David Rosenberg brushed off inflation fears again by pointing to falling lumber and natural gas prices. The veteran economist has repeatedly dismissed inflation as a threat since late last year. He has argued that the upward pressure on consumer costs has now faded, saying it’s “in the rear-view mirror,” while forecasting the rate of price increases could cool down below 2% by the third quarter of 2023. …”Inflation?” he asked. “Maybe in wages in 25% of the economy. …Meanwhile, the likes of lumber and nat gas are quickly heading back to their cycle lows and both down more than -70% from the nearby peaks,” he added. …Rosenberg’s optimism on inflation balances out with his warnings that the US economy will slump into recession this year. The economist dashed hopes of a “no landing” scenario and has predicted a painful downturn that will take hold in the second quarter.

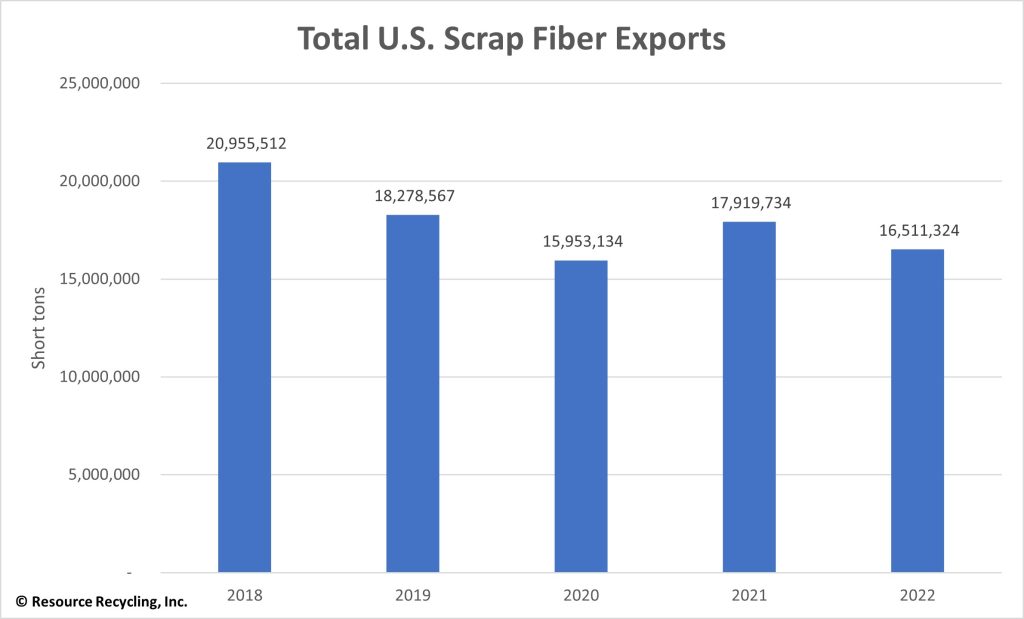

VANCOUVER, B.C. – Canfor Pulp Products reported its 2022 and fourth quarter of 2022 results. Highlights include: 2022 adjusted operating loss of $59 million; adjusted net loss of $43 million, Q4 2022 adjusted operating loss of $42 million; adjusted net loss of $34 million, Q4 pulp production faced with fibre shortages and challenging winter weather conditions. …Canfor Pulp’s CEO, Kevin Edgson, said, “This was a difficult quarter to end a challenging year for Canfor Pulp. Our pulp business faced many uncontrollable challenges this year, but especially in the fourth quarter, including material fibre supply disruptions as a result of sawmill curtailments. The decision to shut down the pulp line at Prince George Pulp and Paper mill was extremely difficult, but necessary, in order to right-size our operating platform and set the Company up for a sustainable long-term future.”

VANCOUVER, B.C. – Canfor Pulp Products reported its 2022 and fourth quarter of 2022 results. Highlights include: 2022 adjusted operating loss of $59 million; adjusted net loss of $43 million, Q4 2022 adjusted operating loss of $42 million; adjusted net loss of $34 million, Q4 pulp production faced with fibre shortages and challenging winter weather conditions. …Canfor Pulp’s CEO, Kevin Edgson, said, “This was a difficult quarter to end a challenging year for Canfor Pulp. Our pulp business faced many uncontrollable challenges this year, but especially in the fourth quarter, including material fibre supply disruptions as a result of sawmill curtailments. The decision to shut down the pulp line at Prince George Pulp and Paper mill was extremely difficult, but necessary, in order to right-size our operating platform and set the Company up for a sustainable long-term future.”

