Taking current trends into account, Canada Mortgage and Housing Corporation has markedly lowered its estimate for how many new homes will be built across the country by 2030. “Last year, we projected that, by 2030, there would be 18.6 million housing units in Canada,” CMHC said in its latest report. “Now, we project 18.2 million units (compared to our estimate of 16.5 million existing units in 2022).” A major driver of this decline is the ongoing shortfall in housing construction. “Materials have gotten more expensive, labour is in short supply, and it’s hard to get financing for construction,” CMHC said. …CMHC stressed that the pace of new construction will almost certainly vary across regions. …“As a result, our lower estimate for growth in household income has a disproportionate lowering effect on housing demand in Ontario,” CMHC said.

Taking current trends into account, Canada Mortgage and Housing Corporation has markedly lowered its estimate for how many new homes will be built across the country by 2030. “Last year, we projected that, by 2030, there would be 18.6 million housing units in Canada,” CMHC said in its latest report. “Now, we project 18.2 million units (compared to our estimate of 16.5 million existing units in 2022).” A major driver of this decline is the ongoing shortfall in housing construction. “Materials have gotten more expensive, labour is in short supply, and it’s hard to get financing for construction,” CMHC said. …CMHC stressed that the pace of new construction will almost certainly vary across regions. …“As a result, our lower estimate for growth in household income has a disproportionate lowering effect on housing demand in Ontario,” CMHC said.

The BMO economics department is virtually alone in arguing against the thesis that Canada’s housing affordability crisis is primarily caused by a shortage of new homes. A well-respected columnist opines in today’s Globe that ‘the supply of housing has slowed to a trickle’ —a trickle, I say. …First, note that said “trickle” saw the most Canadian housing starts in a two-year period on record in 2021/22, and there are a record 340,000 units now under construction. Second, the starts-to-population comparison commits the fatal and basic flaw of comparing a stock (population level) to a flow (housing starts). …The one recent occasion U.S. starts approached current Canadian levels (in 2005) a home price crash ensued. Should we be aiming higher on homebuilding? Absolutely, especially when population growth is booming at 3 per cent year-over-year. But please don’t use the level of population to ‘prove it.’” [to access the full story a Globe and Mail subscription is required]

The BMO economics department is virtually alone in arguing against the thesis that Canada’s housing affordability crisis is primarily caused by a shortage of new homes. A well-respected columnist opines in today’s Globe that ‘the supply of housing has slowed to a trickle’ —a trickle, I say. …First, note that said “trickle” saw the most Canadian housing starts in a two-year period on record in 2021/22, and there are a record 340,000 units now under construction. Second, the starts-to-population comparison commits the fatal and basic flaw of comparing a stock (population level) to a flow (housing starts). …The one recent occasion U.S. starts approached current Canadian levels (in 2005) a home price crash ensued. Should we be aiming higher on homebuilding? Absolutely, especially when population growth is booming at 3 per cent year-over-year. But please don’t use the level of population to ‘prove it.’” [to access the full story a Globe and Mail subscription is required] In the second quarter of 2023, Canada’s forestry and logging sector had a capacity utilization rate of 73.2%, below the industry average of 81.4%, according to Statistics Canada. This represents a notable decline of 2.7 percentage points from the previous quarter’s rate of 75.9%. …The wood products sector also faced challenges, with capacity utilization at 75.7% in the second quarter of 2023. This reflects a slight decline of 0.7 percentage points from the previous quarter, when the rate was 76.4%. The year-over-year comparison shows a larger decline of 6.0 percentage points compared to the second quarter of 2022, when the rate was 81.7%. Lumber production in Canada decreased 6.6% from May to 3 744.2 thousand m3 in June 2023. Production was down 16.8% from June 2022. …The Canadian paper sector’s capacity utilization rate in the second quarter of 2023 was 81.9%, slightly below the industry average and down 0.9 percentage points from 82.8% in the previous quarter.

