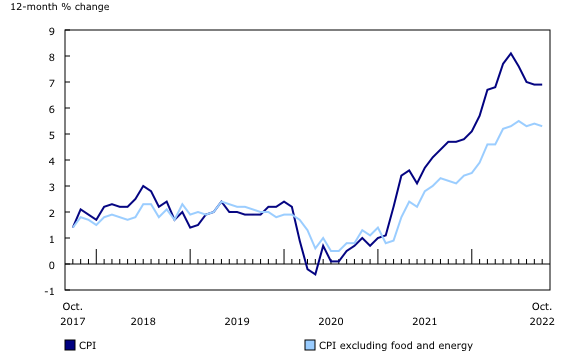

World leaders of the Group of 20 this week concluded a two-day summit in Indonesia at a time when nearly all member nations are battling sky-high inflation rates. While it stayed steady in Canada in October compared to the previous month, inflation remains stubbornly high across many G20 nations and is yet to fall to pre-pandemic levels. Through a declaration, the G20 economies agreed to pace interest rates to avoid any “cross-country spillovers.” So far, Argentina tops G20 economies with a staggering inflation rate of 88 per cent in October, surpassing Turkiye’s at 85.5 per cent. Amongst the advanced G20 economies, the U.K. faces the second-highest inflation of 11.1 per cent, after Italy recorded 12.8 per cent in October 2022. Canada’s current inflation rate was 6.9 per cent in October, matching the 6.9 per cent recorded in September.

World leaders of the Group of 20 this week concluded a two-day summit in Indonesia at a time when nearly all member nations are battling sky-high inflation rates. While it stayed steady in Canada in October compared to the previous month, inflation remains stubbornly high across many G20 nations and is yet to fall to pre-pandemic levels. Through a declaration, the G20 economies agreed to pace interest rates to avoid any “cross-country spillovers.” So far, Argentina tops G20 economies with a staggering inflation rate of 88 per cent in October, surpassing Turkiye’s at 85.5 per cent. Amongst the advanced G20 economies, the U.K. faces the second-highest inflation of 11.1 per cent, after Italy recorded 12.8 per cent in October 2022. Canada’s current inflation rate was 6.9 per cent in October, matching the 6.9 per cent recorded in September.

BURNABY, BC — Interfor recorded net earnings in Q3’22 of $3.5 million compared to $269.9 million in Q2’22 and $65.6 million. Adjusted net earnings in Q3’22 were $31.5 million compared to $280.2 million in Q2’22 and $46.7 million in Q3’21. Adjusted EBITDA was $129.5 million on sales of $1.0 billion in Q3’22 versus $428.6 million on sales of $1.4 billion in Q2’22. Lumber production totaled 986 million board feet, representing a decrease of 30 million board feet quarter-over-quarter. The U.S. South and U.S. Northwest regions accounted for 470 million board feet and 159 million board feet, respectively, compared to 467 million board feet and 163 million board feet in Q2’22. The Eastern Canada Operations produced 198 million board feet versus 211 million board feet in Q2’22. Production in the B.C. region decreased to 159 million board feet from 174 million board feet in Q2’22, in part due to the sale of the Acorn sawmill during Q2’22.

BURNABY, BC — Interfor recorded net earnings in Q3’22 of $3.5 million compared to $269.9 million in Q2’22 and $65.6 million. Adjusted net earnings in Q3’22 were $31.5 million compared to $280.2 million in Q2’22 and $46.7 million in Q3’21. Adjusted EBITDA was $129.5 million on sales of $1.0 billion in Q3’22 versus $428.6 million on sales of $1.4 billion in Q2’22. Lumber production totaled 986 million board feet, representing a decrease of 30 million board feet quarter-over-quarter. The U.S. South and U.S. Northwest regions accounted for 470 million board feet and 159 million board feet, respectively, compared to 467 million board feet and 163 million board feet in Q2’22. The Eastern Canada Operations produced 198 million board feet versus 211 million board feet in Q2’22. Production in the B.C. region decreased to 159 million board feet from 174 million board feet in Q2’22, in part due to the sale of the Acorn sawmill during Q2’22. VANCOUVER, British Columbia — Western Forest Products reported net income of $6.6 million and adjusted EBITDA of $17.3 million in the third quarter of 2022. Results reflect compressed margins on lower lumber production and shipments and $23.1 million of inventory provisions, partly offset by an $18.0 million export tax recovery. Net income in the third quarter of 2022 was $6.6 million as compared to net income of $38.6 million for the second quarter of 2022, and net income of $42.2 million in the third quarter of 2021. …Western’s third quarter adjusted EBITDA was $17.3 million, as compared to adjusted EBITDA of $66.2 million in the second quarter of 2022, and adjusted EBITDA of $66.3 million in the third quarter of 2021. “Our results on the quarter reflect challenging global market conditions, reduced lumber sales volumes and continued pressure on log costs and logistics,” said Steven Hofer, Western’s President and CEO.

