Russ Taylor

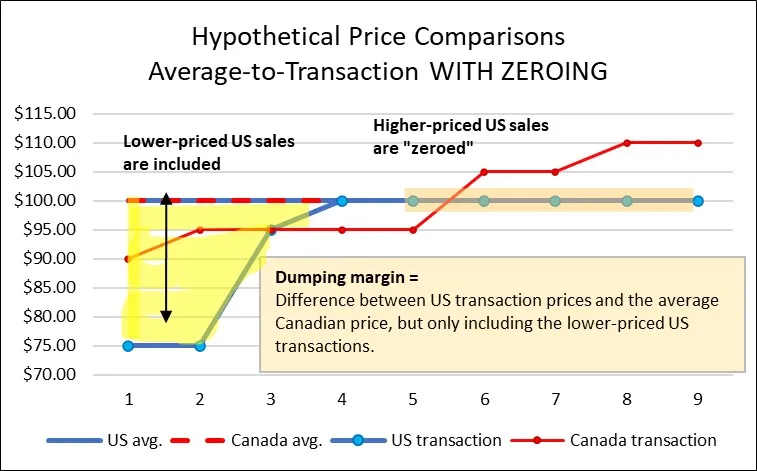

Over the course of my fifty-year career, I have never seen so much misinformation, distortion and political theatre as in 2025. …The recent surge in rhetoric and written attacks aimed at Canada and its softwood lumber industry has been both amusing and perplexing. …The momentum of misinformation continues, with US protectionism and the unrealistic notion of self-sufficiency in softwood lumber production being vigorously promoted. The underlying strategy is clear: penalize all exporters with tariffs to reduce imports, leverage US Trade Law to escalate Canadian duties, inflate US lumber prices, and thus force US lumber buyers to subsidize domestic timber and lumber producers. In this climate, free or fair trade has become undesirable for American lumber companies, especially since the burden of higher-priced lumber—both domestic and imported due to excessive tariffs—is ultimately borne by consumers, home builders and renovators.

US Trade Law has evolved into a permanent tool against Canadian lumber imports, relying on complex methodology to produce calculated duties. Paired with the current US tariff policy, these mechanisms serve to work against all lumber exporters to the US. …While hard facts are the foundation of sound analysis, the intentionally opaque nature of the duty and tariff system makes accessing reliable data difficult. …In conclusion, I urge people to revisit President Ronald Reagan’s 1987 speech on free trade and tariffs, as well as the reports of numerous economists who oppose tariffs. The United States will continue to require billions of board feet of Canadian and other imported lumber. Tariffs will only heighten price volatility and drive prices higher. Fair trade stands to benefit both consumers and producers on both sides of the border, whereas protectionism will result in distinct winners and losers.

Following Tree Frog News’ November 7 op-ed, “

Following Tree Frog News’ November 7 op-ed, “

As trade talks intensify between the US and Canada, those in the forest industry await what will happen with that long-term irritant of a trade file – softwood lumber. The US Lumber Coalition’s (USLC) July 2, 2025 press release, “

As trade talks intensify between the US and Canada, those in the forest industry await what will happen with that long-term irritant of a trade file – softwood lumber. The US Lumber Coalition’s (USLC) July 2, 2025 press release, “

As leaders gather t

As leaders gather t his week at the 2025 Union of BC Municipalities’ convention to chart the future of British Columbia, forestry must be central to those discussions. Forestry touches communities of every size in every part of BC It is not just an industry — it is part of BC’s fabric. And at a time of pressing challenges, forestry offers solutions: for rural, urban and Indigenous communities, it can and should be a unifying force. …Yet the sector faces headwinds. US softwood lumber duties exceed 35%, global markets remain volatile and further tariff increases loom. These forces are beyond our control, but they make action at home urgent. In challenging times, we need to focus on solutions that make us stronger together — solutions that are about “and”, not “or.”

his week at the 2025 Union of BC Municipalities’ convention to chart the future of British Columbia, forestry must be central to those discussions. Forestry touches communities of every size in every part of BC It is not just an industry — it is part of BC’s fabric. And at a time of pressing challenges, forestry offers solutions: for rural, urban and Indigenous communities, it can and should be a unifying force. …Yet the sector faces headwinds. US softwood lumber duties exceed 35%, global markets remain volatile and further tariff increases loom. These forces are beyond our control, but they make action at home urgent. In challenging times, we need to focus on solutions that make us stronger together — solutions that are about “and”, not “or.”

