As we begin to think about our 2026 forecasts, we (and the market) are challenged by the declining quality of information. Across geographies and sectors, both the quantity and quality of stats have been deteriorating over the past few years, reducing the market’s ability to understand the present context and the future outlook. Some information will improve before year-end, but the trend is concerning.

As we begin to think about our 2026 forecasts, we (and the market) are challenged by the declining quality of information. Across geographies and sectors, both the quantity and quality of stats have been deteriorating over the past few years, reducing the market’s ability to understand the present context and the future outlook. Some information will improve before year-end, but the trend is concerning.

At the same time, the need for quality and timely stats is greater than ever. The full impact of seismic changes in global free and fair trade is still unfolding. Commercial pivots take time given pre-tariff inventory builds, contracts, and buyer familiarity and preference. Trade flows are adjusting, but the state of play is fluid and second-order effects will require time to become clear. Some of the second-order effects we are most concerned about include consumer confidence and, therefore, willingness to consume items that require packaging or willingness to commit to the new-home purchases or renos that drive wood products markets. Producers also lack confidence, impacting the willingness to invest in (or close) assets that drive our supply/demand models. Finally, we worry about investor confidence, as assessing an appropriate risk-weighted return is much more difficult in the current environment. Our work has always been supported by timely stats; today, investors need them more than ever.

As a result of the ongoing US government shutdown, much of the regular housing data (starts, permits, etc.) have not been published this month, meaning that we are flying blind, to an extent, in terms of US housing analysis. However, based upon recent solid-wood pricing trends and commentary from industry contacts, there is little to suggest that the US housing market has shown any improvement in the past few weeks. With a seasonally slower period for housing demand and homebuilding activity approaching very quickly, we are unlikely to see any marked improvement in US housing before next spring (at the earliest).

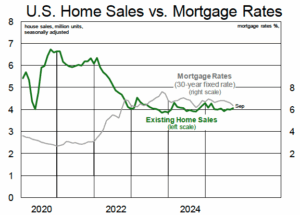

There were some small positives to report this month: US existing-home sales reached a seven-month high in September, driven primarily by a pronounced decline in 30-year mortgage rates; and existing-home sales improved to a seasonally adjusted 4.06MM, up ~2% m/m and ~4% y/y. Despite the modest improvement in sales, existing-home inventories remain elevated at 1.55MM, representing 4.6 months of sales-adjusted supply—one of the highest levels since the pandemic.

There were some small positives to report this month: US existing-home sales reached a seven-month high in September, driven primarily by a pronounced decline in 30-year mortgage rates; and existing-home sales improved to a seasonally adjusted 4.06MM, up ~2% m/m and ~4% y/y. Despite the modest improvement in sales, existing-home inventories remain elevated at 1.55MM, representing 4.6 months of sales-adjusted supply—one of the highest levels since the pandemic.

Data from Freddie Mac showed that 30-year mortgage rates averaged 6.39% in September, the lowest monthly average reported year to date. Rates have stabilized in the low 6% range this month, and this should continue to provide a modest tailwind for existing-home sales; however, we believe further declines will be required before sales can start trending back toward historical averages. Further rate cuts by the Fed would certainly help on this front, but, after US inflation increased to 3% in September (the year to date high), perhaps the Fed will adopt a more hawkish approach.

While the U.S. housing market may see some minor tailwinds from improving affordability over the coming months, that boost to housing (and wood products) demand could be more than offset by the negative impacts of the ongoing government shutdown. A recent survey by real estate brokerage firm Redfin showed that roughly one in six Americans (17%) are delaying major purchases (homes, cars, etc.) due to the ongoing government shutdown; a further 7% of respondents are outright cancelling plans for a major purchase. Massive layoffs by large companies (e.g., Amazon laying off 14,000 corporate workers) also won’t help put potential homebuyers at ease.