Truth and Reconciliation Week leads up to the National Day for Truth and Reconciliation and Orange Shirt Day on September 30, a day dedicated to recognizing the dark history of residential schools and its survivors. This week is a time to reflect on the history and ongoing impacts of the residential school system, the assimilatory actions and mistreatment, and the intergenerational impacts. This week was officially recognized in 2021 due to the hard work of the Truth and Reconciliation Commission of Canada, who devoted their time to speak to survivors, inform and educate Canadians on the history of residential schools, and create a report with 94 Calls to Action to advance reconciliation. Everyone has a role in continually acknowledging the ongoing impact of residential schools, challenging colonial narratives, and working to better understand Indigenous lived experiences. To make reparations for what was lost, we must continuously work to advance relationships with Indigenous Peoples…

Truth and Reconciliation Week leads up to the National Day for Truth and Reconciliation and Orange Shirt Day on September 30, a day dedicated to recognizing the dark history of residential schools and its survivors. This week is a time to reflect on the history and ongoing impacts of the residential school system, the assimilatory actions and mistreatment, and the intergenerational impacts. This week was officially recognized in 2021 due to the hard work of the Truth and Reconciliation Commission of Canada, who devoted their time to speak to survivors, inform and educate Canadians on the history of residential schools, and create a report with 94 Calls to Action to advance reconciliation. Everyone has a role in continually acknowledging the ongoing impact of residential schools, challenging colonial narratives, and working to better understand Indigenous lived experiences. To make reparations for what was lost, we must continuously work to advance relationships with Indigenous Peoples…

Trade negotiations between Canada and the United States are set to drag on well past the initial hopes of an early resolution, with key players now calling mid-2026 an unlikely target and warning the process could slip into 2027. In an interview on The Hub’s Alberta Edge podcast, US Ambassador to Canada Pete Hoekstra and Alberta Premier Danielle Smith both acknowledged momentum around the Canada-US-Mexico Agreement (CUSMA) review has slowed. Hoekstra pointed to the formal comment period now underway, during which businesses and the public in both countries are submitting feedback on how the accord is working. He said this essentially eliminates any chance of a quick, major deal. Trade departments will then have to sift through the submissions and approach what he called the “painstaking” next stage. …The timeline collides directly with US midterm elections in 2026, making Senate ratification anything but a guarantee.

Trade negotiations between Canada and the United States are set to drag on well past the initial hopes of an early resolution, with key players now calling mid-2026 an unlikely target and warning the process could slip into 2027. In an interview on The Hub’s Alberta Edge podcast, US Ambassador to Canada Pete Hoekstra and Alberta Premier Danielle Smith both acknowledged momentum around the Canada-US-Mexico Agreement (CUSMA) review has slowed. Hoekstra pointed to the formal comment period now underway, during which businesses and the public in both countries are submitting feedback on how the accord is working. He said this essentially eliminates any chance of a quick, major deal. Trade departments will then have to sift through the submissions and approach what he called the “painstaking” next stage. …The timeline collides directly with US midterm elections in 2026, making Senate ratification anything but a guarantee.

Canada aims to establish duty-free access for up to 95 per cent of its exports to Indonesia over the next eight to 12 months, International Trade Minister Maninder Sidhu said, after signing a trade agreement. The Comprehensive Economic Partnership Agreement is Canada’s first in the economically crucial Indo-Pacific region since

Canada aims to establish duty-free access for up to 95 per cent of its exports to Indonesia over the next eight to 12 months, International Trade Minister Maninder Sidhu said, after signing a trade agreement. The Comprehensive Economic Partnership Agreement is Canada’s first in the economically crucial Indo-Pacific region since

VICTORIA — Forests Minister Ravi Parmar this week announced major reforms to B.C. Timber Sales, hoping to reverse a two-thirds decline in sales volumes under the NDP. …Parmar said the government will broaden the agency’s mandate to focus on providing wood to support manufacturing, delivering jobs to communities and building partnerships with First Nations. The changes are prompted by a review conducted earlier this year by former B.C. Liberal cabinet minister George Abbott, Vanderhoof councillor Brian Frenkel and First Nations representative Lennard Joe. …Parmar didn’t understate the urgency of delivering logs to all the right places … that day’s Merritt Herald announced Aspen Planer mill was closing for “an indefinite period.” …The company doesn’t lack for wood supply on paper. …For all Parmar’s and Eby’s enthusiasm for boosting the annual harvest, they have not made believers of the Ministry of Finance in their own government.

