At International Pulp Week, three speakers discussed businesses that connect to China’s role in the global pulp industry — including trading, port logistics and the futures market. Haidong Weng, Executive Vice President of Pulp & Paper Research at Xiamen C&D, began with a personal reflection. “My family has been involved in a relationship that’s spanned near 100 years,” he said, referring to US-China ties. He noted that despite today’s challenges, he genuinely believes in “the people-to-people connections between our nations.” Against that backdrop, he provided a granular view of how tariffs and supply chain disruptions are shaping trans-Pacific pulp and paper trade.

At International Pulp Week, three speakers discussed businesses that connect to China’s role in the global pulp industry — including trading, port logistics and the futures market. Haidong Weng, Executive Vice President of Pulp & Paper Research at Xiamen C&D, began with a personal reflection. “My family has been involved in a relationship that’s spanned near 100 years,” he said, referring to US-China ties. He noted that despite today’s challenges, he genuinely believes in “the people-to-people connections between our nations.” Against that backdrop, he provided a granular view of how tariffs and supply chain disruptions are shaping trans-Pacific pulp and paper trade.

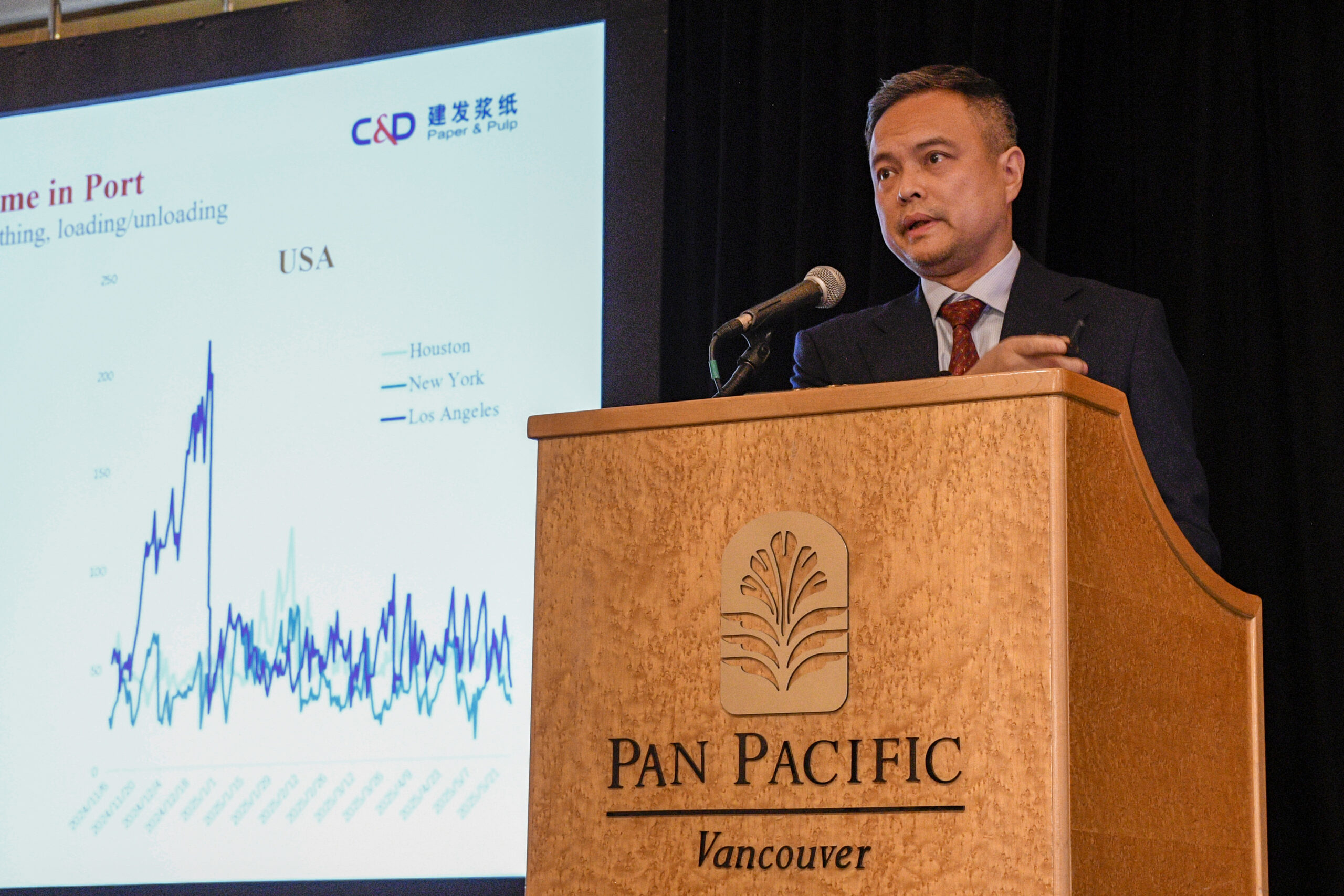

Weng explained that after the US implemented its third wave of tariffs, Chinese exports of paper and board to the US fell sharply, with vessel density in major Chinese ports reflecting a significant pullback in trade flows. US West Coast ports, he added, were particularly affected, with declining vessel calls and longer transit times as shipping lines adjusted. “That involved increases of 14 to 16 days,” Weng noted, referencing the shift of some ships from the Suez Canal to longer routes around the Cape of Good Hope.

Weng explained that after the US implemented its third wave of tariffs, Chinese exports of paper and board to the US fell sharply, with vessel density in major Chinese ports reflecting a significant pullback in trade flows. US West Coast ports, he added, were particularly affected, with declining vessel calls and longer transit times as shipping lines adjusted. “That involved increases of 14 to 16 days,” Weng noted, referencing the shift of some ships from the Suez Canal to longer routes around the Cape of Good Hope.