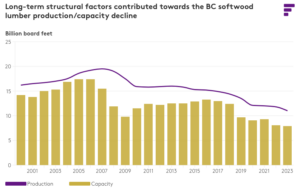

In the second quarter of 2023, Canada’s forestry and logging sector had a capacity utilization rate of 73.2%, below the industry average of 81.4%, according to Statistics Canada. This represents a notable decline of 2.7 percentage points from the previous quarter’s rate of 75.9%. …The wood products sector also faced challenges, with capacity utilization at 75.7% in the second quarter of 2023. This reflects a slight decline of 0.7 percentage points from the previous quarter, when the rate was 76.4%. The year-over-year comparison shows a larger decline of 6.0 percentage points compared to the second quarter of 2022, when the rate was 81.7%. Lumber production in Canada decreased 6.6% from May to 3 744.2 thousand m3 in June 2023. Production was down 16.8% from June 2022. …The Canadian paper sector’s capacity utilization rate in the second quarter of 2023 was 81.9%, slightly below the industry average and down 0.9 percentage points from 82.8% in the previous quarter.  While 2020 and 2021 were phenomenally profitable years for the industry, since the spring of 2022 prices have collapsed below critical break-even levels for North America’s high-cost supplying regions for dimensional lumber: the BC Interior and US West Coast. …Softwood sawmill capacity in BC and the US West Coast totaled 11.8 billion board feet (bbf) and 10.7 bbf in 2022, respectively, or about 31% of the industry capacity base. …To date, 1.7 bbf of indefinite or permanent closures have been announced. This equates to about 2-3% of the North American softwood sawmill capacity base, marking a notable cut to industry supply. …Almost all the announced capacity is in the Northwest and British Columbia, the latter accounting for the lion’s share of the announcements. BC’s total contribution to the capacity losses in this round of cuts, starting in the third quarter of 2022, is about 1.5 bbf, though 200-300 mmbf of these cuts are indefinite rather than permanent closures.

While 2020 and 2021 were phenomenally profitable years for the industry, since the spring of 2022 prices have collapsed below critical break-even levels for North America’s high-cost supplying regions for dimensional lumber: the BC Interior and US West Coast. …Softwood sawmill capacity in BC and the US West Coast totaled 11.8 billion board feet (bbf) and 10.7 bbf in 2022, respectively, or about 31% of the industry capacity base. …To date, 1.7 bbf of indefinite or permanent closures have been announced. This equates to about 2-3% of the North American softwood sawmill capacity base, marking a notable cut to industry supply. …Almost all the announced capacity is in the Northwest and British Columbia, the latter accounting for the lion’s share of the announcements. BC’s total contribution to the capacity losses in this round of cuts, starting in the third quarter of 2022, is about 1.5 bbf, though 200-300 mmbf of these cuts are indefinite rather than permanent closures.

In the past week, China lowered several key interest rates as data showed signs of deflation in the world’s second-largest economy. China’s economy was expected to recover this year, and its slower return to growth is having a direct impact on a number of commodities. …Unemployment claims in the U.S. actually fell last week, pointing to a continuing tight labour market. The unemployment rate is at 5.5% in Canada and 3.5% in the U.S., with hourly wages up 5% and 4.4% respectively (y-o-y) – all contributing factors to the demand for commodities. …Lumber prices have been rising in the past week after having fallen below US$500 per thousand board foot earlier this month. Publicly traded homebuilders in the United States saw their share prices drop over the past week given the macro view of higher housing prices coupled with the highest mortgage rates in 15 years. [to access the full story a Globe and Mail subscription is required]

In the past week, China lowered several key interest rates as data showed signs of deflation in the world’s second-largest economy. China’s economy was expected to recover this year, and its slower return to growth is having a direct impact on a number of commodities. …Unemployment claims in the U.S. actually fell last week, pointing to a continuing tight labour market. The unemployment rate is at 5.5% in Canada and 3.5% in the U.S., with hourly wages up 5% and 4.4% respectively (y-o-y) – all contributing factors to the demand for commodities. …Lumber prices have been rising in the past week after having fallen below US$500 per thousand board foot earlier this month. Publicly traded homebuilders in the United States saw their share prices drop over the past week given the macro view of higher housing prices coupled with the highest mortgage rates in 15 years. [to access the full story a Globe and Mail subscription is required]:format(webp)/cloudfront-us-east-1.images.arcpublishing.com/tgam/F74M3JVLRRPRVIBM6NIGZXVEAU.JPG)