VICTORIA — Forests Minister Ravi Parmar this week announced major reforms to B.C. Timber Sales, hoping to reverse a two-thirds decline in sales volumes under the NDP. …Parmar said the government will broaden the agency’s mandate to focus on providing wood to support manufacturing, delivering jobs to communities and building partnerships with First Nations. The changes are prompted by a review conducted earlier this year by former B.C. Liberal cabinet minister George Abbott, Vanderhoof councillor Brian Frenkel and First Nations representative Lennard Joe. …Parmar didn’t understate the urgency of delivering logs to all the right places … that day’s Merritt Herald announced Aspen Planer mill was closing for “an indefinite period.” …The company doesn’t lack for wood supply on paper. …For all Parmar’s and Eby’s enthusiasm for boosting the annual harvest, they have not made believers of the Ministry of Finance in their own government. The B.C. Government says it’s going to expand the scope of BC Timber Sales. The organization manages 20 per cent of the province’s allowable annual cut for Crown/public timber and the auction of public timber. The government released a review of BC Timber Sales on Tuesday… A Chemainus mill is among two Western Forest Products mills in the Cowichan Valley facing lengthy curtailments, impacting more than 200 workers. …At the Paulcan Jemico mills in Chemainus, there are 50 people working despite tough times for the industry. The owner says profit margins are razor-thin while regulations are always increasing. “We’re making it to the point where no one wants to do business because there is so much uncertainty in what goes on in this industry,” said Paul Beltgens, owner of Paulcan Jemico Industries. Beltgens says unless conditions improve, there’s very little reason to invest in his company’s operations for the future.

The B.C. Government says it’s going to expand the scope of BC Timber Sales. The organization manages 20 per cent of the province’s allowable annual cut for Crown/public timber and the auction of public timber. The government released a review of BC Timber Sales on Tuesday… A Chemainus mill is among two Western Forest Products mills in the Cowichan Valley facing lengthy curtailments, impacting more than 200 workers. …At the Paulcan Jemico mills in Chemainus, there are 50 people working despite tough times for the industry. The owner says profit margins are razor-thin while regulations are always increasing. “We’re making it to the point where no one wants to do business because there is so much uncertainty in what goes on in this industry,” said Paul Beltgens, owner of Paulcan Jemico Industries. Beltgens says unless conditions improve, there’s very little reason to invest in his company’s operations for the future.

THUNDER BAY, Ontario — The Ontario government is investing a further $30 million to support businesses, workers and communities dependent on the province’s forest sector. This funding will build and maintain more forestry access roads and provide immediate support for Ontario sawmills to find new markets for their woodchips. These investments will strengthen Ontario’s forestry sector, create jobs and increase the sector’s competitiveness in the face of increased US softwood lumber duties and the threat of tariffs. …An additional $20 million is being invested through the Provincial Forest Access Roads Funding Program, bringing the government’s total funding for the program to over $79 million this year. …The government is also providing immediate support to sawmills by investing $10 million in the Ontario Sawmill Chip Support Program. The funding provides immediate support to sawmills while they find new, innovative markets for their wood chips such as energy production or alternatives for single-use plastics.

THUNDER BAY, Ontario — The Ontario government is investing a further $30 million to support businesses, workers and communities dependent on the province’s forest sector. This funding will build and maintain more forestry access roads and provide immediate support for Ontario sawmills to find new markets for their woodchips. These investments will strengthen Ontario’s forestry sector, create jobs and increase the sector’s competitiveness in the face of increased US softwood lumber duties and the threat of tariffs. …An additional $20 million is being invested through the Provincial Forest Access Roads Funding Program, bringing the government’s total funding for the program to over $79 million this year. …The government is also providing immediate support to sawmills by investing $10 million in the Ontario Sawmill Chip Support Program. The funding provides immediate support to sawmills while they find new, innovative markets for their wood chips such as energy production or alternatives for single-use plastics.

Canada’s GDP managed to grow for the first time in four months in July, even as the economic impacts of American tariffs began settling in, according to Statistics Canada. On Friday, the agency reported that the gross domestic product increased by 0.2% in July compared with the month prior. In addition, Statistics Canada gave a preliminary estimate for August’s reading to show that the economy was “essentially unchanged in the month.” July’s figure was slightly higher than the 0.1% increase most analysts polled were expecting. …“Canada’s economy is tracking very soft growth in Q3. While not a recession, it’s still an economy that’s bumbling along,” said Derek Holt at the Bank of Nova Scotia. “The combined effect leaves us tracking growth of only about 0.7 per cent at a seasonally adjusted and annualized rate in Q3 — that’s hardly much of any rebound from Q2.”

