The situation surrounding tariffs remains fluid, with a flurry of activity in Washington this week. …On March 6, Trump announced a one-month tariff delay until April 2 on all products from Mexico and Canada that are covered by the United States-Mexico-Canada Agreement (USMCA). While there is no specific language in the USMCA addressing Canadian softwood lumber, NAHB worked with the White House to ensure it was covered under the latest pause on tariff implementation. Two essential materials used in new home construction, softwood lumber and gypsum (used for drywall), are largely sourced from Canada and Mexico, respectively. …If the new tariffs on Mexico and Canada go into effect next month, they are projected to raise the cost of imported construction materials by more than $3 billion. NAHB has received anecdotal reports from members that they are planning for tariffs to increase material costs between $7,500 and $10,000 on the average new single-family home.

The situation surrounding tariffs remains fluid, with a flurry of activity in Washington this week. …On March 6, Trump announced a one-month tariff delay until April 2 on all products from Mexico and Canada that are covered by the United States-Mexico-Canada Agreement (USMCA). While there is no specific language in the USMCA addressing Canadian softwood lumber, NAHB worked with the White House to ensure it was covered under the latest pause on tariff implementation. Two essential materials used in new home construction, softwood lumber and gypsum (used for drywall), are largely sourced from Canada and Mexico, respectively. …If the new tariffs on Mexico and Canada go into effect next month, they are projected to raise the cost of imported construction materials by more than $3 billion. NAHB has received anecdotal reports from members that they are planning for tariffs to increase material costs between $7,500 and $10,000 on the average new single-family home.

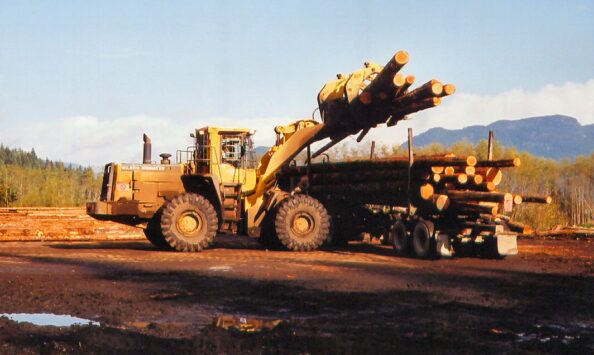

While the market tries to process what’s to come on the trade front, it’s abundantly clear that the new administration is paying special attention to lumber and likely other wood products. Trump and his surrogates have emphasized the point of view that the US has the underlying resources to produce all its own lumber and wood product needs. In response, there have been a number of news articles highlighting the statements and questioning the idea of whether or not America can quickly and completely wean itself off Canadian wood products. …Canada currently supplies about 12.0 BBF of softwood lumber to the US market. After accounting for the 1.3 BBF of exports the US has shipped in recent years, the US is still short just over 3.2 BBF of operable capacity to quickly fill Canadian lumber supply and still meet current demand levels. In other words, at current demand levels, the US softwood lumber market does not clear without Canadian supply.

While the market tries to process what’s to come on the trade front, it’s abundantly clear that the new administration is paying special attention to lumber and likely other wood products. Trump and his surrogates have emphasized the point of view that the US has the underlying resources to produce all its own lumber and wood product needs. In response, there have been a number of news articles highlighting the statements and questioning the idea of whether or not America can quickly and completely wean itself off Canadian wood products. …Canada currently supplies about 12.0 BBF of softwood lumber to the US market. After accounting for the 1.3 BBF of exports the US has shipped in recent years, the US is still short just over 3.2 BBF of operable capacity to quickly fill Canadian lumber supply and still meet current demand levels. In other words, at current demand levels, the US softwood lumber market does not clear without Canadian supply.

US Commerce Secretary Howard Lutnick signaled he doesn’t expect a reprieve on 25% tariffs for steel and aluminum imports scheduled to take effect on Wednesday. The levies, ordered by U.S. President Donald Trump in February, include imports from Canada and Mexico — which are among the top foreign suppliers — and apply to finished metal products, too. U.S. steelmakers have urged Trump to resist exemptions to the tariffs, which risk hitting US companies that use aluminum and steel. Administration officials have said the policy is aimed at cracking down on efforts by countries including Russia and China to bypass existing duties. Last week, Trump imposed sweeping tariffs on imports from Canada and Mexico but later walked back some of the changes — offering a one-month reprieve to automakers and then expanding that pause to all imported goods covered by the free-trade agreement between the US, Canada and Mexico.

