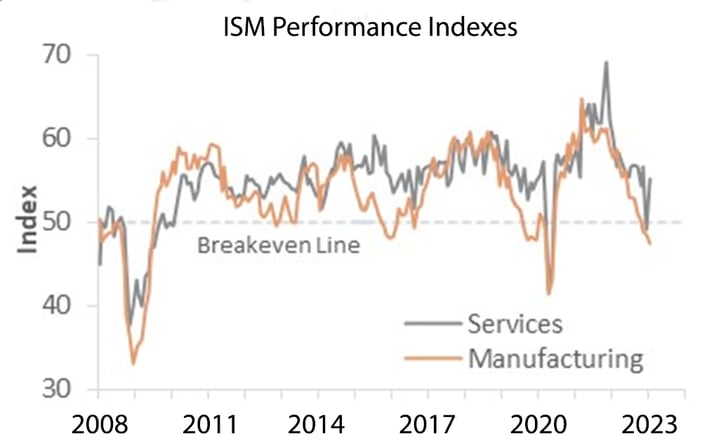

Continued economic downturn ripples across manufacturing. Sentiment is down somewhat, but the services sector is showing promise after an unexpectedly high number of new jobs added to the economy. However, the wood products market continues its dip with a significant year-over-year (YoY) change in softwood lumber price indices. The Institute for Supply Management’s (ISM) monthly sentiment survey of U.S. manufacturers for January 2023 contracted further. …Some good news is present in the forest products sector – at least in pulp & paper. The price index for pulp, paper & allied products rose 0.4% (+9.2% YoY). Wood fiber also saw a modest increase of +0.4%, reflecting a +4.6% YoY rise. Conversely, lumber & wood products dipped -1.5% for a -3.8% YoY decrease. Softwood lumber also fell 5.1%, a stark YoY difference of -26.1% from the same time in 2022. Drops in these numbers highlight continued manufacturing hesitancy in new home starts as interest rates continue rising to combat inflation.

Continued economic downturn ripples across manufacturing. Sentiment is down somewhat, but the services sector is showing promise after an unexpectedly high number of new jobs added to the economy. However, the wood products market continues its dip with a significant year-over-year (YoY) change in softwood lumber price indices. The Institute for Supply Management’s (ISM) monthly sentiment survey of U.S. manufacturers for January 2023 contracted further. …Some good news is present in the forest products sector – at least in pulp & paper. The price index for pulp, paper & allied products rose 0.4% (+9.2% YoY). Wood fiber also saw a modest increase of +0.4%, reflecting a +4.6% YoY rise. Conversely, lumber & wood products dipped -1.5% for a -3.8% YoY decrease. Softwood lumber also fell 5.1%, a stark YoY difference of -26.1% from the same time in 2022. Drops in these numbers highlight continued manufacturing hesitancy in new home starts as interest rates continue rising to combat inflation.