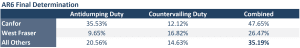

Industry leaders are urging the governments of Canada and the US to prioritize resolving the longstanding softwood lumber dispute after the US more than doubled lumber import duty rates. Construction costs are already rising for American builders, while housing affordability and worries about inflation remain. …The love-hate relationship the US has with Canadian softwood lumber took another turn last week, when the American Building Materials Alliance (ABMA) highlighted one more reason hiking duties on imports of Canadian softwood lumber is a problem for the US construction sector. …ABMA Chair Rod Wiles, a VP at Hammond Lumber Company, said: “Tariffs at this level send a clear signal that the status quo isn’t sustainable, and they can be a tool to bring both sides back to the table. The sooner we can achieve a fair agreement, the better it will be for the entire North American lumber supply chain.”

Industry leaders are urging the governments of Canada and the US to prioritize resolving the longstanding softwood lumber dispute after the US more than doubled lumber import duty rates. Construction costs are already rising for American builders, while housing affordability and worries about inflation remain. …The love-hate relationship the US has with Canadian softwood lumber took another turn last week, when the American Building Materials Alliance (ABMA) highlighted one more reason hiking duties on imports of Canadian softwood lumber is a problem for the US construction sector. …ABMA Chair Rod Wiles, a VP at Hammond Lumber Company, said: “Tariffs at this level send a clear signal that the status quo isn’t sustainable, and they can be a tool to bring both sides back to the table. The sooner we can achieve a fair agreement, the better it will be for the entire North American lumber supply chain.”

The United States is the top wood-importing country. Trade issues and tariffs could be a significant factor in determining the path of least resistance for lumber, lumber futures, and wood product prices over the coming weeks and months. …The offseason for lumber demand is on the horizon. The potential for increased price variance due to the uncertainty created by U.S.-Canada trade relations remains high, and the path of least resistance of U.S. short-term interest rates is likely to be lower. Time will tell if longer-term rates follow any Fed Rate cuts over the coming months. Lumber remains a critical construction material, and the current price levels offer a positive risk-reward profile. Accumulating lumber-related assets on a scale-down basis during periods of price weakness over the coming weeks and months could be optimal for 2026, provided the housing market improves and lumber demand rises.

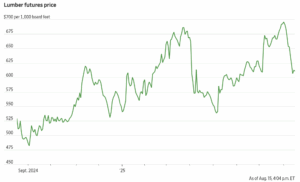

The United States is the top wood-importing country. Trade issues and tariffs could be a significant factor in determining the path of least resistance for lumber, lumber futures, and wood product prices over the coming weeks and months. …The offseason for lumber demand is on the horizon. The potential for increased price variance due to the uncertainty created by U.S.-Canada trade relations remains high, and the path of least resistance of U.S. short-term interest rates is likely to be lower. Time will tell if longer-term rates follow any Fed Rate cuts over the coming months. Lumber remains a critical construction material, and the current price levels offer a positive risk-reward profile. Accumulating lumber-related assets on a scale-down basis during periods of price weakness over the coming weeks and months could be optimal for 2026, provided the housing market improves and lumber demand rises.  Lumber buyers placed unsuccessful bets on tariffs and interest rates Lumber prices have dropped by more than 14% from a record high in early August. Many home builders, contractors and retailers wagered that higher U.S. tariffs on imports would boost the cost of lumber, while lower interest rates would lift demand for the building material. But those bets have failed to pay off – and lumber prices have tallied a steep decline from a record high reached only three weeks ago. That price decline could lead to a drop in production at a time when home-building and housing demand starts to heat up. The demand component for spring 2025 was a “complete swing and a miss,” said Greg Kuta, at lumber broker Westline Capital Strategies. …On Tuesday, lumber futures for September delivery settled at $595.50 per thousand board feet. …Canadian mills are losing out with lumber prices well under the cost of production,” Kuta said.

