GreenFirst entered into a $30M term loan under Canada’s softwood lumber transformation program. In related news: the mayor of Ignace, Ontario is surprised by Domtar mill curtailment; JD Irving reorganizes its chip plant jobs in New Brunswick; BC Premier Eby says market diversifying will help but it will take time; Forest Minister Parmar promotes modular home building; and COFI’s Kim Haakstad says permit delays are hurting the sector. Meanwhile: wildfires contributed to the rise in Canada’s 2025 insured losses; Canfor Pulp reported progress on share acquisition agreement; and Boise Cascade announced leadership changes.

GreenFirst entered into a $30M term loan under Canada’s softwood lumber transformation program. In related news: the mayor of Ignace, Ontario is surprised by Domtar mill curtailment; JD Irving reorganizes its chip plant jobs in New Brunswick; BC Premier Eby says market diversifying will help but it will take time; Forest Minister Parmar promotes modular home building; and COFI’s Kim Haakstad says permit delays are hurting the sector. Meanwhile: wildfires contributed to the rise in Canada’s 2025 insured losses; Canfor Pulp reported progress on share acquisition agreement; and Boise Cascade announced leadership changes.

In Forestry/Carbon news: a Federal report says mismanagement fuelled the 2024 Jasper wildfire; a BC First Nations-owned company is granted court protection at the Walbran Valley logging blockade; ‘Forestry is a Solution ‘ campaign launches in Prince George; an Ohio study says US forests are storing more carbon; and a UK report says cardboard biomass is effective for power generation.

Finally, Steelworkers welcome combustable dust safety reforms on anniversary of Babine mill explosion.

Kelly McCloskey, Tree Frog News Editor

)

Facing growing backlash over the unintended consequences of its reconciliation policies, the B.C. NDP government has hit pause on controversial changes to the Heritage Conservation Act…Forests Minister Ravi Parmar announced the move Monday, saying he’d “heard loud and clear” that municipalities, business groups, the real estate sector and …the public needed more time to understand the changes. “It was very clear to me that I was not in a position to bring forward amendments this spring,” he said. …It’s the opposite approach to where the NDP started on the file just four months ago, charging forward with the changes so aggressively that their passage—following secret negotiations with First Nations and non-disclosure agreements slapped on everyone else—seemed like a fait accompli. …The NDP say they are in listening mode now, on the Heritage Conservation Act. The question is whether the government truly understands that changes built without public trust are simply no longer viable.

Facing growing backlash over the unintended consequences of its reconciliation policies, the B.C. NDP government has hit pause on controversial changes to the Heritage Conservation Act…Forests Minister Ravi Parmar announced the move Monday, saying he’d “heard loud and clear” that municipalities, business groups, the real estate sector and …the public needed more time to understand the changes. “It was very clear to me that I was not in a position to bring forward amendments this spring,” he said. …It’s the opposite approach to where the NDP started on the file just four months ago, charging forward with the changes so aggressively that their passage—following secret negotiations with First Nations and non-disclosure agreements slapped on everyone else—seemed like a fait accompli. …The NDP say they are in listening mode now, on the Heritage Conservation Act. The question is whether the government truly understands that changes built without public trust are simply no longer viable.

Interim opposition leader Trevor Halford told logging contractors Friday that the province’s forestry downturn is being driven by a system that is “not functioning at the pace this sector requires.” Halford, the interim leader of the B.C. Conservatives spoke at the Truck Loggers Association’s convention in Vancouver. “This crisis is not about forests disappearing. It is not about fibre not existing. It is about permits not moving, decisions not being made, and systems that do not function at the pace this sector requires,” Halford said. Halford opened by citing a Vancouver Sun story that described the B.C. forest industry as “on the edge of collapse,” and quoting TLA executive director Peter Lister, who told the convention he had “never seen it as bad” in more than 35 years in the sector. …Halford said the industry has heard “explanations” from the government, but needs measurable results. “Accountability matters. Transparency matters. Results matter,” he said.

Interim opposition leader Trevor Halford told logging contractors Friday that the province’s forestry downturn is being driven by a system that is “not functioning at the pace this sector requires.” Halford, the interim leader of the B.C. Conservatives spoke at the Truck Loggers Association’s convention in Vancouver. “This crisis is not about forests disappearing. It is not about fibre not existing. It is about permits not moving, decisions not being made, and systems that do not function at the pace this sector requires,” Halford said. Halford opened by citing a Vancouver Sun story that described the B.C. forest industry as “on the edge of collapse,” and quoting TLA executive director Peter Lister, who told the convention he had “never seen it as bad” in more than 35 years in the sector. …Halford said the industry has heard “explanations” from the government, but needs measurable results. “Accountability matters. Transparency matters. Results matter,” he said.

