Lumber futures steadied around $540 per thousand board feet, hovering near seven-week lows, after a sharp selloff driven mainly by softer US construction demand and lingering post-rally inventories. US housing starts and builder activity failed to accelerate, leaving order flow thin and dealer and distributor stocks higher than the summer buying binge implied. Supply has only partially adjusted, with North American mills signaling temporary curtailments, but looming US softwood measures and announced support for Canada’s industry have kept export channels and production incentives intact, preventing a rapid physical tightening. Traders are now pricing a likely mix of modest Q4 production cuts, seasonal pre-winter restocking and the risk of trade-related disruptions.

Lumber futures steadied around $540 per thousand board feet, hovering near seven-week lows, after a sharp selloff driven mainly by softer US construction demand and lingering post-rally inventories. US housing starts and builder activity failed to accelerate, leaving order flow thin and dealer and distributor stocks higher than the summer buying binge implied. Supply has only partially adjusted, with North American mills signaling temporary curtailments, but looming US softwood measures and announced support for Canada’s industry have kept export channels and production incentives intact, preventing a rapid physical tightening. Traders are now pricing a likely mix of modest Q4 production cuts, seasonal pre-winter restocking and the risk of trade-related disruptions.

MONTREAL — CN Rail reported its financial and operating results for the third quarter ended September 30, 2025. Highlights include: Revenues of C$4,165 million, an increase of C$55 million, or 1%; Net income of C$1,139 million, an increase of C$54 million, or 5%. …Tracy Robinson, President and Chief Executive Officer said, “We are taking decisive actions to navigate a challenging macro environment including doubling down on productivity efforts, setting our 2026 capital spend at C$2.8 billion*, down nearly C$600 million from this year’s levels, driving increased free cash flow on a go-forward basis. We are positioning this business to benefit from higher future volumes and ensuring everything we do enhances our customers and shareholders long term value.”

MONTREAL — CN Rail reported its financial and operating results for the third quarter ended September 30, 2025. Highlights include: Revenues of C$4,165 million, an increase of C$55 million, or 1%; Net income of C$1,139 million, an increase of C$54 million, or 5%. …Tracy Robinson, President and Chief Executive Officer said, “We are taking decisive actions to navigate a challenging macro environment including doubling down on productivity efforts, setting our 2026 capital spend at C$2.8 billion*, down nearly C$600 million from this year’s levels, driving increased free cash flow on a go-forward basis. We are positioning this business to benefit from higher future volumes and ensuring everything we do enhances our customers and shareholders long term value.” Canadian Pacific Kansas City reported a big profit boost in its latest quarter despite US tariff disruption and fears over fallout from a potential merger of rivals down the line. The railway saw net income for the quarter ended Sept. 30 rise 10% year-over-year to $917 million. Revenues increased three per cent to $3.66 billion on the back of higher shipping volumes. Grain, potash and container volumes rose markedly year-over-year while forest products — struggling under a sectoral tariff imposed by US President Trump — and energy, chemicals and plastics sagged. …Cross-border steel shipments also dropped due to 50% US tariffs on imports of the metal, though CPKC helped make up the decline with domestic traffic and direct Canada-to-Mexico trade, said chief marketing officer John Brooks. A new item of concern crossed the CEO’s desk over the summer. Union Pacific announced in July it wants to buy Norfolk Southern, and potentially trigger a final wave of rail mergers.

