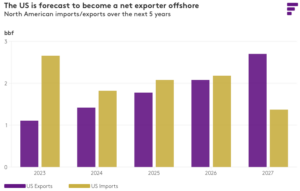

The US will become a net exporter of softwood lumber in overseas trade and overtake Canada as North America’s leading offshore supplier within the next five years as production capacity increases, according to Fastmarkets’ latest forecast. Projections from Fastmarkets’ North American Lumber Forecast Five-Year Outlook released in late June show US exports to overseas destinations increasing steadily, from 1.11 billion board feet (bbf) this year to 2.7 bbf by 2027 (chart). Canadian exports to destinations other than the US are projected to fluctuate more moderately in both directions between 2023 and 2027. The forecast calls for Canadian exports to hover in a 1.78 to 1.82 bbf range from 2024 through 2026 before rising to 1.86 bbf in 2027. North American imports from offshore suppliers, meanwhile, are forecast to peak at 2.66 bbf this year, up from a historically high 2.58 bbf in 2022. But in 2027, imports are forecast to plunge to 1.37 bbf.

The US will become a net exporter of softwood lumber in overseas trade and overtake Canada as North America’s leading offshore supplier within the next five years as production capacity increases, according to Fastmarkets’ latest forecast. Projections from Fastmarkets’ North American Lumber Forecast Five-Year Outlook released in late June show US exports to overseas destinations increasing steadily, from 1.11 billion board feet (bbf) this year to 2.7 bbf by 2027 (chart). Canadian exports to destinations other than the US are projected to fluctuate more moderately in both directions between 2023 and 2027. The forecast calls for Canadian exports to hover in a 1.78 to 1.82 bbf range from 2024 through 2026 before rising to 1.86 bbf in 2027. North American imports from offshore suppliers, meanwhile, are forecast to peak at 2.66 bbf this year, up from a historically high 2.58 bbf in 2022. But in 2027, imports are forecast to plunge to 1.37 bbf.

