Home Depot’s revenue fell short of Wall Street’s estimates in its fiscal fourth-quarter earnings report. …It’s the first time Home Depot missed Wall Street’s revenue expectations since November 2019, before the Covid pandemic. In the quarter ended Jan. 29, Home Depot reported $35.83 billion in sales, up 0.3% from the year ago period, which saw $35.72 billion in revenue. The retailer’s reported net income of $3.36 billion, was also 0.3% higher than the year ago period, which was $3.35 billion. …The company attributed that solely to a drop in lumber costs, which had surged in price due to nationwide shortages in fiscal 2021. The drop in lumber negatively impacted comparable sales by 0.7%, it said. “But for that we would have been right in line with our expectations,” Home Depot CFO Richard McPhail said. …“We’ve seen a little more stability in recent weeks and months, but it’s hard to predict lumber prices.”

Home Depot’s revenue fell short of Wall Street’s estimates in its fiscal fourth-quarter earnings report. …It’s the first time Home Depot missed Wall Street’s revenue expectations since November 2019, before the Covid pandemic. In the quarter ended Jan. 29, Home Depot reported $35.83 billion in sales, up 0.3% from the year ago period, which saw $35.72 billion in revenue. The retailer’s reported net income of $3.36 billion, was also 0.3% higher than the year ago period, which was $3.35 billion. …The company attributed that solely to a drop in lumber costs, which had surged in price due to nationwide shortages in fiscal 2021. The drop in lumber negatively impacted comparable sales by 0.7%, it said. “But for that we would have been right in line with our expectations,” Home Depot CFO Richard McPhail said. …“We’ve seen a little more stability in recent weeks and months, but it’s hard to predict lumber prices.”

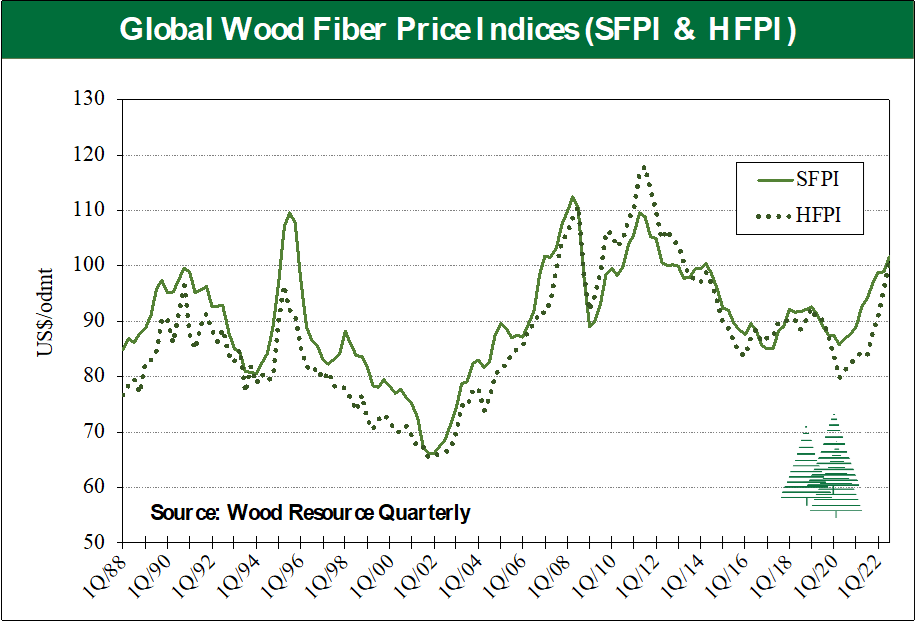

NEW YORK — Mercer International reported fourth quarter 2022 Operating EBITDA of $96.1 million a decrease from $164.9 million in the fourth quarter of 2021 and $140.9 million in the third quarter of 2022. In the fourth quarter of 2022, net income was $20.0 million compared to $74.5 million in the fourth quarter of 2021 and net income of $66.7 million in the third quarter of 2022. In 2022, Operating EBITDA increased by 12% to a record $536.5 million from $478.8 million in 2021. In 2022, net income was a record $247.0 million from $171.0 million in 2021. Mr. Juan Carlos Bueno, the CEO stated: “Our solid fourth quarter operating results reflect strong pulp sales, which were however more than offset by lower sales prices, higher planned maintenance and fiber costs and the negative impact of the weaker US dollar compared to our third quarter operating results.