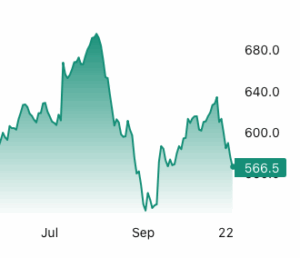

Canadian Pacific Kansas City reported a big profit boost in its latest quarter despite US tariff disruption and fears over fallout from a potential merger of rivals down the line. The railway saw net income for the quarter ended Sept. 30 rise 10% year-over-year to $917 million. Revenues increased three per cent to $3.66 billion on the back of higher shipping volumes. Grain, potash and container volumes rose markedly year-over-year while forest products — struggling under a sectoral tariff imposed by US President Trump — and energy, chemicals and plastics sagged. …Cross-border steel shipments also dropped due to 50% US tariffs on imports of the metal, though CPKC helped make up the decline with domestic traffic and direct Canada-to-Mexico trade, said chief marketing officer John Brooks. A new item of concern crossed the CEO’s desk over the summer. Union Pacific announced in July it wants to buy Norfolk Southern, and potentially trigger a final wave of rail mergers. Lumber futures tumbled toward $560 per thousand board feet, a seven-week low, as weakening demand, persistent oversupply, and trade-policy uncertainties converged. US tariffs are intensifying pressure on Canadian softwood, with existing antidumping and countervailing duties around 35%, plus new Section 232 levies of 10% on timber and 25% on wood products, lifting import costs above 45%. Weak demand compounds the decline, with US residential building permits at a seasonally adjusted 1.4 million units in July, the lowest since June 2020, and construction spending down 3.4% from May 2024. Housing starts remain near five-year lows, keeping retail price pass-through muted despite higher import costs. Export channels have narrowed, with Canadian softwood constrained by tariffs and hardwood exports to China dropping from 40% of volume in 2017 to 7% today. Temporary curtailments and mill closures are emerging, yet abundant inventories and sluggish construction sustain downward pressure. [END]

Lumber futures tumbled toward $560 per thousand board feet, a seven-week low, as weakening demand, persistent oversupply, and trade-policy uncertainties converged. US tariffs are intensifying pressure on Canadian softwood, with existing antidumping and countervailing duties around 35%, plus new Section 232 levies of 10% on timber and 25% on wood products, lifting import costs above 45%. Weak demand compounds the decline, with US residential building permits at a seasonally adjusted 1.4 million units in July, the lowest since June 2020, and construction spending down 3.4% from May 2024. Housing starts remain near five-year lows, keeping retail price pass-through muted despite higher import costs. Export channels have narrowed, with Canadian softwood constrained by tariffs and hardwood exports to China dropping from 40% of volume in 2017 to 7% today. Temporary curtailments and mill closures are emerging, yet abundant inventories and sluggish construction sustain downward pressure. [END] US tariffs on key Canadian goods and weakening global demand triggered a sharp pullback in exports in the second quarter of 2025, according to new data released by

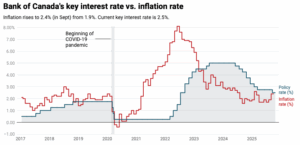

US tariffs on key Canadian goods and weakening global demand triggered a sharp pullback in exports in the second quarter of 2025, according to new data released by  The Bank of Canada cut its interest rate by 25 basis points to 2.25 per cent on Wednesday, but signalled that it may end its easing cycle there if the economy operates in line with its latest forecast. …Bank of Canada governor Tiff Macklem said, “If the economy evolves roughly in line with the outlook in our Monetary Policy Report, governing council sees the current policy rate at about the right level to keep inflation close to 2% while.” …The central bank presented its first baseline forecast since January after trade war uncertainty prompted policymakers to instead assess multiple potential scenarios. After a contraction in the second quarter, the bank expects weak growth for the remainder of 2025, with 0.5% annualized GDP growth in the third quarter and 1% growth in the last quarter of this year. It projects GDP growth of 1.1% in 2026 and 1.6& in 2027.

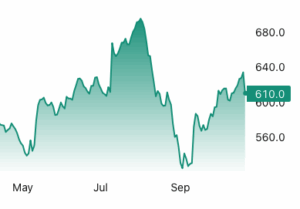

The Bank of Canada cut its interest rate by 25 basis points to 2.25 per cent on Wednesday, but signalled that it may end its easing cycle there if the economy operates in line with its latest forecast. …Bank of Canada governor Tiff Macklem said, “If the economy evolves roughly in line with the outlook in our Monetary Policy Report, governing council sees the current policy rate at about the right level to keep inflation close to 2% while.” …The central bank presented its first baseline forecast since January after trade war uncertainty prompted policymakers to instead assess multiple potential scenarios. After a contraction in the second quarter, the bank expects weak growth for the remainder of 2025, with 0.5% annualized GDP growth in the third quarter and 1% growth in the last quarter of this year. It projects GDP growth of 1.1% in 2026 and 1.6& in 2027. Let’s keep this simple: lumber and steel are two of the biggest drivers of flatbed freight in this country. …So where are we right now, closing out 2025? Lumber futures are sliding off their highs and steel demand is soft with some pockets still running hot. That combination is sending a pretty clear message to flatbed haulers: expect mixed demand instead of broad “every lane is on fire” demand. Some regions will stay busy. Some will get quiet. …Lumber futures have fallen back into the $590–$610/mbf range, down double digits from that August spike, and recently touched the lowest levels in weeks. …There are two main reasons for that weakness: Housing affordability is still brutal. Inventory is sitting. So instead of steady flatbed freight — lumber from mill to yard, yard to jobsite, jobsite to next jobsite — you get pauses. …Lumber and steel tell the truth before the broader market does.