US Commerce Secretary Howard Lutnick signaled he doesn’t expect a reprieve on 25% tariffs for steel and aluminum imports scheduled to take effect on Wednesday. The levies, ordered by U.S. President Donald Trump in February, include imports from Canada and Mexico — which are among the top foreign suppliers — and apply to finished metal products, too. U.S. steelmakers have urged Trump to resist exemptions to the tariffs, which risk hitting US companies that use aluminum and steel. Administration officials have said the policy is aimed at cracking down on efforts by countries including Russia and China to bypass existing duties. Last week, Trump imposed sweeping tariffs on imports from Canada and Mexico but later walked back some of the changes — offering a one-month reprieve to automakers and then expanding that pause to all imported goods covered by the free-trade agreement between the US, Canada and Mexico. President Donald Trump on Thursday signed executive actions that delay for nearly one month tariffs on all products from Mexico and Canada that are covered by the USMCA free trade treaty, a significant walkback of the administration’s signature economic plan that has rattled markets, businesses and consumers. The executive actions follow a discussion Trump held Thursday with Mexican President Claudia Sheinbaum and negotiations between Canadian and Trump administration officials. …Energy from Canada, however, is not included in the USMCA, the White House official said. So that lower 10% tariff is expected to remain in place… but the Trump reduced the tariff on Canadian potash to 10%. …Canada will now pause their planned second round of tariffs on over 4,000 US goods until April 2, Canadian Minister of Finance Dominic LeBlanc said.

President Donald Trump on Thursday signed executive actions that delay for nearly one month tariffs on all products from Mexico and Canada that are covered by the USMCA free trade treaty, a significant walkback of the administration’s signature economic plan that has rattled markets, businesses and consumers. The executive actions follow a discussion Trump held Thursday with Mexican President Claudia Sheinbaum and negotiations between Canadian and Trump administration officials. …Energy from Canada, however, is not included in the USMCA, the White House official said. So that lower 10% tariff is expected to remain in place… but the Trump reduced the tariff on Canadian potash to 10%. …Canada will now pause their planned second round of tariffs on over 4,000 US goods until April 2, Canadian Minister of Finance Dominic LeBlanc said. GENEVA — Canada has requested consultations with the United States on “unjustified tariffs” at the

GENEVA — Canada has requested consultations with the United States on “unjustified tariffs” at the  When President Trump threatened new tariffs on Mexico, Canada and China at the beginning of February, Steve Martinez flew into action. The Idaho-based general contractor spent hundreds of thousands of dollars on materials like lumber, windows, cabinetry and steel to stockpile them before the tariffs hit. …Since his lenders wouldn’t finance these purchases, he is paying out of pocket and using cash. Then after the president abruptly walked them back, Martinez was left with an upended business plan, less cash and feeling confused about what to do next. “I can’t keep ping ponging back and forth,” Martinez said. …Builders have been doing what they can to insulate themselves from higher import costs, from stockpiling materials and appliances to shrinking the size of the homes they will build. But if tariffs take effect long term, they will only be able to absorb so much cost. [to access the full story a WSJ subscription is required]

When President Trump threatened new tariffs on Mexico, Canada and China at the beginning of February, Steve Martinez flew into action. The Idaho-based general contractor spent hundreds of thousands of dollars on materials like lumber, windows, cabinetry and steel to stockpile them before the tariffs hit. …Since his lenders wouldn’t finance these purchases, he is paying out of pocket and using cash. Then after the president abruptly walked them back, Martinez was left with an upended business plan, less cash and feeling confused about what to do next. “I can’t keep ping ponging back and forth,” Martinez said. …Builders have been doing what they can to insulate themselves from higher import costs, from stockpiling materials and appliances to shrinking the size of the homes they will build. But if tariffs take effect long term, they will only be able to absorb so much cost. [to access the full story a WSJ subscription is required] As we enter what are typically the most profitable months for US builders, widespread uncertainty regarding pricing is casting a pall over the industry. Northeastern Retail Lumber Association (NRLA) crystallizes these concerns, noting that: “Despite repeated delays of tariffs on imports from Mexico and Canada, prices continue to fluctuate unpredictably, leading to hoarding by customers, delayed orders for restocking, and customers abandoning purchases due to sudden cost increases.” The NRLA says the current situation recalls the tumult of pandemic-era supply chain shortages. “Now, dealers are reporting the same patterns: unpredictable cost increases, uncertainty in securing supply, and customers unable to move forward with purchases due to rapidly shifting prices.” …NRLA writes that daily price changes are making it impossible for retailers to provide accurate quotes, which constricts pricing guarantees. …NRLA dealers are reporting that even U.S.-made manufactured materials are seeing price increases.