VANCOUVER, British Columbia — Western Forest Products reported net income of $6.6 million and adjusted EBITDA of $17.3 million in the third quarter of 2022. Results reflect compressed margins on lower lumber production and shipments and $23.1 million of inventory provisions, partly offset by an $18.0 million export tax recovery. Net income in the third quarter of 2022 was $6.6 million as compared to net income of $38.6 million for the second quarter of 2022, and net income of $42.2 million in the third quarter of 2021. …Western’s third quarter adjusted EBITDA was $17.3 million, as compared to adjusted EBITDA of $66.2 million in the second quarter of 2022, and adjusted EBITDA of $66.3 million in the third quarter of 2021. “Our results on the quarter reflect challenging global market conditions, reduced lumber sales volumes and continued pressure on log costs and logistics,” said Steven Hofer, Western’s President and CEO.

MONTREAL — Stella-Jones announced financial results for its third quarter ended September 30, 2022. …Sales for the third quarter of 2022 increased by 24% to $842 million, compared to sales of $679 million for the same period in 2021. Excluding the $17 million favourable impact of currency conversion and the contribution from the acquisitions of Cahaba Pressure Treated Forest Products and Cahaba Timber of $17 million, pressure-treated wood sales rose by $125 million, while sales of logs and lumber remained relatively stable. Pressure-treated wood sales attributable to infrastructure-related businesses, namely utility poles, railway ties and industrial products, grew by 15% and residential lumber sales increased by over 30% compared to the lower sales experienced in the same period last year. …“Stella-Jones delivered strong results this quarter, reflecting the robust growth of our infrastructure-related product sales and the normalization of residential lumber sales,” said CEO Éric Vachon.

MONTREAL — Stella-Jones announced financial results for its third quarter ended September 30, 2022. …Sales for the third quarter of 2022 increased by 24% to $842 million, compared to sales of $679 million for the same period in 2021. Excluding the $17 million favourable impact of currency conversion and the contribution from the acquisitions of Cahaba Pressure Treated Forest Products and Cahaba Timber of $17 million, pressure-treated wood sales rose by $125 million, while sales of logs and lumber remained relatively stable. Pressure-treated wood sales attributable to infrastructure-related businesses, namely utility poles, railway ties and industrial products, grew by 15% and residential lumber sales increased by over 30% compared to the lower sales experienced in the same period last year. …“Stella-Jones delivered strong results this quarter, reflecting the robust growth of our infrastructure-related product sales and the normalization of residential lumber sales,” said CEO Éric Vachon.

The best way to fight inflation is to add more supply. …In previous expansions, builders’ housing completion data would move in line with housing starts and permits. However, for the first time in recent modern-day history — due to supply chain issues and other factors — housing completion data has lagged behind housing permits and starts. It simply has taken too long to build homes to full completion over the last several years. …With that said, we all need to hope that the builders can get the wave of multifamily construction onto the market for next year to drive rent inflation lower and lower. That will be a plus for mortgage rates, which can get us out of the housing recession. As you can see from today’s report, we aren’t there yet, but we have the supply coming!

The best way to fight inflation is to add more supply. …In previous expansions, builders’ housing completion data would move in line with housing starts and permits. However, for the first time in recent modern-day history — due to supply chain issues and other factors — housing completion data has lagged behind housing permits and starts. It simply has taken too long to build homes to full completion over the last several years. …With that said, we all need to hope that the builders can get the wave of multifamily construction onto the market for next year to drive rent inflation lower and lower. That will be a plus for mortgage rates, which can get us out of the housing recession. As you can see from today’s report, we aren’t there yet, but we have the supply coming!

