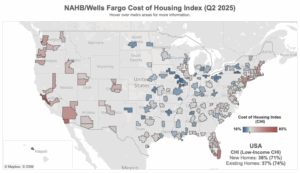

While new homes remain largely unaffordable, builder efforts to improve housing affordability paid dividends in the second quarter of 2025, according to the latest data from the NAHB/Wells Fargo Cost of Housing Index (CHI). The CHI results from the second quarter of 2025 show that a family earning the nation’s median income of $104,200 needed 36% of its income to cover the mortgage payment on a median-priced new home. Low-income families, defined as those earning only 50% of median income, would have to spend 71% of their earnings to pay for the same new home. …The second quarter of 2025 marked the largest historical gap where existing home prices exceeded those of new homes. …The percentage of a family’s income needed to purchase a new home was unchanged at 36% from the first to the second quarter, while the low-income CHI fell from 72% to 71% over the same period.

While new homes remain largely unaffordable, builder efforts to improve housing affordability paid dividends in the second quarter of 2025, according to the latest data from the NAHB/Wells Fargo Cost of Housing Index (CHI). The CHI results from the second quarter of 2025 show that a family earning the nation’s median income of $104,200 needed 36% of its income to cover the mortgage payment on a median-priced new home. Low-income families, defined as those earning only 50% of median income, would have to spend 71% of their earnings to pay for the same new home. …The second quarter of 2025 marked the largest historical gap where existing home prices exceeded those of new homes. …The percentage of a family’s income needed to purchase a new home was unchanged at 36% from the first to the second quarter, while the low-income CHI fell from 72% to 71% over the same period.