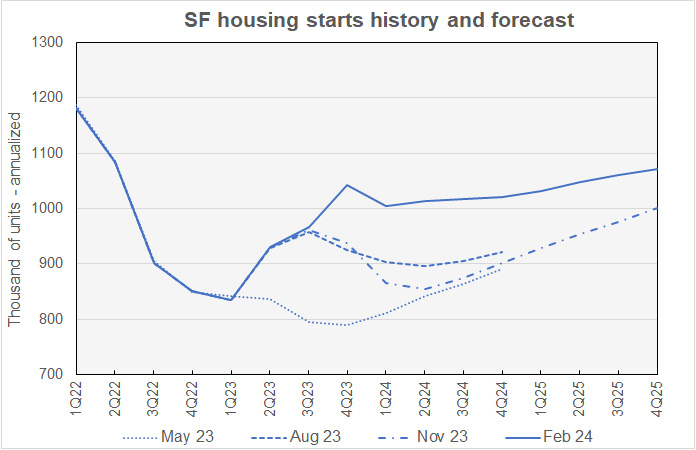

Fannie Mae’s February economic forecast calls for a steady decline in inflation while both GDP growth and employment growth remain positive, if subdued. The housing forecast predicts that multifamily starts will be higher in 2024 but lower in 2025 than they predicted last month. …The largest modification from last month’s forecast was a call for 29,000 (annualized) additional multifamily starts in Q2 2024. …Fannie Mae’s forecasters are predicting that the Federal Reserve will cut the Fed Funds rate by a total of 70 basis points in 2024 and by another 70 basis points in 2025, ending 2025 at a rate of 3.7 percent. …Fannie Mae now expects single-family starts to be 1,014,000 units in 2024, up 25,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 1,053,000 units, up 7,000 units from the level forecast last month. The Fannie Mae February forecast can be found here.

Fannie Mae’s February economic forecast calls for a steady decline in inflation while both GDP growth and employment growth remain positive, if subdued. The housing forecast predicts that multifamily starts will be higher in 2024 but lower in 2025 than they predicted last month. …The largest modification from last month’s forecast was a call for 29,000 (annualized) additional multifamily starts in Q2 2024. …Fannie Mae’s forecasters are predicting that the Federal Reserve will cut the Fed Funds rate by a total of 70 basis points in 2024 and by another 70 basis points in 2025, ending 2025 at a rate of 3.7 percent. …Fannie Mae now expects single-family starts to be 1,014,000 units in 2024, up 25,000 units from the level forecast last month. Single-family starts in 2025 are forecast to be 1,053,000 units, up 7,000 units from the level forecast last month. The Fannie Mae February forecast can be found here.