VANCOUVER, BC – Canfor Pulp Products announced the expiration of the go-shop period provided for in the previously announced arrangement agreement dated December 3, 2025 between Canfor Pulp and Canfor Corporation, pursuant to which Canfor Corp will acquire all of Canfor Pulp’s issued and outstanding common shares not already owned by Canfor Corp and its affiliates. Under the terms of the Arrangement Agreement, each shareholder of Canfor Pulp will have the option to receive: 0.0425 of a common share of Canfor Corp per Canfor Pulp Share held, or $0.50 in cash per Canfor Pulp Share held. …During the Go-Shop Period, Canfor Pulp was permitted to actively solicit, evaluate and enter into negotiations with third parties that expressed an interest in acquiring Canfor Pulp. …The Go-Shop Period expired on January 19, 2026. Canfor Pulp did not receive any Acquisition Proposals.

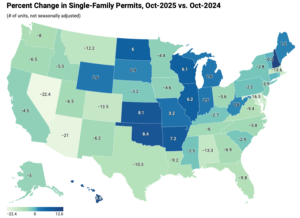

VANCOUVER, BC – Canfor Pulp Products announced the expiration of the go-shop period provided for in the previously announced arrangement agreement dated December 3, 2025 between Canfor Pulp and Canfor Corporation, pursuant to which Canfor Corp will acquire all of Canfor Pulp’s issued and outstanding common shares not already owned by Canfor Corp and its affiliates. Under the terms of the Arrangement Agreement, each shareholder of Canfor Pulp will have the option to receive: 0.0425 of a common share of Canfor Corp per Canfor Pulp Share held, or $0.50 in cash per Canfor Pulp Share held. …During the Go-Shop Period, Canfor Pulp was permitted to actively solicit, evaluate and enter into negotiations with third parties that expressed an interest in acquiring Canfor Pulp. …The Go-Shop Period expired on January 19, 2026. Canfor Pulp did not receive any Acquisition Proposals. In October, single-family building permits weakened, reflecting continued caution among builders amid affordability constraints and financing challenges. In contrast, multifamily permit activity remained steady and continued to perform relatively well. Together, these trends suggest that while demand for new housing persists, builders are adjusting residential construction activity in response to evolving market conditions. Because permits typically precede construction starts, these patterns offer insight into the near-term outlook for residential building activity. Over the first ten months of 2025, the number of single-family permits issued nationwide reached 787,122. On a year-over-year basis, this represents a 7.0 percent decline compared with the October 2024 year-to-date total of 846,446. Multifamily permitting activity was stronger, with 426,352 permits issued nationwide, marking a 5.7 percent increase from the same period last year.

In October, single-family building permits weakened, reflecting continued caution among builders amid affordability constraints and financing challenges. In contrast, multifamily permit activity remained steady and continued to perform relatively well. Together, these trends suggest that while demand for new housing persists, builders are adjusting residential construction activity in response to evolving market conditions. Because permits typically precede construction starts, these patterns offer insight into the near-term outlook for residential building activity. Over the first ten months of 2025, the number of single-family permits issued nationwide reached 787,122. On a year-over-year basis, this represents a 7.0 percent decline compared with the October 2024 year-to-date total of 846,446. Multifamily permitting activity was stronger, with 426,352 permits issued nationwide, marking a 5.7 percent increase from the same period last year.

TIANJIN, CHINA — The global movement against single-use plastics has triggered a significant transformation in the disposable tableware industry, with wood cutlery emerging as a leading alternative. As regulations tighten and consumer preferences shift toward eco-friendly options, manufacturers of disposable wooden utensils are experiencing unprecedented growth and facing new challenges in scaling production, ensuring sustainability, and meeting diverse international standards. Market analysts observe that regulatory pressure represents the primary driver for this sector’s expansion. The European Union’s Single-Use Plastics Directive, along with similar legislation in Canada, Australia, and numerous U.S. states, has created a substantial and sustained demand for compliant alternatives. Within this regulatory framework, wood, particularly from fast-growing, sustainably managed sources like birch and bamboo, has gained favor for its natural composition, biodegradability, and perceived premium feel compared to other alternatives.

TIANJIN, CHINA — The global movement against single-use plastics has triggered a significant transformation in the disposable tableware industry, with wood cutlery emerging as a leading alternative. As regulations tighten and consumer preferences shift toward eco-friendly options, manufacturers of disposable wooden utensils are experiencing unprecedented growth and facing new challenges in scaling production, ensuring sustainability, and meeting diverse international standards. Market analysts observe that regulatory pressure represents the primary driver for this sector’s expansion. The European Union’s Single-Use Plastics Directive, along with similar legislation in Canada, Australia, and numerous U.S. states, has created a substantial and sustained demand for compliant alternatives. Within this regulatory framework, wood, particularly from fast-growing, sustainably managed sources like birch and bamboo, has gained favor for its natural composition, biodegradability, and perceived premium feel compared to other alternatives.