VANCOUVER, BC — Conifex Timber reported results for the fourth quarter and year ended December 31, 2022. EBITDA from continuing operations was $2.3 million for the quarter and $46.7 million for the year, compared to EBITDA of $1.0 million in the fourth quarter of 2021 and $51.8 million for the year. Net income was $24.5 million or $0.61 per share for the year versus net income in the preceding year of $0.60 per share. …While our power plant was not operational during the second half of 2022, we realized the benefit of expected business interruption insurance proceeds and a recovery of softwood lumber duties reflecting the difference between the cash deposit rates and the published final rates for lumber shipments to the United States in 2019 and 2020.

VANCOUVER, BC — Conifex Timber reported results for the fourth quarter and year ended December 31, 2022. EBITDA from continuing operations was $2.3 million for the quarter and $46.7 million for the year, compared to EBITDA of $1.0 million in the fourth quarter of 2021 and $51.8 million for the year. Net income was $24.5 million or $0.61 per share for the year versus net income in the preceding year of $0.60 per share. …While our power plant was not operational during the second half of 2022, we realized the benefit of expected business interruption insurance proceeds and a recovery of softwood lumber duties reflecting the difference between the cash deposit rates and the published final rates for lumber shipments to the United States in 2019 and 2020.

MONTREAL – Stella-Jones announced financial results for its Q4 and year ended December 31, 2022. Sales for the fourth quarter increased by 22% to $665 million, compared to sales of $545 million for the same period in 2021. The growth was driven by the sales of the Company’s infrastructure-related businesses, namely utility poles, railway ties and industrial products. …Gross profit was $112 million in the fourth quarter 2022, versus $65 million in Q4 2021. …Sales in 2022 were up 11% to $3,065 million, compared to $2,750 million in 2021. Excluding the impact of the Cahaba and TEC acquisitions of $66 million and the currency conversion of $73 million, pressure-treated wood sales rose $206 million or 8%. Gross profit was $524 million in 2022 compared to $456 million in 2021, representing a margin of 17.1% and 16.6%, respectively. …“Stella-Jones concluded 2022 on a very strong note, and I am proud of the robust performance we delivered,” said Eric Vachon, President and CEO.

MONTREAL – Stella-Jones announced financial results for its Q4 and year ended December 31, 2022. Sales for the fourth quarter increased by 22% to $665 million, compared to sales of $545 million for the same period in 2021. The growth was driven by the sales of the Company’s infrastructure-related businesses, namely utility poles, railway ties and industrial products. …Gross profit was $112 million in the fourth quarter 2022, versus $65 million in Q4 2021. …Sales in 2022 were up 11% to $3,065 million, compared to $2,750 million in 2021. Excluding the impact of the Cahaba and TEC acquisitions of $66 million and the currency conversion of $73 million, pressure-treated wood sales rose $206 million or 8%. Gross profit was $524 million in 2022 compared to $456 million in 2021, representing a margin of 17.1% and 16.6%, respectively. …“Stella-Jones concluded 2022 on a very strong note, and I am proud of the robust performance we delivered,” said Eric Vachon, President and CEO.

Swedish lumber prices are rising after the sharp fall in last autumn. Price growth was not due to increased demand, but to reduced supply, according to Danske Bank. …“There are many indications that the lumber market has now bottomed out, but we do not believe in a classic economic turnaround with a price rally for lumber. Construction is declining in large parts of the world with lower demand as a result,” said Johan Freij at Danske Bank Sweden. The reduced supply of lumber is due to… Damage from bark beetle in Canada and in Central Europe, but the biggest cause is likely Russia’s invasion of Ukraine. …But what really stands out is the U.S. market. Imports from Europe and Sweden have strengthened dramatically and in 2022 the U.S. has been established as Sweden’s most important lumber product market after the UK.

Swedish lumber prices are rising after the sharp fall in last autumn. Price growth was not due to increased demand, but to reduced supply, according to Danske Bank. …“There are many indications that the lumber market has now bottomed out, but we do not believe in a classic economic turnaround with a price rally for lumber. Construction is declining in large parts of the world with lower demand as a result,” said Johan Freij at Danske Bank Sweden. The reduced supply of lumber is due to… Damage from bark beetle in Canada and in Central Europe, but the biggest cause is likely Russia’s invasion of Ukraine. …But what really stands out is the U.S. market. Imports from Europe and Sweden have strengthened dramatically and in 2022 the U.S. has been established as Sweden’s most important lumber product market after the UK.

