Alain Ouzilleau, owner of Groupe Cabico, spent millions upgrading his two factories in Quebec and Ontario into state-of-the-art facilities shipping around $100-million worth of high-end kitchen cabinets to the US each year. Almost overnight, that business has been thrown into jeopardy. …“We have very long-term loyal customers,” Mr. Ouzilleau said. “But the 50% that is planned to be effective January 1st is just a death sentence.” …Hundreds of other Canadian cabinet and furniture makers also stand to lose their key export business, with limited ability to expand in a crowded domestic market. …What started as tariffs on steel, aluminum and automobiles has expanded to include copper and lumber, with a tariff on heavy trucks slated to come into force in November. The Trump administration is also conducting investigations into aircraft, semiconductors and industrial machinery, among other industries, suggesting more tariffs are on the horizon. [to access the full story a Globe & Mail subscription is required]

Alain Ouzilleau, owner of Groupe Cabico, spent millions upgrading his two factories in Quebec and Ontario into state-of-the-art facilities shipping around $100-million worth of high-end kitchen cabinets to the US each year. Almost overnight, that business has been thrown into jeopardy. …“We have very long-term loyal customers,” Mr. Ouzilleau said. “But the 50% that is planned to be effective January 1st is just a death sentence.” …Hundreds of other Canadian cabinet and furniture makers also stand to lose their key export business, with limited ability to expand in a crowded domestic market. …What started as tariffs on steel, aluminum and automobiles has expanded to include copper and lumber, with a tariff on heavy trucks slated to come into force in November. The Trump administration is also conducting investigations into aircraft, semiconductors and industrial machinery, among other industries, suggesting more tariffs are on the horizon. [to access the full story a Globe & Mail subscription is required]

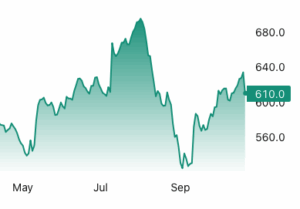

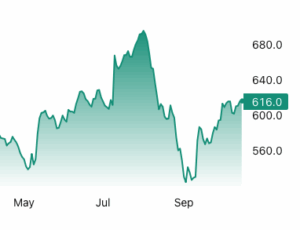

Lumber futures fell below $610 per thousand board feet, their lowest level since October 8 and down 12% from a three-year high in early August, as a slowing US housing market outweighed potential supply curbs from tariffs. August building permits dropped to a seasonally adjusted annualized rate of 1.33 million, the lowest since May 2020, while housing starts fell 8.5%, marking the fourth-lowest reading in over five years. Earlier this month, the US imposed a 10% tariff on Canadian lumber, with the Trump administration stating it aims to expand domestic timber harvesting and reduce reliance on foreign lumber. Looking ahead, expected Federal Reserve rate cuts could stimulate construction and home buying and encourage homeowners to borrow for repairs and renovations, the largest driver of lumber demand. However, signs of a slowing labor market and rising inflation suggest demand may remain subdued.

Lumber futures fell below $610 per thousand board feet, their lowest level since October 8 and down 12% from a three-year high in early August, as a slowing US housing market outweighed potential supply curbs from tariffs. August building permits dropped to a seasonally adjusted annualized rate of 1.33 million, the lowest since May 2020, while housing starts fell 8.5%, marking the fourth-lowest reading in over five years. Earlier this month, the US imposed a 10% tariff on Canadian lumber, with the Trump administration stating it aims to expand domestic timber harvesting and reduce reliance on foreign lumber. Looking ahead, expected Federal Reserve rate cuts could stimulate construction and home buying and encourage homeowners to borrow for repairs and renovations, the largest driver of lumber demand. However, signs of a slowing labor market and rising inflation suggest demand may remain subdued. The Canadian government has opened applications for a $700 million loan guarantee program that helps lumber companies weather mounting US tariffs that have pushed some firms into bankruptcy. The Business Development Bank of Canada

The Canadian government has opened applications for a $700 million loan guarantee program that helps lumber companies weather mounting US tariffs that have pushed some firms into bankruptcy. The Business Development Bank of Canada

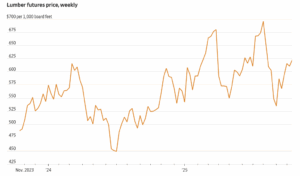

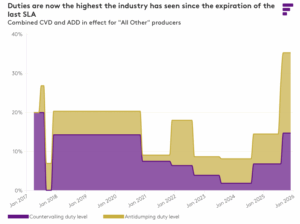

Lumber futures have risen about 19% from a low hit in early September, driven by the production cuts, hopes that declining interest rates will revive the housing market and Trump’s import tax. The 10% levy is on top of steep duties on Canadian lumber, which are adjusted annually in a heavily litigated process that is the result of a decades-long trade dispute. Those antidumping and countervailing duties rose in August to about 35% for most Canadian producers, up from roughly 15%. Canada’s sawmills are by far the largest source of softwood lumber from beyond U.S. borders, fulfilling about 24% of domestic consumption last year. Other significant importers of softwood lumber, the type used to frame houses, include Brazil and European countries such as Germany and Sweden. Homebuilders argue that import taxes will raise construction costs. U.S. lumber producers and timberland owners, however, urged Trump to enact a tariff.