NEW YORK — Mercer International reported fourth quarter 2022 Operating EBITDA of $96.1 million a decrease from $164.9 million in the fourth quarter of 2021 and $140.9 million in the third quarter of 2022. In the fourth quarter of 2022, net income was $20.0 million compared to $74.5 million in the fourth quarter of 2021 and net income of $66.7 million in the third quarter of 2022. In 2022, Operating EBITDA increased by 12% to a record $536.5 million from $478.8 million in 2021. In 2022, net income was a record $247.0 million from $171.0 million in 2021. Mr. Juan Carlos Bueno, the CEO stated: “Our solid fourth quarter operating results reflect strong pulp sales, which were however more than offset by lower sales prices, higher planned maintenance and fiber costs and the negative impact of the weaker US dollar compared to our third quarter operating results.

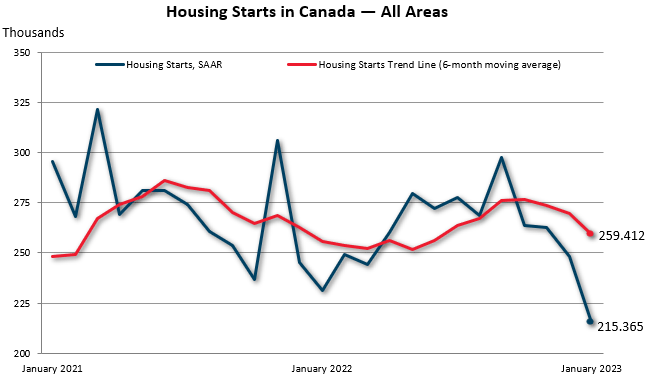

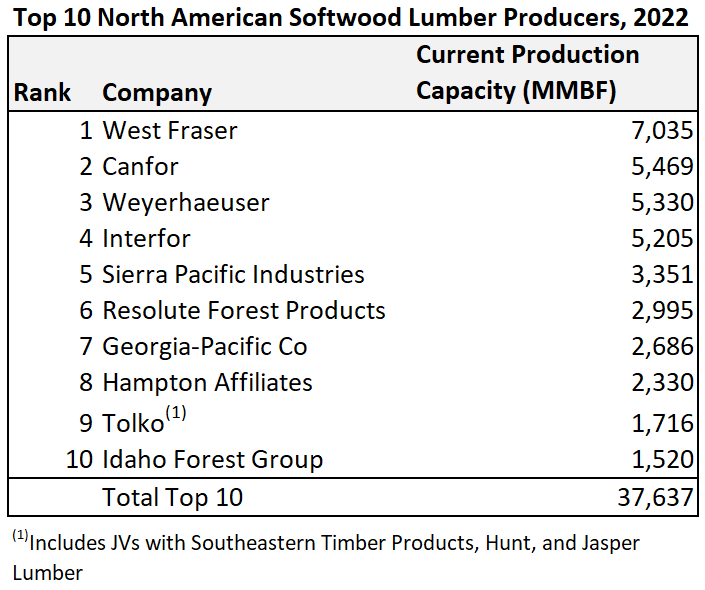

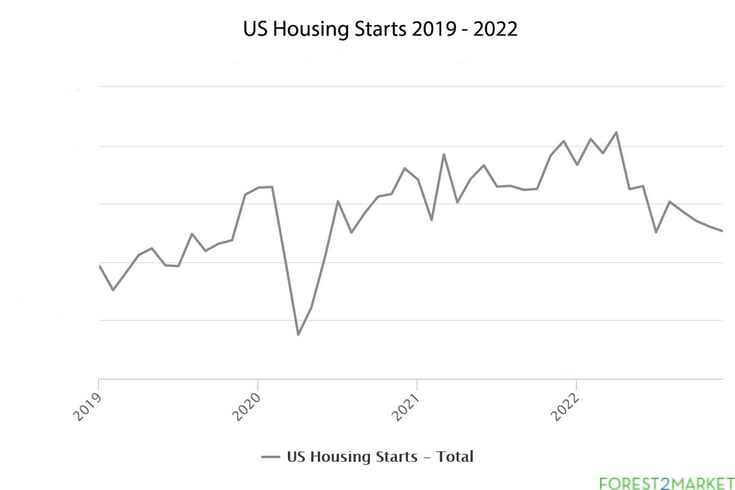

VANCOUVER, B.C. – West Fraser Timber reported today the fourth quarter, 2022 and full year results. Fourth quarter highlights include: Sales of $1.615 billion and earnings of $(94) million, Adjusted EBITDA of $70 million, representing 4% of sales, Lumber segment Adjusted EBITDA of $(77) million, including $39 million of inventory write-downs, North America Engineered Wood Products segment Adjusted EBITDA of $109 million, Pulp & Paper segment Adjusted EBITDA of $15 million. …Annual Highlights include: Sales of $9.701 billion and earnings of $1.975 billion, Adjusted EBITDA1 of $3.212 billion, representing 33% of sales, Lumber segment Adjusted EBITDA1 of $1.328 billion, NA EWP segment Adjusted EBITDA1 of $1.677 billion, Pulp & Paper segment Adjusted EBITDA of $26 million. …“In the fourth quarter of 2022, we faced a challenging demand market as rising interest rates dampened new home construction activity in the U.S., most acutely impacting our Lumber business” said Ray Ferris, CEO.

VANCOUVER, B.C. – West Fraser Timber reported today the fourth quarter, 2022 and full year results. Fourth quarter highlights include: Sales of $1.615 billion and earnings of $(94) million, Adjusted EBITDA of $70 million, representing 4% of sales, Lumber segment Adjusted EBITDA of $(77) million, including $39 million of inventory write-downs, North