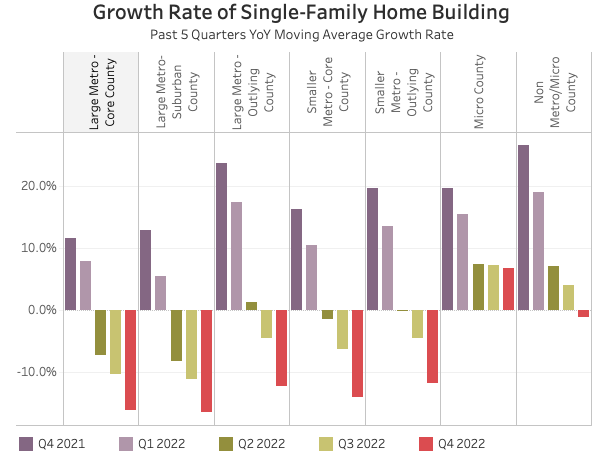

While nationwide single-family housing starts have slowed in the past year, the largest drop on a percentage basis is occurring in the densest counties, due to high housing costs. Meanwhile, multifamily growth was robust throughout much of the nation at the end of 2022, with the notable exception in high-density markets, according to the latest findings from the National Association of Home Builders for the fourth quarter of 2022. …The market share in the single-family market has consistently been changing since the pandemic. As many families move out of densely populated urban centers, there has been more single-family building in outlying areas of metros, small metros, and non-metro areas. The largest increase in market share since the fourth quarter of 2019 was in Micro Counties, where the share increased from 6.0% to 7.4% in the fourth quarter of 2022.

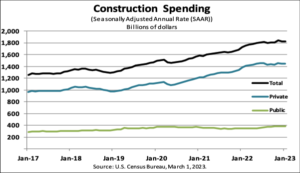

While nationwide single-family housing starts have slowed in the past year, the largest drop on a percentage basis is occurring in the densest counties, due to high housing costs. Meanwhile, multifamily growth was robust throughout much of the nation at the end of 2022, with the notable exception in high-density markets, according to the latest findings from the National Association of Home Builders for the fourth quarter of 2022. …The market share in the single-family market has consistently been changing since the pandemic. As many families move out of densely populated urban centers, there has been more single-family building in outlying areas of metros, small metros, and non-metro areas. The largest increase in market share since the fourth quarter of 2019 was in Micro Counties, where the share increased from 6.0% to 7.4% in the fourth quarter of 2022.  Construction spending during January 2023 was estimated at a seasonally adjusted annual rate of $1,825.7 billion, 0.1 percent (±0.7 percent)* below the revised December estimate of $1,827.5 billion. The January figure is 5.7 percent (±1.2 percent) above the January 2022 estimate of $1,726.6 billion. Spending on private construction was at a seasonally adjusted annual rate of $1,442.6 billion, virtually unchanged from (±0.5 percent) the revised December estimate of $1,442.0 billion. Residential construction was at a seasonally adjusted annual rate of $847.4 billion in January, 0.6 percent (±1.3 percent) below the revised December estimate of $852.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $595.2 billion in January, 0.9 percent (±0.5 percent) above the revised December estimate of $589.9 billion. …In January, the estimated seasonally adjusted annual rate of public construction spending was $383.1 billion, 0.6 percent (±1.2 percent) below the revised December estimate of $385.5 billion.

