Chinese leader Xi Jinping and Canadian PM Mark Carney have announced lower tariffs, signalling a reset in their countries’ relationship after a key meeting in Beijing. China is expected to lower levies on Canadian canola oil from 85% to 15% by 1 March, while Ottawa has agreed to tax Chinese electric vehicles at the most-favoured-nation rate, 6.1%, Carney told reporters. The deal is a breakthrough after years of strained ties and tit-for-tat levies. Xi hailed the “turnaround” in their relationship but it is also a win for Carney, the first Canadian leader to visit China in nearly a decade. He has been trying to diversify Canadian trade away from the US, his country’s biggest trading partner, following the uncertainty caused by Trump’s on-again-off-again tariffs. …Carney said the “world has changed dramatically” and how Canada positions itself “will shape our future for decades to come,” he added.

In related coverage by:

- Government of Canada: Prime Minister Carney forges partnership with China

- The Economist: Mark Carney is on a mission to trade with the world

- Lawrence Martin in the Globe & Mail: Rebuilding relations with China is a gamble Mark Carney has to take

- People’s Republic of China: Joint Statement of the China-Canada Leaders’ Meeting

Global markets plunged Tuesday after President Trump reignited fears of a US trade war with the European Union, America’s largest trading partner. The president showed no signs of backing off his threat from Saturday to hit seven EU countries and the United Kingdom with new tariffs unless they supported his push for American control of Greenland. Asked if he would be willing to use force to seize the semi-autonomous Danish territory, Trump replied, “No comment,” on Monday. The S&P 500 sold off by around 1.3% in early trading, while the Nasdaq Composite plunged 1.7%. The Dow Jones Industrial Average dropped more than 600 points. The S&P 500 has erased its gains for the year so far. Investors also sold off U.S. government bonds, driving up interest rates. Rising returns on US treasuries usually translate into higher mortgage rates and interest on new personal loans.

Global markets plunged Tuesday after President Trump reignited fears of a US trade war with the European Union, America’s largest trading partner. The president showed no signs of backing off his threat from Saturday to hit seven EU countries and the United Kingdom with new tariffs unless they supported his push for American control of Greenland. Asked if he would be willing to use force to seize the semi-autonomous Danish territory, Trump replied, “No comment,” on Monday. The S&P 500 sold off by around 1.3% in early trading, while the Nasdaq Composite plunged 1.7%. The Dow Jones Industrial Average dropped more than 600 points. The S&P 500 has erased its gains for the year so far. Investors also sold off U.S. government bonds, driving up interest rates. Rising returns on US treasuries usually translate into higher mortgage rates and interest on new personal loans.

HÀ NỘI — Despite unprecedented challenges from global markets and the growing impacts of climate change, 2025 marked a historic milestone for Việt Nam’s wood industry, as export turnover of timber and wood products surpassed US$17 billion for the first time. According to data from Việt Nam Customs, exports of timber and wood products reached nearly $1.7 billion in December 2025 alone, bringing total export value for the year to $17.2 billion – an increase of nearly 6 per cent compared with 2024. In 2025, exports of timber and wood products to the US totalled $9.46 billion, up 4.4 per cent year on year and accounting for approximately 55 per cent of the industry’s total export turnover. Việt Nam continued to maintain its position as the largest supplier of wooden furniture to the US market. …Việt Nam’s market share of wooden furniture in the US increased significantly, rising from 40.5 per cent in the first eight months of 2024 to 45.3 per cent in the same period of 2025.

HÀ NỘI — Despite unprecedented challenges from global markets and the growing impacts of climate change, 2025 marked a historic milestone for Việt Nam’s wood industry, as export turnover of timber and wood products surpassed US$17 billion for the first time. According to data from Việt Nam Customs, exports of timber and wood products reached nearly $1.7 billion in December 2025 alone, bringing total export value for the year to $17.2 billion – an increase of nearly 6 per cent compared with 2024. In 2025, exports of timber and wood products to the US totalled $9.46 billion, up 4.4 per cent year on year and accounting for approximately 55 per cent of the industry’s total export turnover. Việt Nam continued to maintain its position as the largest supplier of wooden furniture to the US market. …Việt Nam’s market share of wooden furniture in the US increased significantly, rising from 40.5 per cent in the first eight months of 2024 to 45.3 per cent in the same period of 2025.