Lumber futures have risen about 19% from a low hit in early September, driven by the production cuts, hopes that declining interest rates will revive the housing market and Trump’s import tax. The 10% levy is on top of steep duties on Canadian lumber, which are adjusted annually in a heavily litigated process that is the result of a decades-long trade dispute. Those antidumping and countervailing duties rose in August to about 35% for most Canadian producers, up from roughly 15%. Canada’s sawmills are by far the largest source of softwood lumber from beyond U.S. borders, fulfilling about 24% of domestic consumption last year. Other significant importers of softwood lumber, the type used to frame houses, include Brazil and European countries such as Germany and Sweden. Homebuilders argue that import taxes will raise construction costs. U.S. lumber producers and timberland owners, however, urged Trump to enact a tariff. Lumber futures rose past $610 per thousand board feet in mid-October, approaching monthly highs as markets priced in tighter near-term supply and looming trade restrictions. Under newly announced US Section 232 tariffs that take effect on October 14th, imported softwood lumber will face a 10% duty and finished wood goods such as cabinets and furniture will face higher levies, prompting importers to front-load purchases and draw down inventories. Domestic output is also constrained as sawmills run cautiously after years of underinvestment, logging curbs in sensitive regions and slow capacity restarts have limited production. The cost and delay of switching suppliers is material given that Canadian lumber, which supplies much of US demand, already carries elevated antidumping and countervailing duties, intensifying the supply squeeze.

Lumber futures rose past $610 per thousand board feet in mid-October, approaching monthly highs as markets priced in tighter near-term supply and looming trade restrictions. Under newly announced US Section 232 tariffs that take effect on October 14th, imported softwood lumber will face a 10% duty and finished wood goods such as cabinets and furniture will face higher levies, prompting importers to front-load purchases and draw down inventories. Domestic output is also constrained as sawmills run cautiously after years of underinvestment, logging curbs in sensitive regions and slow capacity restarts have limited production. The cost and delay of switching suppliers is material given that Canadian lumber, which supplies much of US demand, already carries elevated antidumping and countervailing duties, intensifying the supply squeeze. North America’s softwood lumber market looks likely to end 2025 no more settled than it was at the beginning. Producers and buyers alike continue navigating a landscape shaped by fluctuating demand, shifting trade patterns, and an uncertain housing outlook. Despite modest production declines in early 2025, the lumber market remains oversupplied. Mills across the US and Canada are contending with high inventories built up earlier in the year. Expectations of tariff hikes spurred an early rush of exports from Canada to the US, flooding the market while demand was soft. However, in the first half of 2025 softwood lumber exports from Canada to the US declined, while US imports from Europe in the first seven months of 2025 increased by 6% year-over-year. Underlying these supply pressures is a US housing market stuck in the doldrums. August saw an 8.5% decline in overall housing starts, with single-family construction down nearly 7%.

North America’s softwood lumber market looks likely to end 2025 no more settled than it was at the beginning. Producers and buyers alike continue navigating a landscape shaped by fluctuating demand, shifting trade patterns, and an uncertain housing outlook. Despite modest production declines in early 2025, the lumber market remains oversupplied. Mills across the US and Canada are contending with high inventories built up earlier in the year. Expectations of tariff hikes spurred an early rush of exports from Canada to the US, flooding the market while demand was soft. However, in the first half of 2025 softwood lumber exports from Canada to the US declined, while US imports from Europe in the first seven months of 2025 increased by 6% year-over-year. Underlying these supply pressures is a US housing market stuck in the doldrums. August saw an 8.5% decline in overall housing starts, with single-family construction down nearly 7%. President Trump unveiled sweeping tariffs on imported lumber and wood products that his administration says are needed to protect the US economy and boost domestic manufacturing. Starting Oct. 14, softwood lumber will face 10% duties, while kitchen cabinets, bathroom vanities, and other finished wood goods will be hit with 25% tariffs that rise further in January. The biggest blow will fall on Canada, the US’s top lumber supplier, whose lumber exports are already subject to separate duties totaling 35.19%. …Though Canada dominates exports of lumber to the US, many other countries export wood products to the US. The Section 232 tariffs on lumber and wood products affect them in varying ways; some countries benefit from trade deals with the US that cap the rates, and others bear the full brunt. …Though lumber accounts for less than 20% of building costs, the National Association of Homebuilders has long said that restrictions on Canadian lumber translate to higher construction costs. [to access the full story a Bloomberg subscription is required]