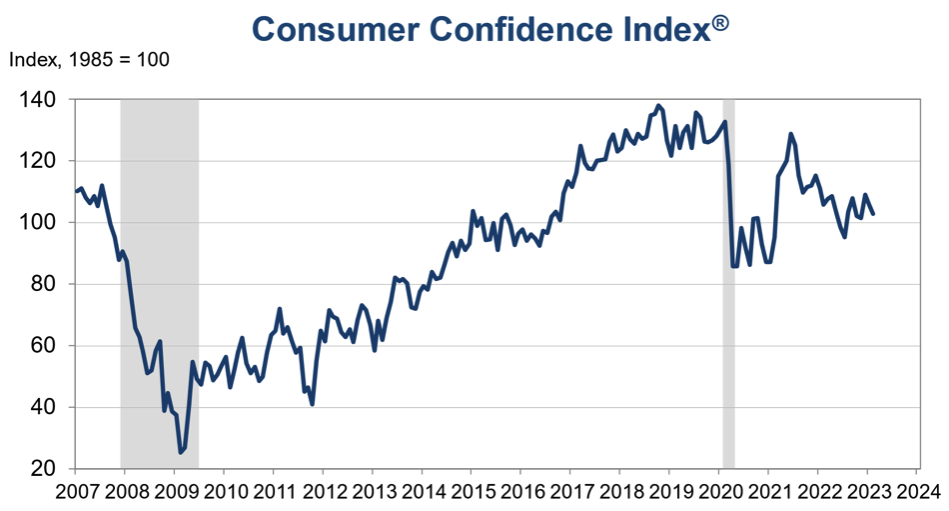

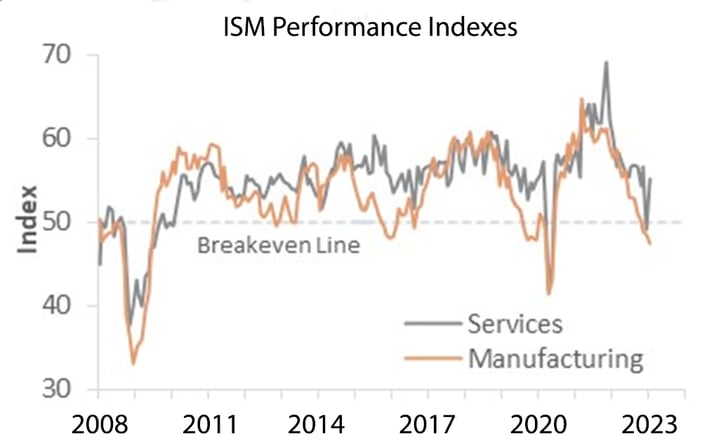

Construction spending during January 2023 was estimated at a seasonally adjusted annual rate of $1,825.7 billion, 0.1 percent (±0.7 percent)* below the revised December estimate of $1,827.5 billion. The January figure is 5.7 percent (±1.2 percent) above the January 2022 estimate of $1,726.6 billion. Spending on private construction was at a seasonally adjusted annual rate of $1,442.6 billion, virtually unchanged from (±0.5 percent) the revised December estimate of $1,442.0 billion. Residential construction was at a seasonally adjusted annual rate of $847.4 billion in January, 0.6 percent (±1.3 percent) below the revised December estimate of $852.1 billion. Nonresidential construction was at a seasonally adjusted annual rate of $595.2 billion in January, 0.9 percent (±0.5 percent) above the revised December estimate of $589.9 billion. …In January, the estimated seasonally adjusted annual rate of public construction spending was $383.1 billion, 0.6 percent (±1.2 percent) below the revised December estimate of $385.5 billion.  The Conference Board Consumer Confidence Index® decreased in February for the second consecutive month. The Index now stands at 102.9 (1985=100), down from 106.0 in January (a downward revision). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased to 152.8 (1985=100) from 151.1 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell further to 69.7 (1985=100) from a downwardly revised 76.0 in January. Notably, the Expectations Index has now fallen well below 80—the level which often signals a recession within the next year. It has been below this level for 11 of the last 12 months.

The Conference Board Consumer Confidence Index® decreased in February for the second consecutive month. The Index now stands at 102.9 (1985=100), down from 106.0 in January (a downward revision). The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—increased to 152.8 (1985=100) from 151.1 last month. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—fell further to 69.7 (1985=100) from a downwardly revised 76.0 in January. Notably, the Expectations Index has now fallen well below 80—the level which often signals a recession within the next year. It has been below this level for 11 of the last 12 months.