TIANJIN, CHINA — The global movement against single-use plastics has triggered a significant transformation in the disposable tableware industry, with wood cutlery emerging as a leading alternative. As regulations tighten and consumer preferences shift toward eco-friendly options, manufacturers of disposable wooden utensils are experiencing unprecedented growth and facing new challenges in scaling production, ensuring sustainability, and meeting diverse international standards. Market analysts observe that regulatory pressure represents the primary driver for this sector’s expansion. The European Union’s Single-Use Plastics Directive, along with similar legislation in Canada, Australia, and numerous U.S. states, has created a substantial and sustained demand for compliant alternatives. Within this regulatory framework, wood, particularly from fast-growing, sustainably managed sources like birch and bamboo, has gained favor for its natural composition, biodegradability, and perceived premium feel compared to other alternatives.

TIANJIN, CHINA — The global movement against single-use plastics has triggered a significant transformation in the disposable tableware industry, with wood cutlery emerging as a leading alternative. As regulations tighten and consumer preferences shift toward eco-friendly options, manufacturers of disposable wooden utensils are experiencing unprecedented growth and facing new challenges in scaling production, ensuring sustainability, and meeting diverse international standards. Market analysts observe that regulatory pressure represents the primary driver for this sector’s expansion. The European Union’s Single-Use Plastics Directive, along with similar legislation in Canada, Australia, and numerous U.S. states, has created a substantial and sustained demand for compliant alternatives. Within this regulatory framework, wood, particularly from fast-growing, sustainably managed sources like birch and bamboo, has gained favor for its natural composition, biodegradability, and perceived premium feel compared to other alternatives.

Each year, the event brings together leading voices from across the global pulp value chain to examine emerging trends, innovations, and the market forces shaping the industry. The 2026 program will feature dynamic discussions on strategy, markets, technology, sustainability, supply chains, and the broader role of pulp-based materials. Speakers have the opportunity to share their insights with a highly engaged international audience. We encourage proposals and topic ideas that can deepen insight and spark meaningful dialogue. Registration for the 21st edition of IPW is now open, and you can benefit from the Early Bird rate until February 16. More details are available on the registration page.

Each year, the event brings together leading voices from across the global pulp value chain to examine emerging trends, innovations, and the market forces shaping the industry. The 2026 program will feature dynamic discussions on strategy, markets, technology, sustainability, supply chains, and the broader role of pulp-based materials. Speakers have the opportunity to share their insights with a highly engaged international audience. We encourage proposals and topic ideas that can deepen insight and spark meaningful dialogue. Registration for the 21st edition of IPW is now open, and you can benefit from the Early Bird rate until February 16. More details are available on the registration page. The French Union of Timber Industries and Builders (UICB) and the French Timber Trade Association (LCB) are joining forces to create the UICCB – the Union of Construction and Timber Trade Industries. The synergy created by the merger of these two major players in the French forestry and timber sector will support the development of companies in the sector, which are naturally committed to decarbonizing the construction process. The new group took shape in December 2025 after a year of discussions and collaboration between the business leaders who head the governing bodies of the UICB and LCB. …The merger of the two entities will… enable them to acquire a stronger position within the emerging forestry and wood sector. …With this ecosystem of complementary professions, the UICCB now stands as the only independent professional organization dedicated to the development of wood construction throughout France.

The French Union of Timber Industries and Builders (UICB) and the French Timber Trade Association (LCB) are joining forces to create the UICCB – the Union of Construction and Timber Trade Industries. The synergy created by the merger of these two major players in the French forestry and timber sector will support the development of companies in the sector, which are naturally committed to decarbonizing the construction process. The new group took shape in December 2025 after a year of discussions and collaboration between the business leaders who head the governing bodies of the UICB and LCB. …The merger of the two entities will… enable them to acquire a stronger position within the emerging forestry and wood sector. …With this ecosystem of complementary professions, the UICCB now stands as the only independent professional organization dedicated to the development of wood construction throughout France.

