Russ Taylor

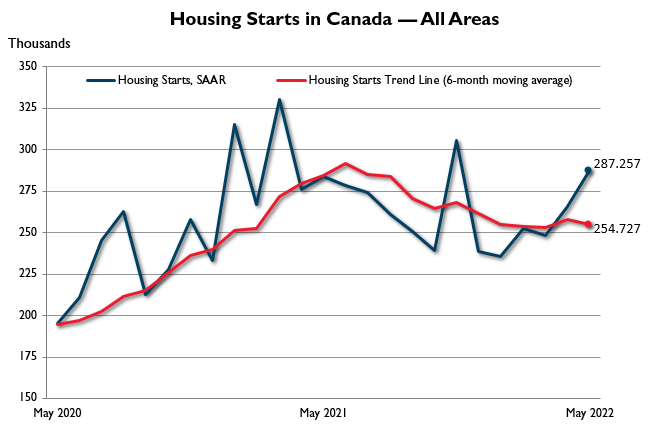

Rising interest rates and building costs have helped contribute to a sluggish pace of home construction in Canada so far in 2023 – and that’s spilled over into a subdued first half of the year for lumber markets, according to industry consultant Russ Taylor. …Low prices and weak demand have seen a reduction in mill operating rates, with BC – typically a high-cost producer – bearing the brunt of the downturn. That’s despite a recent rally partly caused by wildfires. …BC’s year-to-date production is down substantially this year, around 10% lower than prior year in the interior, Taylor said. Coastal production is set to fall by around 5%. The US, by contrast, is faring decidedly better. …One segment that’s accounting for a sizeable share of demand is the DIY space, described by Taylor as a “robust” business at present because many consumers are taking advantage of low prices to carry out smaller projects.

The ongoing paper and packaging slowdown reached into a third consecutive quarter and contributed to falling wood fiber prices across much of North America in Q2 2023. High inflation cooled consumer demand for goods, and paper mills are drawing down finished goods inventories to match current demand levels. The market still fears a recession could be in the future, so caution is dictating most operations. Through early 2023, paper mill closures across North America trimmed production capacity in response to the slowdown. According to the Wood Fiber Review, fiber prices in most regions trended down, unlike the wide range of regional differences just months ago. …Historically high wood fiber prices in the Northwest and Northeast U.S. dipped over 10% for the quarter. In the U.S., only the Lake States reported higher softwood fiber prices, as western Canadian prices inched higher as well. Hardwood prices increased in both the Lake States and the U.S. Northwest.

The ongoing paper and packaging slowdown reached into a third consecutive quarter and contributed to falling wood fiber prices across much of North America in Q2 2023. High inflation cooled consumer demand for goods, and paper mills are drawing down finished goods inventories to match current demand levels. The market still fears a recession could be in the future, so caution is dictating most operations. Through early 2023, paper mill closures across North America trimmed production capacity in response to the slowdown. According to the Wood Fiber Review, fiber prices in most regions trended down, unlike the wide range of regional differences just months ago. …Historically high wood fiber prices in the Northwest and Northeast U.S. dipped over 10% for the quarter. In the U.S., only the Lake States reported higher softwood fiber prices, as western Canadian prices inched higher as well. Hardwood prices increased in both the Lake States and the U.S. Northwest. My lumber demand outlook for 2023 calls for a 4-6 per cent reduction in North American consumption compared to 2022. The one wildcard that I am most worried about, that seems to be brushed off now, is the pending credit crunch at US banks. …With soft demand, supply will see reductions in most regions of the US and Canada, except for the low-cost US South. BC production is expected to be lower in 2023, up to 10 per cent in the Interior and around 5 per cent from the Coast, where other regions should see smaller reductions. Offshore US imports are already trending lower as US prices are now too low to attract any sustained volumes. …Export markets are also flat with Japan, China and Europe all seeing flat to lower demand as there are surplus supply volumes that are currently depressing wood products prices around the world.