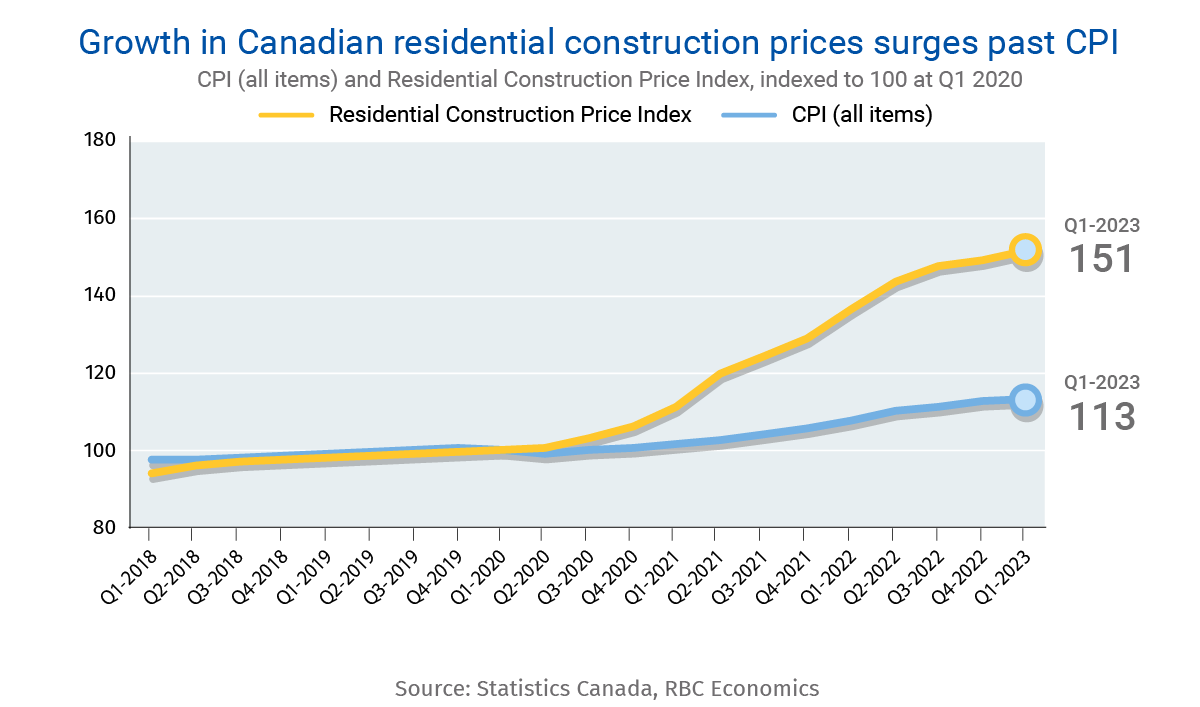

The expected rise in Canada’s population is likely to make the country’s limited housing supply worse – and ultimately lead to even higher home prices, a

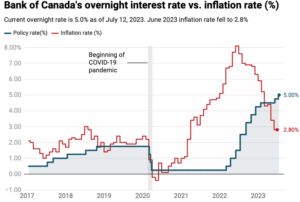

The expected rise in Canada’s population is likely to make the country’s limited housing supply worse – and ultimately lead to even higher home prices, a  OTTAWA – Statistics Canada says Canada’s inflation rate tumbled to 2.8 per cent in June, putting it within the Bank of Canada’s target range for the first time in more than two years. Statistics Canada’s consumer price index report Tuesday says the deceleration was broad-based, though lower gasoline prices compared with last year led the slowdown. But Canadians continue to pay substantially higher prices for groceries, as prices rose 9.1 per cent year-over-year, slightly faster than in May. The annual inflation rate was 3.4 per cent in May. The last time it fell below three per cent was March 2021. …The federal agency says exclude mortgage interest costs, the annual inflation rate would have been two per cent. Tuesday’s report shows prices for a range of goods and services are moderating, serving as good news for consumers.

OTTAWA – Statistics Canada says Canada’s inflation rate tumbled to 2.8 per cent in June, putting it within the Bank of Canada’s target range for the first time in more than two years. Statistics Canada’s consumer price index report Tuesday says the deceleration was broad-based, though lower gasoline prices compared with last year led the slowdown. But Canadians continue to pay substantially higher prices for groceries, as prices rose 9.1 per cent year-over-year, slightly faster than in May. The annual inflation rate was 3.4 per cent in May. The last time it fell below three per cent was March 2021. …The federal agency says exclude mortgage interest costs, the annual inflation rate would have been two per cent. Tuesday’s report shows prices for a range of goods and services are moderating, serving as good news for consumers.

The prime rate at Canada’s six largest banks rose in lockstep after the Bank of Canada’s latest rate hike on Wednesday, further tightening access to credit and the cost of borrowing for Canadians. RBC, TD Bank, BMO, Scotiabank, CIBC and National Bank all raised their prime lending rate to 7.2 per cent as of Thursday. That’s up 25 basis points, following a rate hike of the same magnitude from the Bank of Canada, which raised its target for the overnight rate to a 22-year-high of 5.0 per cent on Wednesday. …Bank of Canada governor Tiff Macklem said Wednesday that the central bank’s policymakers will be taking each upcoming decision on a meeting-by-meeting basis amid concerns the decline in inflation “could stall” on the way back down to its target of two per cent.

The prime rate at Canada’s six largest banks rose in lockstep after the Bank of Canada’s latest rate hike on Wednesday, further tightening access to credit and the cost of borrowing for Canadians. RBC, TD Bank, BMO, Scotiabank, CIBC and National Bank all raised their prime lending rate to 7.2 per cent as of Thursday. That’s up 25 basis points, following a rate hike of the same magnitude from the Bank of Canada, which raised its target for the overnight rate to a 22-year-high of 5.0 per cent on Wednesday. …Bank of Canada governor Tiff Macklem said Wednesday that the central bank’s policymakers will be taking each upcoming decision on a meeting-by-meeting basis amid concerns the decline in inflation “could stall” on the way back down to its target of two per cent. The extreme volatility of lumber markets in 2021 and 2022 appear to be in the rearview mirror, with more stable, normal prices going forward this year, predicts Keta Kosman of Madison Lumber reporter. Prices for Western spruce-pine-fir (SPF) are up this week to US$446 per thousand board feet. …Over the past year, a number of B.C. sawmills have taken either temporary curtailments or been shuttered for good, due in no small part to high operating costs and a dwindling supply of affordable timber. …Rising interest rates aimed at tempering inflation have indeed cooled housing prices. But new housing starts are moving up – an indication of fundamental demand for new homes. …Although other external factors like wildfires or labour disputes – like the current ongoing strike at B.C. ports – will have an impact on lumber markets, generally speaking it looks like some normalcy has returned for lumber demand and prices.