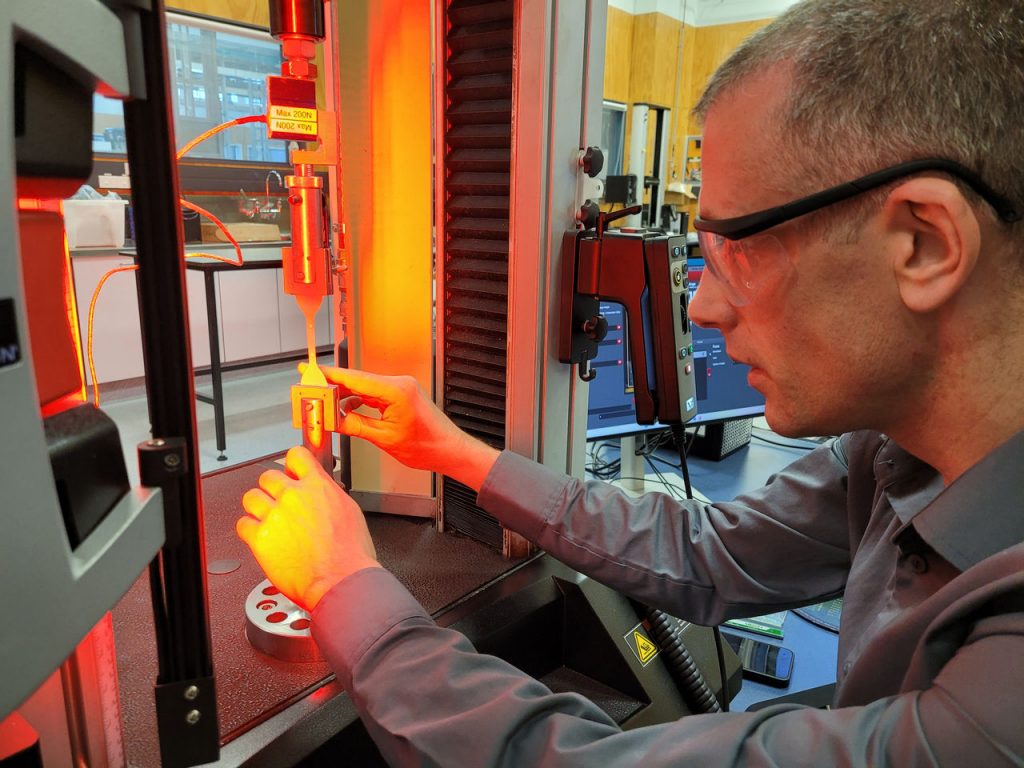

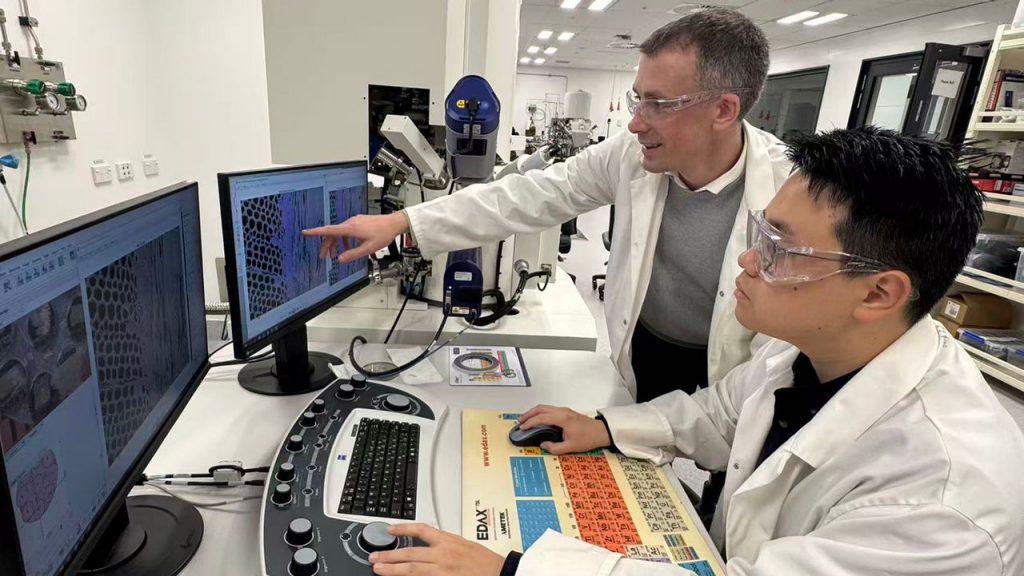

Japan-based materials experts have made impressive progress in the search for a better biodegradable plastic. The breakthrough starts with an abundant material: cellulose from wood pulp. Takuzo Aida, RIKEN Center for Emergent Matter Science research lead, said in a news release that “about one trillion tons” are naturally produced annually. Using it successfully as part of a new plastic could have a widespread impact, because most types of the material take decades to hundreds of years to break down. “This technology will help protect the Earth from plastic pollution,” Aida said in the RIKEN report. …Unlike other biodegradable plastics, RIKEN’s innovation also eliminates harmful microplastics, tiny particles that have saturated our world — found in soil, oceans, and even our bodies.

Japan-based materials experts have made impressive progress in the search for a better biodegradable plastic. The breakthrough starts with an abundant material: cellulose from wood pulp. Takuzo Aida, RIKEN Center for Emergent Matter Science research lead, said in a news release that “about one trillion tons” are naturally produced annually. Using it successfully as part of a new plastic could have a widespread impact, because most types of the material take decades to hundreds of years to break down. “This technology will help protect the Earth from plastic pollution,” Aida said in the RIKEN report. …Unlike other biodegradable plastics, RIKEN’s innovation also eliminates harmful microplastics, tiny particles that have saturated our world — found in soil, oceans, and even our bodies. Recent studies suggest that paper-based advertising may hold a more sustainable footprint than its digital counterpart. This revelation challenges the widely held assumption that ‘going paperless’ automatically equates to environmental responsibility. New data indicates that the full