Kevin Mason

Notwithstanding expectations for slowing global growth in 2024 (ERA forecast GDP growth of 1.1% in the U.S., 0.9% in Europe), the new year has brought with it more challenges, including the extension of the Middle East conflict to the Red Sea. The re-routing of ships around the Horn of Africa is adding 10‒14 days to any Europe–Asia transit and impacting 10‒12% of global seaborne trade. Volumes through the Suez have dropped ~40% since the conflict began. …Global shipping capacity had already been stretched by the back-up at the drought-impacted Panama Canal—and now this. Impacts on the supply of oil and gas could eventually reach into all goods and services (indeed, global destabilization is the point of the Red Sea attacks); so far, however, falling global oil demand has offset any supply impact on energy pricing.

For many exports of pulp and paper & board, the change adds $20‒$60 per metric tonne to container costs in the near-term. Second-order impacts may include keeping more pulp (and paper) in Europe, depressing prices in that market, and keeping more paper & board in Asia, reducing pulp demand there. In other forest products, an interruption in log and glulam shipments from Europe last year drove Pacific Northwest log prices through the roof for the Japanese market; the same may happen again in this context. Higher shipping costs are inflationary. Our base case for 2024 forest products commodity and equity performance has been anchored by our expectations for falling interest rates to boost housing, particularly through the second half of 2024. Joint military efforts are underway to limit disruptions, but the root of the problem cannot be bombed away and Iran appears uninterested in talking. If the disruption lingers, there will be significant first- and second-order impacts on the shape of markets in 2024.

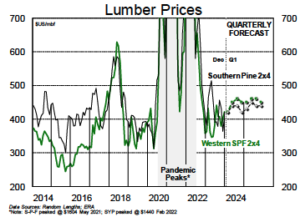

Lumber – It’s been a sluggish start to 2024 for North American lumber markets. S-P-F 2×4 prices, at $442, are up by a mere $2 since the beginning of January but down $3 in the past two weeks. Meanwhile, SYP 2x4s, trading at $400, are down $18 since January began. SYP 2x8s are at only $305. Wintry weather has stymied consumption in several key building regions and a raft of sawmill closure plans did little to jolt the market. An improvement in U.S. housing, or a first Fed rate cut, are the next likely upside catalysts, but may not come until Q2. A rally leading up to the spring building season, though possible, is likely to be muted.

Lumber – It’s been a sluggish start to 2024 for North American lumber markets. S-P-F 2×4 prices, at $442, are up by a mere $2 since the beginning of January but down $3 in the past two weeks. Meanwhile, SYP 2x4s, trading at $400, are down $18 since January began. SYP 2x8s are at only $305. Wintry weather has stymied consumption in several key building regions and a raft of sawmill closure plans did little to jolt the market. An improvement in U.S. housing, or a first Fed rate cut, are the next likely upside catalysts, but may not come until Q2. A rally leading up to the spring building season, though possible, is likely to be muted.

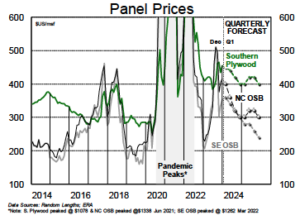

Panel – Cracks appeared in OSB markets last week as Canadian prices declined for the first time since last fall. Benchmark North Central 7/16″ has been unchanged at $415 for eight weeks now, but the price risk appears downside-weighted given those recent price declines of $10–15 in Canada. The restart of Tolko’s High Prairie, Alberta mill has been delayed, with management now targeting a late-Q1 start-up (Q4/2023 was the previous target). In plywood, inclement weather is having an equal impact on supply (via lower peeler log harvests) and demand in the U.S. South. Out west, prices slipped last week but remain historically elevated.

Panel – Cracks appeared in OSB markets last week as Canadian prices declined for the first time since last fall. Benchmark North Central 7/16″ has been unchanged at $415 for eight weeks now, but the price risk appears downside-weighted given those recent price declines of $10–15 in Canada. The restart of Tolko’s High Prairie, Alberta mill has been delayed, with management now targeting a late-Q1 start-up (Q4/2023 was the previous target). In plywood, inclement weather is having an equal impact on supply (via lower peeler log harvests) and demand in the U.S. South. Out west, prices slipped last week but remain historically elevated.

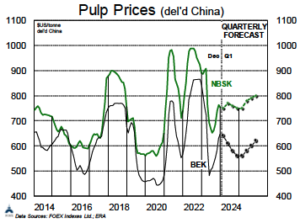

Pulp – Pulp-price direction is unclear. Prior momentum from restocking in China has largely run its course, but pressures from recent closures and downtime are compounding new increases in shipping costs. Producers have lined up behind hardwood increases in North America and Europe for February, but any traction may be slackened by softer markets in China as buyers take Lunar New Year (LNY) holidays through early February. Chinese buying post-LNY will be key to market direction. Several producers have announced January $50 NBSK increases for North America and recent supply reductions should support the hikes. These closures also make it clear that margins remain at challenging levels for many softwood mills.

Pulp – Pulp-price direction is unclear. Prior momentum from restocking in China has largely run its course, but pressures from recent closures and downtime are compounding new increases in shipping costs. Producers have lined up behind hardwood increases in North America and Europe for February, but any traction may be slackened by softer markets in China as buyers take Lunar New Year (LNY) holidays through early February. Chinese buying post-LNY will be key to market direction. Several producers have announced January $50 NBSK increases for North America and recent supply reductions should support the hikes. These closures also make it clear that margins remain at challenging levels for many softwood mills.

Logs – Log prices are stable to slightly down across all regions. In theory, timber should offer downside protection, but the REITs are trending lower alongside solid-wood names. China will be a drag.

Containerboard: The price hike attempted for January was not successful out of the gate, but we suspect prices will grind higher over the coming months (but fall short of targets). Operating rates will continue to improve through 2024‒25 and more price increases are expected.

Boxboard: Price-increase announcements for February surprised the market, with $40‒50 increases slated for coated recycled board, coated unbleached kraft and uncoated recycled paperboard. Early indications are encouraging. Solid bleached sulphate has not seen plans for a price increase, as that market is more fragmented and oversupplied.