STRATHCONA COUNTY, AB – Project Forest has partnered with Keyera and Strathcona County to establish the Keyera Legacy Forest. This forest restoration initiative is focused on restoring wildfire-impacted land and supporting community biodiversity in Alberta’s industrial Heartland. Located in Strathcona County, northeast of Fort Saskatchewan, the project will restore over 95 acres of ecologically degraded land. Strathcona County will use a Conservation Easement to ensure permanence and create a “green island” within Alberta’s Industrial Heartland. …The Keyera Legacy Forest is a unique example demonstrating how restoration and industry can coexist, delivering long-term community and ecological benefits. This is a rare, once-in-a-lifetime opportunity to responsibly restore designated industrial land. This project represents a voluntary commitment by Keyera to invest in long-term environmental stewardship, guided by values rather than obligation.

STRATHCONA COUNTY, AB – Project Forest has partnered with Keyera and Strathcona County to establish the Keyera Legacy Forest. This forest restoration initiative is focused on restoring wildfire-impacted land and supporting community biodiversity in Alberta’s industrial Heartland. Located in Strathcona County, northeast of Fort Saskatchewan, the project will restore over 95 acres of ecologically degraded land. Strathcona County will use a Conservation Easement to ensure permanence and create a “green island” within Alberta’s Industrial Heartland. …The Keyera Legacy Forest is a unique example demonstrating how restoration and industry can coexist, delivering long-term community and ecological benefits. This is a rare, once-in-a-lifetime opportunity to responsibly restore designated industrial land. This project represents a voluntary commitment by Keyera to invest in long-term environmental stewardship, guided by values rather than obligation.

A broad coalition of forestry workers, community leaders and industry representatives has organized a petition asking the public to support their push for the provincial government to take immediate action to address the current challenges faced by an ailing forest industry. The group has launched a new province-wide platform called Forestry Is a Solution to ask British Columbians to show their support for forestry workers and their families. …The campaign has identified as its top priority that the provincial government expedite permits and project approvals to speed up access to economic fibre. It also seeks to improve the competitiveness of BC’s forest industry by reducing administrative barriers and regulatory burdens. The coalition says it’s time to fix BC Timber Sales and its policies to ensure a reliable and competitive supply of logs for mills and secondary manufacturing.

A broad coalition of forestry workers, community leaders and industry representatives has organized a petition asking the public to support their push for the provincial government to take immediate action to address the current challenges faced by an ailing forest industry. The group has launched a new province-wide platform called Forestry Is a Solution to ask British Columbians to show their support for forestry workers and their families. …The campaign has identified as its top priority that the provincial government expedite permits and project approvals to speed up access to economic fibre. It also seeks to improve the competitiveness of BC’s forest industry by reducing administrative barriers and regulatory burdens. The coalition says it’s time to fix BC Timber Sales and its policies to ensure a reliable and competitive supply of logs for mills and secondary manufacturing. Federal forest managers left vast stretches of beetle-killed pine standing in Jasper National Park, a failure that became a key driver of the catastrophic 2024 wildfire that destroyed roughly a third of the town, according to a Canadian Forest Service report that contradicts cabinet’s climate-change narrative. The analysis says a severe Mountain Pine Beetle infestation peaked about seven years before the fire, leaving behind extensive dead lodgepole pine that dramatically worsened fire behavior. …Blacklock’s Reporter says the Forest Service document, Jasper wildfire complex 2024 fire behaviour documentation, reconstruction and analysis, concludes that dead pine from beetle mortality formed a major part of the fuel load. Tree death altered forest structure, accelerated the drying of surface fuels, and created an abundance of dry, woody material that sharply increased fuel consumption and fire intensity. Internal reports and Access to Information records show Parks Canada was slow for years to remove dead pine through cutting or prescribed burns.