My lumber demand outlook for 2023 calls for a 4-6 per cent reduction in North American consumption compared to 2022. The one wildcard that I am most worried about, that seems to be brushed off now, is the pending credit crunch at US banks. …With soft demand, supply will see reductions in most regions of the US and Canada, except for the low-cost US South. BC production is expected to be lower in 2023, up to 10 per cent in the Interior and around 5 per cent from the Coast, where other regions should see smaller reductions. Offshore US imports are already trending lower as US prices are now too low to attract any sustained volumes. …Export markets are also flat with Japan, China and Europe all seeing flat to lower demand as there are surplus supply volumes that are currently depressing wood products prices around the world. Lumber prices have jumped in the past month, as wildfires in Canada raise concerns about supply disruptions while healthy U.S. housing starts boost the demand side. Cash prices have climbed 22% since June 1. They settled last week at US$420 for 1,000 board feet of two-by-fours made from Western spruce, pine and fir, compared with US$343 on June 1, according to Random Lengths. …Key factors that dampened supplies last month included the impact of wildfires in Canada, the lingering effects of previous decisions by producers to reduce B.C. output, and slowing European wood shipments into the U.S. On the demand side, stronger-than-expected data released in mid-June on U.S. housing starts helped bolster the market. …On the Chicago Mercantile Exchange, prices for lumber futures for November delivery rose US$5 to close on Friday at US$555 for 1,000 board feet. That’s up 7% since June 1. [to access the full story a Globe & Mail subscription is required]

Lumber prices have jumped in the past month, as wildfires in Canada raise concerns about supply disruptions while healthy U.S. housing starts boost the demand side. Cash prices have climbed 22% since June 1. They settled last week at US$420 for 1,000 board feet of two-by-fours made from Western spruce, pine and fir, compared with US$343 on June 1, according to Random Lengths. …Key factors that dampened supplies last month included the impact of wildfires in Canada, the lingering effects of previous decisions by producers to reduce B.C. output, and slowing European wood shipments into the U.S. On the demand side, stronger-than-expected data released in mid-June on U.S. housing starts helped bolster the market. …On the Chicago Mercantile Exchange, prices for lumber futures for November delivery rose US$5 to close on Friday at US$555 for 1,000 board feet. That’s up 7% since June 1. [to access the full story a Globe & Mail subscription is required] Surging construction costs in Canada are putting new pressure on home prices, worsening a severe affordability crunch, according to the nation’s largest lender. A gauge of residential construction prices has risen 51% since the first quarter of 2020, outpacing the 13% gain for the consumer price index, Royal Bank of Canada economists said in a report published Wednesday. “The cost of building a home in Canada has never been higher,” the economists said in the report, citing “dramatic jumps” in concrete and structural steel prices since the start of the pandemic along with soaring lumber prices in 2021 and early 2022. …The elevated costs have contributed to a decline in new home construction in the past two quarters. …Wage growth in construction was 9.4% last year, more than double the pace of other industries, they said. …Extreme weather has also hurt availability of critical building materials, driving up prices.

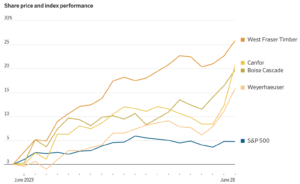

Surging construction costs in Canada are putting new pressure on home prices, worsening a severe affordability crunch, according to the nation’s largest lender. A gauge of residential construction prices has risen 51% since the first quarter of 2020, outpacing the 13% gain for the consumer price index, Royal Bank of Canada economists said in a report published Wednesday. “The cost of building a home in Canada has never been higher,” the economists said in the report, citing “dramatic jumps” in concrete and structural steel prices since the start of the pandemic along with soaring lumber prices in 2021 and early 2022. …The elevated costs have contributed to a decline in new home construction in the past two quarters. …Wage growth in construction was 9.4% last year, more than double the pace of other industries, they said. …Extreme weather has also hurt availability of critical building materials, driving up prices.  Their stocks aren’t as hot as homebuilders’, but Weyerhaeuser, West Fraser Timber, Boise Cascade and others that own sawmills and make wood panels have been big winners this month thanks to the recovery in residential construction. The Census Bureau said earlier this month that housing starts rose in May to a seasonally adjusted annual average of 1.6 million, 22% higher than in April and the most since the Fed began raising interest rates to squelch inflation. That’s a lot more wood than Wall Street thought builders would need. Millions of Americans are locked into mortgage rates below 4% and face much higher borrowing costs if they move. Few existing homes for sale means new construction is the main option for many house hunters. …Raymond James added Weyerhaeuser to its list of top buys. Truist analysts upgraded Boise Cascade and Louisiana-Pacific to buy. [to access the full story a WSJ subscription is required]

