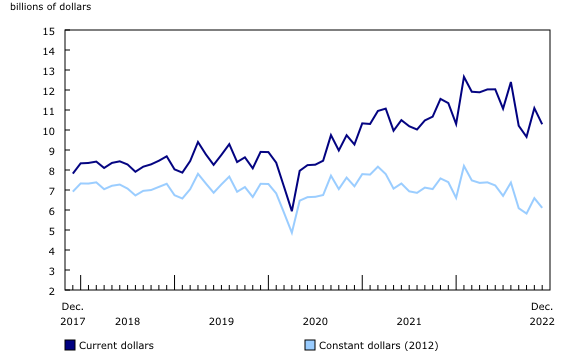

The monthly total seasonally adjusted value of building permits in Canada decreased 7.3% in December to $10.3 billion. Declines were posted in both the residential and the non-residential sectors. On a constant dollar basis (2012=100), the total value of building permits fell 7.4% to $6.1 billion. The total value of residential permits declined 8.4% to $6.5 billion in December. Construction intentions in the single-family homes component decreased 3.9% while multi-family permit values fell 11.6%, with seven provinces posting declines. …The total value of non-residential permits declined 5.3% to $3.8 billion in December. Decreases posted in Ontario more than offset gains posted in seven provinces. Construction intentions in the industrial sector decreased 23.4% in December, following a record high in November.

The monthly total seasonally adjusted value of building permits in Canada decreased 7.3% in December to $10.3 billion. Declines were posted in both the residential and the non-residential sectors. On a constant dollar basis (2012=100), the total value of building permits fell 7.4% to $6.1 billion. The total value of residential permits declined 8.4% to $6.5 billion in December. Construction intentions in the single-family homes component decreased 3.9% while multi-family permit values fell 11.6%, with seven provinces posting declines. …The total value of non-residential permits declined 5.3% to $3.8 billion in December. Decreases posted in Ontario more than offset gains posted in seven provinces. Construction intentions in the industrial sector decreased 23.4% in December, following a record high in November.

Get ready for a lumber surge. The homebuilding business looks like it’s ticking up again after a tricky 2022. And with it investors should see lumber prices lift as well. The latter had a brutal year also. Shawn Hackett, president of Hackett Financial Advisors… “The lumber market has likely made a major low and can trend substantially higher over the next year.” …Optimism among such companies, like those held by the SPDR S&P Homebuilders exchange-traded fund, suggests that demand for new homes and by association lumber, will pick up in the coming months. In addition, to U.S. housing activity, the reopening of China will likely add some lumber demand, Hackett says. As always there are risks. Most notably the Fed may decide to keep raising interest rates… [and] China’s reopening may not last long.

Get ready for a lumber surge. The homebuilding business looks like it’s ticking up again after a tricky 2022. And with it investors should see lumber prices lift as well. The latter had a brutal year also. Shawn Hackett, president of Hackett Financial Advisors… “The lumber market has likely made a major low and can trend substantially higher over the next year.” …Optimism among such companies, like those held by the SPDR S&P Homebuilders exchange-traded fund, suggests that demand for new homes and by association lumber, will pick up in the coming months. In addition, to U.S. housing activity, the reopening of China will likely add some lumber demand, Hackett says. As always there are risks. Most notably the Fed may decide to keep raising interest rates… [and] China’s reopening may not last long. Shares of sawmill owners are way up and lumber futures have risen by the most allowed by exchange rules following Canfor’s announcement that it would close two mills in British Columbia, the latest cutbacks from an industry recalibrating output amid slowdowns in homebuilding and remodeling. Canfor said it would permanently shutter its mill in Chetwynd, British Columbia, and close a larger facility in nearby Houston while a newer facility is built there. The two mills represent about 6.5% of lumber-making capacity in the Canadian province. Altogether, permanent and temporary curtailments announced by Canfor and its rivals… have reduced North America’s sawmill capacity by about 2.2%, said BMO Capital Markets analyst Ketan Mamtora. That’s been enough to reverse the slide in lumber prices. Futures have now risen by the most allowed by exchange rules twice this week. [to access the full story a WSJ subscription is required]

Shares of sawmill owners are way up and lumber futures have risen by the most allowed by exchange rules following Canfor’s announcement that it would close two mills in British Columbia, the latest cutbacks from an industry recalibrating output amid slowdowns in homebuilding and remodeling. Canfor said it would permanently shutter its mill in Chetwynd, British Columbia, and close a larger facility in nearby Houston while a newer facility is built there. The two mills represent about 6.5% of lumber-making capacity in the Canadian province. Altogether, permanent and temporary curtailments announced by Canfor and its rivals… have reduced North America’s sawmill capacity by about 2.2%, said BMO Capital Markets analyst Ketan Mamtora. That’s been enough to reverse the slide in lumber prices. Futures have now risen by the most allowed by exchange rules twice this week. [to access the full story a WSJ subscription is required]

The PPPC released North American Printing & Writing Paper stats for December.

