…There appears to be a return of seasonal stability in home buying, in new housing construction, and thus for lumber demand as well. However, there are quite a few changes in comparison to the past. The most important for sawmills is that a new floor for dimension lumber prices has been established. The main reason for this is because the cost structure for producers has changed completely. Not just general inflation, but more fundamental – structural – changes to the forest industry and sawmilling which have increased operating costs significantly. …To Madison’s it seems that Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) will fluctuate somewhere between US$500 and $700 mfbm. This is because that lower price is very generally the new cost-of-production for most large-volume operators in British Columbia… [and] the habit of continuing to produce lumber despite big drops in demand is no longer the usual method of operating.

…There appears to be a return of seasonal stability in home buying, in new housing construction, and thus for lumber demand as well. However, there are quite a few changes in comparison to the past. The most important for sawmills is that a new floor for dimension lumber prices has been established. The main reason for this is because the cost structure for producers has changed completely. Not just general inflation, but more fundamental – structural – changes to the forest industry and sawmilling which have increased operating costs significantly. …To Madison’s it seems that Western Spruce-Pine-Fir 2×4 #2&Btr KD (RL) will fluctuate somewhere between US$500 and $700 mfbm. This is because that lower price is very generally the new cost-of-production for most large-volume operators in British Columbia… [and] the habit of continuing to produce lumber despite big drops in demand is no longer the usual method of operating.

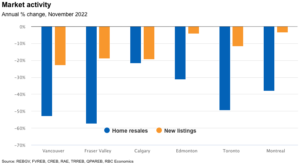

Canada’s housing markets are still squarely in correction mode. The latest results from local real estate boards confirm activity and prices generally remained under intense downward pressure in November. This was entirely expected considering the heavy toll soaring interest rates are taking on buyers from coast to coast. …We think this will continue to be the case into the early part of 2023—conditional on the Bank of Canada halting its rate hiking campaign this month. For the most part, local market activity is downright soft, at levels far below where they were before the pandemic. Vancouver, the Fraser Valley, Toronto, Hamilton, Ottawa and Montreal are among that group. However, areas of the Prairies (including Calgary and Edmonton) continue to operate above pre-pandemic levels. A stronger provincial economy and rising in-migration are no doubt keeping demand relatively solid in those markets.

Canada’s housing markets are still squarely in correction mode. The latest results from local real estate boards confirm activity and prices generally remained under intense downward pressure in November. This was entirely expected considering the heavy toll soaring interest rates are taking on buyers from coast to coast. …We think this will continue to be the case into the early part of 2023—conditional on the Bank of Canada halting its rate hiking campaign this month. For the most part, local market activity is downright soft, at levels far below where they were before the pandemic. Vancouver, the Fraser Valley, Toronto, Hamilton, Ottawa and Montreal are among that group. However, areas of the Prairies (including Calgary and Edmonton) continue to operate above pre-pandemic levels. A stronger provincial economy and rising in-migration are no doubt keeping demand relatively solid in those markets. The continued slowdown in the US housing market has taken its toll on lumber prices, which fell to its lowest level since June 2020 on Monday. The essential building commodity tumbled 9% in three days to a low of $382.80 per thousand board feet, below the $400 level that has served as key resistance since 2013. Lumber rebounded slightly on Tuesday, up about 5% to $411. Prices are down 64% year-to-date. The weakness in lumber largely stems from this year’s deceleration seen in all facets of the housing market, as soaring mortgage rates helped slow down sales, rein in home price growth, and put a serious dent in home builder confidence. …The report showed that builders are adding more buying incentives to spark sales of new homes.