Lumber buyers placed unsuccessful bets on tariffs and interest rates Lumber prices have dropped by more than 14% from a record high in early August. Many home builders, contractors and retailers wagered that higher U.S. tariffs on imports would boost the cost of lumber, while lower interest rates would lift demand for the building material. But those bets have failed to pay off – and lumber prices have tallied a steep decline from a record high reached only three weeks ago. That price decline could lead to a drop in production at a time when home-building and housing demand starts to heat up. The demand component for spring 2025 was a “complete swing and a miss,” said Greg Kuta, at lumber broker Westline Capital Strategies. …On Tuesday, lumber futures for September delivery settled at $595.50 per thousand board feet. …Canadian mills are losing out with lumber prices well under the cost of production,” Kuta said. Lumber futures have dropped about 12% since hitting a three-year high two weeks ago, a sign that wood buyers stocked up before duties on Canadian two-by-fours more than doubled this month and that traders are worried about the U.S. housing market. Futures for September delivery fell to around $610 per thousand board feet late Friday and have declined in nine of the past 10 trading sessions. On-the-spot prices are also down, according to Random Lengths. …Jordan Rizzuto, chief investment officer at GammaRoad Capital Partners… said that besides indicating that lumber was piled high in U.S. lumberyards before the higher duties took effect, the whipsaw in wood prices is a warning sign for other asset classes. “Lumber’s price behavior over the past several weeks relative to countercyclical and defensive assets suggests potential weakening of new construction and cyclical sectors of the economy,” he said. [to access the full story a WSJ subscription is required]

Lumber futures have dropped about 12% since hitting a three-year high two weeks ago, a sign that wood buyers stocked up before duties on Canadian two-by-fours more than doubled this month and that traders are worried about the U.S. housing market. Futures for September delivery fell to around $610 per thousand board feet late Friday and have declined in nine of the past 10 trading sessions. On-the-spot prices are also down, according to Random Lengths. …Jordan Rizzuto, chief investment officer at GammaRoad Capital Partners… said that besides indicating that lumber was piled high in U.S. lumberyards before the higher duties took effect, the whipsaw in wood prices is a warning sign for other asset classes. “Lumber’s price behavior over the past several weeks relative to countercyclical and defensive assets suggests potential weakening of new construction and cyclical sectors of the economy,” he said. [to access the full story a WSJ subscription is required]

Lumber futures fell toward $610 per thousand board feet, retreating from the May-2022 high of $695.5 seen August 1st as weakening demand, recovering supply and tariff-driven trade distortions jointly sapped pricing power. Demand has cooled sharply with US single-family starts slipping to an 11-month low and building permits plunging, a direct consequence of elevated mortgage rates that curbs the core market for lumber. On the supply side, sawmills remain under-utilized but production has stabilized and Canadian mills are ramping output off a curtailment-heavy base, Statistics Canada shows production and shipments recovering into mid-2025, keeping physical availability ample. Tariffs meant to restrict Canadian flows are, in this oversupplied environment, simply redirecting trade and encouraging inventory build rather than creating scarcity, so inventories remain high and limit upside even as duties rise.

Lumber futures fell toward $610 per thousand board feet, retreating from the May-2022 high of $695.5 seen August 1st as weakening demand, recovering supply and tariff-driven trade distortions jointly sapped pricing power. Demand has cooled sharply with US single-family starts slipping to an 11-month low and building permits plunging, a direct consequence of elevated mortgage rates that curbs the core market for lumber. On the supply side, sawmills remain under-utilized but production has stabilized and Canadian mills are ramping output off a curtailment-heavy base, Statistics Canada shows production and shipments recovering into mid-2025, keeping physical availability ample. Tariffs meant to restrict Canadian flows are, in this oversupplied environment, simply redirecting trade and encouraging inventory build rather than creating scarcity, so inventories remain high and limit upside even as duties rise.