Let’s keep this simple: lumber and steel are two of the biggest drivers of flatbed freight in this country. …So where are we right now, closing out 2025? Lumber futures are sliding off their highs and steel demand is soft with some pockets still running hot. That combination is sending a pretty clear message to flatbed haulers: expect mixed demand instead of broad “every lane is on fire” demand. Some regions will stay busy. Some will get quiet. …Lumber futures have fallen back into the $590–$610/mbf range, down double digits from that August spike, and recently touched the lowest levels in weeks. …There are two main reasons for that weakness: Housing affordability is still brutal. Inventory is sitting. So instead of steady flatbed freight — lumber from mill to yard, yard to jobsite, jobsite to next jobsite — you get pauses. …Lumber and steel tell the truth before the broader market does.  Before US President Donald Trump terminated trade negotiations with Canada late Thursday night, premiers were clashing over which tariff-beleaguered industries should be prioritized. Here’s a breakdown of the industries most under threat by tariffs in each province:

Before US President Donald Trump terminated trade negotiations with Canada late Thursday night, premiers were clashing over which tariff-beleaguered industries should be prioritized. Here’s a breakdown of the industries most under threat by tariffs in each province: Lumber futures tumbled toward $590 per thousand board feet, a near one-month low, as weakening US housing activity and pre-tariff front-loading left wholesalers awash with stock while stacked US duties on Canadian imports and trade uncertainty pushed prices lower. US homebuilding has slowed, with housing starts falling 8.5% in August to a 1.307 million annualized pace and building permits drifting lower. Many US buyers front-loaded inventories ahead of expected import tariffs earlier this autumn, leaving distributors to work down excess stock before fresh order flow returns. On the supply side, a 10% Section-232 tariff added in mid-October atop roughly 35% in existing duties lifted border costs above 45% for many Canadian shipments, forcing sellers to find new markets or accept lower domestic prices. Producers like Interfor have trimmed output since mid-October, but the cuts are too recent to significantly reduce inventories or regional log supply.

Lumber futures tumbled toward $590 per thousand board feet, a near one-month low, as weakening US housing activity and pre-tariff front-loading left wholesalers awash with stock while stacked US duties on Canadian imports and trade uncertainty pushed prices lower. US homebuilding has slowed, with housing starts falling 8.5% in August to a 1.307 million annualized pace and building permits drifting lower. Many US buyers front-loaded inventories ahead of expected import tariffs earlier this autumn, leaving distributors to work down excess stock before fresh order flow returns. On the supply side, a 10% Section-232 tariff added in mid-October atop roughly 35% in existing duties lifted border costs above 45% for many Canadian shipments, forcing sellers to find new markets or accept lower domestic prices. Producers like Interfor have trimmed output since mid-October, but the cuts are too recent to significantly reduce inventories or regional log supply. VANCOUVER, BC —

VANCOUVER, BC — OTTAWA — Some economists say surprisingly strong September inflation figures will give the Bank of Canada pause ahead of its interest rate decision next week. Annual inflation accelerated to 2.4% last month, Statistics Canada said Tuesday. That’s a jump of half a percentage point from 1.9% in August and a tick higher than economists’ expectations. …The September inflation report will be the Bank of Canada’s last look at price data before the central bank’s next interest rate decision on Oct. 29. The central bank lowered its benchmark interest rate by a quarter point to 2.5% at its last decision in September. The Bank of Canada’s preferred measures of core inflation showed some stubbornness in September, holding above the three per cent mark. “This will make the Bank of Canada’s decision a bit more interesting next week than previously expected,” said BMO chief economist Doug Porter.