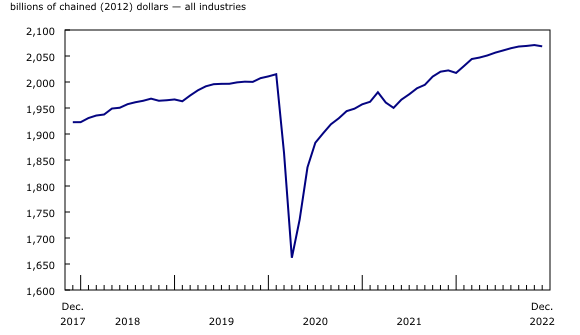

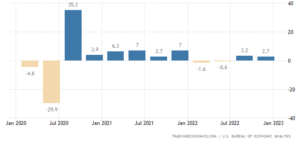

U.S. real gross domestic product (GDP) increased at an annual rate of 2.7% in the Q4 2022, according to the “second” estimate released by the Bureau of Economic Analysis. In the Q3, real GDP increased 3.2%. …In the advance estimate, the increase in real GDP was 2.9%. …The increase in real GDP… was partly offset by decreases in residential fixed investment and exports. Imports decreased. Current‑dollar GDP increased 6.7% at an annual rate, or $421.1 billion, in the Q4 to a level of $26.15 trillion, an upward revision of 0.2 percentage point, or $12.5 billion, from the previous estimate.

U.S. real gross domestic product (GDP) increased at an annual rate of 2.7% in the Q4 2022, according to the “second” estimate released by the Bureau of Economic Analysis. In the Q3, real GDP increased 3.2%. …In the advance estimate, the increase in real GDP was 2.9%. …The increase in real GDP… was partly offset by decreases in residential fixed investment and exports. Imports decreased. Current‑dollar GDP increased 6.7% at an annual rate, or $421.1 billion, in the Q4 to a level of $26.15 trillion, an upward revision of 0.2 percentage point, or $12.5 billion, from the previous estimate.

WILMINGTON, North Carolina – There’s good news for people who are starting to build a house or have plans for a summer project: lumber prices are down from the historic highs buyers saw during the pandemic. Among rising prices in other industries for consumers, relief is on the way for home builders and anyone planning projects that require lumber. The Wilmington-Cape Fear Home Builders Association has seen faster construction rates in the past few months, which can be attributed to increased lumber stock and more affordable prices. …Building material stores aren’t seeing a noticeable difference yet in the lower prices, but it won’t be long before it impacts them. …Lumber prices may be coming down, but other essential homebuilding materials, such as drywall, concrete and metal remain at higher prices.

WILMINGTON, North Carolina – There’s good news for people who are starting to build a house or have plans for a summer project: lumber prices are down from the historic highs buyers saw during the pandemic. Among rising prices in other industries for consumers, relief is on the way for home builders and anyone planning projects that require lumber. The Wilmington-Cape Fear Home Builders Association has seen faster construction rates in the past few months, which can be attributed to increased lumber stock and more affordable prices. …Building material stores aren’t seeing a noticeable difference yet in the lower prices, but it won’t be long before it impacts them. …Lumber prices may be coming down, but other essential homebuilding materials, such as drywall, concrete and metal remain at higher prices.

UK — Imports of the main timber and panel products in 2022 were 2.4 million m3 lower than over the same period in 2021, according to the latest TDUK statistics. The organisation also reported grounds for timber sector optimism in 2023 with improved economic forecasts for later this year. The quantity of all imports in 2022 totalled 9.3 million m3, a decline of 20% from last year. This was driven by reductions in softwood imports, with volumes 25% lower than the record totals seen in 2021. Despite the significant fall in volume and total value, the average cost price of softwood imports rose 7% as global demand remains strong. Only hardwood saw growth last year, with volumes up 7% on 2021. Hardwood imports totalled 576,000m3, at a value of £433 million establishing 2022 as the best year for hardwood imports by the UK this century.

UK — Imports of the main timber and panel products in 2022 were 2.4 million m3 lower than over the same period in 2021, according to the latest TDUK statistics. The organisation also reported grounds for timber sector optimism in 2023 with improved economic forecasts for later this year. The quantity of all imports in 2022 totalled 9.3 million m3, a decline of 20% from last year. This was driven by reductions in softwood imports, with volumes 25% lower than the record totals seen in 2021. Despite the significant fall in volume and total value, the average cost price of softwood imports rose 7% as global demand remains strong. Only hardwood saw growth last year, with volumes up 7% on 2021. Hardwood imports totalled 576,000m3, at a value of £433 million establishing 2022 as the best year for hardwood imports by the UK this century.