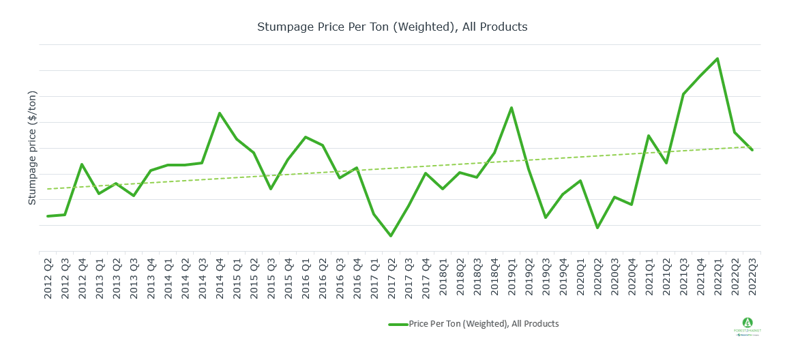

The continued slowdown in the US housing market has taken its toll on lumber prices, which fell to its lowest level since June 2020 on Monday. The essential building commodity tumbled 9% in three days to a low of $382.80 per thousand board feet, below the $400 level that has served as key resistance since 2013. Lumber rebounded slightly on Tuesday, up about 5% to $411. Prices are down 64% year-to-date. The weakness in lumber largely stems from this year’s deceleration seen in all facets of the housing market, as soaring mortgage rates helped slow down sales, rein in home price growth, and put a serious dent in home builder confidence. …The report showed that builders are adding more buying incentives to spark sales of new homes. The weak market conditions that prompted Canfor’s announcement this week of production curtailments at its B.C. and Alberta sawmills will last until about midway through next year, two forest industry watchers are predicting. By then, price of western spruce, pine or fir two-by-fours should have bounced back to the break-even point, both Russ Taylor and Keta Kosman said. They estimate that level to be between US$500-$550 per thousand board feet, well above US$365 that Taylor said was quoted as recently as December 2. …Taylor also noted that Canfor said it anticipates the majority of its B.C. sawmills will operate below full capacity in the new year, indicating its Alberta operations will be back to running at current levels by early 2023 while those in this province will not. He said that’s a function of the difference in the way stumpage works in the two provinces.

The weak market conditions that prompted Canfor’s announcement this week of production curtailments at its B.C. and Alberta sawmills will last until about midway through next year, two forest industry watchers are predicting. By then, price of western spruce, pine or fir two-by-fours should have bounced back to the break-even point, both Russ Taylor and Keta Kosman said. They estimate that level to be between US$500-$550 per thousand board feet, well above US$365 that Taylor said was quoted as recently as December 2. …Taylor also noted that Canfor said it anticipates the majority of its B.C. sawmills will operate below full capacity in the new year, indicating its Alberta operations will be back to running at current levels by early 2023 while those in this province will not. He said that’s a function of the difference in the way stumpage works in the two provinces.  Prices for lumber, the pandemic’s hottest commodity, have been in decline ever since the Fed began raising interest rates, dousing the sizzling housing market. Lately, futures have traded for less than $400 per thousand board feet. They haven’t been so low since June 2020, when many Americans were still in lockdown. It was around then that the market for suburban homes was heating up, stuck-at-home Americans remodeled en masse and bars and restaurants raced to build outdoor dining spaces. Sawmills were caught off guard and wood prices exploded, a sign of the inflation and snarled supply chains that would come do define the economic reopening. [END]

Prices for lumber, the pandemic’s hottest commodity, have been in decline ever since the Fed began raising interest rates, dousing the sizzling housing market. Lately, futures have traded for less than $400 per thousand board feet. They haven’t been so low since June 2020, when many Americans were still in lockdown. It was around then that the market for suburban homes was heating up, stuck-at-home Americans remodeled en masse and bars and restaurants raced to build outdoor dining spaces. Sawmills were caught off guard and wood prices exploded, a sign of the inflation and snarled supply chains that would come do define the economic reopening. [END]

Random-length lumber futures for January delivery have traded between $411.10 and $453.20 per 1,000 board feet since November 3. …Three factors continue to weigh on wood’s price at the $425 level on November 28: Rising US interest rates have pushed conventional thirty-year fixed-rate US mortgages to over 7%… the rapid rise of home prices over the past years has priced out many potential buyers, further decreasing lumber demand… [and] supply chain bottlenecks and decreasing supply. In November 2022, the price is sitting near the recent low, but we are also in the offseason for construction during a highly uncertain time in markets across all asset classes. Lumber’s slumber is a commentary on the overall state of markets across all asset classes in late 2022. A pivot from the Fed could ignite another explosive lumber rally.

