The 2026 Olympics kicks offs in Italy with PEFC-certified forests at the heart of its sustainability aims. In related news: Canada presents bill to support Build Canada Program; UC Berkeley’s mass timber research is decarbonizing construction; wildfire home insurance is under fire in Southern California; New Brunswick minister says no to JD Irving’s land swap idea; and University of BC researchers say wolf reduction boosts caribou survival in rugged terrain areas.

The 2026 Olympics kicks offs in Italy with PEFC-certified forests at the heart of its sustainability aims. In related news: Canada presents bill to support Build Canada Program; UC Berkeley’s mass timber research is decarbonizing construction; wildfire home insurance is under fire in Southern California; New Brunswick minister says no to JD Irving’s land swap idea; and University of BC researchers say wolf reduction boosts caribou survival in rugged terrain areas.

In Business news: New Brunswick’s Susan Holt says no end is in sight for softwood lumber dispute; Canada Wood Group’s Bruce St. John opines on BC’s race to find alternative markets; Cascades exits honeycomb packaging and partition business; Remsoft acquires INFLOR forest management systems; and Metsa Group reports Q4, 2025 net loss. Meanwhile, the USDA firefighting-agency merger is proceeding without Congress’ approval.

Finally, a new study ties wildfire smoke to 24,100 US deaths per year.

Kelly McCloskey, Tree Frog News Editor

The head of the New Brunswick Forest Products Commission was in front of a legislative committee Thursday, answering MLA’s questions about the state of the industry. The commission is a liaison of sorts between the provincial government, saw and pulp mills and wood marketing boards. Tim Fox acknowledged the Commission has been working to try and help the industry through challenging times, but he said everyone has to work together. “There’s obviously our sawmills who are impacted by the tariff situation and that has spilled over into the private woodlot sector as well,” he said after the meeting. …Private producers have recently expressed frustration over how little support there’s been for woodlot owners to help them through the ongoing U.S. tariff situation. Countervailing and anti-dumping duties on softwood are almost a decade old, but U.S. President Donald Trump added another 10 per cent in the fall, bringing tariff totals to 45 per cent.

The head of the New Brunswick Forest Products Commission was in front of a legislative committee Thursday, answering MLA’s questions about the state of the industry. The commission is a liaison of sorts between the provincial government, saw and pulp mills and wood marketing boards. Tim Fox acknowledged the Commission has been working to try and help the industry through challenging times, but he said everyone has to work together. “There’s obviously our sawmills who are impacted by the tariff situation and that has spilled over into the private woodlot sector as well,” he said after the meeting. …Private producers have recently expressed frustration over how little support there’s been for woodlot owners to help them through the ongoing U.S. tariff situation. Countervailing and anti-dumping duties on softwood are almost a decade old, but U.S. President Donald Trump added another 10 per cent in the fall, bringing tariff totals to 45 per cent.