President Trump unveiled sweeping tariffs on imported lumber and wood products that his administration says are needed to protect the US economy and boost domestic manufacturing. Starting Oct. 14, softwood lumber will face 10% duties, while kitchen cabinets, bathroom vanities, and other finished wood goods will be hit with 25% tariffs that rise further in January. The biggest blow will fall on Canada, the US’s top lumber supplier, whose lumber exports are already subject to separate duties totaling 35.19%. …Though Canada dominates exports of lumber to the US, many other countries export wood products to the US. The Section 232 tariffs on lumber and wood products affect them in varying ways; some countries benefit from trade deals with the US that cap the rates, and others bear the full brunt. …Though lumber accounts for less than 20% of building costs, the National Association of Homebuilders has long said that restrictions on Canadian lumber translate to higher construction costs. [to access the full story a Bloomberg subscription is required] Canada’s international trade deficit swelled to $6.3 billion in August, its second-largest shortfall on record, as new United States tariffs took a heavy toll on key exports and injected fresh volatility into cross-border flows. The latest figures, released by Statistics Canada, show how US trade policy continues to affect Canadian exporters and make the Bank of Canada’s next interest rate decision more complicated. Exports in August fell 3% by value and 3.2% in volume, led by sharp declines in copper ore and lumber shipments, both of which were hit by new US tariffs. …Imports, meanwhile, rose 0.9%, buoyed by higher consumer goods, a sign of resilient household demand, even as business investment remained soft. …Exports to the US, Canada’s largest trading partner, fell 3.4% in August after three consecutive monthly gains, and were down 8% year-over-year. Exports to non-US destinations edged up 1.8% from a year ago but slipped 2% from July.

Canada’s international trade deficit swelled to $6.3 billion in August, its second-largest shortfall on record, as new United States tariffs took a heavy toll on key exports and injected fresh volatility into cross-border flows. The latest figures, released by Statistics Canada, show how US trade policy continues to affect Canadian exporters and make the Bank of Canada’s next interest rate decision more complicated. Exports in August fell 3% by value and 3.2% in volume, led by sharp declines in copper ore and lumber shipments, both of which were hit by new US tariffs. …Imports, meanwhile, rose 0.9%, buoyed by higher consumer goods, a sign of resilient household demand, even as business investment remained soft. …Exports to the US, Canada’s largest trading partner, fell 3.4% in August after three consecutive monthly gains, and were down 8% year-over-year. Exports to non-US destinations edged up 1.8% from a year ago but slipped 2% from July. Canada’s merchandise trade deficit widened in August to C$6.32 billion ($4.53 billion) as exports fell faster in both value and volume than the rise in imports on a monthly basis, official government statistics showed on Tuesday. The trade deficit in August was led by drop in exports not only to its top trading partner the U.S. but also because its shipments to the rest of the world shrank in the month. Canada’s international trade numbers took a beating early this year as US President Trump imposed sectoral tariffs on the country, forcing businesses to reorient supply chain from its biggest trading partner. But the shift has been volatile and erratic. Analysts polled by Reuters had forecast the August trade deficit at C$5.55 billion, up from an upwardly revised C$3.82 billion in the prior month. Total exports dropped by 3% while imports increased 0.9%, StatsCan said.

Canada’s merchandise trade deficit widened in August to C$6.32 billion ($4.53 billion) as exports fell faster in both value and volume than the rise in imports on a monthly basis, official government statistics showed on Tuesday. The trade deficit in August was led by drop in exports not only to its top trading partner the U.S. but also because its shipments to the rest of the world shrank in the month. Canada’s international trade numbers took a beating early this year as US President Trump imposed sectoral tariffs on the country, forcing businesses to reorient supply chain from its biggest trading partner. But the shift has been volatile and erratic. Analysts polled by Reuters had forecast the August trade deficit at C$5.55 billion, up from an upwardly revised C$3.82 billion in the prior month. Total exports dropped by 3% while imports increased 0.9%, StatsCan said. It’s hard to find anything good to say about Canadian forestry stocks right now. Some of the biggest names in the sector have been on a downward slide for the past three years. … But the onslaught of grim news has highlighted some bargains. …Okay, the definition of attractive rests on an assumption that risk-averse investors might not want to embrace just yet: Despite Mr. Trump’s bluster, the US still needs Canadian lumber in a big way to feed its lumber-intensive home construction industry. Says who? The National Association of Home Builders, for one. …Some analysts believe that US forestry companies will struggle to replace Canadian softwood. Ben Isaacson, at Bank of Nova Scotia, estimates that US producers would have to build 50 new mills to become fully independent of Canadian lumber. Just two companies build the specialized equipment required in mills. They would struggle to supply even two mills a year. [to access the full story a Globe & Mail subscription is required]