America Engineered Wood Products segment Adjusted EBITDA of $109 million, Pulp & Paper segment Adjusted EBITDA of $15 million. …Annual Highlights include: Sales of $9.701 billion and earnings of $1.975 billion, Adjusted EBITDA1 of $3.212 billion, representing 33% of sales, Lumber segment Adjusted EBITDA1 of $1.328 billion, NA EWP segment Adjusted EBITDA1 of $1.677 billion, Pulp & Paper segment Adjusted EBITDA of $26 million. …“In the fourth quarter of 2022, we faced a challenging demand market as rising interest rates dampened new home construction activity in the U.S., most acutely impacting our Lumber business” said Ray Ferris, CEO. Lumber prices are on the decline again as questions continue to linger about the current state of the housing market. Lumber futures fell 3% to $402 per thousand board feet on Tuesday, an eight-day losing streak that has erased 21% off of futures’ pricing. The 23% price decline in February is an about-face from its strength seen in January, in which the commodity surged 37%. But data Raymond James sees is giving it confidence that a bottom is in for lumber prices. …”We do think a strong case has been made that cash lumber prices will continue to rebalance toward British Columbia’s marginal production costs (which we now estimate ~$500/mbf USD), and likely higher still in 2024,” Horne said. …Raymond James projected that lumber futures could rise to $500 per thousand board feet in the second half of the year, and then rise to $525 in 2024.

Lumber prices are on the decline again as questions continue to linger about the current state of the housing market. Lumber futures fell 3% to $402 per thousand board feet on Tuesday, an eight-day losing streak that has erased 21% off of futures’ pricing. The 23% price decline in February is an about-face from its strength seen in January, in which the commodity surged 37%. But data Raymond James sees is giving it confidence that a bottom is in for lumber prices. …”We do think a strong case has been made that cash lumber prices will continue to rebalance toward British Columbia’s marginal production costs (which we now estimate ~$500/mbf USD), and likely higher still in 2024,” Horne said. …Raymond James projected that lumber futures could rise to $500 per thousand board feet in the second half of the year, and then rise to $525 in 2024.