Home Depot reported Tuesday its third-quarter revenue increased nearly 6% to $38.9 billion, beating analyst expectations, as the retailer continued to beckon customers despite rising costs and macroeconomic pressures. Both its professional and do-it-yourself sales saw positive growth during the period, the retailer’s management said on a call with investors, adding professionals say their backlogs remain strong. …“We’re navigating a unique environment,” Home Depot CEO Ted Decker said on Tuesday’s call with investors. “We can’t predict how the macroeconomic backdrop will affect customers going forward.” Despite this, he added the company believes demand will remain strong, especially as consumers continue to stay home more than usual. The typical Home Depot customer is still able to afford home improvement projects, he said.

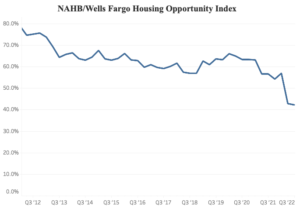

Home Depot reported Tuesday its third-quarter revenue increased nearly 6% to $38.9 billion, beating analyst expectations, as the retailer continued to beckon customers despite rising costs and macroeconomic pressures. Both its professional and do-it-yourself sales saw positive growth during the period, the retailer’s management said on a call with investors, adding professionals say their backlogs remain strong. …“We’re navigating a unique environment,” Home Depot CEO Ted Decker said on Tuesday’s call with investors. “We can’t predict how the macroeconomic backdrop will affect customers going forward.” Despite this, he added the company believes demand will remain strong, especially as consumers continue to stay home more than usual. The typical Home Depot customer is still able to afford home improvement projects, he said. Rising mortgage rates, high inflation, ongoing building material supply chain disruptions, and elevated home prices contributed to housing affordability falling – yet again – to its lowest point since the Great Recession in the third quarter of 2022. According to the NAHB/Wells Fargo Housing Opportunity Index, just 42.2% of new and existing homes sold between the beginning of July and end of September were affordable to families earning the U.S. median income of $90,000. This marks the second consecutive record low for housing affordability in more than a decade, trailing the previous mark of 42.8% set in the second quarter.

Rising mortgage rates, high inflation, ongoing building material supply chain disruptions, and elevated home prices contributed to housing affordability falling – yet again – to its lowest point since the Great Recession in the third quarter of 2022. According to the NAHB/Wells Fargo Housing Opportunity Index, just 42.2% of new and existing homes sold between the beginning of July and end of September were affordable to families earning the U.S. median income of $90,000. This marks the second consecutive record low for housing affordability in more than a decade, trailing the previous mark of 42.8% set in the second quarter.

The U.S. exported 766,508.2 metric tons of wood pellets in September, down from 880,876 metric tons the previous month, but up from 690,514.5 metric tons in September 2021, according to the USDA on Nov. 3. The U.S. exported wood pellets to approximately one dozen countries in September. The U.K. was the top destination for U.S. wood pellet exports at 459,203.7 metric tons, followed by Denmark at 120,703.2 metric tons, Japan at 67,797 metric tons, the Netherlands at 64,664.3 metric tons and Belgium-Luxembourg at 48,392.9 metric tons. The value of U.S. wood pellet exports was at $136.9 million in September, down from $150.74 million in August, but up from $101.96 million in September of last year. Total wood pellet exports for the first nine months of 2022 reached 6.61 million metric tons at a value of $1.14 billion.

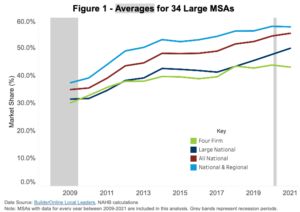

The U.S. exported 766,508.2 metric tons of wood pellets in September, down from 880,876 metric tons the previous month, but up from 690,514.5 metric tons in September 2021, according to the USDA on Nov. 3. The U.S. exported wood pellets to approximately one dozen countries in September. The U.K. was the top destination for U.S. wood pellet exports at 459,203.7 metric tons, followed by Denmark at 120,703.2 metric tons, Japan at 67,797 metric tons, the Netherlands at 64,664.3 metric tons and Belgium-Luxembourg at 48,392.9 metric tons. The value of U.S. wood pellet exports was at $136.9 million in September, down from $150.74 million in August, but up from $101.96 million in September of last year. Total wood pellet exports for the first nine months of 2022 reached 6.61 million metric tons at a value of $1.14 billion. NAHB analysis