As we enter what are typically the most profitable months for US builders, widespread uncertainty regarding pricing is casting a pall over the industry. Northeastern Retail Lumber Association (NRLA) crystallizes these concerns, noting that: “Despite repeated delays of tariffs on imports from Mexico and Canada, prices continue to fluctuate unpredictably, leading to hoarding by customers, delayed orders for restocking, and customers abandoning purchases due to sudden cost increases.” The NRLA says the current situation recalls the tumult of pandemic-era supply chain shortages. “Now, dealers are reporting the same patterns: unpredictable cost increases, uncertainty in securing supply, and customers unable to move forward with purchases due to rapidly shifting prices.” …NRLA writes that daily price changes are making it impossible for retailers to provide accurate quotes, which constricts pricing guarantees. …NRLA dealers are reporting that even U.S.-made manufactured materials are seeing price increases. Thousands of US companies opened for business on Friday with no idea whether they had to pay tariffs. …In imposing the tariffs, Mr. Trump misused the 1977 International Emergency Economic Powers Act. Congress passed IEEPA to give presidents tools to respond quickly to emergencies like wars or terrorist attacks. …IEEPA has never been used for tariffs, and courts should rule that it can’t be. …US trade laws require the president to identify and investigate specific trade practices that harm the U.S. and then propose remedies, such as tariffs or negotiations. A president may impose tariffs on specific goods if fact-finding determines that imports threaten US national security. Mr. Trump’s reasons for imposing tariffs on Canada don’t appear to satisfy these standards. …Faced with Mr. Trump’s tariff threats, Canadian, Mexican and European officials have indicated that they are open to collective action against China, the world’s biggest exporter and a major source of US trade deficits. [to access the full story, a WSJ subscription is required]

Thousands of US companies opened for business on Friday with no idea whether they had to pay tariffs. …In imposing the tariffs, Mr. Trump misused the 1977 International Emergency Economic Powers Act. Congress passed IEEPA to give presidents tools to respond quickly to emergencies like wars or terrorist attacks. …IEEPA has never been used for tariffs, and courts should rule that it can’t be. …US trade laws require the president to identify and investigate specific trade practices that harm the U.S. and then propose remedies, such as tariffs or negotiations. A president may impose tariffs on specific goods if fact-finding determines that imports threaten US national security. Mr. Trump’s reasons for imposing tariffs on Canada don’t appear to satisfy these standards. …Faced with Mr. Trump’s tariff threats, Canadian, Mexican and European officials have indicated that they are open to collective action against China, the world’s biggest exporter and a major source of US trade deficits. [to access the full story, a WSJ subscription is required]

US lumber futures have fallen from their all-time highs after president Trump’s delay to tariffs on Canada this week halted a surge in prices. Contracts tracking a truckload of lumber hit the highest point in their 30-month history this week. …Trump initially planned to impose 25% tariffs on critical Canadian imports, boosting prices, but Thursday’s pause for a month pushed prices for delivery in May down more than 6% over two days, to $651 per MBF. Even so, prices remain elevated as Trump also ordered a federal investigation into Canadian companies potentially dumping excess supplies into the US market. …Together with potential tariffs, the total duty on Canadian imports could rise from 14.5 per cent to 52 per cent. “This is going to be devastating for Canadian producers,” said Dustin Jalbert, senior economist for wood products at price reporting agency Fastmarkets. “No Canadian producer is making the margin to be able to absorb that.”