lifecycle impact of digital advertising – encompassing data centers, device manufacturing, and network infrastructure – generates a significantly larger carbon footprint than traditional print methods. The findings, originating from research conducted by the Öko-Institut in Germany and corroborated by analyses from The Telegraph, Emerce, and RetailTrends, highlight the often-overlooked environmental costs associated with the digital world. While paper production undeniably carries its own environmental burdens, advancements in sustainable forestry practices and paper recycling are mitigating these impacts. …Their findings consistently showed that paper-based advertising, particularly when utilizing recycled paper and responsible forestry practices, generated fewer greenhouse gas emissions than comparable digital campaigns.

Recent studies suggest that paper-based advertising may hold a more sustainable footprint than its digital counterpart. This revelation challenges the widely held assumption that ‘going paperless’ automatically equates to environmental responsibility. New data indicates that the full lifecycle impact of digital advertising – encompassing data centers, device manufacturing, and network infrastructure – generates a significantly larger carbon footprint than traditional print methods. The findings, originating from research conducted by the Öko-Institut in Germany and corroborated by analyses from The Telegraph, Emerce, and RetailTrends, highlight the often-overlooked environmental costs associated with the digital world. While paper production undeniably carries its own environmental burdens, advancements in sustainable forestry practices and paper recycling are mitigating these impacts. …Their findings consistently showed that paper-based advertising, particularly when utilizing recycled paper and responsible forestry practices, generated fewer greenhouse gas emissions than comparable digital campaigns.