OTTAWA — Some economists say surprisingly strong September inflation figures will give the Bank of Canada pause ahead of its interest rate decision next week. Annual inflation accelerated to 2.4% last month, Statistics Canada said Tuesday. That’s a jump of half a percentage point from 1.9% in August and a tick higher than economists’ expectations. …The September inflation report will be the Bank of Canada’s last look at price data before the central bank’s next interest rate decision on Oct. 29. The central bank lowered its benchmark interest rate by a quarter point to 2.5% at its last decision in September. The Bank of Canada’s preferred measures of core inflation showed some stubbornness in September, holding above the three per cent mark. “This will make the Bank of Canada’s decision a bit more interesting next week than previously expected,” said BMO chief economist Doug Porter. Alain Ouzilleau, owner of Groupe Cabico, spent millions upgrading his two factories in Quebec and Ontario into state-of-the-art facilities shipping around $100-million worth of high-end kitchen cabinets to the US each year. Almost overnight, that business has been thrown into jeopardy. …“We have very long-term loyal customers,” Mr. Ouzilleau said. “But the 50% that is planned to be effective January 1st is just a death sentence.” …Hundreds of other Canadian cabinet and furniture makers also stand to lose their key export business, with limited ability to expand in a crowded domestic market. …What started as tariffs on steel, aluminum and automobiles has expanded to include copper and lumber, with a tariff on heavy trucks slated to come into force in November. The Trump administration is also conducting investigations into aircraft, semiconductors and industrial machinery, among other industries, suggesting more tariffs are on the horizon. [to access the full story a Globe & Mail subscription is required]

Alain Ouzilleau, owner of Groupe Cabico, spent millions upgrading his two factories in Quebec and Ontario into state-of-the-art facilities shipping around $100-million worth of high-end kitchen cabinets to the US each year. Almost overnight, that business has been thrown into jeopardy. …“We have very long-term loyal customers,” Mr. Ouzilleau said. “But the 50% that is planned to be effective January 1st is just a death sentence.” …Hundreds of other Canadian cabinet and furniture makers also stand to lose their key export business, with limited ability to expand in a crowded domestic market. …What started as tariffs on steel, aluminum and automobiles has expanded to include copper and lumber, with a tariff on heavy trucks slated to come into force in November. The Trump administration is also conducting investigations into aircraft, semiconductors and industrial machinery, among other industries, suggesting more tariffs are on the horizon. [to access the full story a Globe & Mail subscription is required] Lumber futures fell below $610 per thousand board feet, their lowest level since October 8 and down 12% from a three-year high in early August, as a slowing US housing market outweighed potential supply curbs from tariffs. August building permits dropped to a seasonally adjusted annualized rate of 1.33 million, the lowest since May 2020, while housing starts fell 8.5%, marking the fourth-lowest reading in over five years. Earlier this month, the US imposed a 10% tariff on Canadian lumber, with the Trump administration stating it aims to expand domestic timber harvesting and reduce reliance on foreign lumber. Looking ahead, expected Federal Reserve rate cuts could stimulate construction and home buying and encourage homeowners to borrow for repairs and renovations, the largest driver of lumber demand. However, signs of a slowing labor market and rising inflation suggest demand may remain subdued.

Lumber futures fell below $610 per thousand board feet, their lowest level since October 8 and down 12% from a three-year high in early August, as a slowing US housing market outweighed potential supply curbs from tariffs. August building permits dropped to a seasonally adjusted annualized rate of 1.33 million, the lowest since May 2020, while housing starts fell 8.5%, marking the fourth-lowest reading in over five years. Earlier this month, the US imposed a 10% tariff on Canadian lumber, with the Trump administration stating it aims to expand domestic timber harvesting and reduce reliance on foreign lumber. Looking ahead, expected Federal Reserve rate cuts could stimulate construction and home buying and encourage homeowners to borrow for repairs and renovations, the largest driver of lumber demand. However, signs of a slowing labor market and rising inflation suggest demand may remain subdued. The Canadian government has opened applications for a $700 million loan guarantee program that helps lumber companies weather mounting US tariffs that have pushed some firms into bankruptcy. The Business Development Bank of Canada