The BCTS Review that was launched in January 2025, and co-chaired by Brian Frenkel, Lenny Joe and George Abbott, is nearing an end for public input intake. The BC government describes this initiative as a periodic review to ensure BCTS is evolving in an ever-changing marketplace while meeting its mandate commitments. The reality is that BCTS performance has been seriously impacted over the last few years. This review comes as the Premier seeks to meet his mandated target for a timber harvest of 45 million m3. Raising the BCTS harvest off its historic lows will help the Premier in his drive to 45!

The BCTS Review that was launched in January 2025, and co-chaired by Brian Frenkel, Lenny Joe and George Abbott, is nearing an end for public input intake. The BC government describes this initiative as a periodic review to ensure BCTS is evolving in an ever-changing marketplace while meeting its mandate commitments. The reality is that BCTS performance has been seriously impacted over the last few years. This review comes as the Premier seeks to meet his mandated target for a timber harvest of 45 million m3. Raising the BCTS harvest off its historic lows will help the Premier in his drive to 45! Well, 2025 will prove to be an interesting year ahead. …Provincially there are some glimmers of hope for some directional changes to the current trajectory of BC’s forest sector through the appointment of an energized and determined Minister of Forests. At the recent TLA convention, there also seemed to be acknowledgment that the need for change was recognized with the Premier and Minister. …The government’s forestry mandate appears to be granted for firm actions, even more so with our obvious need for more self-reliance as a country. But muddying the background is the reality that anything that needs to be accomplished must be done within the spectre of massive provincial deficits and a hiring freeze. Where to start?

Well, 2025 will prove to be an interesting year ahead. …Provincially there are some glimmers of hope for some directional changes to the current trajectory of BC’s forest sector through the appointment of an energized and determined Minister of Forests. At the recent TLA convention, there also seemed to be acknowledgment that the need for change was recognized with the Premier and Minister. …The government’s forestry mandate appears to be granted for firm actions, even more so with our obvious need for more self-reliance as a country. But muddying the background is the reality that anything that needs to be accomplished must be done within the spectre of massive provincial deficits and a hiring freeze. Where to start? Planting a tree can seem like an easy win for the planet. It’s a popular pledge for corporations and organizations eager to participate in sustainability programs and promote environmental responsibility. But here’s the catch: not all trees have the same impact, and not all tree-planting efforts contribute to forest sustainability. As we approach International Day of Forests, it’s worth asking: Are we missing the forests for the trees? Many sustainability programs focus on planting but often overlook the critical role of future forest management — particularly the need for processes like forest thinning. Thinning removes competitive trees which allows the healthiest trees to grow larger and more valuable, and be better equipped to withstand droughts, wildfires, diseases and insect infestations.

Planting a tree can seem like an easy win for the planet. It’s a popular pledge for corporations and organizations eager to participate in sustainability programs and promote environmental responsibility. But here’s the catch: not all trees have the same impact, and not all tree-planting efforts contribute to forest sustainability. As we approach International Day of Forests, it’s worth asking: Are we missing the forests for the trees? Many sustainability programs focus on planting but often overlook the critical role of future forest management — particularly the need for processes like forest thinning. Thinning removes competitive trees which allows the healthiest trees to grow larger and more valuable, and be better equipped to withstand droughts, wildfires, diseases and insect infestations.