He also described the cascading effects on US retail markets. “They have to pass the extra cost to the customer, or they have to squeeze their margins, or both,” he said, when commenting on how US importers were managing the additional costs on tissue and packaging imports. Despite the volatility, Weng predicted recovery in shipping flows in the months ahead, “we have already seen the first sign of the recovery.”

The scale and resilience of China’s port logistics were front and centre in a presentation by Tian Jun, representing the Shanghai International Port Group’s Luo Jing Terminal. Tian explained that SIPG views pulp as a strategic growth cargo across its network of general cargo terminals. Strong domestic demand and the expansion of overseas pulp supply underpin the port’s long-term strategy. “We want a cargo that has potential, is sustainable, and is clean. Pulp can satisfy these conditions.” Tian outlined the geographic reach of SIPG’s terminals, adding that Shanghai’s location at the mouth of the Yangtze River offers efficient barge connections to inland factories.

The Luo Jing terminal has been purpose-built for pulp handling, with 17 berths and a large warehouse complex. “We have nine warehouses which can store 460,000 tons of pulp,” he said. “Last year, we adopted a fully electronic paperless system,” Tian said.. “Now our customers do not need to go to customs to get a physical stamp. We can process it electronically and save cost and time for the customers — from 24 hours to 30 minutes,” Tian said. Referencing SIPG’s target of handling five million tons of pulp annually within five years, Tian acknowledged the competitive landscape. “I think it’s a big challenge”, but added that SIPG’s scale, efficiency and customer service would help attract more volume.

The Luo Jing terminal has been purpose-built for pulp handling, with 17 berths and a large warehouse complex. “We have nine warehouses which can store 460,000 tons of pulp,” he said. “Last year, we adopted a fully electronic paperless system,” Tian said.. “Now our customers do not need to go to customs to get a physical stamp. We can process it electronically and save cost and time for the customers — from 24 hours to 30 minutes,” Tian said. Referencing SIPG’s target of handling five million tons of pulp annually within five years, Tian acknowledged the competitive landscape. “I think it’s a big challenge”, but added that SIPG’s scale, efficiency and customer service would help attract more volume.

