Kevin Mason

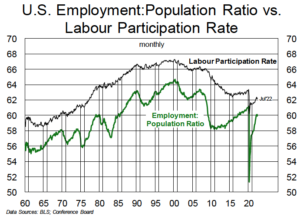

Labour participation rates have failed to return to pre-pandemic levels, job vacancies are outnumbering unemployed workers on both sides of the border, and it appears we are drifting toward a “job-full” recession. One area in which labour shortages are being acutely felt is transportation. Trucker shortages are nothing new, and last year the American Trucking Association reported that the industry had a record-high labour shortage—80,000 drivers—and is anticipating even higher numbers in the years ahead. However, the deterioration of North America’s rail service is a more recent phenomenon as carriers struggle with crew staffing. Canadian forest products companies have long complained about patchy rail service, but the problem has worsened in the past 18 months. When announcing capacity closures in BC last week, West Fraser specifically mentioned transportation constraints that have impaired its ability to reliably access markets. In the U.S., we are also hearing about rail-service reliability issues, with Cascades and Potlatch both calling out rail challenges on recent earnings calls. A recession-induced pullback in demand could ease the strain on the rail networks in the coming months, but there are few obvious signs of just how the structural labour shortages will be addressed.

On company second-quarter calls, there were a few standout examples of efforts being made by companies to tackle the labour challenge. Canfor’s capacity expansion in Mobile, Alabama is one: Canfor will build a new 250MMbf mill on the outskirts of the city to replace its existing mill in downtown Mobile. The current mill will run until the new one is completed, and Canfor hopes to move the workforce over at that time, effectively halving the labour required per MMbf of lumber production. Elsewhere, pellet producer Enviva has tweaked its hiring process in hopes of reducing employee turnover. The company now hires in cohorts instead of filling vacant positions on an ad hoc basis, and retention rates have improved. Labour solutions aren’t easy, but they are being broadly explored.

On company second-quarter calls, there were a few standout examples of efforts being made by companies to tackle the labour challenge. Canfor’s capacity expansion in Mobile, Alabama is one: Canfor will build a new 250MMbf mill on the outskirts of the city to replace its existing mill in downtown Mobile. The current mill will run until the new one is completed, and Canfor hopes to move the workforce over at that time, effectively halving the labour required per MMbf of lumber production. Elsewhere, pellet producer Enviva has tweaked its hiring process in hopes of reducing employee turnover. The company now hires in cohorts instead of filling vacant positions on an ad hoc basis, and retention rates have improved. Labour solutions aren’t easy, but they are being broadly explored.