The extreme volatility of lumber markets in 2021 and 2022 appear to be in the rearview mirror, with more stable, normal prices going forward this year, predicts Keta Kosman of Madison Lumber reporter. Prices for Western spruce-pine-fir (SPF) are up this week to US$446 per thousand board feet. …Over the past year, a number of B.C. sawmills have taken either temporary curtailments or been shuttered for good, due in no small part to high operating costs and a dwindling supply of affordable timber. …Rising interest rates aimed at tempering inflation have indeed cooled housing prices. But new housing starts are moving up – an indication of fundamental demand for new homes. …Although other external factors like wildfires or labour disputes – like the current ongoing strike at B.C. ports – will have an impact on lumber markets, generally speaking it looks like some normalcy has returned for lumber demand and prices.

VANCOUVER, B.C. – West Fraser Timber reported the second quarter results of 2023. Highlights include sales of $1.608 billion and earnings of $(131) million, Adjusted EBITDA of $80 million, representing 5% of sales, Adjusted EBITDA of $10 million North America engineered wood products segment, Adjusted EBITDA of $126 million pulp & paper segment. …“Early in the quarter we continued to experience challenging demand markets, particularly in the Pulp & Paper segment… Combined with declining pulp prices …the Pulp & Paper segment experienced higher losses than expected. Notwithstanding these challenges, we did see signs of demand improvement for some of our key wood building products as the quarter unfolded. Our North America EWP segment saw particular improvement this quarter, with recovering demand in our OSB business. …The product and geographic diversification of our European Engineered Wood Panels segment provided another positive contribution,” said Ray Ferris, CEO.

VANCOUVER, B.C. – West Fraser Timber reported the second quarter results of 2023. Highlights include sales of $1.608 billion and earnings of $(131) million, Adjusted EBITDA of $80 million, representing 5% of sales, Adjusted EBITDA of $10 million North America engineered wood products segment, Adjusted EBITDA of $126 million pulp & paper segment. …“Early in the quarter we continued to experience challenging demand markets, particularly in the Pulp & Paper segment… Combined with declining pulp prices …the Pulp & Paper segment experienced higher losses than expected. Notwithstanding these challenges, we did see signs of demand improvement for some of our key wood building products as the quarter unfolded. Our North America EWP segment saw particular improvement this quarter, with recovering demand in our OSB business. …The product and geographic diversification of our European Engineered Wood Panels segment provided another positive contribution,” said Ray Ferris, CEO.

After a year’s worth of warnings about a recession, Federal Reserve chair Jerome Powell said Wednesday that the central bank’s staff no longer forecasts a nationwide economic downturn. It’s welcome news for the economy to achieve a soft landing, a scenario in which inflation falls, unemployment remains relatively low and a recession is avoided. Housing activity, however, will be limited as the impact of tighter policy continues to reverberate through the economy, housing experts and economists projected following the Fed’s decision to raise interest rates by 25 basis points on Wednesday. Mortgage rates are expected to remain elevated… disincentivizing homeowners to move and finance their new home with higher rates. “Higher mortgage rates change the trade-up calculation for existing homeowners and are keeping as many as 1 in 7 out of the market because they don’t want to give up their existing low rate,” Danielle Hale, chief economist at Realtor.com noted.

After a year’s worth of warnings about a recession, Federal Reserve chair Jerome Powell said Wednesday that the central bank’s staff no longer forecasts a nationwide economic downturn. It’s welcome news for the economy to achieve a soft landing, a scenario in which inflation falls, unemployment remains relatively low and a recession is avoided. Housing activity, however, will be limited as the impact of tighter policy continues to reverberate through the economy, housing experts and economists projected following the Fed’s decision to raise interest rates by 25 basis points on Wednesday. Mortgage rates are expected to remain elevated… disincentivizing homeowners to move and finance their new home with higher rates. “Higher mortgage rates change the trade-up calculation for existing homeowners and are keeping as many as 1 in 7 out of the market because they don’t want to give up their existing low rate,” Danielle Hale, chief economist at Realtor.com noted.

