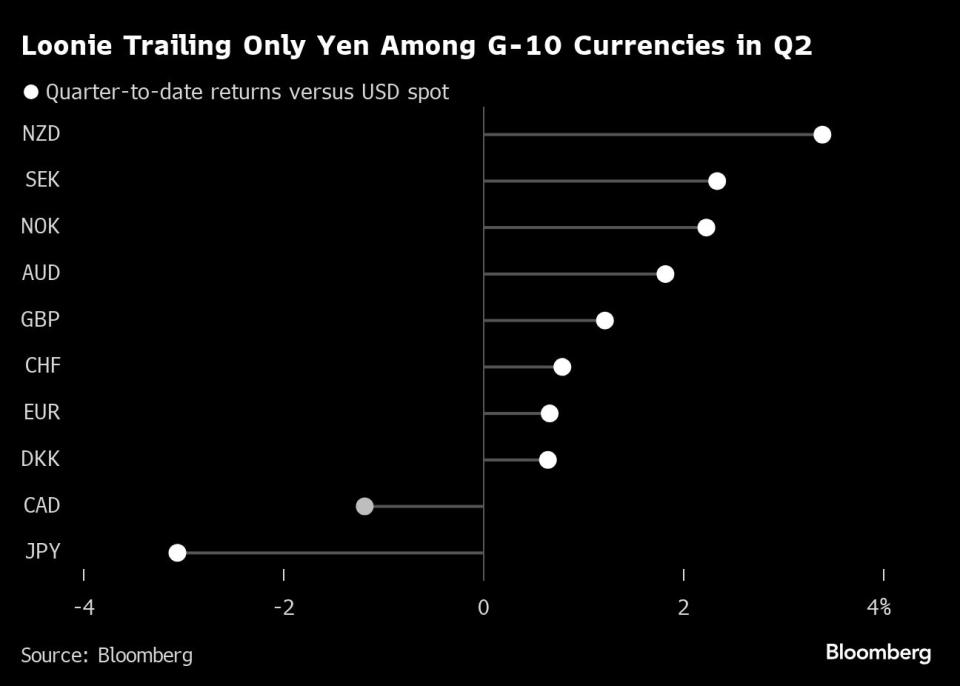

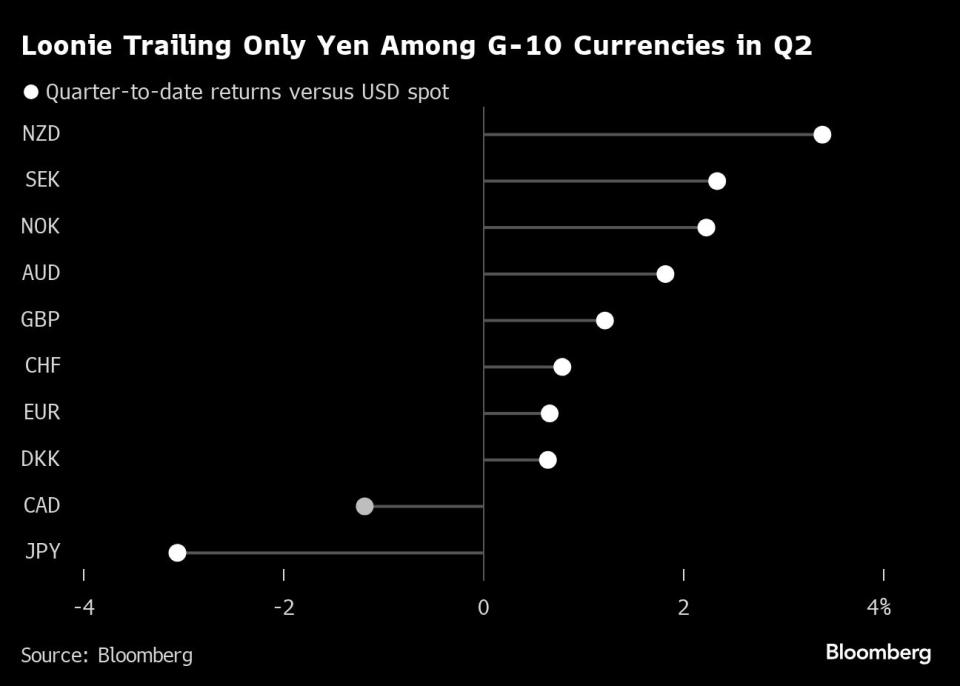

Wall Street is gearing up for a weaker loonie and a series of interest-rate cuts from the Bank of Canada after it became the first Group-of-Seven central bank to ease monetary policy in four years. The Canadian dollar slid against the greenback to its lowest mark since May 23 — hitting 1.3741 per US dollar — after the Bank of Canada on Wednesday lowered benchmark borrowing costs by 25 basis points to 4.75%. The yield on benchmark Canadian two-year government debt fell more than 10 basis points to 3.95% as of 1:00 p.m. in Ottawa, extending a gap to US Treasury counterparts. …“The message is pretty clear,” Bank of Canada Governor Tiff Macklem said. “If the economy continues to evolve broadly as we had expected, if we continue to see inflation pressures easing, it is reasonable to expect that there will be further cuts in interest rates.”

Wall Street is gearing up for a weaker loonie and a series of interest-rate cuts from the Bank of Canada after it became the first Group-of-Seven central bank to ease monetary policy in four years. The Canadian dollar slid against the greenback to its lowest mark since May 23 — hitting 1.3741 per US dollar — after the Bank of Canada on Wednesday lowered benchmark borrowing costs by 25 basis points to 4.75%. The yield on benchmark Canadian two-year government debt fell more than 10 basis points to 3.95% as of 1:00 p.m. in Ottawa, extending a gap to US Treasury counterparts. …“The message is pretty clear,” Bank of Canada Governor Tiff Macklem said. “If the economy continues to evolve broadly as we had expected, if we continue to see inflation pressures easing, it is reasonable to expect that there will be further cuts in interest rates.”