Their stocks aren’t as hot as homebuilders’, but Weyerhaeuser, West Fraser Timber, Boise Cascade and others that own sawmills and make wood panels have been big winners this month thanks to the recovery in residential construction. The Census Bureau said earlier this month that housing starts rose in May to a seasonally adjusted annual average of 1.6 million, 22% higher than in April and the most since the Fed began raising interest rates to squelch inflation. That’s a lot more wood than Wall Street thought builders would need. Millions of Americans are locked into mortgage rates below 4% and face much higher borrowing costs if they move. Few existing homes for sale means new construction is the main option for many house hunters. …Raymond James added Weyerhaeuser to its list of top buys. Truist analysts upgraded Boise Cascade and Louisiana-Pacific to buy. [to access the full story a WSJ subscription is required] A surprise surge in US housing starts in May helped push lumber prices higher on Tuesday as demand for the essential building commodity enters its busiest time of the year. US housing starts soared 21.7% to 1.63 million units last month, which was well ahead of economist estimates. The surprise surge represented the biggest unit increase since January 1990 and the largest percentage gain since October 2016. The surge comes as home builders rush to meet the growing demand of millennial first-time home buyers. Lumber prices jumped as much as 3% to $540 per thousand board feet on Tuesday. …”Limited existing inventory combined with solid demand and improving supply chains helped push single-family starts to an 11-month high in May,” the National Association of Home Builders said. The data was somewhat surprising given that mortgage rates are still well above 6%. Still, building permits also increased in May.

A surprise surge in US housing starts in May helped push lumber prices higher on Tuesday as demand for the essential building commodity enters its busiest time of the year. US housing starts soared 21.7% to 1.63 million units last month, which was well ahead of economist estimates. The surprise surge represented the biggest unit increase since January 1990 and the largest percentage gain since October 2016. The surge comes as home builders rush to meet the growing demand of millennial first-time home buyers. Lumber prices jumped as much as 3% to $540 per thousand board feet on Tuesday. …”Limited existing inventory combined with solid demand and improving supply chains helped push single-family starts to an 11-month high in May,” the National Association of Home Builders said. The data was somewhat surprising given that mortgage rates are still well above 6%. Still, building permits also increased in May.

As amber waves of charred air settled over stretches of eastern North America, with respect to the vast damage that has settled in, it could be understood how many in CRE might have a secondary concern. Would the industry find significant blows to construction supply chains beyond what the pandemic saw? Probably not, according to multiple experts. However, that’s not the same as no impact. On June 9, lumber prices were $510 per thousand boardfeet, up 6.6% from a recent low of $478.50 on May 31. “Currently the Canadian fires have created a short-term uptick in pricing when purchasing lumber products which as of recent has been a flat and slow market,” Mickey’s VP said. He added, “It doesn’t appear that the fires will have a lasting effect on the lumber supply and production in the long term.” …Domain Timber Advisors said, “While we may see a small ripple effect, we don’t believe it will be extremely consequential.

As amber waves of charred air settled over stretches of eastern North America, with respect to the vast damage that has settled in, it could be understood how many in CRE might have a secondary concern. Would the industry find significant blows to construction supply chains beyond what the pandemic saw? Probably not, according to multiple experts. However, that’s not the same as no impact. On June 9, lumber prices were $510 per thousand boardfeet, up 6.6% from a recent low of $478.50 on May 31. “Currently the Canadian fires have created a short-term uptick in pricing when purchasing lumber products which as of recent has been a flat and slow market,” Mickey’s VP said. He added, “It doesn’t appear that the fires will have a lasting effect on the lumber supply and production in the long term.” …Domain Timber Advisors said, “While we may see a small ripple effect, we don’t believe it will be extremely consequential.

VANCOUVER, BC – West Fraser Timber has declared a quarterly dividend of US$0.30 per share [or $1.2 annualized] on the Common shares and Class B Common shares in the capital of the Company, payable on July 7, 2023 to shareholders of record on June 21, 2023. Dividends are designated to be eligible dividends pursuant to subsection 89(14) of the Income Tax Act (Canada) and any applicable provincial legislation pertaining to eligible dividends. Dividends are declared and payable in U.S. dollars. [The annual yield on the dividend is 1.6 percent].