BURNABY, BC — Interfor recorded a Net loss in Q4’22 of $72.2 million compared to Net earnings of $3.5 million in Q3’22 and $69.7 million in Q4’21. Adjusted EBITDA was a loss of $68.7 million on sales of $810.3 million in Q4’22 versus Adjusted EBITDA of $129.5 million on sales of $1.0 billion in Q3’22 and Adjusted EBITDA of $149.5 million on sales of $675.9 million in Q4’21. Lumber demand moderated during the quarter. Interfor’s average selling price was $699 per mfbm, down $101 per mfbm versus Q3’22. …Lumber production totaled 874 million board feet, representing a decrease of 112 million board feet quarter-over-quarter. This decrease reflects temporary production curtailments during Q4’22, primarily related to economic conditions and market uncertainty. For the full year ending December 31, 2022, Interfor recorded Net earnings of $598.2 million compared to Net earnings of $819 million in 2021. Adjusted EBITDA for the full year 2022 was $1,059.4 million compared to $1,246.8 million in 2021.

BURNABY, BC — Interfor recorded a Net loss in Q4’22 of $72.2 million compared to Net earnings of $3.5 million in Q3’22 and $69.7 million in Q4’21. Adjusted EBITDA was a loss of $68.7 million on sales of $810.3 million in Q4’22 versus Adjusted EBITDA of $129.5 million on sales of $1.0 billion in Q3’22 and Adjusted EBITDA of $149.5 million on sales of $675.9 million in Q4’21. Lumber demand moderated during the quarter. Interfor’s average selling price was $699 per mfbm, down $101 per mfbm versus Q3’22. …Lumber production totaled 874 million board feet, representing a decrease of 112 million board feet quarter-over-quarter. This decrease reflects temporary production curtailments during Q4’22, primarily related to economic conditions and market uncertainty. For the full year ending December 31, 2022, Interfor recorded Net earnings of $598.2 million compared to Net earnings of $819 million in 2021. Adjusted EBITDA for the full year 2022 was $1,059.4 million compared to $1,246.8 million in 2021.

November total housing starts trailed 1.4% to finish at 72,372 units. Owner occupied housing fell 15.1%, whereas rental housing posted an 11.4% increase for November for the 21st consecutive monthly gain. The mansion condominium market fell 1.8% in November. Wooden housing slowed 7% to 41,751 units. Post and beam starts fell 8% to 32,558 units. Wooden prefab starts were down 2.6% to 951 units as did total prefab which declined to 9,847 units. Platform frame starts fell 3.3% to 8,242 units. Results of 2×4 starts by housing type were as follows: single family custom homes fell 6% to 2,564 units, rental housing eased 1.4% to 4,768 units and built for sale spec housing dropped 5.4% to 886 units. …In contrast to housing, the non-residential market is registering positive gains. November total non-residential construction starts increased 3.4% to 4,096 units. Total November wood non-residential starts increased 12.9% to 1,657 units.

November total housing starts trailed 1.4% to finish at 72,372 units. Owner occupied housing fell 15.1%, whereas rental housing posted an 11.4% increase for November for the 21st consecutive monthly gain. The mansion condominium market fell 1.8% in November. Wooden housing slowed 7% to 41,751 units. Post and beam starts fell 8% to 32,558 units. Wooden prefab starts were down 2.6% to 951 units as did total prefab which declined to 9,847 units. Platform frame starts fell 3.3% to 8,242 units. Results of 2×4 starts by housing type were as follows: single family custom homes fell 6% to 2,564 units, rental housing eased 1.4% to 4,768 units and built for sale spec housing dropped 5.4% to 886 units. …In contrast to housing, the non-residential market is registering positive gains. November total non-residential construction starts increased 3.4% to 4,096 units. Total November wood non-residential starts increased 12.9% to 1,657 units.  In 2022, Canada’s exports of lumber contracted 10.3% to 33.6 million m3. The value of exports decreased 20% to $10.8 billion. According to Lesprom Analytics, the average price of lumber lost 11% to $321 per m3. Canada decreased exports of lumber to the U.S. by 6.5% to 30.4 million m3 in 2022. Supplies to China fell by 40% to 1.1 million m3, and exports to Japan were less by 37% to 947 thousand m3. [END]