Random-length lumber futures for January delivery have traded between $411.10 and $453.20 per 1,000 board feet since November 3. …Three factors continue to weigh on wood’s price at the $425 level on November 28: Rising US interest rates have pushed conventional thirty-year fixed-rate US mortgages to over 7%… the rapid rise of home prices over the past years has priced out many potential buyers, further decreasing lumber demand… [and] supply chain bottlenecks and decreasing supply. In November 2022, the price is sitting near the recent low, but we are also in the offseason for construction during a highly uncertain time in markets across all asset classes. Lumber’s slumber is a commentary on the overall state of markets across all asset classes in late 2022. A pivot from the Fed could ignite another explosive lumber rally. Pulp shipments were up 2.2% y/y (hardwood +5.2%; softwood -1.0%) in October, which is the weakest y/y growth reported since April 2022. Shipments were down 10.1% m/m, with hardwood (-17.4%) and softwood (-0.3%) both trending lower; however, on a seasonally adjusted basis, shipment volumes decreased a more modest ~1.0% m/m. Commentary out of London Pulp Week earlier this month highlighted easing supply chain conditions, with improving ocean logistics and freight rates, although concerns about pulp demand are emerging with lower consumption of paper and packaging products. Final November list prices for US NBSK were down 1.4% m/m to $1,745/tonne, while SBSK was also down 1.1% m/m $1,720/tonne. We forecast average NBSK list prices for Q422 of $1,750/tonne (a further ~$10/tonne drop in December).

Pulp shipments were up 2.2% y/y (hardwood +5.2%; softwood -1.0%) in October, which is the weakest y/y growth reported since April 2022. Shipments were down 10.1% m/m, with hardwood (-17.4%) and softwood (-0.3%) both trending lower; however, on a seasonally adjusted basis, shipment volumes decreased a more modest ~1.0% m/m. Commentary out of London Pulp Week earlier this month highlighted easing supply chain conditions, with improving ocean logistics and freight rates, although concerns about pulp demand are emerging with lower consumption of paper and packaging products. Final November list prices for US NBSK were down 1.4% m/m to $1,745/tonne, while SBSK was also down 1.1% m/m $1,720/tonne. We forecast average NBSK list prices for Q422 of $1,750/tonne (a further ~$10/tonne drop in December).

The housing market has fallen off a cliff, but for now, homebuilders are biding their time. …The key to the outlook in 2023 is the huge order backlogs that builders accumulated when mortgage rates were still at rock bottom and sales surged during the pandemic. When the housing market slowed earlier this year, that backlog bought homebuilders time to wait out the slump. Though sales have been weak for months, a large chunk of the new homes and earnings builders will deliver in 2023 are based on orders banked in the first half of 2022. As we get into the new year, those order backlogs will shrink and it will be time to think about building a new book of orders for 2024. So while housing starts have slowed, it won’t take much for them to pick up before midyear, even if it means more price cuts and incentives.