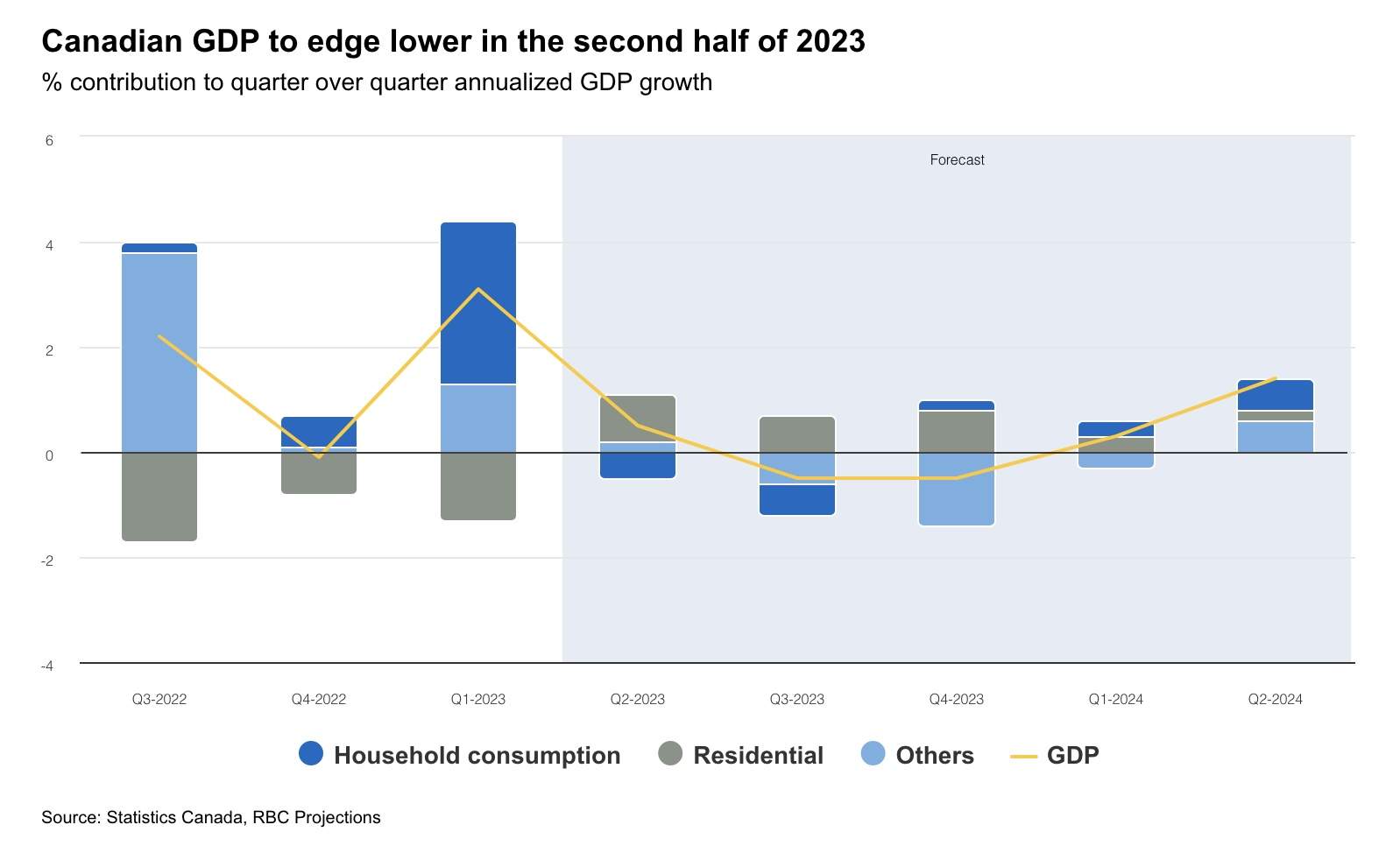

VANCOUVER, BC – West Fraser Timber has declared a quarterly dividend of US$0.30 per share [or $1.2 annualized] on the Common shares and Class B Common shares in the capital of the Company, payable on July 7, 2023 to shareholders of record on June 21, 2023. Dividends are designated to be eligible dividends pursuant to subsection 89(14) of the Income Tax Act (Canada) and any applicable provincial legislation pertaining to eligible dividends. Dividends are declared and payable in U.S. dollars. [The annual yield on the dividend is 1.6 percent]. The economy has proven more resilient than expected in 2023. In both the U.S. and Canada, GDP continued to grow in Q1 as consumer spending held despite higher interest rates and prices. Low unemployment rates have persisted, and inflation is still running above central bank target rates. Concerns about the U.S. regional banking sector have calmed down and the next fight over the U.S. debt limit has been kicked down the road to after the 2024 elections. …Overheating labour market conditions and a large stockpile of household pandemic savings in Canada might delay the full impact of tighter monetary policy. But the surge in interest rates over the last year will continue to take a toll. …We continue to think the most likely base case outlook includes at least ‘mild’ recessions in Canada and the United States—although we now expect declines in GDP to start a quarter later (Q3 and Q4 2023) than previously expected.

The economy has proven more resilient than expected in 2023. In both the U.S. and Canada, GDP continued to grow in Q1 as consumer spending held despite higher interest rates and prices. Low unemployment rates have persisted, and inflation is still running above central bank target rates. Concerns about the U.S. regional banking sector have calmed down and the next fight over the U.S. debt limit has been kicked down the road to after the 2024 elections. …Overheating labour market conditions and a large stockpile of household pandemic savings in Canada might delay the full impact of tighter monetary policy. But the surge in interest rates over the last year will continue to take a toll. …We continue to think the most likely base case outlook includes at least ‘mild’ recessions in Canada and the United States—although we now expect declines in GDP to start a quarter later (Q3 and Q4 2023) than previously expected. Allan Bennett, Director of the Timber Pricing Branch at the BC Ministry of Forests, issued a memorandum regarding BC stumpage lags. Starting June 1, 2023, Stumpage updates will occur monthly rather than quarterly. This will have the following implications: Stumpage lags will be reduced to an average of 3.5 months rather than 6 months; rates will rise and fall quicker as market conditions fluctuate which aligns better with the current volatility in lumber prices; stumpage responsiveness should ensure production aligns with actual market conditions rather than those of 6 months prior; and the change will make planning easier for small licensees that do not harvest regularly.