US lumber futures have fallen from their all-time highs after president Trump’s delay to tariffs on Canada this week halted a surge in prices. Contracts tracking a truckload of lumber hit the highest point in their 30-month history this week. …Trump initially planned to impose 25% tariffs on critical Canadian imports, boosting prices, but Thursday’s pause for a month pushed prices for delivery in May down more than 6% over two days, to $651 per MBF. Even so, prices remain elevated as Trump also ordered a federal investigation into Canadian companies potentially dumping excess supplies into the US market. …Together with potential tariffs, the total duty on Canadian imports could rise from 14.5 per cent to 52 per cent. “This is going to be devastating for Canadian producers,” said Dustin Jalbert, senior economist for wood products at price reporting agency Fastmarkets. “No Canadian producer is making the margin to be able to absorb that.” VANCOUVER, BC — Canfor Corporation reported its fourth quarter of 2024 results. Highlights include: Q4 2024 operating loss of $46 million; shareholder net loss of $63 million; Supply-driven uptick in North American lumber markets and pricing through the fourth quarter led to improved results from the Company’s Western Canadian and US South operations; another quarter of solid earnings from Europe; Improved

VANCOUVER, BC — Canfor Corporation reported its fourth quarter of 2024 results. Highlights include: Q4 2024 operating loss of $46 million; shareholder net loss of $63 million; Supply-driven uptick in North American lumber markets and pricing through the fourth quarter led to improved results from the Company’s Western Canadian and US South operations; another quarter of solid earnings from Europe; Improved

President Trump’s push for tariffs on Canada – and his subsequent delays and exemptions – are frustrating efforts to import lumber from the country and putting the building supply market on edge. The back-and-forth over whether tariffs will be imposed or not has businesses unable to trust price stability, and risks backing up the supply chain for US homebuilders. The reluctance to pay a tariff, which could be changed or cancelled any day, “freezes these markets up,” according to Don Magruder, who runs a building material company based in Florida. …Andy Rielly, president of Rielly Lumber in British Columbia, said he’s been in talks with long-term customers on how to divvy up the extra costs, but not everyone has been able to strike deals. …The US’s National Association of Home Builders chairman Buddy Hughes said tariffs risk worsening housing affordability. …The US Lumber Coalition said that lumber prices are only a fraction of homebuilding costs.

President Trump’s push for tariffs on Canada – and his subsequent delays and exemptions – are frustrating efforts to import lumber from the country and putting the building supply market on edge. The back-and-forth over whether tariffs will be imposed or not has businesses unable to trust price stability, and risks backing up the supply chain for US homebuilders. The reluctance to pay a tariff, which could be changed or cancelled any day, “freezes these markets up,” according to Don Magruder, who runs a building material company based in Florida. …Andy Rielly, president of Rielly Lumber in British Columbia, said he’s been in talks with long-term customers on how to divvy up the extra costs, but not everyone has been able to strike deals. …The US’s National Association of Home Builders chairman Buddy Hughes said tariffs risk worsening housing affordability. …The US Lumber Coalition said that lumber prices are only a fraction of homebuilding costs. The Trump administration is moving at a record pace on a varied list of priorities, but insiders hope a focus on housing will remain at the top of the agenda in 2025. With housing affordability a central focus, bills addressing zoning, permitting, workforce development, and taxes are taking shape. …Despite all these areas of concern, one concern looms largest – tariffs. Approximately 22% of the products used in the average home are imported from China, 70% of lumber used in construction is sourced from Canada, and Mexico is the largest provider of gypsum. …The NAHB has advocated for an exemption for building materials, and the association continues to engage in conversations with lawmakers about the harmful effects these tariffs could have on housing affordability. NAHB’s Karl Eckhart says “These Canadian and Mexican tariffs are going to have a direct and painful impact on the price to build a house.”

The Trump administration is moving at a record pace on a varied list of priorities, but insiders hope a focus on housing will remain at the top of the agenda in 2025. With housing affordability a central focus, bills addressing zoning, permitting, workforce development, and taxes are taking shape. …Despite all these areas of concern, one concern looms largest – tariffs. Approximately 22% of the products used in the average home are imported from China, 70% of lumber used in construction is sourced from Canada, and Mexico is the largest provider of gypsum. …The NAHB has advocated for an exemption for building materials, and the association continues to engage in conversations with lawmakers about the harmful effects these tariffs could have on housing affordability. NAHB’s Karl Eckhart says “These Canadian and Mexican tariffs are going to have a direct and painful impact on the price to build a house.” Lumber producers have migrated from Canada to the US South. Now lumber-futures trading is heading to the Southern pineries as well. The exchange operator CME Group said it would launch trading in Southern yellow pine futures on March 31, a response to rising export taxes on Canadian lumber. The futures contracts—ticker: SYP—will give the South’s loblolly planters, loggers, sawmills, pressure treaters and builders a mechanism to manage their exposure to price swings that is more in line with the local market than existing futures. …Traders and the exchange have for years discussed Southern yellow pine futures as the region’s production grew. Now that Northern lumber is a lot more expensive, they are saying the time is right. …Southern yellow pine doesn’t always work as a substitute for the Northern species favored by home builders. But executives said the growing price difference is prompting pockets of buyers to swap.