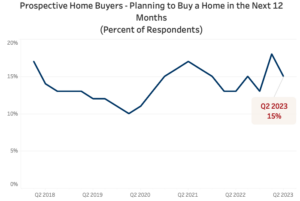

Mortgage rates’ slow –but steady– march upwards combined with the return of home price gains are doing what they are predicted to: slow housing demand. According to the latest Housing Trends Report, the share of adults with plans to purchase a home within a year dropped to 15% in the second quarter of 2023, down from a record high of 18% in the first quarter. First-time buyers are disproportionately affected by elevated mortgage rates and home prices because they generally lack equity savings from a previous home sale to help with a down payment. In the second quarter of 2023, the share of all prospective buyers who are in the market for the first time dropped to 61%, down significantly from 71% in the first quarter.

Mortgage rates’ slow –but steady– march upwards combined with the return of home price gains are doing what they are predicted to: slow housing demand. According to the latest Housing Trends Report, the share of adults with plans to purchase a home within a year dropped to 15% in the second quarter of 2023, down from a record high of 18% in the first quarter. First-time buyers are disproportionately affected by elevated mortgage rates and home prices because they generally lack equity savings from a previous home sale to help with a down payment. In the second quarter of 2023, the share of all prospective buyers who are in the market for the first time dropped to 61%, down significantly from 71% in the first quarter.

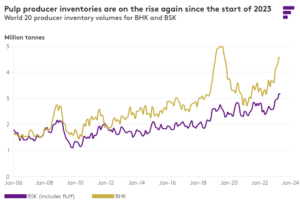

A clearer picture of the pulp market has emerged from the uncertainty that gripped the market a year ago. We are now largely free from the burdens of logistics constraints and pandemic policies, but the volatility in pulp prices witnessed over the past two years remains front of mind. For many in the global pulp industry, skepticism of an extended downturn in the pulp market is still present.

A clearer picture of the pulp market has emerged from the uncertainty that gripped the market a year ago. We are now largely free from the burdens of logistics constraints and pandemic policies, but the volatility in pulp prices witnessed over the past two years remains front of mind. For many in the global pulp industry, skepticism of an extended downturn in the pulp market is still present. WASHINGTON — U.S. single-family homebuilding fell in June after surging in the prior month, but permits for future construction increased solidly as a severe shortage of previously owned houses for sale supports new construction. Single-family housing starts dropped 7.0% to a seasonally adjusted annual rate of 935,000 units last month, the Commerce Department said. Data for May was revised up to show starts vaulting to a rate of 1.005 million units, instead of 997,000 units. May’s pace was the highest in 11 months. The housing market has likely reached a bottom after being pushed into recession by the Federal Reserve’s aggressive monetary policy tightening. …Residential investment has contracted for eight straight quarters, the longest such streak since the collapse of the housing bubble triggered the 2007-2009 Great Recession. Permits for future construction of single-family homes increased 2.2% in June to a rate of 922,000 units.

WASHINGTON — U.S. single-family homebuilding fell in June after surging in the prior month, but permits for future construction increased solidly as a severe shortage of previously owned houses for sale supports new construction. Single-family housing starts dropped 7.0% to a seasonally adjusted annual rate of 935,000 units last month, the Commerce Department said. Data for May was revised up to show starts vaulting to a rate of 1.005 million units, instead of 997,000 units. May’s pace was the highest in 11 months. The housing market has likely reached a bottom after being pushed into recession by the Federal Reserve’s aggressive monetary policy tightening. …Residential investment has contracted for eight straight quarters, the longest such streak since the collapse of the housing bubble triggered the 2007-2009 Great Recession. Permits for future construction of single-family homes increased 2.2% in June to a rate of 922,000 units.