Federal forest managers left vast stretches of beetle-killed pine standing in Jasper National Park, a failure that became a key driver of the catastrophic 2024 wildfire that destroyed roughly a third of the town, according to a Canadian Forest Service report that contradicts cabinet’s climate-change narrative. The analysis says a severe Mountain Pine Beetle infestation peaked about seven years before the fire, leaving behind extensive dead lodgepole pine that dramatically worsened fire behavior. …Blacklock’s Reporter says the Forest Service document, Jasper wildfire complex 2024 fire behaviour documentation, reconstruction and analysis, concludes that dead pine from beetle mortality formed a major part of the fuel load. Tree death altered forest structure, accelerated the drying of surface fuels, and created an abundance of dry, woody material that sharply increased fuel consumption and fire intensity. Internal reports and Access to Information records show Parks Canada was slow for years to remove dead pine through cutting or prescribed burns. U.S. forests have stored more carbon in the past two decades than at any time in the last century, an increase attributable to a mix of natural factors and human activity. To unravel the cause behind this spike, researchers used nationwide forest data to examine how six environmental factors may have contributed to the increase in carbon sequestered by forests. They found that natural forces such as increasing temperatures, shifting precipitation, and carbon fertilization are among the largest contributors to carbon gains, but human drivers, like letting forests get older and planting trees, are also becoming bigger factors. …this new analysis aims to help researchers better separate what portion of carbon held by forests is related to human action and which portion isn’t. …This work highlights the vast difference in the amount of carbon forests can absorb naturally versus when they are actively managed.

U.S. forests have stored more carbon in the past two decades than at any time in the last century, an increase attributable to a mix of natural factors and human activity. To unravel the cause behind this spike, researchers used nationwide forest data to examine how six environmental factors may have contributed to the increase in carbon sequestered by forests. They found that natural forces such as increasing temperatures, shifting precipitation, and carbon fertilization are among the largest contributors to carbon gains, but human drivers, like letting forests get older and planting trees, are also becoming bigger factors. …this new analysis aims to help researchers better separate what portion of carbon held by forests is related to human action and which portion isn’t. …This work highlights the vast difference in the amount of carbon forests can absorb naturally versus when they are actively managed.

A new study has shown for the first time that waste cardboard can be used as an effective source of biomass fuel for large-scale power generation, offering a potential new domestic resource to support the UK’s renewable energy sector. Engineers from the University of Nottingham have carried out the first comprehensive characterisation of cardboard as a fuel source and developed a new method to assess its composition. The research … provides a practical tool for evaluating different grades of cardboard for use in energy production. The study found that cardboard displays distinct physical and chemical properties compared with traditional biomass fuels. These include lower carbon content, a reduced heating value and a high level of calcium carbonate fillers, particularly in printed grades. Calcium carbonate is commonly added to cardboard to improve stiffness and optical qualities, but during combustion it forms ash that can reduce boiler performance.

A new study has shown for the first time that waste cardboard can be used as an effective source of biomass fuel for large-scale power generation, offering a potential new domestic resource to support the UK’s renewable energy sector. Engineers from the University of Nottingham have carried out the first comprehensive characterisation of cardboard as a fuel source and developed a new method to assess its composition. The research … provides a practical tool for evaluating different grades of cardboard for use in energy production. The study found that cardboard displays distinct physical and chemical properties compared with traditional biomass fuels. These include lower carbon content, a reduced heating value and a high level of calcium carbonate fillers, particularly in printed grades. Calcium carbonate is commonly added to cardboard to improve stiffness and optical qualities, but during combustion it forms ash that can reduce boiler performance. PRINCE GEORGE, BC — On the anniversary of the Babine Forest Products mill explosion, the United Steelworkers union is remembering the two workers killed and the more than 20 others injured in the 2012 tragedy, while welcoming long-overdue reforms to BC’s combustible dust safety regulations. Fourteen years ago, two workers went to work at the Babine sawmill near Burns Lake, BC, and did not return home after a powerful explosion caused by combustible wood dust. The disaster remains one of the deadliest industrial workplace tragedies in the province’s history. …At its November 2025 meeting, WorkSafeBC’s Board of Directors approved significant amendments to Part 6 of the Occupational Health and Safety Regulation to modernize how combustible dust hazards are regulated in BC. …The new requirements include mandatory combustion risk assessments, written combustible dust management programs, stronger controls on ignition sources and dust accumulation, and enhanced training and worker consultation. The amendments will come into force on Jan. 4, 2027.

PRINCE GEORGE, BC — On the anniversary of the Babine Forest Products mill explosion, the United Steelworkers union is remembering the two workers killed and the more than 20 others injured in the 2012 tragedy, while welcoming long-overdue reforms to BC’s combustible dust safety regulations. Fourteen years ago, two workers went to work at the Babine sawmill near Burns Lake, BC, and did not return home after a powerful explosion caused by combustible wood dust. The disaster remains one of the deadliest industrial workplace tragedies in the province’s history. …At its November 2025 meeting, WorkSafeBC’s Board of Directors approved significant amendments to Part 6 of the Occupational Health and Safety Regulation to modernize how combustible dust hazards are regulated in BC. …The new requirements include mandatory combustion risk assessments, written combustible dust management programs, stronger controls on ignition sources and dust accumulation, and enhanced training and worker consultation. The amendments will come into force on Jan. 4, 2027.