In 2022, Canada’s exports of lumber contracted 10.3% to 33.6 million m3. The value of exports decreased 20% to $10.8 billion. According to Lesprom Analytics, the average price of lumber lost 11% to $321 per m3. Canada decreased exports of lumber to the U.S. by 6.5% to 30.4 million m3 in 2022. Supplies to China fell by 40% to 1.1 million m3, and exports to Japan were less by 37% to 947 thousand m3. [END]

Vancouver, BC – Western Forest Products Inc. reported a net loss of $21.4 million and adjusted EBITDA of negative $11.9 million in the fourth quarter of 2022. Results reflect compressed margins on lower log and lumber production and shipments and $11.8 million of inventory provisions. Net loss in the fourth quarter of 2022 was $21.4 million ($0.07 per diluted share) as compared to net income of $6.6 million ($0.02 per diluted share) for the third quarter of 2022, and net income of $28.5 million ($0.08 per diluted share) in the fourth quarter of 2021. Highlights:

Vancouver, BC – Western Forest Products Inc. reported a net loss of $21.4 million and adjusted EBITDA of negative $11.9 million in the fourth quarter of 2022. Results reflect compressed margins on lower log and lumber production and shipments and $11.8 million of inventory provisions. Net loss in the fourth quarter of 2022 was $21.4 million ($0.07 per diluted share) as compared to net income of $6.6 million ($0.02 per diluted share) for the third quarter of 2022, and net income of $28.5 million ($0.08 per diluted share) in the fourth quarter of 2021. Highlights:

WASHINGTON – U.S. single-family homebuilding fell in January, but an easing in mortgage rates and improvement in homebuilder confidence suggested the recession-hit housing market was close to finding a floor. Single-family housing starts, which account for the bulk of homebuilding, dropped 4.3% to a seasonally adjusted annual rate of 841,000 units last month. Single-family homebuilding tumbled 27.3% on a year-on-year basis in January. …The sector has been the biggest causality of the Federal Reserve’s aggressive interest rate hiking campaign. …Starts for housing projects with five units or more fell 5.4% to a rate of 457,000 units. Multi-family housing construction remains underpinned by demand for rental accommodation. With both single- and multi-family homebuilding declining, overall housing starts dropped 4.5% to a rate of 1.309 million units last month, the lowest level since June 2020.

WASHINGTON – U.S. single-family homebuilding fell in January, but an easing in mortgage rates and improvement in homebuilder confidence suggested the recession-hit housing market was close to finding a floor. Single-family housing starts, which account for the bulk of homebuilding, dropped 4.3% to a seasonally adjusted annual rate of 841,000 units last month. Single-family homebuilding tumbled 27.3% on a year-on-year basis in January. …The sector has been the biggest causality of the Federal Reserve’s aggressive interest rate hiking campaign. …Starts for housing projects with five units or more fell 5.4% to a rate of 457,000 units. Multi-family housing construction remains underpinned by demand for rental accommodation. With both single- and multi-family homebuilding declining, overall housing starts dropped 4.5% to a rate of 1.309 million units last month, the lowest level since June 2020.