Lumber producers have migrated from Canada to the US South. Now lumber-futures trading is heading to the Southern pineries as well. The exchange operator CME Group said it would launch trading in Southern yellow pine futures on March 31, a response to rising export taxes on Canadian lumber. The futures contracts—ticker: SYP—will give the South’s loblolly planters, loggers, sawmills, pressure treaters and builders a mechanism to manage their exposure to price swings that is more in line with the local market than existing futures. …Traders and the exchange have for years discussed Southern yellow pine futures as the region’s production grew. Now that Northern lumber is a lot more expensive, they are saying the time is right. …Southern yellow pine doesn’t always work as a substitute for the Northern species favored by home builders. But executives said the growing price difference is prompting pockets of buyers to swap.

President Trump is promising to unleash the US timber industry by allowing companies to raze swaths of federally protected national forests. …His order — which calls for the ramping up of the domestic timber production to avoid reliance on “foreign producers” — was followed by sweeping 25% tariffs on Canadian products, including lumber. …However, it’s more complex than simply swapping out Canadian imports for homegrown timber, said industry experts. …Meanwhile, environmental groups say clearcutting national forests will pollute the air and water and exacerbate climate change. Anna Kelly, White House deputy press secretary, referred to multiple organizations that have released statements of support about opening up federal land for logging, including the American Loggers Council, the American Forest Resource Council and the Forest Landowners Association. Increasing logging on federal lands would increase the supply of logs for US industry, said FEA’s Rocky Goodnow… but it won’t replace Canadian imports in the near term.

President Trump is promising to unleash the US timber industry by allowing companies to raze swaths of federally protected national forests. …His order — which calls for the ramping up of the domestic timber production to avoid reliance on “foreign producers” — was followed by sweeping 25% tariffs on Canadian products, including lumber. …However, it’s more complex than simply swapping out Canadian imports for homegrown timber, said industry experts. …Meanwhile, environmental groups say clearcutting national forests will pollute the air and water and exacerbate climate change. Anna Kelly, White House deputy press secretary, referred to multiple organizations that have released statements of support about opening up federal land for logging, including the American Loggers Council, the American Forest Resource Council and the Forest Landowners Association. Increasing logging on federal lands would increase the supply of logs for US industry, said FEA’s Rocky Goodnow… but it won’t replace Canadian imports in the near term.

The Trump administration touted logging as the next frontier in job creation and wildfire prevention, but those goals will face confounding challenges. Trump issued two executive orders on March 1: the first to boost timber production on federal land and the second to address wood product imports. The moves were cheered by the timber industry. “These are common sense directives,” said Travis Joseph, president of the American Forest Resource Council, a timber industry trade group. “Our federal forests have been mismanaged for decades and Americans have paid the price in almost every way – lost jobs, lost manufacturing, and infrastructure.” Timber groups and rural lawmakers also said the orders could help manage overstocked forests and reduce the threat of wildfire. But conservation groups and forestry experts say cutting down more trees doesn’t inherently reduce wildfire risk and can actually increase it. The plan also faces pushback about environmental concerns and economics.

The Trump administration touted logging as the next frontier in job creation and wildfire prevention, but those goals will face confounding challenges. Trump issued two executive orders on March 1: the first to boost timber production on federal land and the second to address wood product imports. The moves were cheered by the timber industry. “These are common sense directives,” said Travis Joseph, president of the American Forest Resource Council, a timber industry trade group. “Our federal forests have been mismanaged for decades and Americans have paid the price in almost every way – lost jobs, lost manufacturing, and infrastructure.” Timber groups and rural lawmakers also said the orders could help manage overstocked forests and reduce the threat of wildfire. But conservation groups and forestry experts say cutting down more trees doesn’t inherently reduce wildfire risk and can actually increase it. The plan also faces pushback about environmental concerns and economics. President Donald Trump took action last weekend to increase domestic logging by circumventing environmental protections and to staunch the flow of imported lumber products primarily from Canada. A pair of executive orders — one addressing timber and wood product imports, the other addressing logging on federal lands — drew praise from the logging industry, condemnation from environmental and wildlife groups, and concern from the construction industry over higher prices. The order rolls back the degree to which the agencies have to comply with the Endangered Species Act or consider negative impacts of logging. …[making] it easier for environmentally damaging clear-cut logging to be approved. …The executive order on timber production … can exempt projects from complying with the landmark law. …allowing projects to proceed even if they will harm a protected species or result in extinction. Historically, the committee has been used to aid recovery from natural disasters, not to expedite resource extraction.