It’s hard to find anything good to say about Canadian forestry stocks right now. Some of the biggest names in the sector have been on a downward slide for the past three years. … But the onslaught of grim news has highlighted some bargains. …Okay, the definition of attractive rests on an assumption that risk-averse investors might not want to embrace just yet: Despite Mr. Trump’s bluster, the US still needs Canadian lumber in a big way to feed its lumber-intensive home construction industry. Says who? The National Association of Home Builders, for one. …Some analysts believe that US forestry companies will struggle to replace Canadian softwood. Ben Isaacson, at Bank of Nova Scotia, estimates that US producers would have to build 50 new mills to become fully independent of Canadian lumber. Just two companies build the specialized equipment required in mills. They would struggle to supply even two mills a year. [to access the full story a Globe & Mail subscription is required] Although we are skeptical how effective the C$500 million in “transition” funding will be, the C$700 million in loan guarantees, which are clearly designed as a short-term lifeline for companies to weather the storm, seem pretty meaningful to the Canadian industry at first glance. …If Canadian producers were to simply absorb the incremental duty rate increase, using today’s FOB price for most Canadian softwood lumber and last year’s export volumes to the US translates to a “just pay it” cost of C$1.6-1.7 billion in additional duty payments over the next 12 months. Canadian mill operators are not in a financial position to simply absorb an additional 21-percentage-point increase in duties, so this is an extreme estimate of the true cost. Mills will curtail output rather than continue producing at heavy losses until prices adjust accordingly. Additionally, there is usually some degree of passthrough from the buyer to the seller.

Although we are skeptical how effective the C$500 million in “transition” funding will be, the C$700 million in loan guarantees, which are clearly designed as a short-term lifeline for companies to weather the storm, seem pretty meaningful to the Canadian industry at first glance. …If Canadian producers were to simply absorb the incremental duty rate increase, using today’s FOB price for most Canadian softwood lumber and last year’s export volumes to the US translates to a “just pay it” cost of C$1.6-1.7 billion in additional duty payments over the next 12 months. Canadian mill operators are not in a financial position to simply absorb an additional 21-percentage-point increase in duties, so this is an extreme estimate of the true cost. Mills will curtail output rather than continue producing at heavy losses until prices adjust accordingly. Additionally, there is usually some degree of passthrough from the buyer to the seller. The softwood lumber trade dispute between the US and Canada, which has led to ever-higher US import duties on Canadian lumber, has lasted for decades. …Canadian lumber has the backing NAHB, which sees lumber tariffs as exacerbating high costs for builders and worsening the US housing affordability crisis. There is currently a “Wall of Wood” in the US, after Canadian producers increased shipments to the US in anticipation of the hike to existing ADD and CVD duties in August. Expectations that a large increase in duties would force the closure of Canadian sawmills, lead to shortages, and a boost in lumber prices, overlooked the current weak US demand for lumber, according to Matt Layman. …As US homebuilders now face additional tariff-driven costs, including a 50% tariff on cabinets and vanities, it’s hard to see the lumber demand situation improving, even if more Canadian suppliers have to curtail production or close sawmills.

The softwood lumber trade dispute between the US and Canada, which has led to ever-higher US import duties on Canadian lumber, has lasted for decades. …Canadian lumber has the backing NAHB, which sees lumber tariffs as exacerbating high costs for builders and worsening the US housing affordability crisis. There is currently a “Wall of Wood” in the US, after Canadian producers increased shipments to the US in anticipation of the hike to existing ADD and CVD duties in August. Expectations that a large increase in duties would force the closure of Canadian sawmills, lead to shortages, and a boost in lumber prices, overlooked the current weak US demand for lumber, according to Matt Layman. …As US homebuilders now face additional tariff-driven costs, including a 50% tariff on cabinets and vanities, it’s hard to see the lumber demand situation improving, even if more Canadian suppliers have to curtail production or close sawmills. Lumber futures prices are trading higher after President Trump slapped a 10% tariff on wood imports. Lumber prices have been on a rollercoaster this year, lifted by higher import taxes and tugged lower by the deteriorating housing and construction markets. …Trump’s executive order said the additional 10% tariff, which will also raise the price of lumber from European suppliers like Germany and Sweden, is aimed at protecting domestic sawmills. …Analysts expect the tariff to benefit domestic sawyers and timberland owners, such as Weyerhaeuser and PotlatchDeltic, at the expense of competitors north of the border, who have been losing US market share because of the duties, challenges supplying their sawmills with logs and the abundance of cheap US pine. “Canadian lumber producers’ cash costs should further increase, resulting in capacity closures and a tightening of lumber supply-demand dynamics,” said Michael Roxland of Truist Securities. [to access the full story a WSJ subscription is required]