Negotiations between the European Commission, European Council, and European Parliament, often referred to as the “trilogue”, have reached a significant conclusion regarding the European Union’s Deforestation Regulation (EUDR). On December 4, 2025, an agreement was reached, which promises to ease the administrative burden on the timber industry across Europe. This marks an important milestone, with changes that significantly affect the way the sector will handle the regulation moving forward. The EUDR, designed to combat global deforestation, will now come into effect in January 2027, offering a twelve-month delay for businesses to adjust. One of the most crucial changes in the reform is the elimination of the complex process requiring the forwarding of reference numbers throughout the entire supply chain. This has been hailed as a victory by many industry leaders, including Dr. Erlfried Taurer, Chairman of the Austrian Timber Industry Association.

Negotiations between the European Commission, European Council, and European Parliament, often referred to as the “trilogue”, have reached a significant conclusion regarding the European Union’s Deforestation Regulation (EUDR). On December 4, 2025, an agreement was reached, which promises to ease the administrative burden on the timber industry across Europe. This marks an important milestone, with changes that significantly affect the way the sector will handle the regulation moving forward. The EUDR, designed to combat global deforestation, will now come into effect in January 2027, offering a twelve-month delay for businesses to adjust. One of the most crucial changes in the reform is the elimination of the complex process requiring the forwarding of reference numbers throughout the entire supply chain. This has been hailed as a victory by many industry leaders, including Dr. Erlfried Taurer, Chairman of the Austrian Timber Industry Association. Canopy and Finance Earth outline strategic pathways for brands and investors to reduce virgin wood exposure and strengthen supply chain resilience. A new research brief released during the World Economic Forum warns that global wood-dependent supply chains face mounting commercial and ecological risk as rising demand, climate impacts, and regulatory pressure push forests toward ecological limits. The brief, produced by environmental non-profit Canopy with Finance Earth, argues that business-as-usual sourcing of virgin wood exposes brands and investors to higher costs, supply volatility, and growing reputational and legal risk over the decade ahead.The analysis comes as Canopy works with more than 1,000 consumer brands representing over $1.2 trillion in combined annual revenue to reduce deforestation and accelerate the adoption of circular and low-impact alternatives across sectors where wood is a primary input, including textiles and packaging.

Canopy and Finance Earth outline strategic pathways for brands and investors to reduce virgin wood exposure and strengthen supply chain resilience. A new research brief released during the World Economic Forum warns that global wood-dependent supply chains face mounting commercial and ecological risk as rising demand, climate impacts, and regulatory pressure push forests toward ecological limits. The brief, produced by environmental non-profit Canopy with Finance Earth, argues that business-as-usual sourcing of virgin wood exposes brands and investors to higher costs, supply volatility, and growing reputational and legal risk over the decade ahead.The analysis comes as Canopy works with more than 1,000 consumer brands representing over $1.2 trillion in combined annual revenue to reduce deforestation and accelerate the adoption of circular and low-impact alternatives across sectors where wood is a primary input, including textiles and packaging.

Scots Pines once dominated the landscape of Scotland, part of the vast Caledonian Forest which began to spread some 10,000 years ago after the end of the last ice age. Now only one per cent of the original forest remains in more than 80 pockets scattered mainly across the Highlands. Conservationists say there is an urgent need to improve the protection of these forests as climate change and threats from disease intensify. A new study from the James Hutton Institute in Aberdeen has revealed the environmental importance of preserving native woodlands. The research suggests the Scots pine alone supports nearly 1,600 separate species, including 227 that rely on it entirely. “Very few other tree species will support that range of biodiversity,” said Dr Ruth Mitchell, who led the study. “Species that use Scots pine include birds, mosses, lichens, fungi and invertebrates.”