In a July 19 Barchart article, I highlighted that… Lumber is signaling that “the Fed has nearly reached its rate hike limit, and mortgage rates could be peaking at the 7% level.” While inflation data continues to show a decline in the economic condition, it remains more than double the Fed’s 2% target rate. Lumber retreated as rates moved higher, but the price stabilized. After reaching a $597 per 1,000 board feet high on July 10, 2023, physical lumber prices dropped as the Fed remained vigilant in its commitment to fight high inflation. The July 25 basis point increase in the Fed Funds Rate, recession fears, and the highest mortgage rates in years sent lumber prices lower. …An over 7% mortgage rate is not bullish for lumber prices. …Markets reflect economics and politics, and lumber is a sentiment barometer, given its penchant for extreme price volatility.

In a July 19 Barchart article, I highlighted that… Lumber is signaling that “the Fed has nearly reached its rate hike limit, and mortgage rates could be peaking at the 7% level.” While inflation data continues to show a decline in the economic condition, it remains more than double the Fed’s 2% target rate. Lumber retreated as rates moved higher, but the price stabilized. After reaching a $597 per 1,000 board feet high on July 10, 2023, physical lumber prices dropped as the Fed remained vigilant in its commitment to fight high inflation. The July 25 basis point increase in the Fed Funds Rate, recession fears, and the highest mortgage rates in years sent lumber prices lower. …An over 7% mortgage rate is not bullish for lumber prices. …Markets reflect economics and politics, and lumber is a sentiment barometer, given its penchant for extreme price volatility.

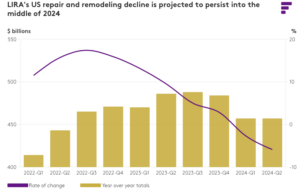

Annual expenditures for repairs and remodeling in owner-occupied homes are expected to decline in the first half of 2024, according to the Leading Indicator of Remodeling Activity for the second quarter (LIRA). Annual increases on a percentage basis reached their peak in the third quarter of 2022, with spending rising 17.4% above the third quarter of 2021. Since then, quarterly gains on an annual basis in repair and remodeling expenditures have declined each quarter. In the first quarter of next year, dwindling gains are projected to transition to year-over-year declines. The LIRA projects year-over-year spending on homeowner repair and remodeling to gain 5.0% in the third quarter of this year and 2.8% in the fourth quarter before declining 2.7% in the first quarter of 2024 and 5.9% in the second quarter.

Annual expenditures for repairs and remodeling in owner-occupied homes are expected to decline in the first half of 2024, according to the Leading Indicator of Remodeling Activity for the second quarter (LIRA). Annual increases on a percentage basis reached their peak in the third quarter of 2022, with spending rising 17.4% above the third quarter of 2021. Since then, quarterly gains on an annual basis in repair and remodeling expenditures have declined each quarter. In the first quarter of next year, dwindling gains are projected to transition to year-over-year declines. The LIRA projects year-over-year spending on homeowner repair and remodeling to gain 5.0% in the third quarter of this year and 2.8% in the fourth quarter before declining 2.7% in the first quarter of 2024 and 5.9% in the second quarter.

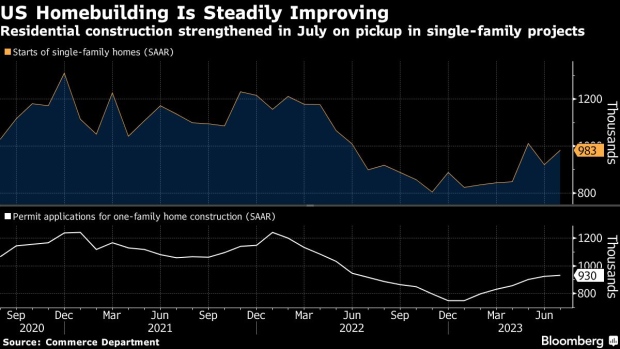

Rising mortgage rates and elevated construction costs have taken a toll on the pace of single-family construction in markets across the nation, with the slowdown most pronounced in large metro areas. Multifamily market growth also fell in most areas of the country, according to the latest findings from the NAHB Home Building Geography Index (HBGI) for the second quarter of 2023. Across the single-family market, the 4-quarter moving average of the year-over-year growth rates remained negative for all markets in the second quarter of 2023. Between the second quarter of 2022 and the second quarter of 2023, the growth rates across all markets fell double digits, with the largest change in growth rate occurring in Large Metro – Outlying Areas.