The Canadian government has opened applications for a $700 million loan guarantee program that helps lumber companies weather mounting US tariffs that have pushed some firms into bankruptcy. The Business Development Bank of Canada  Vancouver, BC — Western Forest Products Inc. reported Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export duty expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. In comparison, the Company reported Adjusted EBITDA of negative $10.7 million in the third quarter of 2024, which included a $1.0 million export duty recovery related to the determination of final duty rates from the fifth AR, and Adjusted EBITDA of $0.5 million in the second quarter of 2025. Net loss was $61.3 million in the third quarter of 2025, as compared to a net loss of $19.6 million in the third quarter of 2024, and net loss of $17.4 million in the second quarter of 2025.

Vancouver, BC — Western Forest Products Inc. reported Adjusted EBITDA of negative $65.9 million in the third quarter of 2025, which included a non-cash export duty expense of $59.5 million related to the determination of final duty rates from the sixth Administrative Review. In comparison, the Company reported Adjusted EBITDA of negative $10.7 million in the third quarter of 2024, which included a $1.0 million export duty recovery related to the determination of final duty rates from the fifth AR, and Adjusted EBITDA of $0.5 million in the second quarter of 2025. Net loss was $61.3 million in the third quarter of 2025, as compared to a net loss of $19.6 million in the third quarter of 2024, and net loss of $17.4 million in the second quarter of 2025.

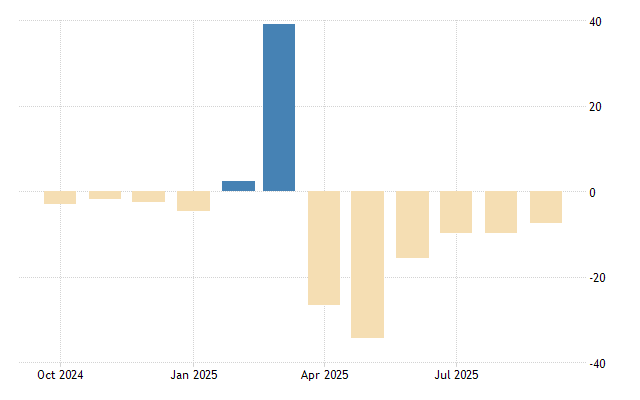

Canada’s merchandise exports fell by three per cent in August to a seasonally adjusted $60.5 billion. This was the second lowest month of the year after April as sales to the U.S. retreated. Imports rose by 0.9 per cent to a seasonally adjusted $66.9 billion during the month. Consequently, the trade deficit grew to $6.3 billion, down from a revised $3.8 billion in July. …The decline was led by a 21.2 per cent drop in forestry products and a 12.5 per cent decline in energy products. The steep decline in forestry products in August 2025 followed the increase of anti-dumping and countervailing duty rates on Canadian softwood lumber that took effect in the U.S. in late July and early August. Section 232 tariffs on lumber in effect in October will be a further headwind. …Year-to-date exports are down slightly (-0.1 per cent) with lower forestry products and building and packaging materials exports (-6.1 per cent)

Canada’s merchandise exports fell by three per cent in August to a seasonally adjusted $60.5 billion. This was the second lowest month of the year after April as sales to the U.S. retreated. Imports rose by 0.9 per cent to a seasonally adjusted $66.9 billion during the month. Consequently, the trade deficit grew to $6.3 billion, down from a revised $3.8 billion in July. …The decline was led by a 21.2 per cent drop in forestry products and a 12.5 per cent decline in energy products. The steep decline in forestry products in August 2025 followed the increase of anti-dumping and countervailing duty rates on Canadian softwood lumber that took effect in the U.S. in late July and early August. Section 232 tariffs on lumber in effect in October will be a further headwind. …Year-to-date exports are down slightly (-0.1 per cent) with lower forestry products and building and packaging materials exports (-6.1 per cent) MONTREAL, Quebec – Stella-Jones announced financial results for its third quarter ended September 30, 2025. Highlights include: Sales of $958 million, up 5% from Q3 2024; Operating income of $135 million, up 4% from Q3 2024; EBITDA of $171 million, or 17.8% margin, up 6% from Q3 2024; and Net Income of $88 million, up 10% from Q3, 2024. …“Stella-Jones achieved another solid performance in the third quarter, supported by volume improvements, robust margins, improved cash flow and a strong balance sheet,” said Eric Vachon, CEO. …The increase in pressure-treated wood sales resulted from an increase in utility poles and industrial products volumes and higher pricing for railway ties and residential lumber. This was partially offset by lower pricing for utility poles. Logs and lumber sales decreased by $14 million or 47%, mainly driven by lower logs activity.