President Donald Trump took action last weekend to increase domestic logging by circumventing environmental protections and to staunch the flow of imported lumber products primarily from Canada. A pair of executive orders — one addressing timber and wood product imports, the other addressing logging on federal lands — drew praise from the logging industry, condemnation from environmental and wildlife groups, and concern from the construction industry over higher prices. The order rolls back the degree to which the agencies have to comply with the Endangered Species Act or consider negative impacts of logging. …[making] it easier for environmentally damaging clear-cut logging to be approved. …The executive order on timber production … can exempt projects from complying with the landmark law. …allowing projects to proceed even if they will harm a protected species or result in extinction. Historically, the committee has been used to aid recovery from natural disasters, not to expedite resource extraction. FRANKFURT – Bayer has told U.S. lawmakers it could stop selling Roundup weedkiller unless they can strengthen legal protection against product liability litigation, according to a financial analyst and a person close to the matter. Bayer has paid about $10 billion to settle disputed claims that Roundup, based on the herbicide glyphosate, causes cancer. About 67,000 further cases are pending for which the group has set aside $5.9 billion in legal provisions. The German company has said plaintiffs should not be able to take Bayer to court by invoking U.S. state rules given the federal U.S. Environmental Protection Agency has repeatedly labelled the product as safe to use, as have regulators in other parts of the world. “Without regulatory clarity (Bayer) will need to exit the business. Bayer have been clear with legislators and farmer groups on this,” analysts at brokerage Jefferies said in a note on Thursday, citing guidance Bayer’s leadership provided in a meeting.

FRANKFURT – Bayer has told U.S. lawmakers it could stop selling Roundup weedkiller unless they can strengthen legal protection against product liability litigation, according to a financial analyst and a person close to the matter. Bayer has paid about $10 billion to settle disputed claims that Roundup, based on the herbicide glyphosate, causes cancer. About 67,000 further cases are pending for which the group has set aside $5.9 billion in legal provisions. The German company has said plaintiffs should not be able to take Bayer to court by invoking U.S. state rules given the federal U.S. Environmental Protection Agency has repeatedly labelled the product as safe to use, as have regulators in other parts of the world. “Without regulatory clarity (Bayer) will need to exit the business. Bayer have been clear with legislators and farmer groups on this,” analysts at brokerage Jefferies said in a note on Thursday, citing guidance Bayer’s leadership provided in a meeting. A bipartisan group of lawmakers on Monday urged the Trump administration to scrap plans to kill more than 450,000 invasive barred owls in West Coast forests as part of efforts to stop the birds from crowding out a smaller type of owl that’s facing potential extinction. The 19 lawmakers claimed the killings would be “grossly expensive” and cost $3,000 per bird. They questioned if the shootings would help native populations of northern spotted owls, which have long been controversial because of logging restrictions in the birds’ forest habitat beginning in the 1990s, and the closely related California spotted owl. Barred owls are native to eastern North America and started appearing in the Pacific Northwest in the 1970s. They’ve quickly displaced many spotted owls, which are smaller birds that need larger territories to breed.