Rising mortgage rates and elevated construction costs have taken a toll on the pace of single-family construction in markets across the nation, with the slowdown most pronounced in large metro areas. Multifamily market growth also fell in most areas of the country, according to the latest findings from the NAHB Home Building Geography Index (HBGI) for the second quarter of 2023. Across the single-family market, the 4-quarter moving average of the year-over-year growth rates remained negative for all markets in the second quarter of 2023. Between the second quarter of 2022 and the second quarter of 2023, the growth rates across all markets fell double digits, with the largest change in growth rate occurring in Large Metro – Outlying Areas.

As US pulp markets limped through the weak demand season of summer, buyers pressured down regular contract prices across key grades but spot market erosion slowed. Pricing for the benchmark northern bleached softwood kraft (NBSK) dropped $50-80/tonne as buyers pared back the wide differential between deals done on and off-contract. Meanwhile, the world’s biggest producer of hardwood announced a $20-50/tonne price increase, effective Sep 1. US NBSK preliminary effective list prices declined with the $50-80/tonne decrease as some buyers pivoted from spot purchases to fill up volumes with regular contract tonnage. US SBSK preliminary effective list prices were down $60-80, according to P&PW surveying. After a spring and summer in which producers lost volume to competitors offering cheaper spot market deals in both NBSK and SBSK, buyers are only refilling contract volumes where suppliers concede to bigger month-over-month decreases than in spot markets.

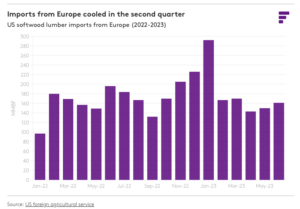

As US pulp markets limped through the weak demand season of summer, buyers pressured down regular contract prices across key grades but spot market erosion slowed. Pricing for the benchmark northern bleached softwood kraft (NBSK) dropped $50-80/tonne as buyers pared back the wide differential between deals done on and off-contract. Meanwhile, the world’s biggest producer of hardwood announced a $20-50/tonne price increase, effective Sep 1. US NBSK preliminary effective list prices declined with the $50-80/tonne decrease as some buyers pivoted from spot purchases to fill up volumes with regular contract tonnage. US SBSK preliminary effective list prices were down $60-80, according to P&PW surveying. After a spring and summer in which producers lost volume to competitors offering cheaper spot market deals in both NBSK and SBSK, buyers are only refilling contract volumes where suppliers concede to bigger month-over-month decreases than in spot markets. After a scorching start to the year, US softwood lumber imports from Europe cooled abruptly in the second quarter. That trend contributed to an overall fade in US demand for foreign lumber through the first half. Imports from the 10 largest European suppliers fell to 428 million board feet (mmbf) in the second quarter, down 30% from the record-setting first-quarter volume of 610 mmbf and lagging the year-ago total by 12%. European shipments to the US declined to the lowest quarterly total since the last three months of 2021. …Many traders anticipated European exports to the US to continue a downward trend through at least the third quarter and to fall short of last year’s record levels. Declining production in Europe has contributed to the fade in exports to the US. …North American exports to offshore destinations, meanwhile, continued to flounder amid weak demand in most key markets.

After a scorching start to the year, US softwood lumber imports from Europe cooled abruptly in the second quarter. That trend contributed to an overall fade in US demand for foreign lumber through the first half. Imports from the 10 largest European suppliers fell to 428 million board feet (mmbf) in the second quarter, down 30% from the record-setting first-quarter volume of 610 mmbf and lagging the year-ago total by 12%. European shipments to the US declined to the lowest quarterly total since the last three months of 2021. …Many traders anticipated European exports to the US to continue a downward trend through at least the third quarter and to fall short of last year’s record levels. Declining production in Europe has contributed to the fade in exports to the US. …North American exports to offshore destinations, meanwhile, continued to flounder amid weak demand in most key markets.