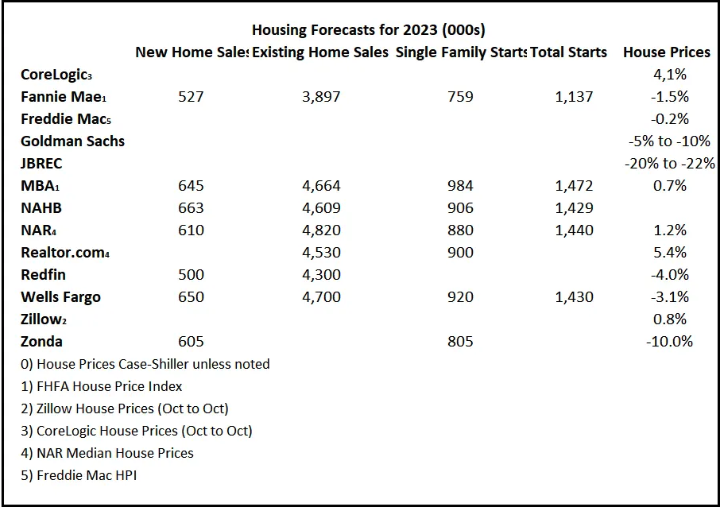

The housing market has fallen off a cliff, but for now, homebuilders are biding their time. …The key to the outlook in 2023 is the huge order backlogs that builders accumulated when mortgage rates were still at rock bottom and sales surged during the pandemic. When the housing market slowed earlier this year, that backlog bought homebuilders time to wait out the slump. Though sales have been weak for months, a large chunk of the new homes and earnings builders will deliver in 2023 are based on orders banked in the first half of 2022. As we get into the new year, those order backlogs will shrink and it will be time to think about building a new book of orders for 2024. So while housing starts have slowed, it won’t take much for them to pick up before midyear, even if it means more price cuts and incentives. Towards the end of each year, I collect some housing forecasts for the following year. For comparison, new home sales in 2022 will probably be around 640 thousand, down from 771 thousand in 2021. Total housing starts will be around 1.55 million in 2022, down slightly from 1.60 million in 2021. Existing home sales will be around 5.1 million in 2022, down from 6.1 million in 2021. As of September, Case-Shiller house prices were up 10.6% year-over-year, but the year-over-year change is slowing rapidly.

Towards the end of each year, I collect some housing forecasts for the following year. For comparison, new home sales in 2022 will probably be around 640 thousand, down from 771 thousand in 2021. Total housing starts will be around 1.55 million in 2022, down slightly from 1.60 million in 2021. Existing home sales will be around 5.1 million in 2022, down from 6.1 million in 2021. As of September, Case-Shiller house prices were up 10.6% year-over-year, but the year-over-year change is slowing rapidly.

The U.S. exported 750,989.2 metric tons of wood pellets in October, down slightly from 766,508.2 metric tons in September, but up when compared to the 422,107 metric tons exported in October 2021, according to data released by the USDA Foreign Agricultural Service on Dec. 6. The U.S. exported wood pellets to more than a dozen countries in October. The U.K. was the top destination at 440,933.9 metric tons, followed by the Netherlands at 228,344 metric tons, Japan at 40,561 metric tons and the French West Indies at 30,113.3 metric tons. The value of U.S. wood pellet exports was at $132.21 million in October, down from $136.9 million the previous month, but up from $58.84 million in October of last year. Total U.S. wood pellet exports for the first 10 months of 2022 reached 7.37 million metric tons at a value of $1.27 billion.

The U.S. exported 750,989.2 metric tons of wood pellets in October, down slightly from 766,508.2 metric tons in September, but up when compared to the 422,107 metric tons exported in October 2021, according to data released by the USDA Foreign Agricultural Service on Dec. 6. The U.S. exported wood pellets to more than a dozen countries in October. The U.K. was the top destination at 440,933.9 metric tons, followed by the Netherlands at 228,344 metric tons, Japan at 40,561 metric tons and the French West Indies at 30,113.3 metric tons. The value of U.S. wood pellet exports was at $132.21 million in October, down from $136.9 million the previous month, but up from $58.84 million in October of last year. Total U.S. wood pellet exports for the first 10 months of 2022 reached 7.37 million metric tons at a value of $1.27 billion.

