site. Citing data from the Census Bureau’s Survey of Construction, the NAHB said a total of 29,000 homes at 5,000-plus square feet were started in 2022, down from 33,000 in 2021. In comparison, new 5,000-plus square feet homes reached a peak of 45,000 in 2006 and then fell to 37,000 in 2007. …Saunders noted that some home builders have switched to building smaller homes while swapping out lesser-priced materials in order to bring down the overall cost of a new home.

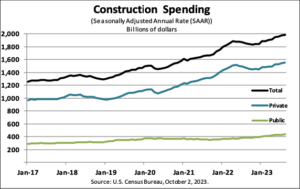

Construction spending during August 2023 was estimated at a seasonally adjusted annual rate of $1,983.5 billion, 0.5 percent (±1.2 percent) above the revised July estimate of $1,973.7 billion. The August figure is 7.4 percent (±1.8 percent) above the August 2022 estimate of $1,847.3 billion. During the first eight months of this year, construction spending amounted to $1,284.7 billion, 4.2 percent (±1.2 percent) above the $1,233.4 billion for the same period in 2022. …Spending on private construction was at a seasonally adjusted annual rate of $1,551.8 billion, 0.5 percent (±0.7 percent) above the revised July estimate of $1,544.6 billion. Residential construction was at a seasonally adjusted annual rate of $879.9 billion in August, 0.6 percent (±1.3 percent) above the revised July estimate of $874.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $671.9 billion in August, 0.3 percent (±0.7 percent) above the revised July estimate of $669.9 billion.

Construction spending during August 2023 was estimated at a seasonally adjusted annual rate of $1,983.5 billion, 0.5 percent (±1.2 percent) above the revised July estimate of $1,973.7 billion. The August figure is 7.4 percent (±1.8 percent) above the August 2022 estimate of $1,847.3 billion. During the first eight months of this year, construction spending amounted to $1,284.7 billion, 4.2 percent (±1.2 percent) above the $1,233.4 billion for the same period in 2022. …Spending on private construction was at a seasonally adjusted annual rate of $1,551.8 billion, 0.5 percent (±0.7 percent) above the revised July estimate of $1,544.6 billion. Residential construction was at a seasonally adjusted annual rate of $879.9 billion in August, 0.6 percent (±1.3 percent) above the revised July estimate of $874.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $671.9 billion in August, 0.3 percent (±0.7 percent) above the revised July estimate of $669.9 billion. The Institute for Supply Management’s (ISM) monthly sentiment survey of U.S. manufacturers reflected a slower contraction in the sector during August. …The PMI registered 47.6%, up 1.2PP from July’s reading. 50% is the breakpoint between contraction and expansion. All subindexes remained at or below 50. …In July, total industrial production (IP) increased 1.0% (-0.2% year-over-year/YoY) following declines in the previous two months. …In the forest products sector, the price indexes were measured as follows:

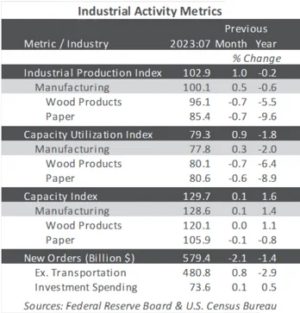

The Institute for Supply Management’s (ISM) monthly sentiment survey of U.S. manufacturers reflected a slower contraction in the sector during August. …The PMI registered 47.6%, up 1.2PP from July’s reading. 50% is the breakpoint between contraction and expansion. All subindexes remained at or below 50. …In July, total industrial production (IP) increased 1.0% (-0.2% year-over-year/YoY) following declines in the previous two months. …In the forest products sector, the price indexes were measured as follows: The SLB recently published its Q2 2023 Report, detailing the SLB and its funded programs’ activities that outperformed on a wide number of measures while defending existing market share and making strategic investments that will help grow and diversify revenue streams.

The SLB recently published its Q2 2023 Report, detailing the SLB and its funded programs’ activities that outperformed on a wide number of measures while defending existing market share and making strategic investments that will help grow and diversify revenue streams.

U.S.

U.S.  Construction input prices ticked up 1.5% in August, the first increase in six months, due to a surge in energy costs, according to a new

Construction input prices ticked up 1.5% in August, the first increase in six months, due to a surge in energy costs, according to a new

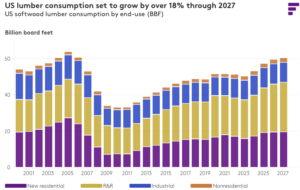

Dustin Jalbert commented that Fastmarkets projects US lumber consumption to grow by 18% through 2027. He highlighted that this growth was primarily fueled by residential construction and repair and remodeling activities. His forecast also projected steady growth in demand for SYP over the next five years, increasing its market share over the decade. An expected increase of about 9 billion board feet is anticipated, driven by factors such as an underbuilt housing market and the availability of home equity. Southern yellow pine runs in contrast to what we’re seeing in the rest of the supply side of the North American lumber market…effectively compensating for the capacity losses in British Columbia. “This is going to continue at a pace of about a billion board feet per year,” Jalbert said.

Dustin Jalbert commented that Fastmarkets projects US lumber consumption to grow by 18% through 2027. He highlighted that this growth was primarily fueled by residential construction and repair and remodeling activities. His forecast also projected steady growth in demand for SYP over the next five years, increasing its market share over the decade. An expected increase of about 9 billion board feet is anticipated, driven by factors such as an underbuilt housing market and the availability of home equity. Southern yellow pine runs in contrast to what we’re seeing in the rest of the supply side of the North American lumber market…effectively compensating for the capacity losses in British Columbia. “This is going to continue at a pace of about a billion board feet per year,” Jalbert said. Russian President Vladimir Putin has signed a decree “On the mandatory sale of revenue in foreign currency received by certain Russian exporters under foreign trade agreements (contracts)”. According to the decree, a specific list of exporters, including 43 groups of companies from various industries such as the fuel and energy complex, black and non-ferrous metallurgy, chemical and forestry industries are required to repatriate and sell foreign currency proceeds on the Russian market. It is noted that this measure is intended to contribute to the stabilization of the ruble. On Monday, the dollar exchange rate on the Moscow Exchange exceeded 102 rubles for the first time since March 23, 2022. …The process will be implemented over 6 months, with volumes and deadlines set by the government.

Russian President Vladimir Putin has signed a decree “On the mandatory sale of revenue in foreign currency received by certain Russian exporters under foreign trade agreements (contracts)”. According to the decree, a specific list of exporters, including 43 groups of companies from various industries such as the fuel and energy complex, black and non-ferrous metallurgy, chemical and forestry industries are required to repatriate and sell foreign currency proceeds on the Russian market. It is noted that this measure is intended to contribute to the stabilization of the ruble. On Monday, the dollar exchange rate on the Moscow Exchange exceeded 102 rubles for the first time since March 23, 2022. …The process will be implemented over 6 months, with volumes and deadlines set by the government.