BURNABY, BC — Interfor recorded net earnings in Q2’25 of $11.1 million compared to a net loss of $35.1 million in Q1’25 and a net loss of $75.8 million Q2’24. Adjusted EBITDA was $17.2 million on sales of $780.5 million in Q2’25 versus Adjusted EBITDA of $48.6 million on sales of $735.5 million in Q1’25 and an Adjusted EBITDA loss of $16.7 million on sales of $771.2 million in Q2’24. …North American lumber markets over the near term are expected to remain volatile as the economy continues to adjust to changing monetary policies, tariffs, labour shortages and geo-political uncertainty. …Overall, the Company is well positioned to navigate this volatility with a diversified product mix in Canada and the US, with approximately 60% of its total lumber produced and sold within the US Ultimately, only about 25% of the Company’s total lumber production is exported from Canada to the U.S. and exposed to duties and any potential tariff.

BURNABY, BC — Interfor recorded net earnings in Q2’25 of $11.1 million compared to a net loss of $35.1 million in Q1’25 and a net loss of $75.8 million Q2’24. Adjusted EBITDA was $17.2 million on sales of $780.5 million in Q2’25 versus Adjusted EBITDA of $48.6 million on sales of $735.5 million in Q1’25 and an Adjusted EBITDA loss of $16.7 million on sales of $771.2 million in Q2’24. …North American lumber markets over the near term are expected to remain volatile as the economy continues to adjust to changing monetary policies, tariffs, labour shortages and geo-political uncertainty. …Overall, the Company is well positioned to navigate this volatility with a diversified product mix in Canada and the US, with approximately 60% of its total lumber produced and sold within the US Ultimately, only about 25% of the Company’s total lumber production is exported from Canada to the U.S. and exposed to duties and any potential tariff. VANCOUVER, BC – Western Forest Products reported its second quarter 2025 financial results. Highlights include: Revenue of $289.1 million (versus $309.5 million in the second quarter of 2024, and $262.5 million in the first quarter of 2025); Adjusted EBITDA of $0.5 million in the second quarter of 2025 (versus $9.4 million in the second quarter of 2024, and $3.5 million in the first quarter of 2025; Net loss was $17.4 million in the second quarter of 2025, as compared to a net loss of $5.7 million in the second quarter of 2024, and net income of $13.8 million in the first quarter of 2025. …Markets in North America are expected to be volatile through the third quarter of 2025 as softwood lumber duties have increased significantly. Persistently high interest rates, low consumer confidence and general economic uncertainty are leading to a slower pace in repairs and renovations, and housing activity. Expectations are for this trend to continue throughout the third quarter of 2025.

VANCOUVER, BC – Western Forest Products reported its second quarter 2025 financial results. Highlights include: Revenue of $289.1 million (versus $309.5 million in the second quarter of 2024, and $262.5 million in the first quarter of 2025); Adjusted EBITDA of $0.5 million in the second quarter of 2025 (versus $9.4 million in the second quarter of 2024, and $3.5 million in the first quarter of 2025; Net loss was $17.4 million in the second quarter of 2025, as compared to a net loss of $5.7 million in the second quarter of 2024, and net income of $13.8 million in the first quarter of 2025. …Markets in North America are expected to be volatile through the third quarter of 2025 as softwood lumber duties have increased significantly. Persistently high interest rates, low consumer confidence and general economic uncertainty are leading to a slower pace in repairs and renovations, and housing activity. Expectations are for this trend to continue throughout the third quarter of 2025. The Canada Mortgage and Housing Corporation (CMHC) has just issued a sobering warning to policymakers regarding the state of Canadian housing. Yet, governments do not appear to be getting the message, nor do they seem willing to take the necessary steps to address the crisis. In their

The Canada Mortgage and Housing Corporation (CMHC) has just issued a sobering warning to policymakers regarding the state of Canadian housing. Yet, governments do not appear to be getting the message, nor do they seem willing to take the necessary steps to address the crisis. In their  VANCOUVER, BC — Conifex Timber reported results for the first quarter ended March 31, 2025. EBITDA was negative $3.2 million for the quarter compared to EBITDA of $4.9 million in the first quarter of 2025 and negative $7.1 million in the second quarter of 2024. Net loss was $8.3 million for the quarter versus net income of $0.6 million in the previous quarter and net loss of $9.7 million in the second quarter of 2024. …Lumber production in the second quarter of 2025 totalled approximately 35.3 million board feet, representing operating rates of approximately 59% of annualized capacity. Second quarter production was negatively impacted by operating the sawmill on a four-day configuration, necessitated by reduced log availability.