MONTREAL, Quebec – Stella-Jones announced financial results for its third quarter ended September 30, 2025. Highlights include: Sales of $958 million, up 5% from Q3 2024; Operating income of $135 million, up 4% from Q3 2024; EBITDA of $171 million, or 17.8% margin, up 6% from Q3 2024; and Net Income of $88 million, up 10% from Q3, 2024. …“Stella-Jones achieved another solid performance in the third quarter, supported by volume improvements, robust margins, improved cash flow and a strong balance sheet,” said Eric Vachon, CEO. …The increase in pressure-treated wood sales resulted from an increase in utility poles and industrial products volumes and higher pricing for railway ties and residential lumber. This was partially offset by lower pricing for utility poles. Logs and lumber sales decreased by $14 million or 47%, mainly driven by lower logs activity. EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results1 for the three months ended September 27, 2025. Acadian generated sales of $23.0 million, compared to $26.0 million in the prior year period. …Operating costs and expenses decreased $2.0 million compared to the prior year period as a result of decreased timber sales volumes and timber services activity, partially offset by higher average operating costs and expenses per m

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results1 for the three months ended September 27, 2025. Acadian generated sales of $23.0 million, compared to $26.0 million in the prior year period. …Operating costs and expenses decreased $2.0 million compared to the prior year period as a result of decreased timber sales volumes and timber services activity, partially offset by higher average operating costs and expenses per m An extended slowdown in sales of cardboard boxes is intensifying concern that this holiday season will be a disappointing one for US retailers. US corrugated box shipments fell to the lowest third-quarter reading since 2015, maintaining the more measured pace seen in the previous quarter, according to the Fibre Box Association. Packaging companies in recent weeks have warned that economic uncertainty is weighing on retailers and consumers. …This time of year is crucial for the box industry, with shipments typically peaking in October as retailers prepare for the holidays. Box plants said orders were flat or below normal in October, while US consumer sentiment fell to a five-month low and manufacturing activity dropped for an eighth straight month. …US box industry shipments are poised to drop 1% to 1.5% this year versus 2024,” IP’s Andy Silvernail said last week. [to access the full story a Bloomberg subscription is required]

An extended slowdown in sales of cardboard boxes is intensifying concern that this holiday season will be a disappointing one for US retailers. US corrugated box shipments fell to the lowest third-quarter reading since 2015, maintaining the more measured pace seen in the previous quarter, according to the Fibre Box Association. Packaging companies in recent weeks have warned that economic uncertainty is weighing on retailers and consumers. …This time of year is crucial for the box industry, with shipments typically peaking in October as retailers prepare for the holidays. Box plants said orders were flat or below normal in October, while US consumer sentiment fell to a five-month low and manufacturing activity dropped for an eighth straight month. …US box industry shipments are poised to drop 1% to 1.5% this year versus 2024,” IP’s Andy Silvernail said last week. [to access the full story a Bloomberg subscription is required] Kimberly-Clark is buying Tylenol maker Kenvue in a cash and stock deal worth about $48.7 billion, creating a massive consumer health goods company. Shareholders of Kimberly-Clark will own about 54% of the combined company. Kenvue shareholders will own about 46%. The combined company will have a large stable of household brands under one roof, putting Kenvue’s Listerine mouthwash and Band-Aid side-by-side with Kimberly-Clark’s Cottonelle toilet paper, Huggies and Kleenex tissues. It will also generate about $32 billion in annual revenue. Kenvue has spent a relatively brief period as an independent company, having been spun off by Johnson & Johnson two years ago. The deal announced Monday is among the largest corporate takeovers of the year. …The deal is expected to close in the second half of next year. It still needs approval from shareholders of both both companies. …Shares of Kimberly-Clark slipped more than 15% before the market open, while Kenvue’s stock jumped more than 20%.