Allan Bennett, Director of the Timber Pricing Branch at the BC Ministry of Forests, issued a memorandum regarding BC stumpage lags. Starting June 1, 2023, Stumpage updates will occur monthly rather than quarterly. This will have the following implications: Stumpage lags will be reduced to an average of 3.5 months rather than 6 months; rates will rise and fall quicker as market conditions fluctuate which aligns better with the current volatility in lumber prices; stumpage responsiveness should ensure production aligns with actual market conditions rather than those of 6 months prior; and the change will make planning easier for small licensees that do not harvest regularly.

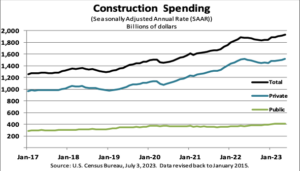

The U.S. Census Bureau announced construction statistics for May 2023: Construction spending during May 2023 was estimated at a seasonally adjusted annual rate of $1,925.6 billion, 0.9 percent above the revised April estimate of $1,909.0 billion. The May figure is 2.4% above the May 2022 estimate of $1,880.9 billion. During the first five months of this year, construction spending amounted to $740.8 billion, 2.9% above the $719.6 billion for the same period in 2022. …Spending on private construction was at a seasonally adjusted annual rate of $1,513.2 billion, 1.1% above the revised April estimate of $1,497.2 billion. Residential construction was at a seasonally adjusted annual rate of $857.4 billion in May, 2.2% above the revised April estimate of $839.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $655.8 billion in May, 0.3% below the revised April estimate of $657.8 billion.

The U.S. Census Bureau announced construction statistics for May 2023: Construction spending during May 2023 was estimated at a seasonally adjusted annual rate of $1,925.6 billion, 0.9 percent above the revised April estimate of $1,909.0 billion. The May figure is 2.4% above the May 2022 estimate of $1,880.9 billion. During the first five months of this year, construction spending amounted to $740.8 billion, 2.9% above the $719.6 billion for the same period in 2022. …Spending on private construction was at a seasonally adjusted annual rate of $1,513.2 billion, 1.1% above the revised April estimate of $1,497.2 billion. Residential construction was at a seasonally adjusted annual rate of $857.4 billion in May, 2.2% above the revised April estimate of $839.4 billion. Nonresidential construction was at a seasonally adjusted annual rate of $655.8 billion in May, 0.3% below the revised April estimate of $657.8 billion.