VANCOUVER, BC — Conifex Timber reported results for the first quarter ended March 31, 2025. EBITDA was negative $3.2 million for the quarter compared to EBITDA of $4.9 million in the first quarter of 2025 and negative $7.1 million in the second quarter of 2024. Net loss was $8.3 million for the quarter versus net income of $0.6 million in the previous quarter and net loss of $9.7 million in the second quarter of 2024. …Lumber production in the second quarter of 2025 totalled approximately 35.3 million board feet, representing operating rates of approximately 59% of annualized capacity. Second quarter production was negatively impacted by operating the sawmill on a four-day configuration, necessitated by reduced log availability.

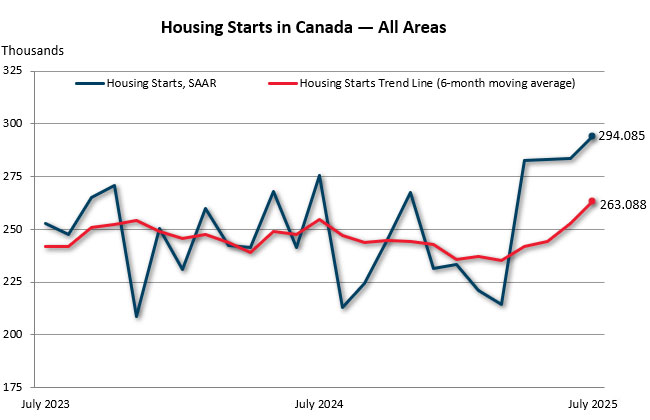

OTTAWA — Canada’s housing crisis may get worse before it starts to show much relief, as new projections say that the number of housing starts will actually decrease this year and next. These new estimates, from both public and private sector housing forecasts, contradict political promises from all levels of government to boost supply of homes across the country. The Canada Mortgage and Housing Corporation (CMHC) forecasts that the total number of housing starts in Canada this year will be about 237,800, down from 245,367 in 2024. CMHC, a Crown corporation that acts as Canada’s national housing agency, also forecasts a drop to no more than 227,734 next year and 220,016 in 2027. Those forecasts are all below the 267,000 annual output for housing starts from 2021-22 and less than half the 480,000 that the CMHC says Canada needs to add each year over the next decade.

OTTAWA — Canada’s housing crisis may get worse before it starts to show much relief, as new projections say that the number of housing starts will actually decrease this year and next. These new estimates, from both public and private sector housing forecasts, contradict political promises from all levels of government to boost supply of homes across the country. The Canada Mortgage and Housing Corporation (CMHC) forecasts that the total number of housing starts in Canada this year will be about 237,800, down from 245,367 in 2024. CMHC, a Crown corporation that acts as Canada’s national housing agency, also forecasts a drop to no more than 227,734 next year and 220,016 in 2027. Those forecasts are all below the 267,000 annual output for housing starts from 2021-22 and less than half the 480,000 that the CMHC says Canada needs to add each year over the next decade. EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended June 28, 2025. “During the second quarter, Acadian delivered mixed results,” said Adam Sheparski, CEO. …Acadian generated sales of $17.1 million, compared to $41.2 million in the prior year period. The second quarter of 2024 included $19.7 million in carbon credit sales, while no carbon credit sales occurred in the second quarter of 2025. Acadian generated $0.8 million of Free Cash Flow during the second quarter and declared dividends of $5.2 million or $0.29 per share to our shareholders. …While the second quarter of the year is traditionally our weakest due to seasonal operating conditions, operating activity in Maine was impacted by prolonged wet conditions which significantly delayed the commencement of deliveries in the spring.