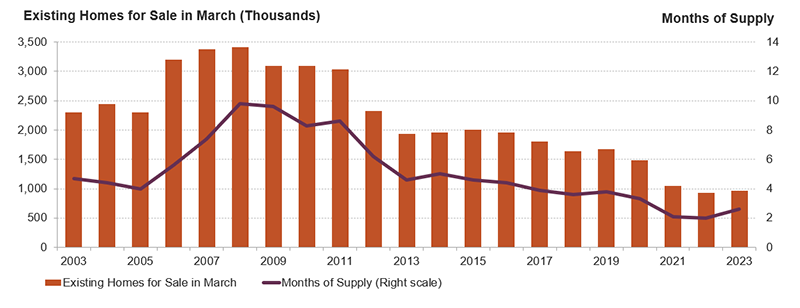

After steadily rising for seven consecutive months, builder confidence retreated in August as rising mortgage rates nearing 7% and stubbornly high shelter inflation have further eroded housing affordability and put a damper on consumer demand. Builder confidence in the market for newly built single-family homes in August fell six points to 50, according to the NAHB/Wells Fargo Housing Market Index (HMI). But while this latest confidence reading is a reminder that housing affordability is an ongoing challenge, demand for new construction continues to be supported by a lack of resale inventory. …All three major HMI indices posted declines in August. The HMI index gauging current sales conditions fell five points to 57, the component charting sales expectations in the next six months declined four points to 55, and the gauge measuring traffic of prospective buyers dropped six points to 34.

After steadily rising for seven consecutive months, builder confidence retreated in August as rising mortgage rates nearing 7% and stubbornly high shelter inflation have further eroded housing affordability and put a damper on consumer demand. Builder confidence in the market for newly built single-family homes in August fell six points to 50, according to the NAHB/Wells Fargo Housing Market Index (HMI). But while this latest confidence reading is a reminder that housing affordability is an ongoing challenge, demand for new construction continues to be supported by a lack of resale inventory. …All three major HMI indices posted declines in August. The HMI index gauging current sales conditions fell five points to 57, the component charting sales expectations in the next six months declined four points to 55, and the gauge measuring traffic of prospective buyers dropped six points to 34.

Beth Pratt, lives high in the Sierra Foothills in Midpines, California. …When Pratt bought her 1house in 1999, she didn’t particularly worry about wildfires—a problem that now plagues her area with disturbing frequency. …Allstate, Pratt’s longtime home insurer, dropped her as a customer in July, she says. …Earlier this year, Allstate and California’s largest insurer, State Farm, announced that they would hold off on writing new policies for homes in the state. …In the past, insurers have generally been able to diversify their own portfolios to balance different risks; historically, insurers that do business across the country could afford a bad year in one or two states. But the math becomes more challenging as disasters proliferate. The cost of reinsurance—essentially, coverage that insurers take out to protect themselves against big losses—has shot upward, in large part because of growing climate risks. [to access the full story, an Atlantic subscription is required]

Beth Pratt, lives high in the Sierra Foothills in Midpines, California. …When Pratt bought her 1house in 1999, she didn’t particularly worry about wildfires—a problem that now plagues her area with disturbing frequency. …Allstate, Pratt’s longtime home insurer, dropped her as a customer in July, she says. …Earlier this year, Allstate and California’s largest insurer, State Farm, announced that they would hold off on writing new policies for homes in the state. …In the past, insurers have generally been able to diversify their own portfolios to balance different risks; historically, insurers that do business across the country could afford a bad year in one or two states. But the math becomes more challenging as disasters proliferate. The cost of reinsurance—essentially, coverage that insurers take out to protect themselves against big losses—has shot upward, in large part because of growing climate risks. [to access the full story, an Atlantic subscription is required].jpg)

UNITED KINGDOM — Housebuilding in the UK last month fell at the second-fastest pace since the first Covid-19 lockdown, reflecting the impact of high interest rates on demand, according to a closely watched survey. The S&P Global/Cips UK Construction Purchasing Managers’ house building sub-index, a measure of activity in the sector, fell to 40.7 in August, down from 43 in July and the second-lowest level since May 2020. A reading below 50 indicates a majority of companies reporting a contraction. Outside the pandemic period, this was the lowest reading since spring 2009, and the sharp drop was the main driver in pushing the overall construction PMI down to 50.8 in August from 51.7 the previous month. The sector also registered a decline in new order volumes for the second time in the past three months, the steepest drop since May 2020.

