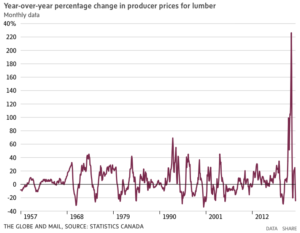

The minutes from the U.S. Federal Reserve’s December meeting along with various payroll reports last week caused lumber prices (along with other commodities) to fall. In its December minutes, the central bank stated it will keep the Fed funds rate “higher for longer” and the ADP private payroll report showed employers added 235,000 jobs in December, above the expected level of 200,000. The payroll reports support the Fed’s stance that interest rates will not be coming down any time soon. Higher interest rates mean higher mortgage rates and a slower housing market, so less demand for lumber. In fact, the price of the commodity is now below the average cost of production. [to access the full story a Globe & Mail subscription is required].

The minutes from the U.S. Federal Reserve’s December meeting along with various payroll reports last week caused lumber prices (along with other commodities) to fall. In its December minutes, the central bank stated it will keep the Fed funds rate “higher for longer” and the ADP private payroll report showed employers added 235,000 jobs in December, above the expected level of 200,000. The payroll reports support the Fed’s stance that interest rates will not be coming down any time soon. Higher interest rates mean higher mortgage rates and a slower housing market, so less demand for lumber. In fact, the price of the commodity is now below the average cost of production. [to access the full story a Globe & Mail subscription is required].