EDMUNDSTON, New Brunswick – Acadian Timber reported financial and operating results for the three months ended June 28, 2025. “During the second quarter, Acadian delivered mixed results,” said Adam Sheparski, CEO. …Acadian generated sales of $17.1 million, compared to $41.2 million in the prior year period. The second quarter of 2024 included $19.7 million in carbon credit sales, while no carbon credit sales occurred in the second quarter of 2025. Acadian generated $0.8 million of Free Cash Flow during the second quarter and declared dividends of $5.2 million or $0.29 per share to our shareholders. …While the second quarter of the year is traditionally our weakest due to seasonal operating conditions, operating activity in Maine was impacted by prolonged wet conditions which significantly delayed the commencement of deliveries in the spring.

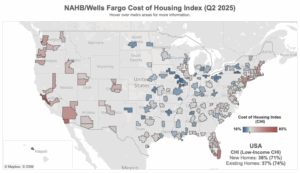

While new homes remain largely unaffordable, builder efforts to improve housing affordability paid dividends in the second quarter of 2025, according to the latest data from the NAHB/Wells Fargo Cost of Housing Index (CHI). The CHI results from the second quarter of 2025 show that a family earning the nation’s median income of $104,200 needed 36% of its income to cover the mortgage payment on a median-priced new home. Low-income families, defined as those earning only 50% of median income, would have to spend 71% of their earnings to pay for the same new home. …The second quarter of 2025 marked the largest historical gap where existing home prices exceeded those of new homes. …The percentage of a family’s income needed to purchase a new home was unchanged at 36% from the first to the second quarter, while the low-income CHI fell from 72% to 71% over the same period.

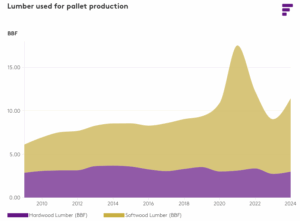

While new homes remain largely unaffordable, builder efforts to improve housing affordability paid dividends in the second quarter of 2025, according to the latest data from the NAHB/Wells Fargo Cost of Housing Index (CHI). The CHI results from the second quarter of 2025 show that a family earning the nation’s median income of $104,200 needed 36% of its income to cover the mortgage payment on a median-priced new home. Low-income families, defined as those earning only 50% of median income, would have to spend 71% of their earnings to pay for the same new home. …The second quarter of 2025 marked the largest historical gap where existing home prices exceeded those of new homes. …The percentage of a family’s income needed to purchase a new home was unchanged at 36% from the first to the second quarter, while the low-income CHI fell from 72% to 71% over the same period.  Economic uncertainty has clouded the pallet market outlook, as July’s job report revealed weaker-than-expected job growth. The elimination of the de minimis tariff exemption for low-value shipments is expected to improve pallet demand. Anticipated interest rate cuts will have a knock-on effect on housing affordability, stimulating the construction sector which in turn impacts lumber prices. …As pallet usage has grown, softwood has become the dominant material used in pallet manufacturing due to its abundance and cost-effectiveness. Hardwood mills were hit hard, and many saw closures, after the Chinese property market collapsed as that was its biggest end-use market. This Canadian softwood lumber supply shock does certainly leave the door open for the hardwood pallet to regain some market share. Supply and demand indicators are pointing to higher prices towards the end of 2025 and into 2026.