Lumber futures prices are trading higher after President Trump slapped a 10% tariff on wood imports. Lumber prices have been on a rollercoaster this year, lifted by higher import taxes and tugged lower by the deteriorating housing and construction markets. …Trump’s executive order said the additional 10% tariff, which will also raise the price of lumber from European suppliers like Germany and Sweden, is aimed at protecting domestic sawmills. …Analysts expect the tariff to benefit domestic sawyers and timberland owners, such as Weyerhaeuser and PotlatchDeltic, at the expense of competitors north of the border, who have been losing US market share because of the duties, challenges supplying their sawmills with logs and the abundance of cheap US pine. “Canadian lumber producers’ cash costs should further increase, resulting in capacity closures and a tightening of lumber supply-demand dynamics,” said Michael Roxland of Truist Securities. [to access the full story a WSJ subscription is required] The Trump administration’s latest tariffs on housing materials could raise the average cost of building a single-family home by nearly $9,000, according to a report Tuesday from UBS. Research analyst John Lovallo said the new levies include “an incremental 10% Section 232 tariff on softwood timber and lumber imports, as well as 25% levies on kitchen cabinets, vanities and upholstered wood products.” UBS estimates the lumber tariff will add about $720 per home, while cabinet and vanity tariffs could tack on another $280. Upholstered wood products were not included in the calculation because they are generally purchased by homeowners rather than builders. “As a result, we now estimate the total tariff impact on the cost to construct an average home at approximately $8.9K,” Lovallo wrote. …“Importantly, we continue to believe this cost impact will be spread throughout the entire housing value chain, with the builders perhaps best positioned to push back on suppliers,” he said.

The Trump administration’s latest tariffs on housing materials could raise the average cost of building a single-family home by nearly $9,000, according to a report Tuesday from UBS. Research analyst John Lovallo said the new levies include “an incremental 10% Section 232 tariff on softwood timber and lumber imports, as well as 25% levies on kitchen cabinets, vanities and upholstered wood products.” UBS estimates the lumber tariff will add about $720 per home, while cabinet and vanity tariffs could tack on another $280. Upholstered wood products were not included in the calculation because they are generally purchased by homeowners rather than builders. “As a result, we now estimate the total tariff impact on the cost to construct an average home at approximately $8.9K,” Lovallo wrote. …“Importantly, we continue to believe this cost impact will be spread throughout the entire housing value chain, with the builders perhaps best positioned to push back on suppliers,” he said.

Section 232 tariffs were once seen as a fortress for US metals. Yet, that fortress now casts a much longer shadow. Companies far removed from the steel and aluminum sector could soon find themselves ensnared in tariffs they never imagined, thanks to the inclusion process for “derivative” products. The Trump Administration has steadily expanded Section 232 authority well beyond their original steel and aluminum targets, to copper, automobiles, trucks, lumber, and even wooden cabinets. These tariffs, which range from 10% (for lumber) to 50% (for steel and aluminum), are layered on top of normal import duties. At first glance, these measures appeared to strike only those industries handling raw materials. But in 2025 the Administration sought to close what it saw as a loophole: downstream products containing tariffed metals that could enter duty-free. As a result, section 232 tariffs were imposed on the raw material and a finite list of derivative products.

Section 232 tariffs were once seen as a fortress for US metals. Yet, that fortress now casts a much longer shadow. Companies far removed from the steel and aluminum sector could soon find themselves ensnared in tariffs they never imagined, thanks to the inclusion process for “derivative” products. The Trump Administration has steadily expanded Section 232 authority well beyond their original steel and aluminum targets, to copper, automobiles, trucks, lumber, and even wooden cabinets. These tariffs, which range from 10% (for lumber) to 50% (for steel and aluminum), are layered on top of normal import duties. At first glance, these measures appeared to strike only those industries handling raw materials. But in 2025 the Administration sought to close what it saw as a loophole: downstream products containing tariffed metals that could enter duty-free. As a result, section 232 tariffs were imposed on the raw material and a finite list of derivative products. Ikea is increasing the amount of products it makes in the US as the world’s largest home furnishings retailer comes under pressure from US President Donald Trump’s tariffs on furniture and kitchen cabinets. The flat-pack retailer, which made revenues of $5.5bn in the US last year, currently produces only about 15% of products that it sells in the US domestically. That compares with 75% local production in Europe and 80% in Asia. “We want to continue to expand in the US and Canada — how do we optimise a good supply set-up where we secure the right access to materials, to components, to production? That’s very long-term work that we’re doing,” Jon Abrahamsson Ring, chief executive of Inter Ikea. Trump imposed tariffs of between 10% and 50% on imports of foreign furniture and wood products. Ikea, which is responsible for about 1% of total industrial production, is set to take a significant hit.