Kimberly-Clark is buying Tylenol maker Kenvue in a cash and stock deal worth about $48.7 billion, creating a massive consumer health goods company. Shareholders of Kimberly-Clark will own about 54% of the combined company. Kenvue shareholders will own about 46%. The combined company will have a large stable of household brands under one roof, putting Kenvue’s Listerine mouthwash and Band-Aid side-by-side with Kimberly-Clark’s Cottonelle toilet paper, Huggies and Kleenex tissues. It will also generate about $32 billion in annual revenue. Kenvue has spent a relatively brief period as an independent company, having been spun off by Johnson & Johnson two years ago. The deal announced Monday is among the largest corporate takeovers of the year. …The deal is expected to close in the second half of next year. It still needs approval from shareholders of both both companies. …Shares of Kimberly-Clark slipped more than 15% before the market open, while Kenvue’s stock jumped more than 20%.

Shares of D.R. Horton took a hit Tuesday, as the home builder confirmed that the market for new houses was still weak, and it wasn’t just because prices and mortgage rates were too high — people are afraid to shell out so much for a new house when they’re worried about the economy and their jobs. …But even with lower prices and mortgage rates, the number of homes closed fell 1.2% to 23,368, which was below the average analyst estimate. And that weakness comes despite higher incentives to home buyers to boost sales, which pushed profits below what Wall Street was expecting. …Chief Executive Paul Romanowski said affordability was certainly still an issue. But consumers were also concerned about the “volatility and uncertainty” in the economy, which may be leading to worries about the job market. It certainly won’t help matters to see large layoff announcements from high-profile companies.

Shares of D.R. Horton took a hit Tuesday, as the home builder confirmed that the market for new houses was still weak, and it wasn’t just because prices and mortgage rates were too high — people are afraid to shell out so much for a new house when they’re worried about the economy and their jobs. …But even with lower prices and mortgage rates, the number of homes closed fell 1.2% to 23,368, which was below the average analyst estimate. And that weakness comes despite higher incentives to home buyers to boost sales, which pushed profits below what Wall Street was expecting. …Chief Executive Paul Romanowski said affordability was certainly still an issue. But consumers were also concerned about the “volatility and uncertainty” in the economy, which may be leading to worries about the job market. It certainly won’t help matters to see large layoff announcements from high-profile companies.

Section 232 tariffs were once seen as a fortress for US metals. Yet, that fortress now casts a much longer shadow. Companies far removed from the steel and aluminum sector could soon find themselves ensnared in tariffs they never imagined, thanks to the inclusion process for “derivative” products. The Trump Administration has steadily expanded Section 232 authority well beyond their original steel and aluminum targets, to copper, automobiles, trucks, lumber, and even wooden cabinets. These tariffs, which range from 10% (for lumber) to 50% (for steel and aluminum), are layered on top of normal import duties. At first glance, these measures appeared to strike only those industries handling raw materials. But in 2025 the Administration sought to close what it saw as a loophole: downstream products containing tariffed metals that could enter duty-free. As a result, section 232 tariffs were imposed on the raw material and a finite list of derivative products.

Section 232 tariffs were once seen as a fortress for US metals. Yet, that fortress now casts a much longer shadow. Companies far removed from the steel and aluminum sector could soon find themselves ensnared in tariffs they never imagined, thanks to the inclusion process for “derivative” products. The Trump Administration has steadily expanded Section 232 authority well beyond their original steel and aluminum targets, to copper, automobiles, trucks, lumber, and even wooden cabinets. These tariffs, which range from 10% (for lumber) to 50% (for steel and aluminum), are layered on top of normal import duties. At first glance, these measures appeared to strike only those industries handling raw materials. But in 2025 the Administration sought to close what it saw as a loophole: downstream products containing tariffed metals that could enter duty-free. As a result, section 232 tariffs were imposed on the raw material and a finite list of derivative products. Ikea is increasing the amount of products it makes in the US as the world’s largest home furnishings retailer comes under pressure from US President Donald Trump’s tariffs on furniture and kitchen cabinets. The flat-pack retailer, which made revenues of $5.5bn in the US last year, currently produces only about 15% of products that it sells in the US domestically. That compares with 75% local production in Europe and 80% in Asia. “We want to continue to expand in the US and Canada — how do we optimise a good supply set-up where we secure the right access to materials, to components, to production? That’s very long-term work that we’re doing,” Jon Abrahamsson Ring, chief executive of Inter Ikea. Trump imposed tariffs of between 10% and 50% on imports of foreign furniture and wood products. Ikea, which is responsible for about 1% of total industrial production, is set to take a significant hit.