Economic uncertainty has clouded the pallet market outlook, as July’s job report revealed weaker-than-expected job growth. The elimination of the de minimis tariff exemption for low-value shipments is expected to improve pallet demand. Anticipated interest rate cuts will have a knock-on effect on housing affordability, stimulating the construction sector which in turn impacts lumber prices. …As pallet usage has grown, softwood has become the dominant material used in pallet manufacturing due to its abundance and cost-effectiveness. Hardwood mills were hit hard, and many saw closures, after the Chinese property market collapsed as that was its biggest end-use market. This Canadian softwood lumber supply shock does certainly leave the door open for the hardwood pallet to regain some market share. Supply and demand indicators are pointing to higher prices towards the end of 2025 and into 2026.

Boosted by a surge in the multifamily sector, US housing starts saw a sizeable jump in July, posting the highest total of starts since February. Housing completions were also up in July, while building permits were down. According to the numbers released by the US Census Bureau on Tuesday, overall housing starts totaled 1.428 million in July, up 5.2% from June and 12.9% above July 2024. It was the highest number of overall starts since February’s 1.490 million. The sector was paced by buildings with five or more units, which had 470,000 starts in July, up from 421,000 in June. This is the highest total of multifamily starts in more than a year. Single-family housing starts were also up, coming in at 939,000 for July. This reflects a 2.8% increase month over month; however, totals are still low compared to most months over the last year. …Odeta Kushi, at First American, said the single-family housing starts numbers are concerning.

Boosted by a surge in the multifamily sector, US housing starts saw a sizeable jump in July, posting the highest total of starts since February. Housing completions were also up in July, while building permits were down. According to the numbers released by the US Census Bureau on Tuesday, overall housing starts totaled 1.428 million in July, up 5.2% from June and 12.9% above July 2024. It was the highest number of overall starts since February’s 1.490 million. The sector was paced by buildings with five or more units, which had 470,000 starts in July, up from 421,000 in June. This is the highest total of multifamily starts in more than a year. Single-family housing starts were also up, coming in at 939,000 for July. This reflects a 2.8% increase month over month; however, totals are still low compared to most months over the last year. …Odeta Kushi, at First American, said the single-family housing starts numbers are concerning.

Box demand touches nearly every industry, from flat-screen TVs to packaged food, all of which see sales fluctuate based on how flush shoppers feel. …Sales of corrugated cardboard used to make boxes are slumping, signaling that retail demand across industries may be due for a correction. US box shipments fell to the lowest second-quarter reading since 2015, with companies like International Paper Co. and Smurfit Westrock Plc reporting drops in box shipments. The drop in packaging demand appears to be tied to President Donald Trump’s mixed messaging on tariffs, with companies not stocking up on packaging while they wait to find out how the levies will affect costs and demand. [to access the full story a Bloomberg subscription is required]

Box demand touches nearly every industry, from flat-screen TVs to packaged food, all of which see sales fluctuate based on how flush shoppers feel. …Sales of corrugated cardboard used to make boxes are slumping, signaling that retail demand across industries may be due for a correction. US box shipments fell to the lowest second-quarter reading since 2015, with companies like International Paper Co. and Smurfit Westrock Plc reporting drops in box shipments. The drop in packaging demand appears to be tied to President Donald Trump’s mixed messaging on tariffs, with companies not stocking up on packaging while they wait to find out how the levies will affect costs and demand. [to access the full story a Bloomberg subscription is required] US mills consumed more recycled paper in 2024 compared to 2023 while exports decrease. The American Forest & Paper Association (AF&PA) recently announced its annual paper recycling rates, with 60%-64% of paper and 69%-74% of cardboard available for recovery being recycled in the United States in 2024. Paper continues to be one of the highest recycled materials in America, supported by successful recycling systems throughout the country. In 2024 alone, 46 million tons of paper was recycled in the U.S., which equates to 125,000 tons of recycled paper being turned into new, essential products like cardboard boxes, paper packaging, and toilet paper every day. …US mills used 1.29 million more tons of recycled paper to make new products in 2024 – that’s 32.7 million tons compared to 31.3 million tons in 2023.