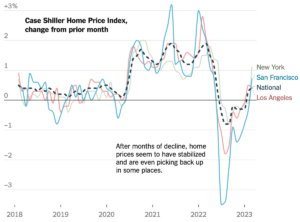

The Fed’s rate increases are aimed at slowing America’s economy — in part by restraining the housing market — to try to bring inflation under control. Those moves worked quickly at first to weaken interest-sensitive parts of the economy: Housing markets across the United States pulled back notably last year. But that cool-down seems to be cracking. …Housing seems to be finding a burst of renewed momentum. Climbing home prices will not prop up official inflation figures. But the revival is a sign of how difficult it is proving for the Fed to curb momentum in the economy at a time when the labor market remains strong and consumer balance sheets are generally healthier than before the pandemic. …The question is whether the economy can slow sufficiently when real estate is stabilizing or even heating back up, leaving homebuilders feeling more optimistic. So far, the Fed’s leader, at least, has sounded unworried. [to access the full story a NY Times subscription is required]

The Fed’s rate increases are aimed at slowing America’s economy — in part by restraining the housing market — to try to bring inflation under control. Those moves worked quickly at first to weaken interest-sensitive parts of the economy: Housing markets across the United States pulled back notably last year. But that cool-down seems to be cracking. …Housing seems to be finding a burst of renewed momentum. Climbing home prices will not prop up official inflation figures. But the revival is a sign of how difficult it is proving for the Fed to curb momentum in the economy at a time when the labor market remains strong and consumer balance sheets are generally healthier than before the pandemic. …The question is whether the economy can slow sufficiently when real estate is stabilizing or even heating back up, leaving homebuilders feeling more optimistic. So far, the Fed’s leader, at least, has sounded unworried. [to access the full story a NY Times subscription is required] High interest rates are usually bad news for home builders. But right now, they are actually making new homes easy to sell by compounding a shortage of available real estate. The supply of previously owned, or existing, homes for sale has dwindled. …Housing has been the No. 1 contributor to still-high inflation in the U.S. …Even at higher rates there are still people who want to buy a home. …It is part of why new home sales have been pushing higher, while sentiment among builders has begun to recover. None of which is to say that home builders are entirely in clover. But they are doing better than many investors expected. It is beginning to look as if the residential investment component of gross domestic product might have swung into positive territory this quarter from the previous quarter for the first time since the first quarter of 2021. [to access the full story a WSJ subscription is required]

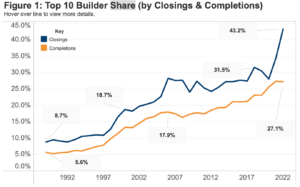

High interest rates are usually bad news for home builders. But right now, they are actually making new homes easy to sell by compounding a shortage of available real estate. The supply of previously owned, or existing, homes for sale has dwindled. …Housing has been the No. 1 contributor to still-high inflation in the U.S. …Even at higher rates there are still people who want to buy a home. …It is part of why new home sales have been pushing higher, while sentiment among builders has begun to recover. None of which is to say that home builders are entirely in clover. But they are doing better than many investors expected. It is beginning to look as if the residential investment component of gross domestic product might have swung into positive territory this quarter from the previous quarter for the first time since the first quarter of 2021. [to access the full story a WSJ subscription is required] The Top 10 builders captured 43.2% of new single-family home closings (i.e., sales) in 2022, the highest percentage on record based on data released by

The Top 10 builders captured 43.2% of new single-family home closings (i.e., sales) in 2022, the highest percentage on record based on data released by

U.S. box demand has been consistently worse than the largest box makers expected over the past three quarters — with recent declines among the steepest since the Great Financial Crisis — and recent signs point to more of the same weakness. The largest U.S. boxboard/folding carton producer, Graphic Packaging, presented at a conference Tuesday at which its CFO Steve Scherger said the company is experiencing destocking among retailers following “awkwardly high” demand a year ago. …Box demand hit record highs during the pandemic… However, as Americans’ real average weekly income has consistently fallen for the past two years, they are now having to take on record levels of credit card debt. Consequently, goods demand has dried up. The rate of box shipment declines accelerated throughout Q1, with March down an eye-opening 11%. The three largest producers reported Q1 declines ranging from 8-13%.