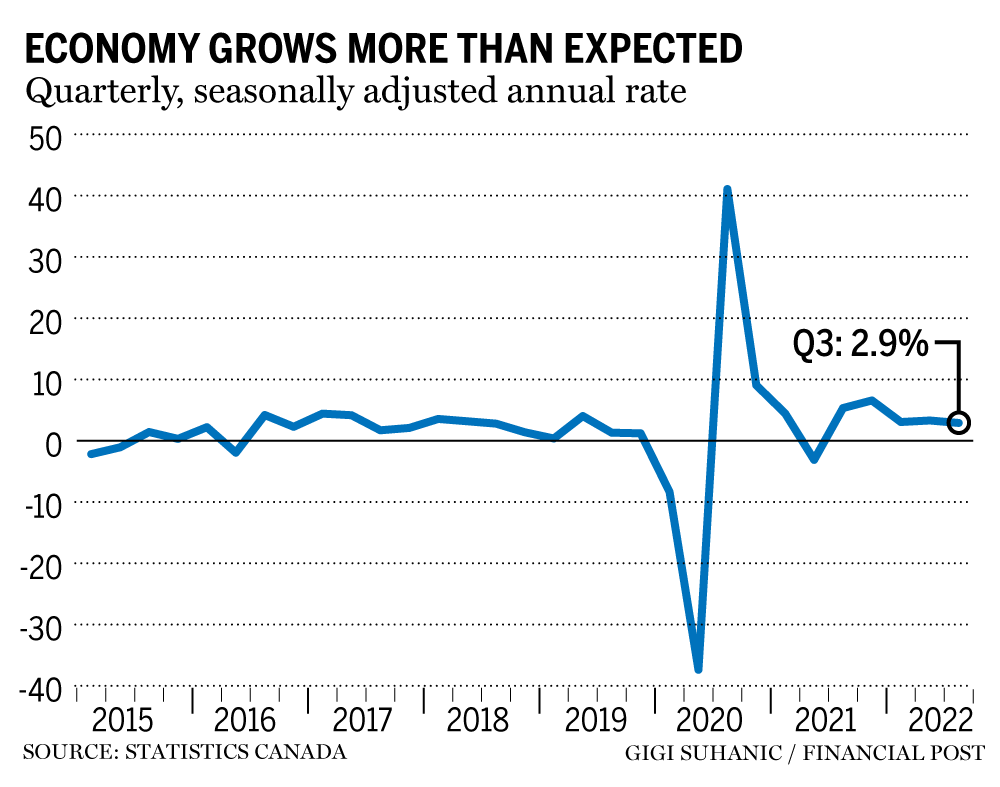

The Housing Market Index, a closely watched industry metric that gauges the outlook for home sales, declined to 33 in November on a hundred-point scale, its lowest level in a decade, save for the first dystopian month of the pandemic. Anything under 50 spells trouble. A month earlier, interest rates on a standard 30-year mortgage passed 7 percent, capping the largest single-year increase in at least 50 years. …The housing market is already in recession and has been since midsummer, according to the National Association of Home Builders, which publishes the Housing Market Index with Wells Fargo. …Where the housing market goes, the broader economy follows. Dietz, Fratantoni and others in the industry expect the nation to tip into recession. …“The housing market leads the U.S. into recession, and it’s likely to pull it out,” Fratantoni said, with recovery arriving around the middle of next year.

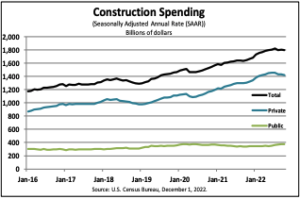

The Housing Market Index, a closely watched industry metric that gauges the outlook for home sales, declined to 33 in November on a hundred-point scale, its lowest level in a decade, save for the first dystopian month of the pandemic. Anything under 50 spells trouble. A month earlier, interest rates on a standard 30-year mortgage passed 7 percent, capping the largest single-year increase in at least 50 years. …The housing market is already in recession and has been since midsummer, according to the National Association of Home Builders, which publishes the Housing Market Index with Wells Fargo. …Where the housing market goes, the broader economy follows. Dietz, Fratantoni and others in the industry expect the nation to tip into recession. …“The housing market leads the U.S. into recession, and it’s likely to pull it out,” Fratantoni said, with recovery arriving around the middle of next year. Total Construction Construction spending during October 2022 was estimated at a seasonally adjusted annual rate of $1,794.9 billion, 0.3 percent below the revised September estimate of $1,800.1 billion. The October figure is 9.2 percent above the October 2021 estimate of $1,644.3 billion. During the first ten months of this year, construction spending amounted to $1,507.8 billion, 10.8 percent above the $1,360.8 billion for the same period in 2021. Private Construction Spending on private construction was at a seasonally adjusted annual rate of $1,420.4 billion, 0.5 percent below the revised September estimate of $1,427.6 billion. Residential construction was at a seasonally adjusted annual rate of $887.2 billion in October, 0.3 percent below the revised September estimate of $890.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $533.2 billion in October, 0.8 percent below the revised September estimate of $537.6 billion.

Total Construction Construction spending during October 2022 was estimated at a seasonally adjusted annual rate of $1,794.9 billion, 0.3 percent below the revised September estimate of $1,800.1 billion. The October figure is 9.2 percent above the October 2021 estimate of $1,644.3 billion. During the first ten months of this year, construction spending amounted to $1,507.8 billion, 10.8 percent above the $1,360.8 billion for the same period in 2021. Private Construction Spending on private construction was at a seasonally adjusted annual rate of $1,420.4 billion, 0.5 percent below the revised September estimate of $1,427.6 billion. Residential construction was at a seasonally adjusted annual rate of $887.2 billion in October, 0.3 percent below the revised September estimate of $890.0 billion. Nonresidential construction was at a seasonally adjusted annual rate of $533.2 billion in October, 0.8 percent below the revised September estimate of $537.6 billion.

