On October 14, the US began charging a Section 232 (“national security”) tariff of 10% on imports of Canadian softwood lumber, on top of the duties that were already being charged. The premise that imports of Canadian 2x4s, sofas and bathroom vanities are somehow a threat to America’s national security is so ludicrous it hardly deserves rebuttal (although you can read a good analysis here). …The duties, in contrast, have been promoted as being carefully calculated responses to Canadian wrongdoing. The US Lumber Coalition outlines how the duty investigations by the US Department of Commerce take over a year to complete. Even the duty rates, calculated to the hundred of a percent, give off an aura of precision and accuracy.

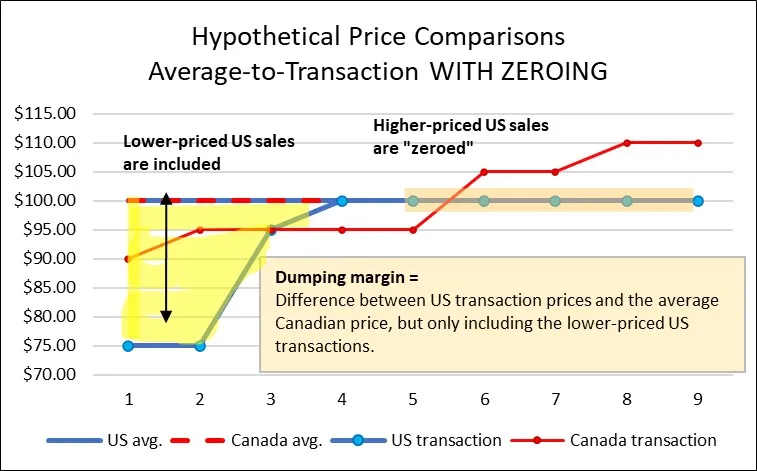

Nevertheless, the duty rates are every bit as ridiculous as the new tariffs; this ridiculousness is just more cleverly hidden. For example, the argument that Canadian companies pay less for their logs than American companies do has been shown to be inaccurate: cost comparisons by analysts such as Forest Economic Advisors show that Canadian mills’ log costs are often higher than those of their US neighbours. Similarly, the argument that Canadian logs are “dumped” into US markets is based on biased calculations, due to the US Commerce Department’s use of zeroing in its calculations. …Selectively including some export sales while excluding others from the calculations – biases the results against importers and yields an imposed competitive advantage to the US domestic mills. …Graphically, we can see that the higher-priced US transactions no longer balance out the lower-priced transactions, because the higher-priced transactions have been “zeroed out” (ignored in the calculations). There is an obvious bias to this calculation method!

Nevertheless, the duty rates are every bit as ridiculous as the new tariffs; this ridiculousness is just more cleverly hidden. For example, the argument that Canadian companies pay less for their logs than American companies do has been shown to be inaccurate: cost comparisons by analysts such as Forest Economic Advisors show that Canadian mills’ log costs are often higher than those of their US neighbours. Similarly, the argument that Canadian logs are “dumped” into US markets is based on biased calculations, due to the US Commerce Department’s use of zeroing in its calculations. …Selectively including some export sales while excluding others from the calculations – biases the results against importers and yields an imposed competitive advantage to the US domestic mills. …Graphically, we can see that the higher-priced US transactions no longer balance out the lower-priced transactions, because the higher-priced transactions have been “zeroed out” (ignored in the calculations). There is an obvious bias to this calculation method!