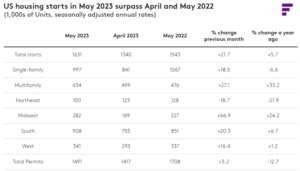

A surge in US housing starts last month caught traders and analysts by surprise and injected a fresh burst of optimism into wood products markets. Total starts in May climbed 21.7% on a monthly basis to a seasonally adjusted annual rate (SAAR) of 1.631 million units. The jump was the largest by percentage since 2016, and the largest month-over-month increase on a per-unit basis since 1990. Gains were spread across sectors, with single-family starts climbing 18.5% to 997,000 units, and multifamily starts jumping 27.1% to 634,000 units. While single-family construction remained below the year-ago level, multifamily starts were 33.2% higher than May 2022. “Part of what is supporting the new side of the market, despite unfavorable mortgage rates, is still the real lack of existing inventory,” said Jennifer Coskren, Fastmarkets senior economist.

A surge in US housing starts last month caught traders and analysts by surprise and injected a fresh burst of optimism into wood products markets. Total starts in May climbed 21.7% on a monthly basis to a seasonally adjusted annual rate (SAAR) of 1.631 million units. The jump was the largest by percentage since 2016, and the largest month-over-month increase on a per-unit basis since 1990. Gains were spread across sectors, with single-family starts climbing 18.5% to 997,000 units, and multifamily starts jumping 27.1% to 634,000 units. While single-family construction remained below the year-ago level, multifamily starts were 33.2% higher than May 2022. “Part of what is supporting the new side of the market, despite unfavorable mortgage rates, is still the real lack of existing inventory,” said Jennifer Coskren, Fastmarkets senior economist.

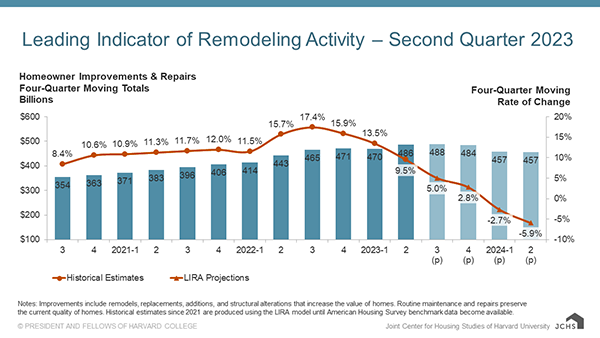

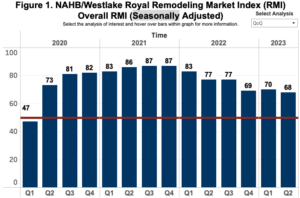

The NAHB/Westlake Royal Remodeling Market Index (RMI) for the second quarter of 2023 posted a reading of 68, edging down 2 points from the first quarter of 2023. Even though the Fed has maintained a hawkish position when it comes to interest rates… the demand for remodeling is holding up despite higher borrowing costs and prices. The remodeling market is experiencing multiple tailwinds which is supporting this demand, including low inventory especially for existing homes, aging housing stock, increased prevalence for employees to work-from-home (WFH), and high levels of equity for existing homeowners. Even after the slight decrease, the RMI remains in positive territory and consistent with NAHB’s forecast that the remodeling sector will grow in 2023, albeit at a slower pace than in 2022.

The NAHB/Westlake Royal Remodeling Market Index (RMI) for the second quarter of 2023 posted a reading of 68, edging down 2 points from the first quarter of 2023. Even though the Fed has maintained a hawkish position when it comes to interest rates… the demand for remodeling is holding up despite higher borrowing costs and prices. The remodeling market is experiencing multiple tailwinds which is supporting this demand, including low inventory especially for existing homes, aging housing stock, increased prevalence for employees to work-from-home (WFH), and high levels of equity for existing homeowners. Even after the slight decrease, the RMI remains in positive territory and consistent with NAHB’s forecast that the remodeling sector will grow in 2023, albeit at a slower pace than in 2022. At the end of the traditional spring buying season, the housing market has shown “distinct signs” of reheating, according to the latest Mortgage Monitor Report from Black Knight. …Home prices increased 0.7% on a sequential basis in May, equating to an annualized growth rate of 8.9%. According to Black Knight, 27 of the 50 largest U.S. metros have returned to their prior home peaks or set new highs during the spring. …For-sale inventory improved modestly during May but is still 51% lower than pre-pandemic levels, continuing to put upward pressure on home prices. Inventory levels have decreased in 95% of major markets. …New construction remains a bright spot in regard to inventory, however, with starts continuing to outpace expectations and reaching their highest level in more than a year. …“As it stands, housing affordability remains dangerously close to its 37-year lows.