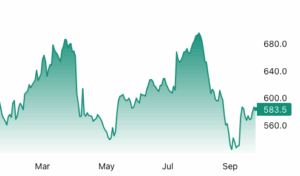

Canada’s GDP managed to grow for the first time in four months in July, even as the economic impacts of American tariffs began settling in, according to Statistics Canada. On Friday, the agency reported that the gross domestic product increased by 0.2% in July compared with the month prior. In addition, Statistics Canada gave a preliminary estimate for August’s reading to show that the economy was “essentially unchanged in the month.” July’s figure was slightly higher than the 0.1% increase most analysts polled were expecting. …“Canada’s economy is tracking very soft growth in Q3. While not a recession, it’s still an economy that’s bumbling along,” said Derek Holt at the Bank of Nova Scotia. “The combined effect leaves us tracking growth of only about 0.7 per cent at a seasonally adjusted and annualized rate in Q3 — that’s hardly much of any rebound from Q2.” Lumber futures traded above $580 per thousand board feet in September, holding above earlier month lows as supply tightened and housing demand showed signs of renewal. Major producers such as Interfor reduced output through maintenance and shift cuts and mill idling while Canadian softwood flows remained constrained by tariff uncertainty which compressed prompt availability. Expectations of Fed further rate cuts later in 2025 encouraged forward looking builders to replenish inventories. New single family sales rose 20.5% to an 800k seasonally adjusted annualized rate in August which was the largest monthly rise since August 2022. Existing home sales held at a 4.00m SAAR in August and housing inventory stood at 1.53m units equivalent to 4.6 months of supply.

Lumber futures traded above $580 per thousand board feet in September, holding above earlier month lows as supply tightened and housing demand showed signs of renewal. Major producers such as Interfor reduced output through maintenance and shift cuts and mill idling while Canadian softwood flows remained constrained by tariff uncertainty which compressed prompt availability. Expectations of Fed further rate cuts later in 2025 encouraged forward looking builders to replenish inventories. New single family sales rose 20.5% to an 800k seasonally adjusted annualized rate in August which was the largest monthly rise since August 2022. Existing home sales held at a 4.00m SAAR in August and housing inventory stood at 1.53m units equivalent to 4.6 months of supply.

BURNABY, BC — Interfor announced that it has entered into an agreement with a syndicate of underwriters led by RBC Capital Markets and Scotiabank, under which the Underwriters have agreed to purchase, on a bought deal basis, 12,437,800 common shares of the Company at a price of $10.05 per Common Share for gross proceeds of $125 million. The Company has agreed to grant the Underwriters an over-allotment option to purchase up to an additional 15% of the Common Shares. …The Company intends to use the net proceeds of the Offering to pay down existing indebtedness and for general corporate purposes. …Proceeds of the Offering are expected to further enhance Interfor’s flexibility to navigate near-term market volatility. The Offering is scheduled to close on or about October 1, 2025.

BURNABY, BC — Interfor announced that it has entered into an agreement with a syndicate of underwriters led by RBC Capital Markets and Scotiabank, under which the Underwriters have agreed to purchase, on a bought deal basis, 12,437,800 common shares of the Company at a price of $10.05 per Common Share for gross proceeds of $125 million. The Company has agreed to grant the Underwriters an over-allotment option to purchase up to an additional 15% of the Common Shares. …The Company intends to use the net proceeds of the Offering to pay down existing indebtedness and for general corporate purposes. …Proceeds of the Offering are expected to further enhance Interfor’s flexibility to navigate near-term market volatility. The Offering is scheduled to close on or about October 1, 2025. Weakening U.S. housing construction has put another dark cloud over BC’s forest industry, increasing the likelihood of more mill shutdowns and layoffs. Lumber prices flatlined in recent weeks due to weak demand, just as new, higher duties in the Canada-U.S. softwood lumber dispute took effect. That means BC mills are operating at losses of up to US$220 per thousand board feet of two-by-fours, according to industry consultant Russ Taylor. …Taylor said market conditions during September are typically favourable for sawmills, but they’re decidedly negative this year. His forecast is that they will remain weak for the rest of the year, which will likely result in mills taking downtime. “We’re seeing it already,” said Kim Haakstad, CEO of the B.C. Council of Forest Industries. “We’re seeing temporary curtailments, we’re seeing extended holiday breaks, we’re seeing reconfigured shift schedules. …Haakstad said Parmar’s recognition of the urgency for change was encouraging.

Weakening U.S. housing construction has put another dark cloud over BC’s forest industry, increasing the likelihood of more mill shutdowns and layoffs. Lumber prices flatlined in recent weeks due to weak demand, just as new, higher duties in the Canada-U.S. softwood lumber dispute took effect. That means BC mills are operating at losses of up to US$220 per thousand board feet of two-by-fours, according to industry consultant Russ Taylor. …Taylor said market conditions during September are typically favourable for sawmills, but they’re decidedly negative this year. His forecast is that they will remain weak for the rest of the year, which will likely result in mills taking downtime. “We’re seeing it already,” said Kim Haakstad, CEO of the B.C. Council of Forest Industries. “We’re seeing temporary curtailments, we’re seeing extended holiday breaks, we’re seeing reconfigured shift schedules. …Haakstad said Parmar’s recognition of the urgency for change was encouraging.