According to the Kitchen Cabinet Manufacturers Association’s (KCMA) monthly Trend of Business Survey, participating cabinet manufacturers reported an increase in overall cabinet sales of 9.7% for December 2022 compared to the same month in 2021. December 2022 sales increases over December 2021: Overall sales up 9.7%, Custom sales up 24.8%, and Semi-custom up 19.3%. …YTD 2022 to 2021: Overall sales up 16.4%, Custom sales up 17.8%, and Semi-custom up 17.4%. …KCMA is the major trade association for kitchen cabinet and bath vanity manufacturers and key suppliers of goods and services to the industry.

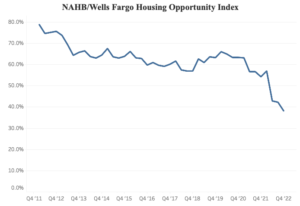

According to the Kitchen Cabinet Manufacturers Association’s (KCMA) monthly Trend of Business Survey, participating cabinet manufacturers reported an increase in overall cabinet sales of 9.7% for December 2022 compared to the same month in 2021. December 2022 sales increases over December 2021: Overall sales up 9.7%, Custom sales up 24.8%, and Semi-custom up 19.3%. …YTD 2022 to 2021: Overall sales up 16.4%, Custom sales up 17.8%, and Semi-custom up 17.4%. …KCMA is the major trade association for kitchen cabinet and bath vanity manufacturers and key suppliers of goods and services to the industry. Mirroring a steep rise in mortgage rates coupled with ongoing building material supply chain bottlenecks that increased construction costs, housing affordability posted three consecutive quarterly declines in 2022 and now stands at its lowest level since the NAHB began tracking it on a consistent basis in 2012. According to the NAHB/Wells Fargo Housing Opportunity Index, just 38.1% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $90,000. The index trails the previous mark of 42.2% in the third quarter and 42.8% set in the second quarter. However, a recent drop in mortgage rates over the past two months signals that declining affordability conditions may have reached their low point for this cycle.

Mirroring a steep rise in mortgage rates coupled with ongoing building material supply chain bottlenecks that increased construction costs, housing affordability posted three consecutive quarterly declines in 2022 and now stands at its lowest level since the NAHB began tracking it on a consistent basis in 2012. According to the NAHB/Wells Fargo Housing Opportunity Index, just 38.1% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $90,000. The index trails the previous mark of 42.2% in the third quarter and 42.8% set in the second quarter. However, a recent drop in mortgage rates over the past two months signals that declining affordability conditions may have reached their low point for this cycle.

As the price of lumber raced up to over $1,500 per thousand board feet in the spring of 2021, economists acknowledged that the supply side of the economy simply couldn’t sustain the housing demand rush unleashed by the pandemic. Of course, we’d later learn that… lumber was actually the canary in the coal mine for inflation at large. That predictive power is why economists and analysts alike are once again paying close attention to lumber. …Fortune reached out to Dustin Jalbert, at Fastmarkets. Here are his predictions:

As the price of lumber raced up to over $1,500 per thousand board feet in the spring of 2021, economists acknowledged that the supply side of the economy simply couldn’t sustain the housing demand rush unleashed by the pandemic. Of course, we’d later learn that… lumber was actually the canary in the coal mine for inflation at large. That predictive power is why economists and analysts alike are once again paying close attention to lumber. …Fortune reached out to Dustin Jalbert, at Fastmarkets. Here are his predictions:

U.S. wood pellet exports reached 917,175.4 metric tons in December, according to data released by the USDA Foreign Agricultural Service. The 917,175.4 metric tons of wood pellets exported in December was up from both 694,199.7 metric tons in November and 798,883.6 metric tons in December 2021. The U.S. exported wood pellets to more than a dozen countries in December. The U.K. was the top destination at 360,711.6 metric tons, followed by Japan at 220,953.7 metric tons and the Netherlands at 212,799.6 metric tons. The value of U.S. wood pellet exports reached $152.95 million in December, up from both $120.94 million the previous month and $101.07 million in December 2021. …Total U.S. wood pellet exports for 2022 reached 8.98 million metric tons at a value of $1.54 billion, compared to 7.45 million metric tons exported in 2021 at a value of $1.05 billion.