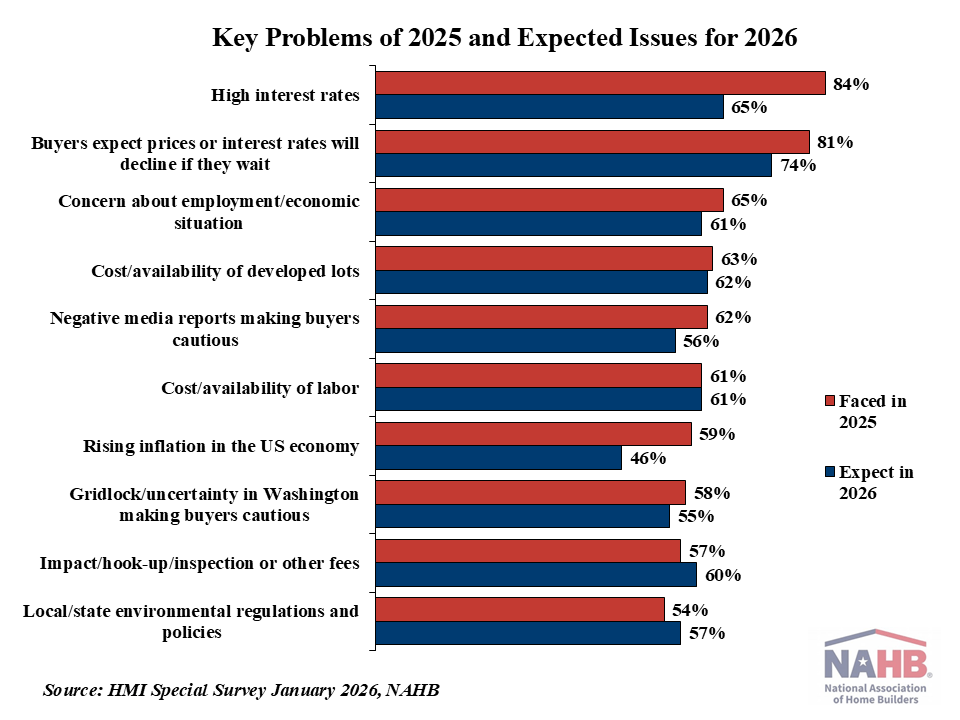

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

Lumber futures slipped below $590 per thousand board feet, the lowest level in nearly four weeks, as housing demand weakened and earlier restocking momentum faded. Demand softened as financing costs edged higher and housing activity cooled, with US pending home sales plunging 9.3% month on month in December 2025, removing a key source of construction and renovation related wood consumption ahead of the spring building season. At the same time, mills continued running to rebuild inventories after the winter squeeze, increasing physical availability while distributors reported quieter order books. The combination of softer demand and rising availability encouraged position unwinds after January’s rally, with falling volumes and open interest amplifying the price decline. [END]

The federal government

The federal government

California’s wildfire insurance crisis intensified this week as major insurers faced renewed scrutiny over denied or delayed payouts, while regulators and lawmakers moved to address mounting consumer complaints. The

California’s wildfire insurance crisis intensified this week as major insurers faced renewed scrutiny over denied or delayed payouts, while regulators and lawmakers moved to address mounting consumer complaints. The

Reducing wolves to protect endangered caribou doesn’t always deliver the expected results—and the shape of the land may be the deciding factor. That’s according to

Reducing wolves to protect endangered caribou doesn’t always deliver the expected results—and the shape of the land may be the deciding factor. That’s according to  Several programs have been suspended at North Island College, but before the decision came down, students and alumni made their displeasure known outside Koumox Hall in two different rallies. …The Ministry of Post Secondary Education sent out a provincial mandate for schools to review all programs last June after federal policy changes regarding the reduction of international student visas issued. The ministry projected it could lead to a province-wide negative annual revenue impact of a $300 million deficit. 15 programs are being considered for suspension including Coastal Forestry Certificate, Coastal Forestry Diploma, and Furniture Design and Joinery Certificate.

Several programs have been suspended at North Island College, but before the decision came down, students and alumni made their displeasure known outside Koumox Hall in two different rallies. …The Ministry of Post Secondary Education sent out a provincial mandate for schools to review all programs last June after federal policy changes regarding the reduction of international student visas issued. The ministry projected it could lead to a province-wide negative annual revenue impact of a $300 million deficit. 15 programs are being considered for suspension including Coastal Forestry Certificate, Coastal Forestry Diploma, and Furniture Design and Joinery Certificate. The Interior Department is blazing ahead with a reorganization plan that will bring all of its wildland firefighting operations into a single agency. Starting next week, all the department’s wildland fire employees and programs will be moved into a new Wildland Fire Service. Congress did not approve funds for this consolidation of federal firefighting programs into one agency. The Wildland Fire Service also stops short of merging wildland fire personnel or programs from the USDA’s Forest Service with those same resources at the Interior Department. An internal memo sent to staff on Monday states the Wildland Fire Service “will unify wildland fire management within DOI only.” According to the memo, obtained by Federal News Network, the Wildland Fire Service will “align operations” with USDA through shared procurement, predictive services, research, and policy reforms.

The Interior Department is blazing ahead with a reorganization plan that will bring all of its wildland firefighting operations into a single agency. Starting next week, all the department’s wildland fire employees and programs will be moved into a new Wildland Fire Service. Congress did not approve funds for this consolidation of federal firefighting programs into one agency. The Wildland Fire Service also stops short of merging wildland fire personnel or programs from the USDA’s Forest Service with those same resources at the Interior Department. An internal memo sent to staff on Monday states the Wildland Fire Service “will unify wildland fire management within DOI only.” According to the memo, obtained by Federal News Network, the Wildland Fire Service will “align operations” with USDA through shared procurement, predictive services, research, and policy reforms. Baker City, Oregon — Baker County Commissioner Christina Witham lauded the Wallowa-Whitman National Forest for cutting and piling trees southwest of Baker City, the start of a project that will continue for several years with a goal of reducing the risk of a wildfire in the city’s watershed. “It’s looking really nice,” Witham said during commissioners’ meeting Wednesday morning, Feb. 4. Witham, whose focus areas as a commissioner include natural resources, said she recently toured some of the work areas with Forest Service officials. …According to the Wallowa-Whitman, the project, which totals about 23,000 acres, is designed not only to reduce the fire risk within the watershed, but also to curb the threat of a fire spreading into the watershed, particularly from the south, a path that summer lightning storms often follow.