U.S. box demand has been consistently worse than the largest box makers expected over the past three quarters — with recent declines among the steepest since the Great Financial Crisis — and recent signs point to more of the same weakness. The largest U.S. boxboard/folding carton producer, Graphic Packaging, presented at a conference Tuesday at which its CFO Steve Scherger said the company is experiencing destocking among retailers following “awkwardly high” demand a year ago. …Box demand hit record highs during the pandemic… However, as Americans’ real average weekly income has consistently fallen for the past two years, they are now having to take on record levels of credit card debt. Consequently, goods demand has dried up. The rate of box shipment declines accelerated throughout Q1, with March down an eye-opening 11%. The three largest producers reported Q1 declines ranging from 8-13%.

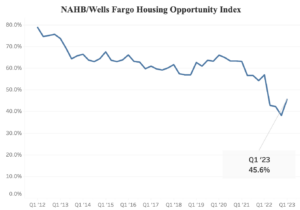

Solid nominal wage gains (unadjusted for inflation) combined with lower mortgage rates and home prices helped to boost housing affordability in the first quarter of 2023, but ongoing building material supply chain issues and expected cooling of wage growth signal ongoing concerns for affordability conditions in the year ahead. 45.6% of new and existing homes sold between the beginning of January and end of March were affordable to families earning the U.S. median income of $96,300. Although higher than in the final quarter of 2022 (38.1%), the latest HOI is still significantly lower than it was a year earlier (56.9%). The HOI shows that the national median home price fell to $365,000 in the first quarter, down from $370,000 in the final quarter of last year. Meanwhile, average mortgage rates were 6.46% in the first quarter, down from a series high of 6.80% in the fourth quarter.

Solid nominal wage gains (unadjusted for inflation) combined with lower mortgage rates and home prices helped to boost housing affordability in the first quarter of 2023, but ongoing building material supply chain issues and expected cooling of wage growth signal ongoing concerns for affordability conditions in the year ahead. 45.6% of new and existing homes sold between the beginning of January and end of March were affordable to families earning the U.S. median income of $96,300. Although higher than in the final quarter of 2022 (38.1%), the latest HOI is still significantly lower than it was a year earlier (56.9%). The HOI shows that the national median home price fell to $365,000 in the first quarter, down from $370,000 in the final quarter of last year. Meanwhile, average mortgage rates were 6.46% in the first quarter, down from a series high of 6.80% in the fourth quarter.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/YPGSKN7BUVPGPGB6QSAZMHPYIM.jpg)

EUROPE — The two largest log-trading regions in Europe are Central Europe (where Austria, Czech Republic, and Germany are the major importers) and Northern Europe (Finland and Sweden are the two log-importing countries). The most significant change in trade flow in Europe over the past few years has been the dramatic decline in log imports to the Nordic countries from Russia. According to Wood Resources International, the total log import volume to Finland and Sweden was just over 8 million m3 last year compared to an average of almost 16 million m3 annually throughout the previous decade. Most of the reduction has been in softwood logs. …The tighter supply of pulplogs and strong pulp markets has pushed log prices upward over the past year. …Rising prices for logs put pressure on local sawmills. They are signaling a more subdued demand and further demands for price reductions.

EUROPE — The two largest log-trading regions in Europe are Central Europe (where Austria, Czech Republic, and Germany are the major importers) and Northern Europe (Finland and Sweden are the two log-importing countries). The most significant change in trade flow in Europe over the past few years has been the dramatic decline in log imports to the Nordic countries from Russia. According to Wood Resources International, the total log import volume to Finland and Sweden was just over 8 million m3 last year compared to an average of almost 16 million m3 annually throughout the previous decade. Most of the reduction has been in softwood logs. …The tighter supply of pulplogs and strong pulp markets has pushed log prices upward over the past year. …Rising prices for logs put pressure on local sawmills. They are signaling a more subdued demand and further demands for price reductions.