Ikea is increasing the amount of products it makes in the US as the world’s largest home furnishings retailer comes under pressure from US President Donald Trump’s tariffs on furniture and kitchen cabinets. The flat-pack retailer, which made revenues of $5.5bn in the US last year, currently produces only about 15% of products that it sells in the US domestically. That compares with 75% local production in Europe and 80% in Asia. “We want to continue to expand in the US and Canada — how do we optimise a good supply set-up where we secure the right access to materials, to components, to production? That’s very long-term work that we’re doing,” Jon Abrahamsson Ring, chief executive of Inter Ikea. Trump imposed tariffs of between 10% and 50% on imports of foreign furniture and wood products. Ikea, which is responsible for about 1% of total industrial production, is set to take a significant hit.

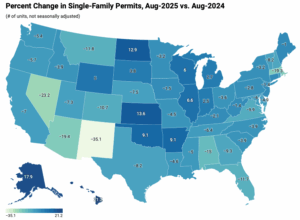

In August, single-family permit activity softened, reflecting caution among developers amid persistent economic headwinds. This trend has been consistent for eight continuous months. On the multifamily front, permitting also cooled in August but remains in the positive territory. While single-family continues to bear the brunt of affordability headwinds, the multifamily space is showing tentative signs of rebalancing. Over the first eight months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 637,096. On a year-over-year (YoY) basis, this is a decline of 7.1% over the August 2024 level of 685,923. For multifamily, the total number of permits issued nationwide reached 330,617. This is 1.4% higher compared to the August 2024 level of 326,080. HBGI analysis indicates that this growth for multifamily development has been concentrated in lower density areas and among smaller builders.

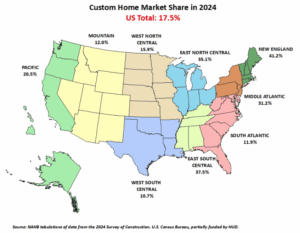

In August, single-family permit activity softened, reflecting caution among developers amid persistent economic headwinds. This trend has been consistent for eight continuous months. On the multifamily front, permitting also cooled in August but remains in the positive territory. While single-family continues to bear the brunt of affordability headwinds, the multifamily space is showing tentative signs of rebalancing. Over the first eight months of 2025, the total number of single-family permits issued year-to-date (YTD) nationwide reached 637,096. On a year-over-year (YoY) basis, this is a decline of 7.1% over the August 2024 level of 685,923. For multifamily, the total number of permits issued nationwide reached 330,617. This is 1.4% higher compared to the August 2024 level of 326,080. HBGI analysis indicates that this growth for multifamily development has been concentrated in lower density areas and among smaller builders. In 2024, 17.5% of all new single-family homes started were custom homes. This share decreased from 18.8% in 2023 and from 20.4% in 2022, according to data tabulated from the Census Bureau’s Survey of Construction (SOC). The custom home market consists of contractor-built and owner-built homes—homes built for owner occupancy on the owner’s land, with either the owner or a builder acting as a general contractor. The alternatives are homes built-for-sale (on the builder’s land, often in subdivisions, with the intention of selling the house and land in one transaction) and homes built-for-rent. In 2024, 73.1% of the single-family homes started were built-for-sale and 9.3% were built-for-rent. At a 17.5% share, the number of custom homes started in 2024 was 176,932, falling from 177,850 in 2023.

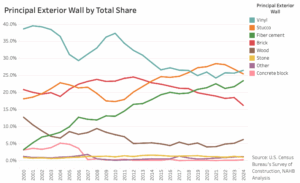

In 2024, 17.5% of all new single-family homes started were custom homes. This share decreased from 18.8% in 2023 and from 20.4% in 2022, according to data tabulated from the Census Bureau’s Survey of Construction (SOC). The custom home market consists of contractor-built and owner-built homes—homes built for owner occupancy on the owner’s land, with either the owner or a builder acting as a general contractor. The alternatives are homes built-for-sale (on the builder’s land, often in subdivisions, with the intention of selling the house and land in one transaction) and homes built-for-rent. In 2024, 73.1% of the single-family homes started were built-for-sale and 9.3% were built-for-rent. At a 17.5% share, the number of custom homes started in 2024 was 176,932, falling from 177,850 in 2023. In 2024, vinyl siding was the most used principal exterior wall material for homes started. It holds just over a quarter share of homes, slightly surpassing stucco for the first time since 2018. …Vinyl was followed closely by stucco at 25%, and by fiber cement siding (such as Hardiplank or Hardiboard) at 23%. Each of these materials holds about a quarter of the market, with another 16% held by brick or brick veneer. Far smaller shares of single-family homes had wood or wood products (6%), stone, rock or other stone materials (1%), other (1%), or cement blocks (.2%) as the principal exterior wall material. …The strongest trend has been the growing popularity in fiber cement siding. The share of exterior siding material for fiber cement siding has increased by 5.5 percentage points in the last ten years…. Also notable is the decline of brick siding, from almost a quarter of homes in 2012, to just 16% in 2024.