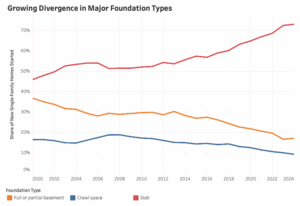

US mills consumed more recycled paper in 2024 compared to 2023 while exports decrease. The American Forest & Paper Association (AF&PA) recently announced its annual paper recycling rates, with 60%-64% of paper and 69%-74% of cardboard available for recovery being recycled in the United States in 2024. Paper continues to be one of the highest recycled materials in America, supported by successful recycling systems throughout the country. In 2024 alone, 46 million tons of paper was recycled in the U.S., which equates to 125,000 tons of recycled paper being turned into new, essential products like cardboard boxes, paper packaging, and toilet paper every day. …US mills used 1.29 million more tons of recycled paper to make new products in 2024 – that’s 32.7 million tons compared to 31.3 million tons in 2023. In 2024, 73% of new single-family homes started were built on slab foundations, according to NAHB analysis of the

In 2024, 73% of new single-family homes started were built on slab foundations, according to NAHB analysis of the

The impact of President Trump’s tariffs on consumer prices is just getting started, according to research by Goldman Sachs Group, adding more uncertainty to a Treasury market that has been gripped by shifting bets on the pace of interest rate cuts. US companies have so far taken the bulk of the hit but the burden will increasingly be passed on to consumers as companies hike prices, economists including Jan Hatzius wrote. Consumers in the US have absorbed an estimated 22% of tariff costs through June, but their share will rise to 67% if the latest tariffs follow the pattern of levies in previous years, they wrote. The net result: faster inflation. The core personal consumer expenditure index, one of the Federal Reserve’s favorite measures of inflation, will hit 3.2% year-on-year in December. They said underlying inflation net of tariffs would be 2.4%. The rate was 2.8% in June.

The impact of President Trump’s tariffs on consumer prices is just getting started, according to research by Goldman Sachs Group, adding more uncertainty to a Treasury market that has been gripped by shifting bets on the pace of interest rate cuts. US companies have so far taken the bulk of the hit but the burden will increasingly be passed on to consumers as companies hike prices, economists including Jan Hatzius wrote. Consumers in the US have absorbed an estimated 22% of tariff costs through June, but their share will rise to 67% if the latest tariffs follow the pattern of levies in previous years, they wrote. The net result: faster inflation. The core personal consumer expenditure index, one of the Federal Reserve’s favorite measures of inflation, will hit 3.2% year-on-year in December. They said underlying inflation net of tariffs would be 2.4%. The rate was 2.8% in June.

This study investigates the economic impact of sawmill entry and exits in Michigan between 2019 and 2023, a period marked by ongoing structural changes in the industry, including the closure of several large mills and the opening of smaller or mid-sized operations. Using observed employment changes… we applied an employment-based multiplier analysis to estimate how net sawmill job losses affected the statewide economy. The results show that while only 273 direct jobs were lost due to net changes from sawmill entry and exit during this period, the broader ripple effects were much larger, approximately 820 jobs and $211 million in output loss. These effects were most pronounced in labor-intensive sectors such as logging and transportation, as well as in downstream sectors like wholesale trade and real estate. The findings highlight the central role of sawmills in regional supply chains and states labor markets, with two-thirds of job losses occurring outside the mills themselves.

This study investigates the economic impact of sawmill entry and exits in Michigan between 2019 and 2023, a period marked by ongoing structural changes in the industry, including the closure of several large mills and the opening of smaller or mid-sized operations. Using observed employment changes… we applied an employment-based multiplier analysis to estimate how net sawmill job losses affected the statewide economy. The results show that while only 273 direct jobs were lost due to net changes from sawmill entry and exit during this period, the broader ripple effects were much larger, approximately 820 jobs and $211 million in output loss. These effects were most pronounced in labor-intensive sectors such as logging and transportation, as well as in downstream sectors like wholesale trade and real estate. The findings highlight the central role of sawmills in regional supply chains and states labor markets, with two-thirds of job losses occurring outside the mills themselves.