Baker City, Oregon — Baker County Commissioner Christina Witham lauded the Wallowa-Whitman National Forest for cutting and piling trees southwest of Baker City, the start of a project that will continue for several years with a goal of reducing the risk of a wildfire in the city’s watershed. “It’s looking really nice,” Witham said during commissioners’ meeting Wednesday morning, Feb. 4. Witham, whose focus areas as a commissioner include natural resources, said she recently toured some of the work areas with Forest Service officials. …According to the Wallowa-Whitman, the project, which totals about 23,000 acres, is designed not only to reduce the fire risk within the watershed, but also to curb the threat of a fire spreading into the watershed, particularly from the south, a path that summer lightning storms often follow. Anytime someone talks about shifting management of federal lands to Idaho, know that they have a bigger goal in mind. In a recent interview on The Ranch Podcast, Rep. Jordan Redman, R-Coeur d’Alene, was frank about his goals for public lands in Idaho. He said his father, former Rep. Eric Redman, dreamed of Idaho taking ownership of federal lands, and his goal is the same. The first step is for Idaho to manage public lands for a bit, then the state takes ownership of them. “How do we get that federal land back in ownership for the state?” Rep. Jordan Redman said. Back? It should be said that Idaho has never owned federal land. Redman should try reading the Constitution he swore to uphold: “… the people of the state of Idaho do agree and declare that we forever disclaim all right and title to the unappropriated public lands lying within the boundaries thereof … .” You can’t get back what you never owned; you can only take it. In service of the goal of taking federal land, Redman made a familiar argument.

Anytime someone talks about shifting management of federal lands to Idaho, know that they have a bigger goal in mind. In a recent interview on The Ranch Podcast, Rep. Jordan Redman, R-Coeur d’Alene, was frank about his goals for public lands in Idaho. He said his father, former Rep. Eric Redman, dreamed of Idaho taking ownership of federal lands, and his goal is the same. The first step is for Idaho to manage public lands for a bit, then the state takes ownership of them. “How do we get that federal land back in ownership for the state?” Rep. Jordan Redman said. Back? It should be said that Idaho has never owned federal land. Redman should try reading the Constitution he swore to uphold: “… the people of the state of Idaho do agree and declare that we forever disclaim all right and title to the unappropriated public lands lying within the boundaries thereof … .” You can’t get back what you never owned; you can only take it. In service of the goal of taking federal land, Redman made a familiar argument.

Chronic exposure to pollution from wildfires has been linked to tens of thousands of deaths annually in the United States, according to a new study. The paper found that from 2006 to 2020, long-term exposure to tiny particulates from wildfire smoke contributed to an average of 24,100 deaths a year in the lower 48 states. “Our message is: Wildfire smoke is very dangerous. It is an increasing threat to human health,” said Yaguang Wei, a study author and assistant professor in the department of environmental medicine at Icahn School of Medicine at Mount Sinai. …“It’s only if we’re doing multiple studies with many different designs that we gain scientific confidence of our outcomes,” said Michael Jerrett, professor of environmental health science at the University of California, Los Angeles. The paper’s researchers focused on deaths linked to chronic exposure to fine particulate matter, or PM2.5 — the main concern from wildfire smoke.

Chronic exposure to pollution from wildfires has been linked to tens of thousands of deaths annually in the United States, according to a new study. The paper found that from 2006 to 2020, long-term exposure to tiny particulates from wildfire smoke contributed to an average of 24,100 deaths a year in the lower 48 states. “Our message is: Wildfire smoke is very dangerous. It is an increasing threat to human health,” said Yaguang Wei, a study author and assistant professor in the department of environmental medicine at Icahn School of Medicine at Mount Sinai. …“It’s only if we’re doing multiple studies with many different designs that we gain scientific confidence of our outcomes,” said Michael Jerrett, professor of environmental health science at the University of California, Los Angeles. The paper’s researchers focused on deaths linked to chronic exposure to fine particulate matter, or PM2.5 — the main concern from wildfire smoke.