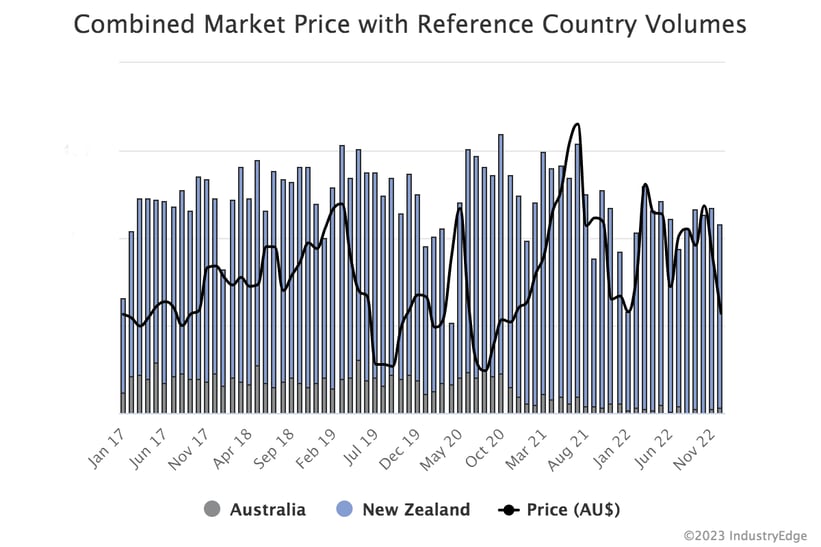

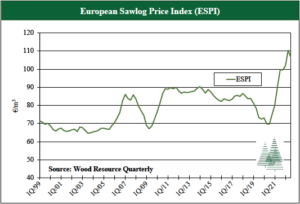

Wood raw-material costs for sawmills in North America and Europe eased in the 3Q/22 as demand and prices for lumber fell. A few countries faced slight log price increases in their local currencies, but with the strengthening US dollar, practically all markets worldwide had lower log costs in dollar terms compared to the 2Q/22. As a result, the Global Sawlog Price Index (GSPI) fell about five percent from its all-time high in the previous quarter. Since the index fell to a ten-year low in early 2020, it has climbed steadily and was up 40% over two years. …The European log market has undergone dramatic changes in supply and demand over the past five years, resulted in the most substantial price fluctuations the Wood Resource Quarterly has observed in almost 30 years of tracking wood markets.

Wood raw-material costs for sawmills in North America and Europe eased in the 3Q/22 as demand and prices for lumber fell. A few countries faced slight log price increases in their local currencies, but with the strengthening US dollar, practically all markets worldwide had lower log costs in dollar terms compared to the 2Q/22. As a result, the Global Sawlog Price Index (GSPI) fell about five percent from its all-time high in the previous quarter. Since the index fell to a ten-year low in early 2020, it has climbed steadily and was up 40% over two years. …The European log market has undergone dramatic changes in supply and demand over the past five years, resulted in the most substantial price fluctuations the Wood Resource Quarterly has observed in almost 30 years of tracking wood markets.

Russia harvested 194.6 million m3 of timber in 2022, which is 13.5% less than in the previous year. This was reported by the state news agency TASS, citing Roslesinforg. The reason for the decline in timber harvesting in the country was European sanctions and a ban on the export of logs introduced by the Russian government. EU sanctions led to a fall in exports and wood processing in the country and, accordingly, the demand for wood raw materials. In all large forest regions of Russia, logging decreased last year. In the Irkutsk region, timber harvesting amounted to 27.9 million m3 (-14.5%), in the Krasnoyarsk Territory – 19.6 million m3 (-20.6%), in the Vologda region. – 14.6 million m3 (-19.6%), in the Arkhangelsk region. – 14.1 million m3 (-12.5%), in Komi – 9.1 million m3 (-5.8%).

Russia harvested 194.6 million m3 of timber in 2022, which is 13.5% less than in the previous year. This was reported by the state news agency TASS, citing Roslesinforg. The reason for the decline in timber harvesting in the country was European sanctions and a ban on the export of logs introduced by the Russian government. EU sanctions led to a fall in exports and wood processing in the country and, accordingly, the demand for wood raw materials. In all large forest regions of Russia, logging decreased last year. In the Irkutsk region, timber harvesting amounted to 27.9 million m3 (-14.5%), in the Krasnoyarsk Territory – 19.6 million m3 (-20.6%), in the Vologda region. – 14.6 million m3 (-19.6%), in the Arkhangelsk region. – 14.1 million m3 (-12.5%), in Komi – 9.1 million m3 (-5.8%).