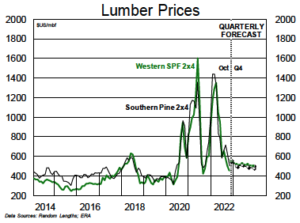

Lumber: SPF lumber prices moved higher on the month as downtime in BC finally started to bite. Currently, 2x4s are trading at $470, up from $430 at the beginning of October. SYP 2x4s prices have trended in the opposite direction, however, declining from $570 at the start of the month to $465 today. …With demand projected to soften further in the coming months (due primarily to slower housing activity), we believe additional downtime will be required to keep markets balanced.

Lumber: SPF lumber prices moved higher on the month as downtime in BC finally started to bite. Currently, 2x4s are trading at $470, up from $430 at the beginning of October. SYP 2x4s prices have trended in the opposite direction, however, declining from $570 at the start of the month to $465 today. …With demand projected to soften further in the coming months (due primarily to slower housing activity), we believe additional downtime will be required to keep markets balanced.

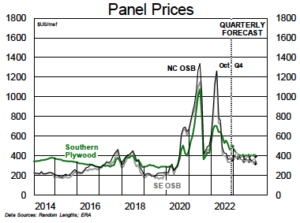

OSB/Plywood: OSB prices have been very stable this month, with benchmark North Central 7/16″ unchanged at $360 for eight consecutive weeks. LP’s 420MMsf Sagola, MI mill comes offline next week and should help tension markets through year-end. However, prices could come under pressure again in H1/23 given expectations for weaker demand from housing. Plywood prices drifted lower last month as supply ran modestly ahead of demand. Offshore imports have declined in recent months, and further cuts are anticipated.

OSB/Plywood: OSB prices have been very stable this month, with benchmark North Central 7/16″ unchanged at $360 for eight consecutive weeks. LP’s 420MMsf Sagola, MI mill comes offline next week and should help tension markets through year-end. However, prices could come under pressure again in H1/23 given expectations for weaker demand from housing. Plywood prices drifted lower last month as supply ran modestly ahead of demand. Offshore imports have declined in recent months, and further cuts are anticipated.

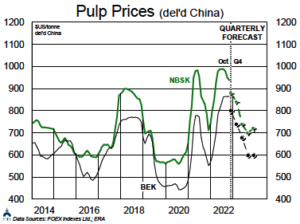

Pulp: The pulp story remains pretty much the same this month, with pulp prices declining for most grades; to date, the declines are modest. Softwood prices have slipped further in China and have begun to fall in Europe and North America. Hardwood pricing, conversely, has remained very high, with one major producer announcing flat pricing through November. We do not believe this bifurcation can persist. …Given inflation across inputs, we have lifted our pricing forecasts through 2023.

Pulp: The pulp story remains pretty much the same this month, with pulp prices declining for most grades; to date, the declines are modest. Softwood prices have slipped further in China and have begun to fall in Europe and North America. Hardwood pricing, conversely, has remained very high, with one major producer announcing flat pricing through November. We do not believe this bifurcation can persist. …Given inflation across inputs, we have lifted our pricing forecasts through 2023.

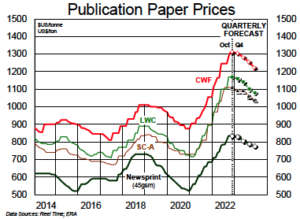

Paper: Further Super Calendar (SC) price hikes have not been announced, and we suspect we are at the peak despite SC not following the Q3 hike in coated grades. Coated price hikes have been successful, as anticipated. Another hike attempt is possible, but it would prove a bridge too far we fear. …Newsprint prices are holding firm, with some strong prices on offer for now in the export markets. Demand is collapsing, but traditional supply discipline will prevent a collapse in prices.

Paper: Further Super Calendar (SC) price hikes have not been announced, and we suspect we are at the peak despite SC not following the Q3 hike in coated grades. Coated price hikes have been successful, as anticipated. Another hike attempt is possible, but it would prove a bridge too far we fear. …Newsprint prices are holding firm, with some strong prices on offer for now in the export markets. Demand is collapsing, but traditional supply discipline will prevent a collapse in prices.

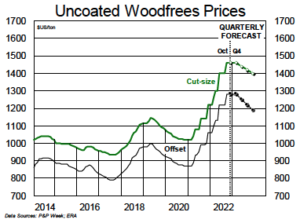

Uncoated woodfree markets remain snug, with the return to offices and the start of school season having helped demand. Mills are running near full capacity and producers were successful recently in pushing up prices by $60/ton. Imports hold more than a 10% market share now and that share continues to grow. …With containerboard markets sluggish, there are reports that at least one machine has pivoted back to UWF grades; it hasn’t been disruptive yet, but the peak is in for this pricing cycle.

Uncoated woodfree markets remain snug, with the return to offices and the start of school season having helped demand. Mills are running near full capacity and producers were successful recently in pushing up prices by $60/ton. Imports hold more than a 10% market share now and that share continues to grow. …With containerboard markets sluggish, there are reports that at least one machine has pivoted back to UWF grades; it hasn’t been disruptive yet, but the peak is in for this pricing cycle.

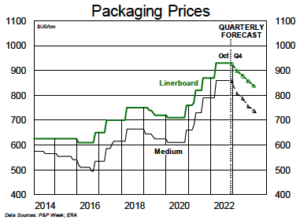

Packaging: Containerboard producers are barely holding onto prices. Box shipments were down sharply in Q3, and Q4 is starting with similar misery. Aggressive downtime was taken in Q3, but it was insufficient to keep inventories from surging. More is needed, and we expect some closures are coming. …Boxboard demand continues to post better numbers than containerboard, and that should persist through 2023 at least. SBS producers have been successful in pushing through another $50 hike. The high price of boxboard has yet to diminish demand and, in fact, the shift from plastics to paper appears to be boosting demand even more than anticipated.

Packaging: Containerboard producers are barely holding onto prices. Box shipments were down sharply in Q3, and Q4 is starting with similar misery. Aggressive downtime was taken in Q3, but it was insufficient to keep inventories from surging. More is needed, and we expect some closures are coming. …Boxboard demand continues to post better numbers than containerboard, and that should persist through 2023 at least. SBS producers have been successful in pushing through another $50 hike. The high price of boxboard has yet to diminish demand and, in fact, the shift from plastics to paper appears to be boosting demand even more than anticipated.