Scots Pines once dominated the landscape of Scotland, part of the vast Caledonian Forest which began to spread some 10,000 years ago after the end of the last ice age. Now only one per cent of the original forest remains in more than 80 pockets scattered mainly across the Highlands. Conservationists say there is an urgent need to improve the protection of these forests as climate change and threats from disease intensify. A new study from the James Hutton Institute in Aberdeen has revealed the environmental importance of preserving native woodlands. The research suggests the Scots pine alone supports nearly 1,600 separate species, including 227 that rely on it entirely. “Very few other tree species will support that range of biodiversity,” said Dr Ruth Mitchell, who led the study. “Species that use Scots pine include birds, mosses, lichens, fungi and invertebrates.” Young tropical forests play a crucial role in slowing climate change. …But, according to a new study, CO2 absorption may be slowed down by the lack of a crucial element that trees need to grow: nitrogen. Published in Nature Communications … the study estimates that if

Young tropical forests play a crucial role in slowing climate change. …But, according to a new study, CO2 absorption may be slowed down by the lack of a crucial element that trees need to grow: nitrogen. Published in Nature Communications … the study estimates that if  The world is losing forests to fire at an unsustainable rate, experts have warned. …in recent decades [wildfire] scale, frequency and intensity in carbon-rich forests have surged. Research from the World Resources Institute (WRI) shows that fires now destroy more than twice as much tree cover as they did two decades ago. In 2024 alone, 135,000km² of forest burned – the most extreme wildfire year on record. Yet fires in other landscapes have not risen in the same way, according to research from the University of Tasmania. While the total area burned globally has fallen for decades as farms have expanded across Africa and slowed the spread of blazes – forests have become a new hotspot. …Four of the five worst years on record have occurred since 2020. Research from the WRI shows that 2024 was the first time that major fires raged across tropical, hot and humid forests such as the Amazon, and boreal forests, such as those spanning Canada’s vast coniferous regions.

The world is losing forests to fire at an unsustainable rate, experts have warned. …in recent decades [wildfire] scale, frequency and intensity in carbon-rich forests have surged. Research from the World Resources Institute (WRI) shows that fires now destroy more than twice as much tree cover as they did two decades ago. In 2024 alone, 135,000km² of forest burned – the most extreme wildfire year on record. Yet fires in other landscapes have not risen in the same way, according to research from the University of Tasmania. While the total area burned globally has fallen for decades as farms have expanded across Africa and slowed the spread of blazes – forests have become a new hotspot. …Four of the five worst years on record have occurred since 2020. Research from the WRI shows that 2024 was the first time that major fires raged across tropical, hot and humid forests such as the Amazon, and boreal forests, such as those spanning Canada’s vast coniferous regions.

When UN Spokesperson Stéphane Dujarric briefed correspondents in New York on Thursday following the release of the White House Memorandum, he insisted that the Organization will continue to carry out its mandates from Member States “with determination.” Wednesday’s memorandum states that the US administration is “ceasing participation in or funding to those entities to the extent permitted by law.” Several of the bodies listed in the memo are funded principally or partially by the regular UN budget, implying that voluntary funding will be impacted, although central funding will continue. However, the White House notes that its funding review of international organisations “remains ongoing,” and it is currently unclear what the impact of the announcement will be. Here’s a breakdown of the 31 UN entities mentioned in the memorandum, and how they are making a positive difference to people, communities and nations, worldwide.

When UN Spokesperson Stéphane Dujarric briefed correspondents in New York on Thursday following the release of the White House Memorandum, he insisted that the Organization will continue to carry out its mandates from Member States “with determination.” Wednesday’s memorandum states that the US administration is “ceasing participation in or funding to those entities to the extent permitted by law.” Several of the bodies listed in the memo are funded principally or partially by the regular UN budget, implying that voluntary funding will be impacted, although central funding will continue. However, the White House notes that its funding review of international organisations “remains ongoing,” and it is currently unclear what the impact of the announcement will be. Here’s a breakdown of the 31 UN entities mentioned in the memorandum, and how they are making a positive difference to people, communities and nations, worldwide. A new study has shown for the first time that waste cardboard can be used as an effective source of biomass fuel for large-scale power generation, offering a potential new domestic resource to support the UK’s renewable energy sector. Engineers from the University of Nottingham have carried out the first comprehensive characterisation of cardboard as a fuel source and developed a new method to assess its composition. The research … provides a practical tool for evaluating different grades of cardboard for use in energy production. The study found that cardboard displays distinct physical and chemical properties compared with traditional biomass fuels. These include lower carbon content, a reduced heating value and a high level of calcium carbonate fillers, particularly in printed grades. Calcium carbonate is commonly added to cardboard to improve stiffness and optical qualities, but during combustion it forms ash that can reduce boiler performance.