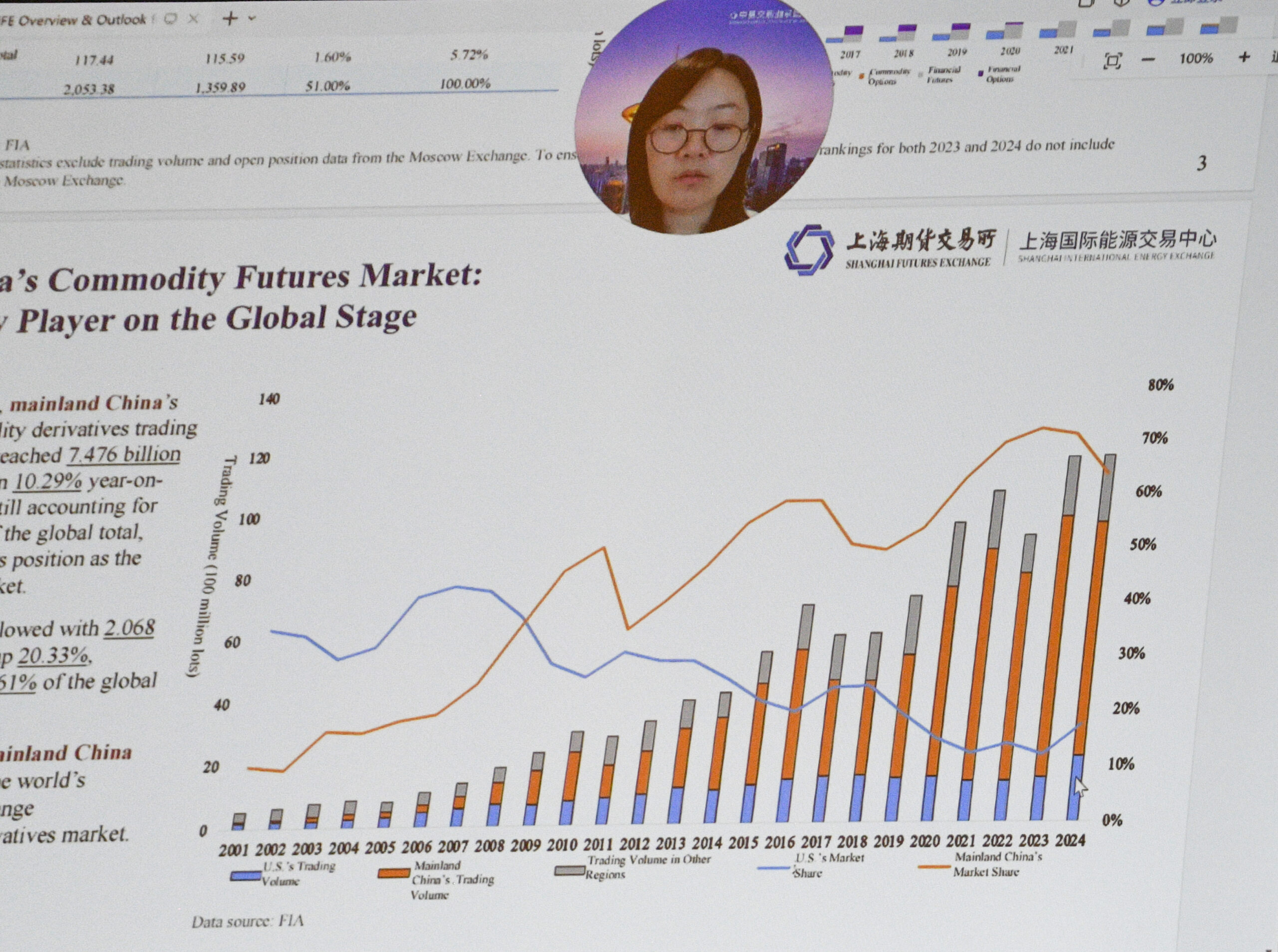

Another presentation came via video from Jin-Feifei of the Shanghai Futures Exchange (SHFE), who provided an overview of China’s pulp futures market. Since the pulp futures contract was launched, trading volume has grown steadily. “It has registered trading volume is 546 million lots and turnover was RMB 26.40 trillion yuan by the end of Q1 2025,” she reported.

Another presentation came via video from Jin-Feifei of the Shanghai Futures Exchange (SHFE), who provided an overview of China’s pulp futures market. Since the pulp futures contract was launched, trading volume has grown steadily. “It has registered trading volume is 546 million lots and turnover was RMB 26.40 trillion yuan by the end of Q1 2025,” she reported.

Delivery volumes are also substantial, with 923,220 tons of pulp delivered in 2024 alone. SHFE has 17 designated delivery facilities across China (11 delivery warehouses, 5 factory warehouses and 1 group delivery facility), Storage Capacity in Use is 920 thousand tons and right now there are 375 thousand tons pulp stored. Chi-Fei Fei noted that SHFE is focused on maintaining a robust risk management framework, with tools such as margin requirements and position limits. The exchange is also embracing global best practices, having joined the UN Sustainable Stock Exchange Initiative this year. “We have become the first commodity futures exchange in the Chinese mainland to participate and well echos the green development of financial market,” she said.