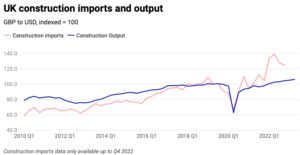

UNITED KINGDOM — Housebuilding in the UK last month fell at the second-fastest pace since the first Covid-19 lockdown, reflecting the impact of high interest rates on demand, according to a closely watched survey. The S&P Global/Cips UK Construction Purchasing Managers’ house building sub-index, a measure of activity in the sector, fell to 40.7 in August, down from 43 in July and the second-lowest level since May 2020. A reading below 50 indicates a majority of companies reporting a contraction. Outside the pandemic period, this was the lowest reading since spring 2009, and the sharp drop was the main driver in pushing the overall construction PMI down to 50.8 in August from 51.7 the previous month. The sector also registered a decline in new order volumes for the second time in the past three months, the steepest drop since May 2020. UK — Brexit, Covid-19 and the conflict in Ukraine have disrupted supply chains and led to a resurgence in global inflation rates not seen in more than 40 years. … In the UK, we rely on imports for many raw materials, and our overall consumption outstrips our production capability. Government data backs this up, showing that the UK construction sector is increasing, not reducing, its spending on imported goods. Following a dip during the pandemic, the total value of the UK’s construction imports rose significantly in 2021 and 2022 by 26.7% and 14.1%, respectively, according to the Department for Business and Trade. …What we are seeing is greater ‘nearshoring’: the practice of outsourcing manufacturing to nearby regions which are closer to national borders. …This continued reliance on EU markets is especially apparent for construction, where materials accounted for 56% of total EU trade in 2022.

UK — Brexit, Covid-19 and the conflict in Ukraine have disrupted supply chains and led to a resurgence in global inflation rates not seen in more than 40 years. … In the UK, we rely on imports for many raw materials, and our overall consumption outstrips our production capability. Government data backs this up, showing that the UK construction sector is increasing, not reducing, its spending on imported goods. Following a dip during the pandemic, the total value of the UK’s construction imports rose significantly in 2021 and 2022 by 26.7% and 14.1%, respectively, according to the Department for Business and Trade. …What we are seeing is greater ‘nearshoring’: the practice of outsourcing manufacturing to nearby regions which are closer to national borders. …This continued reliance on EU markets is especially apparent for construction, where materials accounted for 56% of total EU trade in 2022. BRAMPTON, Ontario — The latest research results from the Paper and Paperboard Packaging Environmental Council (PPEC) show the success of the paper packaging circular economy and continue to confirm that the feedstock used for the production of boxboard and containerboard in Canada is made of primarily recycled content fibres. The latest report represents the results of the 17th biennial Recycled Content survey, which is conducted to determine the average recycled content contained in the major paper packaging grades made by Canadian mills. The 2022 results show that the average recycled content of domestic shipments for the top two major packaging grades was 80.2%. The average recycled content for domestic shipments of boxboard was 86.2%, while the average recycled content for domestic shipments of containerboard was 81%.

BRAMPTON, Ontario — The latest research results from the Paper and Paperboard Packaging Environmental Council (PPEC) show the success of the paper packaging circular economy and continue to confirm that the feedstock used for the production of boxboard and containerboard in Canada is made of primarily recycled content fibres. The latest report represents the results of the 17th biennial Recycled Content survey, which is conducted to determine the average recycled content contained in the major paper packaging grades made by Canadian mills. The 2022 results show that the average recycled content of domestic shipments for the top two major packaging grades was 80.2%. The average recycled content for domestic shipments of boxboard was 86.2%, while the average recycled content for domestic shipments of containerboard was 81%.