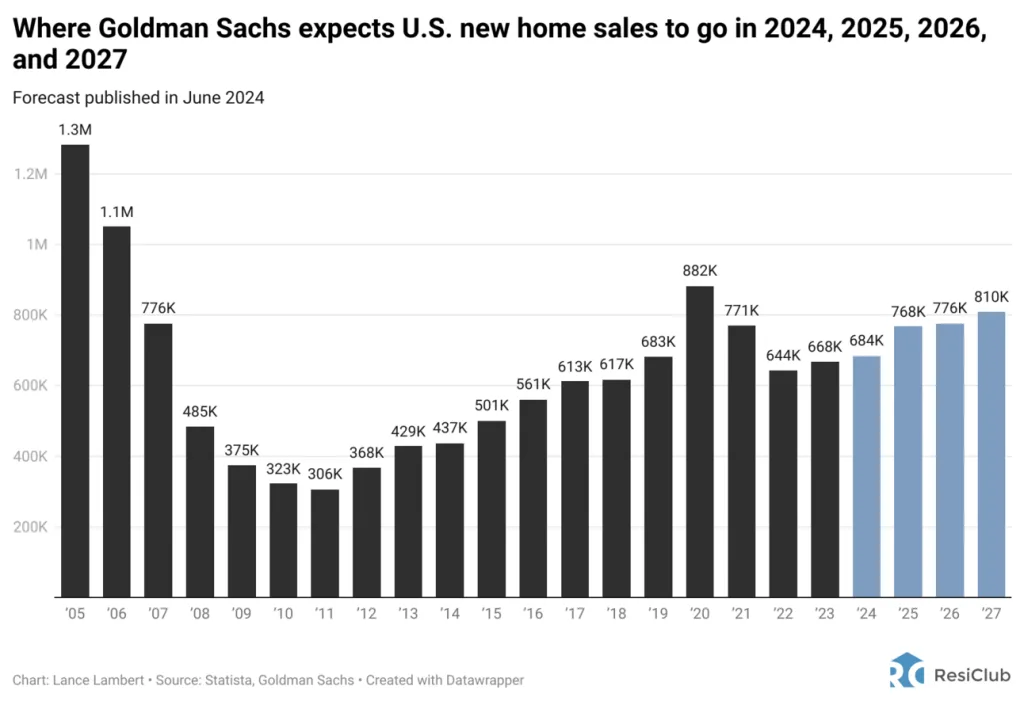

The recession in the U.S. market for existing homes has been so deep that April sales were back to late-’70s levels. …The reason, of course, is that housing affordability has deteriorated so much that many buyers and sellers alike have pulled back from the market. Many homeowners are staying put rather than trading in their 3% mortgage rate for a 7% mortgage rate. …Goldman Sachs projects that existing home sales will slowly drift up from 4.1 million in 2024 to 4.5 million in 2027. Not only is that far below the 6.1 million during the height of the pandemic housing boom in 2021, it’s also well below the 5.3 million U.S. existing home sales during “normal” times in 2019. ….Goldman Sachs predicts the average 30-year fixed mortgage rate will fall to 6.5% by the end of 2024, and to 6.3% by the end of 2025. And analysts at the investment bank forecast that U.S. home prices will rise 3.8% in 2024, followed by 4.4% in 2025.

The recession in the U.S. market for existing homes has been so deep that April sales were back to late-’70s levels. …The reason, of course, is that housing affordability has deteriorated so much that many buyers and sellers alike have pulled back from the market. Many homeowners are staying put rather than trading in their 3% mortgage rate for a 7% mortgage rate. …Goldman Sachs projects that existing home sales will slowly drift up from 4.1 million in 2024 to 4.5 million in 2027. Not only is that far below the 6.1 million during the height of the pandemic housing boom in 2021, it’s also well below the 5.3 million U.S. existing home sales during “normal” times in 2019. ….Goldman Sachs predicts the average 30-year fixed mortgage rate will fall to 6.5% by the end of 2024, and to 6.3% by the end of 2025. And analysts at the investment bank forecast that U.S. home prices will rise 3.8% in 2024, followed by 4.4% in 2025.