A bipartisan group of lawmakers on Monday urged the Trump administration to scrap plans to kill more than 450,000 invasive barred owls in West Coast forests as part of efforts to stop the birds from crowding out a smaller type of owl that’s facing potential extinction. The 19 lawmakers claimed the killings would be “grossly expensive” and cost $3,000 per bird. They questioned if the shootings would help native populations of northern spotted owls, which have long been controversial because of logging restrictions in the birds’ forest habitat beginning in the 1990s, and the closely related California spotted owl. Barred owls are native to eastern North America and started appearing in the Pacific Northwest in the 1970s. They’ve quickly displaced many spotted owls, which are smaller birds that need larger territories to breed. Northeastern Minnesota loggers and the nation’s forest products industry could get a lift under an executive order issued by President Donald Trump. New guidance or updates to facilitate increased timber production, sound forest management, reduced timber delivery time, and decreased timber supply uncertainty, are by the end of March to be issued by the U.S. Secretary of the Interior, Secretary of Agriculture, and U.S. Forest Service chief, under Trump’s “Immediate Expansion of American Timber Production,” order. National and Minnesota timber products officials say Trump’s order is a positive step toward boosting American timber production. “We’ve had nearly 150 mills close across the U.S. in the past 24 months,” Scott Dane, American Loggers Council (ALC) executive director said. “We need to turn the dismantling of the American timber industry around before it is too late. President Trump’s “immediate” increase in lumber production is the beginning of that turnaround.”

Northeastern Minnesota loggers and the nation’s forest products industry could get a lift under an executive order issued by President Donald Trump. New guidance or updates to facilitate increased timber production, sound forest management, reduced timber delivery time, and decreased timber supply uncertainty, are by the end of March to be issued by the U.S. Secretary of the Interior, Secretary of Agriculture, and U.S. Forest Service chief, under Trump’s “Immediate Expansion of American Timber Production,” order. National and Minnesota timber products officials say Trump’s order is a positive step toward boosting American timber production. “We’ve had nearly 150 mills close across the U.S. in the past 24 months,” Scott Dane, American Loggers Council (ALC) executive director said. “We need to turn the dismantling of the American timber industry around before it is too late. President Trump’s “immediate” increase in lumber production is the beginning of that turnaround.” Federal officials are preparing to disband an advisory committee tasked with guiding policies for millions of acres of national forests in the Pacific Northwest. …The 21 members of the Northwest Forest Plan federal advisory committee… have been meeting since summer 2023, hashing out how to tackle wildfires, pests and diseases across nearly 25 million acres of national forests in Oregon, Washington and Northern California. On Thursday, officials with the US Forest Service told committee members the agency was likely to dissolve the group in the coming weeks. Some members said they had been expecting this news. …The Forest Service pulled the committee together to help amend the decades-old Northwest Forest Plan, a set of policies that came out of the timber wars of the 1980s and ’90s. …The committee delivered its recommendations to the Forest Service last year.

Federal officials are preparing to disband an advisory committee tasked with guiding policies for millions of acres of national forests in the Pacific Northwest. …The 21 members of the Northwest Forest Plan federal advisory committee… have been meeting since summer 2023, hashing out how to tackle wildfires, pests and diseases across nearly 25 million acres of national forests in Oregon, Washington and Northern California. On Thursday, officials with the US Forest Service told committee members the agency was likely to dissolve the group in the coming weeks. Some members said they had been expecting this news. …The Forest Service pulled the committee together to help amend the decades-old Northwest Forest Plan, a set of policies that came out of the timber wars of the 1980s and ’90s. …The committee delivered its recommendations to the Forest Service last year. …in the early 2000s, a group of scientists and businessmen began arguing that forest thinning was too much for the government to take on. If Arizona had any hope of decreasing the risk of catastrophic forest fire, private industry would have to play a part. From this debate emerged Arizona Forest Restoration Products, a company that had planned to make oriented strand board from the low-dollar trees. …But …the Forest Service unexpectedly awarded the contract in 2012 to Pioneer Associates, a group it favored, even if they were arguably less qualified and had gathered almost no funding for their proposal. …Pioneer quickly went defunct, and the company that took over its contract, Good Earth, only thinned a fraction of what it promised. …And a cautionary tale as we fall into a pattern of on-again, off-again federal infrastructure funding cuts and threatened tariffs, which were enacted and then delayed on Canada and Mexico until April.

…in the early 2000s, a group of scientists and businessmen began arguing that forest thinning was too much for the government to take on. If Arizona had any hope of decreasing the risk of catastrophic forest fire, private industry would have to play a part. From this debate emerged Arizona Forest Restoration Products, a company that had planned to make oriented strand board from the low-dollar trees. …But …the Forest Service unexpectedly awarded the contract in 2012 to Pioneer Associates, a group it favored, even if they were arguably less qualified and had gathered almost no funding for their proposal. …Pioneer quickly went defunct, and the company that took over its contract, Good Earth, only thinned a fraction of what it promised. …And a cautionary tale as we fall into a pattern of on-again, off-again federal infrastructure funding cuts and threatened tariffs, which were enacted and then delayed on Canada and Mexico until April.