NAHB analysis Soaring US interest rates have done little to curb inflation, but they’re hitting housing hard. The surge in borrowing costs has eroded affordability for buyers, slowing residential sales and building activity, and threatening economic growth. Home sales and housing starts have slumped after peaking during the first couple of years of the Covid-19 pandemic, when low borrowing costs allowed millions to relocate. Housing downturns ripple through the economy. Real estate and construction account for millions of US jobs, and home sales have historically been a driver of consumer spending. For many Americans a home is their biggest asset, so falling values can hurt confidence and spending. Prices have begun to roll over after a huge runup, but a crash isn’t inevitable. Many owners took advantage of low rates to refinance and may stay put. That could keep inventory low, helping support prices.

Soaring US interest rates have done little to curb inflation, but they’re hitting housing hard. The surge in borrowing costs has eroded affordability for buyers, slowing residential sales and building activity, and threatening economic growth. Home sales and housing starts have slumped after peaking during the first couple of years of the Covid-19 pandemic, when low borrowing costs allowed millions to relocate. Housing downturns ripple through the economy. Real estate and construction account for millions of US jobs, and home sales have historically been a driver of consumer spending. For many Americans a home is their biggest asset, so falling values can hurt confidence and spending. Prices have begun to roll over after a huge runup, but a crash isn’t inevitable. Many owners took advantage of low rates to refinance and may stay put. That could keep inventory low, helping support prices.

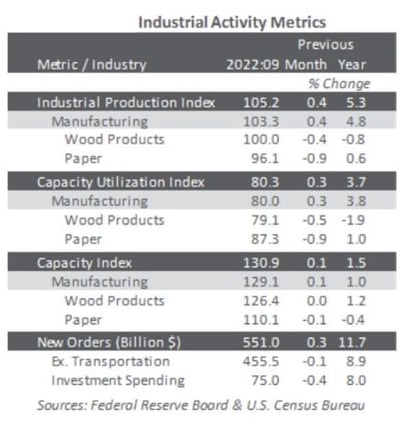

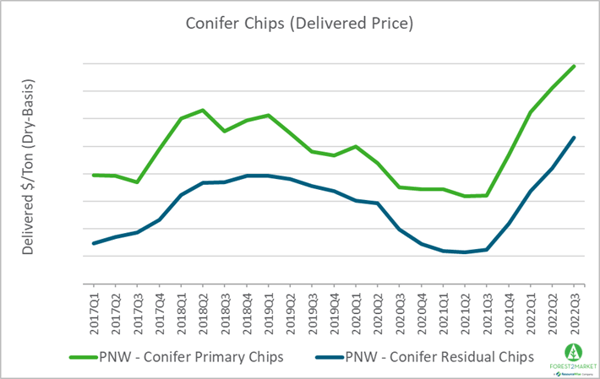

Plan for market conditions to get worse before they get better. Despite battling supply chain issues since late 2020, the construction industry will see continued material price escalation over the next couple of years, according to industry sources. The forecast for year-over-year price escalation in 2022 remains between 9% to 12%, said Michael Hardman, vice president of Turner & Townsend, a U.K.-based global real estate and infrastructure consultancy. At the same time, mounting inflation in the U.S. will further compound these difficulties. …Cement and concrete prices have continued to climb recently, reflecting higher production costs, which were up about 14% year-over-year in the third quarter of 2022. …But while prices for cement and concrete jump, other structural materials, such as steel [and lumber], have experienced a slightly different journey.

Plan for market conditions to get worse before they get better. Despite battling supply chain issues since late 2020, the construction industry will see continued material price escalation over the next couple of years, according to industry sources. The forecast for year-over-year price escalation in 2022 remains between 9% to 12%, said Michael Hardman, vice president of Turner & Townsend, a U.K.-based global real estate and infrastructure consultancy. At the same time, mounting inflation in the U.S. will further compound these difficulties. …Cement and concrete prices have continued to climb recently, reflecting higher production costs, which were up about 14% year-over-year in the third quarter of 2022. …But while prices for cement and concrete jump, other structural materials, such as steel [and lumber], have experienced a slightly different journey.