Lumber prices have reversed course lately after the fire-induced rally met with seasonally sluggish demand. High-cost mills will again be tested and downtime will be needed. A painful quarter or two await. OSB prices appear to have peaked, with oversupply expected in 2024. Share prices are fading but lumber companies are expected to have more upside over the next year than panel producers. Pulp prices are still falling for most grades and regions, save for a bounce off the bottom in China. The majority of prices are expected to bottom in Q3 and prices will trend near trough levels until mill curtailments and/or closures expand. Demand remains horrible as downstream inventories are whittled away. Prices are falling slowly as North American producers embark on significant downtime to keep stocks in check. Prices will continue falling through 2023–24.

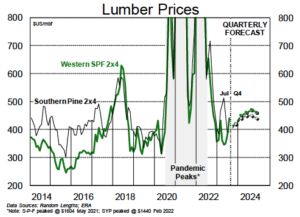

It’s been a challenging month for North American lumber markets, with prices for SYP and S-P-F slumping. S-P-F 2x4s are currently trading at $385, down by $65 in the past three weeks. At $377, SYP 2×4 prices are off by $20 over the same period. A seasonal slowdown in demand has been the primary driver of pricing weakness. The threat of wildfire-related supply disruptions has dissipated in recent weeks (we note that wildfire activity could pick up again before the fire season ends), and buyers appear content to run with lean inventories given uncertainty about H2/23 demand prospects.

It’s been a challenging month for North American lumber markets, with prices for SYP and S-P-F slumping. S-P-F 2x4s are currently trading at $385, down by $65 in the past three weeks. At $377, SYP 2×4 prices are off by $20 over the same period. A seasonal slowdown in demand has been the primary driver of pricing weakness. The threat of wildfire-related supply disruptions has dissipated in recent weeks (we note that wildfire activity could pick up again before the fire season ends), and buyers appear content to run with lean inventories given uncertainty about H2/23 demand prospects.

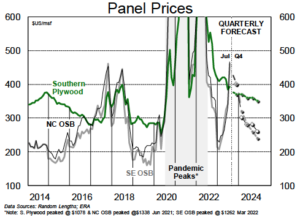

OSB markets have gone on a tear this summer, with benchmark NC 7/16″ prices increasing by $200, to $510, since the beginning of June. H2/23 prospects have improved on news that the start-up of Martco’s Corrigan, TX mill has been pushed from mid-2023 to early 2024; however, with Tolko’s High Prairie mill also set to come back online at the end of the year, oversupply remains a concern for 2024. Plywood markets haven’t seen the same level of excitement as OSB, but prices remain elevated compared to historical averages. The y/y slowdown in offshore imports, coupled with tightness in OSB, has clearly been benefiting plywood producers.

OSB markets have gone on a tear this summer, with benchmark NC 7/16″ prices increasing by $200, to $510, since the beginning of June. H2/23 prospects have improved on news that the start-up of Martco’s Corrigan, TX mill has been pushed from mid-2023 to early 2024; however, with Tolko’s High Prairie mill also set to come back online at the end of the year, oversupply remains a concern for 2024. Plywood markets haven’t seen the same level of excitement as OSB, but prices remain elevated compared to historical averages. The y/y slowdown in offshore imports, coupled with tightness in OSB, has clearly been benefiting plywood producers.

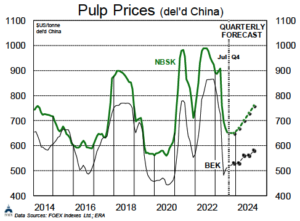

Pulp prices are at or near cyclical lows. Near-term upside is unlikely unless considerably more supply is removed, either temporarily or permanently, but at present more supply is coming to market from new LATAM mills. Hardwood has seen a ~$50 gain in China since May (restocking), but further upside is unlikely given sluggish end demand. Softwood markets are expected to bottom in Q3. Producer inventories remain extremely high and end demand is soft, particularly in Europe. Weighing on the outlook is the start-up of Metsä’s Kemi mill in late Q3. We have flattened our price forecasts and pushed out the expected improvement given the inventory, oversupply and demand headwinds.

Pulp prices are at or near cyclical lows. Near-term upside is unlikely unless considerably more supply is removed, either temporarily or permanently, but at present more supply is coming to market from new LATAM mills. Hardwood has seen a ~$50 gain in China since May (restocking), but further upside is unlikely given sluggish end demand. Softwood markets are expected to bottom in Q3. Producer inventories remain extremely high and end demand is soft, particularly in Europe. Weighing on the outlook is the start-up of Metsä’s Kemi mill in late Q3. We have flattened our price forecasts and pushed out the expected improvement given the inventory, oversupply and demand headwinds.

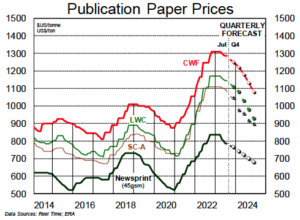

Supercalendered paper prices dropped by only $20 for most accounts to start Q3 (some deals noted earlier). Still, the price decline has been well contained. A similar playbook has unfolded in coated grades, with some spot deals available but overall declines quite mild, especially considering miserable demand. As destocking ends in Q3 (?), price pressure may increase in Q4 as buyers shop around. Imports pose a rising threat. North American newsprint prices have been stable this month, but we foresee a price drop in September (or October) as weak offshore pricing diverts tonnes back to the domestic market. Asian prices are the most challenged at the moment.

Supercalendered paper prices dropped by only $20 for most accounts to start Q3 (some deals noted earlier). Still, the price decline has been well contained. A similar playbook has unfolded in coated grades, with some spot deals available but overall declines quite mild, especially considering miserable demand. As destocking ends in Q3 (?), price pressure may increase in Q4 as buyers shop around. Imports pose a rising threat. North American newsprint prices have been stable this month, but we foresee a price drop in September (or October) as weak offshore pricing diverts tonnes back to the domestic market. Asian prices are the most challenged at the moment.