At the end of the traditional spring buying season, the housing market has shown “distinct signs” of reheating, according to the latest Mortgage Monitor Report from Black Knight. …Home prices increased 0.7% on a sequential basis in May, equating to an annualized growth rate of 8.9%. According to Black Knight, 27 of the 50 largest U.S. metros have returned to their prior home peaks or set new highs during the spring. …For-sale inventory improved modestly during May but is still 51% lower than pre-pandemic levels, continuing to put upward pressure on home prices. Inventory levels have decreased in 95% of major markets. …New construction remains a bright spot in regard to inventory, however, with starts continuing to outpace expectations and reaching their highest level in more than a year. …“As it stands, housing affordability remains dangerously close to its 37-year lows.

The U.S. exported 820,057.5 metric tons of wood pellets in May, up from both 720,209.2 metric tons exported in April and 740,605 metric tons exported in May 2022, according to data released by the USDA Foreign Agricultural Service on July 6. The U.S. exported wood pellets to approximately 16 countries in May. The U.K. was the top destination for U.S. wood pellet exports at 482,213 metric tons, followed by the Netherlands at 131,015.1 metric tons and Japan at 105,806.9 metric tons. The value of U.S. wood pellet exports reached $153.12 million in May, up from both $129.17 million the previous month and $131.78 million in May 2022. Total U.S. wood pellet exports for the first five months of 2023 reached 3.72 million metric tons at a value of $684.37 million, compared to 3.52 million metric tons exported during the same period of last year at a value of $595.78 million. [END]

The U.S. exported 820,057.5 metric tons of wood pellets in May, up from both 720,209.2 metric tons exported in April and 740,605 metric tons exported in May 2022, according to data released by the USDA Foreign Agricultural Service on July 6. The U.S. exported wood pellets to approximately 16 countries in May. The U.K. was the top destination for U.S. wood pellet exports at 482,213 metric tons, followed by the Netherlands at 131,015.1 metric tons and Japan at 105,806.9 metric tons. The value of U.S. wood pellet exports reached $153.12 million in May, up from both $129.17 million the previous month and $131.78 million in May 2022. Total U.S. wood pellet exports for the first five months of 2023 reached 3.72 million metric tons at a value of $684.37 million, compared to 3.52 million metric tons exported during the same period of last year at a value of $595.78 million. [END]

North Carolina has a housing and sawmill problem. The number of local sawmills in North Carolina has been declining, while the population of North Carolina, and the subsequent demand for housing, continues to rise exponentially. North Carolina’s Department of Housing has found that the state will be short a little under a million houses by 2030. Last Tuesday the North Carolina Senate Agriculture Committee passed the Support Local Sawmills Act onto the Rules and Operations Committee. …The act would clear two major barriers that impede the utilization of local lumber. First, it expands the ability of landowners and small sawmill owners to sell their unstamped (also referred to as ungraded) lumber to others for residential construction purposes, promoting a vibrant marketplace for local wood products.Second, the bill eliminates the discretion given to building inspectors, ensuring a standardized process for approving the use of local lumber.

North Carolina has a housing and sawmill problem. The number of local sawmills in North Carolina has been declining, while the population of North Carolina, and the subsequent demand for housing, continues to rise exponentially. North Carolina’s Department of Housing has found that the state will be short a little under a million houses by 2030. Last Tuesday the North Carolina Senate Agriculture Committee passed the Support Local Sawmills Act onto the Rules and Operations Committee. …The act would clear two major barriers that impede the utilization of local lumber. First, it expands the ability of landowners and small sawmill owners to sell their unstamped (also referred to as ungraded) lumber to others for residential construction purposes, promoting a vibrant marketplace for local wood products.Second, the bill eliminates the discretion given to building inspectors, ensuring a standardized process for approving the use of local lumber./cloudfront-ap-southeast-2.images.arcpublishing.com/nzme/I4RK7HL3NHMGY6CM7G6RHOXEHM.jpg)