A new study has shown for the first time that waste cardboard can be used as an effective source of biomass fuel for large-scale power generation, offering a potential new domestic resource to support the UK’s renewable energy sector. Engineers from the University of Nottingham have carried out the first comprehensive characterisation of cardboard as a fuel source and developed a new method to assess its composition. The research … provides a practical tool for evaluating different grades of cardboard for use in energy production. The study found that cardboard displays distinct physical and chemical properties compared with traditional biomass fuels. These include lower carbon content, a reduced heating value and a high level of calcium carbonate fillers, particularly in printed grades. Calcium carbonate is commonly added to cardboard to improve stiffness and optical qualities, but during combustion it forms ash that can reduce boiler performance.

Running along Brazil’s coastline, the Atlantic Forest supports an extraordinary range of life, including hundreds of species of birds, amphibians, reptiles, mammals, and fishes. Much of that richness has been lost. Human development has reduced the forest to roughly one third of its original size. As people move deeper into once intact habitats, wildlife is pushed out, and mosquitoes that once fed on many different animals appear to be shifting their attention toward humans, according to a study published in Frontiers in Ecology and Evolution. …Scientists extracted DNA from the blood inside the mosquitoes and sequenced a specific gene that works like a biological barcode. …Mosquito bites are not just a nuisance. In the regions studied, mosquitoes spread viruses such as Yellow Fever, dengue, Zika, Mayaro, Sabiá, and Chikungunya.

Running along Brazil’s coastline, the Atlantic Forest supports an extraordinary range of life, including hundreds of species of birds, amphibians, reptiles, mammals, and fishes. Much of that richness has been lost. Human development has reduced the forest to roughly one third of its original size. As people move deeper into once intact habitats, wildlife is pushed out, and mosquitoes that once fed on many different animals appear to be shifting their attention toward humans, according to a study published in Frontiers in Ecology and Evolution. …Scientists extracted DNA from the blood inside the mosquitoes and sequenced a specific gene that works like a biological barcode. …Mosquito bites are not just a nuisance. In the regions studied, mosquitoes spread viruses such as Yellow Fever, dengue, Zika, Mayaro, Sabiá, and Chikungunya. Chilean President Gabriel Boric has declared a state of catastrophe in two regions where deadly wildfires have left at least 18 people dead. More than 50,000 people have also been evacuated in the Ñuble and Biobío regions, about 500km (300 miles) south of the capital Santiago. Boric said the death toll was expected to increase. The most dangerous fire has swept through dry forests bordering the coastal city of Concepción. About 250 homes have been destroyed, disaster officials said. Local media have shown pictures of charred cars in the streets. Chile’s forestry agency, Conaf, said firefighters were battling 24 fires across the country on Sunday. The most threatening, it added, were in Ñuble and Biobío. The fires have burnt through 8,500 hectares (21,000 acres) in the two regions so far.

Chilean President Gabriel Boric has declared a state of catastrophe in two regions where deadly wildfires have left at least 18 people dead. More than 50,000 people have also been evacuated in the Ñuble and Biobío regions, about 500km (300 miles) south of the capital Santiago. Boric said the death toll was expected to increase. The most dangerous fire has swept through dry forests bordering the coastal city of Concepción. About 250 homes have been destroyed, disaster officials said. Local media have shown pictures of charred cars in the streets. Chile’s forestry agency, Conaf, said firefighters were battling 24 fires across the country on Sunday. The most threatening, it added, were in Ñuble and Biobío. The fires have burnt through 8,500 hectares (21,000 acres) in the two regions so far.