In 2024, vinyl siding was the most used principal exterior wall material for homes started. It holds just over a quarter share of homes, slightly surpassing stucco for the first time since 2018. …Vinyl was followed closely by stucco at 25%, and by fiber cement siding (such as Hardiplank or Hardiboard) at 23%. Each of these materials holds about a quarter of the market, with another 16% held by brick or brick veneer. Far smaller shares of single-family homes had wood or wood products (6%), stone, rock or other stone materials (1%), other (1%), or cement blocks (.2%) as the principal exterior wall material. …The strongest trend has been the growing popularity in fiber cement siding. The share of exterior siding material for fiber cement siding has increased by 5.5 percentage points in the last ten years…. Also notable is the decline of brick siding, from almost a quarter of homes in 2012, to just 16% in 2024.)

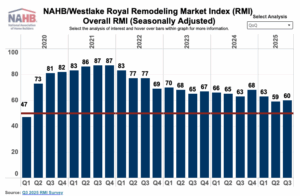

In the third quarter of 2025, the NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 60, up one point compared to the previous quarter. With the reading of 60, the RMI remains solidly in positive territory above 50, but lower than it had been at any time from 2021 through 2024. Overall, remodelers remain optimistic about the market, although slightly less optimistic than they were at this time last year. The most significant headwinds they are facing include high material and labor costs, as well as economic and political uncertainty making some of their potential customers cautious about moving forward with remodeling projects. The small quarter-over-quarter improvement is consistent with flat construction spending trends and the current wait-and-see demand environment.

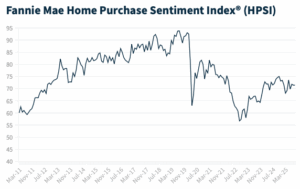

In the third quarter of 2025, the NAHB/Westlake Royal Remodeling Market Index (RMI) posted a reading of 60, up one point compared to the previous quarter. With the reading of 60, the RMI remains solidly in positive territory above 50, but lower than it had been at any time from 2021 through 2024. Overall, remodelers remain optimistic about the market, although slightly less optimistic than they were at this time last year. The most significant headwinds they are facing include high material and labor costs, as well as economic and political uncertainty making some of their potential customers cautious about moving forward with remodeling projects. The small quarter-over-quarter improvement is consistent with flat construction spending trends and the current wait-and-see demand environment. WASHINGTON, DC – Fannie Mae published the results of its September 2025

WASHINGTON, DC – Fannie Mae published the results of its September 2025

President Donald Trump has reignited debate over the nation’s housing shortage, calling on Fannie Mae and Freddie Mac to spur a wave of new home construction. Trump accused large homebuilders of “sitting on 2 million empty lots, a record,” and likened their behavior to OPEC’s control of oil prices. …“I’m asking Fannie Mae and Freddie Mac to get Big Homebuilders going and, by so doing, help restore the American Dream!” The president’s comments come as housing inventory has rebounded from historic lows in 2022, but builders continue to face limited incentives to ramp up construction. …Since taking office, Trump has made housing a central policy focus, including an executive order for emergency price relief and a campaign to pressure the Federal Reserve for lower rates. …Despite Trump’s calls, the mechanics of how Fannie and Freddie might spur more homebuilding remain unclear.

President Donald Trump has reignited debate over the nation’s housing shortage, calling on Fannie Mae and Freddie Mac to spur a wave of new home construction. Trump accused large homebuilders of “sitting on 2 million empty lots, a record,” and likened their behavior to OPEC’s control of oil prices. …“I’m asking Fannie Mae and Freddie Mac to get Big Homebuilders going and, by so doing, help restore the American Dream!” The president’s comments come as housing inventory has rebounded from historic lows in 2022, but builders continue to face limited incentives to ramp up construction. …Since taking office, Trump has made housing a central policy focus, including an executive order for emergency price relief and a campaign to pressure the Federal Reserve for lower rates. …Despite Trump’s calls, the mechanics of how Fannie and Freddie might spur more homebuilding remain unclear.  President Trump’s latest round of tariffs aimed at wood, furniture and other household furnishings could drive up the cost of building and owning homes, further weighing on an already weak housing sector. Analysts said the steep levies could aggravate the nationwide housing shortage by slowing the pace of new home construction. The higher costs, as well as hefty tariffs on steel and aluminum that went into effect in June, could also dampen any jolt the housing market might have derived as the Federal Reserve begins to lower interest rates. …“These tariffs are really hard to understand given that the president has said to his supporters, ‘I want to bring down inflation, I want to bring down interest rates,’” said Anirban Basu, at the Associated Builders and Contractors. …And there could be ripple effects, including higher prices for home insurance because houses and their components would cost more to replace. [to access the full story a NY Times subscription is required]

