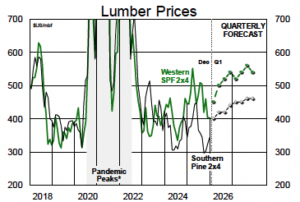

North American lumber markets have enjoyed a bright start to the year, with meaningful price appreciation recorded across virtually all regions and species this month. SYP 2x4s have been the standout performer, with prices increasing by $63 (to $425) since the beginning of January, while S-P-F 2x4s are up by $38 (at $460) over the same period. Lagged housing start data have clouded insights regarding current lumber demand, but we have seen (or heard) little to suggest that underlying demand has improved dramatically over the past couple of months. Instead, we believe that prior supply curtailments coupled with a seasonal inventory build/rebuild has been the catalyst for the recent run in lumber prices.

North American lumber markets have enjoyed a bright start to the year, with meaningful price appreciation recorded across virtually all regions and species this month. SYP 2x4s have been the standout performer, with prices increasing by $63 (to $425) since the beginning of January, while S-P-F 2x4s are up by $38 (at $460) over the same period. Lagged housing start data have clouded insights regarding current lumber demand, but we have seen (or heard) little to suggest that underlying demand has improved dramatically over the past couple of months. Instead, we believe that prior supply curtailments coupled with a seasonal inventory build/rebuild has been the catalyst for the recent run in lumber prices.

Given that recent price increases do not appear to be driven by an uptick in lumber consumption, we suspect that momentum will soon fizzle out, and the deep freeze currently gripping large swathes of North America will likely see trading slow dramatically. These weather events typically stymie lumber consumption on job sites but this is often partially offset by a similar hit to supply, particularly in the U.S. South where the majority of mills are exposed to the elements (in previous winter storms workers have been unable to get to mills, logging trucks are unable to deliver, etc.).

Given that recent price increases do not appear to be driven by an uptick in lumber consumption, we suspect that momentum will soon fizzle out, and the deep freeze currently gripping large swathes of North America will likely see trading slow dramatically. These weather events typically stymie lumber consumption on job sites but this is often partially offset by a similar hit to supply, particularly in the U.S. South where the majority of mills are exposed to the elements (in previous winter storms workers have been unable to get to mills, logging trucks are unable to deliver, etc.).

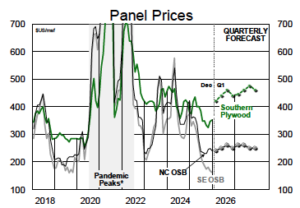

Panels: We are also seeing some tension in OSB markets, with several items posting impressive price gains this month. North Central 7/16ʺ has slipped by $5 to $235, but prices elsewhere range from $180 to $220 following gains of $20 to $50. Downtime taken late last year and the upcoming shut of WFG’s High Level, AB mill has alleviated some near-term concerns about oversupply (delayed capacity expansion is also helping). H1/26 OSB prospects are improving, but risks abound for H2. Stability remains the watchword in plywood, with declining offshore imports helping to keep markets balanced despite sluggish underlying demand.

Panels: We are also seeing some tension in OSB markets, with several items posting impressive price gains this month. North Central 7/16ʺ has slipped by $5 to $235, but prices elsewhere range from $180 to $220 following gains of $20 to $50. Downtime taken late last year and the upcoming shut of WFG’s High Level, AB mill has alleviated some near-term concerns about oversupply (delayed capacity expansion is also helping). H1/26 OSB prospects are improving, but risks abound for H2. Stability remains the watchword in plywood, with declining offshore imports helping to keep markets balanced despite sluggish underlying demand.

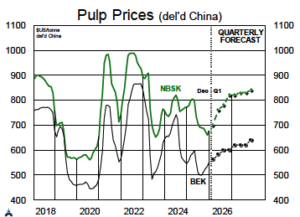

Pulp prices have continued to make slow gains, with some seasonal demand tailwinds in China. Announced hardwood price increases have seen traction in all major markets, although implementation in list markets might take longer than a month. Underlying demand is still not an upside driver and further gains post-LNY may require more supply management. NBSK January prices are down marginally in China, but list prices have ticked up in Europe, in part reflecting typical new year discount inflation. In the U.S., softwood remains oversupplied. The announced fluff price increase has seen resistance and gains will be slow and partial.

Pulp prices have continued to make slow gains, with some seasonal demand tailwinds in China. Announced hardwood price increases have seen traction in all major markets, although implementation in list markets might take longer than a month. Underlying demand is still not an upside driver and further gains post-LNY may require more supply management. NBSK January prices are down marginally in China, but list prices have ticked up in Europe, in part reflecting typical new year discount inflation. In the U.S., softwood remains oversupplied. The announced fluff price increase has seen resistance and gains will be slow and partial.

Paper prices are stable for most grades, although both coated woodfrees and newsprint producers have seen success on recent price hikes. Next up is uncoated woodfrees, where the bulk of the domestic producers have chimed in with prices hikes varying from 3‒9% over Feb/Mar. We expect partial success over a several month period.

Containerboard: Box shipments are expected to post weak results when Q4 numbers are released, but with massive capacity shuts last year the sluggish demand is secondary (tighter markets are coming from shuts). Packaging Corp. was the first major out of the gate with a $70 price hike for March, and others are following.

Boxboard: CRB has been losing market share to bleached grades (SBS/FBB) as bleached producers have lowered prices. With GPK’s new CRB mill in ramp-up phase, that grade will be facing challenges and we suspect a price reduction will be needed to compete with bleached producers. Some European firms appear to be absorbing the tariffs as they ship into the U.S. market. More boxboard downtime/closures are needed.