The PPPC released North American Printing & Writing Paper stats for December.

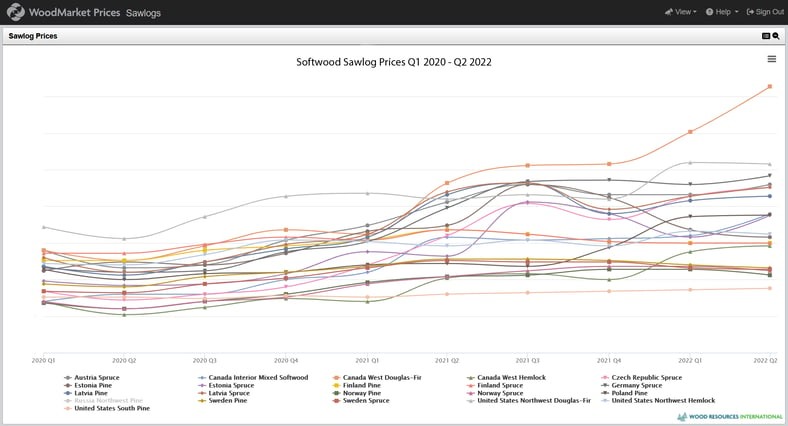

Chicago lumber futures hit a two-year low of below $350 per thousand board feet, erasing the solid gains traders made when prices were as high as $1,400 per thousand board feet. Lumber’s drop, which made it the worst-performing commodity last year, was a sharp reversal from all-time highs recorded in 2021. …While large suppliers are reducing output, purchasers are nonetheless concerned about rising interest rates and passing up low-cost supplies, meaning any price recovery is “not going to go very far,” said Russ Taylor. …Taylor said that new house starts in the US will be roughly 1.2 million in 2023, down from about 1.55 million in 2022. Forecasters predict that lumber prices will range between $475 and $595 per thousand board feet in 2023. Taylor said the break-even price for most sawmills in B.C. is $450 to $500 per thousand board feet.

Chicago lumber futures hit a two-year low of below $350 per thousand board feet, erasing the solid gains traders made when prices were as high as $1,400 per thousand board feet. Lumber’s drop, which made it the worst-performing commodity last year, was a sharp reversal from all-time highs recorded in 2021. …While large suppliers are reducing output, purchasers are nonetheless concerned about rising interest rates and passing up low-cost supplies, meaning any price recovery is “not going to go very far,” said Russ Taylor. …Taylor said that new house starts in the US will be roughly 1.2 million in 2023, down from about 1.55 million in 2022. Forecasters predict that lumber prices will range between $475 and $595 per thousand board feet in 2023. Taylor said the break-even price for most sawmills in B.C. is $450 to $500 per thousand board feet.

Zonda’s New Home Lot Supply Index (LSI) for the last quarter of 2022 shows lot supply loosened year over year across the U.S. The residential real estate indicator, which is based on the number of single-family vacant developed lots and the rate at which those lots are absorbed, came in at 49.1 for Q4 2022, representing a 27.5% increase from Q4 2021. The LSI is now back to late 2020/early 2021 levels, according to Zonda. On a quarter-over-quarter basis, supply increased by 24.9%, up from the third quarter. Despite the increase, the data still reflects a “significantly undersupplied” market nationally. …Ali Wolf, chief economist at Zonda said, “With both sales and starts lower than the frenzied pace seen over the past few years, there are early signs that availability for lots, materials, and labor are improving.

Zonda’s New Home Lot Supply Index (LSI) for the last quarter of 2022 shows lot supply loosened year over year across the U.S. The residential real estate indicator, which is based on the number of single-family vacant developed lots and the rate at which those lots are absorbed, came in at 49.1 for Q4 2022, representing a 27.5% increase from Q4 2021. The LSI is now back to late 2020/early 2021 levels, according to Zonda. On a quarter-over-quarter basis, supply increased by 24.9%, up from the third quarter. Despite the increase, the data still reflects a “significantly undersupplied” market nationally. …Ali Wolf, chief economist at Zonda said, “With both sales and starts lower than the frenzied pace seen over the past few years, there are early signs that availability for lots, materials, and labor are improving.