As the industry plunges headlong into the heart of the home heating season and consumers fire up their pellet appliances, we are being reminded that despite the year’s unique marketplace dynamics, it is the weather that drives demand. …The industry has successfully increased early pellet buying with its end users. By the end of summer, most pellet users have purchased some, but likely not all, the pellets they will need for the season. …It is this late season “top off” that separates the years with strong sales numbers from those with disappointing results. …While the heating season will be all but over before a clear picture of how the year unfolded emerges, I suspect that producers—hoping to avoid two consecutive years where sales fizzled—are taking opportunities to move pellet volume overseas when and where they can.

As the industry plunges headlong into the heart of the home heating season and consumers fire up their pellet appliances, we are being reminded that despite the year’s unique marketplace dynamics, it is the weather that drives demand. …The industry has successfully increased early pellet buying with its end users. By the end of summer, most pellet users have purchased some, but likely not all, the pellets they will need for the season. …It is this late season “top off” that separates the years with strong sales numbers from those with disappointing results. …While the heating season will be all but over before a clear picture of how the year unfolded emerges, I suspect that producers—hoping to avoid two consecutive years where sales fizzled—are taking opportunities to move pellet volume overseas when and where they can.

Consumer sentiment regarding the housing market fell to a record low as mortgage rates rise and make homes much less affordable. About 4 out of every 5 consumers describe home buying conditions as bad, according to the University of Michigan’s consumer sentiment survey for this month. That is the highest number recorded by the survey, which goes back to 1978. The results are yet another indicator that the housing market is getting battered by the Federal Reserve’s historic efforts to hike interest rates to drive down explosive inflation quickly and aggressively. While mortgage rates have dropped a bit in recent days, as of Tuesday, the average 30-year fixed-rate mortgage popped to 6.64%, up a staggering 3.19 percentage points from a year before. …On Tuesday, it was revealed that investor home purchases also plummeted in the third quarter, a sign that not only are traditional buyers pulling back.

Consumer sentiment regarding the housing market fell to a record low as mortgage rates rise and make homes much less affordable. About 4 out of every 5 consumers describe home buying conditions as bad, according to the University of Michigan’s consumer sentiment survey for this month. That is the highest number recorded by the survey, which goes back to 1978. The results are yet another indicator that the housing market is getting battered by the Federal Reserve’s historic efforts to hike interest rates to drive down explosive inflation quickly and aggressively. While mortgage rates have dropped a bit in recent days, as of Tuesday, the average 30-year fixed-rate mortgage popped to 6.64%, up a staggering 3.19 percentage points from a year before. …On Tuesday, it was revealed that investor home purchases also plummeted in the third quarter, a sign that not only are traditional buyers pulling back.

Old corrugated containers (OCC) pricing fell for the fourth straight month by as much as $20 per ton in some regions, and one analyst predicts pricing soon will reach an all-time low. According to Fastmarkets, OCC pricing has dropped $97 per ton in four months, with the November U.S. average price at $29 per ton compared with $137 per ton in December of last year. Adam Josephson, with KeyBanc Capital Markets said that the industry’s operating rate dropped to 87.6 percent—the lowest in any quarter since the Great Recession in 2009—and supply of containerboard at box plants and mills rose to 4.8 weeks at the end of the third quarter, marking the highest in any month since February 2009. He also notes that U.S. containerboard inventories increased by 151,000 tons from the second quarter, reaching nearly 3.02 million tons in September.

Old corrugated containers (OCC) pricing fell for the fourth straight month by as much as $20 per ton in some regions, and one analyst predicts pricing soon will reach an all-time low. According to Fastmarkets, OCC pricing has dropped $97 per ton in four months, with the November U.S. average price at $29 per ton compared with $137 per ton in December of last year. Adam Josephson, with KeyBanc Capital Markets said that the industry’s operating rate dropped to 87.6 percent—the lowest in any quarter since the Great Recession in 2009—and supply of containerboard at box plants and mills rose to 4.8 weeks at the end of the third quarter, marking the highest in any month since February 2009. He also notes that U.S. containerboard inventories increased by 151,000 tons from the second quarter, reaching nearly 3.02 million tons in September.