Ikea is increasing the amount of products it makes in the US as the world’s largest home furnishings retailer comes under pressure from US President Donald Trump’s tariffs on furniture and kitchen cabinets. The flat-pack retailer, which made revenues of $5.5bn in the US last year, currently produces only about 15% of products that it sells in the US domestically. That compares with 75% local production in Europe and 80% in Asia. “We want to continue to expand in the US and Canada — how do we optimise a good supply set-up where we secure the right access to materials, to components, to production? That’s very long-term work that we’re doing,” Jon Abrahamsson Ring, chief executive of Inter Ikea. Trump imposed tariffs of between 10% and 50% on imports of foreign furniture and wood products. Ikea, which is responsible for about 1% of total industrial production, is set to take a significant hit.  With new tariffs taking effect on furniture and lumber, an analysis released by Goldman Sachs finds American consumers are paying for more than half of the cost of the levies imposed by President Donald Trump. In a research note to its clients, the global investment and banking giant said U.S. consumers will absorb 55% of tariff costs by the end of this year. American businesses would pay 22% of the costs, foreign exporters would absorb 18% and 5% would be evaded, according to the Goldman Sachs analysis. Consumers could end up paying 70% of the cost by the end of next year, the report said. “At the moment, however, US businesses are likely bearing a larger share of the costs because some tariffs have just gone into effect and it takes time to raise prices on consumers and negotiate lower import prices with foreign suppliers,” the analysis adds.

With new tariffs taking effect on furniture and lumber, an analysis released by Goldman Sachs finds American consumers are paying for more than half of the cost of the levies imposed by President Donald Trump. In a research note to its clients, the global investment and banking giant said U.S. consumers will absorb 55% of tariff costs by the end of this year. American businesses would pay 22% of the costs, foreign exporters would absorb 18% and 5% would be evaded, according to the Goldman Sachs analysis. Consumers could end up paying 70% of the cost by the end of next year, the report said. “At the moment, however, US businesses are likely bearing a larger share of the costs because some tariffs have just gone into effect and it takes time to raise prices on consumers and negotiate lower import prices with foreign suppliers,” the analysis adds.

Anthony Cabrera, who started working with a contractor in March to construct the three-bedroom house, was eager to get ahead of a fresh round of tariffs on key building materials and home items that took effect earlier this week. Mr Cabrera had already seen his initial budget of roughly $300,000 balloon to $450,000 as prices for a range of products. …A recent report from Goldman Sachs found that US consumers will shoulder as much as 55% of the cost. It takes time to raise prices on consumers, the economists noted, and US firms will increasingly pass on costs in the coming months. The new tariffs “will create additional headwinds for an already challenged housing market” Buddy Hughes, chairman for the NAHB, said. Affordable housing construction could be hit particularly hard, said Elena Patel, of the Urban-Brookings Tax Policy Center. …Matthew Walsh, at Moody’s Analytics, said that cost uncertainty will be the most immediate effect.

Anthony Cabrera, who started working with a contractor in March to construct the three-bedroom house, was eager to get ahead of a fresh round of tariffs on key building materials and home items that took effect earlier this week. Mr Cabrera had already seen his initial budget of roughly $300,000 balloon to $450,000 as prices for a range of products. …A recent report from Goldman Sachs found that US consumers will shoulder as much as 55% of the cost. It takes time to raise prices on consumers, the economists noted, and US firms will increasingly pass on costs in the coming months. The new tariffs “will create additional headwinds for an already challenged housing market” Buddy Hughes, chairman for the NAHB, said. Affordable housing construction could be hit particularly hard, said Elena Patel, of the Urban-Brookings Tax Policy Center. …Matthew Walsh, at Moody’s Analytics, said that cost uncertainty will be the most immediate effect.