Republican-led policy directives could rewrite forest policies that affect public lands in Oregon and the rest of the West. New executive orders from the Trump administration call on federal agencies to fast-track logging projects by circumventing endangered species laws, and to investigate whether lumber imports threaten national security. …Some experts say it’s too soon to tell how these directives will affect Oregon’s timber market, particularly Trump’s order on fast-tracking timber sales to benefit logging companies and mills. Mindy Crandall, associate professor of forest policy at Oregon State University, said Canadian imports make up a large chunk of the U.S.‘s softwood lumber supply. Oregon also leads the nation

Republican-led policy directives could rewrite forest policies that affect public lands in Oregon and the rest of the West. New executive orders from the Trump administration call on federal agencies to fast-track logging projects by circumventing endangered species laws, and to investigate whether lumber imports threaten national security. …Some experts say it’s too soon to tell how these directives will affect Oregon’s timber market, particularly Trump’s order on fast-tracking timber sales to benefit logging companies and mills. Mindy Crandall, associate professor of forest policy at Oregon State University, said Canadian imports make up a large chunk of the U.S.‘s softwood lumber supply. Oregon also leads the nation

Legislation introduced by the Alabama Forestry Association would significantly worsen the condition of local and state roads and bridges, as well as hinder safety inspections of commercial vehicles. “The legislation is to allow significantly heavier axle weights to be hauled by large trucks — a move that is difficult to comprehend when the truckers already complain of sky-high liability insurance rates and serve as the primary target of advertising by personal injury law firms,” said Alabama Department of Transportation Deputy Director George Conner… “The math is simple: heavier truck axle weights are exceptionally dangerous and destroy roads and bridges; even heavier axle weights will be more dangerous and will destroy roads and bridges even more quickly.” …The Forestry Association’s proposal would increase the legal limit for a single axle from 20,000 pounds to 22,000 pounds while increasing the legal limit for two axles (tandem axles) from 34,000 pounds to 44,000 pounds.

Legislation introduced by the Alabama Forestry Association would significantly worsen the condition of local and state roads and bridges, as well as hinder safety inspections of commercial vehicles. “The legislation is to allow significantly heavier axle weights to be hauled by large trucks — a move that is difficult to comprehend when the truckers already complain of sky-high liability insurance rates and serve as the primary target of advertising by personal injury law firms,” said Alabama Department of Transportation Deputy Director George Conner… “The math is simple: heavier truck axle weights are exceptionally dangerous and destroy roads and bridges; even heavier axle weights will be more dangerous and will destroy roads and bridges even more quickly.” …The Forestry Association’s proposal would increase the legal limit for a single axle from 20,000 pounds to 22,000 pounds while increasing the legal limit for two axles (tandem axles) from 34,000 pounds to 44,000 pounds. Eastwood Forests has deployed slightly more than half of its debut fund through deals that have included acquisitions in Costa Rica, Panama and Canada. North Carolina-headquartered Eastwood announced its acquisition of 14,500 ha of northern Vancouver Island timberland from Western Forest Products for $69.2 million in February. …Eastwood VP for transactions Prab Dahal said “Western has done a good job in managing the forests but our philosophies are slightly different in that we probably would not have as much openings and as much clear-cuts as Western did in the past,” said Dahal. …“It has more versatility than the typical natural forest that we look for elsewhere,” said Dahal. “We can manage this purely for carbon and still do good, or manage purely as a plantation and continuously manage with a harvesting level that is sustainable and can do good, financially, for our investors.” …Eastwood was established in 2022.

Eastwood Forests has deployed slightly more than half of its debut fund through deals that have included acquisitions in Costa Rica, Panama and Canada. North Carolina-headquartered Eastwood announced its acquisition of 14,500 ha of northern Vancouver Island timberland from Western Forest Products for $69.2 million in February. …Eastwood VP for transactions Prab Dahal said “Western has done a good job in managing the forests but our philosophies are slightly different in that we probably would not have as much openings and as much clear-cuts as Western did in the past,” said Dahal. …“It has more versatility than the typical natural forest that we look for elsewhere,” said Dahal. “We can manage this purely for carbon and still do good, or manage purely as a plantation and continuously manage with a harvesting level that is sustainable and can do good, financially, for our investors.” …Eastwood was established in 2022.