INTERNATIONAL BUILDERS SHOW — Rose Quint (NAHB) and Donald Ruthroff (Design Story Spaced) shared how home buyer preferences are shifting, characteristics desired by first-time and repeat buyers, and how builders can incorporate design trends to provide homes buyers want. …Quint forecast that the average home size and the market share of amenities such as three or more bathrooms and three-car garages would increase in 2023 due to the projected decrease in single-family starts. Homes will trend larger in part because many potential buyers will not have access to the market due to affordability concerns, shrinking the number of buyers and shifting the market toward buyers with higher levels of income. …Donald Ruthroff, founder and principal of California-based Design Story Spaces, shared how design trends are shifting to focus on the health of residents and to maximize smaller spaces.

INTERNATIONAL BUILDERS SHOW — Rose Quint (NAHB) and Donald Ruthroff (Design Story Spaced) shared how home buyer preferences are shifting, characteristics desired by first-time and repeat buyers, and how builders can incorporate design trends to provide homes buyers want. …Quint forecast that the average home size and the market share of amenities such as three or more bathrooms and three-car garages would increase in 2023 due to the projected decrease in single-family starts. Homes will trend larger in part because many potential buyers will not have access to the market due to affordability concerns, shrinking the number of buyers and shifting the market toward buyers with higher levels of income. …Donald Ruthroff, founder and principal of California-based Design Story Spaces, shared how design trends are shifting to focus on the health of residents and to maximize smaller spaces.

The nation might be in the clutches of a dire housing shortage, but builders won’t be putting up enough new homes this year to make much of a dent. Housing starts are expected to fall to about 744,000 single-family homes in 2023 as builders continue to pull back, according to the NAHB forecast. That’s down about 12% from last year. However, NAHB expects new construction will rebound in the second half of the year, giving a boost to the overall economy. “Typically, single-family construction tends to recover before the economy rebounds,” says NAHB Chief Economist Robert Dietz. …“The fundamental challenge to the housing remains a lack of homes for sale,” says Dietz. “ …Economists say this won’t be anything like the housing crash in the mid-2000s. Back then, there were more homes than buyers for them. This time the opposite is true.

The nation might be in the clutches of a dire housing shortage, but builders won’t be putting up enough new homes this year to make much of a dent. Housing starts are expected to fall to about 744,000 single-family homes in 2023 as builders continue to pull back, according to the NAHB forecast. That’s down about 12% from last year. However, NAHB expects new construction will rebound in the second half of the year, giving a boost to the overall economy. “Typically, single-family construction tends to recover before the economy rebounds,” says NAHB Chief Economist Robert Dietz. …“The fundamental challenge to the housing remains a lack of homes for sale,” says Dietz. “ …Economists say this won’t be anything like the housing crash in the mid-2000s. Back then, there were more homes than buyers for them. This time the opposite is true. LAS VEGAS — The housing recession that began in 2022 will bleed into 2023 as elevated inflation and mortgage rates, coupled with stubbornly high building material construction costs, are expected to push the overall economy into a mild recession this year. However, the second half of 2023 could lead to a turning point. …NAHB is projecting that single-family production will fall to 744,000 units this year before rebounding to a 925,000 annual pace in 2024…On the multifamily front… NAHB is projecting that multifamily starts will fall 28% this year to a 391,000 total and will stabilize in 2024 at about 374,000 starts. …Residential remodeling activity is estimated to increase 7% on a nominal basis in 2022 following a growth rate of 13% in 2021 as people continue to use their home for more purposes such as offices, schools and gyms. However, with housing demand weakening, remodeling growth is expected to slow, posting a nominal 5% gain this year and a 4% increase in 2024.

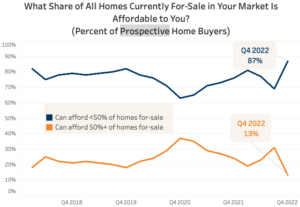

LAS VEGAS — The housing recession that began in 2022 will bleed into 2023 as elevated inflation and mortgage rates, coupled with stubbornly high building material construction costs, are expected to push the overall economy into a mild recession this year. However, the second half of 2023 could lead to a turning point. …NAHB is projecting that single-family production will fall to 744,000 units this year before rebounding to a 925,000 annual pace in 2024…On the multifamily front… NAHB is projecting that multifamily starts will fall 28% this year to a 391,000 total and will stabilize in 2024 at about 374,000 starts. …Residential remodeling activity is estimated to increase 7% on a nominal basis in 2022 following a growth rate of 13% in 2021 as people continue to use their home for more purposes such as offices, schools and gyms. However, with housing demand weakening, remodeling growth is expected to slow, posting a nominal 5% gain this year and a 4% increase in 2024. Buyers’ outlook for housing affordability took a sharp negative turn in the final quarter of 2022, when a record high of 87% reported being able to afford fewer than 50% of the homes for-sale in their markets. The remaining 13% can afford the majority of homes available, less than half the 31% who could in the third quarter. Affordability expectations between the third and fourth quarters of 2022 worsened in all regions. The share of buyers able to afford less than half the homes available in their markets rose in the Northeast, from 66% to 89%; in the Midwest, from 83% to 84%; in the South, from 77% to 83%, and in the West, from 58% to 87%.