U.S. wood pellet exports reached 917,175.4 metric tons in December, according to data released by the USDA Foreign Agricultural Service. The 917,175.4 metric tons of wood pellets exported in December was up from both 694,199.7 metric tons in November and 798,883.6 metric tons in December 2021. The U.S. exported wood pellets to more than a dozen countries in December. The U.K. was the top destination at 360,711.6 metric tons, followed by Japan at 220,953.7 metric tons and the Netherlands at 212,799.6 metric tons. The value of U.S. wood pellet exports reached $152.95 million in December, up from both $120.94 million the previous month and $101.07 million in December 2021. …Total U.S. wood pellet exports for 2022 reached 8.98 million metric tons at a value of $1.54 billion, compared to 7.45 million metric tons exported in 2021 at a value of $1.05 billion.

Europe has continued to feel the impacts of Russia’s war against Ukraine. The consequence is a full cessation on the import of wood raw materials to countries like Finland. …Finnish pulpmills and sawmills have long been dependent on imported wood raw materials to meet their wood fiber needs. …Finland’s wood raw-material imports from Russia fell dramatically in 2022 following many years of active trade between the two countries. Russia decided to halt softwood log exports starting January 1, 2022. …The strong pulp market made the Finnish pulp industry search for alternative supply sources to keep operating rates high. …In Q3 2022, imports were mainly up from Sweden and the Baltic States. But there were also a few shipments of logs and wood chips from Brazil, South Africa, and Uruguay.

Europe has continued to feel the impacts of Russia’s war against Ukraine. The consequence is a full cessation on the import of wood raw materials to countries like Finland. …Finnish pulpmills and sawmills have long been dependent on imported wood raw materials to meet their wood fiber needs. …Finland’s wood raw-material imports from Russia fell dramatically in 2022 following many years of active trade between the two countries. Russia decided to halt softwood log exports starting January 1, 2022. …The strong pulp market made the Finnish pulp industry search for alternative supply sources to keep operating rates high. …In Q3 2022, imports were mainly up from Sweden and the Baltic States. But there were also a few shipments of logs and wood chips from Brazil, South Africa, and Uruguay. Western markets turned out to be inaccessible for Russian lumber producers after the introduction of sanctions against Russia. Russian lumber exporters were unable to redirect exports from European markets to Asian ones. Russia reduced lumber exports by 25% to 22 million m3 in 2022. The export value fell by 18% to $5 billion. This does not include exports to Kazakhstan, Kyrgyzstan, Belarus and Armenia, which accounted for about 1 million m3 of lumber in 2021. In 2022, China, Uzbekistan, Egypt, Japan, Azerbaijan, Estonia, Tajikistan, South Korea, Finland, Germany reduced purchases of Russian lumber, all these countries together imported more than 20 million m3 of lumber. China reduced the purchase of lumber from Russia by 10% to 14 million m3 last year. …Like a year ago, Uzbekistan was the largest consumer of Russian lumber in Central Asia. …At the same time Russia increased lumber exports to Turkey by 45%, up to 120 thousand m3 in 2022.

Western markets turned out to be inaccessible for Russian lumber producers after the introduction of sanctions against Russia. Russian lumber exporters were unable to redirect exports from European markets to Asian ones. Russia reduced lumber exports by 25% to 22 million m3 in 2022. The export value fell by 18% to $5 billion. This does not include exports to Kazakhstan, Kyrgyzstan, Belarus and Armenia, which accounted for about 1 million m3 of lumber in 2021. In 2022, China, Uzbekistan, Egypt, Japan, Azerbaijan, Estonia, Tajikistan, South Korea, Finland, Germany reduced purchases of Russian lumber, all these countries together imported more than 20 million m3 of lumber. China reduced the purchase of lumber from Russia by 10% to 14 million m3 last year. …Like a year ago, Uzbekistan was the largest consumer of Russian lumber in Central Asia. …At the same time Russia increased lumber exports to Turkey by 45%, up to 120 thousand m3 in 2022.