In many places, moose, bear, wolves and other wildlife can simply walk between the two nations. There are barriers — roads, development and a lack of protected habitat on either side — but for more than a century, relatively relaxed border policy and a shared sense of purpose saw conservationists in both countries working together to overcome them. Now, US President Trump has ratcheted up the challenges to cross-border conservation. …Many of Trump’s actions have explicit implications for cross-border conservation — in North America and globally. …Canadian conservation organizations have reported losing co-funding as a result of Trump’s cuts to foreign aid. As his administration has stretched staffing thin and proposed deep budget cuts at the US National Park Service, it ended funding many found crucial to habitat conservation work across the border. Trump has also withdrawn from the Green Climate Fund and the Paris Agreement.

In many places, moose, bear, wolves and other wildlife can simply walk between the two nations. There are barriers — roads, development and a lack of protected habitat on either side — but for more than a century, relatively relaxed border policy and a shared sense of purpose saw conservationists in both countries working together to overcome them. Now, US President Trump has ratcheted up the challenges to cross-border conservation. …Many of Trump’s actions have explicit implications for cross-border conservation — in North America and globally. …Canadian conservation organizations have reported losing co-funding as a result of Trump’s cuts to foreign aid. As his administration has stretched staffing thin and proposed deep budget cuts at the US National Park Service, it ended funding many found crucial to habitat conservation work across the border. Trump has also withdrawn from the Green Climate Fund and the Paris Agreement. OTTAWA, ON – Today, the Honourable Tim Hodgson, Minister of Energy and Natural Resources, announced over $1.44 million in funding for 10 projects under Natural Resources Canada’s Global Forest Leadership Program, delivered through the International Model Forest Network. This funding will help restore damaged ecosystems, support agroforestry and sustainable local businesses, empower Indigenous and local communities — especially women and youth — and improve global forest management and restoration. Healthy forests around the world contribute to carbon sequestration and climate resilience, benefitting Canadians and the global community. As a leader in sustainable forest management, Canada plays a key role in advancing sustainable forestry worldwide, and the federal government remains committed to sharing its expertise, fostering collaboration and helping restore, manage and conserve forests around the world to protect biodiversity and help tackle climate change and environmental damage.

OTTAWA, ON – Today, the Honourable Tim Hodgson, Minister of Energy and Natural Resources, announced over $1.44 million in funding for 10 projects under Natural Resources Canada’s Global Forest Leadership Program, delivered through the International Model Forest Network. This funding will help restore damaged ecosystems, support agroforestry and sustainable local businesses, empower Indigenous and local communities — especially women and youth — and improve global forest management and restoration. Healthy forests around the world contribute to carbon sequestration and climate resilience, benefitting Canadians and the global community. As a leader in sustainable forest management, Canada plays a key role in advancing sustainable forestry worldwide, and the federal government remains committed to sharing its expertise, fostering collaboration and helping restore, manage and conserve forests around the world to protect biodiversity and help tackle climate change and environmental damage. GATINEAU

GATINEAU

In a career that has spanned nearly 40 years in the forestry industry, Michael McKay says he’s never had to face a situation like the one he’s staring at now. “This is probably one of the biggest, I mean with this fire and the current state of the industry, to have it all come together at once, it’s definitely about as tough as it’s been,” McKay said. The president of Franklin Forest Products is facing a perfect storm of problems but is pivoting as best he can to weather through it. The latest issue was the Mount Underwood Fire which started Aug. 11 and ended up destroying half of the company’s powerline despite his employees trying to save it. …The blaze interrupted the implementation of a new Gang Mill plant that would have added more staff to the company’s roster of 35 employees. …”It’s been four years and wood’s not coming out, there’s just no wood coming out of the bush and all we are is a bunch of too many squirrels chasing too few nuts,” McKay said.

In a career that has spanned nearly 40 years in the forestry industry, Michael McKay says he’s never had to face a situation like the one he’s staring at now. “This is probably one of the biggest, I mean with this fire and the current state of the industry, to have it all come together at once, it’s definitely about as tough as it’s been,” McKay said. The president of Franklin Forest Products is facing a perfect storm of problems but is pivoting as best he can to weather through it. The latest issue was the Mount Underwood Fire which started Aug. 11 and ended up destroying half of the company’s powerline despite his employees trying to save it. …The blaze interrupted the implementation of a new Gang Mill plant that would have added more staff to the company’s roster of 35 employees. …”It’s been four years and wood’s not coming out, there’s just no wood coming out of the bush and all we are is a bunch of too many squirrels chasing too few nuts,” McKay said.

Fall issue of WorkSafe Magazine

Fall issue of WorkSafe Magazine