Buyers’ outlook for housing affordability took a sharp negative turn in the final quarter of 2022, when a record high of 87% reported being able to afford fewer than 50% of the homes for-sale in their markets. The remaining 13% can afford the majority of homes available, less than half the 31% who could in the third quarter. Affordability expectations between the third and fourth quarters of 2022 worsened in all regions. The share of buyers able to afford less than half the homes available in their markets rose in the Northeast, from 66% to 89%; in the Midwest, from 83% to 84%; in the South, from 77% to 83%, and in the West, from 58% to 87%.

WASHINGTON – The American Forest & Paper Association (AF&PA) released its Q4 2022 Containerboard Quarterly report. According to the report, total Containerboard production decreased 5% when compared to the full year of 2021.

WASHINGTON – The American Forest & Paper Association (AF&PA) released its Q4 2022 Containerboard Quarterly report. According to the report, total Containerboard production decreased 5% when compared to the full year of 2021.

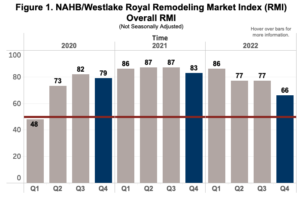

The NAHB/Westlake Royal Remodeling Market Index (RMI) for the fourth quarter of 2022 posted a reading of 66, falling 17 points from the fourth quarter of 2021. While there is a sharp decline in RMI year-over-year, it remains in positive territory as remodeling continues to outperform the rest of the residential construction sector. …Nevertheless, remodelers are noticing a pullback from consumers due to the elevated costs of materials and labor. NAHB forecasts that the remodeling sector will experience a slowing nominal growth rate in 2023, but activity should pick up towards the latter half of the year. …In the fourth quarter of 2022, the Current Conditions component index was 75, dropping 14 points compared to the fourth quarter of 2021. …The Future Indicators Index was 58, which is 19 points lower than the fourth quarter of 2021.

The NAHB/Westlake Royal Remodeling Market Index (RMI) for the fourth quarter of 2022 posted a reading of 66, falling 17 points from the fourth quarter of 2021. While there is a sharp decline in RMI year-over-year, it remains in positive territory as remodeling continues to outperform the rest of the residential construction sector. …Nevertheless, remodelers are noticing a pullback from consumers due to the elevated costs of materials and labor. NAHB forecasts that the remodeling sector will experience a slowing nominal growth rate in 2023, but activity should pick up towards the latter half of the year. …In the fourth quarter of 2022, the Current Conditions component index was 75, dropping 14 points compared to the fourth quarter of 2021. …The Future Indicators Index was 58, which is 19 points lower than the fourth quarter of 2021.

New US home construction declined for a fourth-straight month in December, wrapping up a disappointing year for an industry that saw annual housing starts fall for the first time since 2009. Residential starts decreased 1.4% last month to a 1.38 million annualized rate, a five-month low. New construction fell 3% in 2022 after surging the prior year. The December drop was due to a slump in multifamily projects. Single-family homebuilding jumped to a 909,000 annualized rate last month, the most since August. However, for all of last year about 1 million one-family houses were started, down 10.6% from 2021 — the biggest drop since 2009. …Applications to build, a proxy for future construction, fell 1.6% to an annualized 1.33 million units in December, the fewest since May 2020. Permits for construction of one-family homes dropped 6.5% last month, also the lowest since the early months of the pandemic.

New US home construction declined for a fourth-straight month in December, wrapping up a disappointing year for an industry that saw annual housing starts fall for the first time since 2009. Residential starts decreased 1.4% last month to a 1.38 million annualized rate, a five-month low. New construction fell 3% in 2022 after surging the prior year. The December drop was due to a slump in multifamily projects. Single-family homebuilding jumped to a 909,000 annualized rate last month, the most since August. However, for all of last year about 1 million one-family houses were started, down 10.6% from 2021 — the biggest drop since 2009. …Applications to build, a proxy for future construction, fell 1.6% to an annualized 1.33 million units in December, the fewest since May 2020. Permits for construction of one-family homes dropped 6.5% last month, also the lowest since the early months of the pandemic.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/2FJPY3KS6BPNFCBD7RY6QRAZTA.jpg)