President Trump’s latest round of tariffs aimed at wood, furniture and other household furnishings could drive up the cost of building and owning homes, further weighing on an already weak housing sector. Analysts said the steep levies could aggravate the nationwide housing shortage by slowing the pace of new home construction. The higher costs, as well as hefty tariffs on steel and aluminum that went into effect in June, could also dampen any jolt the housing market might have derived as the Federal Reserve begins to lower interest rates. …“These tariffs are really hard to understand given that the president has said to his supporters, ‘I want to bring down inflation, I want to bring down interest rates,’” said Anirban Basu, at the Associated Builders and Contractors. …And there could be ripple effects, including higher prices for home insurance because houses and their components would cost more to replace. [to access the full story a NY Times subscription is required]

Anthony Cabrera, who started working with a contractor in March to construct the three-bedroom house, was eager to get ahead of a fresh round of tariffs on key building materials and home items that took effect earlier this week. Mr Cabrera had already seen his initial budget of roughly $300,000 balloon to $450,000 as prices for a range of products. …A recent report from Goldman Sachs found that US consumers will shoulder as much as 55% of the cost. It takes time to raise prices on consumers, the economists noted, and US firms will increasingly pass on costs in the coming months. The new tariffs “will create additional headwinds for an already challenged housing market” Buddy Hughes, chairman for the NAHB, said. Affordable housing construction could be hit particularly hard, said Elena Patel, of the Urban-Brookings Tax Policy Center. …Matthew Walsh, at Moody’s Analytics, said that cost uncertainty will be the most immediate effect.

Anthony Cabrera, who started working with a contractor in March to construct the three-bedroom house, was eager to get ahead of a fresh round of tariffs on key building materials and home items that took effect earlier this week. Mr Cabrera had already seen his initial budget of roughly $300,000 balloon to $450,000 as prices for a range of products. …A recent report from Goldman Sachs found that US consumers will shoulder as much as 55% of the cost. It takes time to raise prices on consumers, the economists noted, and US firms will increasingly pass on costs in the coming months. The new tariffs “will create additional headwinds for an already challenged housing market” Buddy Hughes, chairman for the NAHB, said. Affordable housing construction could be hit particularly hard, said Elena Patel, of the Urban-Brookings Tax Policy Center. …Matthew Walsh, at Moody’s Analytics, said that cost uncertainty will be the most immediate effect.

China’s pulp and paper industry continues to expand at an unprecedented pace, with new mill projects, advanced technologies, and state-backed financing driving record output. What began as a push to meet domestic demand has now evolved into an era of overcapacity and a structural imbalance that is reshaping trade dynamics, pricing strategies, and sustainability priorities worldwide. This expansion has far-reaching effects: global producers are contending with lower-priced exports, disrupted supply chains, and a shifting balance of power that challenges traditional market leaders in North America and Europe. …Industry observers expect consolidation in China’s pulp and paper sector, as smaller and less efficient mills struggle to survive. Strategic investments in transparency, benchmarking, and efficiency will be crucial for staying competitive in a tightening global market.

China’s pulp and paper industry continues to expand at an unprecedented pace, with new mill projects, advanced technologies, and state-backed financing driving record output. What began as a push to meet domestic demand has now evolved into an era of overcapacity and a structural imbalance that is reshaping trade dynamics, pricing strategies, and sustainability priorities worldwide. This expansion has far-reaching effects: global producers are contending with lower-priced exports, disrupted supply chains, and a shifting balance of power that challenges traditional market leaders in North America and Europe. …Industry observers expect consolidation in China’s pulp and paper sector, as smaller and less efficient mills struggle to survive. Strategic investments in transparency, benchmarking, and efficiency will be crucial for staying competitive in a tightening global market. The UK timber industry is currently experiencing a crisis, even as it reports record sales of softwood, raising concerns over supply chain challenges, rising costs, and sustainability issues. The surge in softwood sales, particularly in the construction and woodworking sectors, has overshadowed the ongoing difficulties facing the industry. While the demand for timber has been high, particularly due to the growing construction boom and a shift toward more sustainable building materials, the challenges related to timber shortages and price increases remain deeply concerning for businesses across the sector. …The Timber Trade Federation (TTF) reports that softwood sales in the UK reached record levels in 2024. However, one of the most pressing issues facing the UK timber sector is the disruption of supply chains. The UK has faced considerable difficulty in securing a steady supply of raw timber. The global timber shortage has exacerbated the situation.

The UK timber industry is currently experiencing a crisis, even as it reports record sales of softwood, raising concerns over supply chain challenges, rising costs, and sustainability issues. The surge in softwood sales, particularly in the construction and woodworking sectors, has overshadowed the ongoing difficulties facing the industry. While the demand for timber has been high, particularly due to the growing construction boom and a shift toward more sustainable building materials, the challenges related to timber shortages and price increases remain deeply concerning for businesses across the sector. …The Timber Trade Federation (TTF) reports that softwood sales in the UK reached record levels in 2024. However, one of the most pressing issues facing the UK timber sector is the disruption of supply chains. The UK has faced considerable difficulty in securing a steady supply of raw timber. The global timber shortage has exacerbated the situation.